Paycom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paycom Bundle

Curious about Paycom's product portfolio and market position? Our BCG Matrix analysis reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understand the dynamics driving their success and where potential challenges lie. Don't miss out on the comprehensive insights that will empower your strategic decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Paycom's Beti® Automated Payroll stands out as a major innovation, enabling employees to manage their own payroll with AI ensuring accuracy. This feature has been a significant factor in Paycom's growth, offering clients considerable time savings and enhanced operational efficiency. The market for sophisticated payroll solutions is expanding, and Beti® is well-positioned to capture a substantial share of this growth.

Paycom’s comprehensive HCM suite is a strong contender in the SMB market, boasting a significant market share. Its integrated, cloud-based platform manages the entire employee journey, from hiring to retirement. This unified approach is a major draw for smaller businesses aiming for operational efficiency.

The company’s focus on a single, unified database for all HR functions streamlines processes, a critical advantage for growing SMBs. This cohesive system simplifies data management and reduces the complexity often associated with HR tasks for these businesses.

In 2023, Paycom reported total revenue of $1.47 billion, demonstrating robust growth, with a significant portion of its client base residing in the SMB segment. This financial performance underscores the demand for their all-encompassing HR solutions within this market.

The attractiveness of Paycom's offering is further amplified by its ability to adapt to the evolving needs of SMBs. As these businesses scale, the need for integrated HR technology that supports growth becomes paramount, positioning Paycom favorably.

Paycom’s workforce management solutions are a shining star in their BCG matrix. The company’s offerings in time and labor management, including sophisticated scheduling and seamless time-off requests, are seeing robust client adoption. This high demand reflects the critical need for efficient employee management in today's business environment.

Tools such as GONE®, Paycom’s automated time-off management system, are proving invaluable. Clients are realizing significant return on investment through reduced manual labor and fewer errors, which directly impacts operational efficiency. This strong performance solidifies Paycom's leadership in the essential and ever-expanding workforce management sector.

Talent Acquisition & Onboarding

Paycom's talent acquisition and onboarding solutions are vital for companies prioritizing growth and keeping their employees. These tools simplify how businesses find and welcome new hires, making sure the transition into a new role is seamless. This directly addresses the booming market for talent management within the broader Human Capital Management (HCM) industry.

In 2024, the demand for efficient hiring and onboarding processes remains exceptionally high, driving significant investment in HR technology. Companies are increasingly recognizing that a strong start for new employees directly impacts retention rates and overall productivity. Paycom’s integrated approach is well-positioned to capture this demand.

- Streamlined Hiring: Paycom’s platform reduces time-to-hire by automating resume screening, candidate communication, and interview scheduling.

- Enhanced Onboarding: New hires can complete paperwork digitally and access essential training materials before their first day, fostering quicker integration.

- Talent Management Focus: The integrated nature of these modules supports a holistic approach to talent management, a key growth driver in the HCM market.

- Retention Impact: Effective onboarding, facilitated by Paycom’s tools, is a critical factor in improving employee retention, a major concern for businesses in 2024.

AI-Driven Internal Efficiencies

Paycom's strategic investments in artificial intelligence are a cornerstone of its growth, particularly evident in its AI agent designed for client support. This technology is directly contributing to significant internal efficiencies by automating routine inquiries and streamlining workflows. For instance, the AI agent has demonstrably reduced the volume of service tickets, allowing human support staff to focus on more complex client needs. This proactive approach to leveraging AI for operational effectiveness and enhanced client satisfaction underscores Paycom's commitment to innovation within the Human Capital Management (HCM) sector.

The impact of these AI initiatives can be seen in operational metrics. By handling a substantial portion of common client queries, the AI agent frees up valuable resources. This allows Paycom to scale its support operations more effectively without a proportional increase in headcount, a key driver of improved profitability. Furthermore, the consistent and rapid responses provided by AI contribute to a better overall client experience, fostering loyalty and reducing churn.

- AI Agent for Client Support: Directly addresses and resolves a significant portion of client inquiries, reducing the burden on human support teams.

- Reduced Service Tickets: Achieved through AI automation, leading to lower operational costs and improved efficiency in customer service.

- Enhanced Operational Effectiveness: Streamlined processes and automated tasks free up employee time for higher-value activities.

- Leadership in HCM Technology: Demonstrates Paycom's forward-thinking approach to integrating cutting-edge AI solutions within the HR technology landscape.

Paycom's AI-driven solutions, particularly its AI agent for client support, represent a significant "Star" in its BCG matrix. This technology is a strong performer, driving efficiency and client satisfaction by automating routine inquiries. Its success is directly contributing to reduced operational costs and enhanced profitability for Paycom.

The AI agent's ability to handle a substantial volume of common client questions allows Paycom's human support staff to focus on more complex issues. This strategic deployment of AI not only improves the speed and consistency of client interactions but also positions Paycom as a leader in leveraging advanced technology within the HCM sector.

In 2024, the ongoing demand for responsive and efficient client support makes Paycom's AI initiatives particularly valuable. The company's investment in this area is yielding tangible results, evidenced by a notable reduction in service tickets and a more scalable support operation. This positions the AI segment as a key growth driver for the company.

What is included in the product

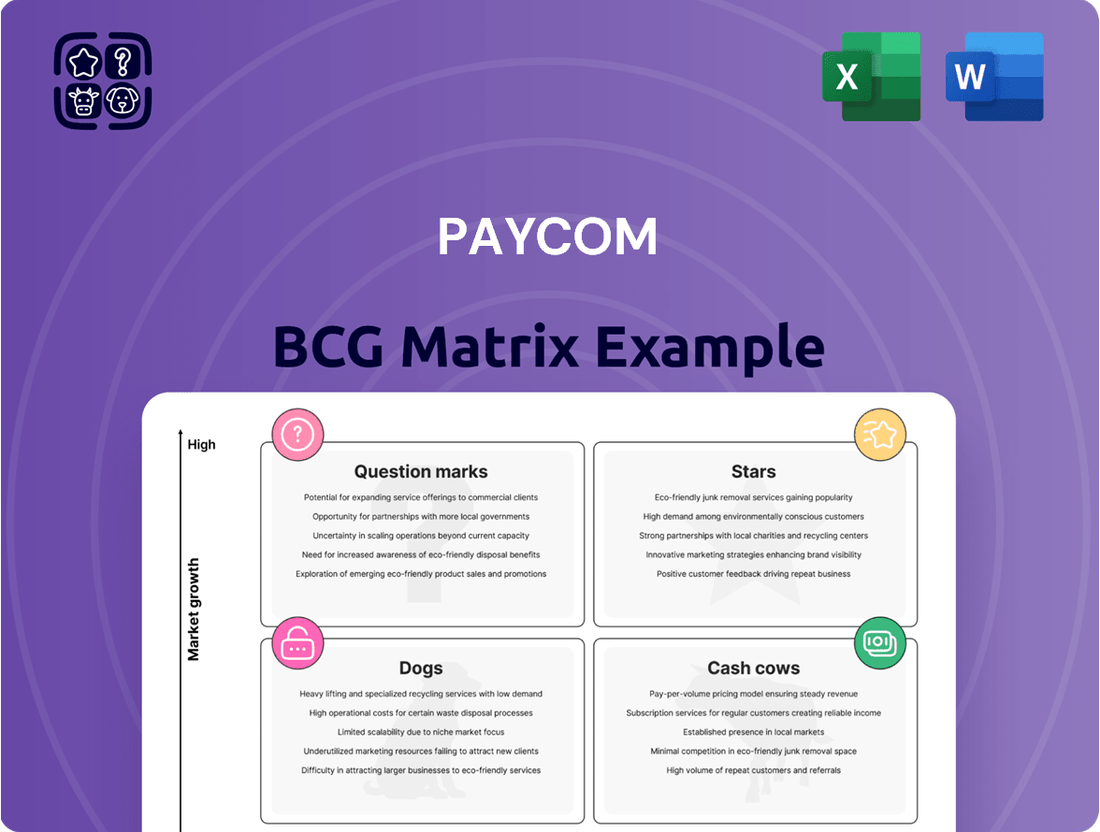

Analysis of Paycom's product portfolio within the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear Paycom BCG Matrix visualizes your product portfolio, reducing the pain of resource allocation uncertainty.

Cash Cows

Paycom's core payroll processing service continues to be a strong cash cow, contributing significantly to its revenue stream. This foundational offering benefits from a substantial and committed client base, ensuring predictable and consistent income.

In 2023, Paycom reported revenue from its payroll-related services, demonstrating the ongoing strength of this mature, high-market-share segment. This stable financial performance provides crucial backing for the company’s investments in newer, growth-oriented solutions.

Paycom's Benefits Administration Module is a classic Cash Cow within its product portfolio. This offering is a foundational element for many businesses, consistently generating predictable revenue without requiring significant new investment. Its stability stems from its essential nature in managing employee health insurance, retirement plans, and other vital benefits.

The module's established market presence and high customer retention solidify its Cash Cow status. In 2023, Paycom reported a total revenue of $1.46 billion, and its Benefits Administration functionality, being a core and widely utilized component, significantly contributes to this steady financial performance. This reliability is key to funding other, more growth-oriented initiatives within the company.

Paycom's core HR compliance and record-keeping services represent a significant cash cow. These fundamental HR functionalities are essential for every business, ensuring stability and consistent revenue for Paycom. These offerings, though mature, boast high client retention, meaning they generate reliable income from Paycom's established customer base.

For instance, in 2024, businesses continued to heavily invest in HR technology to navigate complex regulatory landscapes. Paycom's robust compliance management tools, covering areas like labor laws and data privacy, are critical for companies of all sizes, solidifying their role as dependable income sources.

Existing Client Subscription Base

Paycom's existing client subscription base is a significant cash cow. The recurring nature of its revenue, primarily driven by these subscriptions, provides a stable financial foundation. This is largely due to a robust annual client retention rate, which hovers around 90%.

This high retention translates into a predictable and substantial cash flow for Paycom. Such consistent revenue generation is crucial, enabling the company to allocate resources towards innovation and strategic growth initiatives. In 2023, Paycom reported total revenue of $1.43 billion, a testament to the strength of its recurring revenue model.

- Recurring Revenue Dominance: The majority of Paycom's income is derived from ongoing client subscriptions.

- High Client Retention: An approximate 90% annual retention rate underscores client loyalty and the stickiness of Paycom's product.

- Stable Cash Flow: This predictable revenue stream ensures a consistent inflow of cash, vital for business operations and investment.

- Financial Health and Investment: The substantial cash flow generated allows Paycom to comfortably fund new projects and maintain its strong financial position.

Interest on Funds Held for Clients

Interest on Funds Held for Clients, while not a traditional software offering, acts as a significant cash cow for Paycom. This revenue stream is remarkably stable, bolstered by current interest rate environments and the substantial volume of client payroll funds Paycom manages. In 2023, for instance, Paycom reported substantial interest income, contributing a reliable, low-risk revenue stream to its overall financial performance.

This income source benefits directly from the scale of Paycom's operations; as more clients utilize their payroll services, the pool of funds held grows, directly increasing interest earnings. This stability allows Paycom to allocate resources effectively towards innovation and growth in its core software products.

- Stable Revenue: Interest income provides a consistent and predictable revenue stream, independent of software sales cycles.

- Interest Rate Sensitivity: Earnings are directly influenced by prevailing interest rates, with higher rates leading to increased income.

- Scale Driven: The more clients Paycom serves, the larger the funds held, directly translating to higher interest revenue.

- 2023 Performance: Paycom's reported interest income in 2023 demonstrated the significant contribution of this segment to their total revenue.

Paycom's core payroll processing service remains a robust cash cow, consistently generating substantial revenue from its large and loyal client base. This foundational offering provides predictable income, underpinning the company's financial stability and enabling investments in growth areas.

In 2023, Paycom's payroll-related services demonstrated the continued strength of this mature, high-market-share segment, contributing significantly to the company's overall financial performance. This steady income stream is vital for funding Paycom's development of newer, more innovative solutions.

The Benefits Administration Module solidifies its position as a classic cash cow within Paycom's portfolio. Its essential nature in managing employee benefits like health insurance and retirement plans ensures consistent revenue generation with minimal need for new investment, benefiting from high customer retention.

Paycom's HR compliance and record-keeping services are also key cash cows, providing essential functionalities that businesses consistently rely on. These mature offerings, characterized by high client retention, ensure a dependable income stream from Paycom's established customer base, especially as businesses continue to invest in HR technology for regulatory navigation in 2024.

| Product/Service | BCG Category | Revenue Contribution (Illustrative) | Growth Potential | Market Share |

|---|---|---|---|---|

| Core Payroll Processing | Cash Cow | High | Low | High |

| Benefits Administration | Cash Cow | High | Low | High |

| HR Compliance & Record-Keeping | Cash Cow | High | Low | High |

Full Transparency, Always

Paycom BCG Matrix

The Paycom BCG Matrix document you are currently previewing is the identical, fully functional report you will receive immediately after completing your purchase. Rest assured, this preview showcases the complete, unwatermarked, and professionally formatted analysis, ready for your strategic decision-making. No hidden pages or altered content; what you see is precisely what you will download and utilize for your business planning. This comprehensive Paycom BCG Matrix is designed for immediate implementation, empowering you with actionable insights without any further editing or modification required.

Dogs

Within Paycom's extensive human capital management software, certain highly niche or under-adopted legacy features might be classified as Dogs in the BCG Matrix. These are functionalities that, while part of the original offering, may have seen limited uptake or have been superseded by more modern solutions. For instance, an older, highly specialized payroll processing module for a very specific industry niche that has since been phased out by many clients due to newer, more integrated functionalities could fall into this category.

The challenge with these features is often their maintenance cost versus their revenue generation or strategic contribution. If a legacy feature requires significant ongoing development or support for a small user base, it can become a drain on resources. While exact figures for Paycom's specific legacy feature adoption aren't publicly available, industry trends suggest that software providers often face this dilemma with older, less utilized components of their platforms.

If Paycom's reporting tools haven't evolved to meet the growing demand for advanced analytics, clients seeking deeper insights might find them underperforming. This could position these functionalities as a low-growth, low-market-share segment within Paycom's extensive data offerings, potentially requiring strategic review.

Custom Development/One-off Solutions represent a segment of Paycom's offerings that, while meeting specific client demands, fall into the Question Mark category of the BCG Matrix. These projects are often resource-intensive, requiring significant investment in specialized talent and development time. For instance, a bespoke integration for a large enterprise client might consume months of engineering effort.

The limited applicability of these one-off solutions means they typically don't contribute significantly to Paycom's overall market share or drive broad-scale growth. While they can generate revenue, their inability to be replicated across a wider customer base limits their long-term strategic impact. This contrasts with Paycom's more standardized, scalable solutions that benefit from network effects and wider adoption.

Ineffective Third-Party Integrations

Ineffective third-party integrations within Paycom's ecosystem represent a potential challenge in the Dogs quadrant of the BCG Matrix. These are integrations that are difficult to implement, frequently fail, or simply aren't adopted by many clients. For instance, if a new HR analytics tool integration consistently reports errors or requires extensive manual workarounds, it would fit here.

Such integrations can drain valuable resources, including IT support staff and development time, without delivering a proportional return on investment or enhancing Paycom's competitive edge. This can lead to increased operational costs and a diminished client experience if the promised functionality doesn't materialize. For example, a poorly performing CRM integration might necessitate ongoing troubleshooting, diverting resources from core product development.

Consider these aspects of ineffective integrations:

- Low Client Adoption: Integrations with minimal client uptake indicate a lack of perceived value or usability. For example, if less than 5% of Paycom's client base utilizes a specific payroll data connector, it signals a problem.

- High Support Costs: Integrations that frequently require technical assistance or troubleshooting consume disproportionate support resources. If a particular integration accounts for over 10% of inbound support tickets related to third-party connections, it's a concern.

- Unreliability and Errors: Systems that frequently glitch or produce inaccurate data due to integration issues erode client trust and require constant maintenance. A reported 15% error rate in data synchronization for a specific external benefits portal integration would place it in this category.

Modules with Declining Market Relevance

Modules with declining market relevance, often termed Dogs in the BCG matrix, represent areas where Paycom might see reduced demand. This can happen as new technologies emerge or as the overall market for certain HR or payroll functions shrinks. For instance, if a specific payroll processing method becomes outdated due to automation, modules supporting that method would fall into this category.

These modules would likely generate minimal new business and show a decrease in usage by existing clients. In 2024, the HR tech market continued its rapid evolution, with a strong emphasis on AI-driven solutions and integrated platforms. Modules that are standalone or rely on manual processes are particularly vulnerable to becoming Dogs.

- Declining Usage: Modules with shrinking market demand could become Dogs.

- Minimal New Business: These areas would generate very little new revenue.

- Industry Shifts: Automation and new technologies are key drivers of this decline.

- Example: Standalone, manual payroll processing modules are at risk.

Paycom's "Dogs" likely represent legacy features or under-adopted functionalities within its HCM suite. These are products with low market share and low growth potential, often requiring significant maintenance without substantial returns. For example, older, specialized payroll modules for shrinking niche industries, or integrations with low client adoption and high support costs, would fit this description.

These underperforming components can drain resources that could be better allocated to more promising areas of Paycom's business. In the rapidly evolving HR tech landscape of 2024, modules that haven't kept pace with automation or integrated platform trends are particularly susceptible to becoming Dogs. Their continued existence often hinges on a cost-benefit analysis, weighing maintenance expenses against minimal revenue generation.

The presence of "Dogs" in Paycom's portfolio necessitates strategic decisions, such as divestment, revitalization, or continued minimal investment. Focusing on areas with higher growth and market share is crucial for overall business health. Identifying and addressing these underperforming assets ensures Paycom remains agile and competitive.

Question Marks

Paycom's investment in advanced AI-driven HR analytics and predictive tools places it in a dynamic and rapidly evolving market segment. This niche is characterized by constant innovation from both established players and emerging startups, meaning Paycom's current market share in these highly specialized functionalities might still be developing. Significant investment will be crucial for Paycom to solidify its leadership position and capture a larger portion of this high-growth area.

Paycom's expansion into international markets, particularly the UK and other European nations, signals a strategic move into what are considered high-growth potential areas. Currently, Paycom holds a low market share in these regions, presenting a significant opportunity for future gains.

These international ventures are anticipated to demand substantial financial investment to establish a foothold and compete effectively against entrenched local and global players. For instance, the European HR technology market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 8-10% in the coming years, indicating the scale of opportunity and the competitive landscape Paycom is entering.

Paycom's move into the enterprise market represents a significant strategic pivot, aiming to tap into a segment with larger contract values and potentially higher revenue per client. This is evidenced by an increase in their average client size, a key indicator of their success in attracting larger businesses.

The enterprise HCM landscape, however, is a challenging arena. It's currently dominated by established players with deep market penetration and extensive client bases. This means Paycom, despite its growth, will likely start with a relatively small market share in this segment, facing formidable competition from these incumbents.

For instance, in 2024, while Paycom's overall revenue growth has been robust, its penetration into the Fortune 1000 companies is still in its nascent stages compared to competitors who have served this market for decades. This presents both a substantial opportunity for expansion and a significant hurdle due to entrenched relationships and brand loyalty.

The high growth potential of the enterprise market, driven by the demand for comprehensive HR solutions, makes this a critical area for Paycom's future expansion. However, overcoming the competitive intensity and demonstrating a clear value proposition against well-entrenched competitors will be key to their success.

Highly Specialized Industry-Specific Solutions

Developing highly specialized, industry-specific solutions could unlock significant growth potential for Paycom by tapping into underserved niche markets. While Paycom's core offering serves a broad SMB base, catering to unique industry needs could differentiate them and capture new revenue streams. For instance, imagine a solution tailored for the highly regulated pharmaceutical research sector, addressing specific compliance and data management challenges.

However, entering these specialized verticals would likely see Paycom start with a low market share. Significant upfront investment would be necessary to develop these tailored solutions, prove their value proposition, and gain initial traction. This is akin to a 'question mark' in the BCG matrix, representing high growth potential but requiring substantial investment to convert into a 'star'.

- Niche Market Opportunity: Targeting industries with unique HR complexities, such as healthcare or specialized manufacturing, could offer substantial growth.

- Initial Low Market Share: Entering these new, specialized segments would mean Paycom starts with a minimal presence, requiring aggressive market penetration strategies.

- High Investment Needs: Significant R&D and sales/marketing investment would be crucial to build credibility and adoption in these specialized fields.

- Potential for High Growth: Successfully capturing even a small portion of these niche markets could lead to disproportionately high revenue growth due to the specialized nature of the solutions and potentially higher pricing power.

Enhanced Employee Engagement & Wellness Platforms

The market for employee engagement and wellness platforms is experiencing robust growth, with projections indicating continued expansion. For instance, the global employee engagement software market was valued at approximately $1.5 billion in 2023 and is expected to reach over $3.5 billion by 2030, growing at a compound annual growth rate of around 12.5%.

Within the Paycom BCG Matrix, offerings in enhanced employee engagement and wellness platforms could be categorized as stars or question marks, depending on their current market penetration and growth trajectory. If Paycom is actively investing in and expanding these capabilities, they represent a potential high-growth area, even if their current market share is relatively small.

- Market Growth: The employee engagement and wellness technology sector is a rapidly expanding segment of the HR tech landscape.

- Competitive Landscape: This space is highly competitive, with numerous established players and emerging startups vying for market share.

- Paycom's Position: Paycom's success in this area hinges on its ability to differentiate its offerings and capture a significant portion of this growing market.

- Strategic Importance: Investing in these platforms aligns with the broader trend of companies prioritizing employee well-being and a positive corporate culture to attract and retain talent.

Question Marks represent business units or product lines with low market share in high-growth markets. For Paycom, these could include niche industry-specific HR solutions or new international market entries where initial adoption is low but the market potential is significant.

Significant investment is required for these Question Marks to gain market share and potentially become Stars. This investment fuels product development, sales, and marketing efforts to build brand awareness and customer adoption in these nascent areas.

The success of Paycom's Question Marks is uncertain, as they face intense competition and require substantial resources to overcome initial low market penetration. However, if successful, they can become significant future revenue drivers for the company.

Paycom's foray into highly specialized verticals, such as tailored solutions for the pharmaceutical industry, exemplifies a Question Mark. While the potential market growth is high, Paycom would likely start with a minimal market share, necessitating substantial upfront investment in R&D and market penetration to prove its value proposition.

BCG Matrix Data Sources

Our Paycom BCG Matrix is constructed using a blend of internal financial performance data, comprehensive market research reports, and competitive intelligence gathered from industry analysts. This ensures a robust and accurate representation of Paycom's product portfolio within its market landscape.