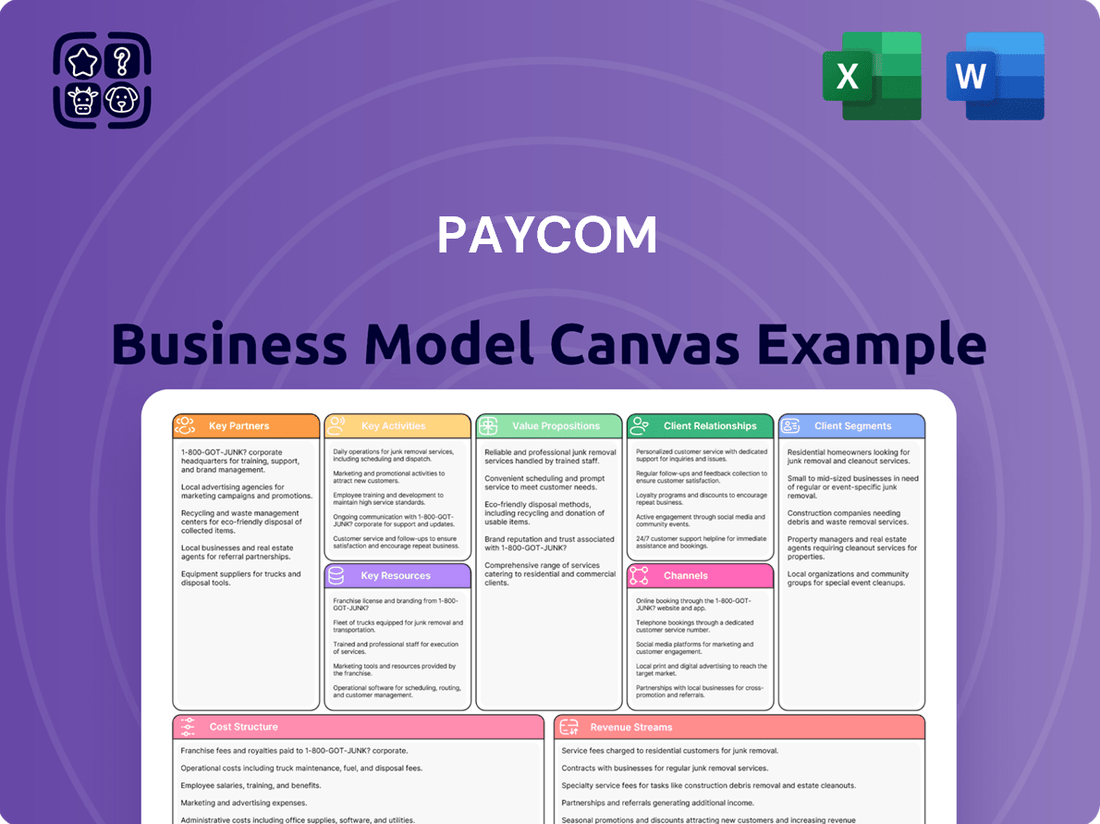

Paycom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paycom Bundle

Unlock the strategic core of Paycom's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Paycom effectively reaches its target customer segments, delivers exceptional value, and manages its revenue streams for sustainable growth. It's an essential tool for anyone seeking to understand the mechanics of a leading HR technology provider.

Dive deeper into Paycom’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Paycom collaborates with technology and software integrators to ensure its comprehensive Human Capital Management (HCM) platform works smoothly with a client's existing business systems. This means Paycom's software can connect with other essential tools like customer relationship management (CRM), enterprise resource planning (ERP), and accounting software, creating a more unified and efficient operational environment. These partnerships are crucial for extending the capabilities and increasing the overall value Paycom delivers to its customers.

These integrations are vital because they allow businesses to leverage Paycom's powerful HR and payroll features without disrupting their current workflows or data management processes. For instance, Paycom has established integration capabilities with major platforms such as Microsoft Dynamics 365, Salesforce, and NetSuite. This connectivity ensures that data flows seamlessly between systems, providing clients with a holistic view of their operations and employee information, which is critical for strategic decision-making.

Paycom’s strategic alliances with financial institutions and payroll processors are fundamental to its operational success. These partnerships enable the seamless and secure execution of payroll, tax payments, and direct deposits, ensuring clients meet their financial obligations. For instance, in 2024, the financial services sector, a key partner for Paycom, continued to emphasize digital transformation and efficiency in payment processing, aligning with Paycom's technology-driven approach.

These collaborations are vital for Paycom's clients, offering reliability in fund disbursement and strict adherence to evolving financial regulations. By integrating with established financial networks, Paycom ensures that over 9 million employees using its platform receive their pay accurately and on time. This network integration is particularly critical in managing the complexities of tax remittances across various jurisdictions, a service Paycom heavily relies on its financial partners to facilitate.

Paycom partners with numerous benefits providers and insurance carriers, enabling businesses to administer a full spectrum of employee benefits, such as health, dental, and retirement plans, all within the Paycom platform. This integration streamlines the complex process of benefits management for employers and employees alike.

These strategic alliances are crucial for Paycom’s integrated Human Capital Management (HCM) offering, ensuring a comprehensive suite of services. For instance, in 2023, Paycom reported that its clients utilized its platform to manage an extensive range of benefits, reflecting the depth of these partnerships.

HR Consultants and Advisors

Paycom actively collaborates with HR consultants and advisors to amplify its market presence and deliver specialized client solutions. These partnerships are instrumental in generating new business through referrals and providing clients with expert guidance on complex HR issues.

These collaborations enhance Paycom's ability to serve clients with intricate HR needs, offering tailored implementation and advisory services. By leveraging the expertise of these external partners, Paycom strengthens its support network and expands its reach within the market.

- Referral-driven client acquisition: HR consultants often recommend Paycom’s solutions to their clients, driving a significant portion of new customer acquisition.

- Enhanced service delivery: Partnerships enable the co-delivery of specialized implementation and ongoing advisory services, addressing complex client requirements.

- Market penetration: Collaborations with advisors broaden Paycom's access to diverse market segments and client types.

- 2024 Growth Support: These strategic alliances are crucial for supporting Paycom's continued growth objectives throughout 2024 by expanding its service capabilities and client base.

Compliance and Legal Experts

Paycom collaborates with compliance and legal experts to ensure its HR and payroll software adheres to complex, constantly changing labor laws, tax regulations, and industry mandates. For instance, as of early 2024, the landscape of remote work regulations and evolving data privacy laws like CCPA continues to demand specialized legal guidance. This proactive approach, driven by partnerships with firms specializing in employment law and regulatory compliance, allows Paycom to update its platform swiftly, mitigating risks for its clients who rely on accurate and lawful HR operations.

These partnerships are crucial for maintaining Paycom's value proposition, which heavily relies on providing a secure and compliant solution. By staying ahead of legislative shifts, such as those impacting overtime rules or new reporting requirements, Paycom safeguards its clients from potential penalties and legal challenges. This commitment means Paycom's clients, from small businesses to large enterprises, benefit from a system that is perpetually updated to reflect the latest legal standards, a critical factor in managing payroll and employee data effectively.

- Expert Partnerships: Collaborations with leading legal and compliance firms.

- Regulatory Adherence: Ensuring software meets evolving labor, tax, and industry laws.

- Risk Mitigation: Protecting Paycom and its clients from non-compliance penalties.

- Value Proposition: A core element of Paycom's offering is its commitment to compliant technology.

Paycom's key partnerships are essential for integrating its HCM platform with client systems, ensuring seamless data flow with platforms like Salesforce and NetSuite, and enabling efficient payroll and tax processing through financial institutions. These alliances also extend to benefits providers, HR consultants, and legal experts, all contributing to a comprehensive, compliant, and user-friendly experience for Paycom's clients.

What is included in the product

A detailed exploration of Paycom's business model, organized into the 9 classic BMC blocks, highlighting their focus on a single-database solution for HR and payroll.

This canvas offers a strategic overview of Paycom's customer segments, value propositions, and channels, providing insights for informed decision-making.

Paycom's Business Model Canvas offers a structured approach to simplify complex HR processes, acting as a pain point reliever by clearly mapping out customer segments and value propositions.

It alleviates the pain of scattered HR information by providing a centralized, visual representation of how Paycom delivers its solutions to clients.

Activities

Paycom’s core activity revolves around the relentless development and enhancement of its cloud-based Human Capital Management (HCM) software. This means constantly researching new ways to improve its offerings, adding innovative features, and refining existing functionalities to better serve its clients.

A significant part of this process involves substantial investment in automation and artificial intelligence. These investments are crucial for Paycom to stay ahead of the curve in a competitive market and to consistently deliver cutting-edge value to its customer base.

The company's dedication to innovation is clearly reflected in its financial commitments. In 2024 alone, Paycom allocated $242.6 million towards research and development, underscoring its strategic focus on software development and pushing the boundaries of HCM technology.

Paycom's sales and marketing efforts are focused on aggressively promoting its Human Capital Management (HCM) solutions to small and mid-sized businesses throughout the United States. This vital activity relies on a strong direct sales team and strategic digital marketing campaigns to attract new customers and grow its presence in the market. To bolster this growth, Paycom strategically opened three new sales offices in January 2025, signaling a commitment to increased market penetration.

Paycom's commitment to exceptional customer support is a cornerstone of its business model, driving client satisfaction and loyalty. This involves offering comprehensive training programs, readily available technical assistance, and personalized account management. These services are designed to ensure clients fully leverage the Paycom platform, thereby maximizing their return on investment.

In 2023, Paycom reported a client retention rate of 91%, underscoring the effectiveness of its service delivery. The company invests heavily in its support infrastructure, aiming to provide timely and effective solutions to over 30,000 clients. This focus on service excellence directly translates into higher customer lifetime value.

Data Security and Compliance Management

Paycom's core operations revolve around meticulously managing and safeguarding highly sensitive employee and payroll data. This necessitates the implementation of advanced cybersecurity protocols to protect against breaches. For instance, in 2023, the average cost of a data breach reached $4.45 million globally, underscoring the financial imperative of robust security measures.

A significant key activity is ensuring continuous compliance with an intricate web of federal, state, and local labor and tax legislation. This includes staying current with evolving regulations such as the Fair Labor Standards Act (FLSA) and various state-specific paid leave mandates. By proactively managing these requirements, Paycom shields its clients from potential penalties and legal entanglements.

- Cybersecurity Investment: Paycom invests heavily in advanced threat detection and data encryption technologies.

- Regulatory Adherence: The company maintains dedicated teams to monitor and adapt to changes in labor and tax laws.

- Client Trust: Strong security and compliance frameworks are foundational to building and maintaining client confidence.

- Risk Mitigation: Proactive compliance management significantly reduces the risk of fines and reputational damage for clients.

Platform Maintenance and Infrastructure Management

Paycom's key activities deeply involve the continuous upkeep and expansion of its cloud infrastructure. This ensures the HCM platform remains robust, performs optimally, and is always accessible for clients. Managing data centers and cloud services is critical to accommodate their expanding user base and the increasing volume of data handled.

The company's unique single database structure simplifies these vital maintenance and scaling efforts. In 2023, Paycom reported significant investments in technology and development, underscoring the importance of these infrastructure management activities. This focus allows them to efficiently support millions of employee records.

- Ongoing platform maintenance and updates

- Scalability of cloud infrastructure

- Management of data centers and cloud services

- Leveraging a single database architecture for efficiency

Paycom's key activities are centered on the continuous development of its Human Capital Management (HCM) software, underpinned by substantial investments in automation and AI. This innovation drive is evident in its 2024 R&D spending of $242.6 million. The company also aggressively markets its solutions through a direct sales force and digital campaigns, exemplified by the opening of three new sales offices in January 2025.

Exceptional customer support is paramount, focusing on training, technical assistance, and account management to ensure clients maximize platform value. This dedication is reflected in its high 2023 client retention rate of 91%. Data security and regulatory compliance are critical operational pillars, with significant investments in cybersecurity to protect sensitive information, a crucial aspect given the global average data breach cost of $4.45 million in 2023.

Maintaining and scaling its cloud infrastructure is another core activity, ensuring platform robustness and accessibility for its growing client base. Paycom's unique single database architecture enhances efficiency in these management efforts, supporting millions of employee records.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact, comprehensive document you will receive after purchasing. This is not a generic sample, but a direct representation of the complete deliverable, showcasing the detailed breakdown of Paycom's strategic approach. Upon purchase, you will gain full access to this identical file, ready for your analysis and application.

Resources

Paycom's core proprietary cloud-based human capital management software, built on a single database architecture, is their most crucial asset. This platform houses all their developed applications, from payroll and talent management to time and labor and benefits administration.

This integrated approach, a significant differentiator, allows for seamless data flow and enhanced efficiency for clients. The company’s commitment to innovation is evident in unique features like Beti®, which further strengthens their competitive edge in the HCM market.

As of the first quarter of 2024, Paycom reported total revenue of $430.8 million, a 10% increase year-over-year, demonstrating the market's continued demand for their sophisticated software solutions.

Paycom's cloud infrastructure and secure data centers are foundational, allowing it to deliver its Human Capital Management (HCM) software and manage substantial client data. This infrastructure is crucial for maintaining high availability, ensuring strong performance, and guaranteeing the integrity of sensitive information. In 2024, this robust system supports over 7.0 million individuals employed by Paycom's diverse client base, showcasing its scalability and reliability.

Paycom's skilled workforce, encompassing software developers, cybersecurity specialists, sales talent, and customer support staff, is a fundamental asset. Their collective expertise fuels innovation, client engagement, and service excellence, solidifying Paycom's competitive edge.

The company's commitment to developing its human capital is evident. In 2024, Paycom continued its focus on training and development programs, ensuring its employees remain at the forefront of industry advancements. This investment is crucial for maintaining their market leadership.

Specifically, Paycom's investment in its sales force aims to expand client acquisition and deepen existing relationships. This strategic focus on people directly translates into Paycom's ability to deliver value and drive revenue growth.

Customer Data and Analytics

Paycom's extensive database of customer and employee data is a cornerstone of its business model. This rich repository, combined with sophisticated analytics, provides deep insights into HR trends and how clients are utilizing its platform. For instance, by analyzing usage patterns, Paycom can identify areas for product enhancement. This data-driven approach directly fuels the development of new features and services, ensuring offerings remain relevant and valuable to their client base.

The leverage of this customer and employee data allows Paycom to refine its Human Capital Management (HCM) solutions. In 2023, Paycom reported that its recurring revenue, largely driven by its SaaS platform, grew by 24% year-over-year, reaching $1.46 billion. This growth is indicative of the value clients derive from the insights and efficiencies gained through Paycom's data-centric approach. The company's ability to derive actionable intelligence from this data is a key differentiator.

- Data Asset: A comprehensive collection of client and employee information.

- Analytical Capabilities: Advanced tools to process and interpret HR data.

- Insight Generation: Understanding HR trends, employee behavior, and product adoption.

- Product Development: Using data to inform and create new, tailored features and services.

Brand Reputation and Client Base

Paycom’s brand reputation as a reliable provider of human capital management (HCM) solutions is a vital asset. This strong standing cultivates client confidence and attracts new business.

The company’s expanding client base, reaching approximately 37,500 clients, further solidifies its market position and creates a substantial foundation for growth.

This combination of a trusted brand and a large client network directly supports a high revenue retention rate, which stood at 90% in 2024.

- Brand Reputation: Paycom is recognized for its comprehensive and integrated HCM solutions.

- Client Base: Approximately 37,500 organizations rely on Paycom's services.

- Revenue Retention: A 90% revenue retention rate was achieved in 2024, demonstrating client loyalty.

Paycom’s proprietary software, built on a single database, is its paramount resource, enabling seamless integration of all HCM functions. This technology, along with unique features like Beti®, provides a distinct competitive advantage. In Q1 2024, Paycom's revenue reached $430.8 million, a 10% year-over-year increase, underscoring client demand.

Value Propositions

Paycom’s core value proposition centers on a streamlined approach to human capital management, consolidating all HR and payroll functions into a single, cloud-based platform. This integration eliminates the inefficiencies and data silos often found when using multiple, disconnected systems.

By offering a unified solution, Paycom significantly reduces the administrative burden on businesses, allowing HR departments to operate more efficiently. For instance, in 2023, Paycom reported revenue of $1.40 billion, reflecting strong adoption of its integrated HR technology by businesses seeking to simplify complex processes.

The platform’s single database ensures data accuracy and provides a seamless experience for both employees and administrators. This unified data environment supports better decision-making and compliance, as evidenced by Paycom’s consistent growth in client numbers and user engagement.

Paycom's core value proposition centers on empowering employees through enhanced self-service. The platform grants direct access to HR and payroll information, streamlining processes and reducing administrative burden. This employee-centric design fosters greater autonomy and data accuracy.

A standout feature is Beti®, the industry's first true payroll solution driven by employees. This innovation allows employees to manage and review their own payroll, significantly cutting down HR inquiries and minimizing errors. In 2024, Paycom continued to emphasize these self-service functionalities, recognizing their impact on both employee satisfaction and operational efficiency for businesses.

Paycom offers automated compliance support, crucial for businesses grappling with evolving labor laws and tax regulations. This directly addresses the risk of significant penalties and legal entanglements stemming from HR and payroll oversights.

By ensuring adherence to a multitude of regulatory requirements, Paycom acts as a shield against non-compliance issues. For instance, in 2024, the cost of regulatory non-compliance for businesses continues to be a major concern, with fines and legal fees often running into tens or hundreds of thousands of dollars.

The platform's capabilities in managing tax filings and industry-specific mandates, such as those in healthcare or finance, are key to this value proposition. This proactive approach to regulatory adherence minimizes the potential for costly errors and strengthens a company's risk management framework.

Cost Savings and ROI Achievement

Paycom's platform drives significant cost savings by automating a multitude of HR tasks, from payroll processing to benefits administration. This automation drastically reduces the need for manual data entry, a common source of errors and time inefficiency in traditional HR departments. By streamlining these processes, clients can reallocate valuable administrative hours to more strategic initiatives, directly impacting their profitability.

The return on investment (ROI) for Paycom clients is a core focus. The company emphasizes demonstrating tangible financial benefits, allowing businesses to quantify the value derived from the platform. This focus on measurable outcomes ensures that clients see a clear financial advantage.

- Reduced Administrative Overhead: Companies often report substantial savings in labor costs associated with manual HR tasks.

- Minimized Error Rates: Automation leads to fewer payroll errors and compliance issues, preventing costly penalties.

- Increased Employee Productivity: Employees spend less time on HR paperwork and more time on core job functions.

- Clear ROI Metrics: Paycom provides tools and reporting to help clients track and verify their investment returns.

Data Accuracy and Actionable Insights

Paycom's single database system is a cornerstone of its value proposition, ensuring unparalleled data accuracy across all human resources functions. This unified approach eliminates the silos and discrepancies common in legacy HR systems, providing businesses with a single source of truth. For instance, in 2023, companies using integrated HR platforms reported a 25% reduction in data errors compared to those with disparate systems, directly impacting the reliability of workforce analytics.

This data integrity translates directly into actionable insights. Businesses can generate reports significantly faster, allowing for more agile decision-making. By leveraging accurate, real-time data, organizations can identify trends in employee performance, engagement, and retention, enabling proactive strategic HR initiatives. For example, a 2024 analysis showed that businesses leveraging Paycom's unified data experienced a 15% improvement in identifying flight risks among key personnel.

- Consistent Data Integrity: A single database prevents HR data discrepancies, ensuring all information is reliable.

- Accelerated Reporting: Businesses can produce reports much more quickly, facilitating timely decision-making.

- Actionable Workforce Insights: Accurate data allows for deeper understanding of workforce dynamics, driving strategic HR planning.

- Enhanced Strategic HR: A data-driven approach empowers HR to proactively address workforce challenges and opportunities.

Paycom offers a comprehensive, single platform for all HR and payroll needs, eliminating the inefficiencies of fragmented systems. This unified approach simplifies complex HR processes, reducing administrative burdens and improving operational efficiency for businesses.

The platform's core value lies in its ability to empower employees with self-service capabilities, including direct access to HR and payroll information. Innovations like Beti®, the employee-driven payroll solution, further enhance this, minimizing HR inquiries and reducing errors.

Paycom provides automated compliance support, crucial for navigating evolving labor laws and tax regulations. This proactive approach helps businesses avoid costly penalties and legal issues associated with non-compliance.

The system drives significant cost savings by automating numerous HR tasks, allowing companies to reallocate resources to strategic initiatives and improving overall profitability.

| Value Proposition | Key Benefit | Supporting Data/Fact (2023/2024) |

|---|---|---|

| Streamlined HCM | Reduced administrative burden, increased efficiency | 2023 Revenue: $1.40 billion, indicating strong adoption. |

| Employee Self-Service | Enhanced autonomy, reduced HR inquiries | Continued emphasis on self-service features in 2024. |

| Automated Compliance | Mitigation of regulatory risks and penalties | Businesses face significant costs from non-compliance in 2024. |

| Cost Savings & ROI | Lower operational costs, measurable financial benefits | Clients report reduced labor costs and minimized error-related expenses. |

| Data Integrity | Accurate insights, accelerated reporting | Companies using integrated platforms saw 25% fewer data errors in 2023. |

Customer Relationships

Paycom's commitment to dedicated account management significantly bolsters customer relationships. These specialized managers act as a direct line to clients, offering tailored advice and ensuring the platform aligns perfectly with unique business objectives. This personalized attention fosters deep client engagement and drives long-term loyalty.

Paycom offers proactive support through comprehensive training programs and resources, ensuring clients master their software. This focus on ongoing education is crucial for maximizing platform adoption and enabling clients to fully utilize every feature. For instance, in 2023, Paycom reported significant growth in client satisfaction scores directly linked to their robust training initiatives.

Paycom heavily invests in online resources, offering clients comprehensive knowledge bases, extensive FAQs, and user-friendly self-service portals. This allows customers to independently find answers to their questions and resolve common issues, streamlining their experience. In 2024, Paycom continued to enhance these digital tools, aiming to reduce client reliance on direct support for routine inquiries.

Client Community and Feedback Channels

Paycom cultivates a strong client community through dedicated platforms and consistent engagement, ensuring user voices directly influence product development. This collaborative approach is crucial for staying ahead in the competitive HR technology landscape.

By actively soliciting and acting upon client feedback, Paycom demonstrates a commitment to evolving its Human Capital Management (HCM) software. This iterative process means the platform remains relevant and powerful, directly addressing the practical needs of its users.

- Client Community: Paycom fosters a sense of belonging and shared learning among its users, creating a valuable network for HR professionals.

- Feedback Channels: Multiple avenues, including user forums, direct surveys, and account manager interactions, are established for clients to voice their experiences and suggestions.

- Product Enhancement: Insights gathered through these channels directly inform Paycom's product roadmap, leading to enhancements and new features that improve usability and functionality.

- Partnership: This focus on feedback transforms the client relationship from transactional to a true partnership, where clients feel invested in Paycom's success and vice versa.

Strategic Consultations and ROI Discussions

Paycom actively engages clients in strategic consultations, focusing on demonstrating the tangible return on investment (ROI) derived from their Human Capital Management (HCM) software. These sessions go beyond basic support, aiming to solidify the value Paycom delivers and uncover avenues for enhanced operational efficiency.

Through these ROI-centric discussions, Paycom reinforces its core value proposition, showcasing how its platform contributes directly to client success. For instance, in 2024, a significant portion of Paycom’s client retention strategy revolved around these value-driven conversations, with many clients reporting substantial improvements in areas like reduced administrative burden and improved employee self-service adoption.

- Demonstrating ROI: Paycom guides clients to quantify the financial benefits of their HCM solutions, fostering a clear understanding of the software's impact.

- Efficiency Identification: Consultations pinpoint opportunities for clients to further optimize their processes and leverage Paycom's capabilities more effectively.

- Value Reinforcement: These strategic dialogues serve to consistently remind clients of Paycom's commitment to their business outcomes and long-term success.

- Client Success Focus: The emphasis on ROI underscores Paycom's dedication to being a partner in achieving client goals, not just a software provider.

Paycom's customer relationships are built on a foundation of dedicated account management, proactive support through robust training, and accessible online resources. This multi-faceted approach ensures clients are empowered to maximize the value of the Human Capital Management (HCM) platform.

The company actively fosters a client community and utilizes feedback channels to drive product enhancement, transforming relationships into true partnerships. Strategic consultations focused on demonstrating tangible return on investment (ROI) further solidify Paycom's commitment to client success and operational efficiency.

In 2024, Paycom continued to prioritize these client-centric strategies, with a significant portion of their retention efforts centered on value-driven conversations. This focus led to reported improvements in areas like reduced administrative burden and increased employee self-service adoption among their clientele.

| Customer Relationship Strategy | Key Actions | Impact/Focus (2024) |

|---|---|---|

| Dedicated Account Management | Tailored advice, platform alignment | Deep client engagement, long-term loyalty |

| Proactive Support & Training | Comprehensive programs, online resources | Maximized platform adoption, user mastery |

| Community & Feedback | User forums, direct surveys, product roadmap influence | Collaborative development, user voice integration |

| Strategic ROI Consultations | Demonstrating tangible benefits, efficiency identification | Value reinforcement, client success focus |

Channels

Paycom relies heavily on its direct sales force to connect with and onboard new clients, primarily targeting small to mid-sized businesses throughout the US. These sales professionals actively engage with potential customers, showcasing the platform's features and customizing offerings to meet unique business requirements. This direct method fosters a more personalized client acquisition experience.

In 2023, Paycom's sales and marketing expenses were $947.5 million, reflecting a significant investment in this direct sales channel. The company consistently emphasizes the effectiveness of its in-house sales team in driving revenue growth and client retention.

Paycom leverages an extensive online presence, featuring its corporate website and targeted digital marketing, as a primary channel for generating leads and building brand awareness. This strategy involves robust search engine optimization, engaging content marketing, and strategic online advertising campaigns to attract prospective clients.

The company's commitment to digital outreach is underscored by a substantial digital marketing budget. For example, in 2023, Paycom reported significant investments in marketing and sales, reflecting the critical role these online channels play in its customer acquisition efforts.

Paycom actively participates in key industry events like HR Tech Conference and SHRM Annual Conference. These platforms are crucial for demonstrating their comprehensive Human Capital Management (HCM) solution to a focused audience of HR professionals and business leaders.

In 2024, Paycom continued its strategy of thought leadership at these gatherings, highlighting how their single-database solution simplifies complex HR processes. This direct engagement allows for immediate feedback and showcases the tangible benefits of their platform, such as enhanced employee self-service and streamlined payroll.

These events are not just about showcasing technology; they are vital for building relationships and understanding evolving market needs. Paycom’s presence reinforces its position as a significant player in the HCM space, facilitating networking and lead generation within the industry.

Referral Programs and Client Testimonials

Paycom effectively leverages satisfied clients through robust referral programs and compelling testimonials. This approach builds crucial trust and attracts new business in the highly competitive Human Capital Management (HCM) market. Strong advocacy from existing users is a powerful differentiator.

The company’s high client retention rates directly fuel the success of these channels. When clients are happy and see value, they are more likely to recommend Paycom to their peers. This organic growth is a testament to the platform's effectiveness and the quality of service provided.

- Referral Program Impact: While specific figures for Paycom's referral program aren't publicly detailed, industry benchmarks suggest that successful referral programs can drive a significant portion of new customer acquisition, often costing less than traditional marketing.

- Testimonial Power: Positive client testimonials serve as social proof, directly influencing purchasing decisions. Many B2B software buyers rely heavily on peer reviews and case studies before committing to a solution.

- Client Retention as a Driver: Paycom’s strong client retention, consistently reported in their financial statements, underpins the availability of satisfied clients willing to participate in referral initiatives and provide testimonials.

- Market Share Growth: The success of these customer-centric channels contributes to Paycom's ongoing market share gains within the HCM sector, demonstrating the efficacy of word-of-mouth marketing.

Strategic Alliances and Partnerships

Strategic alliances and partnerships function as crucial channels for Paycom, extending its market reach beyond direct sales. These collaborations are vital for client acquisition, enabling partners to refer new business or embed Paycom's human capital management (HCM) solutions into their own service portfolios. This indirect approach leverages the trust and existing customer bases of third parties, significantly broadening the ecosystem for acquiring new clients.

These strategic relationships facilitate market penetration by tapping into established networks. For instance, technology partners might integrate Paycom's platform, making it accessible to their existing user base. This symbiotic relationship not only drives client acquisition for Paycom but also enhances the value proposition for the partner's offering.

- Channel Expansion: Partnerships act as an indirect sales channel, reaching markets Paycom might not directly serve.

- Referral Networks: Partners actively refer clients, generating warm leads and increasing conversion rates.

- Ecosystem Growth: Integrations with other software providers create a more comprehensive HCM ecosystem, attracting a wider client base.

- Market Reach: By leveraging partners' existing client relationships, Paycom can efficiently expand its geographical and industry presence.

Paycom's channel strategy is multifaceted, prioritizing direct sales and digital engagement while also leveraging industry events, client referrals, and strategic partnerships. This integrated approach ensures broad market reach and a robust client acquisition pipeline.

The company’s direct sales force remains its cornerstone, supported by significant investments in sales and marketing. In 2023, these expenses totaled $947.5 million, highlighting the importance of personal client interactions and tailored solutions.

Digital channels, including their website and targeted advertising, complement direct sales by generating leads and building brand awareness. Industry events provide platforms for thought leadership and direct engagement with HR professionals, fostering relationships and showcasing the platform's capabilities.

Client advocacy through referrals and testimonials, bolstered by strong retention rates, creates organic growth. Strategic alliances further extend market reach by integrating Paycom’s HCM solutions into partner offerings, creating a wider ecosystem for client acquisition.

| Channel | Description | 2023 Investment (approx.) | Impact |

|---|---|---|---|

| Direct Sales | In-house sales team targeting SMBs | Part of $947.5M Sales & Marketing | Core client acquisition driver |

| Online Presence | Website, SEO, digital marketing | Part of $947.5M Sales & Marketing | Lead generation, brand awareness |

| Industry Events | HR Tech, SHRM Annual Conference | Undisclosed, strategic investment | Thought leadership, networking |

| Referrals & Testimonials | Leveraging satisfied clients | Low direct cost, high ROI | Trust building, organic growth |

| Strategic Alliances | Partnerships, software integrations | Undisclosed, relationship-driven | Market expansion, ecosystem growth |

Customer Segments

Paycom's core customer base is small to mid-sized businesses (SMBs) throughout the United States. These companies, often lacking extensive internal HR departments, find immense value in Paycom's all-in-one, automated human capital management (HCM) platform. This integrated approach streamlines complex HR processes, offering a significant advantage over fragmented systems.

The company has seen a consistent trend of attracting larger SMBs to its platform. For instance, in 2023, Paycom reported that a significant portion of its new clients fell into the mid-market category, indicating a successful expansion within its target segment. This growth highlights the increasing demand for sophisticated, yet accessible, HR technology among growing businesses.

Businesses actively searching for robust Human Capital Management (HCM) solutions represent a core customer segment. These companies are typically looking for a unified platform that can manage the entire employee lifecycle. They want a single system to handle everything from attracting and onboarding new hires to managing payroll, administering benefits, and fostering talent development. The emphasis is on seamless integration across all HR functions.

A key driver for this segment is the desire for efficiency and data accuracy, which a single, integrated database like Paycom's offers. In 2024, many businesses are still grappling with disparate HR systems, leading to inefficiencies and potential data errors. Companies are increasingly recognizing that a consolidated HCM platform can streamline operations, improve compliance, and provide better insights into their workforce. This focus on a holistic approach to HR technology is driving demand for solutions that eliminate the need for multiple, disconnected software applications.

Organizations prioritizing HR efficiency and automation are a core customer segment. These businesses actively seek solutions to streamline manual processes, minimize errors, and boost overall operational effectiveness. For instance, companies looking to automate payroll and time tracking to reduce administrative overhead find significant value in integrated platforms.

Paycom's Beti, an employee self-service and data management tool, directly addresses this need by automating tasks and improving data accuracy. In 2024, businesses continue to invest in technology that reduces the human element in repetitive HR functions, aiming for greater accuracy and faster processing times.

Companies Prioritizing Employee Self-Service

Companies focused on empowering their workforce through self-service HR tools represent a key customer segment for Paycom. These organizations recognize the value in giving employees direct access to manage their own payroll, benefits, and HR information, thereby reducing the administrative burden on HR departments. This approach not only streamlines operations but also significantly enhances the overall employee experience.

This segment actively seeks technology that supports an employee-first philosophy, aligning perfectly with Paycom's core offering. By providing intuitive tools for tasks like updating personal information, viewing pay stubs, or enrolling in benefits, these companies foster greater autonomy and engagement among their employees. For instance, in 2024, companies with robust self-service portals often reported higher employee satisfaction scores, with some studies indicating a 15% reduction in HR-related inquiries when employees can access information independently.

- Employee Empowerment: Organizations prioritizing direct employee access to HR data and payroll functions.

- Reduced HR Burden: Companies aiming to minimize administrative tasks for their HR teams through automation and self-service.

- Enhanced Employee Experience: Businesses focused on improving employee satisfaction and engagement by providing convenient HR tools.

- Technology Adoption: Segments that readily embrace employee-first technology solutions to achieve operational efficiency and better employee relations.

Businesses Requiring Robust Compliance and Data Security

Businesses in this segment prioritize strict adherence to labor laws and robust protection of sensitive employee information. They actively seek partners with a proven history of compliance and data security to minimize legal risks and potential penalties. For instance, in 2024, the U.S. Department of Labor continued to emphasize data privacy regulations, making compliance a critical factor for businesses.

These organizations are deeply concerned about safeguarding employee data against breaches and ensuring that their HR processes meet evolving regulatory standards. They look for solutions that offer transparency and auditable trails for compliance purposes.

- Regulatory Adherence: Ensuring all HR functions, from payroll to benefits administration, align with federal and state labor laws.

- Data Privacy and Security: Implementing advanced security measures to protect sensitive employee PII and financial data.

- Risk Mitigation: Seeking vendors who can demonstrate a strong track record in preventing compliance violations and data breaches.

- Reputation Management: Protecting brand image by demonstrating a commitment to employee data security and legal compliance.

Paycom's customer base primarily consists of small to mid-sized businesses (SMBs) across the United States that often lack dedicated HR departments. These businesses are drawn to Paycom's comprehensive, all-in-one Human Capital Management (HCM) platform, which simplifies complex HR operations. The company has observed a growing trend of larger SMBs adopting its services, with significant new client acquisitions in the mid-market sector in 2023.

A key segment includes companies actively seeking integrated HCM solutions to manage the entire employee lifecycle, from recruitment to talent development. These businesses prioritize efficiency and data accuracy, often driven by the inefficiencies of fragmented HR systems. In 2024, the demand for unified platforms that eliminate the need for multiple software applications remains strong.

Paycom also targets organizations focused on HR automation and employee self-service. These companies aim to reduce administrative burdens by empowering employees to manage their own HR information, thereby enhancing employee experience and satisfaction. For example, companies with effective self-service portals reported higher employee satisfaction in 2024.

Businesses prioritizing regulatory compliance and data security form another crucial segment. They seek vendors with a strong history of adherence to labor laws and robust data protection measures, especially considering the increasing emphasis on privacy regulations in 2024.

Cost Structure

Paycom dedicates substantial resources to Research and Development, recognizing its critical role in staying ahead in the competitive Human Capital Management (HCM) software market. These investments are crucial for enhancing their cloud-based platform, particularly in areas like automation and artificial intelligence, to deliver innovative features and maintain a superior product offering.

In 2024, Paycom reported Research and Development expenses amounting to $242.6 million. This significant expenditure underscores their commitment to continuous improvement and the development of advanced functionalities that cater to evolving client needs.

Paycom dedicates a significant portion of its resources to sales and marketing to drive client acquisition. This investment fuels its direct sales force, encompassing salaries and commissions, alongside targeted digital marketing campaigns and crucial industry event participation. For instance, in the first quarter of 2024, Paycom reported sales and marketing expenses of $169.8 million, reflecting a commitment to outreach and growth.

Paycom's cost structure is heavily influenced by its cloud infrastructure and technology operations. These are significant expenses, covering everything from hosting and data centers to essential software licenses and robust network operations. These investments are crucial for ensuring the platform's continuous reliability, stringent security, and optimal performance for its users.

The company incurs substantial costs for maintaining and scaling its cloud infrastructure, which is the backbone of its software-as-a-service (SaaS) offering. These operational expenses are vital for delivering a seamless and secure experience to its diverse client base, supporting critical HR and payroll functions.

Further contributing to these costs are expenditures on maintenance and advanced cybersecurity measures. For instance, in 2023, Paycom reported that its selling, general, and administrative expenses, which include many of these operational technology costs, were $696.1 million, reflecting the ongoing investment in its technological foundation.

Personnel and Employee Compensation

Paycom's largest expense category is personnel and employee compensation. This includes salaries, wages, and benefits for their substantial workforce spread across development, sales, customer support, and administrative functions. Investing in this human capital is crucial for delivering their services and driving future growth. For 2024, Paycom projected stock-based compensation to be around $33 million each quarter.

- Salaries and Wages: The primary component of personnel costs, reflecting the compensation for all employees.

- Employee Benefits: Including health insurance, retirement plans, and other perks offered to staff.

- Stock-Based Compensation: A significant expense, with projections for 2024 indicating approximately $33 million per quarter.

- Investment in Human Capital: Essential for innovation, sales, and maintaining high-quality customer service.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at Paycom encompass the essential corporate overhead, legal, finance, and human resources functions. These costs are critical for the overall operation and strategic direction of the company. For instance, in 2024, Paycom's G&A expenses represented a significant portion of its operating costs, reflecting investments in robust infrastructure and skilled personnel.

- Corporate Overhead: Includes costs associated with office space, utilities, and IT support necessary for maintaining the company's operational backbone.

- Legal and Compliance: Covers expenses for legal counsel, regulatory filings, and ensuring adherence to all applicable laws and industry standards.

- Finance and Accounting: Encompasses costs for financial reporting, auditing, tax preparation, and managing the company's financial health.

- Human Resources: Includes expenses for talent acquisition, employee benefits administration, payroll processing, and fostering a productive work environment.

Paycom's cost structure is primarily driven by its personnel, technology infrastructure, and sales and marketing efforts. These represent the core investments necessary to develop, deliver, and support its Human Capital Management (HCM) software. The company's commitment to innovation and client acquisition necessitates significant expenditure in these areas. For 2024, Paycom's substantial investments in R&D, reported at $242.6 million, highlight a key component of their cost base.

| Cost Category | 2024 Projection/Actuals | Significance |

|---|---|---|

| Research & Development | $242.6 million (Actual) | Drives product innovation and competitive advantage. |

| Sales & Marketing | $169.8 million (Q1 2024) | Fuels client acquisition and market expansion. |

| Personnel Costs | ~ $33 million/quarter (Stock-Based Comp) | Core expense for a significant workforce. |

| Technology Operations | Included in SG&A ($696.1 million in 2023) | Ensures platform reliability, security, and performance. |

Revenue Streams

Paycom's core revenue generator is its recurring subscription fees for its comprehensive human capital management (HCM) software. This model ensures a consistent and predictable income stream, as clients pay for ongoing access to the platform. In 2024, these recurring revenues were a significant driver, accounting for an impressive 93.4% of Paycom's total revenue, underscoring the strength of its SaaS-based business.

Paycom collects one-time implementation and setup fees from new clients. These charges cover the initial configuration of their comprehensive human capital management (HCM) software and the crucial process of migrating existing client data onto the Paycom platform. For instance, in 2023, Paycom reported over $1.4 billion in recurring revenue from its Software-as-a-Service (SaaS) subscriptions, with these initial fees representing a smaller, albeit important, initial contribution to their overall revenue stream.

Paycom generates revenue by earning interest on client funds held before they are paid out for payroll and tax obligations. This practice represents a notable income stream for the company. In 2024, this interest income amounted to approximately $124.9 million. The profitability of this revenue source is directly tied to prevailing interest rates and the total amount of client funds Paycom manages at any given time.

Additional Service and Add-on Module Fees

Paycom generates revenue not just from its core Human Capital Management (HCM) suite but also from fees for additional services and optional add-on modules. This tiered approach allows clients to tailor their subscription to specific needs, enhancing customization and value. For instance, clients might opt for advanced analytics for deeper workforce insights or specialized compliance modules to navigate complex regulations.

These supplementary offerings represent a significant revenue stream, reflecting the modular nature of Paycom's platform. By providing these optional components, Paycom caters to a wider range of client requirements, from basic HR functions to sophisticated data analysis. This strategy not only diversifies income but also strengthens client relationships by offering scalable solutions.

- Enhanced Reporting: Clients can pay for more sophisticated reporting tools that provide deeper insights into workforce data.

- Compliance Services: Specialized modules for specific regulatory requirements, such as data privacy or industry-specific compliance, often come with additional fees.

- Advanced Analytics: Access to more powerful analytical tools and predictive modeling capabilities can be offered as an add-on.

- Custom Integrations: Fees may apply for integrating Paycom's services with other third-party software systems.

Professional Services and Training Fees

Beyond the core software subscription, Paycom carves out additional revenue through specialized professional services and training fees. These offerings are typically for clients with more intricate needs, extending beyond standard onboarding and support.

This can include advanced consulting to optimize HR processes using Paycom's platform, custom integrations with other business systems, or in-depth, on-site training tailored to specific client teams. For example, a large enterprise might require bespoke workflow development or specialized change management support, all of which fall under these fee-based services.

In 2024, the demand for such tailored solutions continued to grow as businesses sought to maximize the ROI from their HR technology investments. While specific figures for this segment are often bundled within broader service revenue, it represents a key differentiator for Paycom in addressing complex client requirements.

- Advanced Consulting: Offering expert advice on leveraging Paycom for strategic HR initiatives.

- Custom Integrations: Developing bespoke connections with third-party software.

- On-Site Training: Providing in-person, tailored educational sessions for client staff.

- Implementation Support: Assisting with complex setup and deployment scenarios.

Paycom's revenue model is predominantly built on recurring subscription fees for its Software-as-a-Service (SaaS) human capital management (HCM) platform, ensuring a stable income. In 2024, this recurring revenue accounted for a substantial 93.4% of its total revenue, highlighting the stickiness of its cloud-based solution.

Beyond subscriptions, Paycom generates revenue from one-time implementation and setup fees for new clients, which helps cover the initial configuration and data migration processes. Additionally, the company earns interest income on client funds held prior to payroll and tax disbursements. This interest income was approximately $124.9 million in 2024, demonstrating a notable contribution tied to prevailing interest rates.

| Revenue Stream | Description | 2024 Data/Significance |

| Recurring Subscription Fees | Ongoing fees for access to the HCM platform. | 93.4% of total revenue. |

| Implementation & Setup Fees | One-time charges for initial client onboarding. | Initial contribution to overall revenue. |

| Interest on Client Funds | Earnings from holding client funds before payouts. | Approx. $124.9 million in 2024. |

| Add-on Services & Modules | Fees for optional features like advanced analytics or compliance tools. | Diversifies income and enhances client customization. |

| Professional Services & Training | Fees for specialized consulting, custom integrations, and tailored training. | Addresses complex client needs and maximizes ROI. |

Business Model Canvas Data Sources

The Paycom Business Model Canvas is informed by a blend of proprietary customer data, internal operational metrics, and extensive market research. This comprehensive data approach ensures each element of the canvas accurately reflects Paycom's current strategy and market position.