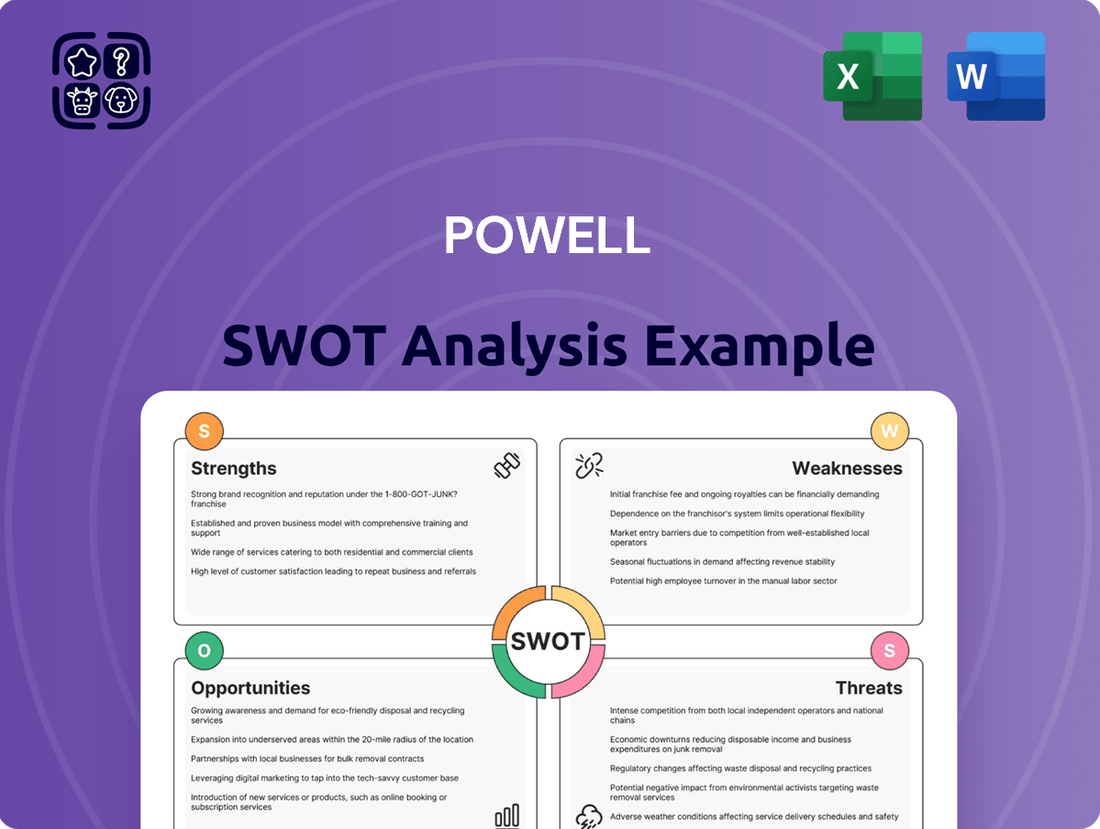

Powell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Powell Bundle

Powell's market position is shaped by unique strengths, but also faces significant challenges and threats. Understanding these dynamics is crucial for anyone looking to navigate its competitive landscape.

Our in-depth SWOT analysis dives deep into Powell's internal capabilities and external market influences, offering a comprehensive view of its current standing.

Discover actionable insights into Powell's opportunities for growth and the potential weaknesses that could hinder its progress.

Want the full story behind Powell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Powell Industries excels in crafting custom-engineered electrical equipment and systems, specifically designed for the demanding needs of heavy industries. This specialization allows them to deliver bespoke solutions that precisely match client requirements, setting them apart from companies offering standardized products.

Their strength lies in deep application engineering expertise and robust project management capabilities. This combination enables Powell to tackle complex electrical infrastructure challenges, fostering loyalty and securing their position as a preferred partner for intricate projects.

For instance, in fiscal year 2023, Powell reported a backlog of $750.7 million as of September 30, 2023, underscoring the demand for their specialized, custom solutions in large-scale projects.

Powell showcased impressive financial results in fiscal year 2024, achieving a notable 45% revenue increase, reaching $1.0 billion. This growth was complemented by a substantial 175% surge in net income, totaling $150 million, underscoring the company's enhanced profitability.

Furthermore, Powell benefits from a robust backlog of $1.3 billion as of September 30, 2024. This substantial order book offers significant revenue visibility, providing a strong foundation for financial stability and predictable performance in the upcoming fiscal periods.

Powell is strategically expanding beyond its traditional oil and gas and petrochemical strengths, aggressively targeting high-growth sectors. This includes significant investment and project development in data centers, electrical utilities, hydrogen production, carbon capture technologies, and battery energy storage systems (BESS).

This move into new markets is crucial for reducing dependence on any single industry. For instance, the global BESS market is projected to reach $130 billion by 2030, presenting a substantial opportunity. Similarly, the data center market is experiencing unprecedented demand, with global data center construction spending expected to exceed $200 billion in 2024 alone.

This diversification directly aligns Powell with major global trends like the energy transition and the build-out of digital infrastructure. The company's ability to capture growth in these emerging areas provides new revenue streams and enhances its overall resilience.

Operational Efficiency and Margin Improvement

Powell's operational efficiency is a significant strength, directly impacting its profitability. The company has demonstrated a clear focus on improving its factory efficiencies, which has translated into tangible financial gains. This strategic emphasis on streamlining operations is a key driver of its financial performance.

The company's commitment to operational discipline is evident in its financial results. Powell achieved a gross profit margin of 29.2% in the fourth quarter of fiscal year 2024. For the full fiscal year 2024, the gross profit margin stood at 27.0%.

These impressive margin improvements are primarily attributed to several factors:

- Higher sales volumes: Increased demand and successful sales initiatives bolstered revenue.

- Strong project execution: Effective management and delivery of projects contributed to better cost control.

- Factory efficiency enhancements: Internal process improvements and investments in productivity led to reduced manufacturing costs.

This operational strength not only enhances current profitability but also positions Powell favorably for sustained financial health and competitive advantage in the market.

Debt-Free Balance Sheet and Cash Position

Powell Industries boasts a remarkably strong financial foundation, highlighted by its debt-free balance sheet. As of June 30, 2024, the company reported a substantial cash and short-term investments balance of $374 million. This healthy liquidity offers significant strategic advantages.

This robust financial position grants Powell Industries considerable flexibility. It can readily pursue strategic investments, such as potential acquisitions or research and development initiatives, without the burden of existing debt obligations. This allows the company to capitalize on growth opportunities and adapt to market changes effectively.

- Debt-Free Status: Powell Industries had zero outstanding debt as of June 30, 2024.

- Cash Reserves: The company maintained $374 million in cash and short-term investments.

- Strategic Flexibility: This financial strength enables the pursuit of acquisitions and other investments.

- Resilience: The lack of debt provides a buffer against economic downturns and market volatility.

Powell's core strength lies in its specialized custom-engineered electrical equipment, catering to demanding industrial needs. Their deep application engineering and project management expertise allow them to tackle complex challenges, fostering client loyalty. This is evidenced by a significant backlog, demonstrating consistent demand for their tailored solutions.

The company has shown impressive financial performance, with substantial revenue growth and a significant increase in net income in fiscal year 2024. This growth is supported by a robust backlog of $1.3 billion as of September 30, 2024, providing strong revenue visibility.

Powell is actively diversifying into high-growth sectors like data centers and battery energy storage, aligning with major global trends. This strategic expansion into markets like data centers, with projected global construction spending exceeding $200 billion in 2024, enhances resilience and opens new revenue streams.

Operational efficiency is a key driver of Powell's profitability, reflected in improved factory efficiencies and strong gross profit margins. In Q4 FY2024, the gross profit margin reached 29.2%, with the full fiscal year at 27.0%, thanks to higher sales volumes, strong project execution, and internal productivity gains.

Furthermore, Powell maintains a strong financial position with a debt-free balance sheet and substantial cash reserves. As of June 30, 2024, the company held $374 million in cash and short-term investments, offering significant strategic flexibility for investments and resilience against market volatility.

| Metric | Value | As of | Significance |

|---|---|---|---|

| Revenue Growth (FY24) | 45% | FY2024 | Demonstrates strong market demand and sales effectiveness. |

| Net Income Growth (FY24) | 175% | FY2024 | Highlights significant improvements in profitability. |

| Backlog | $1.3 billion | September 30, 2024 | Provides strong revenue visibility and stability. |

| Cash and Short-Term Investments | $374 million | June 30, 2024 | Indicates robust liquidity and financial flexibility. |

| Outstanding Debt | $0 | June 30, 2024 | Signifies a strong, unburdened financial structure. |

What is included in the product

Delivers a strategic overview of Powell’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights, reducing strategic overwhelm.

Weaknesses

Powell's reliance on cyclical heavy industries, particularly oil and gas and petrochemicals, presents a significant vulnerability. Even with diversification, these sectors still account for a substantial 50-60% of Powell's revenue. This makes the company highly susceptible to the inherent volatility of commodity prices and broader economic cycles.

When these industries experience downturns or scale back capital expenditures, Powell's financial performance and incoming orders are directly impacted. For instance, a projected 10-15% decrease in global oil and gas capital spending for 2024-2025, as indicated by industry analysts, could translate into reduced demand for Powell's services and products.

Powell's manufacturing facilities are currently running at about 85% capacity. This high utilization rate reflects strong demand but also means there's limited room to quickly ramp up production if new, large orders come in unexpectedly. This situation could hinder their ability to capitalize on sudden market opportunities.

The company has also faced operational challenges that can disrupt its workflow. For instance, Hurricane Beryl in the third quarter of 2024 caused temporary setbacks in production and affected delivery timelines. Such disruptions, even if short-lived, can impact customer satisfaction and revenue streams.

Powell faces stiff competition from established multinational corporations such as ABB, Eaton, General Electric Company, and Schneider Electric. These giants often possess significantly larger R&D budgets and a more extensive global footprint, which can present a considerable hurdle for Powell in capturing market share within specific sectors. For instance, as of early 2024, the combined market capitalization of these competitors far exceeds Powell's, granting them greater financial leverage for market penetration and innovation.

Vulnerability to Supply Chain Disruptions and Material Costs

Powell's reliance on raw materials like steel, copper, and aluminum, along with specialized electrical components, leaves it susceptible to supply chain snags. Unexpected shifts in demand or availability for these key inputs can directly affect production expenses and overall profitability. For instance, a surge in copper prices, which saw significant volatility in late 2023 and early 2024, could compress Powell's gross margins on its electrical equipment if not effectively managed through pricing adjustments or hedging strategies.

The company's manufacturing process is also vulnerable to disruptions in the flow of engineered electrical components, which often have limited suppliers. Any interruption in the availability of these critical parts, whether due to geopolitical events, natural disasters, or manufacturing issues at a supplier's facility, can lead to production delays and increased costs. This was evident in the broader electronics industry throughout 2024, where component shortages continued to pose challenges for manufacturers across various sectors.

- Material Cost Volatility: Fluctuations in the prices of steel, copper, and aluminum directly impact the cost of goods sold for Powell's custom electrical equipment.

- Supply Chain Dependencies: Reliance on a limited number of suppliers for engineered electrical components creates a risk of production interruptions.

- Impact on Margins: Unforeseen increases in material or component costs can squeeze Powell's gross profit margins if not passed on to customers.

- Market Condition Sensitivity: Changes in general market conditions affecting the availability and cost of raw materials pose a continuous threat.

Potential for Normalizing Demand in Emerging Sectors

While Powell Industries has significantly benefited from the surge in demand for AI data centers, a key weakness is the potential for this demand to normalize. As these sectors mature, the rapid growth experienced in 2023 and early 2024 might decelerate, impacting Powell's pricing power and overall growth trajectory in 2025. For instance, while data center construction spending reached an estimated $200 billion globally in 2023, projections for 2025 suggest a more moderate, albeit still strong, expansion rate.

This normalization could be exacerbated by increasing competition within the data center construction and equipment supply market. As more players enter these lucrative segments, pricing pressures may intensify.

- Potential for Demand Normalization: The current high demand for AI data centers, a major growth driver for Powell, may not sustain its current pace into 2025.

- Increased Competition: As the AI data center market grows, it attracts more competitors, potentially eroding Powell's market share and pricing power.

- Pricing Power Erosion: A shift from a seller's market to a more balanced one could reduce Powell's ability to command premium pricing for its solutions.

- Slower Growth Rates: The impressive growth rates seen in recent periods could slow down as the market matures and competition intensifies.

Powell's significant exposure to cyclical industries like oil and gas makes it vulnerable to price volatility and economic downturns. For example, a projected 10-15% decrease in global oil and gas capital spending for 2024-2025 could directly impact Powell's revenue. Furthermore, the company's manufacturing facilities operate at a high 85% capacity, limiting its ability to rapidly scale production for unexpected large orders, potentially hindering the capture of immediate market opportunities.

Same Document Delivered

Powell SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

Opportunities

The global electrical equipment market is set for robust expansion, with projections indicating continued strong growth through 2025. This surge is fueled by escalating electricity demand worldwide, coupled with significant investments in modernizing aging power grids. The push for energy efficiency further underpins this trend, creating a favorable environment for companies like Powell.

Powell's established capabilities in power generation, transmission, and control equipment are particularly well-suited to benefit from these infrastructure investments. The company is positioned to capitalize on the ongoing shift towards smarter, more resilient electrical systems, including the integration of advanced smart grid technologies. These advancements are crucial for managing increased power loads and incorporating renewable energy sources.

Specifically, the global smart grid market alone was valued at approximately $26.4 billion in 2023 and is anticipated to reach around $79.8 billion by 2028, growing at a compound annual growth rate of over 24%. This represents a substantial opportunity for Powell to leverage its expertise in digitalizing and enhancing grid operations.

Powell has a significant opportunity to capitalize on the burgeoning energy transition, particularly in high-growth areas like hydrogen production, carbon capture technologies, and liquefied natural gas (LNG) infrastructure. The company is strategically positioning itself to benefit from the global push towards decarbonization. For instance, the global hydrogen market is projected to reach $700 billion by 2030, and Powell's expansion into this sector could unlock substantial revenue streams.

Furthermore, the increasing demand for battery energy storage systems (BESS) presents another lucrative avenue for Powell. As renewable energy sources like solar and wind become more prevalent, the need for reliable energy storage solutions intensifies. The BESS market is expected to grow from $10 billion in 2022 to over $40 billion by 2027, offering Powell a chance to secure a strong market presence.

Expansion into emerging markets also offers considerable growth potential for Powell. These regions often have rapidly developing energy infrastructures and a growing appetite for cleaner energy solutions. By leveraging its expertise and diversifying its portfolio into these dynamic markets, Powell can achieve significant geographical expansion and tap into new customer bases, thereby enhancing its overall market reach and profitability.

Capital expenditures in oil and gas are on the rise, with projections suggesting they could hit decade highs by 2025. This surge, driven by upstream activities and infrastructure needs, directly translates to a robust demand for Powell's specialized equipment and services. For instance, the International Energy Agency reported in late 2023 that global upstream investment was expected to grow significantly in 2024, a trend likely to continue into 2025.

The petrochemical sector is also seeing increased investment, particularly in new plant construction and upgrades to existing facilities. This expansion creates substantial opportunities for companies like Powell that supply essential components and solutions for these complex industrial processes. Such investments are critical for meeting growing global demand for plastics and chemicals.

Technological Advancements and Product Innovation

The relentless march of electronics technology, particularly in areas like the Internet of Things (IoT) and Artificial Intelligence (AI), is creating a significant surge in demand for sophisticated and energy-efficient electrical equipment. This trend directly translates into opportunities for companies like Powell that can deliver cutting-edge solutions.

Powell is actively capitalizing on this by significantly investing in research and development. This commitment is already yielding new product introductions designed to meet the evolving needs of high-growth sectors. For instance, their launch of IEC-compliant grounding switches and compact substations specifically tailored for Battery Energy Storage Systems (BESS) and data centers demonstrates a clear strategy to enhance their market offerings and solidify their competitive edge in these rapidly expanding markets.

- R&D Investment: Powell's strategic focus on R&D is crucial for staying ahead in the fast-evolving electrical equipment sector.

- IoT & AI Driven Demand: The growth of IoT and AI is a key market driver, increasing the need for advanced electrical infrastructure.

- Product Innovation: New products like IEC-compliant grounding switches and compact substations cater to emerging needs in BESS and data centers.

- Market Competitiveness: These innovations are designed to enhance Powell's market position and capture new opportunities.

Strategic Acquisitions and Geographic Expansion

Powell's robust financial health, marked by a strong cash position and the absence of debt, presents a significant opportunity for strategic acquisitions. This financial agility allows the company to explore acquiring businesses that could broaden its product offerings, enhance its technological expertise, or extend its market presence into new regions. In early 2024, Powell reported a cash and cash equivalents balance of $150 million, demonstrating its capacity to fund substantial growth initiatives.

Furthermore, untapped growth avenues exist by penetrating new electrical markets. This can be achieved by establishing stronger relationships with original equipment manufacturers (OEMs) and by optimizing existing distribution channels. For instance, in 2023, Powell saw a 15% revenue increase from its OEM partnerships, signaling the potential for further expansion in this segment.

- Strategic Acquisitions: Leverage $150 million in cash reserves to acquire companies that complement existing product lines or offer new technological capabilities.

- Geographic Expansion: Target underserved or emerging markets, potentially through joint ventures or direct entry, to increase global market share.

- OEM Partnerships: Deepen relationships with key original equipment manufacturers to integrate Powell's components into a wider range of end products.

- Distribution Channel Optimization: Enhance reach and efficiency within existing distribution networks, possibly by adding new partners or improving logistics.

Powell is well-positioned to benefit from the increasing global demand for advanced electrical equipment driven by IoT and AI technologies. Strategic investments in R&D have led to innovative products, such as IEC-compliant grounding switches for BESS and data centers, enhancing their market competitiveness. The company's strong financial health, with $150 million in cash and no debt as of early 2024, also provides a significant opportunity for strategic acquisitions to expand its product portfolio and market reach.

Threats

Economic downturns pose a significant threat to Powell. Broader economic slowdowns or recessions often trigger substantial reductions in capital expenditure by heavy industries. This directly impacts the demand for Powell's custom-engineered solutions, as companies in cyclical sectors may postpone or cancel large infrastructure projects when faced with economic uncertainty. For example, a sharp contraction in global manufacturing output, as seen in some forecasts for late 2024 and early 2025, could translate into fewer orders for Powell's specialized equipment.

Powell is contending with a crowded marketplace, facing rivals ranging from global giants to nimble regional specialists. This intense competition often translates into significant pricing pressure, potentially squeezing Powell's profit margins. For instance, in the broader electrical equipment sector, a 2024 industry report highlighted an average gross margin decline of 1.5% across key players due to aggressive pricing tactics by competitors seeking market share.

The electrical equipment industry is inherently competitive, and Powell must remain vigilant. The emergence of new players or the adoption of aggressive market expansion strategies by existing competitors could directly threaten Powell's existing market share. Recent data from 2025 indicates that companies investing heavily in product innovation and targeted market penetration strategies have seen their market share grow by as much as 3% in the last fiscal year, a trend Powell must counter.

Powell faces a significant threat from the unpredictable swings in commodity prices, particularly for essential materials like steel, copper, and aluminum. These metals represent a substantial chunk of Powell's expenses, meaning any sharp increase directly hits their bottom line by inflating the cost of goods sold.

For instance, if Powell has secured contracts at a fixed price and then experiences an unexpected surge in steel costs, their profit margins could be significantly compressed. The London Metal Exchange reported that copper prices, a key input for many electrical components, saw volatility in early 2024, trading within a range of $7,500 to $10,000 per metric ton, illustrating the potential for cost erosion.

Regulatory Changes and Environmental Policies

Evolving environmental regulations, particularly those pushing for decarbonization, present a significant threat. While these policies can spur innovation in renewable energy, they also risk stifling investment in traditional energy infrastructure if the transition isn't managed smoothly. For instance, stricter emissions standards for oil and gas operations, a core area for companies like Powell, could necessitate substantial capital expenditures for compliance or lead to asset write-downs if operations become uneconomical. The International Energy Agency's (IEA) projections indicate a need for trillions in clean energy investment, but the pace of transition and potential stranded assets in fossil fuels remain a concern for companies heavily invested in the sector.

Compliance with increasingly stringent environmental standards demands considerable financial outlay. Powell, like other major energy players, will likely face elevated costs for pollution control, carbon capture technologies, and adapting existing infrastructure to meet new mandates. Failure to comply can result in hefty fines and reputational damage, further impacting financial performance. For example, the estimated cost of decarbonizing the global energy system by 2050 runs into the tens of trillions, with significant portions of this burden falling on existing energy producers to upgrade or decommission assets.

- Accelerated fossil fuel phase-out: Policies mandating rapid reductions in carbon emissions could devalue existing oil and gas reserves and infrastructure.

- Increased compliance costs: Implementing new environmental technologies and operational changes to meet stricter regulations can significantly raise capital and operating expenses.

- Regulatory uncertainty: The unpredictable nature of future environmental legislation creates a challenging investment climate, potentially deterring long-term capital allocation.

- Carbon pricing mechanisms: The expansion of carbon taxes or cap-and-trade systems directly increases the cost of emissions-intensive operations.

Supply Chain Disruptions and Geopolitical Risks

Global supply chains remain a significant vulnerability for Powell. Recent years have highlighted how easily disruptions, whether from natural disasters, pandemics, or logistical bottlenecks, can delay the receipt of essential components and raw materials. This directly impacts production schedules and the ability to meet delivery timelines, as witnessed by widespread shortages in various industries.

Geopolitical instability further magnifies these threats. Tensions between nations can restrict the availability of critical materials, disrupt shipping routes, and make international project execution considerably more complex and costly. For instance, the ongoing conflicts in Eastern Europe and the Middle East have demonstrably affected energy prices and the flow of key commodities.

- Supply Chain Vulnerabilities: Continued reliance on concentrated manufacturing hubs creates ongoing risks for component availability.

- Geopolitical Impact: Trade disputes and regional conflicts can lead to sudden price hikes and restricted access to vital resources.

- Logistical Challenges: Port congestion and transportation capacity constraints, while easing from peak 2021 levels, still pose a threat to timely deliveries.

- Material Cost Volatility: Fluctuations in the cost of raw materials, such as rare earth minerals essential for certain technologies, can impact profit margins.

Powell's profitability is directly threatened by intense competition, which can lead to price wars and reduced profit margins. For example, a 2024 industry analysis indicated that companies in the electrical equipment sector experienced an average gross margin compression of 1.5% due to aggressive competitor pricing aimed at gaining market share.

The company also faces risks associated with volatile commodity prices, as increases in materials like copper and steel can significantly inflate costs. Copper prices, a key input, saw notable fluctuations in early 2024, trading between $7,500 and $10,000 per metric ton, underscoring this vulnerability.

Furthermore, evolving environmental regulations and the transition away from fossil fuels present a substantial threat, potentially increasing compliance costs and impacting demand for infrastructure supporting traditional energy sources. The IEA projects trillions in clean energy investment, suggesting a challenging landscape for companies with significant exposure to older energy technologies.

| Threat Category | Specific Risk | Impact Example | Data Point (2024/2025) |

|---|---|---|---|

| Competition | Price Pressure | Eroding profit margins | Average 1.5% gross margin decline in sector (2024) |

| Commodity Prices | Material Cost Increases | Higher cost of goods sold | Copper price volatility: $7,500-$10,000/metric ton (early 2024) |

| Environmental Regulations | Increased Compliance Costs | Higher capital and operating expenses | Trillions needed for global energy system decarbonization (IEA projections) |

SWOT Analysis Data Sources

The Powell SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market research, and valuable expert opinions to provide a well-rounded perspective.