OKI Electric Industry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OKI Electric Industry Bundle

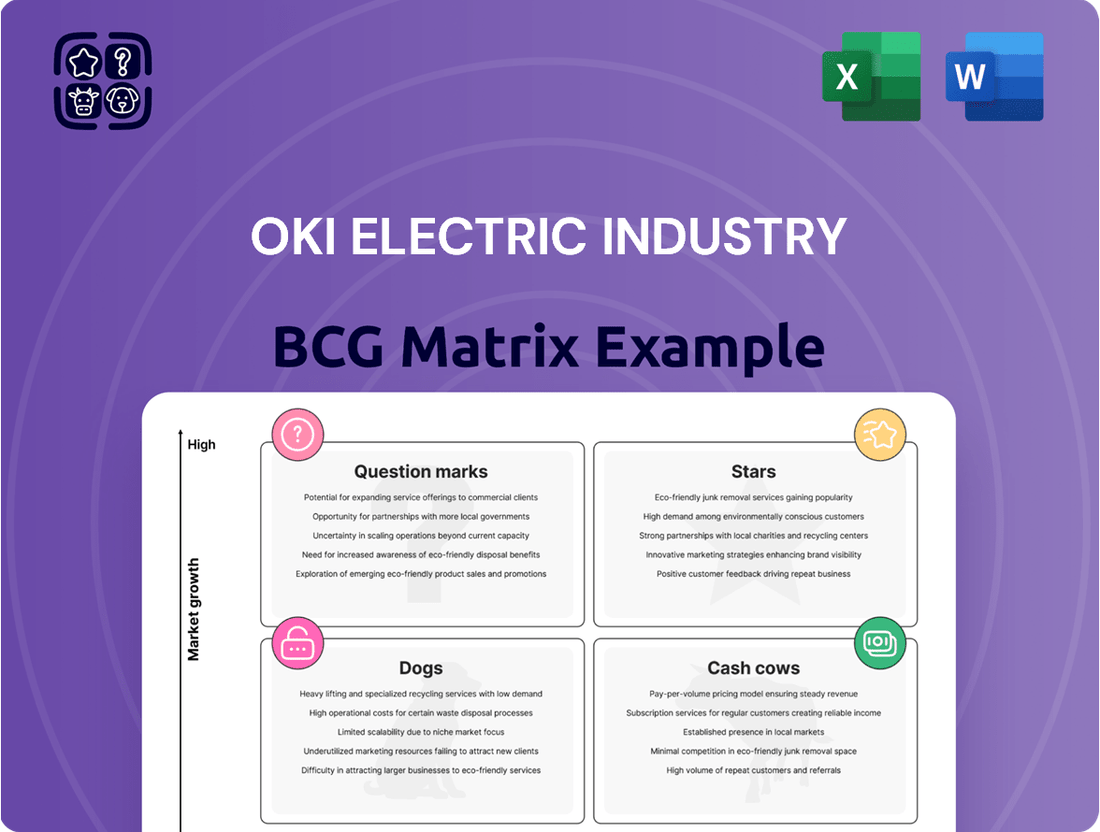

Curious about OKI Electric Industry's strategic positioning? This preview offers a glimpse into their product portfolio's potential, hinting at their Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for navigating the competitive landscape.

To truly unlock the strategic advantage, dive deeper with the full OKI Electric Industry BCG Matrix. Gain a comprehensive view of their market share and growth rates, enabling informed decisions about resource allocation and future investments.

This detailed report goes beyond a simple categorization, providing actionable insights and strategic recommendations tailored to OKI's specific market. Don't miss out on the opportunity to leverage this powerful analytical tool.

Purchase the full BCG Matrix today and equip yourself with the knowledge to identify opportunities, manage risks, and drive sustainable growth for OKI Electric Industry.

Stars

OKI Electric Industry's next-generation AI semiconductor testing PCBs represent a strong star in their EMS business. The company is actively developing and preparing for mass production of 124-layer PCBs, crucial for advanced AI semiconductors and high bandwidth memory, indicating substantial future revenue potential.

The escalating demand for sophisticated PCBs, driven by AI advancements, expanding data centers, and the rollout of next-generation communication networks, firmly places OKI within a rapidly expanding market segment. This strategic focus capitalizes on a clear trend toward higher processing power and data throughput.

Investments in new manufacturing lines at their Joetsu Plant underscore OKI's commitment to this high-growth area. The objective is to significantly boost sales by supplying critical components to semiconductor manufacturing and testing equipment makers, positioning them as a key enabler in the AI hardware ecosystem.

OKI Electric Industry's Public Solutions, encompassing defense, disaster preparedness, and private network expansion, demonstrated strong momentum in FY2024. This segment is poised for continued growth in FY2025, benefiting from favorable market conditions and OKI's deep-rooted expertise in critical infrastructure.

The company is strategically enhancing its offerings in advanced social infrastructure, particularly in emerging areas like V2X communication and automated driving. This forward-looking approach addresses escalating demands within the public sector, positioning OKI to capitalize on these high-growth sub-segments.

OKI Electric Cable is strategically focusing on the burgeoning robotics and industrial automation (FA) sector by offering specialized motion-tolerant and flexible cables, along with flexible printed circuits (FPCs). This move is driven by the significant growth in physical AI and the widespread adoption of robots across various industries, creating a robust demand for dependable and resilient components.

Their participation in key industry events, such as AUTOMATE 2025, underscores their commitment to expanding their presence in this high-growth market. By capitalizing on their proven technological prowess in mobility-oriented equipment, OKI aims to secure a more substantial market share. The global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 14% through 2030, indicating substantial opportunities for OKI's specialized offerings.

Digital Transformation (DX) Solutions & Services

OKI Electric Industry's Digital Transformation (DX) Solutions & Services are positioned as a strong contender in the growth phase, likely falling into the Stars category of the BCG matrix. Their significant investment in DX, exemplified by their strategic partnership with FPT, underscores a commitment to expanding capabilities in high-demand areas like AI, ERP, and automotive technology. This collaboration is geared towards delivering cutting-edge software solutions globally, aiming to bolster business continuity and foster cross-industry expansion.

The company's strategic emphasis on data-driven management, coupled with the leveraging of its internal DX expertise as an external competitive advantage, signals a clear focus on a high-growth trajectory. For instance, OKI's integration of AI and IoT technologies into its offerings aims to address the increasing demand for smart manufacturing and operational efficiency across various sectors.

- Strategic Partnerships: Collaborations like the one with FPT are crucial for accelerating software development and enhancing expertise in AI and automotive tech.

- Market Focus: The aim is to provide advanced software solutions to global markets, driving growth and business continuity.

- Internal Expertise as Differentiator: Leveraging internal DX knowledge externally is a key strategy for market advantage.

- Growth Drivers: Focus on data-driven management and advanced technologies like AI and ERP are key to future expansion.

New Frontier Technologies & Innovation Initiatives

OKI Electric Industry is investing heavily in new frontier technologies and innovation initiatives as outlined in its Medium-Term Business Plan 2025. These efforts are concentrated on high-growth potential markets, signaling a strategic push into areas like advanced remote operations, logistics, and healthcare. The company is also exploring novel applications for its Crystal Film Bonding (CFB) technology, aiming to leverage its core competencies for future business development.

These strategic investments in research and development, coupled with commercialization efforts, position these emerging areas as potential future Stars in OKI's BCG Matrix. For example, OKI announced in April 2024 its continued focus on developing solutions for the logistics sector, aiming to improve efficiency through advanced automation and connectivity. This commitment reflects a broader strategy to tap into markets projected for significant expansion in the coming years.

- Focus Areas: Advanced remote operations, logistics, healthcare, and Crystal Film Bonding (CFB) technology.

- Strategic Rationale: Targeting high-growth potential markets identified in the Medium-Term Business Plan 2025.

- Investment: Significant R&D and commercialization investments are being made to foster these new ventures.

- Market Potential: These initiatives are positioned to become future Stars by capitalizing on emerging technological trends and market demands.

OKI Electric Industry's advanced semiconductor testing PCBs are a prime example of a Star within their EMS business. The company's commitment to mass producing 124-layer PCBs for AI semiconductors highlights a significant future revenue stream, driven by the insatiable demand for high-performance computing components.

The company's Public Solutions segment, particularly in defense and disaster preparedness, demonstrated robust performance in FY2024 and is projected for continued growth in FY2025. This segment benefits from ongoing government investment in critical infrastructure and national security, positioning OKI as a key supplier.

OKI Electric Cable's strategic pivot towards the robotics and industrial automation sector, offering specialized cables and flexible printed circuits, capitalizes on the accelerating adoption of automation. The global industrial robotics market's impressive growth, with a projected CAGR exceeding 14% through 2030, underscores the immense potential for OKI's specialized offerings.

The company's Digital Transformation (DX) Solutions & Services, bolstered by strategic alliances like the one with FPT, are set to capture significant market share. By focusing on AI, ERP, and automotive technologies, OKI is tapping into high-demand sectors with strong growth prospects.

| Business Segment | BCG Category | Key Growth Drivers | FY2024/2025 Outlook |

|---|---|---|---|

| Semiconductor Testing PCBs (AI) | Star | AI semiconductor demand, high bandwidth memory | Strong revenue potential, mass production planned |

| Public Solutions (Defense, Disaster Preparedness) | Star | Government investment in critical infrastructure | Continued growth projected for FY2025 |

| Robotics & Industrial Automation Cables | Star | Global robotics market growth (14%+ CAGR), physical AI adoption | Expanding market presence, capitalizing on tech prowess |

| Digital Transformation (DX) Solutions | Star | AI, ERP, automotive technology demand, strategic partnerships | Global market expansion, driving business continuity |

What is included in the product

This BCG Matrix overview provides tailored analysis for OKI Electric Industry's product portfolio, highlighting which units to invest in, hold, or divest.

The OKI Electric Industry BCG Matrix provides a clear, one-page overview, relieving the pain of strategic ambiguity by placing each business unit in its appropriate quadrant.

Cash Cows

OKI Electric Industry's traditional ATM solutions are firmly positioned as a Cash Cow. This mature market, despite its moderate growth, consistently provides stable cash flow for the company. This is driven by the enduring need for physical cash transactions, including withdrawals, transfers, and deposits.

OKI's strength in this segment comes from its established global presence and a complete value chain. This includes everything from installation and maintenance to outsourcing services, securing a significant market share. For instance, in 2023, the global ATM market was valued at approximately $20 billion, with OKI holding a notable position within it.

OKI Electric Industry's involvement in the ETRIA joint venture, alongside Ricoh and Toshiba Tec, highlights a strategic move to solidify its position in the established printer market. This collaboration focuses on the development and manufacturing of multifunction printers (MFPs), a segment characterized by stable demand and limited growth.

By leveraging shared resources and expertise, OKI aims to enhance operational efficiency and reduce costs within this mature product line. The integration of its proprietary LED print head technology, coupled with the commonization of printer engines and parts across the joint venture, is designed to maintain a competitive edge.

This approach is specifically engineered to ensure the printer business continues to serve as a dependable source of cash flow for OKI. In fiscal year 2023, the global MFP market was valued at approximately $45 billion, with steady, albeit modest, growth projected for the coming years, underscoring the cash cow nature of this segment when managed effectively.

OKI Electric Industry's core public safety and disaster preparedness systems, including air traffic control, ETC, and municipal radio systems, represent a significant Cash Cow within its BCG Matrix. These are foundational, mature technologies with consistent demand, primarily fueled by necessary renewals and upgrades, rather than rapid expansion. For example, in fiscal year 2023, OKI reported stable revenue contributions from its social infrastructure segment, which encompasses these critical systems, underscoring their reliable performance.

The company leverages its extensive history and established partnerships with government bodies and local authorities to maintain a dominant market position. This strong customer loyalty and deep sector expertise translate into predictable revenue streams and robust profitability. OKI's ability to secure long-term maintenance and upgrade contracts for these essential services solidifies their status as a dependable source of cash flow for the organization.

General Component Products

The General Component Products segment of OKI Electric Industry demonstrated consistent performance in FY2024. This stability suggests a solid footing in the established component manufacturing market, where demand remains predictable. The company's strategy here centers on operational efficiency and maintaining high-quality standards to ensure this segment continues to be a reliable source of revenue and profit, acting as a foundational cash-generating business.

OKI's Component Products division, in FY2024, contributed to the company's overall financial health through its steady revenue streams. While specific growth figures for this segment in isolation are not always detailed, the broader operational stability points to its role as a mature business within OKI's portfolio. This segment is crucial for providing the consistent cash flow needed to support other, potentially higher-growth, areas of the business.

- Stable Market Position: The segment benefits from consistent demand across various industrial applications.

- Focus on Efficiency: OKI prioritizes operational excellence to maximize profitability from established product lines.

- Foundation for Growth: Steady cash generation supports investments in other strategic business areas.

- FY2024 Performance: Indicated steady revenue contributions, underscoring its mature and reliable nature.

Existing Enterprise Solutions (excluding new banknote projects)

OKI Electric Industry's Existing Enterprise Solutions, excluding new banknote initiatives, are considered cash cows within its BCG Matrix. While operating income saw a dip, primarily due to the completion of significant projects such as the new Japanese banknotes, the fundamental business supporting financial institutions and retail operations remains robust.

This segment thrives on the consistent demand for system renewals and the ongoing needs of domestic financial institutions. OKI benefits from a substantial installed base in this mature market, which translates to reliable, albeit modest, cash flow generation.

- Segment Contribution: Enterprise Solutions, despite a decline in operating income, continues to be a stable contributor.

- Market Maturity: The market for financial and retail systems is mature, indicating steady demand for maintenance and upgrades.

- Installed Base Advantage: OKI's significant existing customer base ensures recurring revenue streams.

- Predictable Cash Flow: The segment provides dependable, albeit slow-growing, cash inflows.

OKI Electric Industry's ATM solutions operate in a stable, mature market that consistently generates reliable cash flow. The global ATM market, valued at approximately $20 billion in 2023, continues to see demand for essential cash transactions, with OKI leveraging its established global presence and comprehensive service offerings to maintain a significant market share.

The company's printer business, bolstered by the ETRIA joint venture, also functions as a cash cow. This segment, within the $45 billion global MFP market in 2023, focuses on operational efficiency through shared resources and technology, ensuring predictable revenue from a mature product line with steady demand.

OKI's core public safety and disaster preparedness systems, including air traffic control and municipal radio, are vital cash cows. These foundational technologies benefit from consistent demand driven by necessary upgrades and renewals, supported by OKI's long-standing government partnerships and deep sector expertise, as evidenced by stable revenue contributions in fiscal year 2023.

The General Component Products segment consistently performed in FY2024, highlighting its role as a mature business providing steady revenue streams. This segment's focus on operational efficiency and quality ensures it acts as a foundational cash-generating unit, supporting the company's broader financial health.

Existing Enterprise Solutions, excluding new banknote projects, are also cash cows, driven by the robust demand from domestic financial institutions and retail operations. OKI's substantial installed base in this mature market ensures reliable, predictable cash flow generation through system renewals and ongoing support.

Preview = Final Product

OKI Electric Industry BCG Matrix

The OKI Electric Industry BCG Matrix preview you are viewing is the identical, fully rendered document you will receive upon purchase, offering immediate strategic insights without any alterations or watermarks. This comprehensive analysis, meticulously prepared, will be directly delivered to you, ensuring you gain access to the complete, actionable data for informed decision-making. Expect the exact same professional formatting and in-depth analysis that supports strategic planning and competitive positioning. This is not a sample; it is the final, ready-to-deploy BCG Matrix report for OKI Electric Industry.

Dogs

While OKI Electric Industry is strategically investing in high-tech printed circuit boards (PCBs) within its Electronic Manufacturing Services (EMS) segment, which may be positioned as Stars or Question Marks, the more commoditized areas of its EMS business faced significant headwinds in FY2024. This broader, less specialized EMS operation reported an operating loss.

The struggle in FY2024 suggests that undifferentiated EMS, lacking a high-value niche, operates in a highly competitive, low-growth market. Such operations often contend with thin profit margins, classifying them as a 'Dog' within the BCG Matrix, which can drain valuable resources from more promising ventures.

OKI Electric Industry's legacy telecommunication network infrastructure business, while historically a strong suit, might now face challenges. If segments of this infrastructure haven't kept pace with advancements like 5G or private networks, they could be categorized as Dogs in the BCG matrix. This implies a position of low market share in a low-growth sector.

Businesses in this category often require ongoing investment for maintenance without yielding significant returns. For instance, a telecommunications company might still be servicing older copper-based networks. While these networks are still functional, their revenue generation potential is limited compared to newer fiber-optic or wireless infrastructure. Such a situation can indeed become a cash trap, tying up capital that could be better deployed elsewhere.

Older OKI printer models, especially those predating the ETRIA joint venture, represent a category with significant challenges. These products often found themselves in mature markets characterized by fierce price wars and a general downturn in the demand for conventional office printing solutions. Consequently, their market share was typically small, and the returns on investment were minimal, draining resources without substantial upside.

Specific Regional ATM Projects with Collectability Issues

OKI Electric Industry's experience with a specific ATM project in China highlights a potential 'Dog' category. The company recorded a provision against trade receivables for this project in fiscal year 2024, directly affecting profitability. This situation exemplifies how large, singular projects can become problematic if collectability falters or market conditions change drastically, tying up capital with minimal to negative returns.

This scenario suggests a localized issue where OKI holds a low market share and faces profitability challenges within that specific regional project. Such an investment, if unable to generate expected returns or recover its invested capital, fits the description of a 'Dog' in the BCG matrix, indicating a need for careful strategic review.

- Provision Impact: OKI's FY2024 results were negatively impacted by a provision against receivables for a China-based ATM project.

- 'Dog' Characteristics: Such projects, facing collectability issues or market shifts, can represent 'Dogs' with tied-up capital and low/negative returns.

- Localized Struggle: This indicates a localized low market share and profitability problem for OKI in that specific venture.

Non-Strategic, Low-Performing Legacy Software Services

Non-Strategic, Low-Performing Legacy Software Services within OKI Electric Industry's BCG Matrix represent offerings that are not aligned with the company's digital transformation goals. These services often operate in mature, stagnant markets where competition is fierce and differentiation is minimal, leading to a lack of competitive advantage. For instance, if OKI has older, proprietary software solutions for specific industrial equipment that are no longer in high demand due to the rise of cloud-based or more adaptable systems, these would fit this category. Such services can become a drain on resources, requiring ongoing maintenance and support without generating substantial revenue or contributing to future growth objectives.

These legacy services might be characterized by declining market share and low profitability. In 2023, for example, companies in the industrial software sector that hadn't invested in modernization or shifted to subscription-based models often saw revenue stagnation. OKI's focus on areas like IoT and smart manufacturing means that older, standalone software packages without integration capabilities are likely candidates for this classification. The challenge is to identify these services and make strategic decisions regarding their future, which could include phasing them out or seeking divestment opportunities.

- Diverting Resources: Legacy software maintenance can consume a significant portion of IT budgets, potentially diverting funds from more innovative projects.

- Low Growth Potential: Services in saturated markets with little innovation offer minimal opportunity for revenue expansion.

- Strategic Misalignment: Offerings that do not support OKI's core strategic initiatives, such as digital transformation, are considered non-strategic.

- Candidate for Divestment: Identifying these services allows for potential divestment to focus resources on higher-performing or strategically aligned business units.

OKI Electric Industry's less specialized Electronic Manufacturing Services (EMS) operations, which reported an operating loss in FY2024, can be classified as Dogs. These segments likely operate in mature, low-growth markets with intense price competition, leading to thin profit margins and a low market share.

Similarly, legacy telecommunication infrastructure that hasn't been updated to meet current standards, such as 5G, also falls into the Dog category. These operations require continuous investment for maintenance but offer limited revenue potential, acting as a drain on resources.

Older printer models, particularly those sold before the ETRIA joint venture, represent another 'Dog' segment. These products competed in saturated markets with declining demand for conventional printing, yielding minimal returns and small market shares.

Question Marks

OKI Electric Industry's Ship Classification AI System Technology fits squarely into the question mark category of the BCG Matrix. This innovative system leverages deep learning to analyze underwater sound signatures, enabling accurate ship classification. Its novelty in a niche market suggests significant growth potential, driven by rising demands for maritime security and environmental surveillance.

While the technology itself is groundbreaking, its market share is likely nascent. As a new entrant, it requires substantial investment for research, development, and market penetration to achieve wider adoption and compete effectively. Early adoption rates and initial sales figures for such specialized AI systems are often low, characteristic of question mark products.

OKI Electric Industry's SHO-XYZ Location and Inventory Management System, launched in February 2025, is positioned as a potential Star in the BCG Matrix. This innovative system leverages smartphones for precise indoor and outdoor tracking of products and equipment, tapping into the burgeoning IoT and smart logistics market, which is projected to reach over $200 billion globally by 2027.

Given its recent introduction, SHO-XYZ likely holds a low initial market share. However, its alignment with the rapidly expanding IoT sector suggests significant growth potential. The company will need to invest heavily in sales and marketing to capture a larger piece of this dynamic market.

OKI Electric Industry's Medium-Term Business Plan 2025 highlights the strategic imperative of developing its air display business for international markets. This move positions OKI to potentially tap into the burgeoning demand for advanced display technologies in sectors like automotive, aviation, and augmented reality. The global augmented reality market, for instance, was valued at approximately $30.10 billion in 2023 and is projected to grow substantially.

While the air display sector, especially for novel applications, presents a promising high-growth avenue, OKI's current global market penetration in this specific niche is likely modest. This implies a need for substantial investment in research and development to refine its offerings and in market entry strategies to build brand recognition and customer bases. Establishing strategic global partnerships will be crucial for navigating diverse regulatory environments and distribution channels.

Crystal Film Bonding (CFB) Technology

OKI Electric Industry is investing in Crystal Film Bonding (CFB) technology as a key driver for future business growth. This advanced approach facilitates the 3D integration of thin-film analog integrated circuits, pushing the boundaries of electronic component manufacturing. The company sees significant potential in this high-growth area, though its market penetration is still developing.

CFB technology positions OKI within the Question Mark quadrant of the BCG matrix. This classification reflects its status as an emerging, high-potential technology with an uncertain market share and future trajectory. While market adoption and large-scale production are still in their nascent stages, the innovation itself points towards a promising future in advanced electronics.

- High-Growth Potential: CFB technology targets the rapidly evolving advanced electronics sector, characterized by increasing demand for miniaturization and enhanced functionality.

- Emerging Market Position: As a relatively new technology, CFB currently holds a low market share, necessitating further investment in development and market penetration.

- Strategic Focus: OKI's commitment to CFB underscores its strategy to create new business opportunities by leveraging cutting-edge material and component capabilities.

- Future Outlook: The success of CFB will depend on its ability to achieve scalable production and widespread market acceptance in the coming years.

Strategic Overseas Market Expansions for New Solutions

OKI Electric Industry's strategic overseas market expansion for new solutions, particularly in the ASEAN region through its partnership with FPT, positions these offerings as potential Stars or Question Marks in the BCG Matrix. This collaboration is designed to accelerate growth in advanced software solutions, tapping into markets with high digital adoption rates. For instance, the digital transformation market in Southeast Asia was projected to reach USD 175 billion by 2025, indicating substantial opportunity.

However, OKI's current market share for these specific new solutions in these burgeoning markets is likely nascent. This necessitates significant investment in marketing and sales to build brand awareness and secure initial customer traction, characteristic of Question Mark products. The company's focus on leveraging FPT's established presence in regions like Vietnam, where FPT is a leading IT services provider, is a critical step in overcoming this initial hurdle.

- Focus on ASEAN: Targeting high-growth digital transformation markets.

- Partnership Leverage: Utilizing FPT's established network and expertise for market entry.

- Investment Requirement: Significant capital needed for brand building and market penetration.

- Potential Growth: High upside if new solutions gain market acceptance and scale.

OKI Electric Industry's advanced air display technology, targeting sectors like automotive and AR, represents a Question Mark. While the global AR market was valued at approximately $30.10 billion in 2023 and shows strong growth potential, OKI's current market share in this niche is likely limited. Significant investment in R&D and market penetration strategies is required to capitalize on this high-growth opportunity.

The company's Crystal Film Bonding (CFB) technology, enabling 3D integration of analog ICs, also falls into the Question Mark category. This cutting-edge approach targets advanced electronics, a sector with increasing demand for miniaturization. However, CFB is still in its early stages, with uncertain market share and requiring substantial investment for scalable production and market acceptance.

| Initiative | BCG Category | Rationale | Investment Need | Market Potential |

| Air Display Technology | Question Mark | High growth potential in AR/automotive, but low current market share. | High for R&D and market entry. | Significant, driven by AR market growth ($30.10B in 2023). |

| Crystal Film Bonding (CFB) | Question Mark | Emerging tech for advanced electronics, requires scaling. | High for production and market adoption. | Promising for miniaturization and enhanced functionality. |

BCG Matrix Data Sources

This BCG Matrix for OKI Electric Industry is built on a foundation of verified market intelligence, integrating financial statements, industry growth forecasts, and competitive landscape analysis.