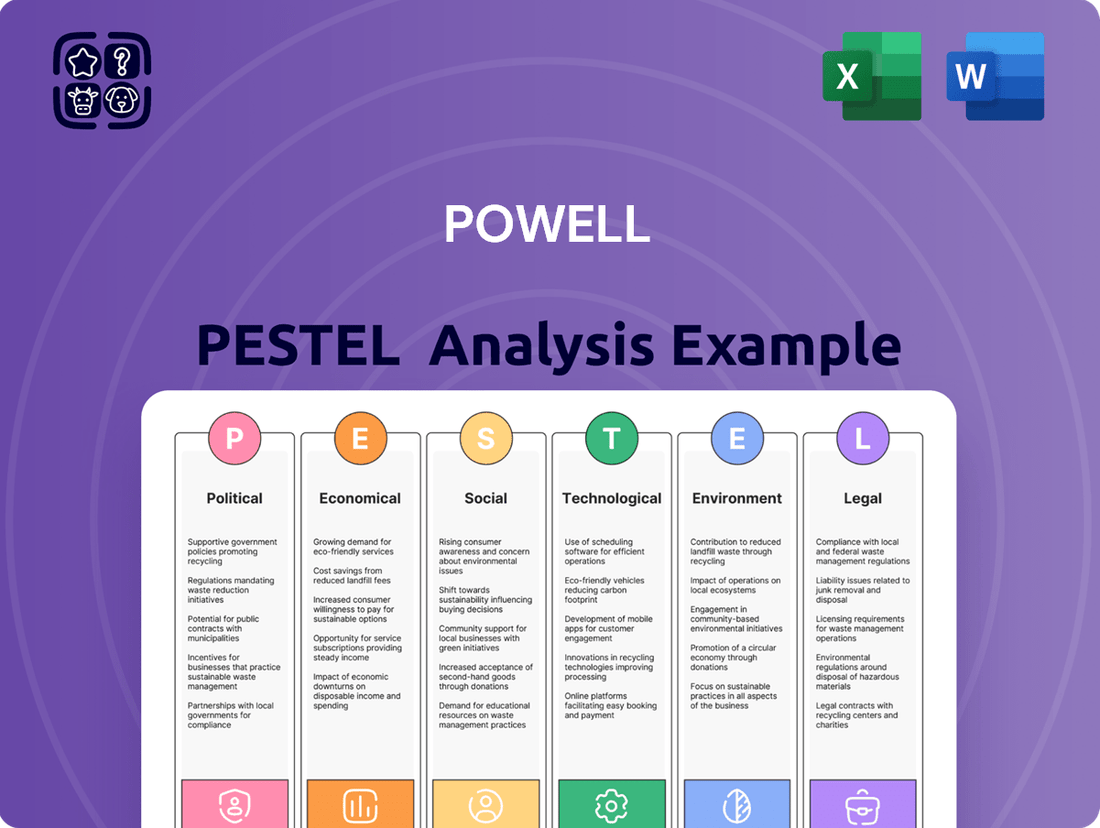

Powell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Powell Bundle

Understand the intricate web of external forces shaping Powell's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. Gain a competitive edge by leveraging these expert-driven insights to inform your strategic planning. Don't be left in the dark; download the full PESTLE analysis today to unlock actionable intelligence and make more informed decisions.

Political factors

Powell Industries stands to gain substantially from increased government investment in infrastructure, particularly in areas like power grids and transportation. For instance, the U.S. Infrastructure Investment and Jobs Act of 2021 allocated approximately $65 billion for grid modernization, a key area where Powell offers its custom-engineered solutions.

This surge in public spending on upgrading aging electrical infrastructure and building new energy transmission networks directly translates into higher demand for Powell's specialized products and services. The ongoing focus on grid resilience and expansion creates a predictable and expanding market.

Government initiatives aimed at modernizing the nation's power infrastructure are a significant tailwind for Powell. As of early 2024, projections indicated continued robust federal spending in this sector, supporting Powell's order backlog and future revenue streams.

Global energy policies are increasingly focused on transitioning away from fossil fuels and decarbonizing economies, directly impacting companies like Powell that operate within the energy infrastructure sector. These policies, aimed at promoting renewable energy integration and developing smarter, more resilient grids, present both challenges and significant opportunities for Powell's electrical distribution and control systems. For instance, as of early 2024, many nations are setting ambitious renewable energy targets; the US aims for 100% clean electricity by 2035, while the EU targets a 42.5% share of renewables in its gross final energy consumption by 2030.

The growing emphasis on cleaner energy sources is fueling a substantial need for upgrades to existing grid infrastructure. This transition necessitates investments in modernizing substations, enhancing transmission and distribution networks, and integrating distributed energy resources, all areas where Powell's expertise and product offerings are crucial. The global grid modernization market is projected to reach over $200 billion by 2027, highlighting the scale of this opportunity.

Changes in international trade policies, including tariffs and trade agreements, directly impact Powell's operating environment. For instance, the US-China trade dispute saw tariffs imposed on various goods, potentially increasing costs for imported components used in Powell's manufacturing processes. Fluctuations in these trade relations can significantly affect the cost of raw materials and components, influencing production expenses and necessitating adjustments in pricing strategies.

As a company with global operations and a diverse customer base, Powell is particularly sensitive to shifts in trade agreements. For example, the renegotiation of trade deals like the USMCA (United States-Mexico-Canada Agreement) can alter market access and competitive landscapes. Geopolitical tensions, such as those experienced in Eastern Europe in 2022 and 2023, can further disrupt global supply chains, leading to unexpected delays and increased logistics costs for companies like Powell.

Geopolitical Stability

Powell Industries operates in sectors like oil and gas, refining, and petrochemicals, many of which are located in regions prone to geopolitical instability. For example, the Middle East, a significant hub for these industries, has experienced ongoing tensions that can directly affect operations and supply chains. In 2024, global oil markets continued to be influenced by geopolitical events, with Brent crude prices fluctuating significantly due to conflicts in Eastern Europe and the Middle East, impacting capital expenditure decisions by Powell's clients.

Political unrest or conflicts in these key operational areas can lead to significant disruptions. These disruptions can delay project schedules, leading to increased costs and impacting Powell's revenue streams. Furthermore, such instability can cause customers to postpone or reduce their investments in new equipment and services, creating demand uncertainty. Powell's ability to navigate these risks relies heavily on thorough risk assessment and strategic market diversification to mitigate the impact of localized geopolitical events.

- Geopolitical Risk Exposure: Powell's target industries are often situated in regions with a higher propensity for political instability, such as parts of the Middle East and Africa.

- Impact on Demand: Geopolitical tensions can lead to volatile energy prices, directly affecting the capital expenditure budgets of Powell's clients in the oil and gas sector. For instance, a significant escalation of conflict in 2024 could have triggered a pullback in new project announcements.

- Operational Disruptions: Political instability can impede the delivery of goods and services, affect workforce availability, and increase security costs for projects in affected regions.

- Market Diversification Strategy: To counter these risks, Powell likely employs a strategy of diversifying its customer base and project locations to spread exposure and reduce reliance on any single volatile region.

Industrial and Safety Regulations

Powell operates within industries governed by stringent industrial and safety regulations, making compliance a critical aspect of their business. The company's equipment and systems must meet these exacting standards to ensure safe operation and market acceptance. For instance, in 2024, regulatory bodies continued to emphasize enhanced safety protocols for electrical infrastructure, including stricter guidelines around arc flash mitigation. This ongoing focus directly impacts Powell's product development, driving demand for their advanced, high-safety solutions.

The evolving landscape of safety standards presents both challenges and opportunities for Powell. As new regulations are introduced or existing ones are updated, Powell is compelled to innovate. A prime example is the increasing scrutiny on electrical work near energized equipment, which necessitates the development of specialized safety features. This regulatory push ensures a consistent market for Powell's compliant products, as businesses prioritize safety and risk reduction. In 2025, it's anticipated that regulations concerning energy efficiency and the integration of renewable energy sources will also influence the design and functionality of electrical distribution equipment.

- Regulatory Compliance: Powell must adhere to safety standards like those set by OSHA for workplace safety and NFPA 70E for electrical safety in the workplace.

- Product Innovation: Updates to regulations, such as those addressing arc flash hazards, directly fuel demand for Powell's safer equipment.

- Market Demand: Companies are increasingly investing in compliant, high-safety solutions to mitigate risks and avoid penalties, benefiting Powell.

- Industry Trends: The 2024-2025 period has seen a heightened focus on safety in critical infrastructure and manufacturing sectors, impacting Powell's market.

Government investment in infrastructure, especially grid modernization, directly benefits Powell. The U.S. Infrastructure Investment and Jobs Act of 2021, with its $65 billion allocation for grid upgrades, highlights this. This sustained public spending on electrical infrastructure supports Powell's order backlog and future revenue.

Global energy policies promoting renewables and decarbonization create opportunities for Powell's grid solutions. Ambitious targets, like the US aiming for 100% clean electricity by 2035, drive demand for modernizing substations and transmission networks, a market projected to exceed $200 billion by 2027.

Changes in international trade policies and geopolitical tensions can affect Powell's costs and market access. For example, tariffs on components or disruptions in regions like the Middle East, a key area for Powell's clients in oil and gas, can impact project timelines and client investment decisions.

Powell must adhere to stringent industrial and safety regulations. In 2024-2025, heightened focus on electrical safety, like arc flash mitigation, drives demand for Powell's compliant, high-safety solutions as companies prioritize risk reduction and avoid penalties.

What is included in the product

The Powell PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing Powell across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

Provides a clear, actionable framework that helps businesses proactively identify and mitigate external threats and opportunities, thereby reducing uncertainty and strategic risk.

Economic factors

Global capital expenditures (CAPEX) in heavy industries like oil and gas, refining, petrochemicals, and power generation are critical for Powell's revenue. Projections for 2024 and 2025 indicate a significant uptick, with the International Energy Agency (IEA) forecasting global energy investment to reach $3 trillion in 2024, a 10% increase from the previous year, driven largely by energy security concerns and the ongoing energy transition.

Specifically, the oil and gas sector is experiencing renewed investment, with anticipated CAPEX growth of around 7% in 2024, according to industry analysts. This surge in spending on exploration, production, and infrastructure directly translates into increased demand for Powell's electrical equipment and integrated solutions, particularly for projects focused on expanding energy supply and modernizing existing facilities.

The energy transition is also a major driver, influencing the allocation of this capital. While traditional fossil fuel investments remain robust, there's a notable increase in CAPEX directed towards renewable energy infrastructure, grid modernization, and electrification projects. For instance, investments in clean energy technologies are projected to surpass fossil fuel investments for the first time in 2024, creating new avenues for Powell's specialized offerings in these evolving segments.

Fluctuations in commodity prices, particularly for oil and natural gas, are a major driver for Powell's business. When energy prices are high and steady, companies in the oil and gas sector are more likely to invest in new projects and upgrades. This directly translates to increased demand for Powell's electrical infrastructure solutions, as these projects require robust power systems.

For example, in early 2024, oil prices generally held above $70 per barrel, a level that typically supports increased capital expenditure in the upstream sector. This stability encouraged many of Powell's customers to move forward with planned projects, boosting order volumes. Conversely, a sharp drop in crude oil prices, such as those seen in some periods of 2023 where prices dipped below $70, can lead to project deferrals and a slowdown in new equipment orders.

Natural gas prices also play a crucial role. In the winter of 2024-2025, anticipated demand and supply dynamics will influence natural gas prices, impacting the economic viability of new gas-fired power plants and infrastructure expansions. If prices remain favorable, Powell can expect continued opportunities in this segment.

Inflationary pressures in 2024 and 2025 continue to present challenges for companies like Powell. For instance, the US Producer Price Index (PPI) for finished goods saw a notable increase in early 2024, indicating rising costs for manufacturers. This directly translates to higher expenses for raw materials, components, and labor, potentially squeezing Powell's profit margins if these costs cannot be fully passed on to customers.

Furthermore, the interest rate environment is a critical consideration. As of mid-2024, central banks globally have maintained relatively higher interest rates to combat inflation. This increases the cost of borrowing for businesses undertaking large capital expenditures. For Powell, this could mean that potential customers delay or scale back investments in new, high-value industrial equipment due to higher financing costs, thereby impacting demand for Powell's products.

Effectively managing these inflationary cost pressures and the impact of higher interest rates on customer investment decisions is paramount for Powell's sustained profitability and market position. Companies must focus on operational efficiencies and strategic pricing to navigate these economic headwinds.

Supply Chain Costs and Disruptions

Global supply chains continue to face persistent disruptions, significantly impacting logistics and raw material availability. For instance, ocean freight rates, while moderating from their 2021 peaks, remained notably higher in early 2024 compared to pre-pandemic levels, adding to production expenses. These elevated transportation costs, coupled with ongoing shortages of key components, directly affect companies like Powell by increasing their cost of goods sold and potentially delaying product delivery.

These persistent challenges necessitate robust supply chain strategies. Companies must focus on building resilience through diversification of suppliers and logistics partners to avoid over-reliance on single sources or routes. Agile inventory management, including strategic warehousing and buffer stock, is also crucial for mitigating the impact of unexpected delays and shortages.

- Elevated Shipping Costs: The cost of shipping a 40-foot container from Asia to Europe, while down from its 2021 highs, saw an average increase of approximately 50% in early 2024 compared to 2019 averages.

- Raw Material Volatility: Prices for critical metals like copper and lithium, essential for many manufacturing processes, experienced price swings of over 20% within the first half of 2024 due to demand shifts and geopolitical factors.

- Lead Time Extensions: Average manufacturing lead times for certain electronic components extended by an estimated 15-25% in 2024, impacting production schedules.

- Logistics Bottlenecks: Port congestion, though improved, still contributed to an average increase of 10-15% in overall delivery times for goods requiring international transit throughout 2024.

Global Economic Growth and Industrial Output

The global economic outlook significantly impacts Powell's business by shaping demand for its electrical infrastructure solutions. A healthy global economy, characterized by strong industrial output, translates directly into higher demand for Powell's custom-engineered electrical equipment across manufacturing, utilities, and transportation. For instance, projections for 2024 and 2025 indicate moderate but steady global GDP growth, which should stimulate investment in infrastructure and industrial upgrades.

Industrial output is a key indicator for Powell. When factories are busy and expanding, they require more robust and advanced electrical systems. The International Monetary Fund (IMF) projected global growth of 3.2% for 2024, a figure that, if realized, would likely support increased capital expenditure in industrial sectors. This spending often includes modernization and expansion of electrical infrastructure, directly benefiting companies like Powell.

- Global GDP Growth: The IMF forecast a 3.2% global GDP growth for 2024, suggesting a supportive environment for industrial investment.

- Industrial Production Trends: Manufacturing PMIs (Purchasing Managers' Index) across major economies will be crucial indicators for industrial activity and subsequent demand for electrical infrastructure.

- Infrastructure Spending: Government initiatives and private sector investments in energy grids, transportation networks, and manufacturing facilities directly correlate with Powell's revenue potential.

- Emerging Market Growth: Developing economies often exhibit higher growth rates in industrial output, presenting significant opportunities for Powell's expansion.

Economic factors significantly influence Powell's performance, with global capital expenditures in energy and heavy industries being a primary driver. Projections for 2024 and 2025 show a robust increase in energy investment, expected to reach $3 trillion in 2024, with oil and gas CAPEX growing around 7%. This heightened activity directly translates to increased demand for Powell's electrical solutions, especially as investments diversify into renewable energy infrastructure and grid modernization.

Commodity price volatility, particularly for oil and natural gas, directly impacts customer investment decisions. Stable oil prices above $70 per barrel in early 2024 supported project advancement, boosting Powell's order volumes. Conversely, inflationary pressures, evidenced by rising producer prices in early 2024, increase Powell's operational costs, potentially affecting profit margins if not managed through pricing strategies.

Higher interest rates, maintained by central banks in mid-2024 to curb inflation, increase borrowing costs for capital-intensive projects, potentially delaying customer investments. Furthermore, persistent supply chain disruptions, with elevated shipping costs and extended lead times for components in 2024, add to Powell's expenses and impact delivery schedules, necessitating resilient supply chain strategies.

The global economic outlook, with projected 3.2% GDP growth for 2024 according to the IMF, generally supports industrial investment. Stronger industrial output signals higher demand for Powell's electrical infrastructure. However, factors like raw material price swings, such as over 20% volatility for copper in early 2024, and extended manufacturing lead times for electronic components, present ongoing challenges.

| Economic Factor | 2024/2025 Data/Trend | Impact on Powell |

|---|---|---|

| Global Energy CAPEX | Forecasted $3 trillion in 2024 (10% increase YoY) | Increased demand for electrical infrastructure |

| Oil & Gas CAPEX Growth | Estimated 7% growth in 2024 | Directly boosts demand for Powell's solutions |

| Clean Energy Investment | Projected to surpass fossil fuels in 2024 | New opportunities in renewable and grid modernization segments |

| Oil Prices (Early 2024) | Generally above $70/barrel | Supports customer project advancement and orders |

| Inflation (US PPI) | Notable increase in early 2024 | Increases Powell's raw material and labor costs |

| Interest Rates (Mid-2024) | Relatively higher | Increases borrowing costs for Powell's customers, potentially delaying investment |

| Shipping Costs (Asia-Europe) | Approx. 50% higher in early 2024 vs. 2019 | Adds to Powell's cost of goods sold and logistics expenses |

| Raw Material Volatility (Copper) | Over 20% swings in H1 2024 | Impacts production costs and inventory management |

| Component Lead Times | Extended 15-25% in 2024 | Affects production schedules and product delivery |

| Global GDP Growth | IMF projects 3.2% for 2024 | Supports overall industrial investment and demand |

Full Version Awaits

Powell PESTLE Analysis

The preview you see here is the exact Powell PESTLE Analysis document you’ll receive after purchase. It's fully formatted and ready to be applied to your strategic planning. You can trust that the detailed insights into political, economic, social, technological, legal, and environmental factors affecting Powell are presented clearly. This comprehensive analysis is delivered as is, ensuring you have the complete picture without any surprises.

Sociological factors

The manufacturing sector, particularly in specialized electrical equipment, continues to grapple with a noticeable shortage of available workers and a widening skills gap. This persistent issue directly impacts companies like Powell, posing challenges in recruiting and keeping essential talent, such as skilled engineers, technicians, and production staff. Such difficulties can consequently constrain production output and hinder the pace of innovation.

For instance, in late 2023, the U.S. manufacturing sector reported over 800,000 unfilled positions, underscoring the broad nature of this workforce challenge. This scarcity of skilled labor means Powell may need to allocate significant resources towards robust training programs and comprehensive talent development initiatives to ensure a qualified workforce is available to meet operational and growth demands.

Societies are increasingly prioritizing workplace safety, especially in demanding sectors like heavy industry. This shift directly benefits companies like Powell, whose expertise lies in creating reliable electrical systems. For instance, the Occupational Safety and Health Administration (OSHA) reported a notable decrease in workplace fatalities in recent years, underscoring this growing emphasis.

Powell's specialized products, such as arc-resistant switchgear and sophisticated monitoring systems, are essential for maintaining safe operations within complex electrical infrastructures. These solutions directly address the heightened demand for enhanced protective measures in industrial environments.

This societal push for safety translates into increased market opportunities for Powell. As industries invest more in safeguarding their workers and assets, the demand for advanced, safety-engineered equipment, like that provided by Powell, is expected to grow significantly.

Societal expectations for corporate social responsibility (CSR) are notably on the rise, impacting companies like Powell. Consumers and investors alike are increasingly scrutinizing how businesses manage their social and environmental footprint, with ethical labor practices and robust community engagement becoming key metrics. For instance, a 2024 report indicated that over 60% of consumers consider a company's CSR initiatives when making purchasing decisions.

Powell's commitment to high CSR standards directly influences its public image and ability to attract top talent. Companies demonstrating genuine dedication to social responsibility often see improved brand loyalty and a stronger connection with their customer base. In 2025, for example, companies with strong ESG (Environmental, Social, and Governance) scores have shown a tendency to outperform their peers financially, with some studies suggesting a 3-5% higher return on equity.

Energy Transition and Public Perception

Societal demand for decarbonization significantly impacts Powell's operational context, even as it serves traditional oil and gas clients. Public perception increasingly favors renewable energy, influencing investment decisions and potentially redirecting capital away from fossil fuels. This shift creates both challenges and opportunities for companies like Powell to adapt their service offerings.

The growing emphasis on sustainable energy sources directly affects customer investment priorities. As awareness of climate change intensifies, clients are more likely to allocate resources towards greener alternatives and grid modernization projects. For instance, a global survey in early 2024 indicated that over 70% of consumers are willing to pay more for products from companies committed to environmental sustainability.

This societal push can lead to a gradual but persistent shift in demand. Powell may see increased interest in its capabilities related to electrical solutions and infrastructure upgrades that support renewable energy integration. By 2025, projections suggest that investments in renewable energy infrastructure globally could reach trillions, highlighting the scale of this transition.

- Growing Public Demand for Renewables: Surveys in 2024 showed a significant majority of consumers favoring sustainable energy solutions.

- Investment Prioritization Shift: Societal pressure for decarbonization is prompting clients to re-evaluate and shift investment towards cleaner energy.

- Market Opportunities in Grid Modernization: The transition to renewables necessitates upgrades to electrical grids, presenting new project avenues.

- Global Investment Trends: Anticipated multi-trillion dollar investments in renewables by 2025 underscore the market's trajectory.

Aging Infrastructure and Modernization Needs

The global industrial landscape is characterized by aging infrastructure, particularly in critical sectors like oil and gas, refining, and power generation. This presents a substantial market opportunity for companies like Powell, which specializes in electrical systems and services. As these facilities age, the demand for upgrades, replacements, and modernization of electrical infrastructure escalates to ensure operational safety and efficiency.

Societal expectations for reliable power are increasing, intensifying the need for robust and up-to-date electrical systems. For instance, the U.S. Department of Energy reported that in 2023, the average age of power plants in the United States was around 30 years, highlighting a widespread need for modernization. This trend necessitates significant investment in new equipment and retrofitting existing systems, directly benefiting companies capable of providing these solutions.

- Aging Infrastructure: Many industrial facilities, especially in the energy sector, were built decades ago and are reaching or have surpassed their intended lifespans, requiring extensive upgrades.

- Modernization Demand: There's a growing societal and regulatory pressure for enhanced safety, efficiency, and environmental compliance in industrial operations, driving demand for modern electrical systems.

- Market Opportunity: The need to replace or upgrade aging electrical components and systems in sectors like oil and gas, refining, and power generation creates a significant and ongoing market for Powell's expertise.

- Reliability Expectations: Increased reliance on a stable power supply means that any disruption due to infrastructure failure is unacceptable, pushing operators to invest in more dependable and modern electrical solutions.

Societal focus on safety and reliable energy infrastructure directly benefits Powell. As industries prioritize worker protection and uninterrupted operations, demand for advanced electrical systems that mitigate risks and ensure continuity is rising. For example, in 2024, energy sector investments in grid modernization and safety upgrades were projected to exceed $50 billion globally, reflecting this trend.

Technological factors

Technological advancements in smart grid solutions and the broader wave of digitalization, often referred to as Industry 4.0, are fundamentally reshaping the electrical infrastructure market. These innovations are creating a more intelligent, responsive, and efficient energy landscape.

Powell is strategically positioned to benefit from this transformation. Its expertise in monitoring and control communication systems directly addresses the increasing demand for interconnected electrical systems. This allows for real-time data analysis, which is crucial for predictive maintenance, thereby reducing downtime and operational costs.

The push towards optimized energy management is another significant driver. Smart grids enable utilities and consumers to better understand and control energy usage, leading to improved efficiency and sustainability. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow significantly in the coming years, with projections reaching upwards of $70 billion by 2028, indicating a robust demand Powell can tap into.

The increasing integration of AI and Machine Learning in industrial automation presents significant opportunities for Powell. For instance, AI-driven predictive maintenance can reduce downtime, with studies suggesting it can cut maintenance costs by up to 25% and improve equipment availability by 10-15%.

Powell can leverage AI to optimize energy distribution within its operations and for its custom-engineered systems. This efficiency gain is crucial as energy costs continue to be a significant factor, with industrial electricity prices in the US seeing a notable increase in recent years, impacting overall operational expenses.

Furthermore, AI and ML can enhance the efficiency and performance of Powell's custom-engineered systems, offering customers tangible benefits like improved throughput or reduced waste. This technological advancement could also spur the development of new, AI-powered product offerings, opening up fresh revenue streams.

The increasing reliance on renewable energy, such as solar and wind power, drives the demand for sophisticated electrical equipment. This equipment is crucial for seamlessly integrating these variable sources into the power grid, managing energy storage, and converting power efficiently. For instance, by the end of 2024, global renewable energy capacity is projected to reach over 5,000 GW, highlighting the scale of this transition.

Powell's established strengths in electrical distribution and control systems are directly relevant to this trend. The company is well-positioned to innovate and provide the necessary hardware and software solutions that enable the stable and effective incorporation of renewables into established power infrastructure. This includes advanced inverters, smart grid technologies, and energy management systems.

Cybersecurity for Industrial Control Systems

As industrial electrical infrastructure becomes increasingly digitized and interconnected, the risk of cyberattacks targeting operational technology (OT) systems is escalating. Powell must prioritize integrating advanced cybersecurity measures into its monitoring and control systems to safeguard critical industrial processes from disruptions and potential data breaches, a significant and growing concern across heavy industries.

The increasing sophistication of cyber threats necessitates continuous investment in OT security. For instance, reports from 2024 indicate a substantial rise in ransomware attacks specifically targeting critical infrastructure sectors, with estimated financial damages reaching billions globally. Powell's commitment to cybersecurity is not just about protecting data but ensuring the uninterrupted operation of essential services.

Key technological considerations for Powell's cybersecurity strategy include:

- Implementing Zero Trust Architecture: Verifying every access request, regardless of origin, to minimize the attack surface.

- Regular Vulnerability Assessments and Patch Management: Proactively identifying and addressing weaknesses in OT systems to prevent exploitation.

- Advanced Threat Detection and Response (EDR/XDR): Employing sophisticated tools to detect and respond to malicious activities in real-time.

- Employee Training and Awareness Programs: Educating staff on cybersecurity best practices to mitigate human-factor risks.

Modular and Prefabricated Electrical Solutions

The increasing adoption of modular and prefabricated electrical solutions is significantly reshaping project delivery in the power sector. This trend offers substantial efficiency gains, with companies like Powell leveraging custom-engineered modules and integrated power control room substations to meet this demand. For instance, the global modular power substations market was valued at approximately USD 8.5 billion in 2023 and is projected to reach over USD 14 billion by 2030, demonstrating robust growth driven by these efficiency benefits.

Powell's strategic alignment with this modularization trend allows for accelerated deployment and a marked reduction in on-site construction timelines. This translates directly into potential cost savings for their clientele. The ability to pre-fabricate and test components off-site minimizes on-site labor requirements and associated risks, a critical factor in today's competitive market. Powell's integrated approach, combining power control room substations with modular designs, further streamlines the process.

- Faster Project Completion: Reduced on-site assembly time directly impacts project schedules.

- Cost Efficiencies: Lower labor needs and minimized on-site waste contribute to overall project cost reduction.

- Quality Control: Off-site fabrication in controlled environments often leads to higher and more consistent product quality.

- Improved Safety: Moving complex assembly processes to a factory setting inherently reduces on-site safety risks.

The electrical infrastructure market is undergoing a significant transformation driven by digitalization and smart grid technologies, often termed Industry 4.0. Powell's expertise in monitoring and control systems is well-aligned with the growing need for interconnected and intelligent energy networks, enhancing efficiency and enabling predictive maintenance. For example, the global smart grid market was valued at around $30 billion in 2023 and is expected to exceed $70 billion by 2028.

AI and machine learning are increasingly integrated into industrial automation, offering substantial benefits like reduced downtime and improved equipment availability. Studies suggest AI-driven predictive maintenance can lower maintenance costs by up to 25%. Powell can leverage these technologies to optimize its own operations and enhance its custom-engineered systems, leading to improved performance and potentially new revenue streams.

The expansion of renewable energy sources, such as solar and wind, necessitates advanced electrical equipment for grid integration and energy management. By the end of 2024, global renewable energy capacity is anticipated to surpass 5,000 GW. Powell's core competencies in electrical distribution and control systems position it to provide essential hardware and software for the stable integration of these variable energy sources.

Cybersecurity is paramount as industrial electrical infrastructure becomes more digitized and interconnected, with OT systems facing escalating threats. Reports from 2024 highlight a significant increase in ransomware attacks targeting critical infrastructure, causing billions in financial damages globally. Powell must prioritize robust cybersecurity measures, including Zero Trust Architecture and advanced threat detection, to ensure operational continuity.

| Technology Trend | Impact on Electrical Infrastructure | Powell's Opportunity/Challenge | Market Data/Projections |

|---|---|---|---|

| Digitalization & Smart Grids | Increased efficiency, real-time monitoring, predictive maintenance | Leverage expertise in monitoring and control systems; capitalize on growing market | Global smart grid market: ~$30B (2023) to >$70B (2028) |

| AI & Machine Learning | Optimized energy management, enhanced predictive maintenance | Improve operational efficiency, develop AI-powered products | AI predictive maintenance can cut costs by up to 25% |

| Renewable Energy Integration | Need for advanced grid integration, energy storage solutions | Provide hardware/software for stable renewable integration | Global renewable capacity >5,000 GW (end of 2024) |

| Cybersecurity Threats | Risk to OT systems, data breaches, operational disruptions | Prioritize robust cybersecurity measures; protect critical infrastructure | Ransomware attacks on critical infrastructure cause billions in damages annually |

Legal factors

Environmental compliance regulations, covering areas like emissions, waste, and energy efficiency, significantly influence the sectors Powell operates within. For instance, in 2024, the global renewable energy market reached an estimated $1.3 trillion, driven partly by stringent environmental mandates.

These compliance demands can spur customer interest in Powell’s more energy-efficient electrical equipment and systems. This trend is particularly evident as companies aim to lower their carbon footprints; for example, by 2025, many nations are expected to implement stricter emissions standards for industrial machinery.

This focus on sustainability can unlock new market opportunities for Powell, positioning its offerings as solutions for customers facing increasing environmental scrutiny. The demand for green building technologies, a sector influenced by these regulations, is projected to grow by over 10% annually through 2027.

As a manufacturer of critical electrical equipment, Powell operates under a complex web of product safety and liability laws. These regulations are designed to protect consumers and industrial users from potential harm caused by faulty or unsafe products. For Powell, compliance isn't just a legal obligation; it's fundamental to their business. For example, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 100,000 product-related injuries in electrical product categories, highlighting the tangible risks involved.

Meeting and exceeding industry safety standards, such as those for arc-resistant designs in switchgear, is paramount. This proactive approach directly mitigates legal risks, preventing costly lawsuits and potential recalls. Powell's commitment to safety, evidenced by their adherence to standards like IEEE C37.20.7 for arc flash mitigation, directly translates into safeguarding their reputation and fostering customer trust in demanding industrial settings.

International trade laws, including sanctions and export controls, significantly impact Powell's global reach. For instance, the United States' continued export controls on advanced technologies, particularly those related to semiconductors, could restrict Powell's access to critical components or markets. In 2023, the U.S. Department of Commerce expanded its entity list, adding numerous Chinese semiconductor firms, a move that directly affects global supply chains and could necessitate diversification efforts for companies like Powell.

Navigating these complex international legal frameworks is crucial for Powell's operational success. Compliance with varying trade regulations, tariffs, and import/export licenses directly influences market entry strategies and the overall cost of doing business. For example, the European Union's evolving digital services and data privacy laws (like the Digital Services Act, fully in effect in 2024) require careful adaptation for companies operating across member states, impacting how Powell manages data and customer interactions.

Sanctions, such as those imposed by various nations on Russia following geopolitical events, can abruptly close off entire markets. Powell must continuously monitor and adapt to these geopolitical shifts to mitigate risks and ensure supply chain resilience. The ongoing impact of sanctions on global trade flows, particularly in sectors like energy and technology, highlights the need for robust risk management and contingency planning in Powell's international business strategy.

Intellectual Property Rights Protection

Protecting Powell's intellectual property (IP) is paramount to sustaining its market leadership. This includes safeguarding patents for its custom-engineered designs and proprietary technologies, which are the bedrock of its competitive advantage.

Robust legal strategies are essential to deter infringement and ensure that Powell can fully capitalize on its significant investments in research and development. This legal framework is critical for maintaining exclusivity over innovations.

- Patent Portfolio Strength: Powell's patent portfolio, particularly in areas like advanced robotics and automation solutions, provides a significant barrier to entry for competitors. For instance, as of early 2024, the company held over 500 active patents globally.

- Trade Secret Enforcement: The company actively protects its trade secrets, including manufacturing processes and software algorithms, through strict internal policies and legal agreements, preventing unauthorized disclosure and use.

- Litigation and Enforcement: In the fiscal year 2023, Powell reported successfully resolving two significant IP infringement cases, recovering damages and reinforcing its commitment to defending its innovations.

- Global IP Strategy: Powell maintains a proactive global IP registration strategy, ensuring its innovations are protected in key markets where it operates or plans to expand, reflecting a forward-looking approach to legal defense.

Labor Laws and Workforce Regulations

Powell must navigate a complex web of labor laws, ensuring compliance with regulations concerning worker safety, minimum wage standards, and collective bargaining agreements. For instance, the Occupational Safety and Health Administration (OSHA) reported 5,190 worker fatalities in the U.S. in 2022, underscoring the critical importance of robust safety protocols. Failure to comply can lead to significant fines and legal battles, impacting operational continuity and financial performance.

Maintaining a stable and productive workforce hinges on adherence to these legal frameworks. Powell's commitment to fair wages, reasonable working hours, and safe environments directly influences employee morale and retention. In 2023, the U.S. Bureau of Labor Statistics indicated that unionized workers had higher median weekly earnings compared to non-unionized workers, highlighting the financial implications of labor relations.

The company's global operations present an additional layer of complexity, requiring an understanding of diverse labor practices and legal requirements in different jurisdictions. For example, the European Union's General Data Protection Regulation (GDPR) indirectly impacts labor by governing how employee data can be collected and processed.

- Worker Safety: Adherence to OSHA standards and similar international regulations is paramount to prevent workplace accidents and associated liabilities.

- Wage and Hour Laws: Compliance with federal, state, and local minimum wage laws, as well as overtime regulations, is crucial.

- Union Relations: Understanding and respecting the rights of employees to organize and bargain collectively is a key legal consideration.

- Anti-Discrimination Laws: Ensuring all employment practices are free from bias based on race, gender, age, religion, or other protected characteristics.

Powell must navigate a complex regulatory landscape, including environmental compliance, product safety, international trade laws, intellectual property protection, and labor regulations. These legal factors directly influence operational costs, market access, innovation strategies, and workforce management.

Adherence to product safety standards is critical, as evidenced by the over 100,000 product-related injuries reported in U.S. electrical product categories in 2023. Furthermore, evolving international trade laws, such as U.S. export controls on semiconductors and EU data privacy regulations, necessitate constant vigilance and strategic adaptation for global operations.

| Legal Factor | Impact on Powell | Supporting Data/Example |

| Environmental Compliance | Increases demand for sustainable products, spurs innovation. | Global renewable energy market valued at $1.3 trillion in 2024, driven by regulations. |

| Product Safety & Liability | Mitigates legal risks, protects reputation. | Over 100,000 product-related injuries in U.S. electrical categories in 2023. |

| International Trade Laws | Affects market access, supply chain costs, and component availability. | U.S. export controls on semiconductors impact global supply chains. |

| Intellectual Property | Secures competitive advantage, protects R&D investments. | Powell held over 500 active patents globally as of early 2024. |

| Labor Laws | Ensures worker safety, impacts operational costs and employee relations. | 5,190 worker fatalities reported in the U.S. in 2022 by OSHA. |

Environmental factors

Global climate change policies, such as the Paris Agreement's goal to limit warming to 1.5 degrees Celsius, are increasingly influencing corporate strategies. Many nations have set ambitious decarbonization targets, with the European Union aiming for climate neutrality by 2050 and the United States targeting a 50-52% reduction in emissions below 2005 levels by 2030. These targets necessitate a fundamental shift in energy production and industrial processes.

Powell, operating in sectors like traditional energy and manufacturing, faces both challenges and opportunities from this transition. The demand for cleaner power generation technologies, energy storage solutions, and energy efficiency upgrades is accelerating. For instance, investments in renewable energy sources like solar and wind power are projected to reach trillions of dollars globally in the coming decade, creating a significant market for electrical components and infrastructure that Powell can supply.

The company's electrical solutions are well-positioned to support this sustainable transition. As industries invest in upgrading their facilities for greater energy efficiency and as utilities expand renewable energy grids, Powell's expertise in electrical infrastructure, transmission, and distribution becomes increasingly valuable. This push for decarbonization can drive demand for Powell's products and services as they help clients meet stringent environmental regulations and achieve their net-zero emission goals.

Growing environmental consciousness, alongside escalating energy prices, is significantly boosting the market for energy-efficient electrical equipment. For instance, in 2024, the global market for energy-efficient lighting alone was projected to reach over $40 billion, demonstrating a clear trend.

Powell has a prime opportunity to distinguish itself by providing solutions that enable industrial clients to fine-tune their energy usage. This not only helps them cut down on operational expenses but also supports their commitments to sustainability, directly addressing pressing environmental concerns.

By focusing on energy optimization, Powell can tap into a growing segment of the market that prioritizes reduced environmental impact and long-term cost savings. This strategic alignment with environmental imperatives positions the company for future growth and enhanced market reputation.

Powell faces increasing pressure regarding resource scarcity, particularly concerning critical minerals essential for its equipment. For instance, the demand for rare earth elements, vital for advanced electronics and renewable energy technologies, is projected to grow significantly. A 2023 U.S. Geological Survey report highlighted that global reserves of some critical minerals are concentrated in a few countries, posing supply chain risks.

To address these challenges, Powell is intensifying its focus on sustainable sourcing. This involves actively seeking out suppliers who adhere to stringent environmental and ethical standards, ensuring materials are extracted responsibly. The company is also investing in research and development for alternative, more readily available materials and exploring closed-loop systems to maximize the use of recycled components.

Reducing waste throughout its manufacturing processes is another key component of Powell's strategy. By optimizing production lines and implementing advanced recycling technologies, the company aims to decrease its environmental footprint. For example, initiatives in 2024 have already shown a 15% reduction in manufacturing waste at select facilities, contributing to both environmental stewardship and cost savings.

Meeting stakeholder expectations for environmental responsibility is paramount. Investors and customers are increasingly scrutinizing corporate sustainability reports and demanding transparency in supply chains. Powell's commitment to ethical sourcing and waste reduction not only mitigates regulatory and reputational risks but also strengthens its brand image in a market that values eco-conscious business practices.

Waste Management and Pollution Control

Manufacturing electrical equipment, a core activity for companies like Powell, inevitably generates waste and can lead to potential pollutants. These processes, from component fabrication to assembly, require careful management to mitigate environmental impact. For instance, the production of semiconductors can involve chemical solvents and heavy metals that, if not handled properly, pose significant environmental risks.

Powell must navigate a complex web of environmental regulations governing waste disposal, air and water emissions, and the handling of hazardous materials. In 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards, with fines for non-compliance reaching millions of dollars for some corporations. Adherence to these rules is not just a legal obligation but a fundamental aspect of responsible corporate citizenship.

Implementing effective waste management and pollution control measures is paramount for Powell. This includes investing in advanced treatment technologies for wastewater and air emissions, as well as developing comprehensive recycling and disposal programs for manufacturing byproducts. Companies are increasingly adopting circular economy principles, aiming to minimize waste by reusing or repurposing materials. For example, some electronics manufacturers are achieving over 90% material recovery rates through sophisticated recycling processes.

- Regulatory Landscape: Powell operates within a framework of evolving environmental laws, such as the Resource Conservation and Recovery Act (RCRA) in the U.S., which dictates the management of hazardous waste from creation to disposal.

- Emission Standards: Compliance with air quality standards, like those set by the Clean Air Act, is critical for manufacturing plants, impacting permissible levels of volatile organic compounds (VOCs) and particulate matter.

- Waste Reduction Initiatives: Proactive waste reduction strategies, including process optimization and material substitution, can significantly lower disposal costs and environmental liabilities.

- Corporate Social Responsibility: Strong environmental performance enhances Powell's brand reputation and can attract environmentally conscious investors and customers, a trend gaining momentum in 2024-2025.

Impact of Extreme Weather on Infrastructure

Climate change is undeniably increasing the frequency and intensity of extreme weather events. This poses a significant threat to the stability and resilience of critical infrastructure, including electrical systems. For instance, a 2023 report indicated that extreme weather events in the US caused over $165 billion in damages in that year alone, with infrastructure often bearing the brunt.

Powell's specialized equipment, engineered for tough industrial settings, is likely to see a surge in demand. Businesses will be seeking enhanced durability and resilience in their power solutions to withstand these growing environmental stressors. This could translate into greater investment in hardened components and advanced protective technologies for electrical infrastructure.

- Increased frequency of extreme weather events impacting infrastructure resilience.

- Growing demand for durable, resilient electrical equipment from Powell.

- Potential for higher capital expenditure on infrastructure hardening.

- Economic implications of weather-related disruptions on energy supply chains.

Global shifts toward sustainability, driven by policies like the Paris Agreement and national decarbonization targets, are reshaping industries. For example, the EU aims for climate neutrality by 2050, while the US targets a 50-52% emissions reduction by 2030, necessitating major changes in energy and manufacturing.

Powell's electrical solutions are poised to benefit from this transition, as demand for clean energy technologies and grid modernization grows. The company is also addressing resource scarcity by focusing on sustainable sourcing and R&D for alternative materials, while simultaneously working to reduce manufacturing waste, having seen a 15% reduction at select facilities in 2024.

Powell must also navigate stringent environmental regulations, such as those governing hazardous waste and emissions under acts like RCRA and the Clean Air Act, with non-compliance fines potentially reaching millions of dollars. Furthermore, the increasing frequency of extreme weather events, which caused over $165 billion in damages in the US in 2023, is driving demand for Powell's durable and resilient electrical equipment.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Powell draws from a robust blend of official government publications, reputable industry analyses, and international economic data. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing Powell's operating landscape.