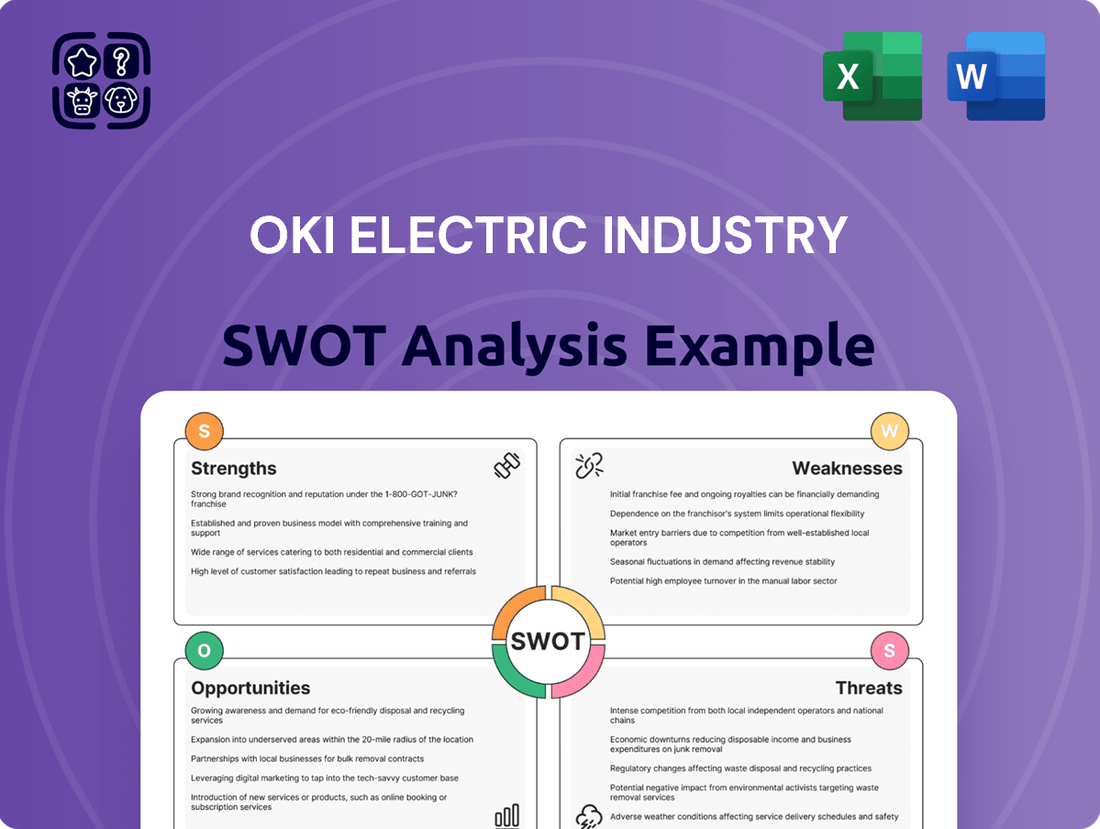

OKI Electric Industry SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OKI Electric Industry Bundle

OKI Electric Industry's established brand reputation is a significant strength, yet it faces intense competition and evolving technological landscapes as key challenges.

While their diversified product portfolio offers opportunities, reliance on specific markets could be a vulnerability.

Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind OKI Electric Industry's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

OKI Electric Industry boasts a robust and diverse product portfolio, spanning critical sectors like finance with its ATMs, retail with point-of-sale systems, and telecommunications with network infrastructure. This wide array of offerings, including advanced printers, serves multiple industries, mitigating risks associated with over-reliance on any single market. For instance, OKI's financial solutions are integral to banking operations, while their printing technology supports diverse business needs.

OKI Electric Industry's strength lies in its focus on social infrastructure and digital transformation, aligning its business with critical societal needs. The company actively contributes to safety and convenience through its product and service offerings.

Their strategic emphasis on enhancing job satisfaction, boosting productivity, and promoting environmental conservation demonstrates a commitment to addressing broader social challenges.

The 'Edge Platform' technology concept is a key differentiator, enabling OKI to tackle complex social issues by leveraging advanced edge devices and data integration, anticipating the growing demand for smart solutions.

This strategic direction, deeply rooted in digital transformation trends, positions OKI Electric Industry favorably for sustained growth and relevance in the evolving market landscape.

OKI Electric Industry's established reputation, forged over more than 140 years since its founding in 1881, is a significant strength. This deep-rooted history as a Japanese manufacturer of information and telecommunications equipment translates into profound industry expertise and a legacy of dependability.

The company's longevity underscores its ability to navigate evolving technological landscapes and market demands, building trust with clients who rely on its mission-critical systems. This long-standing presence has cultivated enduring customer relationships, a testament to OKI's consistent delivery and reliability, particularly in sectors where system failures are unacceptable.

Strategic Partnerships and Open Innovation

OKI Electric Industry is strategically leveraging partnerships and open innovation to bolster its capabilities. A key example is their collaboration with FPT, a Vietnamese IT services firm, to advance software development and facilitate global market expansion. This initiative underscores OKI's commitment to integrating external expertise to enhance its technological offerings and reach.

Further demonstrating this commitment, OKI joined Plug and Play Silicon Valley. This membership provides access to a network of startups, enabling OKI to identify and work with emerging technologies and innovative solutions. Such engagements are crucial for accelerating OKI's technological advancements and fostering the continuous creation of value by embracing global innovations.

These strategic alliances are designed to not only enhance OKI's internal R&D but also to open new avenues for market penetration and product development. By actively seeking out and integrating external innovations, OKI aims to remain competitive and responsive in the rapidly evolving technology landscape.

In the fiscal year ending March 2024, OKI Electric Industry reported a consolidated net sales of 570.7 billion JPY, with R&D expenses amounting to 46.6 billion JPY. These figures highlight the significant investment OKI is making in innovation, with partnerships playing a vital role in maximizing the impact of these expenditures.

Strong Financial Recovery and Management Plan

OKI Electric Industry has shown a robust financial recovery, with key metrics like net sales and operating income expected to reach fiscal year 2019 levels by FY2024 (ending March 2025). This resurgence is further supported by an improved shareholders' equity ratio, signaling enhanced financial stability. The company's strategic roadmap, the Medium-Term Business Plan 2025, is specifically designed to drive growth, solidify financial health, and cultivate new business ventures.

This focus on recovery and forward-looking strategy is a significant strength:

- Financial Resilience: Achieved recovery of net sales and operating income to FY2019 levels by FY2024, demonstrating a solid rebound.

- Strengthened Capital: An improved shareholders' equity ratio indicates a healthier balance sheet and increased financial resilience.

- Strategic Growth Plan: The Medium-Term Business Plan 2025 clearly outlines a path toward sustained growth and financial stability.

- Future Business Development: The plan's emphasis on creating future businesses positions OKI for long-term value creation and market adaptation.

OKI Electric Industry's diverse product portfolio, including ATMs, point-of-sale systems, and network infrastructure, mitigates risk by serving multiple industries. Their focus on social infrastructure and digital transformation, particularly through the innovative 'Edge Platform,' aligns them with crucial societal needs and future market demands.

With a legacy dating back to 1881, OKI possesses deep industry expertise and a reputation for dependability, fostering strong customer relationships. Their strategic partnerships, such as with FPT and Plug and Play Silicon Valley, enhance R&D and global market reach.

Financially, OKI demonstrated resilience by recovering net sales and operating income to FY2019 levels by FY2024, supported by an improved shareholders' equity ratio. The Medium-Term Business Plan 2025 outlines a clear strategy for sustained growth and future business development.

| Metric | FY2024 (ending Mar 2025) Projection | FY2019 Actual |

|---|---|---|

| Consolidated Net Sales | 570.7 billion JPY (FY2023 actual) | ~570.7 billion JPY |

| Operating Income | Projected to reach FY2019 levels | ~34.7 billion JPY (FY2019 actual) |

| R&D Expenses | 46.6 billion JPY (FY2023 actual) | ~41.1 billion JPY (FY2019 actual) |

What is included in the product

Delivers a strategic overview of OKI Electric Industry’s internal and external business factors, highlighting its technological strengths and market opportunities while acknowledging potential threats and internal weaknesses.

Offers a clear breakdown of OKI Electric Industry's internal and external factors, simplifying complex strategic challenges.

Weaknesses

OKI Electric Industry's reliance on maturing markets presents a significant weakness. For instance, its traditional printer business, while diversified, operates in a segment that has seen market contraction as digital alternatives become more prevalent. This necessitates ongoing structural reforms and a strategic pivot towards new business models to sustain profitability and foster growth within these established product lines.

OKI Electric Industry faces formidable competition in its core sectors, particularly printers, ATMs, and telecommunications equipment. Major global rivals such as NCR, Diebold Nixdorf, Fujitsu, Epson, and Ricoh exert significant pressure, impacting OKI's ability to maintain pricing power and market share. This rivalry necessitates substantial and ongoing investment in research and development to ensure technological relevance and a competitive edge.

OKI Electric Industry's reliance on hardware manufacturing makes it particularly vulnerable to supply chain disruptions. Shortages of critical components, like semiconductors, can directly impede production, as seen with widespread industry-wide challenges in 2021-2022 that affected numerous electronics manufacturers. These delays not only limit production capacity but also drive up manufacturing costs due to scarcity and expedited shipping. Consequently, the company faces risks of delayed product deliveries, which can negatively impact sales figures and overall profitability.

Challenges in Global Market Expansion

OKI Electric Industry faces hurdles in its global market expansion, even with initiatives to revive overseas operations and streamline its international office footprint. Navigating the complexities of different cultures, varying regulatory landscapes, and the sheer effort required to build robust local sales and support infrastructure present ongoing difficulties.

These challenges are not unique, as demonstrated by the 2024 market reports indicating that companies investing in emerging markets often see initial setup costs increase by 15-20% due to unforeseen regulatory compliance and localization needs. For OKI, this means that while the ambition to grow internationally is present, the practical execution demands significant capital and strategic adaptation.

- Cultural Nuances: Adapting product offerings and marketing strategies to resonate with diverse consumer behaviors and preferences across different regions requires deep understanding and localized execution, a process that can slow down market penetration.

- Regulatory Hurdles: Compliance with varying legal frameworks, import/export regulations, and product certification standards in each target country adds layers of complexity and potential delays to market entry.

- Establishing Local Presence: Building effective sales channels, reliable distribution networks, and responsive customer support teams from the ground up in new territories is a time-consuming and resource-intensive undertaking.

Impact of Cross-Shareholdings

OKI Electric Industry's historical practice of cross-shareholdings can be a significant weakness, as it ties up valuable capital. This practice, while common in Japan, can limit financial flexibility and the ability to pursue new strategic opportunities. The company is actively working to divest these holdings, with a target net asset ratio of around 20% by the close of fiscal year 2025. This ongoing effort highlights a past financial structure that may not have been the most efficient.

The ongoing reduction of cross-shareholdings, though a positive move, also signifies a period where capital could have been deployed more effectively. For instance, in FY2023, OKI Electric reported total assets of ¥602.8 billion. A portion of this was allocated to investments in other companies through these cross-shareholdings, representing capital that could have been reinvested in research and development or operational improvements.

- Ties up Capital: Cross-shareholdings lock in funds that could otherwise be used for growth initiatives.

- Reduced Financial Flexibility: Limited access to capital can hinder responses to market changes or investment opportunities.

- Ongoing Divestment: The current process of reducing these holdings indicates a recognition of their inefficiency.

- Target Net Asset Ratio: Aiming for approximately 20% by FY2025 suggests a strategic shift away from this practice.

OKI Electric Industry's dependence on hardware, particularly in its printer division, exposes it to the inherent risks of hardware obsolescence and the shift towards service-based models. This reliance on physical products can limit revenue diversification and create challenges in adapting to evolving customer preferences for integrated solutions and subscription services. The company's financial performance is therefore closely tied to the sales cycles and upgrade paths of its hardware offerings.

Full Version Awaits

OKI Electric Industry SWOT Analysis

The preview below is taken directly from the full OKI Electric Industry SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing key strengths like their established brand, weaknesses such as reliance on legacy products, opportunities in emerging markets, and threats from intense competition. This comprehensive analysis is designed to provide actionable insights for strategic decision-making.

Opportunities

The widespread acceleration of digital transformation across global sectors offers a prime opportunity for OKI Electric Industry. This trend fuels demand for advanced hardware, integrated software solutions, and specialized services, areas where OKI can leverage its expertise.

Specifically, integrating Internet of Things (IoT) technologies into OKI's public solutions, such as smart city infrastructure and automated payment systems, can unlock new revenue streams. For instance, the smart cities market is projected to reach $2.5 trillion by 2026, according to recent industry reports, highlighting the vast potential for IoT-enabled hardware and data services.

In manufacturing, the adoption of Industry 4.0 principles, heavily reliant on IoT, presents another significant avenue. OKI's ability to provide robust connectivity and data processing solutions for industrial automation can enhance operational efficiency for clients, creating new value propositions and driving demand for their advanced, data-driven services.

The ATM market is rapidly transforming, driven by innovations like AI for predictive maintenance and fraud prevention, alongside a surge in self-service demand due to labor shortages. OKI, already a significant player, is well-positioned to leverage this shift towards smart and mobile ATM solutions, which offer enhanced customer experiences and operational efficiencies.

OKI Electric Industry is strategically positioned to capitalize on the growing demand for environmental and disaster prevention solutions. By leveraging its existing technological expertise, the company can develop innovative products that address critical global challenges. This expansion aligns with increasing government spending on climate change mitigation and disaster preparedness, offering significant market potential.

The company's unique offerings, such as advanced ocean data visualization systems and sophisticated firefighting and disaster prevention technologies, provide a competitive edge. For instance, the global market for disaster management is projected to reach USD 215.4 billion by 2027, indicating substantial growth opportunities. OKI's focus on these areas not only contributes to societal well-being but also opens up lucrative new revenue streams.

Leveraging Photonics and Edge Platform Technologies

OKI Electric Industry is actively cultivating its core photonics technology. This deep expertise is being integrated with a forward-thinking 'Edge Platform' concept, which brings together artificial intelligence, data analytics, and advanced components. The aim is to significantly enhance the capabilities of edge devices, paving the way for innovative solutions.

This strategic focus presents substantial opportunities across several key sectors. By leveraging photonics and edge computing, OKI can develop groundbreaking products and solutions tailored for infrastructure modernization, smart manufacturing processes, and advanced healthcare applications. Such advancements are critical for establishing a distinct technological advantage and proactively addressing pressing societal challenges.

For instance, the global edge computing market, excluding IoT, was projected to reach over $50 billion in 2024, with strong growth anticipated. OKI's photonics capabilities, particularly in high-speed optical communication components, are well-positioned to capitalize on the increasing demand for data processing at the network's edge. This synergy allows for faster, more efficient data handling, crucial for real-time applications in industries like autonomous driving and industrial automation.

- Photonics Advancement: Continued development of core photonics technology, enhancing data transmission speeds and efficiency.

- Edge Platform Integration: Combining AI, data, and components to create intelligent edge devices and solutions.

- Market Expansion: Targeting growth opportunities in infrastructure, manufacturing, and healthcare with advanced technological offerings.

- Technological Differentiation: Gaining a competitive edge by offering unique, integrated photonics and edge solutions.

Strategic Acquisitions and Alliances for Market Penetration

OKI Electric Industry's pursuit of strategic acquisitions and alliances presents a significant opportunity for accelerated market penetration, particularly in high-growth regions like ASEAN. Their existing partnership with FPT, a leading IT services company in Vietnam, exemplifies this strategy. This collaborative approach not only expands OKI's geographic reach but also bolsters its expertise in crucial areas such as software development and digital transformation services.

By acquiring or partnering with companies possessing advanced technologies or established customer networks, OKI can bypass lengthy organic growth cycles. This allows for faster access to new markets and the integration of cutting-edge capabilities, essential for staying competitive in the rapidly evolving tech landscape. For instance, acquiring a specialized AI firm could immediately enhance OKI's offerings in intelligent automation solutions.

These strategic moves can be further leveraged to:

- Expand into emerging markets, capitalizing on untapped demand for digital and IT services.

- Acquire specialized technological expertise, such as advanced cybersecurity or IoT solutions, to complement existing product lines.

- Strengthen its position in key growth sectors like smart factories and telecommunications infrastructure.

- Gain immediate access to new customer bases and distribution channels in target regions.

OKI Electric Industry is well-positioned to capitalize on the accelerating digital transformation trend, which fuels demand for its advanced hardware and integrated solutions. The company's focus on IoT integration within public infrastructure, like smart cities, presents a substantial growth opportunity, with the smart cities market expected to reach $2.5 trillion by 2026.

Further expansion into Industry 4.0 adoption by manufacturing clients, leveraging OKI's robust connectivity and data processing, offers new value propositions and drives demand for data-driven services.

The evolving ATM market, driven by AI and self-service demand, allows OKI to enhance its offerings with smart and mobile solutions, improving customer experience and operational efficiency.

OKI's commitment to its core photonics technology, coupled with an 'Edge Platform' concept integrating AI and data analytics, enables the development of advanced solutions for infrastructure, smart manufacturing, and healthcare, tapping into the projected $50 billion edge computing market in 2024.

| Opportunity | Description | Market Projection/Data Point |

| Digital Transformation | Leveraging AI, IoT, and edge computing in solutions. | Smart Cities Market: $2.5 trillion by 2026. |

| Industry 4.0 | Providing connectivity and data processing for manufacturing automation. | Growth driven by demand for operational efficiency. |

| ATM Market Evolution | Developing smart and mobile ATM solutions with AI features. | Increased self-service demand and labor shortages. |

| Photonics & Edge Computing | Integrating photonics with edge platforms for advanced solutions. | Edge Computing Market (excl. IoT): Over $50 billion in 2024. |

Threats

The rapid pace of technological advancement, especially in IT and telecommunications, presents a significant threat of product obsolescence for OKI Electric Industry. For instance, the continuous evolution of 5G technology and the emerging 6G standards mean that current network equipment could quickly fall behind, requiring substantial R&D investment to remain competitive. Failure to adapt to these fast-moving trends, as seen with the rapid shift from 4G to 5G infrastructure deployments globally in 2023-2024, could render OKI's existing product portfolio less attractive to customers seeking the latest capabilities, directly impacting market share and revenue streams.

OKI Electric Industry faces significant headwinds from a crowded global marketplace, where many large and nimble players vie for market share across all its operational areas. This intense rivalry directly translates into fierce pricing pressure, forcing OKI to constantly innovate and refine its offerings to remain competitive. For instance, the semiconductor industry, a key area for OKI, saw global revenue reach an estimated $600 billion in 2024, with fierce competition driving down average selling prices in many segments.

The sheer number of competitors makes it difficult for OKI to capture substantial market share, particularly in established and saturated markets where growth is slower. This environment can put a strain on profit margins, as companies are often compelled to lower prices to attract or retain customers. In 2024, reports indicated that profit margins for many electronics manufacturers hovered in the low single digits due to this very dynamic.

Global economic headwinds, including persistent inflation and the potential for widespread recessions in major markets, pose a significant threat to OKI Electric Industry. For instance, a projected global GDP growth of just 2.6% for 2024, down from 3.0% in 2023 according to the IMF, suggests a challenging demand environment for industrial electronics and telecommunications equipment.

Energy shortages and the resulting price volatility directly impact OKI's manufacturing costs and can squeeze profit margins. Furthermore, ongoing supply chain disruptions, a legacy of recent global events, continue to create uncertainty in component availability, potentially delaying production and impacting revenue realization.

Heightened geopolitical tensions, particularly in regions where OKI has significant overseas operations or sales, present a substantial risk. Trade disputes and sanctions can disrupt market access and increase the cost of doing business, directly affecting sales figures and operational stability in key international markets.

Cybersecurity and Data Privacy Concerns

OKI Electric Industry, as a key supplier of telecommunication infrastructure for critical sectors such as finance and public safety, is inherently exposed to substantial cybersecurity risks. The increasing stringency of data privacy regulations worldwide, including GDPR and similar frameworks, presents a significant compliance challenge and a potential threat. A data breach could result in severe financial penalties, with fines potentially reaching millions of dollars, and cause irreparable damage to OKI's reputation and customer trust. For instance, in 2023, the global average cost of a data breach reached $4.45 million USD, a figure that underscores the potential financial impact.

The evolving landscape of cyber threats means constant vigilance and investment in advanced security measures are paramount. OKI's reliance on interconnected systems and the sensitive nature of the data it handles makes it a prime target for sophisticated cyberattacks. Failure to adequately protect this data could lead to:

- Significant financial losses due to regulatory fines and remediation costs.

- Erosion of customer confidence and market share.

- Disruption of critical services provided to its clients.

- Potential legal liabilities and lawsuits from affected parties.

Talent Acquisition and Retention Challenges

In today's fast-paced tech world, grabbing and keeping top talent, especially in fields like AI, software, and photonics, is super important. OKI Electric Industry needs these skilled people to drive innovation. A lack of qualified workers or a culture that doesn't keep employees engaged could really slow down OKI's plans for growth.

The competition for these specialized skills is fierce. For instance, a 2024 report indicated that global demand for AI specialists outstripped supply by over 200%, impacting companies across all sectors. This talent gap directly affects OKI's ability to develop cutting-edge products and solutions.

Here are some key aspects of the talent challenge for OKI:

- Intensified Competition: Major tech players and emerging startups are all vying for the same limited pool of highly skilled engineers and researchers, driving up compensation and benefits demands.

- Evolving Skill Requirements: The rapid advancement of technologies means that existing skill sets quickly become outdated, necessitating continuous investment in employee training and development, a significant cost factor.

- Global Talent Mobility: While global hiring can expand the talent pool, it also introduces complexities related to visa regulations, cultural integration, and potential attrition as employees may seek opportunities closer to home or in different markets.

- Employee Value Proposition: Beyond salary, attracting and retaining talent increasingly depends on a company's culture, career development opportunities, and its commitment to innovation and social responsibility, areas where OKI must remain competitive.

Intensified global competition, especially in the semiconductor and telecommunications sectors, puts significant pressure on OKI Electric Industry's pricing and profit margins. The rapid pace of technological change, exemplified by the ongoing transition to 6G, necessitates continuous R&D investment to avoid product obsolescence, a challenge amplified by the estimated $600 billion global semiconductor market in 2024 experiencing fierce price competition.

Economic headwinds, including projected slower global GDP growth of 2.6% in 2024 according to the IMF, coupled with energy price volatility and persistent supply chain disruptions, directly impact OKI's manufacturing costs and revenue realization. Geopolitical tensions also pose a threat, potentially disrupting market access and increasing operational costs in key international markets.

Cybersecurity risks are a major concern, given OKI's role in critical infrastructure and the sensitive data it handles. The global average cost of a data breach reaching $4.45 million USD in 2023 highlights the severe financial and reputational consequences of any security lapse. Furthermore, the fierce competition for specialized talent, with AI specialist demand outstripping supply by over 200% in 2024, presents a significant hurdle for OKI's innovation and growth strategies.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including OKI Electric Industry's official financial reports, comprehensive market research, and expert industry analysis to provide a robust strategic overview.