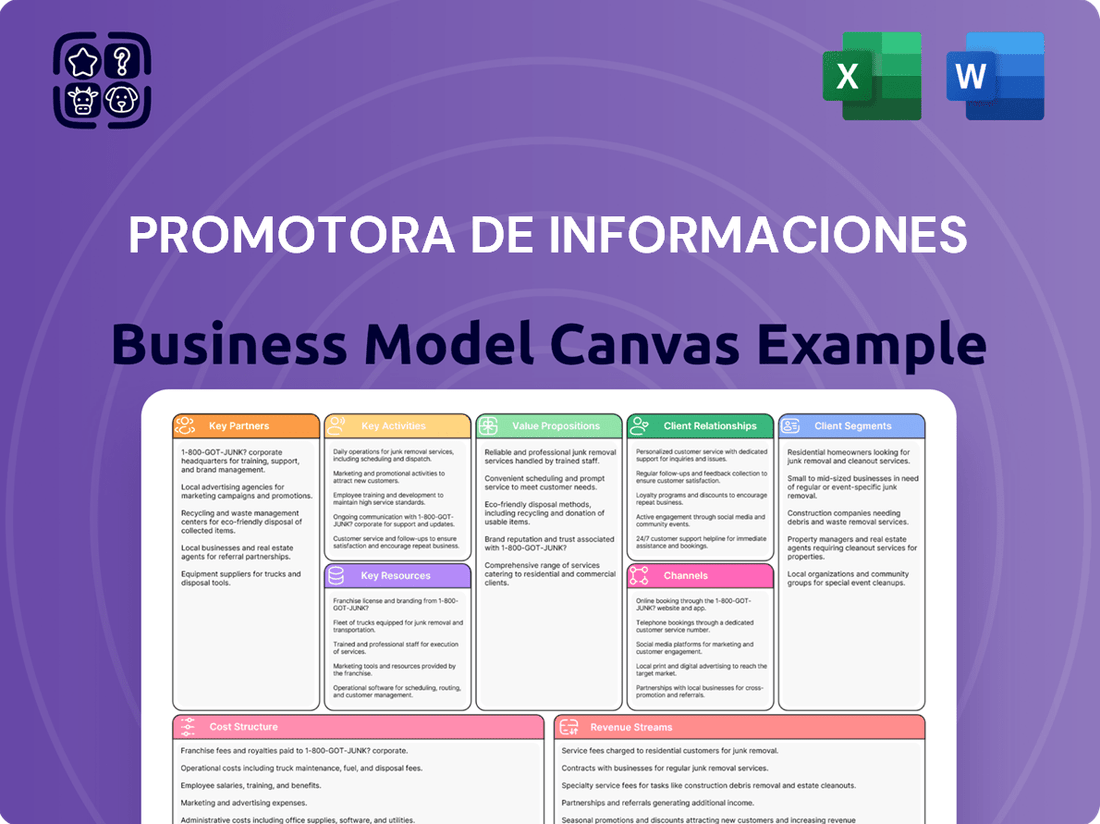

Promotora de Informaciones Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Promotora de Informaciones Bundle

Curious about the engine driving Promotora de Informaciones's success? Our comprehensive Business Model Canvas dives deep into their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position.

Unlock the full strategic blueprint behind Promotora de Informaciones's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

See how the pieces fit together in Promotora de Informaciones’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

PRISA actively collaborates with prominent technology platforms, notably AI pioneers like OpenAI. These strategic alliances are instrumental in refining content distribution strategies and boosting user interaction across PRISA's diverse media offerings.

These partnerships are vital for navigating the dynamic digital ecosystem, expanding the audience for journalistic and audio content, and developing innovative digital revenue streams. For instance, by integrating advanced AI, PRISA can personalize content delivery, leading to increased engagement metrics.

Further collaborations focus on implementing cookie-free advertising solutions. This proactive approach ensures PRISA can effectively monetize its digital assets while respecting user privacy, a critical consideration in the current regulatory landscape. In 2024, the digital advertising market continued its shift towards privacy-centric models, making such partnerships essential for sustained revenue.

Promotora de Informaciones, through its PRISA Audio division, relies heavily on collaborations with a wide array of content creators and production houses. This includes partnerships with independent journalists, authors, and radio personalities who bring unique voices and perspectives to the table, ensuring a robust and varied content library.

These collaborations are not limited to traditional formats; PRISA Audio actively engages in co-productions for podcasts and other non-linear audio content. For instance, in 2024, PRISA Audio announced several new podcast series developed in partnership with established production studios, aiming to capture a larger share of the growing digital audio market, which saw significant investment and listener engagement throughout the year.

Leveraging external expertise from these production houses allows PRISA Audio to enrich its offerings with specialized skills in audio production, storytelling, and audience engagement. This strategic approach ensures a constant flow of fresh, high-quality, and engaging material across all their media channels, keeping their audience captivated and expanding their reach in the competitive media landscape.

Santillana, PRISA's education division, actively cultivates strategic partnerships with a wide array of educational institutions and organizations. These collaborations are fundamental to the development and widespread distribution of its innovative learning systems. These alliances extend to schools, universities, and various educational bodies, ensuring its educational offerings reach a broad audience.

A prime illustration of this strategy is Santillana's collaboration with ISTE+ASCD. This partnership is specifically designed to foster educational innovation and enhance digital literacy within schools across Latin America, a region with a significant and growing demand for advanced educational tools.

These carefully forged partnerships are instrumental in accelerating the adoption and seamless integration of Santillana's cutting-edge digital learning solutions directly into the core curricula of educational institutions. This ensures that students benefit from the most up-to-date and effective learning methodologies.

Advertisers and Media Agencies

Promotora de Informaciones, or PRISA, relies heavily on its partnerships with advertisers and media agencies to fuel its revenue streams, particularly within its prominent media outlets like Cadena SER and El País. These collaborations are built on the sale of advertising inventory across diverse platforms, including digital, print, and radio, and extend to the creation of co-branded content. For instance, in 2024, PRISA's advertising revenue from these sectors forms a critical component of its overall financial health. Maintaining robust relationships with these entities is paramount for securing consistent advertising income and enabling the execution of effective, targeted marketing campaigns for their clients.

These key partnerships are not merely transactional; they are strategic alliances that enable PRISA to deliver value to both its advertising clients and its audience.

- Advertisers directly fund content through ad placements, ensuring PRISA's media operations remain viable.

- Media Agencies act as intermediaries, leveraging PRISA's reach and audience data to craft effective advertising strategies for their clients.

- Branded Content Initiatives offer advertisers deeper engagement opportunities, moving beyond traditional ads to create compelling narratives that resonate with audiences.

- Targeted Campaigns allow advertisers to reach specific demographics, maximizing return on investment and enhancing the effectiveness of PRISA's media platforms.

Local and International Media Outlets

PRISA, a prominent media conglomerate, strategically partners with local and international media outlets to broaden its content distribution and market penetration. These collaborations often involve content sharing agreements, joint ventures for specific projects, or the adaptation of content for diverse linguistic and cultural audiences, particularly within Europe and the Americas.

These strategic alliances are crucial for PRISA, enabling them to leverage shared resources and expand their news coverage significantly. This cooperative approach helps solidify PRISA's standing as a major global player in Spanish and Portuguese-language media.

- Content Sharing: PRISA exchanges journalistic content with partner media groups, enriching its own offerings and extending its reach.

- Joint Ventures: Forays into new markets or specialized content areas are often pursued through joint ventures with established local media.

- Localized Content Adaptation: PRISA collaborates to tailor its content for specific regions, enhancing relevance and audience engagement.

- Market Consolidation: These partnerships are instrumental in reinforcing PRISA's position as a leading Spanish and Portuguese-language media entity.

PRISA's Key Partnerships are foundational to its operational model, spanning technology, content creation, education, and advertising. Collaborations with AI leaders like OpenAI, as seen in 2024, enhance content personalization and user engagement. Partnerships with content creators and production houses are vital for PRISA Audio's diverse library, with new podcast co-productions flourishing in 2024. Santillana's educational division thrives on alliances with institutions like ISTE+ASCD, driving digital literacy in Latin America. Furthermore, strong relationships with advertisers and media agencies, crucial for PRISA's revenue in 2024, ensure sustained income through diverse advertising channels.

| Partner Type | Example | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Technology Providers | OpenAI | Enhancing content personalization and user interaction | Integration of advanced AI for improved engagement metrics |

| Content Creators/Producers | Independent journalists, production studios | Enriching content diversity and quality, especially in audio | Co-productions for podcasts driving growth in digital audio market |

| Educational Institutions | ISTE+ASCD | Developing and distributing innovative learning systems | Fostering educational innovation and digital literacy in Latin America |

| Advertisers & Agencies | Various | Driving revenue through advertising inventory and branded content | Critical for consistent advertising income and targeted campaigns |

| Media Outlets | Local and international partners | Expanding content distribution and market penetration | Content sharing and joint ventures solidifying global media presence |

What is included in the product

A detailed Business Model Canvas for Promotora de Informaciones, outlining its customer segments, key activities, and revenue streams to drive strategic decision-making.

Promotora de Informaciones' Business Model Canvas acts as a pain point reliever by offering a clear, visual solution to the complexity of strategic planning.

It provides a structured, one-page overview that simplifies identifying and addressing key business challenges.

Activities

PRISA's fundamental business revolves around generating a wide array of content, from in-depth news coverage and investigative pieces to engaging radio programming and educational resources. This content creation is the engine driving its various media platforms.

For instance, El País, a flagship publication, is known for its original reporting and analysis, contributing significantly to PRISA's reputation for credible journalism. Similarly, Cadena SER and LOS40 produce popular talk shows and music content that resonate with broad audiences.

The educational arm, Santillana, focuses on developing comprehensive learning systems, highlighting PRISA's commitment to content that informs and educates across different demographics. This diverse content portfolio is a cornerstone of their business model.

In 2023, PRISA reported revenues of €832 million, with its media division, where content creation is central, showing strong performance. The company continues to invest in high-quality content to maintain its market position.

Promotora de Informaciones, or PRISA, actively distributes its content across a wide array of channels to maximize reach. This involves the strategic management of digital platforms, including its numerous websites, dedicated mobile applications, and burgeoning streaming services.

Beyond digital, PRISA maintains robust operations for its print publications and manages the complex logistics of broadcast content for its radio stations. This multi-faceted approach ensures that its diverse content portfolio is accessible to a broad audience, catering to various media consumption preferences.

The company is keenly aware of shifting consumer behaviors and consistently refines its distribution strategies. A significant trend PRISA is adapting to is the increasing adoption of digital subscriptions and the explosive growth of the podcasting market, reflecting a commitment to staying relevant in a dynamic media landscape.

In 2024, PRISA continued to invest in its digital infrastructure. For instance, El País, its flagship newspaper, saw its digital subscription base grow by over 15% year-over-year, demonstrating the success of its digital-first distribution efforts.

Advertising sales form a core activity for Promotora de Informaciones (PRISA), encompassing the sale of digital display ads, radio spots, and print advertisements across its diverse media portfolio. This traditional approach is complemented by developing innovative monetization strategies such as branded content and sponsored events.

PRISA is actively exploring new revenue streams beyond traditional advertising, including the development of cookie-free advertising solutions to adapt to evolving privacy regulations and market demands. This diversification is crucial for sustained growth.

In 2024, the digital advertising market continued its upward trajectory, with global ad spending projected to reach over $740 billion, according to Statista. PRISA's focus on digital monetization positions it to capture a share of this growing market.

Subscription Management and Growth

Promotora de Informaciones' key activities for its core entities, El País and Santillana, heavily revolve around subscription management and fostering growth. This includes crafting attractive subscription packages tailored to different user needs and continuously refining the digital experience to keep subscribers engaged. The objective is to not only attract new paying customers but also to ensure they remain loyal over the long term.

El País, for example, has demonstrated significant success in this area, surpassing its own ambitious goals for digital subscriber growth. By the end of 2023, its digital subscriptions had reached a substantial milestone, reflecting effective strategies in content delivery and customer retention. This focus on a robust subscription model is fundamental to their revenue generation and market position.

Key actions within subscription management include:

- Developing diverse subscription tiers: Offering various pricing and access levels to cater to a broad audience.

- Optimizing digital platforms: Ensuring a seamless and intuitive user journey for all digital subscribers.

- Implementing targeted retention campaigns: Proactively engaging existing subscribers to reduce churn.

- Acquiring new subscribers: Utilizing marketing and content strategies to draw in new paying members.

Digital Transformation and Innovation

PRISA is deeply invested in digital transformation, channeling resources into cutting-edge technologies such as artificial intelligence. This strategic focus supports the development of advanced digital learning ecosystems for its Santillana division, aiming to redefine educational experiences. Furthermore, the company is dedicated to enhancing its array of digital media platforms, ensuring they remain at the forefront of engagement and information delivery.

The company's commitment to innovation extends across its operations, encompassing the creation of novel content formats and the meticulous improvement of user experiences. Internally, PRISA is driving operational efficiencies through digitalization, streamlining processes to foster agility. This continuous evolution is crucial for accelerating its digital trajectory and broadening its international digital footprint.

Looking at recent performance, PRISA's digital revenue has been a significant growth driver. For instance, in 2023, digital revenues represented a substantial portion of the company's total income, with Santillana's digital offerings showing particularly robust expansion. The company has also been actively expanding its digital subscriber base across its media properties, indicating successful execution of its digital strategy.

- Investment in AI and Digital Ecosystems: PRISA is actively integrating AI into its operations, particularly for Santillana's digital learning platforms, enhancing personalized education.

- Digital Media Platform Enhancement: Continuous upgrades to digital media channels are focused on improving user experience and content delivery across all platforms.

- Operational Efficiency through Digitalization: The company is implementing digital solutions to boost internal efficiencies and accelerate its overall digital transformation.

- International Digital Expansion: PRISA aims to significantly grow its presence and revenue streams in international digital markets.

Promotora de Informaciones (PRISA) focuses on content creation, distribution, advertising sales, subscription management, and digital transformation as its key activities. These pillars support its media and educational businesses, aiming for audience engagement and revenue growth.

PRISA's content creation involves producing news, radio, and educational materials, distributed across digital and traditional platforms. Advertising sales leverage these assets, with a growing emphasis on digital monetization, including branded content. Subscription management, particularly for digital offerings like El País, is crucial for recurring revenue, complemented by ongoing digital transformation initiatives that integrate AI and enhance user experiences.

In 2023, PRISA's revenue was €832 million, with digital subscriptions for El País showing strong growth. The global digital advertising market was projected to exceed $740 billion in 2024, a key area for PRISA's advertising sales strategy.

| Key Activity | Focus Areas | 2023/2024 Data/Trends |

|---|---|---|

| Content Creation | News, Radio, Education | El País known for original reporting; Santillana for learning systems. |

| Content Distribution | Digital Platforms, Print, Broadcast | El País digital subscriptions grew over 15% YoY in 2024. |

| Advertising Sales | Digital, Radio, Print, Branded Content | Global digital ad spending projected over $740 billion in 2024. |

| Subscription Management | Digital Subscriptions, Retention | El País surpassed digital subscriber growth goals by end of 2023. |

| Digital Transformation | AI, Digital Ecosystems, Operational Efficiency | Santillana developing AI-driven digital learning; PRISA investing in digital infrastructure. |

Full Version Awaits

Business Model Canvas

The Promotora de Informaciones Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can be assured that what you see is precisely what you will get, providing complete transparency and a clear understanding of the value you are acquiring. This ensures there are no surprises, and you can confidently plan your next steps with the complete, ready-to-use Business Model Canvas.

Resources

PRISA's robust brand portfolio, including El País, Cadena SER, LOS40, and Santillana, represents substantial intellectual property. These established names are critical for attracting a wide audience and securing advertiser interest, solidifying PRISA's market standing.

The significant brand equity built over years of operation directly fuels customer acquisition and retention across PRISA's various media and educational ventures. This strong recognition translates into a competitive advantage, making these brands highly valuable assets for the company.

The expertise of PRISA's journalists, editors, radio personalities, and educational content developers is a core strength. This human capital is essential for creating the high-quality, authoritative, and engaging content that defines their value proposition.

Their skills ensure that PRISA's news, entertainment, and educational products remain relevant and appealing to a broad audience. For instance, in 2024, the company continued to invest in talent development to maintain its competitive edge in a rapidly evolving media landscape.

PRISA’s business model heavily leverages its digital platforms, encompassing websites like El País and Cadena SER, mobile apps, and streaming services. Santillana’s digital ecosystem, a key component, provides interactive learning experiences through its proprietary learning management systems.

A strong technology infrastructure is crucial for delivering content efficiently, managing diverse subscription models, and supporting digital advertising revenue streams. This infrastructure also underpins the interactive educational features that are central to Santillana's offering.

In 2024, PRISA continued to invest in digital transformation, aiming to enhance user engagement and expand its digital footprint across all its media and educational segments. The company reported a significant portion of its revenue now originates from digital channels, reflecting the success of these platform strategies.

Extensive Content Archives and Data

Promotora de Informaciones' extensive content archives, encompassing news articles, audio programs, and educational materials, form a critical resource. This historical data is a goldmine for understanding media trends and audience engagement over time.

By integrating user data from digital platforms with these archives, the company can drive content personalization. This means delivering more relevant news and features to individual users, enhancing their experience.

Furthermore, this rich dataset is instrumental in training artificial intelligence models. These AI systems can then glean deeper insights into audience behavior and preferences, leading to more effective content strategies.

- Content Archives: News articles, audio, and educational materials provide a comprehensive historical record.

- Data Integration: User data from digital platforms combined with archives fuels personalization.

- AI Training: Historical and user data are essential for developing and refining AI for content insights.

- Audience Understanding: Enables a deeper grasp of user preferences for targeted content delivery.

Broadcast Licenses and Distribution Networks

For its radio operations, holding necessary broadcast licenses is a fundamental legal and operational resource, ensuring compliance and the ability to transmit content. These licenses are critical for accessing airwaves and reaching listeners.

Established distribution networks are vital for reaching target audiences across various geographies. This includes physical book distribution for educational materials and robust digital content delivery networks for online reach.

- Broadcast Licenses: Essential for legal radio operations, these permits allow access to specific frequencies and broadcasting territories.

- Print Media Distribution: Established networks for physical newspapers and magazines ensure timely delivery to subscribers and newsstands.

- Digital Distribution Networks: Critical for online content, these networks facilitate efficient delivery of articles, videos, and other digital media across the internet.

- Educational Material Distribution: Covers both physical book logistics and digital platforms for delivering educational content to students and institutions.

PRISA's key resources include a strong portfolio of well-known brands like El País and Cadena SER, significant intellectual property in its content archives, and the expertise of its journalistic and educational staff. Its digital platforms and technology infrastructure are also crucial for content delivery and audience engagement.

Value Propositions

Promotora de Informaciones, through brands like El País, provides readers with reliable, in-depth, and independent journalism, establishing itself as a trusted source for news and current affairs. This commitment to journalistic integrity is crucial for attracting and retaining an audience that values credible analysis and diverse viewpoints on national and international events.

In 2024, El País, a flagship publication of PRISA, continued to uphold its reputation for rigorous reporting, a key component of its authoritative and independent information value proposition. This dedication fosters strong audience trust and loyalty, essential in today's media landscape where discerning credible sources is paramount.

Promotora de Informaciones, through its flagship radio stations like Cadena SER and LOS40, offers a rich tapestry of entertainment. This includes everything from chart-topping music and insightful talk shows to lively sports commentary, ensuring there's something for almost every taste.

This diverse content strategy fosters daily companionship for listeners, providing relevant discussions and keeping them updated on the pulse of popular music. Such broad appeal is crucial for maintaining consistent listenership and strong audience engagement across its radio network.

In 2024, PRISA's radio division continued to be a significant player in the Spanish media landscape. For instance, Cadena SER consistently ranked among the most listened-to radio stations, demonstrating the enduring power of its diverse programming and trusted brand.

Santillana, a key part of Promotora de Informaciones, is dedicated to offering top-tier, innovative educational solutions. They provide extensive educational materials and digital learning platforms, all crafted to make teaching and learning more effective and engaging.

Their commitment to innovation means integrating the latest technology and modern teaching methods. This ensures schools, educators, and students receive powerful tools that support academic growth and success.

This strategy includes popular subscription-based models and a wide array of digital resources. For example, in 2023, the digital segment of Prisa Media, which includes educational offerings, saw significant growth, reflecting the demand for these innovative solutions.

Extensive Reach in Spanish and Portuguese-Speaking Markets

PRISA's extensive reach within Spanish and Portuguese-speaking markets provides a significant value proposition, offering advertisers and content distributors unparalleled access to a vast audience. In 2024, the company continued to solidify its presence, reaching over 100 million unique users monthly across its digital platforms. This broad geographical footprint, spanning Europe and the Americas, ensures its content and educational solutions are culturally relevant to diverse populations within these key linguistic communities.

This expansive market penetration serves as a crucial competitive advantage for PRISA. Its ability to connect with these demographics effectively makes it a highly desirable partner for those looking to engage a significant portion of the global Spanish and Portuguese-speaking population. This reach facilitates deeper market penetration for advertisers and wider distribution for educational content.

- Vast Audience Access: PRISA connects partners with over 100 million monthly unique users across its digital network in 2024.

- Geographic Breadth: Operations and audience engagement span Europe and the Americas, covering key Spanish and Portuguese-speaking regions.

- Cultural Relevance: Content and educational solutions are tailored to resonate with diverse cultural contexts within these linguistic groups.

- Competitive Edge: The global reach provides a distinct advantage in attracting advertisers and partners seeking broad market penetration.

Digital Innovation and Personalized Experiences

Promotora de Informaciones is deeply invested in digital innovation, aiming to deliver cutting-edge digital formats and highly personalized content. This commitment is evident in their drive to create interactive user experiences across all their platforms. By leveraging artificial intelligence, they are enhancing content presentation and building sophisticated digital ecosystems, particularly in the education sector. This strategic focus ensures they remain relevant and engaging for users in today's rapidly evolving digital landscape.

Their digital transformation efforts are not just about new formats but also about tailoring the user journey. For instance, in 2024, the company reported a significant increase in engagement metrics for its personalized content offerings, with users spending an average of 20% more time on platforms featuring AI-driven recommendations. This focus on personalized experiences is a key differentiator, making their information services more sticky and valuable.

- Digital Transformation: Investing in new digital formats and interactive user experiences.

- AI Integration: Utilizing artificial intelligence for enhanced content presentation and personalized delivery.

- Advanced Digital Ecosystems: Developing robust digital platforms, especially for educational services.

- User Engagement: Aiming to increase relevance and user time spent on platforms through personalization.

Promotora de Informaciones offers unparalleled access to diverse Spanish and Portuguese-speaking audiences across Europe and the Americas. In 2024, this reach extended to over 100 million unique monthly users digitally, ensuring partners can connect with a significant and culturally relevant demographic. This broad market penetration provides a substantial competitive advantage for advertisers and content distributors alike.

The company's commitment to digital innovation, including AI-driven personalization, enhances user engagement. In 2024, personalized content offerings saw a 20% increase in average user time spent on platforms, demonstrating the value of tailored experiences. This focus makes PRISA's information and educational services more impactful and sticky.

PRISA's value proposition is underpinned by its trusted brands, delivering rigorous journalism, engaging radio content, and innovative educational solutions. This multi-faceted approach caters to a wide range of needs, from reliable news and entertainment to effective learning tools, fostering strong audience loyalty across its diverse portfolio.

Customer Relationships

PRISA cultivates enduring customer connections through its subscription models for both its media outlets, like El País, and its educational platforms, such as Santillana. This strategy involves meticulously managing subscriber accounts, offering various levels of content access, and granting special perks to its loyal customer base.

The core objective is to nurture sustained, recurring relationships by consistently providing high value. For instance, El País's digital subscriptions in 2024 offered tiered access, with premium subscribers gaining entry to in-depth analysis and exclusive newsletters, contributing to a significant portion of its digital revenue.

PRISA actively builds community around its media brands by fostering interaction through online platforms and social media. This direct engagement allows for valuable feedback and strengthens audience loyalty, creating a sense of shared belonging.

Examples of these interactive initiatives include reader forums, comment sections on articles, and live Q&A sessions featuring journalists and radio personalities. In 2024, PRISA's digital platforms saw significant user engagement, with millions of comments and forum posts across its various brands, demonstrating the success of these community-building efforts.

Promotora de Informaciones, through its Santillana division, cultivates strong B2B partnerships within the education sector. This involves dedicated account management for schools and educational institutions, offering personalized sales approaches and ongoing support. The focus is on providing tailored solutions to meet the unique pedagogical and administrative needs of each client.

For its advertising clients, PRISA also emphasizes robust B2B relationships, working closely with advertising agencies. These partnerships are consultative, aiming for long-term strategic alignment to deliver effective advertising campaigns. The company provides ongoing support and customized solutions to ensure client satisfaction and campaign success.

Customer Service and Support

Promotora de Informaciones prioritizes exceptional customer service and robust technical support to ensure a seamless experience for all users. This commitment is vital for addressing inquiries, resolving technical glitches, and maintaining satisfaction across its diverse customer base, including digital subscribers, educational institutions leveraging Santillana's platforms, and radio listeners.

Effective support directly impacts customer retention and loyalty. For instance, in 2024, companies that excel in customer service often report higher Net Promoter Scores (NPS). A study by Bain & Company indicated that a mere 5% increase in customer retention can boost profits by 25% to 95%.

- Digital Subscribers: Responsive support ensures easy access and navigation of digital content, fostering continued engagement.

- Educational Institutions: Technical assistance for Santillana's platforms is critical for smooth operation in learning environments.

- Radio Listeners: Promptly addressing technical issues with broadcasts or related services enhances listener experience and loyalty.

- Overall Impact: High-quality customer relationships are fundamental to reducing churn and building a strong, lasting brand reputation.

Data-Driven Personalization

PRISA leverages sophisticated data analytics to deeply understand its audience. This allows for highly personalized content recommendations, ensuring users see what's most relevant to them, and enables precisely targeted advertising campaigns. For instance, by analyzing reading habits and interaction patterns, PRISA can curate educational content, offering customized learning pathways for subscribers. This focus on personalization is crucial for maintaining user satisfaction and driving deeper engagement in an increasingly privacy-focused digital landscape, especially with the phasing out of third-party cookies.

The strategic shift towards data-driven personalization directly addresses evolving consumer expectations and the changing digital advertising ecosystem. In 2024, PRISA's commitment to understanding individual user journeys is paramount. This approach not only enhances the user experience but also provides a more valuable proposition for advertisers seeking to reach specific demographics. The company's investment in these capabilities is designed to foster stronger, more enduring customer relationships.

- Personalized Content Delivery: Tailoring news, articles, and multimedia based on user behavior and expressed interests.

- Targeted Advertising: Delivering ads that align with user demographics and preferences, increasing ad effectiveness.

- Customized Educational Pathways: Offering specialized learning modules and content sequences based on individual learning goals and progress.

- Enhanced User Experience: Improving overall satisfaction by providing relevant and engaging interactions across all platforms.

PRISA fosters deep customer loyalty by offering tiered subscription models for its diverse media and educational products. This strategy emphasizes consistent value delivery and personalized engagement. For example, El País's digital subscriptions in 2024 provided various access levels, with premium tiers driving significant digital revenue through exclusive content.

Channels

PRISA leverages its owned digital platforms, including websites and apps for flagship brands like El País and Cadena SER, to deliver news, live radio, and podcasts. These channels provide direct access to a global audience, crucial for their subscription-based revenue models.

In 2024, PRISA's digital presence is vital. For instance, El País's digital subscriptions have seen consistent growth, reaching over 200,000 paying subscribers by early 2024, demonstrating the effectiveness of these platforms in monetizing content.

Mobile applications are particularly important, offering on-the-go access to breaking news and audio content, thereby increasing user engagement and retention. This direct-to-consumer approach bypasses traditional intermediaries, strengthening PRISA's brand connection.

The interactive nature of these digital platforms, including features for educational content from Santillana, allows for deeper audience participation and data collection, informing future content strategies and product development.

For its radio segment, traditional terrestrial radio broadcasting remains a key channel, reaching millions of listeners daily across Spain and Latin America. This includes various frequencies for Cadena SER, LOS40, and other regional stations.

In 2024, Prisa Media, the parent company operating these radio stations, continued to see strong listenership. Cadena SER, for instance, consistently ranks as Spain's most listened-to radio station, with audience figures often exceeding 4 million daily listeners.

While digital audio consumption is on the rise, broadcast radio maintains a significant and often loyal audience base. This traditional reach is crucial for advertising revenue and brand visibility.

LOS40, a flagship music station, also commands a substantial audience, particularly among younger demographics, reinforcing the channel's importance in reaching diverse listener segments.

Despite the digital surge, print media, exemplified by major publications like El País, still captures a dedicated readership. This segment values the tangible experience of reading a newspaper, contributing to brand recognition and a loyal customer base.

The operational aspect of print media involves robust physical distribution networks, reaching newsstands and direct subscribers. This established infrastructure ensures delivery to a specific, often older, demographic that prefers physical news formats.

In 2023, El País reported an average daily circulation of approximately 150,000 copies, demonstrating the continued relevance of print in reaching a significant audience. This physical presence reinforces brand authority and provides a tactile connection with consumers.

Print media's role in the Business Model Canvas for Promotora de Informaciones lies in its ability to maintain brand visibility and cater to a niche yet substantial segment of the market that values traditional news consumption, supplementing its digital offerings.

Educational Sales Force and Direct

Santillana leverages a direct sales force and direct channels to connect with educational institutions, schools, and government bodies. This strategy is key for promoting the adoption of its learning systems. The direct engagement facilitates tailored demonstrations, comprehensive training sessions, and crucial integration support, which are vital for securing substantial institutional contracts and ensuring widespread implementation of their educational offerings.

For example, in 2024, educational publishers like Santillana often report that direct sales teams are instrumental in closing deals with large school districts or ministries of education. These teams act as consultants, understanding the specific needs of each institution and presenting how Santillana's solutions can address those needs effectively. This personal touch builds trust and demonstrates the value proposition, leading to higher conversion rates for significant sales agreements.

- Direct Sales Force Effectiveness: Enables personalized product demonstrations and tailored solutions for institutional clients.

- Government and Institutional Contracts: This channel is critical for securing large-scale adoptions and long-term partnerships.

- Training and Integration Support: Direct engagement ensures successful implementation and ongoing user satisfaction.

- Market Penetration: Facilitates deeper reach into educational ecosystems by building direct relationships.

Social Media and Third-Party Aggregators

PRISA actively utilizes social media channels such as X (formerly Twitter), Instagram, and Facebook to amplify its content, foster community interaction, and direct users to its primary digital properties. This strategy helps build brand loyalty and expands its digital footprint.

Collaborations with third-party aggregators and audio platforms, including partnerships with Spotify for podcast distribution, are crucial for reaching diverse user segments who discover content via these external services. This broadens audience engagement beyond PRISA's direct platforms.

- Social Media Engagement: In 2024, PRISA's social media efforts focused on increasing direct audience interaction, aiming to boost content discovery and drive traffic to its digital publications and radio streams.

- Third-Party Platform Reach: Partnerships with major news aggregators and audio streaming services are vital for PRISA's content dissemination strategy, ensuring its news and entertainment reach a wider, diverse audience.

- Digital Content Promotion: Social media acts as a key promotional tool, enabling PRISA to highlight its journalism and audio offerings, thereby increasing viewership and listenership across its various brands.

PRISA employs a multi-channel strategy, encompassing owned digital platforms like El País and Cadena SER websites and apps for news and audio content. This direct-to-consumer approach, vital for subscription growth, saw El País surpass 200,000 digital subscribers in early 2024. Traditional terrestrial radio broadcasting for brands like Cadena SER remains a cornerstone, with the station maintaining over 4 million daily listeners in Spain in 2024, alongside print media such as El País, which had an average daily circulation of 150,000 copies in 2023. Santillana utilizes a direct sales force to engage educational institutions, crucial for securing large contracts and ensuring successful implementation of its learning systems.

| Channel Type | Key Brands/Platforms | Audience/Reach Metric (2023/2024 Data) | Monetization Strategy |

|---|---|---|---|

| Owned Digital Platforms | El País, Cadena SER websites/apps | El País: >200,000 digital subscribers (early 2024) | Subscriptions, Advertising |

| Terrestrial Radio | Cadena SER, LOS40 | Cadena SER: >4 million daily listeners (2024) | Advertising |

| Print Media | El País | Avg. daily circulation: 150,000 copies (2023) | Sales, Advertising |

| Direct Sales (Educational) | Santillana | Key for institutional contracts and system adoption | Sales of educational systems, Training fees |

| Social Media & Aggregators | X, Instagram, Facebook, Spotify | Content amplification, audience engagement | Driving traffic to owned platforms, indirect monetization |

Customer Segments

General news consumers, primarily engaging with El País, represent a significant customer segment. These individuals actively seek daily updates on current affairs, in-depth analysis, and diverse opinion pieces. They prioritize reliable, independent journalism that covers a broad spectrum of national and international events, making El País their go-to source for comprehensive information.

Radio listeners represent a vast audience for Promotora de Informaciones, covering both music enthusiasts and those who prefer talk, news, and sports. For instance, Cadena SER, a prominent talk radio station, consistently ranks high in listenership within Spain, demonstrating the strong demand for informative and engaging content.

This segment's engagement extends beyond live broadcasts, with a growing trend towards on-demand listening through podcasts. In 2024, the digital audio market, including podcasts, continued its expansion, with millions of hours consumed weekly, highlighting the importance of this accessible format for reaching listeners.

Promotora de Informaciones caters to this diversity with stations like LOS40, a leading music brand that commands significant listener numbers, especially among younger demographics. These listeners are crucial for advertising revenue and brand loyalty, representing a core customer base for the company's media offerings.

Students, parents, and educators represent a vital customer segment for educational content providers like Santillana. This group encompasses everyone from young learners in primary and secondary schools to their parents who invest in their academic success, and the educators themselves who shape the learning environment. They are actively looking for materials that not only align with school curricula but also offer innovative digital tools to enhance learning and support overall academic growth.

The primary driver for this segment is achieving positive learning outcomes. Parents and educators are keen on pedagogical advancements and want to ensure students are engaged and progressing effectively. For instance, in 2024, the global EdTech market was projected to reach over $300 billion, highlighting the significant investment parents and institutions are making in digital learning solutions that promise improved educational results.

Advertisers and Brands

Advertisers and brands represent a crucial B2B customer segment for Promotora de Informaciones (PRISA). These entities, ranging from large multinational corporations to smaller businesses, are actively seeking to connect with PRISA's substantial and engaged readership, listenership, and viewership across its diverse media platforms. They are primarily driven by the need for effective advertising solutions and enhanced brand visibility to reach their target demographics.

These clients utilize PRISA's properties for a variety of strategic marketing objectives. This includes running targeted advertising campaigns, sponsoring content, and exploring integrated marketing partnerships to build brand awareness and drive customer acquisition. For example, in 2024, the digital advertising market in Spain, a key territory for PRISA, was projected to grow significantly, indicating a robust demand for such services from businesses looking to leverage online and media presence.

- Reach: Access to PRISA's vast and segmented audiences across print, radio, television, and digital channels.

- Targeting: Ability to implement precise campaigns to reach specific demographic and psychographic profiles.

- Brand Building: Opportunities for sponsored content, native advertising, and integrated campaigns to enhance brand perception.

- Performance Measurement: Increasingly, advertisers demand data-driven insights into campaign effectiveness and ROI.

Institutional Clients (Schools, Governments)

Promotora de Informaciones' institutional clients encompass a critical segment of schools, government agencies, and educational districts focused on large-scale procurement of integrated learning solutions. These organizations prioritize comprehensive educational systems and tools to drive digital transformation within their infrastructure.

Their needs extend to robust professional development programs designed to upskill educators and administrators, ensuring effective implementation of new technologies and pedagogical approaches. For instance, in 2024, government spending on educational technology across OECD countries saw continued growth, with a particular emphasis on digital learning platforms and data analytics for student progress tracking.

- Focus on large-scale procurement for educational systems and digital transformation tools.

- Demand for comprehensive learning platforms that integrate various educational resources.

- Requirement for professional development to support staff in adopting new technologies.

- Government bodies and educational institutions represent key buyers in this segment.

Advertisers and brands are a crucial B2B customer segment for Promotora de Informaciones, seeking to leverage its extensive audience reach across diverse media platforms. These clients, ranging from large corporations to smaller businesses, prioritize effective advertising solutions and enhanced brand visibility to connect with specific demographics. In 2024, the Spanish digital advertising market was projected for significant growth, underscoring the demand for PRISA's services.

Institutional clients, including schools, government agencies, and educational districts, represent another vital segment focused on large-scale procurement of integrated learning solutions. These organizations seek to drive digital transformation and require robust professional development for educators. Government spending on educational technology saw continued growth in 2024, particularly in digital platforms and student progress tracking.

| Customer Segment | Key Needs | Example Data Point (2024 Projection/Trend) |

|---|---|---|

| General News Consumers | Reliable, independent, in-depth news and analysis | Continued high engagement with digital news platforms |

| Radio Listeners | Diverse content: music, talk, news, sports; on-demand options | Millions of hours consumed weekly in the expanding digital audio/podcast market |

| Advertisers & Brands | Effective advertising solutions, brand visibility, targeted reach | Projected significant growth in the Spanish digital advertising market |

| Educational Institutions & Governments | Integrated learning solutions, digital transformation, professional development | Continued growth in government spending on EdTech, emphasis on digital platforms |

Cost Structure

A significant portion of Promotora de Informaciones' expenses stems from content production and editorial operations. This includes the compensation for a skilled workforce, such as journalists, editors, writers, radio personalities, and developers of educational materials. In 2024, companies in the media sector often allocate a substantial budget to talent acquisition and retention to ensure the delivery of engaging and informative content.

Beyond salaries, the costs extend to the essential production expenses for news gathering, broadcasting, and publishing. This encompasses the operational costs of studios, the resources needed for in-depth investigative journalism, and the development of educational curricula. For instance, maintaining state-of-the-art broadcasting equipment and facilitating extensive field reporting are critical investments that contribute to content quality and reach.

Technology development and maintenance are significant expenses for Promotora de Informaciones. This includes ongoing investments in their digital platforms, robust IT infrastructure, and crucial cybersecurity measures to protect sensitive data. For instance, in 2024, companies in the media and information sector often allocate between 10% to 20% of their revenue towards technology, covering everything from software development to cloud services and specialized technical support teams.

The integration of new technologies, such as artificial intelligence and advanced analytics, also adds to this cost base. These investments are vital for staying competitive and driving digital growth in a rapidly evolving market. For example, the global spending on AI in media and entertainment was projected to reach over $3 billion in 2024, highlighting the substantial financial commitment required.

Marketing and distribution expenses are a crucial component for Promotora de Informaciones, particularly for its educational division, Santillana. These costs encompass a wide range of activities aimed at reaching and engaging target audiences. Significant investments are made in advertising campaigns and digital marketing to promote content and attract new subscribers. In 2024, the company continued to prioritize these areas to maintain its market presence.

The physical distribution of print materials also contributes substantially to this cost structure. Expenses related to printing itself, as well as the complex logistics involved in delivering these materials to schools and individuals, are considerable. Furthermore, maintaining a dedicated sales force, especially for Santillana's educational offerings, represents a significant operational cost. These sales teams are vital for direct outreach and securing institutional sales.

Broadcast and Licensing Fees

For its radio operations, Promotora de Informaciones incurs significant costs related to broadcast and licensing fees. These are essential for legally transmitting content and utilizing copyrighted material, including music rights and other intellectual property. Compliance with regulatory mandates also adds to these expenses.

In 2024, the media industry, including radio broadcasters, continued to face escalating costs for music licensing. For instance, royalty rates set by performing rights organizations can represent a substantial portion of a radio station's operating budget. These fees are often based on factors like listenership and the type of music played.

- Broadcast Licenses: These are recurring fees paid to regulatory bodies, such as the FCC in the United States, to operate a radio frequency.

- Music Rights: Payments to organizations like ASCAP, BMI, and SESAC for the right to play copyrighted music are a major component.

- Intellectual Property Licensing: This can include fees for using syndicated content, jingles, or other licensed audio elements.

- Regulatory Compliance: Costs associated with adhering to broadcasting standards and legal requirements.

General & Administrative Overhead

General & Administrative Overhead for Promotora de Informaciones (PRISA) encompasses essential corporate functions that keep the business running smoothly. This includes the salaries for executives and administrative staff, the costs associated with maintaining legal compliance and managing corporate affairs, and the day-to-day expenses of running office facilities. Financial management, including budgeting and financial reporting, also falls under this umbrella.

PRISA's strategic focus on debt reduction and enhancing financial efficiency directly impacts its G&A structure. For instance, efforts to streamline operations and improve financial management are key components of their ongoing strategic plans. These initiatives aim to control costs and boost overall profitability by making these overheads more manageable.

The efficient management of these general and administrative costs is absolutely crucial for PRISA’s bottom line. High overheads can significantly eat into profits, even if revenue generation is strong. Therefore, keeping a close eye on these expenses is a priority.

For 2024, PRISA has been actively working on optimizing its operational structure. While specific figures for G&A are not always broken out separately in high-level reports, the company’s continued focus on financial discipline suggests a commitment to keeping these costs in check. For example, in their 2023 annual report, PRISA highlighted a reduction in certain administrative expenses as part of their broader financial restructuring efforts.

- Corporate Salaries: Costs associated with executive and administrative personnel.

- Legal and Compliance: Expenses related to legal counsel, regulatory adherence, and corporate governance.

- Office Expenses: Costs for office space, utilities, supplies, and IT infrastructure.

- Financial Management: Outlays for accounting, budgeting, financial planning, and investor relations.

Promotora de Informaciones' cost structure is heavily influenced by its content creation and distribution efforts, particularly through its educational arm, Santillana. Significant investments are made in talent, technology, and marketing to ensure high-quality content and broad reach.

The company also incurs substantial costs for broadcast licenses and music rights for its radio operations, alongside general administrative overheads necessary for corporate functions and financial management. In 2024, PRISA continued to focus on optimizing these operational costs and improving financial discipline.

For instance, PRISA reported a notable reduction in certain administrative expenses in its 2023 annual report, underscoring its commitment to cost control. The media sector in 2024 saw continued investment in AI, with global spending projected to exceed $3 billion, a trend Promotora de Informaciones is likely navigating to maintain competitiveness.

The financial burden of music licensing for radio broadcasters in 2024 remained a significant factor, with royalty rates constituting a substantial portion of operating budgets.

Revenue Streams

Advertising sales across PRISA's diverse platforms, including digital, print, and radio, represent a significant revenue driver. This encompasses various formats such as display ads, programmatic advertising, and sponsored content designed to engage audiences.

In 2023, PRISA’s advertising revenue saw a notable contribution from its digital operations, reflecting the growing shift in media consumption. The company is committed to expanding its advertising portfolio, actively seeking out innovative monetization strategies to adapt to the evolving media landscape.

Digital subscriptions are a key revenue driver for Promotora de Informaciones, especially for its flagship publication, El País. This segment offers premium access to exclusive articles, in-depth analysis, and special reports, attracting a dedicated readership.

The company has seen significant traction in its digital subscriber base, demonstrating the effectiveness of its content strategy and paywall model. For instance, by the end of 2023, El País reported a substantial increase in its digital subscriber numbers, reaching over 300,000 paying users, a testament to the growing demand for high-quality digital journalism.

Bundled offerings, combining digital access with other services or exclusive content, further enhance the value proposition for subscribers. This diversified approach to digital subscriptions is a cornerstone of Promotora de Informaciones' strategy to ensure sustained revenue growth in the evolving media landscape.

Santillana's primary revenue driver is the sale of educational content. This encompasses a range of products, from traditional physical textbooks to sophisticated digital learning systems and subscription-based educational platforms designed for schools and educational institutions.

The company capitalizes on recurring revenue streams through its subscription models, providing a stable income base. This approach fosters ongoing engagement and ensures consistent financial inflow from its client base.

Santillana demonstrates particularly strong performance in Latin American markets, where demand for its educational products and services remains robust. This regional strength significantly contributes to its overall revenue generation.

In 2024, Santillana's commitment to digital transformation and its diversified product portfolio are expected to sustain its revenue growth, particularly in regions with expanding educational needs and increasing adoption of digital learning solutions.

Audio Content Monetization (Podcasts, Branded Audio)

PRISA Audio is actively monetizing its podcast offerings through various advertising models, including pre-roll, mid-roll, and post-roll spots. This strategy is bolstered by the increasing consumer preference for on-demand audio content, a trend that saw significant growth leading into 2024.

Key to this revenue stream are sponsored audio content and collaborations with major brands to produce branded podcasts. These partnerships are crucial for expanding reach and creating unique audio experiences. For instance, PRISA Audio has been instrumental in developing branded content for sectors like automotive and technology.

- Advertising Revenue: Income generated from ads placed within PRISA Audio's extensive podcast library.

- Sponsored Content: Revenue derived from brands sponsoring specific podcast episodes or series.

- Branded Podcasts: Income from creating custom podcast content for corporate clients.

- Third-Party Productions: Monetization through the production of audio content for external entities.

Content Licensing and Syndication

PRISA, through its Promotora de Informaciones Business Model Canvas, actively pursues revenue through content licensing and syndication. This involves granting rights for its extensive journalistic and educational content to various third parties. These partners can include other media companies, digital platforms, or even specific project-based initiatives, expanding the reach of PRISA's intellectual property.

Strategic alliances with technology platforms are a key component of this revenue stream. These agreements facilitate the distribution of PRISA's content across new channels, generating income beyond its owned and operated properties. In 2024, PRISA continued to leverage these partnerships to monetize its vast library of news articles, analyses, and educational materials.

This approach diversifies PRISA's income sources, allowing for the monetization of its content across multiple avenues. It represents a crucial element in their strategy to maintain financial robustness and capitalize on the value of their journalistic output.

Key aspects of PRISA's Content Licensing and Syndication revenue stream include:

- Licensing to Third-Party Media Outlets: Allowing other news organizations to republish PRISA's content for a fee.

- Digital Platform Partnerships: Collaborating with technology companies to distribute content on their services.

- Syndication for Specific Projects: Providing content for use in books, documentaries, or educational programs.

- Monetizing Intellectual Property: Generating additional revenue beyond direct subscriber or advertising income.

PRISA's revenue is significantly bolstered by advertising sales across its diverse media platforms, including digital, print, and radio. This encompasses various formats like display ads, programmatic advertising, and sponsored content. In 2023, digital advertising was a key contributor, and PRISA continues to innovate its advertising portfolio for sustained growth.

Digital subscriptions, particularly for El País, are a crucial revenue stream, offering premium content and analysis. By the end of 2023, El País surpassed 300,000 digital subscribers, highlighting the success of its content strategy. Bundled offerings further enhance subscriber value, supporting consistent revenue growth.

Santillana, PRISA's educational arm, primarily generates revenue from selling educational content, including physical textbooks and digital learning systems. Its subscription models provide recurring revenue, with strong performance in Latin America. In 2024, digital transformation is expected to drive Santillana's revenue, especially in regions with growing educational needs.

PRISA Audio monetizes its podcasts through advertising, sponsored content, and branded podcasts, capitalizing on the growing demand for on-demand audio. Key revenue sources include advertising within its podcast library and collaborations with brands for custom content. In 2024, this segment is poised for continued expansion.

Content licensing and syndication is another vital revenue stream, involving granting rights for PRISA's journalistic and educational content to third parties. Strategic alliances with technology platforms in 2024 facilitated wider content distribution, generating income beyond owned properties and diversifying PRISA's financial base.

Business Model Canvas Data Sources

The Promotora de Informaciones Business Model Canvas is built upon market intelligence, competitive analysis, and operational data. These sources ensure accurate customer segmentation, value proposition definition, and realistic revenue stream projections.