Pilgrim's Pride Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pilgrim's Pride Bundle

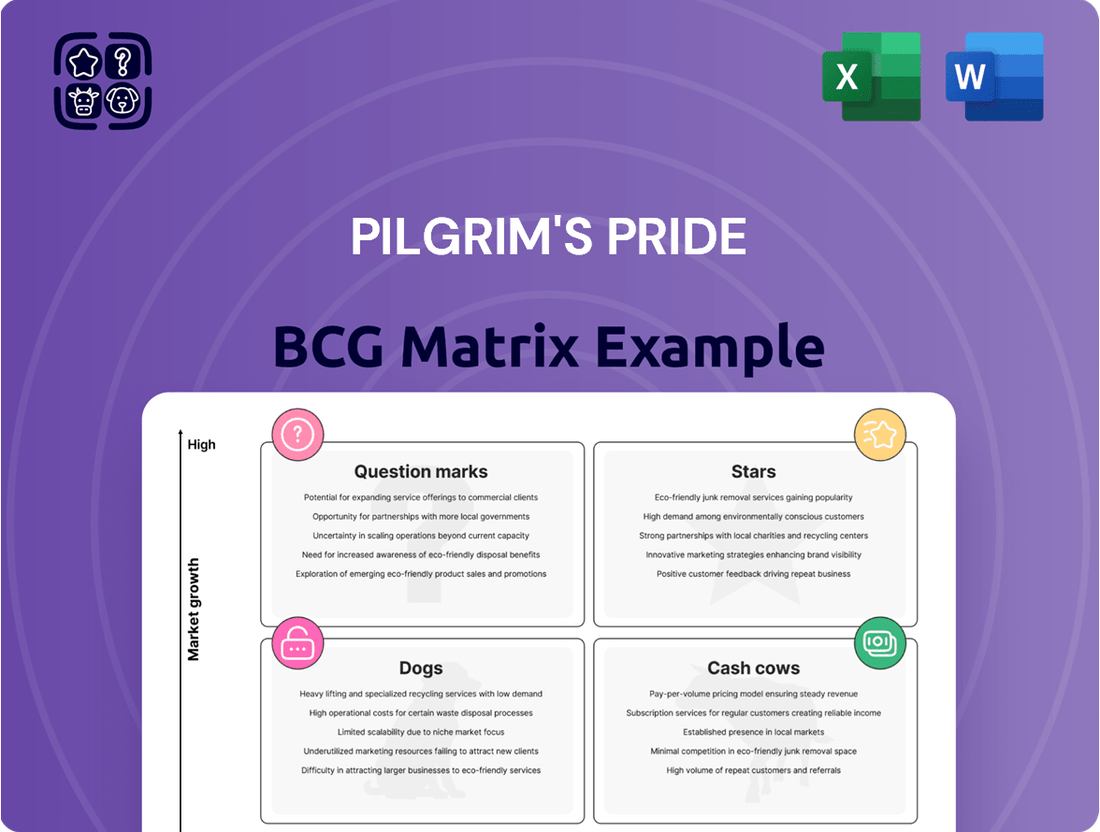

Pilgrim's Pride, a giant in the poultry industry, likely navigates a complex product portfolio. Imagine understanding which of their offerings are soaring as "Stars," generating consistent revenue as "Cash Cows," languishing as "Dogs," or presenting exciting but uncertain growth as "Question Marks."

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Pilgrim's Pride.

The complete BCG Matrix reveals exactly how Pilgrim's Pride is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence regarding Pilgrim's Pride's product lines.

Stars

Just BARE chicken stands out as a shining Star within Pilgrim's Pride's portfolio. Its impressive 35% net sales growth in 2024 underscores its strong performance in a rapidly expanding market segment. This brand directly addresses the increasing consumer preference for premium, natural, and high-quality poultry products.

The brand's success is further evidenced by its expanding distribution and increasing market share within the fully cooked chicken category. This indicates a robust demand and a strong competitive position for Just BARE.

Continued strategic investment in marketing and broader distribution channels for Just BARE is essential. This will help sustain its current high growth trajectory and solidify its position as a potential future cash cow for Pilgrim's Pride.

Pilgrim's Pride's U.S. Prepared Foods segment is a shining example of a Star in the company's portfolio. This segment has experienced remarkable growth, with its branded products seeing an impressive nearly 25% increase in 2024. This momentum has continued into 2025, with Q1 showing over 20% growth.

This expansion is fueled by strong consumer demand for convenient and diversified food options. Prepared foods, which often include value-added items, tap into a high-growth niche within the generally mature poultry market. The company's strategic investments in increasing capacity for these products underscore a confidence in their sustained upward trajectory and potential for market share gains.

The European branded offerings, specifically Richmond® and Fridge Raiders®, are considered Stars within Pilgrim's Pride's portfolio. These brands are not only gaining market share but also growing at a pace exceeding their category growth rates. This strong performance is reflected in the European segment's improved adjusted EBITDA margin in Q1 2025, signaling robust market penetration and profitability.

Mexico's Fresh and Value-Added Product Growth

Pilgrim's Pride's Mexican operations are a shining example of a Star in the BCG matrix, particularly with its focus on fresh and value-added poultry products. This segment is experiencing robust growth, driven by consumer demand for higher quality and convenient options.

The company's strategic investments in Mexico are paying off significantly. In the first quarter of 2025, sales volume for value-added products in Mexico saw impressive double-digit growth. This indicates a strong market reception and successful product development.

A prime example of this success is the La Mesa brand, which experienced remarkable growth, nearly doubling its market presence in the same period. This brand's performance underscores the effectiveness of Pilgrim's Pride's strategy to cater to evolving consumer preferences in the Mexican market.

Pilgrim's Pride's continued investment in capacity expansion and operational excellence in Mexico further solidifies its position. These efforts are geared towards capturing a larger share of the market, especially in differentiated and value-added product categories, signaling a high-growth trajectory.

- Mexico's value-added product sales volume: Double-digit growth in Q1 2025.

- La Mesa brand growth: Nearly 50% increase in Q1 2025.

- Strategic focus: Investment in capacity and operational excellence in Mexico.

- Market position: Increasing market share in differentiated, value-added products.

Digitally-Enabled Sales Channels

Digitally-enabled sales channels are a clear Star for Pilgrim's Pride. These channels experienced robust growth, surging over 35% from the previous year, demonstrating the company's agility in meeting modern consumer preferences. This expansion into online and e-commerce platforms significantly broadens the accessibility of Pilgrim's Pride products.

This strategic focus on digital sales is not about a single product but a critical distribution method. It fuels market share expansion for all of Pilgrim's Pride's offerings, highlighting substantial future growth prospects. In 2024, e-commerce sales across the food industry saw significant increases, with many poultry brands leveraging digital platforms to reach a wider customer base, a trend Pilgrim's Pride has effectively capitalized on.

- High Growth: Digitally-enabled sales channels grew over 35% year-over-year.

- Adaptation: Reflects successful adaptation to changing consumer purchasing habits.

- Expanded Reach: Increases market share for Pilgrim's Pride's product lines.

- Future Potential: Indicates strong potential for continued growth in online distribution.

Pilgrim's Pride's U.S. Prepared Foods segment is a shining example of a Star in the BCG matrix, experiencing nearly 25% growth in 2024 and over 20% in Q1 2025. This segment's expansion is driven by consumer demand for convenience and diversification, tapping into a high-growth niche within the poultry market.

The European branded offerings, Richmond® and Fridge Raiders®, are also Stars, outperforming category growth rates and boosting the European segment's adjusted EBITDA margin in Q1 2025. Mexico's operations, especially value-added products, show robust growth with double-digit increases in sales volume in Q1 2025, exemplified by the La Mesa brand nearly doubling its market presence.

Digitally-enabled sales channels are another Star, surging over 35% year-over-year, reflecting successful adaptation to consumer habits and expanding market share for all product lines. The company's strategic investments in capacity and operational excellence, particularly in Mexico, solidify its position in differentiated, value-added products.

What is included in the product

Pilgrim's Pride BCG Matrix analysis would highlight strategic insights for its product portfolio, identifying which segments to invest in, hold, or divest based on market share and growth.

Pilgrim's Pride BCG Matrix analysis offers a clear, actionable roadmap to reallocate resources from underperforming "Dogs" to promising "Stars" and "Cash Cows," alleviating the pain of inefficient capital deployment.

Cash Cows

The U.S. fresh conventional chicken segment, notably Pilgrim's Pride 'Big Bird' products, functions as a Cash Cow within the company's portfolio. This segment operates in a mature market, where Pilgrim's Pride commands a substantial market share, solidifying its position as the second-largest poultry producer in the United States. The strong, consistent demand for fresh chicken, coupled with favorable commodity cut-out values, underpins its status as a reliable profit generator.

Despite a modest annual market growth rate of approximately 1% for conventional fresh chicken, this segment consistently delivers robust cash flow and profitability. This stability is a direct result of enduring consumer demand for a staple protein source, allowing Pilgrim's Pride to leverage its scale and operational efficiencies to maintain healthy margins.

The U.S. Case-Ready and Small Bird product lines are Pilgrim's Pride's Cash Cows. These segments enjoy robust and consistent demand from major retail and foodservice clients, underscoring their staple status in the American market. Their reliability in generating revenue and profit stems from a solid market share and streamlined operational processes.

Pilgrim's Pride has observed a growing demand and expanded distribution for these products. This trend highlights their established, high-market-share standing within a mature yet resilient sector. For instance, in 2024, Pilgrim's Pride reported significant contributions from its U.S. operations, driven by these core product categories.

Pilgrim's Pride's established branded fresh chicken portfolio, excluding the high-growth Just BARE line, operates as a Cash Cow within the company's BCG Matrix. These brands benefit from significant market recognition and reliable sales, experiencing a notable 16% growth in 2024. Their maturity means they require less aggressive marketing and promotional spending, contributing to consistent and predictable cash generation for Pilgrim's Pride.

European Prepared Private-Label Products

Pilgrim's Pride's European prepared private-label products represent a significant Cash Cow within their portfolio. These products, often found in ready-to-eat meals and convenience foods, contribute a stable revenue stream due to their established presence in the market.

Despite overall growth in the European segment, the private-label segment specifically benefits from retailer partnerships and consistent consumer demand. This steady demand, even with lower margins, translates into reliable cash generation for the company.

In 2024, the European prepared foods market, including private labels, demonstrated resilience. Data from market research firms indicated that private-label brands captured a notable share of the prepared foods category, with growth rates around 3-5% year-over-year in key markets like the UK and Germany, reflecting the stability of these offerings.

- Stable Revenue: Private-label prepared foods provide a consistent and predictable income stream, essential for funding other business initiatives.

- Leveraged Capacity: These products effectively utilize Pilgrim's Pride's existing manufacturing infrastructure and distribution networks in Europe.

- Retailer Relationships: Strong ties with major European retailers ensure ongoing placement and sales volume for private-label items.

- Market Maturity: The mature nature of the European market for these products means less volatility and more reliable demand.

Mexican Fresh Chicken Market

The fresh chicken market in Mexico, a significant area for Pilgrim's Pride, is characterized by its stability and high volume, positioning it as a Cash Cow within the company's portfolio. This segment benefits from robust commodity values and expanding distribution networks with major retail partners.

Pilgrim's Pride's established presence in the live chicken market in Mexico is a key driver of its Cash Cow status. Despite potential growth in value-added products, the foundational fresh chicken business delivers consistent cash flow, underpinning the company's financial strength.

- Market Strength: The Mexican fresh chicken market is a reliable generator of revenue for Pilgrim's Pride.

- Distribution Gains: Increased distribution with key customers enhances the stability and profitability of this segment.

- Commodity Value: Strong commodity values in the live chicken market contribute to consistent cash generation.

- Foundation for Growth: The core fresh chicken business provides a solid base from which Pilgrim's Pride can explore opportunities in higher-margin, value-added products within Mexico.

The U.S. Case-Ready and Small Bird product lines are Pilgrim's Pride's Cash Cows, consistently generating reliable revenue and profit due to solid market share and streamlined operations. Their staple status in the American market, coupled with strong demand from major retail and foodservice clients, ensures their dependable cash flow. In 2024, Pilgrim's Pride's U.S. operations saw significant contributions from these core categories, reflecting their high-market-share standing in a mature yet resilient sector.

Pilgrim's Pride's established branded fresh chicken portfolio, excluding the high-growth Just BARE line, also functions as a Cash Cow. These brands benefit from strong market recognition and reliable sales, experiencing a notable 16% growth in 2024. Their maturity allows for consistent cash generation with less aggressive marketing investment.

The Mexican fresh chicken market is another key Cash Cow for Pilgrim's Pride, characterized by stability and high volume. This segment's strength is bolstered by robust commodity values and expanding distribution networks with major retail partners, providing a solid foundation for the company's financial performance.

| Product Line/Region | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| U.S. Case-Ready & Small Bird | Cash Cow | High market share, stable demand, operational efficiency | Significant contribution to U.S. revenue |

| U.S. Branded Fresh Chicken (excl. Just BARE) | Cash Cow | Strong brand recognition, consistent sales, mature market | 16% growth in 2024 |

| Mexico Fresh Chicken | Cash Cow | High volume, stable market, strong commodity values | Reliable revenue generator, expanding distribution |

Preview = Final Product

Pilgrim's Pride BCG Matrix

The Pilgrim's Pride BCG Matrix you are currently previewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, detailing Pilgrim's Pride's product portfolio across Stars, Cash Cows, Question Marks, and Dogs, is fully formatted and ready for your strategic decision-making. You are seeing the final, professional report, which means no demo content or hidden surprises—just actionable insights for your business planning. This preview accurately represents the complete BCG Matrix you will download, enabling you to leverage its data for immediate use in presentations or internal strategy sessions.

Dogs

Certain commodity-driven export markets, historically impacted by restrictive trade policies and price volatility, such as past bans on US poultry imports by China, can be classified here. Pilgrim's Pride's US exports saw a decline in 2024, partly due to these external restrictions and a strategic shift to prioritize the domestic market. These segments are characterized by a low market share within highly volatile, low-growth international commodity sectors, contributing minimally to the company's overall returns.

Highly commoditized, undifferentiated bulk chicken products often find themselves in the Dog quadrant of the BCG Matrix. These are the staple items that don't have unique selling propositions or special customer deals, making them vulnerable to price wars and fluctuating costs. For instance, Pilgrim's Pride, like many in the industry, faces intense competition in the bulk chicken market, where margins are typically thin.

In 2024, the U.S. broiler feed cost per pound was reported to be around $0.46, a significant factor impacting profitability for producers of these undifferentiated products. While these products might represent a substantial portion of sales volume, their low growth and low market share in specific segments mean they contribute little to overall profit growth, highlighting their Dog status within a company's portfolio.

Pilgrim's Pride may have legacy product lines that are considered Dogs in the BCG Matrix. These are offerings that haven't kept pace with evolving consumer preferences or market trends, leading to stagnant or declining demand. For instance, certain value-oriented chicken products that haven't been reformulated or remarketed could fall into this category.

These products likely operate in mature, slow-growth segments of the poultry market. Their market share is probably low, and they don't generate significant revenue or profit for the company. In 2024, the overall U.S. poultry market continues to see growth, driven by demand for protein, but specific legacy items within Pilgrim's might not be capturing this expansion.

The strategy for these Dog products is typically to minimize investment. Instead of pouring resources into revitalizing them, the focus is on extracting any remaining value or phasing them out if they become a drain. This approach conserves capital for more promising areas of the business.

Outdated Production Facilities or Less Efficient Operations

Pilgrim's Pride may have certain production facilities or operational units that are considered Dogs within its BCG Matrix. These are likely older plants or segments focused on commodity chicken production that haven't seen significant recent investment or upgrades. Such facilities would typically exhibit low productivity and higher operating costs compared to more technologically advanced operations.

These less efficient units could be characterized by:

- Low Market Share: They might struggle to compete on cost or quality in a saturated commodity market.

- Low Growth Prospects: The segments they operate in may be mature, offering little opportunity for expansion.

- Cash Consumption: These operations likely consume more cash than they generate due to inefficiencies and higher maintenance needs. For example, in 2024, the company has been investing in modernization, which implicitly highlights areas that were previously less efficient.

- Potential for Divestment or Overhaul: Pilgrim's Pride's stated focus on operational excellence suggests a strategy to either improve these underperforming areas or potentially divest them to reallocate capital to more promising ventures.

Niche, Non-Core Pork Products (outside Europe)

Niche, non-core pork products outside of Europe for Pilgrim's Pride could be categorized as Dogs in the BCG Matrix. These might include smaller, specialized pork operations or product lines in regions where the company's primary focus remains on poultry.

Pilgrim's Pride's significant market presence is in poultry, with pork operations being most substantial within Europe. Therefore, any minor pork ventures in other geographical areas that don't contribute significantly to the company's overall strategy or market share would likely fall into this category.

These niche pork products would typically operate in low-growth, fragmented markets, resulting in low returns on investment.

- Limited Market Share: These products likely hold a small percentage of their respective markets.

- Low Growth Potential: The segments they operate in are not experiencing substantial expansion.

- Low Profitability: Returns generated are minimal, often insufficient to justify continued investment.

- Strategic Disconnect: They do not align with Pilgrim's Pride's core business strategy, which is heavily weighted towards poultry.

Pilgrim's Pride's "Dogs" represent segments with low market share in low-growth markets, such as certain legacy or niche product lines. These offerings, like undifferentiated bulk chicken products, face intense price competition, as evidenced by the 2024 U.S. broiler feed cost of approximately $0.46 per pound. Such segments demand minimal investment, focusing instead on extracting any residual value or eventual divestment to optimize capital allocation towards more promising ventures.

Question Marks

Pilgrim's Pride's potential expansion into plant-based protein alternatives, through research and development or strategic alliances, positions these ventures within the Question Mark quadrant of the BCG matrix. This market is experiencing rapid growth, with global plant-based meat market projected to reach $85 billion by 2030, but Pilgrim's Pride currently holds a minimal share in this developing sector.

These initiatives, while offering the promise of substantial future expansion and a hedge against potential declines in traditional poultry consumption, necessitate significant capital outlay and carry inherent risks due to the unpredictable nature of consumer acceptance and evolving market dynamics. For instance, the plant-based sector saw major players like Beyond Meat and Impossible Foods invest heavily in marketing and production in 2023 and 2024, yet profitability remains a challenge for many.

Pilgrim's Pride's potential entry into new geographic markets beyond its core US, Mexico, and European operations represents a classic "Question Mark" in the BCG matrix. Asia, with its burgeoning middle class and increasing demand for protein, offers substantial growth prospects. For instance, the Asia-Pacific poultry market was valued at approximately $118 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030.

However, these nascent markets require significant upfront capital for establishing robust supply chains, distribution networks, and brand recognition. The company must navigate diverse regulatory landscapes and consumer preferences, which adds layers of complexity and risk.

Pilgrim's Pride's success in these new territories hinges on its ability to adapt its product offerings and operational strategies to local conditions, a process that carries inherent uncertainty and requires careful market research and phased investment.

Pilgrim's Pride's high-end specialty or organic chicken product lines, such as its "Simply Nature" organic line or niche offerings like heritage breed chicken, likely fall into the Question Marks category. These products cater to a growing, health-conscious consumer base. The organic chicken market is experiencing robust growth, projected with a CAGR of 14.95% from 2025 to 2033.

Despite this market potential, Pilgrim's Pride's penetration in these specific high-end segments may still be nascent, meaning their market share is relatively small compared to established players or even emerging niche brands. This limited distribution and early market stage necessitate significant investment in brand building, consumer education, and expanding retail partnerships.

To transition these products from Question Marks to Stars, Pilgrim's Pride must strategically invest in marketing campaigns that highlight the unique value proposition of its specialty and organic offerings. Securing wider distribution channels, both online and in premium grocery stores, will be crucial to capture a larger share of this expanding market.

Advanced Sustainable/Eco-Friendly Product Lines

Pilgrim's Pride's exploration into advanced sustainable and eco-friendly product lines, extending beyond standard antibiotic-free offerings, signifies a forward-looking strategy. These initiatives, while tapping into a burgeoning consumer interest in environmental responsibility, currently face the hurdle of higher production costs. As of 2024, the market for these premium sustainable products is still developing, with adoption rates not yet reaching critical mass.

These emerging product categories are positioned in the Question Marks quadrant of the BCG matrix. They require significant capital investment to develop and scale, acting as cash consumers with uncertain future returns. For example, investments in novel feed alternatives or advanced waste reduction technologies, while promising long-term benefits, demand substantial upfront funding.

- High Production Costs: Advanced sustainable practices, like regenerative agriculture sourcing or carbon-neutral packaging, often translate to increased operational expenses compared to conventional methods.

- Developing Market Share: While consumer awareness is rising, the actual market penetration for these niche eco-friendly products is still relatively low in 2024, limiting immediate revenue generation.

- Investment Intensive: Pilgrim's Pride's commitment to these lines means ongoing cash outflows for research, development, and market education.

- Potential Future Stars: Successful scaling and increased consumer acceptance could transform these Question Marks into Stars, generating significant future revenue.

Innovative Product Pipeline beyond Core Offerings

Pilgrim's Pride's innovative product pipeline, a key area for future growth, has introduced a significant number of new items. In the third quarter of 2024 alone, the company launched over 280 new products. These are not just variations but are designed to be differentiated and innovative, catering to changing consumer tastes and demands.

These new offerings represent potential stars within the BCG matrix. They exhibit high growth potential due to their innovative nature and alignment with market trends. However, as many are new to the market, they currently hold a low market share. This characteristic necessitates substantial investment to build brand awareness, expand distribution, and achieve broader consumer adoption.

- Over 280 new products launched in Q3 2024

- Focus on innovation and differentiation

- High growth potential

- Currently low market share, requiring investment

Pilgrim's Pride's ventures into emerging categories like plant-based proteins and expansion into new, high-growth geographic markets are classic Question Marks. These areas offer significant future potential but require substantial investment and face considerable uncertainty regarding consumer adoption and competitive landscapes. For example, the global plant-based meat market is projected to reach $85 billion by 2030, yet Pilgrim's Pride's current share is minimal, demanding investment in marketing and production to gain traction, similar to the heavy investments made by Beyond Meat and Impossible Foods in 2023-2024.

High-end specialty or organic chicken lines, alongside advanced sustainable product offerings, also fall into the Question Mark category. While the organic chicken market shows strong growth, projected at a 14.95% CAGR from 2025 to 2033, Pilgrim's Pride's penetration in these niche segments may still be limited, necessitating investment in brand building and wider distribution. Similarly, sustainable product lines face higher production costs and developing market share in 2024, requiring ongoing capital for R&D and market education.

The company's innovative product pipeline, with over 280 new products launched in Q3 2024, represents potential Stars but are currently Question Marks due to their low market share. These initiatives require significant investment to build brand awareness and achieve broader consumer adoption, highlighting the need for strategic capital allocation to convert these nascent products into market leaders.

| Category | Market Growth | Pilgrim's Pride Share | Investment Need | Key Challenges |

| Plant-Based Proteins | High (projected $85B by 2030) | Minimal | High | Consumer acceptance, competition |

| New Geographic Markets (e.g., Asia) | High (APAC poultry market ~$118B in 2023, 7%+ CAGR) | Low | High | Supply chains, regulations, local preferences |

| Specialty/Organic Chicken | High (Organic CAGR 14.95% from 2025-2033) | Low/Nascent | Medium | Brand building, distribution expansion |

| Sustainable/Eco-Friendly Lines | Developing | Low | High | Production costs, market penetration |

| Innovative Product Pipeline (Q3 2024 launches) | High Potential | Low | Medium | Brand awareness, consumer adoption |

BCG Matrix Data Sources

Our Pilgrim's Pride BCG Matrix is built on a foundation of robust data, encompassing financial reports, market share analyses, and industry growth projections.