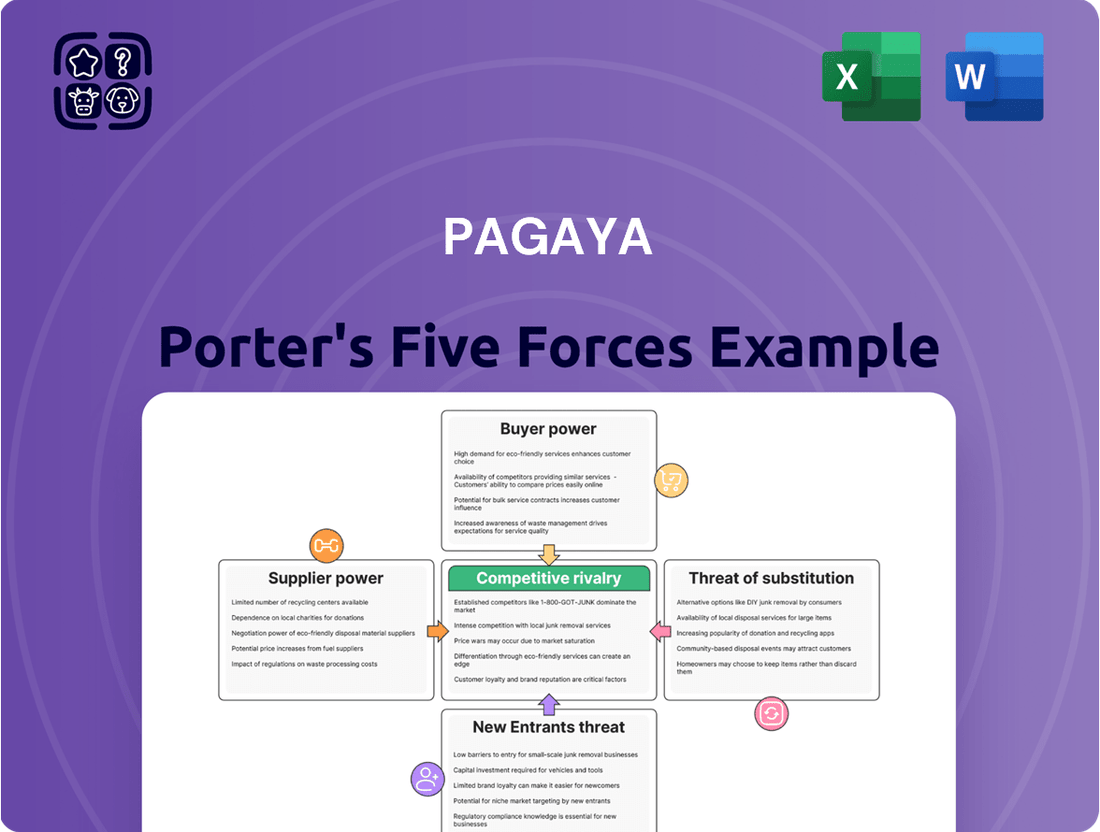

Pagaya Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pagaya Bundle

Pagaya's competitive landscape is shaped by a complex interplay of industry forces. Understanding the bargaining power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry is crucial for strategic planning. Furthermore, the presence of substitutes can significantly impact Pagaya's market position and profitability. This brief overview only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Pagaya’s competitive dynamics, market pressures, and strategic advantages in detail. This comprehensive report offers actionable insights into each force, providing a data-driven framework to understand Pagaya's real business risks and market opportunities.

Suppliers Bargaining Power

Pagaya's reliance on data providers for its AI-driven credit assessment models means these suppliers can wield considerable influence. The quality and uniqueness of the data, whether traditional credit scores or alternative sources like utility payments and rental history, directly impact Pagaya's ability to accurately underwrite loans, particularly for those with thin credit files. For instance, in 2024, the demand for sophisticated alternative data to identify creditworthy individuals outside traditional metrics has surged, potentially increasing the bargaining power of providers offering these niche datasets.

The bargaining power of data providers for Pagaya can be seen as moderate to high. This is especially true when providers possess proprietary datasets that are difficult for Pagaya to replicate, such as specialized fraud detection algorithms or unique demographic information crucial for assessing underserved populations. However, Pagaya's strategy of integrating multiple alternative data sources helps to diversify its reliance and thereby mitigate the power of any single provider. The growing ecosystem of data aggregators and specialized data analytics firms in 2024 offers Pagaya more options, potentially capping supplier power.

The bargaining power of suppliers in AI/ML talent and technology for a company like Pagaya is a nuanced consideration. Highly specialized AI and machine learning professionals, especially those with proven success in financial services, are in high demand and represent a scarce resource. This scarcity can translate into significant leverage for these individuals and the firms that employ them, allowing them to command higher salaries and more favorable contract terms.

Furthermore, the providers of cutting-edge AI/ML frameworks, platforms, and advanced technological tools also hold considerable power. Companies that develop proprietary algorithms or specialized hardware for AI computation can dictate terms, especially if their offerings are essential for competitive advantage. For instance, the cost of specialized AI chips and cloud computing resources crucial for training complex models can fluctuate based on supplier availability and demand.

However, Pagaya's strategy appears to mitigate this supplier power to some extent. By developing its own proprietary AI network, Pagaya likely reduces its dependence on external vendors for its core AI development and innovation. This in-house capability means they are not solely reliant on third-party AI solutions or talent pools, thereby lessening the bargaining power of those external suppliers.

The market for AI talent saw robust growth, with the global AI market size estimated to be around $200 billion in 2023 and projected to grow significantly. This overall expansion, while increasing the pool of AI professionals, also highlights the intense competition for top-tier talent, underscoring the potential leverage held by these skilled individuals.

Pagaya's reliance on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud likely means these suppliers wield significant bargaining power. These providers benefit from immense economies of scale and offer critical services that are difficult and costly to replicate, especially for a technology-forward company like Pagaya. In 2024, the cloud computing market continued its robust growth, with AWS, Azure, and Google Cloud holding substantial market share, indicating their entrenched positions.

Capital Providers (for Securitization)

Pagaya's business model hinges on securitization, requiring substantial capital from institutional investors who purchase asset-backed securities (ABS) or enter forward flow agreements. These capital providers wield considerable bargaining power because they supply the essential funding for Pagaya's loan originations.

The ability to attract a broad range of investors and consistently oversubscribe ABS offerings, as demonstrated by Pagaya's performance in recent transactions, suggests a degree of leverage. However, the overall health and sentiment of capital markets can significantly impact the bargaining power of these crucial capital providers.

- Investor Demand: Pagaya's success in oversubscribing ABS deals, such as its auto loan securitization in early 2024 which saw strong demand from a diverse investor base, highlights its ability to attract capital.

- Market Conditions: Fluctuations in interest rates and overall economic stability directly influence investor appetite for ABS, thereby affecting their bargaining power.

- Diversification Strategy: By cultivating relationships with multiple institutional investors, Pagaya aims to mitigate the concentrated power of any single capital provider.

Regulatory and Compliance Software Vendors

The bargaining power of regulatory and compliance software vendors, critical for financial institutions like Pagaya, is moderate. These vendors offer specialized RegTech solutions that are indispensable for navigating the intricate and ever-changing landscape of financial regulations, thereby helping to mitigate risks such as fraud and money laundering.

The necessity for Pagaya to adhere to stringent financial regulations, including those related to data privacy and consumer protection, underscores the importance of these software providers. For instance, in 2024, the global RegTech market was valued at approximately $12.7 billion, with a projected compound annual growth rate (CAGR) of over 20% through 2030, indicating increasing reliance and demand.

- High Switching Costs: Implementing and integrating new compliance software often involves significant upfront investment and can disrupt existing workflows, making it costly and time-consuming for Pagaya to switch vendors.

- Specialized Nature of Software: The highly specialized nature of regulatory compliance software means there are fewer direct substitutes, giving vendors leverage in pricing and contract terms.

- Vendor Consolidation: The RegTech market is seeing some consolidation, which can further concentrate power in the hands of fewer, larger suppliers.

- Essential for Risk Mitigation: These software solutions are not optional; they are essential for Pagaya to avoid hefty fines, legal repercussions, and reputational damage, thereby increasing the suppliers' leverage.

Data providers are key to Pagaya's AI models, influencing its ability to assess credit, especially for those with limited credit history. The demand for unique data sources in 2024 boosted the bargaining power of suppliers offering specialized datasets. Pagaya mitigates this by integrating multiple data sources, increasing its options and potentially limiting any single supplier's influence.

Pagaya's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud gives these suppliers significant leverage due to their scale and essential services. The continued growth of the cloud computing market in 2024, with these providers holding large market shares, solidifies their strong positions.

Institutional investors who provide capital through ABS or forward flow agreements for Pagaya's loan originations hold considerable bargaining power. While Pagaya's success in oversubscribing deals, like its auto loan securitization in early 2024, shows strong investor demand, market conditions and interest rates can shift this power balance.

What is included in the product

Pagaya's Porter's Five Forces analysis assesses the competitive intensity and attractiveness of its market by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly identify and quantify competitive pressures with a dynamic, interactive Pagaya Porter's Five Forces analysis, empowering strategic clarity.

Customers Bargaining Power

Pagaya's customer base, primarily banks and fintechs, holds significant bargaining power. These institutions, especially larger ones like JPMorgan Chase or Bank of America, represent substantial transaction volumes, giving them leverage in negotiations with Pagaya. For instance, in 2024, US commercial banks held over $23.5 trillion in assets, indicating the scale of potential business.

The ability of these financial institutions to develop or adopt in-house AI solutions directly impacts their bargaining power. If a bank can replicate Pagaya's AI-driven credit assessment capabilities internally, their reliance on Pagaya decreases, strengthening their negotiating position. This is particularly true for institutions already investing heavily in digital transformation and data science talent.

Fintech lenders like Klarna and LendingClub, which partner with Pagaya, possess considerable bargaining power. Their growing reliance on digital platforms and a keen focus on customer experience means they can demand favorable terms, as they represent a significant channel for Pagaya's AI-driven lending solutions.

These fintechs are increasingly sophisticated, offering innovative digital lending experiences that attract a large customer base. This strong customer acquisition capability gives them leverage in negotiations with service providers like Pagaya, as they can potentially develop or partner with alternative risk assessment technologies.

In 2024, the fintech lending sector continued its robust growth, with many platforms reporting double-digit percentage increases in loan originations. This market strength allows these fintech partners to negotiate better rates and service level agreements with Pagaya, as they are key drivers of transaction volume.

Pagaya's value proposition, enabling partners to reach more borrowers and improve risk assessment, is a crucial aspect of these partnerships. However, the fintechs' ability to switch or supplement these services means they can exert pressure on Pagaya to maintain competitive pricing and service delivery.

Pagaya's strategy of broadening its network of lending partners across personal loans, auto loans, and point-of-sale financing directly counters customer bargaining power. By bringing on diverse partners, including major financial institutions, Pagaya reduces its reliance on any single client. This diversification means that individual customers have less leverage to demand lower fees or more favorable terms, as Pagaya can shift business to other partners.

Value Proposition and Differentiation

Pagaya's AI-driven network is designed to transform the credit landscape by pinpointing and assisting a broader range of borrowers. This unique value proposition is central to mitigating customer bargaining power.

When Pagaya's advanced technology demonstrably boosts its partners' profitability and market reach, it diminishes the customers' motivation to seek alternatives. This creates a stickier ecosystem, effectively reducing the leverage customers hold.

- Enhanced Profitability for Partners: Pagaya's platform aims to improve partner profitability by enabling them to serve a wider credit spectrum, potentially increasing loan origination volume and reducing default rates through advanced risk assessment.

- Customer Retention through Value: By offering a superior, AI-powered lending solution, Pagaya makes it less attractive for partners to switch to less sophisticated or less effective systems, thereby limiting their perceived need to bargain for better terms.

- Data-Driven Differentiation: Pagaya's proprietary algorithms and extensive data network provide a competitive edge that is difficult for traditional lenders to replicate, further strengthening its position against potential customer demands for lower rates or less stringent terms.

Switching Costs for Partners

The bargaining power of customers, specifically Pagaya's partners, is influenced by switching costs. Integrating Pagaya's proprietary API and capital solutions into a partner's existing infrastructure requires significant technical and operational investment. This deep integration creates substantial switching costs, making it cumbersome and expensive for partners to move to a different AI credit assessment provider. Consequently, once a partner is integrated, their ability to negotiate better terms or switch providers is diminished, thereby reducing their bargaining power.

These integration efforts act as a significant barrier to exit. For example, a partner might need to reconfigure their core systems, retrain staff, and potentially undergo new compliance checks if they were to switch. This complexity means that the initial investment in integrating with Pagaya locks them in, effectively reducing their leverage in future negotiations. This dynamic is crucial for understanding the competitive landscape Pagaya operates within.

The high switching costs directly translate to a lower bargaining power for Pagaya's partners.

- Technical Integration Effort: Pagaya's API requires substantial technical resources from partners for seamless integration into their systems.

- Operational Investment: Partners invest not just financially but also operationally in adapting their workflows to Pagaya's platform.

- Reduced Flexibility: Once integrated, partners face challenges in easily switching to competitors due to the sunk costs and operational disruption.

- Lowered Negotiation Leverage: The difficulty in switching limits partners' ability to demand more favorable terms or pricing from Pagaya.

Pagaya's partners, primarily banks and fintechs, hold considerable bargaining power due to their market influence and ability to develop alternative solutions. However, Pagaya mitigates this through diversification and a unique value proposition, making switching costly for partners.

| Factor | Impact on Pagaya's Bargaining Power with Customers | Supporting Data (2024) |

|---|---|---|

| Partner Size & Volume | High Power (Large partners drive significant volume) | US Commercial Banks held over $23.5 trillion in assets. |

| In-house Capability | High Power (Ability to replicate Pagaya's tech reduces reliance) | Increased investment by financial institutions in AI and data science talent. |

| Fintech Sophistication | High Power (Strong customer acquisition and alternative tech) | Fintech lending sector continued robust growth with double-digit originations. |

| Switching Costs | Low Power (High integration effort makes switching difficult) | Significant technical and operational investment required for API integration. |

Preview the Actual Deliverable

Pagaya Porter's Five Forces Analysis

This preview displays the complete Pagaya Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the financial technology sector. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file. This analysis meticulously breaks down the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products, providing actionable insights for strategic decision-making. The document you see here is exactly what you’ll be able to download after payment, ensuring you receive a comprehensive and ready-to-use competitive landscape assessment.

Rivalry Among Competitors

The competitive rivalry in AI/ML lending solutions is intensifying as the market for these platforms experiences rapid expansion. Many companies are entering this space, all aiming to capture a significant portion of the growing demand for digital lending and AI-powered credit assessment.

This heightened competition is fueled by the broader trend of digital transformation within financial services, pushing more institutions to adopt AI. For instance, in 2024, the global AI in finance market was projected to reach hundreds of billions of dollars, with lending solutions being a major driver.

The presence of numerous startups and established fintech companies offering increasingly sophisticated AI/ML lending tools means that differentiation through innovation and customer service is crucial. This dynamic environment forces existing players to continually enhance their algorithms and platform capabilities to stay ahead.

Pagaya's competitive landscape includes traditional credit bureaus like Equifax, Experian, and TransUnion, which operate with established FICO scoring models. These incumbents are not static; they are actively incorporating alternative data and advanced analytics, mirroring Pagaya's approach and increasing the intensity of indirect competition.

While Pagaya utilizes alternative data for broader credit accessibility, traditional bureaus are also enhancing their offerings. For instance, Experian's Ascend platform aims to provide more predictive insights by integrating diverse data sets, directly challenging Pagaya's value proposition in credit assessment.

The rivalry is further fueled by the sheer scale and long-standing trust associated with traditional credit reporting agencies. In 2023, the top three credit bureaus collectively reported billions of credit files, demonstrating their deep market penetration and the significant inertia Pagaya must overcome.

Large financial institutions are increasingly investing in proprietary AI and machine learning for credit underwriting, posing a significant competitive threat. This 'build vs. buy' approach allows them to tailor solutions precisely to their needs and leverage vast internal datasets, potentially offering a competitive edge over firms relying on external technology providers. For instance, in 2024, major banks continued to allocate significant portions of their technology budgets towards in-house data science and AI development, with some reporting double-digit percentage increases year-over-year for these initiatives.

Emergence of New Fintech Competitors

The digital lending platform sector is experiencing rapid expansion, fueled by substantial FinTech investments, which consistently spawns new startups. These emerging companies can rapidly capture market share by focusing on underserved niches or deploying groundbreaking technologies.

New competitors frequently introduce innovative credit solutions, often leveraging advanced data analytics and AI to streamline underwriting and offer more personalized loan products. This dynamic environment intensifies pressure on established players like Pagaya.

- FinTech Funding Surge: Global FinTech investment reached $150 billion in 2023, indicating robust interest in new entrants.

- Startup Ecosystem Growth: The number of FinTech startups has grown by over 40% in the last three years, many targeting credit markets.

- Disruptive Technology Adoption: Companies utilizing AI for credit scoring saw an average 20% increase in loan approval rates compared to traditional methods in early 2024.

Product and Service Differentiation

Competitive rivalry is significantly shaped by how well companies can make their products and services stand out. Pagaya's approach, leveraging a massive data network and AI to offer tailored capital solutions, sets it apart from more generalized AI platforms or traditional lending institutions. This differentiation is key to its competitive position, but it necessitates ongoing investment in innovation to maintain its unique advantage.

Maintaining this edge is crucial in a dynamic market. For instance, in 2024, the demand for AI-driven financial solutions continued to surge, intensifying competition. Companies that can demonstrate superior data utilization and predictive accuracy, like Pagaya aims to do, are better positioned to attract and retain partners. The ability to adapt and refine its AI models is therefore a constant requirement for Pagaya to stay ahead.

- Data Network Scope: Pagaya's access to and analysis of a broad spectrum of consumer and transactional data is a core differentiator.

- AI Model Sophistication: Continuous improvement of its AI algorithms for credit underwriting and risk assessment is vital.

- Capital Solutions Breadth: Offering a range of capital solutions tailored to partner needs further distinguishes Pagaya.

- Partnership Ecosystem: The strength and interconnectedness of its partner network contribute to its unique value proposition.

The competitive rivalry in AI/ML lending solutions is intensifying as the market for these platforms experiences rapid expansion. Many companies are entering this space, all aiming to capture a significant portion of the growing demand for digital lending and AI-powered credit assessment. This heightened competition is fueled by the broader trend of digital transformation within financial services, pushing more institutions to adopt AI. For instance, in 2024, the global AI in finance market was projected to reach hundreds of billions of dollars, with lending solutions being a major driver.

The presence of numerous startups and established fintech companies offering increasingly sophisticated AI/ML lending tools means that differentiation through innovation and customer service is crucial. This dynamic environment forces existing players to continually enhance their algorithms and platform capabilities to stay ahead. Pagaya's competitive landscape includes traditional credit bureaus like Equifax, Experian, and TransUnion, which operate with established FICO scoring models. These incumbents are not static; they are actively incorporating alternative data and advanced analytics, mirroring Pagaya's approach and increasing the intensity of indirect competition. While Pagaya utilizes alternative data for broader credit accessibility, traditional bureaus are also enhancing their offerings. For example, Experian's Ascend platform aims to provide more predictive insights by integrating diverse data sets, directly challenging Pagaya's value proposition in credit assessment. The rivalry is further fueled by the sheer scale and long-standing trust associated with traditional credit reporting agencies. In 2023, the top three credit bureaus collectively reported billions of credit files, demonstrating their deep market penetration and the significant inertia Pagaya must overcome.

Large financial institutions are increasingly investing in proprietary AI and machine learning for credit underwriting, posing a significant competitive threat. This build vs. buy approach allows them to tailor solutions precisely to their needs and leverage vast internal datasets, potentially offering a competitive edge over firms relying on external technology providers. In 2024, major banks continued to allocate significant portions of their technology budgets towards in-house data science and AI development, with some reporting double-digit percentage increases year-over-year for these initiatives. The digital lending platform sector is experiencing rapid expansion, fueled by substantial FinTech investments, which consistently spawns new startups. These emerging companies can rapidly capture market share by focusing on underserved niches or deploying groundbreaking technologies. New competitors frequently introduce innovative credit solutions, often leveraging advanced data analytics and AI to streamline underwriting and offer more personalized loan products. This dynamic environment intensifies pressure on established players like Pagaya.

Pagaya's approach, leveraging a massive data network and AI to offer tailored capital solutions, sets it apart from more generalized AI platforms or traditional lending institutions. This differentiation is key to its competitive position, but it necessitates ongoing investment in innovation to maintain its unique advantage. Maintaining this edge is crucial in a dynamic market. In 2024, the demand for AI-driven financial solutions continued to surge, intensifying competition. Companies that can demonstrate superior data utilization and predictive accuracy, like Pagaya aims to do, are better positioned to attract and retain partners. The ability to adapt and refine its AI models is therefore a constant requirement for Pagaya to stay ahead.

| Key Competitor Aspect | Pagaya's Approach | Competitive Pressure | Market Trend (2024) | Impact on Pagaya |

| Data Utilization | Broad, alternative data network | Traditional bureaus enhancing data integration | Increasing demand for AI-driven insights | Need for continuous data sourcing and model refinement |

| AI Sophistication | Proprietary AI/ML models | In-house AI development by large banks | Focus on predictive accuracy and efficiency | Requires ongoing R&D for algorithmic superiority |

| Market Entry | FinTech startup disruption | Established players adapting | High FinTech investment ($150B in 2023) | Agility and innovation are critical for market share |

| Differentiation | Tailored capital solutions | Niche focus by new entrants | Growth in specialized lending platforms | Maintaining unique value proposition through partnerships and technology |

SSubstitutes Threaten

Lenders can choose to continue using or return to traditional, manual credit underwriting. This approach relies on conventional credit scores and human decision-making, acting as a direct substitute, especially for institutions wary of new technology or those managing less risky portfolios. For instance, while sophisticated AI-driven underwriting saw significant adoption, a portion of the market, particularly smaller community banks, may still process a substantial volume of loans through entirely manual or semi-automated means, citing regulatory comfort and familiarity.

Lenders can bypass end-to-end AI platforms by sourcing alternative data independently and integrating it into their existing, simpler in-house credit assessment systems. This strategy enables a degree of innovation without committing to a full platform integration. For example, a lender might subscribe to a specialized fraud detection data service and a separate credit bureau data feed, combining these inputs internally.

Lenders have a significant number of alternative data analytics and decision engine software options available, allowing them to develop custom credit models instead of solely depending on Pagaya's AI network. These generic tools offer considerable flexibility, enabling institutions to tailor solutions to their specific needs, a key consideration for many financial firms. For instance, companies like SAS and IBM offer robust analytics platforms that can be adapted for credit scoring. The availability of these alternatives means lenders are not locked into a single provider, potentially reducing reliance on Pagaya's proprietary technology.

Not Lending to Underserved Segments

Financial institutions might opt out of lending to creditworthy individuals with limited credit histories, a segment Pagaya's AI targets. This avoidance strategy sidesteps the complexities of advanced credit assessment but significantly curtails market penetration and future expansion opportunities.

By not serving these underserved segments, traditional lenders forgo a substantial growth avenue. For instance, in 2024, the U.S. Census Bureau reported that approximately 10% of U.S. adults are credit invisible, representing millions of potential customers.

- Limited Market Reach: Financial institutions that avoid 'new-to-credit' populations miss out on a significant customer base.

- Growth Constraints: By not developing AI for credit assessment, these institutions limit their potential for future growth and innovation in lending.

- Competitive Disadvantage: Competitors leveraging AI to serve these segments gain a first-mover advantage and build loyalty early.

- Missed Revenue Opportunities: The potential revenue from these previously unbanked or underbanked individuals remains untapped.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms present a distinct threat of substitutes for Pagaya's business model. These platforms offer an alternative avenue for borrowers seeking credit, directly connecting them with individual investors. This bypasses the traditional banking system and, importantly, can circumvent the need for an intermediary like Pagaya for credit assessment and loan origination.

While P2P platforms may employ their own proprietary algorithms, their core function as a direct funding channel for borrowers poses a competitive threat. For instance, by Q1 2024, the P2P lending market continued to grow, with platforms facilitating billions in loans, demonstrating their capacity to absorb a segment of the credit market that might otherwise utilize Pagaya's services.

- Alternative Credit Access: P2P platforms provide borrowers with a direct route to funding, reducing reliance on traditional financial institutions or credit enablers.

- Disintermediation: They can directly link borrowers and investors, potentially cutting out the need for a specialized credit assessment and loan servicing intermediary.

- Growing Market Share: The P2P lending sector, as of early 2024, has shown consistent growth, indicating an increasing acceptance and utilization by both borrowers and lenders.

- Technological Parity: Many P2P platforms utilize sophisticated algorithms for credit scoring, offering a comparable, if not alternative, technological solution to Pagaya's AI-driven approach.

The threat of substitutes for Pagaya's services is multifaceted, ranging from traditional credit underwriting to alternative lending platforms. Lenders can revert to manual underwriting, relying on established credit scores and familiar processes, particularly those institutions that are hesitant about adopting new technologies or manage less risky loan portfolios. This approach offers a sense of regulatory comfort and operational familiarity.

Furthermore, lenders can opt to build their own in-house credit assessment systems by independently sourcing alternative data, thereby integrating it into simpler existing frameworks rather than committing to an end-to-end AI platform. This allows for a degree of customized innovation without the overhead of a comprehensive AI solution. For example, a financial institution might subscribe to separate data services for fraud detection and credit bureau information, combining these inputs internally.

The market also offers a wide array of generic alternative data analytics and decision engine software, enabling financial institutions to develop bespoke credit models. This flexibility means lenders are not tethered to a single proprietary technology provider like Pagaya. In 2024, platforms from major tech companies like IBM and SAS continue to offer robust analytics capabilities that can be adapted for credit scoring purposes, underscoring the availability of viable substitutes. These alternatives empower lenders to tailor their credit assessment strategies to their unique risk appetites and operational needs.

Peer-to-peer (P2P) lending platforms also represent a significant substitute, directly connecting borrowers with investors and bypassing traditional intermediaries like Pagaya. By Q1 2024, the P2P lending market continued its growth trajectory, facilitating billions in loans and demonstrating its capacity to capture a segment of the credit market that might otherwise engage with AI-driven credit solutions. Many of these platforms utilize sophisticated algorithms, offering a technologically comparable alternative to Pagaya's AI-driven approach.

| Substitute Type | Description | Key Features | Market Relevance (2024) |

|---|---|---|---|

| Traditional Manual Underwriting | Reliance on conventional credit scores and human decision-making. | Familiarity, regulatory comfort. | Still prevalent in smaller institutions and for less risky portfolios. |

| In-House Data Sourcing | Independent acquisition and integration of alternative data into existing systems. | Customization, control over data inputs. | Allows for incremental innovation without full platform commitment. |

| Generic Analytics Software | Utilizing broad platforms for custom model development. | Flexibility, reduced vendor lock-in. | Companies like SAS and IBM provide adaptable credit scoring tools. |

| Peer-to-Peer (P2P) Lending | Direct borrower-investor connection, bypassing intermediaries. | Disintermediation, alternative credit access. | Growing market facilitating billions in loans, often using proprietary algorithms. |

Entrants Threaten

Entering the AI-driven financial technology sector, particularly for companies like Pagaya that focus on securitization and capital solutions, demands significant upfront investment. This capital is crucial for developing sophisticated AI technology, acquiring vast amounts of data for model training, navigating stringent regulatory landscapes, and crucially, funding the actual loan originations.

Pagaya's demonstrated ability to secure billions of dollars through Asset-Backed Securities (ABS) transactions is a clear testament to the substantial financial resources needed to operate in this arena. For instance, in 2023 alone, Pagaya facilitated over $2.5 billion in ABS issuances across various asset classes, underscoring the scale of capital required. This high capital threshold acts as a formidable barrier, deterring potential new players who may lack the necessary funding to compete effectively.

The financial services sector is a minefield of regulations, and any newcomer must meticulously navigate licensing requirements, stringent data privacy laws like GDPR and CCPA, and consumer protection mandates, such as fair lending practices. Building AI models that not only perform well but also adhere to these evolving compliance standards, while simultaneously building trust with regulatory bodies, presents a substantial hurdle that deters many potential entrants.

Pagaya's competitive advantage is significantly bolstered by its access to a vast network of proprietary data and deep AI expertise. The company has processed trillions of dollars in loan applications, feeding its continuously improving AI and machine learning models. This scale of data allows Pagaya to refine its risk assessment and operational efficiency in ways that are difficult for newcomers to replicate.

New entrants face a substantial hurdle in building comparable datasets and attracting the specialized AI talent required to compete effectively. The sheer volume and complexity of data needed to train sophisticated models represent a considerable investment and time commitment. Furthermore, securing top-tier AI professionals is a highly competitive endeavor, creating a significant barrier to entry for aspiring competitors aiming to match Pagaya's technological capabilities.

Establishing Lending Partner Network

Pagaya's success hinges on its extensive network of lending partners, including banks and fintech companies. This established infrastructure acts as a significant barrier to entry for potential competitors. It takes considerable time, consistent performance, and the development of deep trust to build and maintain these crucial relationships.

New entrants would face the daunting task of replicating this partner ecosystem. Without a proven track record and the inherent trust Pagaya has cultivated, it's challenging for newcomers to attract and onboard quality lending institutions. This network effect makes it difficult for new players to quickly achieve the scale necessary to compete effectively in the market.

For instance, as of early 2024, Pagaya reported partnerships with a significant number of financial institutions across various sectors, demonstrating the breadth and depth of its network. This extensive reach, built over years, provides a competitive advantage that is not easily overcome by emerging companies.

- Network Strength: Pagaya's business model is fundamentally built upon a wide and deep network of established lending partners.

- Barriers to Entry: Building comparable trust and relationships with financial institutions requires substantial time and proven performance, posing a significant hurdle for new entrants.

- Scalability Challenge: New competitors struggle to quickly scale their operations due to the difficulty in replicating Pagaya's extensive partner ecosystem.

- Competitive Advantage: The established network provides Pagaya with a distinct advantage, making it hard for new players to gain traction and compete on a similar level.

Network Effects and Brand Reputation

Pagaya's expanding network of lending partners and capital providers fosters significant network effects. As more partners join, the platform becomes more valuable for all participants, attracting further growth and making it difficult for newcomers to replicate this established ecosystem. For instance, in 2023, Pagaya facilitated over $1.5 billion in loan originations, demonstrating the scale of its active network.

The company's strong brand reputation, built on a track record of consistent asset performance and successful securitization transactions, presents a formidable barrier. New entrants struggle to establish the trust and credibility that Pagaya has cultivated with both its partners and investors. In 2024, Pagaya's securitization volume continues to grow, reinforcing its market standing.

- Network Effects: Increased value for participants as the network grows.

- Brand Reputation: Established trust in asset performance and securitization.

- Credibility Barrier: Difficulty for new entrants to gain market share against an established reputation.

- 2023 Loan Origination: Over $1.5 billion facilitated, showcasing network scale.

The threat of new entrants into Pagaya's AI-driven financial solutions space is considerably low. This is primarily due to the immense capital requirements for technology development, data acquisition, and regulatory compliance, coupled with the difficulty in replicating Pagaya's established network of lending partners and its strong brand reputation. Potential entrants face significant hurdles in matching the scale of data and AI expertise that Pagaya has cultivated.

| Barrier | Description | Pagaya's Advantage | New Entrant Challenge |

|---|---|---|---|

| Capital Requirements | Developing AI, data acquisition, regulatory navigation, loan origination funding. | Secured billions in ABS issuances; over $2.5 billion in ABS in 2023. | Requires substantial upfront investment, difficult for underfunded players. |

| Regulatory Landscape | Licensing, data privacy, consumer protection, compliance. | Navigates complex regulations with sophisticated AI models. | Time-consuming and costly to build compliant systems and gain regulatory trust. |

| Data & AI Expertise | Vast proprietary data, AI/ML model refinement. | Trillions of loan applications processed; continuous model improvement. | Difficult to acquire comparable datasets and specialized AI talent. |

| Network of Partners | Established relationships with banks and fintechs. | Extensive network built on time, performance, and trust; partnerships with numerous institutions as of early 2024. | Challenging to replicate trust and onboard quality institutions without a proven track record. |

| Brand Reputation | Track record of asset performance and successful securitization. | Strong credibility with partners and investors; growing securitization volume in 2024. | Hard to establish trust and credibility against an established market player. |

Porter's Five Forces Analysis Data Sources

Our Pagaya Porter's Five Forces analysis is built upon a robust foundation of data, including proprietary performance metrics, partnership agreements, and customer transaction data. We supplement this with public financial disclosures and industry-wide performance benchmarks to provide a comprehensive view of the competitive landscape.