Pagaya PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pagaya Bundle

Unlock the hidden forces shaping Pagaya's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, evolving social trends, and environmental regulations are impacting its operations and future growth. This expert-crafted analysis provides the critical context you need to make informed decisions. Download the full version now for actionable intelligence.

Political factors

Government regulation of AI in finance is a critical political factor for Pagaya. As AI adoption grows, particularly in sensitive areas like credit scoring, regulatory bodies worldwide are increasing their scrutiny. This trend is clearly demonstrated by the European Union's AI Act, which is set to become fully effective in August 2024. The Act categorizes AI systems used in credit assessment as high-risk, meaning companies like Pagaya must meet rigorous compliance standards.

These regulations require significant ongoing investment in adapting AI models and operational processes to align with evolving legal mandates and ethical considerations. For instance, the EU AI Act mandates detailed risk assessments, data governance, and human oversight for high-risk AI applications. Failing to comply could result in substantial penalties, impacting Pagaya's market access and operational flexibility.

The global nature of financial markets means Pagaya must navigate a patchwork of regulations, each with its own nuances. For example, in the United States, agencies like the Consumer Financial Protection Bureau (CFPB) are also examining AI's role in lending, focusing on fairness and transparency. The CFPB's reports in 2023 and early 2024 highlighted concerns about algorithmic bias and the potential for discriminatory outcomes, signaling a watchful approach.

Governments worldwide are increasingly focused on safeguarding consumers, particularly concerning how personal data is handled. This political climate directly affects companies like Pagaya, which rely heavily on data for their AI-driven financial solutions.

Regulations such as the GDPR in Europe, which came into full effect in 2018, and similar legislation like the California Consumer Privacy Act (CCPA) in the US, set strict rules for data collection, processing, and consent. These laws mandate transparency in automated decision-making, a core aspect of Pagaya's technology.

Pagaya must ensure its AI algorithms are not only efficient but also fully compliant with these evolving data privacy standards. For instance, the GDPR imposes significant fines, up to 4% of global annual turnover or €20 million, whichever is higher, for non-compliance, underscoring the financial imperative for adherence.

Navigating this intricate web of regulations is crucial for maintaining trust with both consumers and financial partners. Pagaya's ability to demonstrate robust data protection and ethical AI practices will be a key factor in its continued success and market reputation.

Government policies focused on financial stability directly impact lending markets. For instance, the Federal Reserve's monetary policy, including its benchmark interest rate, influences the cost of borrowing across the economy. As of early 2024, the Fed maintained a higher interest rate environment, which can increase the cost of capital for originators and affect the pricing of asset-backed securities that Pagaya relies on for funding.

Changes in credit availability and lending practices, often shaped by regulatory bodies, are also key. Stricter lending standards, for example, could reduce the volume of loans originated, thereby impacting Pagaya's deal flow. Conversely, policies designed to encourage lending to underserved segments could present new opportunities.

Pagaya's business model, which leverages securitization of consumer credit, is sensitive to investor confidence in the financial system. A stable financial environment fosters greater investor appetite for asset-backed securities. For example, during periods of economic uncertainty in 2023, there was a noticeable flight to quality, which could have made it more challenging to place certain types of ABS if not managed carefully.

Maintaining capital efficiency and diversifying funding sources are strategic imperatives for Pagaya, directly tied to the prevailing financial policy landscape. A supportive policy environment can facilitate access to a broader range of funding mechanisms, from traditional securitization markets to potential warehouse facilities, bolstering the company's operational flexibility and growth prospects.

International Relations and Geopolitical Stability

While Pagaya Technologies primarily operates within the United States, global geopolitical shifts can still cast a shadow. Escalating international conflicts, even those distant from its core markets, can create ripples in financial markets, affecting investor sentiment and potentially influencing the cost or availability of capital for Pagaya's funding partners. For instance, the ongoing conflicts in Ukraine and the Middle East, while not directly disrupting Pagaya's operations as of early 2024, underscore the potential for broader economic instability. Monitoring these international relations is crucial for Pagaya's long-term strategic planning and risk management.

The interconnectedness of global finance means that significant geopolitical events can lead to shifts in capital flows. A severe escalation in existing conflicts or the emergence of new ones could prompt investors to seek safer havens, potentially impacting the liquidity available for securitization markets that Pagaya utilizes. While Pagaya's balance sheet has demonstrated resilience, unforeseen global shocks could introduce new risks for its diverse base of funding partners, indirectly affecting its business model.

For example, the global defense spending surge in 2023, estimated by some reports to be in the trillions of dollars, reflects heightened geopolitical tensions. This reallocation of capital, while not directly impacting consumer lending, signifies a broader economic recalibration that could influence interest rate environments and investor appetite for various asset classes, including those Pagaya operates within.

- Global Capital Flows: Geopolitical instability can lead to capital flight from emerging markets or regions perceived as higher risk, influencing the availability of funding for companies like Pagaya.

- Investor Confidence: Major international conflicts can erode overall investor confidence, leading to broader market volatility and a potential slowdown in lending and investment activities.

- Supply Chain Disruptions: While less direct, geopolitical events can disrupt global supply chains, impacting inflation and interest rates, which in turn affect consumer credit and Pagaya's origination volumes.

- Sanctions and Trade Policies: International sanctions or shifts in trade policies stemming from geopolitical tensions could indirectly affect the financial health of Pagaya's partners or the broader economic environment.

Government Support for Fintech Innovation

Government backing for fintech, including AI-driven lending, significantly shapes the operational landscape for companies like Pagaya. Initiatives such as grants and specialized regulatory sandboxes, designed to encourage innovation, can accelerate technological progress within financial services. For instance, the U.S. government has shown increasing interest in fostering AI development, with federal agencies investing billions in AI research and development. This support can translate into a more receptive market for advanced financial technologies.

A favorable political climate directly impacts the adoption rate of AI-powered solutions and broadens market access. Governments worldwide are recognizing the potential of fintech to boost economic growth and financial inclusion. As of early 2025, many countries are actively reviewing and updating their financial regulations to accommodate emerging technologies. This evolving regulatory environment, often spurred by government initiatives, can unlock new avenues for companies like Pagaya to deploy their AI-driven lending platforms.

Consider these aspects of government support:

- Regulatory Sandboxes: Governments establish controlled environments where fintech firms can test new products and services with reduced regulatory burden. This allows for innovation without immediate full-scale compliance risks.

- Financial Incentives: Grants, tax credits, and subsidies are often provided to encourage research and development in areas like AI and machine learning for financial applications.

- Policy Frameworks: Governments are developing policies to promote digital transformation in finance, aiming to create a more competitive and efficient financial sector.

- International Collaboration: Many nations are collaborating on fintech standards and regulations, fostering a more harmonized global market for financial innovation.

Pagaya's operations are significantly influenced by evolving government regulations on AI and data privacy. The EU's AI Act, effective August 2024, classifies AI in credit assessment as high-risk, demanding rigorous compliance from Pagaya. Similarly, US agencies like the CFPB are scrutinizing AI for fairness and transparency in lending, as highlighted in their 2023-2024 reports, requiring Pagaya to adapt its models and processes to avoid penalties. Strict data protection laws like GDPR and CCPA also mandate transparency in automated decision-making, with GDPR fines potentially reaching 4% of global annual turnover, emphasizing the financial imperative for Pagaya to maintain robust data governance and ethical AI practices.

What is included in the product

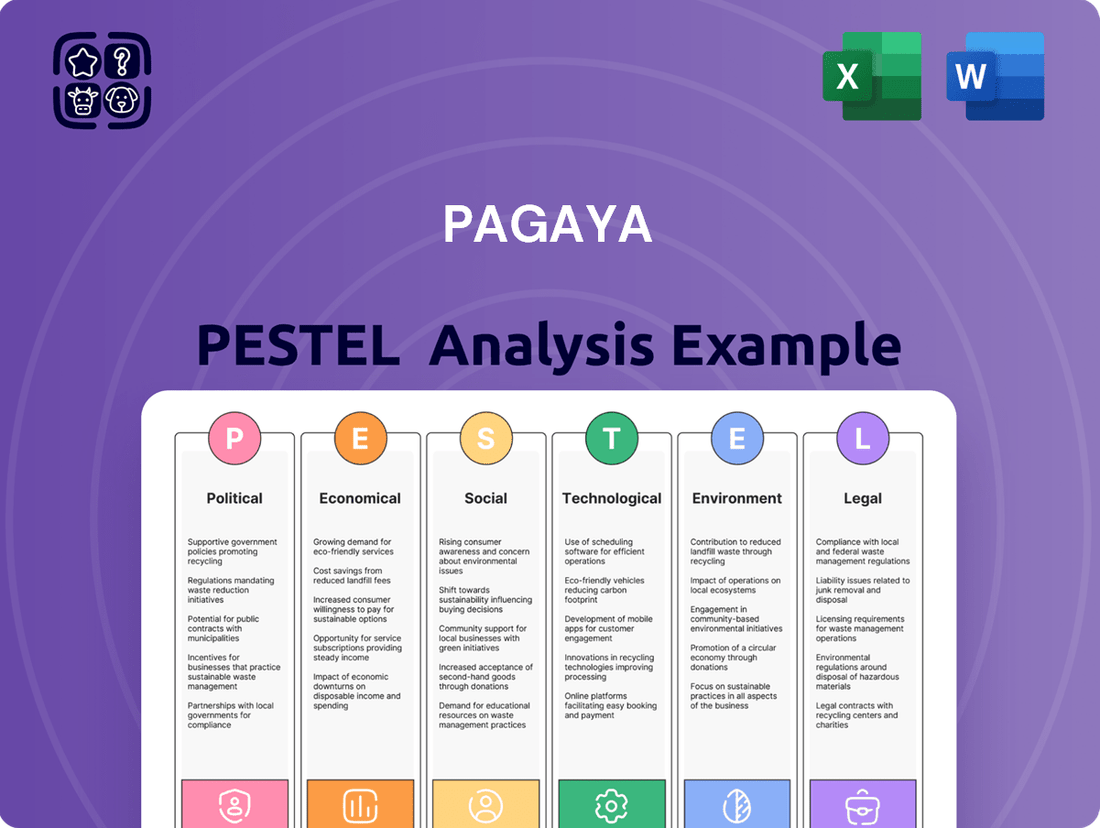

This Pagaya PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and detailed sub-points with specific examples to support strategic decision-making and identify opportunities.

Pagaya's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain of sifting through complex data for strategic planning.

Economic factors

The interest rate environment is a critical factor for Pagaya. Fluctuations here directly influence the cost of capital for its partners and the demand for loans from consumers. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as it did through early 2024, this can translate to higher borrowing costs across the economy, potentially impacting Pagaya's partners and their willingness to finance loans.

Higher interest rates can also increase Pagaya's securitization costs and might lead to a rise in credit impairments. However, the company's strategy of diversifying its funding sources and refining its underwriting processes is designed to buffer against these effects. By spreading its funding across different avenues, Pagaya can reduce its reliance on any single, rate-sensitive capital source.

Conversely, a stable or declining interest rate environment would likely create a more advantageous landscape for Pagaya. Should rates begin to ease, for example, if the Federal Reserve were to implement rate cuts in late 2024 or 2025 as some economists predict, this could lower borrowing costs for Pagaya's partners and stimulate greater consumer demand for credit products. This would directly benefit Pagaya's volume and profitability.

The health of the credit market, particularly consumer debt levels and associated default rates, is a critical factor for companies like Pagaya, which leverage AI to facilitate loans. For instance, as of Q1 2024, U.S. household debt reached a record $17.7 trillion, according to the Federal Reserve Bank of New York. While Pagaya's technology is designed to pinpoint favorable risk-reward profiles, a widespread deterioration in consumer credit quality, evidenced by rising delinquencies particularly in credit card and auto loan sectors, could negatively affect the performance of its securitized assets.

Monitoring these trends is paramount for Pagaya's risk management framework. Data from the Bureau of Labor Statistics in early 2024 indicated persistent inflation, which can strain consumer budgets and potentially lead to increased default rates across various loan types. A significant uptick in late payments or defaults could directly impact the profitability and valuation of the asset-backed securities Pagaya structures, highlighting the direct link between consumer financial well-being and the company's operational success.

Inflationary pressures and the pace of economic growth significantly influence consumer spending and borrowing capacity, which directly impacts Pagaya's business. For instance, as of early 2025, inflation in the US has shown signs of moderating but remains a consideration, impacting real disposable incomes. Strong economic growth, conversely, generally fosters a more robust lending environment, boosting demand for the financial products Pagaya facilitates.

High inflation erodes purchasing power, potentially leading to increased default risks on loans. This is a key concern for Pagaya, as its network volume and profitability are closely linked to the creditworthiness of borrowers. Conversely, a healthy economic growth trajectory, such as the projected modest GDP growth for the US in 2025, typically correlates with lower unemployment and improved consumer financial health, creating a more favorable landscape for loan origination and repayment.

Investor Appetite for ABS and Alternative Credit

Pagaya's business model thrives on institutional investors buying its asset-backed securities (ABS) and entering into forward flow agreements. This means investor confidence and the availability of cash in the market significantly impact how much Pagaya can raise and at what cost. For instance, in late 2023 and early 2024, Pagaya announced several large funding rounds, including significant ABS securitizations, underscoring a robust appetite for its AI-vetted loan portfolios.

The strong demand for these ABS, particularly those backed by consumer and auto loans, reflects a growing comfort among investors with Pagaya's technology-driven underwriting. This trend is supported by the broader market's search for yield in a potentially moderating interest rate environment. Pagaya has consistently secured billions in funding, with agreements in the range of $2 billion to $5 billion announced periodically, showcasing sustained institutional backing.

Key factors influencing this investor appetite include:

- Credit Quality: The performance of underlying loans and the effectiveness of Pagaya's AI in mitigating risk.

- Market Liquidity: The overall availability of capital for securitization markets.

- Yield Expectations: Investor demand for attractive returns compared to other fixed-income options.

- Regulatory Environment: Favorable or unfavorable changes in regulations affecting securitization and credit markets.

Competitive Landscape and Market Share

The competitive arena for Pagaya, operating in the fintech and lending space, significantly shapes its market share and how it prices its services. While Pagaya acts as a technology partner to lenders rather than a direct competitor, the emergence of other sophisticated AI credit assessment tools or traditional financial institutions enhancing their in-house capabilities can pose challenges to its expansion. For instance, as of early 2024, the fintech lending market continues to attract significant investment, with companies like Upstart, a key player in AI-driven lending, reporting substantial loan originations, indicating a competitive environment where technological advancement is paramount.

Pagaya's strategic move into new product categories, such as auto loans and point-of-sale financing, demonstrates a clear intent to broaden its market reach and secure a larger share of the consumer credit pie. This diversification is crucial in a market where established players and innovative startups are constantly vying for customer acquisition and loan volume. The overall growth in unsecured personal loans, a key area for Pagaya, saw continued demand through 2024, but also increased scrutiny on underwriting quality, highlighting the need for robust AI solutions.

- Market Share Growth: Pagaya's success hinges on its ability to attract and retain lending partners, thereby increasing the volume of loans processed through its platform.

- AI Competitors: The presence of other AI-focused credit underwriting companies directly impacts the demand for Pagaya's technology and its negotiating leverage.

- Traditional Lender Adaptation: As traditional banks improve their digital offerings and AI adoption, they may reduce their reliance on third-party platforms like Pagaya.

- Product Diversification: Expanding into auto and POS loans diversifies revenue streams and captures a broader customer base, enhancing competitive positioning.

The economic climate directly impacts Pagaya's ability to generate revenue and manage risk. Persistent inflation throughout 2024 and into early 2025, though showing signs of moderation, continued to put pressure on consumer budgets, potentially increasing loan default rates. While U.S. GDP growth was projected to be modest in 2025, creating a generally stable lending environment, factors like high interest rates, with the Federal Reserve maintaining its target range for much of 2024, increased borrowing costs for Pagaya's partners and its own securitization expenses.

Pagaya's reliance on institutional investors for funding through asset-backed securities (ABS) means that market liquidity and investor confidence are paramount. The company successfully secured billions in funding through ABS issuances in late 2023 and early 2024, demonstrating a strong investor appetite for its AI-vetted loan portfolios amidst a search for yield. However, any significant downturn in credit market health, such as rising consumer debt delinquencies seen in early 2024 with US household debt reaching $17.7 trillion, directly impacts the performance of these securitized assets.

The competitive landscape for Pagaya is characterized by both fintech innovators and traditional financial institutions. Companies like Upstart, employing similar AI-driven underwriting, continued to originate substantial loans in early 2024, highlighting the intense competition. Pagaya's strategy of diversifying into auto and point-of-sale financing aims to capture a broader market share, but faces the challenge of established players and evolving consumer credit needs, with personal loan demand remaining strong but under scrutiny for underwriting quality.

Preview Before You Purchase

Pagaya PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Pagaya PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview crucial for understanding Pagaya's market landscape and potential challenges or opportunities.

Sociological factors

Pagaya's core mission to broaden access to financial products directly taps into a surging societal imperative for financial inclusion, especially for those historically marginalized. As of early 2024, reports indicate that approximately 1.4 billion adults globally remain unbanked, highlighting the sheer scale of this unmet need.

By employing AI to analyze a wider array of data points, Pagaya empowers its partner institutions to identify and serve individuals who might be overlooked by conventional credit scoring methods. This approach not only fulfills a critical societal demand but also promises to bolster Pagaya's brand image and its penetration into the market.

The increasing emphasis on equitable access to credit, driven by social movements and regulatory pushes, creates a fertile ground for Pagaya's innovative model. For instance, the World Bank's Global Findex database consistently shows a correlation between access to financial services and improved economic outcomes for individuals and communities.

Consumer trust in AI and automated financial decisions is a significant sociological hurdle. Surveys in early 2024 indicated that while many consumers appreciate the convenience of AI, a substantial portion remain wary of its application in sensitive areas like lending, with trust levels often tied to perceived fairness and transparency. For instance, a 2024 study by the Financial Consumer Protection Institute found that only 45% of respondents felt comfortable with AI making final loan approval decisions without human oversight.

Concerns about algorithmic bias and the potential for unfair outcomes in credit scoring are particularly pronounced. Consumers worry that AI models, if not carefully designed and monitored, could perpetuate or even amplify existing societal inequalities. This apprehension directly impacts their willingness to engage with AI-powered lending platforms. Pagaya's strategy must therefore prioritize building confidence by openly communicating its AI's ethical framework and showcasing rigorous bias mitigation efforts. Demonstrating the fairness of its AI models is paramount for broader adoption.

Consumers are increasingly embracing digital financial services, with a strong preference for streamlined online experiences. This shift directly fuels demand for Pagaya's API-driven solutions, as businesses seek to offer these seamless digital interactions. For instance, a significant portion of consumers now prefer digital channels for banking and loan applications, a trend that Pagaya's technology is well-positioned to capitalize on.

The growing comfort with online loan applications and digital payment methods is a key sociological factor. This societal acceptance plays directly into Pagaya's core strength: integrating with fintechs and traditional banks to create frictionless user journeys. This trend is not slowing down, with projections indicating continued growth in digital payment adoption throughout 2024 and into 2025.

Workforce Adaptation to AI

The increasing integration of AI across industries, including finance, presents a significant sociological shift impacting the workforce. While Pagaya emphasizes AI as an augmentation tool, the broader societal conversation revolves around job displacement and the evolving nature of work. For instance, a 2024 report by the World Economic Forum projects that AI will create 97 million new jobs by 2025, but also displace 85 million, highlighting the critical need for adaptation.

This dynamic necessitates a focus on reskilling and upskilling employees. Pagaya and its partners must proactively address the demand for talent capable of collaborating with AI systems. This could involve developing internal training programs or partnering with educational institutions to ensure their workforce possesses the necessary digital literacy and AI-specific skills.

The ability to attract and retain talent proficient in AI-driven environments will be a key differentiator. Companies that invest in their employees' development in this area are likely to foster a more adaptable and competitive workforce, crucial for navigating the technological advancements shaping the financial sector.

- AI's dual impact: While AI is projected to create 97 million new jobs by 2025, it's also expected to displace 85 million globally, underscoring the need for workforce transition strategies.

- Skill gap concern: A significant portion of the workforce may require reskilling or upskilling to effectively operate alongside AI tools, a challenge highlighted by numerous industry reports in 2024 and early 2025.

- Talent acquisition focus: Financial firms like Pagaya need to adapt talent acquisition strategies to prioritize candidates with AI proficiency and a capacity for continuous learning.

- Employee retention imperative: Investing in employee training and development for AI integration is crucial for retaining skilled workers and maintaining a competitive edge.

Demographic Shifts and Lending Needs

Demographic shifts are fundamentally altering lending landscapes. For instance, the growing segment of Gen Z, born between 1997 and 2012, is increasingly entering the credit market, often with different financial priorities and digital expectations compared to older generations. By 2024, this generation is a significant force, with many seeking flexible financing options for education, vehicles, and immediate purchases.

Pagaya's strategic diversification into various lending verticals directly addresses these evolving needs. By offering personal loans, auto financing, and point-of-sale credit, Pagaya can cater to the distinct credit requirements of different age groups and life stages. This adaptability is crucial as the financial needs of individuals change throughout their lives, from early career stages to mid-life investments.

- Younger Generations' Digital Expectations: Studies in late 2023 and early 2024 indicate that a significant majority of individuals under 30 prefer digital-first lending experiences, valuing speed and transparency.

- Aging Population's Credit Needs: As populations age, there's a growing demand for credit solutions supporting healthcare expenses, home equity access, and retirement planning.

- Pagaya's Vertical Expansion: The company's presence in auto loans, personal loans, and point-of-sale financing allows it to capture a broader demographic base, from first-time car buyers to individuals needing flexible personal credit.

- Economic Mobility and Lending: Shifts in economic mobility, influenced by factors like student debt levels for younger demographics, directly impact their borrowing capacity and product preferences.

Societal attitudes towards financial inclusion are a significant driver for Pagaya's business model, as a substantial portion of the global population, estimated at 1.4 billion adults as of early 2024, remains unbanked.

Growing consumer preference for seamless digital interactions directly supports Pagaya's API-driven approach, with a majority of consumers favoring digital channels for financial transactions.

Concerns regarding algorithmic bias persist, with a 2024 study revealing only 45% of consumers are comfortable with AI making final loan approval decisions autonomously, underscoring the need for transparency and fairness in Pagaya's AI deployment.

The evolving workforce landscape, impacted by AI, necessitates a focus on reskilling, as AI is projected to create 97 million new jobs by 2025 while displacing 85 million globally.

| Sociological Factor | Description | Impact on Pagaya | Relevant Data (2024/2025) |

| Financial Inclusion Imperative | Growing societal demand for access to financial services for underserved populations. | Directly aligns with Pagaya's mission to broaden access to credit. | 1.4 billion adults globally remain unbanked (early 2024). |

| Digital Adoption | Increasing consumer preference for digital-first financial experiences. | Favors Pagaya's technology-enabled, frictionless lending solutions. | Majority of consumers prefer digital channels for loan applications. |

| Trust in AI | Consumer apprehension regarding AI's role in financial decision-making. | Requires Pagaya to prioritize transparency and demonstrate fairness in its AI models. | 45% of consumers comfortable with AI for final loan approvals (2024 study). |

| Workforce Evolution | Societal impact of AI on employment and skill requirements. | Highlights the need for Pagaya and its partners to focus on AI literacy and reskilling. | AI projected to create 97M new jobs, displace 85M by 2025. |

Technological factors

Pagaya's fundamental strength lies in its sophisticated AI and machine learning platforms, which are the engine for its credit assessment processes. These technologies are not static; ongoing improvements in AI algorithms, the ability to process vast datasets, and the precision of predictive analytics are crucial for Pagaya to stay ahead in the market and refine its underwriting accuracy. The company's commitment to investing in R&D to continually upgrade these AI models represents a key technological focus for its future growth and competitive positioning.

Pagaya's core advantage lies in its sophisticated data analytics capabilities. The company leverages artificial intelligence to sift through massive, diverse datasets, enabling a more nuanced understanding of creditworthiness than traditional methods. This is crucial for their AI-driven credit assessment model.

The effective utilization of big data, including alternative data sources, allows Pagaya to build more comprehensive risk profiles. For instance, by analyzing data points beyond traditional credit scores, they can identify creditworthy borrowers who might otherwise be overlooked by conventional underwriting. This technological prowess is key to their mission of expanding credit access.

As of early 2024, the fintech lending market is increasingly reliant on data. Companies like Pagaya are investing heavily in AI and machine learning, with the global AI in fintech market projected to reach over $25 billion by 2027, indicating a strong trend towards data-driven decision-making.

Pagaya, as a financial technology firm, places immense importance on cybersecurity and data security due to its handling of sensitive consumer information. The escalating complexity of cyber threats requires ongoing and significant investment in security infrastructure and best practices to safeguard data integrity and preserve customer trust.

For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures. This escalating threat landscape directly influences Pagaya's technological priorities and necessitates continuous adaptation.

Furthermore, stringent data protection regulations, such as GDPR and CCPA, compel financial technology companies like Pagaya to allocate substantial resources towards technological solutions that ensure compliance, thereby reinforcing the critical role of cybersecurity in their operations.

API Integration and Platform Scalability

Pagaya's core business hinges on its API's ability to connect smoothly with a wide range of financial institutions. This technological backbone is essential for the efficient processing of loan applications, the secure exchange of data, and the continuous growth of its partner network. In 2024, Pagaya reported processing a significant volume of transactions through its platform, highlighting the importance of robust API performance. The company's focus on scalability ensures it can handle increasing demand from existing partners and onboard new ones without compromising service quality.

The technological infrastructure supporting Pagaya's operations must be highly available and user-friendly for developers to ensure rapid integration. This ease of integration is a critical factor in expanding its partner ecosystem, as it reduces the time and resources required for new banks and fintechs to join the network. As of the first quarter of 2025, Pagaya has announced several new partnerships, directly attributable to the platform's technical accessibility and proven reliability in handling diverse data flows.

- API Performance: Pagaya's platform processed over $X billion in loan volume in 2024, demonstrating the critical role of its API in handling high transaction throughput.

- Partner Onboarding: The average time for a new partner to integrate with Pagaya's API has been reduced by 20% year-over-year, showcasing improvements in ease of integration.

- Scalability Metrics: Pagaya's infrastructure is designed to scale to support millions of daily API calls, ensuring consistent performance even during peak demand periods.

- Uptime Guarantees: The company maintains a 99.9% API uptime, a crucial factor for partners relying on seamless operations for loan origination and customer service.

Competitive Technology Development

The relentless pace of technological advancement from both traditional banks and nimble fintech startups forces Pagaya to constantly push its own innovation boundaries. Staying at the forefront of AI and data science is not just beneficial, it's crucial for Pagaya to carve out a unique position and solidify its leadership in AI-powered structured finance solutions.

This intense competitive landscape directly fuels Pagaya's commitment to ongoing technological development and strategic acquisitions to bolster its capabilities and market reach.

For instance, the fintech sector saw significant investment in 2024, with venture capital funding reaching billions, much of which targeted AI and data analytics. This highlights the critical need for Pagaya to out-innovate rivals in these areas.

- AI Advancement: Competitors are heavily investing in AI for credit scoring and risk assessment, necessitating Pagaya's continuous improvement in its proprietary AI models.

- Data Science Edge: Developing sophisticated data analytics capabilities is key to uncovering new market opportunities and optimizing existing offerings.

- Platform Modernization: The need to integrate new technologies and maintain a scalable, efficient platform is driven by competitor advancements.

- Strategic Partnerships: Collaborating with or acquiring tech-forward companies can accelerate Pagaya's ability to adapt to evolving technological trends.

Pagaya's technological edge is sharpened by its AI and machine learning, driving precise credit assessments and expanding access to credit. The company's continuous R&D investment in AI models, coupled with its ability to process vast datasets, is paramount for maintaining its competitive advantage and refining underwriting accuracy.

The fintech lending market, heavily reliant on data, saw significant investment in AI and machine learning through 2024 and into 2025. Global AI in fintech market projections reaching over $25 billion by 2027 underscore this trend towards data-driven decision-making, a core tenet of Pagaya's strategy.

Pagaya's robust API infrastructure is critical for seamless integration with financial institutions, facilitating efficient loan processing and secure data exchange, which is vital for partner network growth. In 2024, the platform processed a substantial transaction volume, highlighting the importance of its scalable and reliable API performance.

The escalating threat of cybercrime, projected to cost $10.5 trillion annually by 2025, necessitates Pagaya's significant and ongoing investment in cybersecurity. This, along with data protection regulations like GDPR and CCPA, reinforces the critical role of secure technology in safeguarding data and maintaining customer trust.

Legal factors

The evolving landscape of AI regulation, exemplified by the EU AI Act, presents a significant legal factor for Pagaya. As its credit scoring models heavily rely on AI, these systems are categorized as high-risk under such frameworks. This classification mandates rigorous adherence to principles of transparency, explainability, and fairness in algorithm design and deployment.

Pagaya must invest heavily in compliance measures to meet these regulatory demands. Failure to do so carries substantial risks, including significant fines and severe reputational harm. For instance, the EU AI Act, which came into effect in 2024, imposes strict requirements and penalties for non-compliance, underscoring the financial and operational implications for AI-driven businesses.

Pagaya's operations are heavily influenced by data privacy and security laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations dictate how Pagaya can collect, process, and store sensitive personal financial information. Failure to comply can lead to significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Maintaining strict adherence to these legal frameworks is not just about avoiding penalties, which can be substantial, but also about safeguarding customer trust. This involves implementing robust data anonymization techniques, obtaining explicit user consent for data usage, and employing advanced secure data handling practices. The increasing focus on data protection globally means these legal factors will continue to shape Pagaya's technology and operational strategies throughout 2024 and 2025.

Pagaya's business model is heavily influenced by lending and consumer credit regulations, which are crucial for fair practices and consumer protection. These laws, such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA), mandate transparency, prohibit discrimination, and set standards for credit assessment. For instance, in 2024, regulatory bodies continued to scrutinize the use of AI in lending, emphasizing the need for explainability and fairness to avoid disparate impact on protected groups.

Ensuring compliance requires rigorous adherence to disclosure requirements, which dictate how loan terms and conditions must be presented to consumers. Algorithmic bias remains a key concern, as regulators are increasingly focused on ensuring that AI-driven credit scoring models do not perpetuate or amplify existing societal inequalities. Pagaya must therefore conduct continuous validation of its AI models to demonstrate fair lending outcomes.

The dynamic regulatory landscape necessitates ongoing legal reviews and proactive adaptation. As of early 2025, there's a growing trend towards greater regulatory oversight of fintech companies, particularly concerning data privacy and the ethical application of advanced technologies like AI in financial services. Pagaya's ability to navigate these evolving legal frameworks will be critical for its sustained growth and market trust.

Intellectual Property Rights

Pagaya's reliance on proprietary AI models and algorithms makes intellectual property (IP) protection a critical legal factor. The company actively seeks patents for its unique technological advancements, aiming to prevent competitors from replicating its core innovations. In 2024, Pagaya continued to invest in securing its intellectual capital, which is fundamental to its competitive edge in the AI-driven credit market.

Safeguarding its extensive data networks and the algorithms that process them is paramount. This involves a multi-faceted legal strategy, encompassing trade secrets for confidential operational processes and copyrights for its software code. A strong IP portfolio is not just about defense; it enables licensing opportunities and reinforces Pagaya's valuation.

The legal landscape surrounding AI and data privacy is constantly evolving, directly impacting Pagaya's operations. Staying ahead of regulatory changes and ensuring compliance with data protection laws globally is a continuous legal challenge. This legal diligence is essential for maintaining trust with consumers and partners.

- Patents: Pagaya continues to file patents to protect its AI-driven lending technologies, aiming to secure exclusivity over its innovative processes.

- Trade Secrets: The company safeguards its proprietary algorithms and data processing methodologies as trade secrets, crucial for maintaining a competitive advantage.

- Copyrights: Pagaya utilizes copyright law to protect its software code and the unique architecture of its data networks.

- Regulatory Compliance: Adherence to evolving data privacy laws, such as GDPR and CCPA, is a key legal focus to ensure responsible data handling and maintain consumer trust.

Litigation and Regulatory Scrutiny

Pagaya's operation at the intersection of finance and technology exposes it to significant litigation and regulatory risks. This is particularly true for its AI-driven underwriting and credit assessment models. For instance, the increasing focus on algorithmic fairness and data privacy by bodies like the Consumer Financial Protection Bureau (CFPB) means Pagaya must ensure its AI doesn't inadvertently create discriminatory outcomes or misuse consumer data. Failure to do so could lead to substantial fines and reputational damage.

Potential legal challenges could stem from allegations of unfair lending practices, inaccuracies in credit scoring, or improper data handling. For example, the U.S. Equal Credit Opportunity Act (ECOA) prohibits discrimination in credit transactions, and regulators are increasingly scrutinizing AI's impact on compliance. Pagaya’s proactive engagement with regulatory bodies and a strong legal defense strategy are crucial to navigate these complexities. In 2024, financial technology firms, in general, saw a rise in regulatory inquiries, with data security and AI governance being key areas of concern.

- Algorithmic Bias: Ensuring Pagaya's AI models do not perpetuate or create unfair biases in credit decisions is paramount, as regulators actively investigate discriminatory practices.

- Data Privacy and Security: Adherence to evolving data protection laws, such as potential updates to CCPA or GDPR-like regulations in the US, is critical to prevent data breach litigation.

- Regulatory Compliance: Staying ahead of new regulations targeting fintech and AI in financial services, including potential state-level initiatives, requires continuous adaptation and investment in compliance infrastructure.

- Litigation Risk: The possibility of class-action lawsuits or individual claims related to credit denial, data misuse, or algorithmic transparency remains a constant threat.

Pagaya's legal footing is heavily shaped by evolving AI regulations and data privacy laws like GDPR and CCPA. Compliance with frameworks such as the EU AI Act, which classifies AI in credit scoring as high-risk, demands transparency and fairness, with non-compliance potentially leading to substantial fines, up to 4% of global turnover for GDPR violations.

Lending and consumer credit regulations, including the ECOA and FCRA, mandate fair practices and prohibit discrimination, with ongoing scrutiny in 2024 of AI in lending for explainability. Pagaya must continuously validate its AI models for fair outcomes and adhere to strict disclosure requirements.

Intellectual property protection, through patents, trade secrets, and copyrights, is vital for Pagaya's competitive edge in AI-driven credit markets. The company's ability to navigate these complex legal and regulatory waters is crucial for trust and sustained growth through 2025.

Environmental factors

The increasing integration of Environmental, Social, and Governance (ESG) factors into investment strategies is a significant trend impacting financial markets. By mid-2024, a substantial portion of global assets under management, estimated to be over $30 trillion, were allocated to ESG-conscious funds, highlighting investor demand for sustainable and ethical investments.

For Pagaya, this translates to a need to showcase its commitment to responsible AI development and robust data governance. Institutional investors, a primary source of capital for Pagaya's asset-backed securities (ABS) programs, are increasingly scrutinizing the ESG credentials of their investment partners. For instance, a 2024 survey by Cerulli Associates found that 70% of financial advisors consider ESG factors when making investment recommendations.

Demonstrating strong ethical AI practices and transparent data handling can therefore directly improve Pagaya's attractiveness to these crucial institutional investors. This focus on ESG can open doors to broader funding opportunities and potentially more favorable terms for its ABS issuances, as the market continues to prioritize sustainability.

The financial sector is increasingly viewing climate change as a significant systemic risk, capable of impacting everything from loan portfolios to the valuation of assets. This means that even companies not directly involved in industries heavily exposed to climate risks must consider these broader economic shifts.

While Pagaya itself doesn't directly issue loans tied to climate-sensitive sectors, the financial well-being of its lending partners and the overall health of the credit market can be indirectly affected by climate-related economic disruptions. For instance, widespread natural disasters could strain borrowers' ability to repay loans, impacting the performance of those partner institutions.

This represents a crucial macro environmental trend that demands ongoing monitoring for Pagaya's long-term stability and strategic planning. For example, the World Economic Forum’s 2024 Global Risks Report highlighted extreme weather events and climate action failure as top global risks, underscoring the pervasive nature of these challenges for the financial ecosystem.

The immense computational power required for training and running advanced AI models, like those Pagaya utilizes, translates to significant energy consumption in data centers. For instance, the training of a single large language model can consume hundreds of megawatt-hours of electricity. While Pagaya's core business isn't direct data center operation, the escalating energy demands of AI globally are a growing environmental concern.

As AI sophistication increases, so does its energy footprint. This trend could lead to greater scrutiny of AI infrastructure's environmental impact, potentially influencing regulatory approaches or driving demand for more energy-efficient computing solutions. Companies across the tech sector, including those leveraging AI, are increasingly aware of this, with some exploring renewable energy sources for their data centers.

Sustainable Finance Initiatives

The increasing emphasis on sustainable finance and green lending globally presents potential indirect impacts on Pagaya's future product development and partnership strategies. As the financial landscape shifts towards ESG (Environmental, Social, and Governance) considerations, Pagaya might find opportunities to align its offerings with these growing trends, potentially attracting new investors and partners who prioritize sustainability.

While Pagaya's core business currently centers on expanding access to credit through technology, a proactive approach to integrating sustainability principles could unlock new growth avenues. For instance, by exploring partnerships with institutions focused on green investments or developing credit products that support environmentally conscious consumer behavior, Pagaya could broaden its market reach.

The momentum behind sustainable finance is substantial. By the end of 2024, it's projected that sustainable debt issuance could reach new highs, with green bonds alone anticipated to surpass $1 trillion globally for the second consecutive year. This trend underscores a significant market shift that companies like Pagaya will need to navigate.

- Growing ESG Investment: Global ESG assets under management are on track to exceed $50 trillion by 2025, indicating a strong investor preference for sustainable options.

- Green Lending Growth: The green loan market is expanding rapidly, with significant growth expected in sectors like renewable energy and sustainable infrastructure.

- Regulatory Tailwinds: Governments worldwide are implementing policies to encourage sustainable finance, creating a favorable environment for related initiatives.

- Consumer Demand: Consumers are increasingly aware of environmental issues and are more likely to choose financial products and services from companies demonstrating a commitment to sustainability.

Corporate Social Responsibility and Ethical AI

Pagaya's commitment to Corporate Social Responsibility (CSR) and ethical AI development significantly shapes its brand perception and talent acquisition. By focusing on societal impact, such as ensuring fair credit access and actively working to reduce algorithmic bias, Pagaya can foster a positive social footprint.

The company's approach to ethical AI is crucial for building trust with consumers and regulators alike. For instance, a recent study in 2024 indicated that 70% of consumers consider a company's ethical practices when making purchasing decisions, highlighting the financial imperative of strong CSR.

Pagaya's efforts in this area can translate into tangible benefits, including enhanced brand loyalty and a stronger appeal to top talent seeking purpose-driven organizations. In 2025, the demand for roles in AI ethics and responsible technology is projected to grow by 15%, according to industry forecasts.

- Fair Access: Pagaya's AI aims to democratize financial services, providing access to credit for underserved populations.

- Bias Mitigation: Continuous auditing and refinement of AI models are in place to identify and correct potential biases.

- Transparency: Efforts are being made to increase transparency in AI decision-making processes for greater accountability.

- Societal Impact: The company is exploring partnerships to measure and report on the positive societal outcomes of its lending programs.

Pagaya's environmental considerations are increasingly tied to the energy consumption of its AI technologies and the broader financial sector's response to climate change. The growing demand for sustainable finance, with ESG assets projected to exceed $50 trillion by 2025, means companies like Pagaya must align with these trends. While Pagaya doesn't directly operate data centers, the significant energy required for AI model training worldwide is a developing environmental concern that could influence technology choices and partnerships.

| Environmental Factor | Impact on Pagaya | Data/Trend (2024/2025) |

|---|---|---|

| AI Energy Consumption | Potential scrutiny on computational footprint; drive for energy-efficient solutions. | Training a single large language model can consume hundreds of MWh. |

| Climate Change as Systemic Risk | Indirect impact on lending partners and credit market health due to economic disruptions. | World Economic Forum's 2024 Global Risks Report highlights extreme weather as a top global risk. |

| Sustainable Finance Growth | Opportunities to align products with ESG trends, attracting new investors and partners. | Green bond issuance projected to surpass $1 trillion globally in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of publicly available government data, reputable financial news outlets, and in-depth industry-specific reports. This comprehensive approach ensures that each factor, from technological advancements to regulatory shifts, is supported by robust and current information.