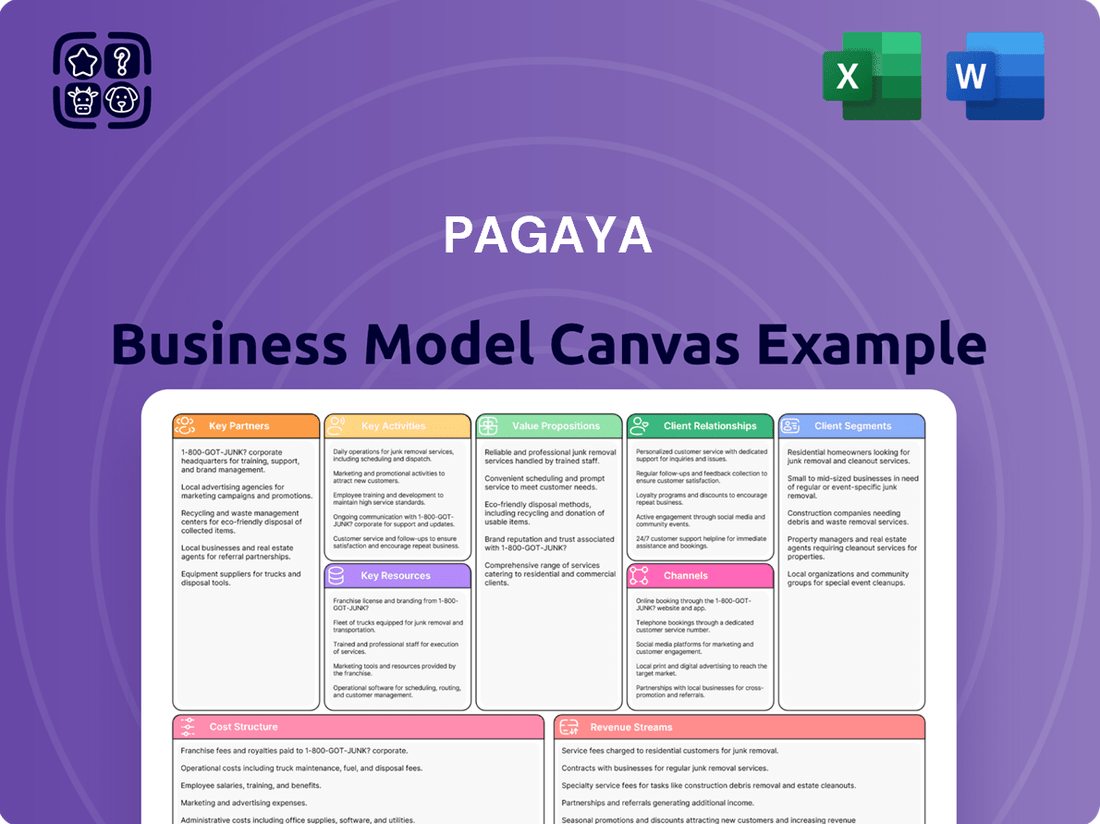

Pagaya Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pagaya Bundle

Unlock the full strategic blueprint behind Pagaya's innovative business model. This comprehensive Business Model Canvas reveals how Pagaya leverages technology to connect consumers with financing and how its partners benefit. Discover their unique value proposition, customer segments, and key revenue streams.

Dive deeper into Pagaya’s real-world strategy with the complete Business Model Canvas. From key resources and activities to cost structure and channels, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Pagaya operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Pagaya’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Pagaya’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Pagaya partners extensively with traditional banks and credit unions, which are key lending institutions seeking to enhance their loan underwriting capabilities. These financial partners leverage Pagaya’s advanced AI technology to expand their loan portfolios, particularly in areas like personal loans and auto financing, without taking on disproportionate risk. In this symbiotic relationship, the lending institutions provide the necessary licenses, their balance sheets, and an established customer base. Pagaya's network facilitated over $8.5 billion in network volume in 2023, showcasing the scale of these collaborations.

Pagaya partners with leading digital-native lenders and neobanks, integrating its AI-driven credit assessment capabilities directly into their platforms via API. This enables partners to offer a broader array of credit products and make faster, more precise lending decisions. For example, Pagaya’s network volume reached $8.7 billion in 2023, with continued growth projected for 2024, demonstrating the scale of these integrations. This collaboration is vital for reaching the expanding tech-savvy consumer segment.

Pagaya partners with institutional investors like asset managers, pension funds, and insurance companies. These crucial partners purchase the asset-backed securities created from loans underwritten by Pagaya's AI. This provides the primary funding mechanism, enabling over $20 billion in network volume by early 2024. Their demand fuels a flywheel effect, driving lending partner growth and ensuring critical liquidity and scale for Pagaya's network.

Auto Dealerships & Lenders

Pagaya maintains strong partnerships within the automotive finance sector, collaborating directly with dealerships and auto lenders to deliver instant credit decisions. This strategic alliance significantly streamlines the car buying experience for consumers, while empowering dealers to secure financing solutions for a broader spectrum of customers. The automotive segment represents a crucial vertical for Pagaya's network expansion and growth in 2024.

- Pagaya’s network includes thousands of auto dealerships.

- The platform facilitates billions in annual automotive loan originations.

- Automotive financing is a key driver of Pagaya’s growth in 2024.

- Partnerships enable access to a wider pool of credit-deserving customers.

Data & Technology Providers

Pagaya partners with major credit bureaus, alternative data providers, and cloud infrastructure giants like AWS to power its AI network. These relationships are crucial, supplying the vast datasets for its AI models and the scalable computing power needed for real-time analysis. The quality and breadth of these data collaborations are a significant source of Pagaya’s competitive edge in the lending space.

- Pagaya processed over 2.7 million network submissions in Q1 2024, emphasizing data reliance.

- AWS provides the foundational infrastructure, supporting Pagaya's cloud-native AI platform.

- Alternative data sources, beyond traditional credit scores, enhance risk assessment capabilities.

Pagaya's key partnerships encompass financial institutions, including banks and digital lenders, leveraging its AI to expand loan portfolios, generating over $8.7 billion in network volume in 2023.

Institutional investors are critical, providing over $20 billion in network funding by early 2024 through asset-backed securities purchases.

Strategic alliances with automotive dealerships and major data/cloud providers like AWS further enable over 2.7 million network submissions in Q1 2024, driving significant growth.

| Partner Type | Contribution | 2023/2024 Data |

|---|---|---|

| Financial Institutions | Loan Underwriting | >$8.7B Network Volume (2023) |

| Institutional Investors | Funding Source | >$20B Network Volume (Early 2024) |

| Data/Cloud Providers | AI Infrastructure/Data | >2.7M Submissions (Q1 2024) |

What is included in the product

This Pagaya Business Model Canvas provides a detailed breakdown of their AI-driven credit network, covering customer segments, value propositions, and revenue streams.

It offers a strategic overview of Pagaya's operations, ideal for understanding their unique approach to lending and potential for growth.

Pagaya's Business Model Canvas offers a structured approach to identifying and addressing key pain points in the lending ecosystem, providing a clear roadmap for financial innovation.

It serves as a powerful tool for dissecting the complexities of credit markets, enabling the company to pinpoint and alleviate inefficiencies for both consumers and partners.

Activities

Pagaya's core activity centers on the continuous research, development, and refinement of its proprietary machine learning algorithms for credit assessment. In 2024, their data scientists and engineers are intensely focused on enhancing predictive accuracy and reducing bias across diverse lending products. This constant innovation ensures their AI models adapt swiftly to evolving macroeconomic conditions and new asset classes, like expanded auto loan capabilities. Maintaining this technological edge is crucial for processing billions of dollars in loan originations annually.

Pagaya's core activity involves ingesting and analyzing vast, diverse datasets from its network of lending partners and various third-party sources. This crucial process includes meticulous data cleaning, advanced feature engineering, and running complex simulations to accurately assess credit risk. The ability to effectively process billions of data points, contributing to over $20 billion in network volume as of early 2024, is central to Pagaya's unique value proposition. This deep analytical capability allows for more precise and inclusive lending decisions, driving their AI-powered financial network.

Pagaya's key activities include the technical and operational work of onboarding new lending partners onto its AI network. This involves crucial API integration to ensure seamless data flow between Pagaya's platform and its partners' systems. Providing dedicated partner support is essential for efficient operations and continued collaboration. A smooth integration process is vital, directly contributing to accelerating network growth, as seen with Pagaya's expanding active network of lending partners in 2024.

Capital Markets Execution

Pagaya actively structures, markets, and sells asset-backed securities to its network of institutional investors. This complex process involves financial engineering, engaging with critical rating agencies, and meticulous investor relations to ensure consistent demand for these securities. By transforming loan originations into investable assets, Pagaya secures essential liquidity for its financial ecosystem. In 2024, Pagaya continued its robust issuance strategy, with significant volumes of ABS offerings.

- Pagaya executed multiple ABS transactions in 2024, maintaining strong market presence.

- These transactions provide crucial liquidity, supporting ongoing loan originations.

- Engaging rating agencies ensures high credit quality for institutional investors.

- The firm's investor relations efforts are key to consistent demand for securitized assets.

Regulatory Compliance & Risk Management

Pagaya operates within the highly regulated financial services industry, making rigorous adherence to compliance a core activity. This includes ensuring its AI models are fair and compliant with evolving regulations, like those concerning fair lending and consumer protection, which saw increased scrutiny in 2024. Managing data privacy and security, crucial given the sensitive financial information processed, remains paramount, with data breaches costing companies an average of $4.45 million globally. Overseeing the overall risk profile of its vast network of partners is vital for Pagaya's long-term sustainability and maintaining trust.

- Regulatory changes, such as potential updates to fair lending laws in 2024, require continuous model adjustments.

- Pagaya’s AI models undergo regular audits to ensure fairness and prevent bias, reflecting industry best practices for responsible AI.

- Robust data encryption and access controls are implemented to protect sensitive consumer financial data.

- Proactive risk assessments help manage credit, operational, and cyber risks across its lending network.

Pagaya's key activities revolve around the continuous development of its AI algorithms for credit assessment, processing over $20 billion in network volume as of early 2024. They actively onboard new lending partners and manage vast datasets to facilitate precise lending decisions. Pagaya also focuses on structuring and selling asset-backed securities, maintaining robust issuance in 2024 to ensure crucial liquidity. Finally, strict compliance with evolving financial regulations and robust risk management are paramount, reflecting increased scrutiny in 2024.

Full Document Unlocks After Purchase

Business Model Canvas

The Pagaya Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This means there are no mockups or samples; you are viewing a direct snapshot of the final deliverable. Upon completing your order, you will gain full access to this comprehensive, professionally structured Business Model Canvas, ready for your immediate use and customization.

Resources

Pagaya’s most critical resource is its proprietary AI and machine learning platform, encompassing its advanced algorithms and data processing infrastructure. This intellectual property acts as the central engine for its entire business model, powering credit assessments. In Q1 2024, Pagaya's network volume reached $2.4 billion, reflecting the platform's operational scale. This sophisticated technology creates a significant barrier to entry for potential competitors, underpinning Pagaya's unique market position.

Pagaya’s core strength is its vast and differentiated data assets, fueling its AI models. The company maintains an extensive data lake, continuously growing with anonymized historical and real-time data from various partners and sources. This sheer scale and diversity of information create a potent network effect, as every new data point analyzed further refines and enhances the intelligence of Pagaya’s AI. As of 2024, their proprietary data insights drive more precise credit assessments, allowing for broader financial inclusion and improved risk management across their network.

Pagaya's success hinges on its elite human capital, specifically top-tier data science, machine learning, and software engineering talent. These experts are crucial for building, maintaining, and innovating the company's AI-driven financial technology platform. Attracting and retaining such specialized professionals is paramount for Pagaya to sustain its competitive edge in the rapidly evolving fintech landscape. For instance, in 2024, Pagaya continued to invest heavily in its R&D, underscoring the importance of this talent pool for future product development and market expansion.

Network of Lending & Investor Partners

Pagaya’s established, trust-based relationships with a diverse network of over 160 lending partners and numerous institutional investors are a strategic asset. This robust, two-sided network is crucial, providing a consistent supply of loan applications, totaling 2.4 million in Q1 2024, alongside robust demand for the resulting credit assets. The extensive breadth and depth of this network, built over years, are challenging for competitors to replicate. This makes it a core competitive advantage for Pagaya.

- Over 160 lending partners as of Q1 2024.

- Processed 2.4 million applications in Q1 2024.

- Strategic two-sided network for supply and demand.

- Difficult to replicate due to established trust.

Access to Capital Markets

Pagaya’s robust access to capital markets, primarily through asset-backed securitization, is a cornerstone resource. This established infrastructure allows Pagaya to consistently raise capital by selling asset-backed securities, providing essential liquidity for its lending partners to originate more loans. In 2024, Pagaya continued its strong securitization activity, enabling a scalable financial ecosystem. This consistent capital flow directly underpins the growth and reach of their AI-powered network, facilitating broader credit access.

- Pagaya leverages its strong reputation to access capital markets via securitization.

- This capability ensures consistent liquidity for lending partners through asset-backed securities.

- The firm’s securitization volume continued robustly in 2024, supporting growth.

- This resource is fundamental to the scalability of Pagaya’s entire lending ecosystem.

Pagaya’s core resources are its proprietary AI and machine learning platform, fueled by vast, continuously growing data assets. Elite human capital, especially in data science, drives innovation and maintains its technological edge. Crucially, established relationships with over 160 lending partners as of Q1 2024 and robust access to capital markets via securitization ensure consistent loan supply and liquidity. These elements collectively underpin Pagaya’s scalable, AI-driven financial ecosystem.

| Resource | Description | 2024 Data Point |

|---|---|---|

| AI Platform | Proprietary algorithms and infrastructure | Q1 2024 network volume: $2.4 billion |

| Data Assets | Extensive, diverse data lake | Drives precise credit assessments in 2024 |

| Human Capital | Top-tier data science, engineering talent | Continued R&D investment in 2024 |

| Lending Network | Relationships with partners and investors | Over 160 lending partners, 2.4 million applications Q1 2024 |

| Capital Access | Securitization capabilities | Robust securitization activity in 2024 |

Value Propositions

Pagaya empowers lending partners to approve a higher percentage of loan applications by identifying creditworthy borrowers often overlooked by traditional scoring models. This allows partners to expand their loan portfolios and increase interest income without elevating their existing risk appetite. By leveraging Pagaya's AI, financial institutions can grow their market share, fostering significant top-line revenue growth. For example, in 2024, partners continued to see expanded access to credit for previously underserved populations, translating into measurable increases in loan originations through the network.

Pagaya’s AI-driven models offer lenders a more precise and holistic view of a borrower's credit risk, moving beyond legacy systems like FICO scores. This advanced assessment leads to better-priced loans and a notable reduction in expected default rates on approved incremental volume. For instance, in 2024, lenders leveraging such AI often report improved portfolio performance, enhancing the overall quality and profitability of their loan books. This enables partners to expand their lending footprint with greater confidence and optimized returns.

Pagaya's AI technology indirectly benefits consumers, especially those in near-prime segments or with thin credit files, by looking beyond traditional metrics.

This offers more individuals the opportunity to secure credit at fair rates, promoting significant financial inclusion.

In 2024, Pagaya's network enabled billions in originations, expanding access for previously underserved borrowers.

This approach effectively broadens the total addressable market for credit, reaching a wider range of consumers.

For Investors: Access to AI-Powered Credit Assets

Pagaya offers institutional investors access to a unique, diversified asset class of consumer credit assets, distinct from traditional fixed income. These loans are underwritten using Pagaya's proprietary AI lens, which evaluates over 1,600 data points per applicant, yielding a differentiated risk-return profile. This approach provides a significant source of alpha for sophisticated investment portfolios, attracting capital despite market fluctuations.

- Pagaya's network facilitated over $8 billion in originations in 2023.

- The AI model aims for lower default rates compared to conventional underwriting.

- Institutional assets under management (AUM) reached approximately $7.9 billion by Q1 2024.

- Investors seek this alternative for enhanced portfolio diversification.

For Partners: Seamless Technology Integration

Pagaya offers partners a fully integrated AI-as-a-Service solution that plugs directly into their existing loan origination systems. This allows lenders to leverage sophisticated artificial intelligence without the immense cost and time associated with building such capabilities in-house. The model ensures a frictionless, low-lift implementation, streamlining credit assessment processes. In 2024, Pagaya continues to expand its network, demonstrating proven efficiency gains for financial institutions.

- Seamless AI integration into current loan systems.

- Eliminates high in-house development costs and time for partners.

- Designed for low-lift, frictionless deployment.

- Enhances credit decisioning for a growing network of lenders in 2024.

Pagaya offers lending partners expanded, lower-risk loan origination and market share growth, with AI-driven insights reducing defaults in 2024. Consumers gain increased access to fair credit, with billions in 2024 originations for underserved segments. Institutional investors access a unique, diversified asset class with differentiated risk-return profiles, reflected in approximately $7.9 billion AUM by Q1 2024.

| Beneficiary | Core Value | 2024 Impact |

|---|---|---|

| Lending Partners | Expanded, Lower-Risk Originations | Increased loan volumes |

| Consumers | Enhanced Credit Access | Billions in originations |

| Institutional Investors | Diversified Asset Access | $7.9B AUM (Q1 2024) |

Customer Relationships

Pagaya cultivates high-touch, consultative relationships with its lending partners through dedicated success and account managers. These teams provide ongoing support, strategic advice, and comprehensive performance analytics, ensuring partners maximize the value of the Pagaya AI-powered platform. This commitment fosters deep, long-term strategic alignment, as evidenced by Pagaya’s network expanding to over 150 partners by early 2024. Such personalized engagement enhances partner satisfaction and drives continued loan originations across their diverse network.

Pagaya maintains robust ties with its institutional investor base through a specialized capital markets and investor relations team. This team ensures consistent communication, providing detailed performance reports for their asset-backed securities. For instance, in 2024, Pagaya continued its strong securitization pace, enabling significant capital deployment. Trust and transparency remain foundational, fostering long-term partnerships essential for Pagaya's continued funding and market expansion.

Pagaya’s customer relationship model is B2B2C, where the end-borrower remains the partner’s customer. Pagaya ensures its AI-driven technology integrates seamlessly, making the process largely invisible to the consumer. This allows the borrower to receive a fast, data-driven decision directly from the financial institution they trust. For instance, Pagaya's network volume reached $2.3 billion in Q1 2024, demonstrating widespread partner integration. This seamless co-branded experience solidifies the partner's relationship with their customer while leveraging Pagaya's advanced capabilities.

Automated Reporting & Analytics Portal

Pagaya provides its lending partners with a sophisticated, self-service analytics portal, offering real-time data and comprehensive reports. This tool details key metrics such as application volume and approval rates, empowering partners with actionable insights to manage their lending operations efficiently. For example, Pagaya’s network processed over $8 billion in loan originations in 2023, with the portal providing transparency on these significant volumes. This direct access to performance data enhances partner autonomy and operational agility within the Pagaya AI network.

- Real-time access to application volume data.

- Detailed reporting on loan approval rates.

- Insights into portfolio performance metrics.

- Empowers partners to optimize lending strategies.

Developer & Technical Support

Pagaya ensures a seamless experience for fintech partners by providing robust developer documentation and dedicated technical support for API integration. This crucial relationship focuses on a smooth and efficient onboarding process, allowing partners to quickly leverage Pagaya's AI-driven network. Quick resolution of technical issues is paramount, maintaining high partner satisfaction and the overall stability of the Pagaya AI network, which processed over 25.5 million loan applications in 2023.

- Dedicated technical teams support complex API integrations.

- Comprehensive documentation streamlines partner onboarding.

- Rapid issue resolution is critical for network reliability.

- Supports a growing network of over 150 financial partners as of early 2024.

Pagaya fosters robust relationships with over 150 lending partners through dedicated support and a self-service analytics portal, enhancing operational efficiency. For instance, Q1 2024 network volume hit $2.3 billion, driven by seamless B2B2C integration. Strong ties with institutional investors ensure continuous capital, with ongoing securitization in 2024. Technical support for API integration guarantees smooth partner onboarding and network stability.

| Customer Segment | Key Relationship Aspect | 2024 Data Point |

|---|---|---|

| Lending Partners | Consultative support, Analytics Portal | Over 150 partners (early 2024) |

| Institutional Investors | Investor Relations, Capital Markets | Continued securitization pace (2024) |

| End-Borrowers (B2B2C) | Seamless AI integration via partners | $2.3 billion network volume (Q1 2024) |

Channels

Pagaya's primary channel for scaling its AI-driven lending network is a dedicated direct B2B enterprise sales force.

This team actively targets key decision-makers within banks, credit unions, and large fintech companies, cultivating relationships essential for partnership growth.

They navigate a complex sales cycle, demonstrating clear return on investment and managing intricate regulatory and technical diligence processes.

By Q1 2024, Pagaya's network expanded to include 165 lending partners, a testament to the effectiveness of this focused direct sales strategy in securing new enterprise-level collaborations.

Pagaya’s primary channel for delivering its AI-driven financial technology is through its API, allowing partners to seamlessly integrate the company’s decisioning engine directly into their existing digital loan origination systems. This real-time integration ensures scalable value delivery, serving as the critical technical infrastructure underpinning Pagaya’s network. As of early 2024, Pagaya reported continued expansion, facilitating billions in loan originations through this embedded approach, demonstrating its core operational efficiency.

Pagaya’s Capital Markets Desk is crucial for transacting with institutional investor customers, facilitating the placement of asset-backed securities. This specialized team leverages established relationships and investor roadshows to connect with firms seeking exposure to diverse credit assets. In 2024, Pagaya continued to actively securitize loans, with its ABS issuances providing vital funding. This channel is essential for maintaining liquidity and expanding the ecosystem's capacity.

Industry Conferences & Strategic Events

Pagaya leverages major industry conferences like Money20/20, which saw over 13,000 attendees in 2024, as a crucial channel. These events are vital for generating new leads, fostering networking opportunities with potential lending partners and investors, and significantly building brand recognition. Participating in these strategic gatherings, such as the Money20/20 Europe 2024 conference held in Amsterdam, allows Pagaya to showcase its AI-driven financial technology and expand its network within the fintech ecosystem. This direct engagement serves as a core component of their business development strategy.

- Lead generation: Identifying new financial institutions.

- Networking: Connecting with over 2,300 companies at key events.

- Brand building: Enhancing market presence and trust.

- Partner acquisition: Securing new lending agreements.

Referrals & Ecosystem Partnerships

Pagaya leverages strong relationships with consultants, other technology vendors, and influential figures across the financial ecosystem to drive a significant referral channel. A robust reputation for delivering proven results naturally generates word-of-mouth marketing and strategic introductions, validating the model’s success. For instance, Pagaya’s network expanded to over 150 partners by early 2024, demonstrating the reach of its ecosystem approach.

- Strategic introductions from financial influencers drive new client acquisition.

- Word-of-mouth from successful deployments validates Pagaya’s AI-driven lending solutions.

- Ecosystem partnerships contribute significantly to organic growth, reducing customer acquisition costs.

- Pagaya's network reached over 150 partners by early 2024, showing broad integration.

Pagaya primarily leverages a direct B2B sales force to secure new lending partners, expanding its network to 165 by Q1 2024. Its API provides seamless integration for scalable loan originations, facilitating billions in early 2024. The Capital Markets Desk engages institutional investors through ABS issuances, while industry conferences like Money20/20 and strategic referrals, contributing to over 150 partners, bolster brand and growth.

| Channel | 2024 Data Point | Impact |

|---|---|---|

| Direct Sales | 165 lending partners (Q1 2024) | Core partner acquisition |

| API Integration | Billions in loan originations (early 2024) | Scalable value delivery |

| Industry Conferences | 13,000+ Money20/20 attendees | Lead generation, brand |

Customer Segments

Large banks and credit unions, managing trillions in assets, represent a key customer segment for Pagaya, seeking to modernize their consumer lending operations. These established financial institutions are driven to improve efficiency and compete effectively with agile fintechs. They aim to safely expand their loan books, especially as fintechs captured over 60% of the personal loan market share by 2024. This segment provides a large, stable source of loan volume, essential for Pagaya's growth. Their focus is on leveraging AI to enhance risk assessment and reach more qualified borrowers.

Fintech lenders and neobanks form a key customer segment, comprising digital-first companies offering personal loans and point-of-sale financing solutions. These entities are early technology adopters, actively seeking best-in-class AI to power their underwriting and gain a competitive edge in the evolving credit landscape. They highly value speed and seamless API integration for efficient operations, crucial for rapid credit decisions. As of 2024, many neobanks are expanding their credit products, with some seeing substantial increases in loan volume driven by advanced AI for better risk assessment.

Automotive lenders and captive finance companies are a pivotal customer segment for Pagaya, comprising finance arms of major auto manufacturers and large dealership groups. These entities demand swift, dependable credit decisions to streamline vehicle sales processes. Pagaya’s AI-powered network helps these lenders expand their reach, particularly within the non-prime segment, which saw significant growth in 2023 and remains a focus in 2024 with over $1.5 trillion in outstanding auto loan debt. Pagaya’s ability to serve this high-volume market with enhanced approval rates is a core strategic priority.

Institutional Asset Managers

Institutional asset managers represent a core customer segment for Pagaya, comprising major players like pension funds, insurance companies, and specialized credit funds. These entities actively purchase the asset-backed securities (ABS) that Pagaya originates through its network. Their primary demand is for access to unique, high-quality credit assets that align with their specific risk-return objectives and diversification strategies. In 2024, the global ABS market continues to be a significant area of interest for these large investors seeking yield and portfolio diversification.

- Pension funds seek stable, long-term returns from diversified asset classes.

- Insurance companies invest for liability matching and capital efficiency.

- Specialized credit funds target specific risk-adjusted returns from alternative credit.

- Access to Pagaya’s AI-driven credit assets offers unique diversification opportunities.

Point-of-Sale (POS) & Merchant Financing Providers

This segment includes companies offering buy now, pay later (BNPL) or other financing options directly at the point of checkout, both online and in physical stores. These providers critically require instant credit decisioning to facilitate immediate consumer purchases, a process where speed is paramount. Pagaya's advanced AI models empower these partners to approve a significantly higher volume of transactions in real-time, expanding their addressable market. The global BNPL market continued its robust growth into 2024, emphasizing the demand for efficient credit solutions.

- BNPL payment volume in the U.S. was projected to reach over $70 billion in 2024.

- Real-time credit decisioning significantly reduces cart abandonment rates for merchants.

- Pagaya's AI helps partners expand credit access beyond traditional prime borrowers.

- Enhanced approval rates lead to increased revenue for POS financing providers.

Pagaya serves diverse customer segments, including large banks modernizing lending and fintechs leveraging AI for competitive underwriting. Automotive lenders rely on swift credit decisions within the $1.5 trillion auto loan market, while BNPL providers benefit from instant approvals, with US volume projected over $70 billion in 2024. Institutional asset managers also form a key segment, investing in the asset-backed securities originated through Pagaya’s network.

| Customer Segment | Key Need | 2024 Data Point |

|---|---|---|

| Large Banks/Credit Unions | Modernize Lending | Fintechs >60% personal loan market |

| Fintech Lenders/Neobanks | AI Underwriting | Neobanks expanding credit products |

| Automotive Lenders | Swift Credit Decisions | >$1.5T auto loan debt |

| BNPL/POS Financing | Instant Approvals | US BNPL >$70B projected volume |

| Institutional Asset Managers | Unique Credit Assets | Global ABS market significant |

Cost Structure

Research and Development is a significant component of Pagaya's cost structure, largely driven by compensation for its extensive team of data scientists, engineers, and product developers. This includes substantial expenses for cloud computing resources, essential for advanced model training and real-time analysis. For example, Pagaya’s R&D expenses reached $29.1 million in Q1 2024, highlighting this ongoing investment. This continuous commitment to R&D is considered the primary driver for maintaining Pagaya's long-term competitive advantage in the AI-driven credit industry.

Pagaya’s Sales & Marketing expenses are crucial for acquiring new lending partners, encompassing the salaries of their enterprise sales force, dedicated marketing program spend, and costs associated with attending industry events. These investments are vital for expanding the top of the funnel and driving network growth as Pagaya scales its AI-driven platform. For instance, in Q1 2024, Pagaya reported a significant increase in operating expenses, partly driven by continued investment in sales and marketing to expand its partner network and product offerings. This strategic spending is directly tied to the growth in their network volume, which saw substantial year-over-year increases through early 2024, demonstrating the direct impact of these costs on business expansion.

Pagaya’s General & Administrative (G&A) costs encompass essential corporate functions like executive salaries, legal, compliance, finance, and human resources teams, plus other overhead. As a publicly traded fintech, regulatory compliance and robust corporate governance are substantial and necessary components of this cost base, supporting the entire organization. For instance, Pagaya reported G&A expenses of $33.5 million for Q1 2024, demonstrating the ongoing investment in these foundational operations. These expenses are vital for Pagaya's operational integrity and continued expansion within the lending ecosystem.

Securitization & Transaction Costs

Pagaya incurs significant variable costs each time it structures and sells an asset-backed security. These securitization and transaction costs include legal fees, rating agency fees, and other transactional expenses associated with each deal. Such expenses are directly tied to the volume of assets being securitized, reflecting a scalable cost structure. For instance, in 2024, these fees remain a substantial component of Pagaya’s operational outlay as they scale their network.

- Legal fees for deal structuring and documentation.

- Rating agency fees for credit assessments.

- Underwriting and other transactional expenses.

Data Acquisition & Infrastructure

Pagaya’s Data Acquisition & Infrastructure costs encompass licensing data from diverse third-party providers, essential for fueling their AI models. These expenses also cover the significant underlying cloud infrastructure, including data storage, network, and processing capabilities. Unlike R&D which focuses on personnel, these costs represent the raw material and machinery enabling their AI-driven lending decisions. Such expenditures naturally scale with the volume of data processed and the increasing complexity of their proprietary AI models, reflecting a core operational investment.

- Pagaya's data infrastructure costs are a significant operational expense, with cloud services often representing a substantial portion.

- In 2024, cloud spending for AI-driven platforms like Pagaya continues to grow, with major providers optimizing for data-intensive workloads.

- Data licensing fees are dynamic, influenced by data volume, quality, and exclusivity agreements.

- The company's investment in scalable infrastructure directly supports its expansion into new asset classes and partnerships.

Pagaya’s cost structure is heavily weighted towards Research & Development and Data Acquisition, fueling its AI models and platform. Significant General & Administrative and Sales & Marketing expenses support corporate functions and partner network expansion. Variable securitization and transaction costs scale directly with the volume of asset-backed securities issued. For example, Q1 2024 saw R&D at $29.1 million and G&A at $33.5 million.

| Cost Category | Primary Components | Q1 2024 Snapshot |

|---|---|---|

| R&D | Personnel, Cloud Computing | $29.1 Million |

| G&A | Corporate Overhead, Compliance | $33.5 Million |

| Securitization | Legal, Rating Agency Fees | Volume-Dependent |

Revenue Streams

Pagaya's primary revenue stream comes from network and securitization fees, generated as loans originated by partners are funded through their extensive network. This fee is typically a percentage of the volume of assets facilitated, especially when these loans are placed into asset-backed securities. For instance, in Q1 2024, Pagaya reported a total network volume of 2.4 billion, directly driving this revenue. This revenue stream is intrinsically linked to the successful scaling and efficiency of Pagaya's AI-driven network and its ability to connect lenders with institutional investors.

Pagaya generates significant revenue through premium fees, often called a spread, on the assets it originates and then sells to institutional investors. This premium reflects the superior value created by Pagaya's AI-driven underwriting, as investors are willing to pay more for assets with a data-informed, lower risk profile. For example, Pagaya's network volume grew to $2.3 billion in Q1 2024, demonstrating the scale of assets generating these fees. This revenue stream directly monetizes their core technology, showcasing how advanced AI translates into tangible financial gains.

Pagaya secures a portion of its revenue through contractual platform fees, charging recurring access fees to some lending partners for utilizing its AI-driven network. This model provides a predictable, SaaS-like revenue stream that is not solely dependent on fluctuating transaction volumes. Such fees help smooth Pagaya's overall revenue profile, complementing its performance-based income. This recurring charge also strengthens partner commitment within the Pagaya AI Network, which saw significant expansion in 2024. This predictable component enhances financial stability for the company.

Investment Income from Retained Interests

Pagaya strategically retains a portion of the securitized assets it originates, often the most junior or equity tranches, enabling it to earn investment income from their performance. This retention aligns Pagaya's financial interests with those of its funding partners, fostering trust and shared upside. For instance, as of early 2024, Pagaya's retained interests in securitizations continued to contribute to its non-fee-based revenue streams. However, this strategy also exposes Pagaya to direct credit risk should the underlying loan performance deteriorate.

- Pagaya retains junior tranches, like equity, from securitizations.

- This generates investment income from asset performance.

- It aligns Pagaya's interests with funding partners.

- The company assumes direct credit risk on these retained assets.

Servicing & Administration Fees

Pagaya earns revenue through servicing and administration fees by offering ongoing functions related to the loan portfolios, even when partners typically handle these tasks. These services include performance reporting, detailed analytics, and comprehensive portfolio management, providing an essential support layer for their network. This represents an ancillary yet recurring revenue opportunity for Pagaya. For instance, in 2024, Pagaya's total revenue reached $820.7 million, with a portion derived from such ongoing platform and servicing contributions.

- Pagaya generates fees for providing ongoing administration and servicing functions for loan portfolios.

- Services include performance reporting, analytics, and portfolio management.

- This stream represents an ancillary, recurring revenue opportunity.

- Pagaya's total revenue for 2024 was $820.7 million, encompassing these contributions.

Pagaya's revenue streams encompass network and securitization fees, premium spreads on AI-underwritten assets, and predictable contractual platform fees. The company also earns investment income from retained junior tranches of securitized assets. Additionally, servicing and administration fees contribute to its income, with total 2024 revenue reaching $820.7 million. This diverse model leverages Pagaya's AI to monetize loan facilitation and portfolio management.

| Revenue Stream | Q1 2024 Volume | 2024 Total Revenue |

|---|---|---|

| Network/Premium Fees | $2.4 Billion | Included |

| Platform/Servicing Fees | N/A | Included |

| Retained Interest Income | N/A | Included |

Business Model Canvas Data Sources

The Pagaya Business Model Canvas is built upon a foundation of proprietary data analytics, real-time market intelligence, and extensive financial modeling. These sources ensure each canvas block is informed by actionable insights and predictive performance metrics.