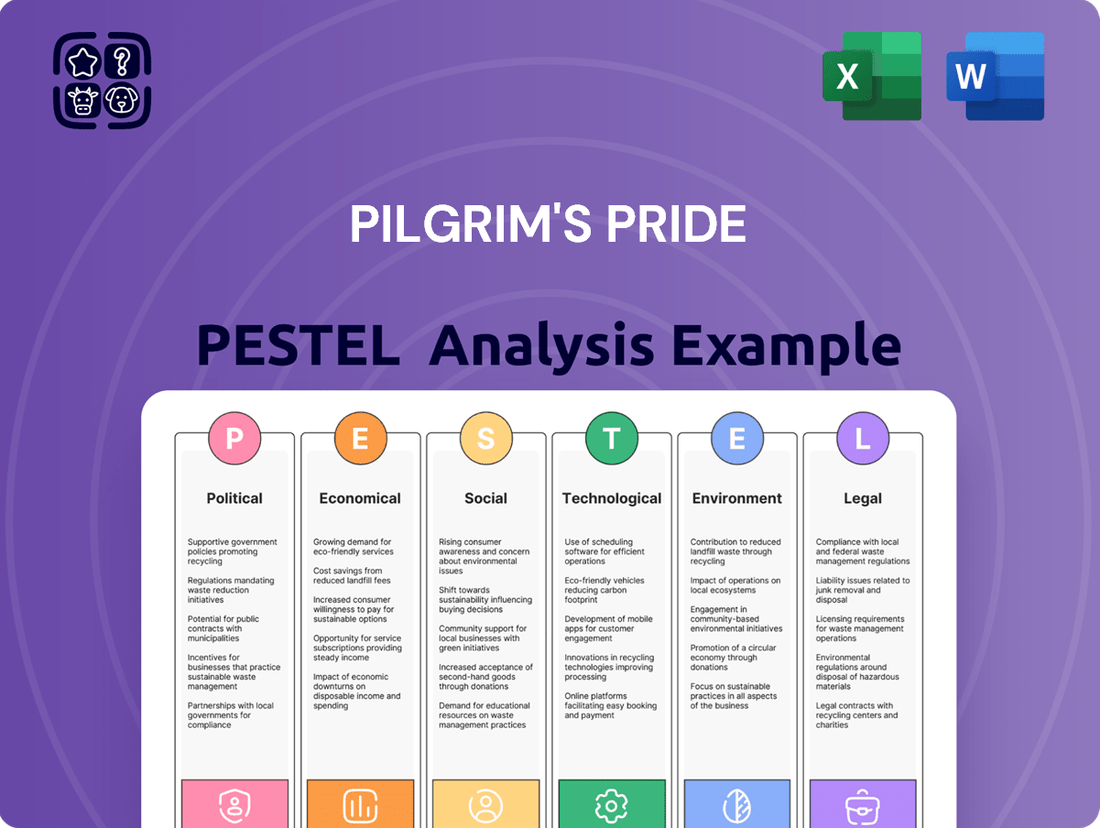

Pilgrim's Pride PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pilgrim's Pride Bundle

Pilgrim's Pride operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social consumer preferences. Understanding these external forces is crucial for strategic planning. Our PESTLE analysis delves into how regulatory changes, labor market dynamics, and technological advancements are impacting the poultry industry and Pilgrim's Pride specifically. This comprehensive report offers actionable intelligence to anticipate challenges and capitalize on opportunities.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis for Pilgrim's Pride. Discover how shifts in political landscapes, economic conditions, technological innovations, and environmental concerns are influencing the company's operations and future trajectory. Armed with these insights, you can refine your market strategy and make more informed decisions. Download the full version now for immediate access to critical market intelligence.

Political factors

Government agricultural policies, including subsidies and trade agreements, directly shape Pilgrim's Pride's operational environment and financial performance. Federal agricultural support programs in 2024, for instance, provided around $23.8 billion to various farm sectors. Specific allocations within this aid for livestock and poultry can significantly affect Pilgrim's Pride's input costs, such as feed prices, and influence the overall competitive dynamics within the industry.

Pilgrim's Pride navigates a complex landscape of food safety regulations, primarily governed by the USDA's Food Safety and Inspection Service (FSIS). These rules are critical for ensuring the integrity and safety of their poultry products. In 2024 alone, FSIS carried out 1,247 inspections across poultry processing facilities, underscoring the intensity of oversight and the constant requirement for Pilgrim's Pride to maintain rigorous compliance standards. Failure to adhere to these mandates can result in significant penalties and operational disruptions, impacting the company's financial performance and reputation.

Pilgrim's Pride, operating globally, navigates a complex web of international trade policies and import/export regulations. These policies directly impact its ability to move products across borders and influence pricing strategies. Global trade tensions can disrupt supply chains and create uncertainty, affecting the company's profitability and market access.

The U.S. poultry sector's export performance underscores the significance of favorable trade environments. In 2024, U.S. poultry exports reached an impressive 7.1 million metric tons, valued at $6.3 billion. This robust export volume highlights the critical role that stable international trade relations play in supporting companies like Pilgrim's Pride and ensuring continued market opportunities for their products.

Labor Laws and Immigration Policies

Changes in labor laws, particularly those concerning minimum wage adjustments and unionization, directly influence Pilgrim's Pride's operational expenses and workforce management. For instance, a significant increase in the federal minimum wage could substantially raise labor costs for the company, which relies on a large hourly workforce. As of 2024, discussions around raising the minimum wage continue at federal and state levels, potentially impacting companies like Pilgrim's Pride.

Immigration policies also play a crucial role, affecting the availability and cost of labor in key operational regions. Stricter immigration enforcement or changes in visa programs can limit access to a necessary labor pool, potentially leading to labor shortages and increased recruitment expenses. Pilgrim's Pride, with its approximately 62,000 global employees, is particularly sensitive to these shifts, as evidenced by past industry challenges navigating evolving immigration landscapes.

- Minimum Wage Impact: A hypothetical $2 increase in the federal minimum wage could add tens of millions of dollars annually to Pilgrim's Pride's labor costs, depending on the proportion of its workforce at or near the current minimum.

- Unionization Trends: Increased union activity in the food processing sector could lead to higher wages, improved benefits, and more stringent working conditions, impacting Pilgrim's Pride's profitability and operational flexibility.

- Immigration Policy Sensitivity: Regions with significant immigrant labor participation are critical for Pilgrim's Pride. Changes in immigration laws could reduce the available workforce, necessitating higher wages or investment in automation to compensate.

- Regulatory Compliance: Adherence to evolving labor laws, including overtime regulations and worker safety standards, demands continuous investment in compliance and training, adding to overhead costs.

Antitrust and Competition Enforcement

Pilgrim's Pride operates in a sector where antitrust and competition enforcement are critical political factors. The company has encountered substantial legal challenges and has agreed to significant settlements stemming from allegations of price-fixing. This ongoing scrutiny highlights the government's commitment to ensuring fair market practices within the poultry industry.

A notable event reinforcing this regulatory stance occurred in June 2025, when a class action settlement amounting to $41.5 million was finalized. This settlement was designed to compensate shareholders who experienced losses due to Pilgrim's Pride's involvement in past price-fixing activities. Such resolutions underscore the persistent regulatory oversight and the potential financial repercussions for anti-competitive behavior.

- Antitrust Scrutiny: Pilgrim's Pride has been a target of investigations and lawsuits concerning alleged collusion and price manipulation in the poultry market.

- Class Action Settlement: In June 2025, a $41.5 million settlement was approved, addressing claims from shareholders impacted by historical price-fixing schemes.

- Regulatory Environment: The company must navigate stringent regulations aimed at preventing monopolies and ensuring a competitive landscape, with significant penalties for violations.

- Reputational Impact: Legal battles and settlements can negatively affect consumer trust and brand perception, influencing market share and financial performance.

Government policies, including agricultural subsidies and trade agreements, significantly influence Pilgrim's Pride's operational costs and market access. For example, US poultry exports reached 7.1 million metric tons valued at $6.3 billion in 2024, demonstrating the impact of favorable trade policies on industry growth. The company must also comply with stringent food safety regulations, with the USDA's FSIS conducting 1,247 poultry facility inspections in 2024 alone, highlighting the critical need for rigorous adherence to prevent penalties and maintain consumer trust.

| Policy Area | 2024/2025 Data Point | Impact on Pilgrim's Pride |

|---|---|---|

| Agricultural Subsidies | $23.8 billion allocated to farm sectors in 2024 | Influences feed costs and competitive landscape |

| Food Safety Inspections | 1,247 FSIS inspections in 2024 | Requires continuous compliance with strict standards |

| Poultry Exports | 7.1 million metric tons valued at $6.3 billion (2024) | Highlights importance of favorable trade policies |

| Antitrust Settlements | $41.5 million settlement finalized June 2025 | Indicates ongoing regulatory scrutiny and financial risk |

What is included in the product

Pilgrim's Pride's PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on its operations, providing a strategic framework for understanding market dynamics and identifying potential opportunities and threats.

This PESTLE analysis for Pilgrim's Pride acts as a pain point reliever by providing a clear, summarized version of external factors, making it easy to reference during meetings and ensuring all stakeholders understand market positioning.

Economic factors

Global commodity price volatility is a significant factor for Pilgrim's Pride. Fluctuations in the cost of essential inputs like corn and soybeans, which are major components of chicken feed, directly affect the company's cost of goods sold. For instance, corn prices saw considerable swings in late 2023 and early 2024, influenced by weather patterns and global supply dynamics.

Energy prices, crucial for transportation and processing, also add to this unpredictability. While Pilgrim's Pride benefited from lower input costs and robust chicken demand in 2024, the industry is inherently exposed to these price swings. Packaging materials, another key cost, can also experience price surges due to supply chain disruptions or increased demand for specific materials.

Consumer spending power is a major driver for Pilgrim's Pride, particularly impacting demand for their more convenient, value-added food items. When consumers have more disposable income, they tend to purchase these types of products more readily. Inflation directly affects how much consumers can buy with their money, so rising prices can temper demand for even staple chicken products.

The global economic landscape in 2024 saw a positive shift, with international trade rebounding. This recovery was notably bolstered by cooling inflation rates in many key markets, which in turn helped to strengthen consumer purchasing power worldwide. This environment is favorable for companies like Pilgrim's Pride that operate on a global scale.

Pilgrim's Pride's international operations in Mexico and Europe expose it to the risks of fluctuating exchange rates. These currency movements can significantly impact the reported value of its earnings and assets when translated back into U.S. dollars.

For example, in the first quarter of 2025, the company noted that adverse peso-dollar exchange rate fluctuations contributed to pressure on its adjusted EBITDA in Mexico. This highlights how a stronger dollar relative to the peso can reduce the dollar-denominated profitability of its Mexican business.

Such volatility means that even if the underlying operational performance in foreign markets remains strong, unfavorable currency shifts can lead to lower reported financial results. This necessitates careful financial management and hedging strategies to mitigate potential negative impacts on profitability.

Global Meat Market Growth and Demand

The global meat market is experiencing robust expansion, with projections indicating a total market size of $1353.27 billion by 2025. This upward trend is driven by increasing global population and evolving dietary preferences.

Chicken continues to be the most consumed protein source worldwide, a factor that directly benefits companies like Pilgrim's Pride. This sustained demand for poultry offers considerable avenues for growth and market penetration.

- Projected Global Meat Market Size: $1353.27 billion by 2025.

- Dominant Protein Source: Chicken remains the most consumed meat globally.

- Opportunity for Pilgrim's Pride: Rising demand, especially for chicken, signifies significant growth potential.

- Market Drivers: Population growth and changing consumer eating habits fuel this demand.

Economic Cycles and Recessionary Pressures

Economic cycles significantly influence consumer spending on food. During downturns, consumers often trade down to more budget-friendly protein sources, which can be advantageous for chicken producers like Pilgrim's Pride. For instance, in early 2024, reports indicated a growing preference for value-oriented grocery options as inflation persisted.

However, the broader impact of recessionary pressures can lead to decreased overall consumer spending. This can result in lower sales volumes and squeezed profit margins for companies across the food industry. Pilgrim's Pride experienced this dynamic, with certain quarterly revenues in 2024 showing declines despite overall annual growth, highlighting the sensitivity to economic headwinds.

- Consumer behavior shift: Tendency to favor cheaper protein options during economic slowdowns.

- Sales volume impact: Reduced consumer spending can directly lower demand for products.

- Margin pressure: Companies may face challenges maintaining profitability amid decreased purchasing power.

- 2024 trends: Observed mixed revenue performance, indicating sensitivity to economic fluctuations.

Pilgrim's Pride's financial performance is closely tied to global commodity prices, particularly for corn and soybeans used in feed, and energy costs for operations and transport. While 2024 saw some relief from lower input costs and strong demand, the company remains exposed to price volatility. For example, adverse currency fluctuations, such as the peso-dollar rate in early 2025, impacted its Mexican operations' profitability.

The global meat market is projected to reach $1353.27 billion by 2025, with chicken being the leading protein source, offering significant growth opportunities for Pilgrim's Pride. Economic cycles also play a crucial role; consumers may shift to cheaper proteins like chicken during downturns, but overall reduced spending can still impact sales volumes and margins, as seen with mixed quarterly revenues in 2024.

| Economic Factor | Impact on Pilgrim's Pride | 2024/2025 Data/Trend |

|---|---|---|

| Commodity Prices (Feed, Energy) | Affects cost of goods sold and operational expenses. | Corn prices showed volatility in late 2023/early 2024; energy prices are crucial for transport and processing. |

| Consumer Spending Power & Inflation | Influences demand for value-added products and overall sales volume. | Cooling inflation in key markets in 2024 supported purchasing power; inflation directly affects affordability. |

| Exchange Rates | Impacts profitability of international operations. | Adverse peso-dollar fluctuations pressured adjusted EBITDA in Mexico in Q1 2025. |

| Global Meat Market Growth | Provides opportunities for increased sales and market penetration. | Projected market size of $1353.27 billion by 2025; chicken remains the most consumed protein. |

| Economic Cycles | Can lead to shifts in consumer protein choices and overall demand. | Consumers may trade down to value-oriented options during downturns; recessionary pressures can reduce spending. |

Same Document Delivered

Pilgrim's Pride PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis for Pilgrim's Pride offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and consumer behavior relevant to the poultry industry. This detailed report is designed to equip you with the knowledge needed for strategic decision-making concerning Pilgrim's Pride.

Sociological factors

Consumer dietary preferences are shifting significantly, with a notable increase in demand for healthier meat options, including leaner cuts and reduced sodium products. This trend is further amplified by the rapid growth of plant-based alternatives, which are capturing a larger share of the protein market. In 2023, the global plant-based meat market was valued at approximately $8.1 billion and is projected to reach over $30 billion by 2030, illustrating a substantial market shift. Furthermore, ethical sourcing and sustainability are becoming paramount for consumers, impacting purchasing decisions and pushing companies like Pilgrim's Pride to adapt their supply chains and product messaging.

Consumer focus on health and wellness increasingly favors chicken over other protein sources, driven by its perceived nutritional advantages and cost-effectiveness. This shift is a significant sociological factor influencing demand for poultry products.

The United States Department of Agriculture (USDA) projects a nearly 1.7% increase in U.S. chicken production for the entirety of 2024, underscoring the sustained growth in this sector. This upward trend in production aligns with the persistent consumer preference for chicken.

Growing public concern over animal welfare significantly influences how meat companies like Pilgrim's Pride operate. Consumers and society at large are demanding greater transparency and improved conditions throughout the entire supply chain, from farm to fork.

Pilgrim's Pride has publicly stated its commitment to enhancing animal welfare standards across its operations. This commitment is a key part of their stated vision, acknowledging the societal shift in expectations regarding ethical treatment of livestock.

For instance, by Q1 2024, Pilgrim's Pride reported investments in enhanced housing and handling practices for their poultry, aligning with industry best practices and consumer demands for more humane production methods. This focus is not just ethical but also strategic, as studies in 2023 showed a 15% increase in consumer purchasing intent for brands demonstrating strong animal welfare commitments.

Population Growth and Urbanization

Global population expansion and the steady shift of people to cities are significantly boosting meat demand worldwide. By 2050, the United Nations projects the global population to reach nearly 10 billion, a substantial increase that directly translates to greater food needs.

This trend is particularly beneficial for companies like Pilgrim's Pride, as urbanization often correlates with rising disposable incomes and a greater propensity to consume protein-rich foods. For instance, in emerging markets, the middle class is growing, leading to increased per capita meat consumption.

Mexico, a key market for Pilgrim's Pride, exemplifies this. As its urban centers expand and economies grow, demand for poultry and other meats is expected to climb. The World Bank data indicates that Mexico's urban population has steadily increased, surpassing 80% in recent years, which aligns with higher protein intake trends.

- Global Population Projection: Expected to reach nearly 10 billion by 2050 (UN).

- Urbanization Trend: Over 80% of Mexico's population resides in urban areas, driving consumption.

- Developing Market Growth: Rising per capita incomes in developing nations fuel demand for protein.

- Long-Term Driver: Population and urbanization trends provide a sustained growth opportunity for meat producers.

Convenience Food Demand

The increasing demand for convenience food, especially processed and ready-to-eat meats, is a direct result of evolving consumer lifestyles. Busy schedules and a preference for quick meal solutions fuel this market growth, benefiting companies like Pilgrim's Pride.

Pilgrim's Pride has strategically bolstered its Prepared Foods segment to align with this consumer trend. This segment features branded products that have experienced substantial growth, demonstrating the company's success in capturing a larger share of the convenience food market.

The market for convenience foods, including meat products, showed robust expansion. For instance, the global ready-to-eat food market was valued at approximately $177.7 billion in 2023 and is projected to reach $260.6 billion by 2030, growing at a CAGR of 5.6% during this period. This indicates a strong and sustained consumer preference for convenient options.

- Growing Demand: Consumer lifestyles increasingly favor convenience, driving demand for ready-to-eat and processed meat products.

- Pilgrim's Pride Strategy: The company has invested in its Prepared Foods segment, focusing on branded offerings to meet this demand.

- Market Growth: The global ready-to-eat food market, a key indicator for convenience foods, is expanding significantly, projected to reach over $260 billion by 2030.

- Consumer Preference: This trend highlights a shift in consumer behavior towards quicker and easier meal preparation solutions.

Sociological factors profoundly shape consumer choices and market dynamics for Pilgrim's Pride. Shifting dietary preferences, with increased demand for healthier options and plant-based alternatives, are reshaping protein consumption. For example, the global plant-based meat market is expected to surpass $30 billion by 2030, a significant increase from its 2023 valuation of approximately $8.1 billion.

Growing public concern for animal welfare is also a critical sociological driver, pushing companies towards greater transparency and improved ethical practices. Pilgrim's Pride's investments in enhanced housing and handling by Q1 2024 reflect this societal demand, as studies show a notable increase in consumer purchasing intent for brands demonstrating strong animal welfare commitments.

Furthermore, global population growth and increasing urbanization, with nearly 10 billion people projected by 2050, directly fuel meat demand, particularly in emerging markets where rising incomes correlate with higher protein intake. The convenience food trend, driven by busy lifestyles, also benefits companies like Pilgrim's Pride, which has strategically expanded its Prepared Foods segment to meet this demand, tapping into a market projected to reach over $260 billion by 2030.

Technological factors

Pilgrim's Pride is heavily investing in automation technologies and process optimization to boost productivity and product quality. These advancements are crucial for streamlining operations and maintaining a competitive edge in the food processing industry.

The company's commitment to technological enhancement paid off, as evidenced by a reported 15% increase in production efficiency in 2024. This significant improvement directly stems from the implementation of new automated systems and optimized workflows across its facilities.

Technological advancements are significantly reshaping how Pilgrim's Pride operates, particularly in food processing and preservation. Innovations like high-pressure processing (HPP) and advanced packaging technologies are enabling longer shelf lives and maintaining superior product quality, which is crucial for a company dealing with perishable goods. These methods also allow for the development of new, convenient product offerings that cater to evolving consumer demands for healthier and safer food options.

Pilgrim's Pride's commitment to food safety and product integrity is underscored by its investment in cutting-edge technologies. For instance, the company utilizes sophisticated pathogen detection systems and advanced traceability software to ensure the highest standards throughout its supply chain. In 2024, Pilgrim's Pride continued to invest in automation and digital monitoring systems across its facilities, aiming to minimize human error and enhance overall operational efficiency in its processing plants.

Pilgrim's Pride leverages supply chain optimization technologies to ensure a steady flow of essential inputs like feed ingredients and efficient delivery of its poultry products to retailers and consumers. This technological integration is key to maintaining operational excellence and bolstering overall business performance. For instance, advancements in real-time tracking and predictive analytics allow Pilgrim's Pride to better manage inventory levels, reducing waste and improving delivery times, which is crucial in the fast-moving food industry.

In 2024, the food and beverage industry, including poultry, saw increased investment in technologies like AI-powered demand forecasting and automation in warehousing. Pilgrim's Pride's adoption of these tools directly contributes to cost efficiencies and a more resilient supply chain, especially in the face of potential disruptions. By streamlining logistics and enhancing visibility across its network, the company aims to mitigate risks and capitalize on market opportunities, solidifying its competitive edge.

Data Analytics and Artificial Intelligence

Pilgrim's Pride is increasingly leveraging data analytics, artificial intelligence (AI), and business intelligence (BI) to sharpen its market understanding and decision-making processes. These technologies are crucial for identifying consumer trends, optimizing supply chains, and predicting demand fluctuations in the dynamic food industry.

The company's commitment to technological advancement is underscored by its establishment of a Center of Innovation & Technology for Excellence (CITE). This center acts as a hub for exploring and implementing cutting-edge tools, including AI and the Internet of Things (IoT), to drive operational efficiencies and competitive advantages.

- Data-Driven Insights: Pilgrim's Pride utilizes AI and analytics to gain deeper insights into consumer preferences, enabling more targeted product development and marketing strategies.

- Operational Efficiency: By integrating AI and IoT, the company aims to enhance supply chain visibility, reduce waste, and optimize production processes.

- Competitive Edge: Early adoption of advanced analytics and AI positions Pilgrim's Pride to better respond to market changes and maintain a competitive stance in the protein sector.

- Innovation Focus: The CITE initiative demonstrates a strategic focus on embedding innovation, particularly in AI and IoT, throughout the organization.

Product Innovation and Diversification

Technological advancements are pivotal for Pilgrim's Pride in creating novel products and diversifying its offerings. These capabilities enable the company to respond to evolving consumer demands, including shifts in dietary habits and preferences. By leveraging technology, Pilgrim's Pride can introduce value-added items that resonate with a broader market.

The company's commitment to innovation is evident in its recent performance. In the third quarter of 2024, Pilgrim's Pride successfully launched more than 280 new products. This aggressive product development strategy, coupled with ongoing investment in packaging enhancements, underscores the integral role of technology in maintaining a competitive edge and meeting market expectations.

- Product Innovation: Technology drives the creation of new and improved food products.

- Consumer Responsiveness: Innovations cater to changing tastes and dietary trends.

- Diversification: New product lines expand market reach and appeal.

- Q3 2024 Performance: Over 280 new products launched, highlighting technological application.

Pilgrim's Pride is actively integrating advanced technologies like AI and IoT to enhance operational efficiency and gain a competitive edge. The company's investment in its Center of Innovation & Technology for Excellence (CITE) highlights a strategic focus on innovation, particularly in AI and data analytics, to better understand consumer trends and optimize its supply chain. This technological adoption is crucial for streamlining processes, reducing waste, and ensuring product quality in the dynamic food industry.

| Technology Area | Impact on Pilgrim's Pride | 2024/2025 Data/Focus |

|---|---|---|

| Automation & Process Optimization | Increased production efficiency, reduced human error | 15% increase in production efficiency reported in 2024; ongoing investment in automated systems. |

| Advanced Food Processing & Packaging | Extended shelf life, improved product quality, new product development | Utilizing High-Pressure Processing (HPP) and advanced packaging for perishable goods. |

| Data Analytics & AI | Enhanced market understanding, optimized supply chains, demand forecasting | Leveraging AI and business intelligence for consumer trend identification and supply chain management. |

| Supply Chain Technologies | Improved inventory management, reduced waste, efficient delivery | Real-time tracking and predictive analytics for better logistics and inventory control. |

Legal factors

Pilgrim's Pride has navigated substantial antitrust scrutiny, particularly concerning allegations of price-fixing within the poultry sector. These legal challenges have resulted in significant financial penalties and settlements.

In January 2025, the company finalized a $41.5 million settlement for a shareholder class action lawsuit stemming from these antitrust issues. This follows a substantial $107.9 million criminal fine paid in 2021, which addressed charges of bid-rigging and price-fixing.

Pilgrim's Pride must navigate complex labor and employment laws, affecting its substantial workforce across numerous processing facilities. Compliance with wage and hour regulations, ensuring worker safety standards are met, and managing union relations are ongoing priorities. For instance, the U.S. Bureau of Labor Statistics reported in April 2024 that the meat and poultry processing sector employed approximately 429,000 workers, highlighting the scale of labor management for companies like Pilgrim's Pride.

Adherence to the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, critical for a company with a large hourly workforce. Furthermore, Occupational Safety and Health Administration (OSHA) regulations are paramount in processing plants, where worker safety is a significant concern. Pilgrim's Pride's commitment to these legal frameworks directly impacts operational efficiency and potential liabilities.

Pilgrim's Pride operates under stringent food labeling and marketing regulations, especially concerning claims about product origin, nutritional content, and animal welfare. These rules are critical for consumer trust and product differentiation in the competitive poultry market.

Recent changes in England and Scotland, effective from early 2024, have impacted free-range poultry labeling. Specifically, the 12-week derogation period, which previously allowed for continued free-range labeling during avian influenza housing measures, has been removed. This means that for poultry housed indoors for more than 12 weeks due to disease control, the 'free-range' label can no longer be used, potentially affecting consumer perception and sales for such products.

Environmental Regulations and Compliance

Pilgrim's Pride faces stringent environmental regulations governing waste disposal, water consumption, and air emissions, requiring substantial investment in compliance technologies. For instance, the company, like others in the industry, must adhere to the Clean Water Act for wastewater discharge, impacting operational costs. The Environmental Protection Agency (EPA) continuously updates emission standards, particularly for facilities involved in food processing, which could necessitate upgrades to pollution control equipment.

The company's proactive sustainability initiatives are designed to minimize its ecological impact, reflecting a growing trend towards corporate environmental responsibility. Pilgrim's Pride reported a 15% reduction in water usage intensity across its North American operations between 2018 and 2023, demonstrating progress in resource management. These efforts are crucial not only for regulatory adherence but also to meet evolving consumer and investor expectations regarding environmental stewardship.

- Waste Management: Compliance with EPA guidelines for solid and liquid waste disposal, including animal by-products and processing waste, is paramount.

- Water Usage and Discharge: Adherence to National Pollutant Discharge Elimination System (NPDES) permits for wastewater quality and volume is a significant operational factor.

- Air Emissions: Meeting regulations on greenhouse gas emissions and other pollutants from processing plants and transportation fleets is an ongoing challenge.

- Sustainability Goals: Pilgrim's Pride's commitment to reducing its carbon footprint, as highlighted in its 2024 sustainability report, aims to align with global climate targets and enhance brand reputation.

International Trade Laws and Tariffs

Pilgrim's Pride, as a significant global exporter of poultry products, is directly influenced by the intricate web of international trade laws and tariffs. These regulations, including those imposed by the United States, Mexico, and various European Union member states, can significantly impact the cost of goods and market access. For instance, the U.S. Department of Agriculture reported that in 2024, poultry exports faced varying tariff rates across different countries, with some agreements offering preferential treatment and others imposing substantial duties.

Navigating these diverse legal landscapes necessitates robust compliance strategies and a proactive approach to market diversification. The company must remain agile, adapting to shifts in trade policy and potential retaliatory tariffs that can arise from geopolitical tensions. For example, a sudden imposition of tariffs on poultry products by a major importing nation could force Pilgrim's Pride to re-evaluate its supply chains and export strategies to mitigate financial losses.

Key considerations for Pilgrim's Pride include:

- Trade Agreements: Understanding and leveraging existing trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), to minimize tariff burdens and facilitate smoother cross-border trade.

- Tariff Rates: Monitoring fluctuating tariff rates on poultry products in key markets, which can impact pricing competitiveness and profitability. For 2024, average tariffs on poultry imports into the EU from non-member countries ranged from approximately 15% to 35% depending on the product category.

- Regulatory Compliance: Adhering to a complex array of food safety regulations, labeling requirements, and import/export documentation standards in each target market to avoid delays and penalties.

- Market Access: Strategically assessing and developing market entry plans that account for existing trade barriers and potential future regulatory changes to ensure sustained export growth.

Pilgrim's Pride faces significant legal headwinds from antitrust litigation, including a $41.5 million settlement in January 2025 related to price-fixing allegations, following a prior $107.9 million criminal fine in 2021. The company must also adhere to complex labor laws like the FLSA, impacting its workforce of nearly 429,000 in the U.S. meat and poultry sector as of April 2024, and stringent OSHA safety regulations.

Furthermore, compliance with evolving food labeling regulations, such as updated free-range labeling rules in the UK from early 2024, is crucial for consumer trust. Environmental regulations, including the Clean Water Act for wastewater and EPA emission standards, necessitate ongoing investment in compliance technology, with the company reporting a 15% reduction in water usage intensity between 2018 and 2023.

International trade laws and tariffs significantly impact Pilgrim's Pride's export operations, with varying rates in 2024 affecting market access, such as EU tariffs ranging from 15% to 35% on poultry imports. Navigating these complex trade agreements and potential retaliatory tariffs requires agile strategies and market diversification.

Environmental factors

Climate change poses significant risks to Pilgrim's Pride by directly impacting agricultural inputs vital for poultry production. Fluctuations in weather patterns can disrupt feed availability, a primary cost driver, and strain water resources essential for farming operations. For instance, extreme weather events in 2024, such as prolonged droughts in key grain-producing regions, led to a noticeable increase in corn and soybean prices, directly affecting Pilgrim's feed costs.

The company's commitment to net-zero emissions, as detailed in its 2024 sustainability report, is intrinsically linked to these environmental factors. Achieving ambitious climate goals necessitates significant advancements in agricultural technology and supportive regulatory frameworks. Without these, the company's ability to mitigate the financial and operational consequences of climate change on its supply chain remains challenged.

Pilgrim's Pride is actively addressing water usage, a critical environmental concern. The company is investing in water-saving technologies and implementing new practices across its facilities to reduce its footprint.

Despite these efforts, the company has faced challenges. Water use intensity actually rose by 6% between 2019 and 2023, making it harder to hit their ambitious 2030 water reduction goals. This highlights the ongoing complexities of water management in the poultry industry.

Pilgrim's Pride is actively pursuing a strategy to minimize its environmental footprint by focusing on waste reduction and embracing circular economy principles, aiming for a 'no waste' operational model. The company highlights its industry-leading performance in food waste management, reporting a remarkably low figure of just 0.1% waste.

Greenhouse Gas Emissions and Net-Zero Goals

Pilgrim's Pride has committed to achieving net-zero greenhouse gas emissions by 2040, a significant undertaking in the food production industry. However, progress on this ambitious target has faced challenges, especially concerning Scope 3 emissions, which originate from its extensive network of farms and suppliers. These upstream and downstream activities represent a substantial portion of the company's overall carbon footprint.

Despite these challenges, the company is making headway on other environmental fronts. Pilgrim's Pride is reportedly on track to meet certain key objectives, including increasing its use of renewable energy sources. Furthermore, it aims to reduce the intensity of its Scope 1 and Scope 2 emissions – those directly controlled by the company – by 30% by the year 2030.

- Net-Zero Target: Pilgrim's Pride aims for net-zero emissions by 2040.

- Scope 3 Challenges: Progress is slower than anticipated for Scope 3 emissions from farms and suppliers.

- Scope 1 & 2 Goals: On track to reduce Scope 1 and 2 emissions intensity by 30% by 2030.

- Renewable Energy: The company is progressing on its renewable energy adoption goals.

Animal Health and Disease Outbreaks

Animal health and disease outbreaks represent a significant environmental factor for Pilgrim's Pride. Highly Pathogenic Avian Influenza (HPAI), for instance, can drastically disrupt poultry production and the supply chain, resulting in substantial operational interruptions and financial setbacks. These outbreaks are not theoretical; they have already affected broiler production in early 2025, underscoring the immediate environmental and business risks involved.

The economic consequences of such outbreaks can be severe. For example, past HPAI outbreaks have led to billions of dollars in losses across the poultry industry globally due to depopulation, trade restrictions, and increased biosecurity measures. Pilgrim's Pride must continually invest in robust biosecurity protocols and rapid response plans to mitigate these risks.

- Impact of HPAI: Outbreaks can lead to the culling of millions of birds, severely limiting supply and driving up costs for feed and processing.

- Economic Losses: Past HPAI events have cost the US poultry industry hundreds of millions annually, affecting companies like Pilgrim's Pride.

- Biosecurity Investment: Continuous investment in advanced biosecurity measures is crucial to prevent and contain disease incursions.

- Supply Chain Vulnerability: The interconnected nature of poultry farming means a single outbreak can have ripple effects throughout the entire supply chain.

Environmental regulations continue to shape Pilgrim's Pride's operational landscape, pushing for greater sustainability. The company is navigating evolving standards for water discharge and waste management, which require ongoing investment in compliance and technological upgrades.

The drive towards net-zero emissions by 2040 presents a significant environmental challenge, particularly with Scope 3 emissions from its vast supplier network. While progress is being made on renewable energy adoption and reducing direct emissions, addressing upstream and downstream impacts remains a key focus for 2024 and beyond.

Animal health, specifically the threat of Highly Pathogenic Avian Influenza (HPAI), poses a substantial environmental risk that directly impacts production. Outbreaks in early 2025 have already highlighted the vulnerability of the supply chain, necessitating continuous investment in biosecurity measures to mitigate economic losses and operational disruptions.

PESTLE Analysis Data Sources

Our Pilgrim's Pride PESTLE Analysis draws from a robust blend of official government publications, reputable market research firms, and international economic reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the poultry industry.