Paycom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paycom Bundle

Paycom operates in a dynamic HR technology landscape, facing varying degrees of influence from suppliers and buyers. The threat of new entrants and substitute products also plays a significant role in shaping its competitive environment. Understanding these forces is crucial for any stakeholder looking to navigate this market effectively.

The full Porter's Five Forces Analysis for Paycom delves deeper into each of these pressures, offering a comprehensive view of the industry's structure and Paycom's strategic positioning within it. This detailed examination provides actionable insights into the competitive intensity and potential profitability of the HR tech sector.

Ready to move beyond the basics? Get a full strategic breakdown of Paycom’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Paycom's reliance on specialized technology components and cloud infrastructure providers means its bargaining power of suppliers is influenced by supplier concentration. If a few dominant players control essential services or components, they could dictate terms. This is particularly relevant for cloud infrastructure, where a handful of major providers exist.

However, the sheer scale of these major cloud providers, serving a vast customer base, often dilutes their individual leverage over any single client like Paycom. For instance, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, while dominant, have thousands of enterprise clients, making it less likely they would exert extreme pressure on one customer unless Paycom's contract represented an unusually large portion of their business.

The uniqueness of Paycom's required technology components also plays a role. If these are highly proprietary and difficult to source elsewhere, suppliers of these specific parts could hold more sway. Conversely, if alternatives are readily available, Paycom’s bargaining power increases.

In 2024, the cloud computing market continued its robust growth, with giants like AWS, Azure, and Google Cloud holding significant market share. For example, AWS is estimated to hold around 31% of the cloud infrastructure market as of early 2024, demonstrating significant concentration, yet this also signifies their need to maintain broad customer relationships.

The effort and cost for Paycom to switch core technology suppliers, like changing its primary data center providers or replacing fundamental software development tools, would be substantial. These high switching costs can significantly increase supplier power, making it challenging for Paycom to easily transition to alternative vendors without incurring significant disruption and expense.

Paycom currently hosts its comprehensive human capital management solution in multiple secure data centers. Furthermore, the company has plans to open a fourth data center by mid-2025. This multi-location strategy is designed to enhance resilience and potentially mitigate some of the risks associated with reliance on a single infrastructure supplier.

The availability of substitute inputs significantly impacts supplier bargaining power. When a company, like Paycom, can easily find alternative sources for its operational needs, such as office supplies or marketing services, the suppliers of those items have less leverage. For instance, if Paycom needs new computers, and there are many reputable manufacturers offering similar products at competitive prices, the power of any single computer supplier is diminished.

However, the situation changes dramatically when dealing with specialized inputs. For Paycom, critical components like highly specific HR and payroll compliance data are not easily substituted. If only a few providers offer the depth and accuracy of data required to ensure client compliance with ever-changing regulations, these specialized data providers gain considerable bargaining power. In 2024, the complexity and frequency of regulatory updates in payroll and HR mean that access to accurate, up-to-date data is paramount, limiting Paycom's ability to switch providers without significant risk or cost.

Importance of Supplier's Input to Paycom's Product

Paycom's robust Human Capital Management (HCM) software relies heavily on critical technology components and specialized data feeds. When a supplier's contribution is both essential and unique, with few or no readily available substitutes, that supplier gains significant leverage. This power directly impacts Paycom's ability to maintain the quality and functionality of its core product offerings.

For instance, if Paycom integrates a proprietary AI algorithm for talent acquisition from a single vendor, that vendor's bargaining power is amplified. In 2024, the increasing complexity of HR technology, particularly in areas like data analytics and compliance, means that specialized third-party integrations are often indispensable.

- Reliance on proprietary data: Paycom's platform integrates various data streams, some of which may be sourced from specialized providers.

- Impact on innovation: If a key technology component is supplied by a single entity, Paycom’s ability to innovate in that specific area can be constrained by the supplier.

- Cost implications: A supplier with high bargaining power can dictate terms and pricing for essential inputs, potentially increasing Paycom's cost of goods sold.

- Switching costs: The effort and expense involved in finding and integrating an alternative supplier for critical components can be substantial, further empowering existing suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into developing their own Human Capital Management (HCM) software solutions is generally low for Paycom. The significant investment required for developing sophisticated HCM platforms, coupled with navigating complex regulatory landscapes such as GDPR and CCPA, presents a substantial barrier. Furthermore, the established customer loyalty and the deep integration of existing HCM systems within client operations make it difficult for new entrants, even those with existing supplier relationships, to gain traction.

For instance, cloud infrastructure providers, a key supplier category, typically lack the specialized domain expertise in HR processes and payroll compliance necessary to build a competitive HCM offering. While some niche software component suppliers might possess relevant technology, the broader market entry requires extensive sales, marketing, and customer support infrastructure that is distinct from their current business models. In 2024, the HCM market continued to be dominated by established players, underscoring the difficulty of disruptive entry.

- High Development Costs: Building a comprehensive HCM suite requires substantial capital expenditure for software development, research, and ongoing updates.

- Regulatory Complexity: Compliance with labor laws, data privacy regulations (like those in the EU and US), and tax requirements demands specialized knowledge and continuous adaptation.

- Customer Lock-in: Existing HCM providers benefit from strong customer relationships and the cost and effort involved for businesses to switch systems.

- Lack of Core Competency: Many potential suppliers, particularly in areas like cloud infrastructure, do not possess the core HR and payroll expertise needed to compete effectively in the HCM software market.

Paycom's bargaining power with suppliers is influenced by the concentration of providers for critical inputs like specialized HR data and technology components. When only a few suppliers offer unique, indispensable services, their leverage increases significantly. This is particularly true for data providers ensuring compliance with complex regulations, a market where alternatives are limited in 2024 due to the intricacy of HR and payroll laws.

High switching costs for Paycom, involving the integration of new technology or data sources, further empower suppliers. The substantial effort and expense to transition away from an established provider can make it challenging for Paycom to negotiate better terms or find alternative solutions without considerable disruption.

The threat of suppliers integrating forward into the HCM market is low due to the significant investment and specialized HR expertise required. Established players, like Paycom, benefit from strong customer relationships and deep system integration, creating high barriers to entry for potential competitors, even those supplying components.

| Supplier Type | Key Input | Supplier Bargaining Power Factors | Paycom's Mitigation Strategies | 2024 Relevance |

|---|---|---|---|---|

| Cloud Infrastructure | Data Center Services, Computing Power | Provider Concentration (AWS, Azure, Google Cloud) | Multi-location data centers, Scale of providers dilutes individual leverage | Continued growth in cloud market, significant concentration but broad customer base for providers. |

| Specialized Data Providers | HR & Payroll Compliance Data | Uniqueness of data, Regulatory complexity, Few alternatives | Focus on data accuracy and breadth, potential for long-term contracts | Increased regulatory complexity and frequency of updates in 2024; critical for compliance. |

| Technology Component Vendors | Proprietary Software, AI Algorithms | Uniqueness of components, High integration costs for Paycom | Diversification of technology stack where possible, strategic partnerships | Increasing reliance on specialized third-party integrations for HR tech innovation. |

What is included in the product

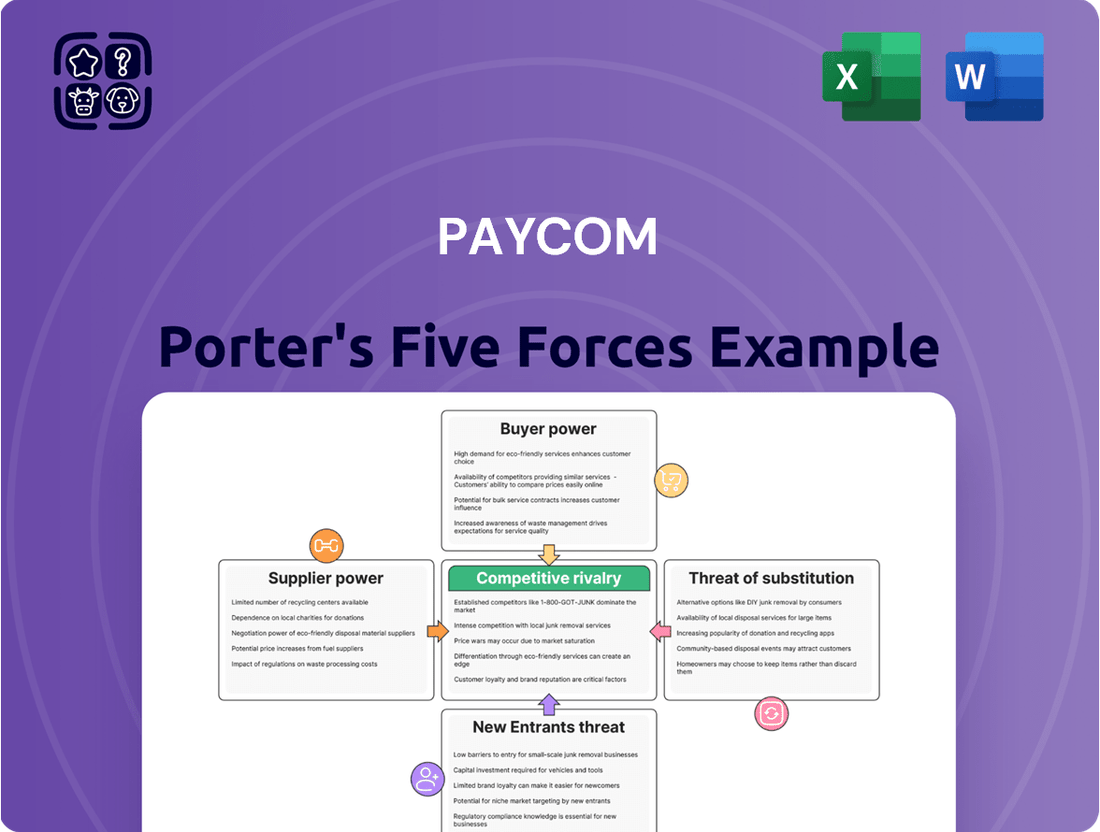

This analysis unpacks the competitive intensity within the HR technology market, focusing on Paycom's specific position. It examines the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of each Porter's Five Forces, empowering strategic decision-making.

Customers Bargaining Power

Customers face considerable switching costs when moving from Paycom to another Human Capital Management (HCM) provider. These costs include the complex and time-consuming process of data migration, the expense and effort involved in retraining employees on a new system, and the potential for significant disruption to essential HR and payroll operations. For instance, a company might spend thousands of dollars on consulting fees and internal resources just to accurately transfer employee data and configure new workflows.

These substantial switching barriers effectively diminish the bargaining power of individual customers once they have committed to Paycom's platform. The investment in time, money, and operational integration makes it economically unfeasible for many to switch, thereby strengthening Paycom's position and reducing the immediate threat of customer defection due to price or feature demands.

Customer concentration is a key factor in assessing the bargaining power of customers. For Paycom, this is a significant advantage. In 2024, Paycom's business model was characterized by serving a vast array of small to mid-sized businesses.

Crucially, no single client represented more than a minuscule fraction of Paycom's total revenue, with each accounting for less than 0.5%. This broad client diversification significantly dilutes the bargaining power of any individual customer.

The ability of a single client to exert pressure on Paycom is severely limited because the loss of any one client would have a negligible effect on the company's overall financial performance. This low customer concentration therefore translates to lower customer bargaining power.

The availability of numerous Human Capital Management (HCM) software alternatives significantly amplifies customer bargaining power. Competitors such as ADP, Paychex, Workday, Paylocity, UKG, and Rippling offer comparable solutions, providing clients with ample choice.

Furthermore, organizations can opt for less sophisticated methods like manual processes or leverage Professional Employer Organizations (PEOs). This wide array of substitutes means that if Paycom's pricing, features, or service levels are perceived as unfavorable, customers can readily switch to a competitor or an alternative solution, putting pressure on Paycom to remain competitive.

Price Sensitivity of Customers

The price sensitivity of customers is a key factor influencing the bargaining power of buyers for Paycom. Small to mid-sized businesses, often operating with tighter budgets, tend to be more sensitive to the recurring costs associated with software subscriptions like those offered by Paycom. This sensitivity can lead them to actively seek out more cost-effective solutions, even if they require some compromise on features or immediate ROI.

While Paycom effectively highlights the return on investment (ROI) its platform delivers through automation and efficiency gains, the reality of customer budget constraints cannot be ignored. The availability of lower-cost competitors or alternative, less integrated solutions can create significant pricing pressure on Paycom. For instance, if a competitor offers a core HR function at a substantially lower price point, it may entice budget-conscious SMBs to explore those options.

- Price Sensitivity in SMBs: Many small and medium-sized businesses (SMBs) are highly attuned to subscription costs, particularly for essential business software.

- Paycom's Value Proposition vs. Cost: Paycom's focus on ROI through automation is a strong selling point, but it must contend with budget limitations faced by many of its target customers.

- Competitive Pricing Landscape: The presence of lower-cost alternatives, even if less comprehensive, can force Paycom to be mindful of its pricing strategy to remain competitive.

- Impact on Negotiations: Heightened price sensitivity empowers customers to negotiate more aggressively on contract terms and pricing, potentially impacting Paycom's revenue and profit margins.

Customer's Ability to Backward Integrate

The bargaining power of Paycom's customers is significantly constrained by their inability to backward integrate and develop their own Human Capital Management (HCM) software. For small to mid-sized businesses, the undertaking of creating a comprehensive HCM solution from scratch is practically infeasible. This is due to the substantial financial investment, the need for specialized technical expertise, and the continuous demands of software maintenance and updates.

The high barrier to entry for developing proprietary HCM systems effectively limits customer leverage. Without the option to build their own internal solutions, clients are less likely to exert significant price pressure on Paycom. This dependence on Paycom's established platform solidifies Paycom's position and reduces the threat of customers switching to self-developed alternatives.

- High Development Costs: Building an HCM suite requires millions in R&D, talent acquisition, and infrastructure, making it prohibitive for most SMBs.

- Specialized Expertise Needed: Developing and maintaining HR software demands deep knowledge in areas like payroll processing, benefits administration, compliance, and data security.

- Ongoing Maintenance & Updates: Regulations and technology evolve rapidly, necessitating continuous investment in updates and support, which is a significant ongoing burden.

- Limited Customer Integration Power: The inability to create in-house solutions directly reduces the bargaining power of Paycom's customer base.

The bargaining power of Paycom's customers is relatively low due to high switching costs, including data migration, retraining, and operational disruption. Paycom's business model, serving numerous small to mid-sized businesses with no single client exceeding 0.5% of revenue in 2024, further dilutes individual customer leverage. Customers also cannot backward integrate to develop their own HCM solutions, a process that is prohibitively expensive and complex for most businesses.

| Factor | Impact on Customer Bargaining Power | Paycom's Position |

|---|---|---|

| Switching Costs | High (data migration, retraining) | Reduces customer threat of switching |

| Customer Concentration | Low (clients <0.5% of revenue in 2024) | Dilutes individual customer leverage |

| Availability of Substitutes | High (ADP, Paychex, Workday, etc.) | Increases pressure for competitive pricing/features |

| Ability to Backward Integrate | None (infeasible for SMBs) | Limits customer price pressure |

Full Version Awaits

Paycom Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase. You're looking at the actual, professionally written Paycom Porter's Five Forces Analysis, detailing competitive intensity and industry attractiveness. Once you complete your purchase, you’ll get instant access to this exact file, fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The human capital management (HCM) software market is a crowded space, making competitive rivalry a significant force. Paycom faces a diverse array of competitors, from giants like ADP and Workday to many smaller, specialized firms. This fragmentation means companies are constantly battling for customer attention and market share.

This intense competition is particularly pronounced in the mid-market segment, where Paycom primarily focuses. In 2024, the HCM market continues to see significant investment and innovation, with companies like UKG and Ceridian also holding substantial positions. The sheer number of vendors means that differentiation and value proposition are critical for success.

The human capital management (HCM) market is experiencing robust growth, with projections indicating an annual expansion rate of 9%. This healthy growth offers a larger pie for all participants. However, it doesn't necessarily mean a reduction in competitive intensity.

Instead, companies are aggressively vying for market share within this expanding sector. The drive to capture a greater portion of this growing market fuels a high level of rivalry among HCM providers.

Paycom distinguishes itself through a unique single database architecture and a strong emphasis on employee self-service and automation, which it claims delivers substantial return on investment for its clients. This approach aims to streamline HR processes and enhance employee engagement.

While high switching costs are a common characteristic of Human Capital Management (HCM) software, discouraging clients from moving to competitors, the market is still dynamic. Companies like Paycom face continuous efforts to attract new clients and retain their existing customer base, as competitors also offer compelling differentiated features.

Exit Barriers

The payroll and HR software industry, like many SaaS businesses, presents significant exit barriers. Developing and maintaining sophisticated cloud-based platforms requires substantial ongoing investment in technology, specialized infrastructure, and skilled personnel. This high fixed cost structure makes it economically challenging for companies to simply shut down operations without incurring significant losses.

These elevated exit barriers mean that even businesses struggling with profitability may feel compelled to remain in the market rather than abandon their investments. This can, in turn, prolong competitive pressure, as these firms continue to operate and vie for market share, even if their performance is suboptimal.

- High Upfront Investment: Companies in the HR tech space often invest hundreds of millions in developing and refining their cloud-based platforms. For instance, major players continually reinvest in R&D to stay ahead in features and security.

- Specialized Infrastructure: Maintaining secure, scalable, and compliant data centers and cloud infrastructure is a significant ongoing expense, creating a barrier to exiting without disposing of these assets at a loss.

- Skilled Workforce: A trained workforce of developers, cybersecurity experts, and customer support specialists is crucial. Disbanding such a team or reallocating these specialized skills elsewhere can be a costly and complex process.

- Customer Contracts and Switching Costs: Long-term contracts and the effort involved for clients to switch payroll providers also contribute to the inertia, making it harder for underperforming companies to exit gracefully.

Strategic Stakes

The Human Capital Management (HCM) sector is a crucial battleground for many tech firms, fueling substantial investments in research and development, sales operations, and marketing initiatives. This intense focus on innovation is evident as companies like Paycom continuously enhance their offerings. For instance, Paycom's dedication to R&D is reflected in its continuous development of advanced features.

Companies are aggressively pursuing technological advancements to capture market share and ensure long-term growth. This includes the integration of artificial intelligence for enhanced functionality and the expansion of global capabilities to cater to a wider client base. By staying ahead of the curve, these businesses aim to solidify their position in a highly competitive landscape.

- Innovation Drive: Companies are investing heavily in R&D to introduce new features, such as AI-powered tools for employee management and global HCM solutions.

- Strategic Importance: The HCM market is highly strategic for technology companies, driving aggressive spending to maintain a competitive edge.

- Market Share Focus: Continuous innovation is key to capturing and retaining market share in the dynamic HCM industry.

- Future Growth: Investments in new technologies and global expansion are critical for driving future revenue growth and profitability.

The competitive rivalry in the HCM market is fierce, with Paycom facing numerous competitors ranging from large established players to niche specialists. This intense competition drives constant innovation and a focus on customer acquisition and retention. The market's rapid growth, projected at 9% annually, fuels this rivalry as companies aggressively seek to capture market share.

Paycom differentiates itself through its single database architecture and emphasis on employee self-service, aiming to deliver tangible ROI. Despite high switching costs, the dynamic nature of the HCM sector means competitors continuously introduce compelling features to attract and retain clients. Exit barriers are high due to substantial investment in technology, infrastructure, and skilled personnel, forcing even struggling firms to remain competitive.

| Competitor | Market Focus | Key Differentiator |

|---|---|---|

| ADP | Small to large businesses | Comprehensive payroll and HR services |

| Workday | Mid-size to enterprise | Cloud-native HCM and financial management |

| UKG | Small to enterprise | Workforce management and HR solutions |

| Ceridian | Mid-size to enterprise | Dayforce HCM platform |

SSubstitutes Threaten

Traditional in-house HR management, often involving manual processes and spreadsheets, presents a significant threat of substitution for integrated Human Capital Management (HCM) solutions like Paycom. Smaller businesses, particularly those with straightforward HR requirements, may find these simpler, lower-cost alternatives appealing. For instance, a survey in early 2024 indicated that nearly 40% of small businesses still rely on spreadsheets for critical HR functions, highlighting the persistent appeal of manual methods due to perceived cost savings.

Professional Employer Organizations (PEOs) present a significant threat of substitution for Human Capital Management (HCM) software providers like Paycom. PEOs offer a complete outsourcing solution for HR functions, encompassing payroll, benefits administration, and regulatory compliance. This comprehensive service model directly replaces the need for businesses to manage these processes internally, even with sophisticated HCM software.

For companies aiming to delegate HR responsibilities entirely, PEOs act as a compelling alternative to relying solely on an HCM platform. The appeal lies in shifting the burden of HR management and associated liabilities to a third party. This can be particularly attractive to small and medium-sized businesses that may lack dedicated HR expertise or resources.

The PEO industry itself is substantial. For instance, in 2024, the PEO industry in the United States was estimated to serve approximately 175,000 businesses and provide health benefits to about 3.7 million worksite employees. This widespread adoption highlights the established market presence and perceived value of PEO services as a substitute for internal HR management or standalone HCM software solutions.

The threat of substitutes for Paycom's comprehensive Human Capital Management (HCM) suite comes from what's known as 'point solutions.' Instead of adopting an all-in-one platform, businesses might opt for specialized, standalone software for specific HR needs. For instance, a company could use a separate payroll processor, a dedicated time and attendance system, or an independent applicant tracking system.

This 'best-of-breed' strategy allows organizations to select the top-performing software for each individual function. Companies might choose this approach if they believe these specialized tools offer superior features or a more cost-effective solution for their particular requirements. For example, a small business might find it more economical to use a free or low-cost payroll service alongside a separate, highly-rated applicant tracking system.

The availability of these specialized, often more affordable, alternatives can limit the pricing power of integrated HCM providers like Paycom. In 2024, the market for specialized HR software remains robust, with many vendors offering highly competitive solutions. This fragmented market means businesses have numerous options to piece together their HR technology stack, potentially bypassing the need for a single, unified platform.

Generic Business Software with HR Modules

Enterprise Resource Planning (ERP) systems from larger vendors, such as SAP or Oracle, frequently offer integrated Human Resources (HR) modules. These can function as substitutes for specialized Human Capital Management (HCM) software like Paycom, particularly for organizations that prefer a unified system for all their enterprise needs and may not require the most advanced HR functionalities.

The market for ERP software remains robust, with the global ERP market size estimated to reach approximately $60.1 billion in 2024, according to various industry reports. This indicates a substantial presence of potential substitute solutions. Companies that find the core HR functionalities within these broad ERP systems sufficient for their operational requirements might opt against investing in a separate, dedicated HCM platform.

- Significant Market Presence: Major ERP providers like SAP and Oracle have established, large customer bases, offering integrated HR modules as part of their broader suites.

- Cost Considerations: For some businesses, leveraging existing ERP investments for HR functions can appear more cost-effective than adopting a new, specialized HCM solution.

- Integration Preference: Companies prioritizing a single point of integration for all business processes may lean towards ERP solutions with built-in HR capabilities.

- Functional Adequacy: If an organization's HR needs are relatively basic, the HR modules within ERP systems may adequately meet their requirements.

Outsourcing HR Functions

Companies increasingly opt to outsource specific HR functions such as recruitment, payroll processing, or benefits administration to external consultants or specialized service providers. This practice presents a significant threat of substitutes for in-house HR software solutions. For instance, in 2024, the global HR outsourcing market was valued at approximately $30 billion, demonstrating a substantial shift towards external service providers.

These outsourced services can directly replace the need for a comprehensive HR software suite, particularly for smaller to medium-sized businesses that may find dedicated software expensive or overly complex. Specialized providers often offer tailored expertise that can be more cost-effective than investing in and maintaining in-house technology. This trend is further amplified by the growing demand for compliance and specialized HR knowledge, which external vendors can readily supply.

- Outsourcing HR can be more cost-effective for SMEs than investing in full HR software suites.

- Specialized HR outsourcing firms offer deep expertise in areas like compliance and recruitment.

- The global HR outsourcing market continues to grow, indicating a strong preference for external solutions.

- Technological advancements in outsourcing platforms make these services increasingly competitive against in-house software.

The threat of substitutes for Paycom's integrated HCM solutions is multifaceted. Businesses can opt for manual processes and spreadsheets, especially smaller companies with simpler HR needs, as highlighted by nearly 40% of small businesses still using spreadsheets for HR in early 2024. Alternatively, Professional Employer Organizations (PEOs) offer a complete HR outsourcing solution, serving an estimated 175,000 businesses and 3.7 million employees in the US in 2024, directly competing with standalone HCM platforms.

| Substitute Type | Description | Key Appeal | 2024 Data Point/Trend |

|---|---|---|---|

| Manual HR Processes/Spreadsheets | In-house management using basic tools. | Perceived cost savings, simplicity for small businesses. | ~40% of small businesses still rely on spreadsheets for critical HR functions. |

| Professional Employer Organizations (PEOs) | Full HR outsourcing including payroll, benefits, compliance. | Delegation of HR burden and liability, specialized expertise. | Serves ~175,000 businesses and 3.7 million worksite employees in the US. |

| Point Solutions | Specialized, standalone software for specific HR functions (e.g., payroll, ATS). | Best-of-breed features, potentially lower cost for specific needs. | Fragmented market with numerous specialized vendors offering competitive solutions. |

| Integrated ERP Systems | HR modules within broader enterprise resource planning software. | Unified system for all business processes, leveraging existing investments. | Global ERP market estimated at ~$60.1 billion in 2024. |

| HR Outsourcing Services | External consultants or providers for specific functions like recruitment or payroll. | Cost-effectiveness for SMEs, specialized expertise, compliance focus. | Global HR outsourcing market valued at ~$30 billion in 2024. |

Entrants Threaten

Developing and maintaining a sophisticated cloud-based Human Capital Management (HCM) software platform like Paycom demands massive upfront and continuous investment. This includes significant capital for cutting-edge technology, ongoing research and development to stay competitive, and building a strong sales and marketing apparatus.

These substantial capital requirements act as a formidable barrier for new companies looking to enter the HCM software market. For instance, companies in the SaaS sector often report R&D spending in the tens of millions of dollars annually, with infrastructure costs also running into the millions. This high financial hurdle makes it challenging for smaller players to compete with established giants.

The payroll and HR sector operates under a dense web of regulations, demanding specialized knowledge of tax codes and labor laws. For instance, the U.S. alone has federal, state, and local tax requirements that change frequently, impacting how businesses handle payroll. New entrants must invest heavily in legal and compliance infrastructure to navigate this intricate environment.

The threat of new entrants in the HR technology space, particularly for companies like Paycom, is significantly mitigated by the critical factor of brand recognition and trust. Handling sensitive employee data, from payroll details to personal information, necessitates a deep level of client confidence in security and reliability. Newcomers face an uphill battle in establishing this trust, as established providers like Paycom have cultivated strong reputations over many years. For instance, in 2024, the cybersecurity landscape continues to be a major concern for businesses, making them hesitant to switch to unproven solutions for mission-critical HR functions.

Customer Switching Costs

Customers face substantial switching costs when adopting a Human Capital Management (HCM) system, a significant barrier for new entrants. These costs often involve not only financial outlays for new software and implementation but also the considerable time and effort required for data migration, employee retraining, and the disruption to ongoing HR processes. For instance, a company switching from one HCM provider to another in 2024 might spend anywhere from tens of thousands to hundreds of thousands of dollars, depending on the size of the organization and the complexity of their HR operations. This inherent stickiness of existing clients makes it challenging for new competitors to gain market share, even if they offer superior technology or pricing. Paycom, like other established players, benefits from this entrenched customer base, as the perceived risk and effort of switching often outweigh the potential benefits for many businesses.

The high switching costs create a loyal customer base for incumbents like Paycom. This loyalty stems from the significant investment already made in the current system and the associated operational integration. For example, a 2023 industry report indicated that over 70% of businesses consider switching HCM providers to be a "major undertaking." This makes it difficult for new entrants to persuade existing clients to move, even with potentially innovative features or more competitive pricing. The inertia built into these systems acts as a powerful deterrent to disruption.

- High Implementation Investment: Businesses often invest heavily in initial setup, customization, and data migration when deploying an HCM system.

- Employee Training and Adoption: Significant resources are dedicated to training staff on new software, and resistance to change can slow adoption.

- Data Integration Complexity: Migrating historical HR data, payroll records, and benefits information is a complex and time-consuming process.

- Process Re-engineering: Companies may need to redesign existing HR workflows to align with the new system's capabilities.

Economies of Scale and Experience Curve

Existing Human Capital Management (HCM) providers, like Paycom, leverage significant economies of scale. This means they can spread their substantial development, sales, and customer support costs across a vast customer base. For instance, in 2024, major HCM players continued to invest heavily in R&D, with some reporting over 15% of revenue dedicated to innovation, a level difficult for newcomers to match.

These established players can therefore offer more competitive pricing or reinvest more into enhancing their product offerings. A new entrant would find it extremely challenging to achieve similar cost efficiencies without a large, established customer base. This inherent disadvantage makes it difficult for new companies to compete effectively on price or feature set from the outset.

- Economies of Scale: Established HCM providers benefit from lower per-unit costs in development, sales, and support due to their large operational footprint.

- Experience Curve: Over time, existing firms gain efficiency through learning and process optimization, further reducing costs and improving service delivery.

- Barriers to Entry: New entrants face a significant hurdle in matching the cost structure and operational efficiency of incumbent players, impacting their ability to offer competitive pricing.

- Investment Requirements: Reaching a scale comparable to market leaders would necessitate massive upfront investment in technology, sales infrastructure, and marketing, which is a substantial risk for new ventures.

The threat of new entrants for Paycom is generally low due to the substantial capital required for platform development and maintenance, as well as the need for extensive sales and marketing infrastructure. Furthermore, navigating the complex regulatory landscape of payroll and HR demands specialized expertise and significant investment in compliance. These factors create high barriers to entry, making it difficult for new companies to challenge established players like Paycom.

Porter's Five Forces Analysis Data Sources

Our analysis of Paycom's competitive landscape leverages data from public financial filings, industry analyst reports, and proprietary market research. This ensures a comprehensive understanding of the forces shaping the HR technology sector.