nVent Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

nVent Electric Bundle

Unlock the strategic roadmap for nVent Electric with our comprehensive PESTLE Analysis. Understand how evolving political landscapes, economic shifts, and technological advancements are directly impacting their operations and future growth potential. This analysis delves into the crucial social, environmental, and legal factors that shape their market. Gain a significant competitive advantage by leveraging these expertly curated insights for your own strategic planning and investment decisions. Don't miss out on the critical intelligence that can redefine your market approach. Download the full PESTLE Analysis of nVent Electric now and secure your future success.

Political factors

Governments globally are significantly boosting infrastructure spending, with a particular focus on smart cities, renewable energy installations, and the expansion of data centers. This strategic investment directly supports nVent Electric plc, as their core business involves providing essential electrical connection and protection solutions vital for such large-scale developments.

In the United States, the Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a prime example, allocating an estimated $1.2 trillion (signed into law in November 2021) towards modernizing roads, bridges, public transit, expanding broadband access, and advancing clean energy initiatives. This substantial federal funding is expected to generate considerable demand for nVent's comprehensive product portfolio, from electrical enclosures to wiring solutions, supporting the underlying electrical infrastructure required for these projects.

Similarly, European nations are also channeling significant funds into green infrastructure and digital transformation, with initiatives like the European Green Deal aiming to spur investments in renewable energy and energy-efficient buildings. This creates a robust market for nVent's solutions designed for these evolving energy and data infrastructure needs.

Changes in international trade policies, particularly the imposition or adjustment of tariffs, directly influence nVent Electric's operational costs and market standing. For instance, the company has navigated significant tariff impacts, which have historically affected its revenue streams and overall profitability, a trend that continued into early 2024.

These trade policy shifts necessitate constant vigilance and strategic adaptation. nVent's ability to maintain an efficient supply chain and competitive pricing hinges on its responsiveness to evolving trade landscapes, ensuring it can mitigate potential disruptions and capitalize on new market opportunities as they arise throughout 2024 and 2025.

Governments worldwide are aggressively pushing for electrification and decarbonization, driven by climate change concerns. This translates into significant investment in electrical grids and renewable energy sources. For instance, the Biden administration's Inflation Reduction Act of 2022 allocated hundreds of billions of dollars towards clean energy and climate initiatives, impacting the demand for infrastructure solutions.

These global political agendas directly boost the market for nVent's products, which are essential for building out this new electrical infrastructure. Think of charging stations for electric vehicles, grid modernization projects, and the integration of solar and wind power – nVent's enclosures, connection systems, and surge protection are critical components.

nVent's business model is well-aligned with this transition, as its offerings facilitate the move towards a more sustainable and electrified global economy. The company's solutions enable the reliable and safe operation of these new energy systems, positioning it to benefit from this ongoing transformation.

Regulatory Stability and Business Environment

The stability of political and regulatory landscapes where nVent Electric operates significantly influences its business continuity and investment strategies. A predictable legal framework, such as the consistent enforcement of manufacturing standards and trade agreements, fosters a more secure operating environment. For instance, nVent's presence in diverse markets means navigating varying degrees of regulatory stability; a stable environment in the US, a major market for electrical components, supports predictable demand and capital allocation. Conversely, rapid shifts in environmental regulations or trade policies in key regions could introduce unforeseen costs or disrupt supply chains. The company's 2024 outlook, as reflected in its financial reports, aims to leverage stable regulatory environments for predictable growth in its electrical and fastening solutions segments.

- Regulatory Stability: nVent operates in over 30 countries, requiring adaptation to diverse political and legal systems.

- Business Environment: Favorable government policies supporting infrastructure development, a key market for nVent's products, contribute to a positive business climate.

- Risk Factors: Political instability or sudden policy changes in regions like Europe or Asia could impact nVent's manufacturing and sales operations.

- Investment Climate: Predictable tax laws and corporate governance standards encourage nVent's ongoing investment in R&D and facility upgrades.

Global Standards and Compliance

Changes in global electrical and safety standards directly impact nVent's product development and market entry strategies. For instance, the ongoing push for greater energy efficiency in electrical systems, reflected in updated building codes and product certifications across major markets like the EU and North America, necessitates product redesign and testing. In 2024, several key international bodies, including the International Electrotechnical Commission (IEC), continued to refine standards for areas like smart grid technology and renewable energy integration, directly influencing nVent's product roadmaps for enclosures and electrical components.

Compliance with a patchwork of national and international regulations remains a significant operational factor for nVent’s global sales. In 2025, nVent continues to navigate evolving requirements such as the Restriction of Hazardous Substances (RoHS) directive in various regions, which impacts material sourcing and product composition. The company's ability to adapt to these diverse regulatory landscapes is crucial for maintaining its competitive edge and avoiding costly market access barriers. For example, the EU’s Green Deal initiatives are increasingly scrutinizing the lifecycle impact of electrical equipment, requiring manufacturers to demonstrate sustainability throughout their supply chains.

Political agreements fostering harmonization of standards can significantly boost nVent's market expansion. Conversely, regulatory fragmentation can escalate compliance costs and slow down new product introductions. As of early 2025, trade discussions and multilateral agreements aim to create more unified frameworks, potentially simplifying nVent's global operations. However, geopolitical tensions can also lead to divergence, as seen with some nations implementing unique national certifications that differ from established international norms, presenting ongoing challenges for multinational manufacturers like nVent.

- Harmonization Efforts: Continued international collaboration on standards, such as those advanced by the IEC, aims to streamline compliance for companies like nVent, potentially reducing time-to-market for new products in 2024-2025.

- Divergence Risks: The adoption of distinct national standards, exemplified by specific requirements in China or India for electrical safety certifications, can increase nVent's operational complexity and costs.

- Regulatory Scrutiny: Evolving environmental regulations, such as those related to material sustainability and energy efficiency, are compelling nVent to invest in R&D for compliance with emerging global mandates.

Governmental support for infrastructure modernization, particularly in areas like renewable energy and data centers, directly fuels demand for nVent's electrical solutions. The Bipartisan Infrastructure Investment and Jobs Act in the US, with its $1.2 trillion allocation, exemplifies this trend, driving need for components that nVent provides. Similarly, Europe's Green Deal initiatives are spurring investments in green infrastructure, further benefiting nVent's market position.

Shifting trade policies and tariffs significantly impact nVent's operational costs and market competitiveness, a factor that remained relevant into early 2024. Navigating these changes requires strategic adaptation to ensure efficient supply chains and pricing, crucial for maintaining profitability through 2025.

Global political agendas focused on electrification and decarbonization, supported by initiatives like the Inflation Reduction Act of 2022, are creating substantial opportunities for nVent. These policies necessitate robust electrical infrastructure, directly aligning with nVent's product offerings for grid modernization and renewable energy integration.

What is included in the product

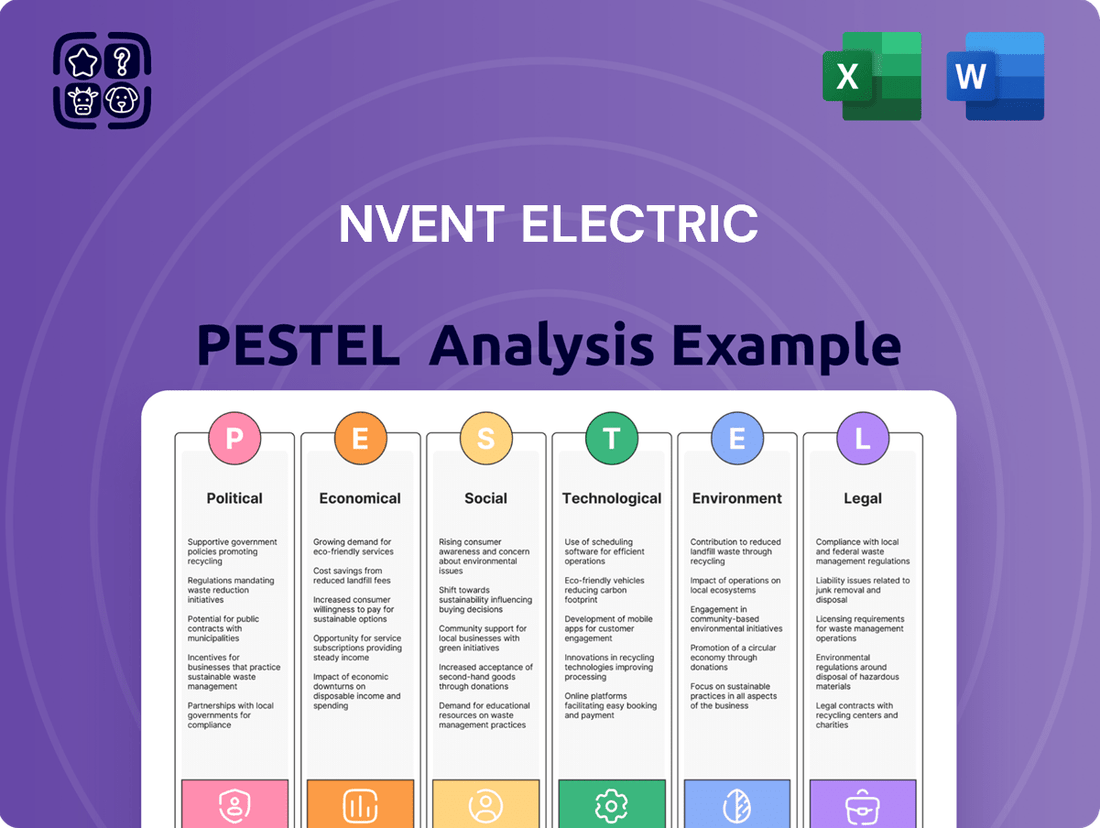

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting nVent Electric, dissecting their influence across Political, Economic, Social, Technological, Environmental, and Legal domains.

It provides actionable insights for strategic decision-making by highlighting current trends and potential future impacts specific to nVent Electric's operations and industry.

Provides a clear, actionable framework that helps nVent Electric identify and mitigate external threats, thereby reducing uncertainty and enabling more confident strategic decision-making.

Economic factors

The health of the global economy significantly impacts nVent Electric's business, as industrial activity directly drives demand for its electrical enclosure, connection, and fastening solutions. A robust global economy means more construction and expansion in the commercial, industrial, infrastructure, and energy sectors, all key markets for nVent. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight acceleration from 2023, indicating a generally supportive environment for capital expenditures.

Specifically, a resilient US economy, a primary market for nVent, and signs of recovering growth in Europe are positive indicators. These regions often lead global industrial output and investment. The US economy, for example, demonstrated strong GDP growth in early 2024, and while European growth has been more tempered, forecasts suggest a gradual improvement throughout the year, which should translate into increased demand for nVent's products as businesses invest in new facilities and upgrades.

Inflationary pressures are a significant concern for nVent Electric. The rising costs of raw materials, essential components, and labor directly impact manufacturing expenses, potentially squeezing profit margins. For instance, nVent's 2024 10-K filing specifically highlighted the impact of increased labor costs due to inflation.

To navigate these challenges, nVent must focus on robust cost management. This involves strategic pricing adjustments to pass on some of the increased costs to customers. Equally important is the optimization of its supply chain to secure more favorable terms and reduce overall expenditures.

Moderating interest rates are a significant tailwind for capital-intensive businesses like nVent Electric. As borrowing costs ease, the financial feasibility of large-scale infrastructure and industrial upgrade projects improves, making them more attractive for investment. This directly translates to increased demand for nVent's electrical connection and protection solutions.

Lower borrowing costs are expected to stimulate construction and expansion projects across various sectors. For instance, the favorable outlook for data center construction, coupled with moderating interest rates, can directly boost nVent's sales in this critical vertical. Similarly, utility companies, facing the need to upgrade aging infrastructure, will find it more economical to proceed with these investments.

The macroeconomic outlook for infrastructure development is broadly favorable, with the expectation of moderating interest rates through 2025. This environment supports increased capital expenditure by businesses and governments alike. For example, many countries are prioritizing grid modernization and renewable energy integration, projects that heavily rely on nVent's product portfolio.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for nVent Electric plc, a global entity. Fluctuations in exchange rates directly impact the translation of its foreign-denominated revenues, expenses, and profits into its primary reporting currency, the US Dollar. This can lead to unpredictable swings in reported financial performance, even if underlying operational performance remains stable. For instance, a stronger US Dollar can devalue earnings generated in weaker currencies, while a weaker Dollar can boost them.

Managing this inherent risk is crucial for nVent's financial stability and strategic planning. The company employs various strategies to mitigate these effects. These often include hedging techniques, such as forward contracts and options, to lock in exchange rates for future transactions. Geographic diversification of its operations and sales also plays a role, spreading exposure across different currency zones and reducing reliance on any single currency's performance.

In 2024, the global economic landscape continued to be shaped by shifting currency dynamics. Many emerging market currencies experienced notable depreciation against the US Dollar, influenced by factors like interest rate differentials and geopolitical uncertainties. Conversely, some developed market currencies showed resilience or even appreciation. nVent’s ability to navigate these complex currency movements is vital for maintaining its competitive edge and delivering consistent shareholder value.

- Global Exposure: nVent Electric operates in numerous countries, making it susceptible to the financial impact of fluctuating currency values.

- Reporting Impact: Changes in exchange rates can distort reported revenues and profitability when foreign earnings are converted to USD.

- Risk Mitigation: Strategies like currency hedging and geographic diversification are employed to manage this economic exposure.

- 2024 Trends: Emerging market currencies generally weakened against the USD in 2024, presenting both challenges and opportunities for multinational corporations like nVent.

Market Demand in Key Verticals (Data Centers, Utilities, Renewables)

The demand for data processing and storage is a powerful economic driver for nVent, particularly within its data solutions segment. The exponential growth in data generation, fueled by AI and cloud computing, necessitates increased investment in robust infrastructure. In 2024, the global data center market was projected to reach over $300 billion, with continued strong growth expected through 2025, directly benefiting nVent's offerings.

Investments in power utility upgrades represent another key economic factor. Aging infrastructure across many regions requires significant modernization to ensure grid reliability and accommodate new energy demands. This translates into substantial opportunities for nVent's electrical infrastructure solutions, as utilities globally commit billions to grid resilience and expansion projects. For instance, the US government's Infrastructure Investment and Jobs Act allocated significant funding towards grid modernization efforts, impacting the utility sector's capital expenditure.

The expansion of renewable energy projects, including solar and wind farms, is also a major economic tailwind for nVent. These projects require specialized electrical components and protection solutions for their often remote and demanding environments. As global efforts to decarbonize accelerate, the market for renewable energy infrastructure continues to grow, with substantial capital being deployed in 2024 and projected to continue into 2025.

- Data Center Growth: Global data center market projected to exceed $300 billion in 2024, with continued expansion driven by AI and cloud services.

- Utility Modernization: Significant capital expenditure by utilities worldwide on grid upgrades and resilience, supported by government initiatives like the US Infrastructure Investment and Jobs Act.

- Renewable Energy Expansion: Increasing global investment in solar and wind energy projects, creating demand for specialized electrical infrastructure solutions.

- nVent's Position: Data solutions and electrical infrastructure are identified as high-growth areas, positioning nVent to capitalize on these economic trends.

Global economic growth is a key driver for nVent Electric, with industrial and infrastructure spending directly influencing demand for its products. The International Monetary Fund (IMF) forecast global growth at 3.2% for 2024, signaling a generally supportive environment for capital expenditures. This positive outlook is further bolstered by signs of economic recovery in Europe, a significant market for nVent, complementing the already resilient US economy.

Inflation remains a critical factor, increasing nVent's manufacturing costs for raw materials and labor, as noted in their 2024 filings. To counter this, the company focuses on cost management and strategic pricing. Moderating interest rates, however, provide a tailwind, making large-scale projects more financially viable and boosting demand for nVent's infrastructure solutions.

Currency fluctuations present ongoing challenges for nVent's global operations, impacting reported earnings when converted to USD. The company actively manages this through hedging and geographic diversification. In 2024, many emerging market currencies depreciated against the dollar, influencing nVent's financial performance and competitive positioning.

| Economic Factor | Impact on nVent Electric | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for industrial and infrastructure solutions | IMF projected 3.2% global growth in 2024 |

| Inflation | Increases manufacturing costs (materials, labor) | nVent noted rising labor costs in 2024 filings |

| Interest Rates | Lower rates improve project feasibility, boosting demand | Rates expected to moderate through 2025 |

| Currency Exchange Rates | Affects reported foreign earnings | Emerging market currencies generally weakened against USD in 2024 |

Full Version Awaits

nVent Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of nVent Electric delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into market trends, competitive landscapes, and strategic opportunities.

Sociological factors

The availability of a skilled workforce is crucial for nVent Electric, particularly in manufacturing, engineering, and the installation of their complex electrical solutions. A tightening labor market for specialized trades, like electricians and advanced manufacturing technicians, directly impacts nVent's ability to scale production and execute projects efficiently.

For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 6% job growth for electricians between 2022 and 2032, indicating continued demand but also potential competition for talent. This shortage can slow down market expansion and the successful implementation of new projects for companies reliant on these specialized skills.

Consequently, nVent's strategic focus on investment in robust training programs and talent development initiatives is not just beneficial but essential. By fostering internal expertise and partnering with educational institutions, nVent can ensure a pipeline of qualified workers to meet its operational and growth needs.

Global urbanization continues at a rapid pace, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2021. This surge fuels the expansion of smart cities, necessitating sophisticated electrical infrastructure for everything from efficient energy distribution and robust connectivity to enhanced public safety systems. nVent's expertise in critical electrical infrastructure solutions, including enclosures, surge protection, and thermal management, directly addresses the growing demand for resilient and intelligent urban environments.

The increasing complexity of urban systems, driven by IoT integration and smart grid technologies, creates a sustained demand for nVent's specialized products. For instance, the need for reliable power and data management in smart city applications is paramount, positioning nVent to capitalize on this ongoing trend. Their commitment to providing solutions that ensure operational continuity and safety in these dynamic environments aligns perfectly with urban development strategies worldwide.

Societal expectations for safety and reliability in electrical systems are intensifying, particularly for critical infrastructure like data centers and healthcare facilities. This growing demand directly fuels the market for advanced protection solutions, a core area for nVent. For instance, the global market for electrical safety devices was projected to reach over $35 billion in 2024, with a significant portion driven by these heightened expectations.

Consumers and various industries now anticipate electrical installations to be not just functional but exceptionally robust, designed to proactively prevent failures and guarantee uninterrupted operations. This aligns perfectly with nVent's strategic focus on connecting and protecting critical electrical infrastructure, positioning the company to capitalize on these evolving societal priorities.

Sustainability and Ethical Business Practices

Societal expectations regarding environmental responsibility are significantly shaping consumer choices and investor sentiment. nVent Electric's commitment to sustainability, evidenced by its ongoing efforts to reduce CO2e emissions and its recognition as one of the World's Most Ethical Companies®, directly addresses these growing demands. This focus not only bolsters its brand image but also appeals to a broader base of stakeholders who prioritize ethical operations. For instance, in their 2023 ESG report, nVent highlighted a 7% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress in their environmental stewardship.

- Growing Consumer Demand: Surveys in 2024 indicate that over 60% of consumers are willing to pay more for products from companies with strong sustainability records.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) funds saw continued growth, with global ESG assets projected to reach $50 trillion by 2025, making ethical practices a key investment criterion.

- Brand Reputation: nVent's acknowledgement as one of the World's Most Ethical Companies® by Ethisphere for multiple consecutive years (including 2024) reinforces its market position and trust among customers and partners.

- Operational Efficiency: Investments in sustainable practices often lead to long-term cost savings through reduced energy consumption and waste management, benefiting nVent's financial performance.

Digitalization and Connectivity Adoption

Societies globally are embracing digitalization at an unprecedented pace, with the Internet of Things (IoT) and the rollout of 5G technology becoming increasingly commonplace. This societal shift necessitates robust and advanced electrical infrastructure capable of supporting these interconnected systems. For instance, the global IoT market was projected to reach over $1.6 trillion by 2025, highlighting the immense scale of this digital transformation.

nVent Electric's product portfolio is strategically positioned to capitalize on this trend. Their solutions are crucial for enabling the widespread adoption of digitalization across various industries. Whether it's facilitating industrial automation with reliable power and data connectivity or supporting the development of smart grids that manage energy more efficiently, nVent’s offerings are integral to building the digital future.

Consider these points regarding nVent's role in digitalization:

- Enabling IoT Growth: nVent provides enclosures, thermal management, and electrical connection solutions vital for the deployment and operation of IoT devices in diverse environments.

- 5G Infrastructure Support: The expansion of 5G networks requires significant upgrades to electrical infrastructure, including robust power distribution and protection, areas where nVent excels.

- Smart Grid Advancement: As grids become smarter and more distributed, nVent's solutions for power quality and surge protection are essential for maintaining grid stability and reliability.

- Data Center Demand: The surge in data generation and processing, driven by digitalization, fuels demand for secure and efficient data center infrastructure, a key market for nVent's specialized electrical products.

Societal expectations for safety and reliability in electrical systems are intensifying, particularly for critical infrastructure like data centers and healthcare facilities. This growing demand directly fuels the market for advanced protection solutions, a core area for nVent. For instance, the global market for electrical safety devices was projected to reach over $35 billion in 2024, with a significant portion driven by these heightened expectations.

Consumers and various industries now anticipate electrical installations to be not just functional but exceptionally robust, designed to proactively prevent failures and guarantee uninterrupted operations. This aligns perfectly with nVent's strategic focus on connecting and protecting critical electrical infrastructure, positioning the company to capitalize on these evolving societal priorities.

Societal expectations regarding environmental responsibility are significantly shaping consumer choices and investor sentiment. nVent Electric's commitment to sustainability, evidenced by its ongoing efforts to reduce CO2e emissions and its recognition as one of the World's Most Ethical Companies® for 2024, directly addresses these growing demands.

The increasing digitalization and adoption of IoT and 5G technologies necessitate robust electrical infrastructure. nVent's solutions are crucial for enabling this widespread adoption across industries, from industrial automation to smart grids. For example, the global IoT market was projected to exceed $1.6 trillion by 2025, underscoring the scale of this digital transformation and the demand for reliable connectivity.

| Societal Factor | Impact on nVent Electric | Supporting Data (2024/2025) |

| Safety & Reliability Expectations | Increased demand for advanced protection and robust infrastructure solutions. | Global electrical safety devices market projected > $35 billion in 2024. |

| Environmental Responsibility | Boosts brand reputation and investor appeal; drives demand for sustainable solutions. | nVent recognized as World's Most Ethical Company® for 2024; 7% reduction in Scope 1 & 2 emissions (2023 vs. 2019 baseline). |

| Digitalization & IoT Adoption | Drives demand for infrastructure supporting connected systems and data centers. | Global IoT market projected > $1.6 trillion by 2025; 5G infrastructure upgrades require enhanced electrical solutions. |

Technological factors

Continuous innovation in electrical connection and protection is vital for nVent's market standing. This includes advancements like smart circuit breakers and increasingly sophisticated enclosure designs. For instance, the global electrical enclosures market was valued at approximately $9.5 billion in 2023 and is projected to grow, indicating a strong demand for these advanced solutions. nVent's focus on integrating these technologies directly impacts its ability to offer competitive and future-proof products.

The increasing demand for high-density data centers, especially those powering AI, is fueling the need for sophisticated thermal management like liquid cooling. This shift is a significant technological factor for nVent Electric.

nVent's strategic partnership with NVIDIA to implement liquid cooling technologies places them at the cutting edge of this crucial technological advancement. This collaboration aims to boost both performance and energy conservation within data centers.

The global liquid cooling market is projected to reach $12.8 billion by 2028, growing at a CAGR of 22.1% from 2023, highlighting the substantial market opportunity driven by this technological evolution.

The booming integration of Internet of Things (IoT), Artificial Intelligence (AI), and smart grid technologies presents a significant opportunity for nVent Electric. These advanced systems require robust and intelligent electrical components to function effectively, a niche nVent is well-positioned to serve. For instance, the global IoT market is projected to reach over $1.5 trillion by 2025, highlighting the vast demand for the infrastructure nVent provides.

nVent's comprehensive portfolio of electrical enclosures, connection and fastening solutions, and surge protection devices are critical for building the secure and reliable backbone of these smart technologies. As utilities and industries increasingly adopt smart grid solutions, the demand for nVent's advanced energy management and distribution products is expected to surge, supporting a more efficient and resilient power infrastructure.

Automation and Digitalization in Manufacturing

Technological advancements are significantly reshaping manufacturing, and nVent Electric is actively integrating these changes. Automation and digitalization are key drivers, promising to boost nVent's operational efficiency and product quality. For instance, the global industrial automation market was valued at approximately $215 billion in 2023 and is projected to grow substantially, indicating a strong trend toward adopting these technologies.

Embracing these innovations allows nVent to streamline production processes, reduce manual labor costs, and improve the precision of its output. This digital transformation is not just about efficiency; it also enhances nVent's ability to respond faster to market demands, thereby improving its speed to market for new and existing products. The company's strategic investments in advanced manufacturing techniques are aimed at solidifying its competitive edge in the evolving industrial landscape.

- Increased Efficiency: Automation can reduce cycle times and minimize errors, leading to higher output.

- Enhanced Quality Control: Digitalization allows for real-time monitoring and data analysis, improving product consistency.

- Cost Reduction: Streamlined operations and reduced waste contribute to lower manufacturing costs.

- Improved Agility: Faster production cycles enable quicker adaptation to changing customer needs and market trends.

New Product Development and Innovation Pipeline

nVent Electric's commitment to a strong new product introduction (NPI) pipeline is a critical technological driver for its expansion, particularly in areas like electrification, sustainability, and digitalization. This focus ensures the company remains competitive by aligning its offerings with evolving market demands.

The company's innovation efforts are demonstrably yielding results, with a significant portion of its new products designed to have a positive sustainability impact. This strategic emphasis on green innovation not only caters to growing environmental consciousness but also opens new market opportunities and enhances brand reputation.

For example, in 2023, nVent reported that 75% of its new product revenue was associated with sustainability benefits, highlighting the tangible impact of its R&D investments. This trend is expected to continue, with a substantial portion of the product development roadmap geared towards solutions that reduce energy consumption and improve resource efficiency.

Key areas of technological focus within nVent's innovation pipeline include:

- Advancements in smart grid technologies: Developing solutions that enhance the reliability and efficiency of electrical distribution networks.

- Sustainable electrical protection and connection solutions: Innovations aimed at reducing environmental footprint in electrical infrastructure.

- Digitalization of electrical systems: Creating products that integrate with IoT and data analytics for improved performance monitoring and control.

- Energy transition solutions: Products supporting renewable energy integration and electric vehicle charging infrastructure.

Technological advancements in electrification and connectivity are paramount for nVent's growth, particularly in areas like data centers and smart grids. The company's strategic focus on liquid cooling, demonstrated by its partnership with NVIDIA, positions it to capitalize on the high-performance computing trend. This is supported by the global liquid cooling market's projected expansion to $12.8 billion by 2028.

nVent is also leveraging the proliferation of IoT, AI, and smart grid technologies, where its robust electrical infrastructure solutions are essential. The global IoT market's projected growth to over $1.5 trillion by 2025 underscores the demand for reliable connectivity components. Furthermore, nVent's integration of automation and digitalization in its manufacturing processes, with the global industrial automation market valued at approximately $215 billion in 2023, enhances operational efficiency and product quality.

The company's new product introduction pipeline heavily emphasizes sustainability, with 75% of its new product revenue in 2023 linked to sustainability benefits. This reflects a strategic alignment with market demands for environmentally conscious solutions in energy transition and electrical infrastructure.

| Key Technological Trends | Market Relevance for nVent | Data/Projections |

| Data Center Advancements (AI, Liquid Cooling) | High-performance computing requires advanced thermal management. | Liquid cooling market to reach $12.8 billion by 2028 (CAGR 22.1%). |

| IoT, AI, and Smart Grid Integration | Demand for robust electrical components for intelligent systems. | Global IoT market projected over $1.5 trillion by 2025. |

| Manufacturing Automation & Digitalization | Improved operational efficiency and product quality. | Industrial automation market valued at ~$215 billion in 2023. |

| Sustainability-focused Innovation | Growing demand for eco-friendly electrical solutions. | 75% of nVent's 2023 new product revenue linked to sustainability. |

Legal factors

nVent Electric operates under a complex web of product safety and quality regulations globally, impacting its electrical connection and protection solutions. These regulations, such as those from UL (Underwriters Laboratories) and CE marking in Europe, mandate stringent testing and adherence to performance standards. Failure to comply can lead to significant financial penalties, product recalls, and severe damage to nVent's brand reputation, as seen in past industry-wide recalls of electrical components due to safety concerns.

nVent Electric operates under a complex web of Environmental, Health, and Safety (EHS) laws, encompassing U.S. federal, state, and local regulations, as well as international standards. These regulations dictate environmental practices and worker safety across its global manufacturing footprint. For instance, in 2023, nVent reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating ongoing efforts to meet evolving environmental mandates.

Compliance with these EHS requirements, particularly those concerning carbon dioxide equivalent (CO2e) emissions and waste management, directly impacts nVent's manufacturing processes and overall operational expenses. The company's commitment to sustainability, as evidenced by its 2025 goal to achieve a 20% reduction in waste generation intensity, underscores the financial implications of adhering to these legal frameworks and the drive for efficiency.

nVent Electric must navigate a complex web of international trade laws and sanctions to ensure its global operations remain compliant. Failure to adhere to export controls and economic sanctions can lead to significant penalties and disrupt market access, impacting nVent's ability to serve customers worldwide. For instance, in 2023, companies faced increased scrutiny regarding trade with nations under specific sanctions, requiring robust due diligence processes.

Shifts in these regulatory landscapes directly influence nVent's strategic planning, affecting everything from where it can source components to which markets it can sell its products. The ongoing geopolitical tensions in 2024 continue to highlight the volatility of international trade agreements and the potential for new sanctions to emerge, necessitating agile adaptation from nVent.

The imposition or alteration of trade tariffs presents a substantial financial consideration for nVent, potentially increasing the cost of goods sold or impacting the competitiveness of its offerings in certain regions. For example, the United States' imposition of tariffs on steel and aluminum in prior years had a ripple effect across manufacturing industries, including those nVent operates within.

Data Privacy and Cybersecurity Regulations

The increasing digitalization of operations means nVent Electric must navigate a complex landscape of data privacy and cybersecurity regulations. Compliance with evolving laws like the General Data Protection Regulation (GDPR) and various national cybersecurity mandates is critical. Failure to protect sensitive customer and company data can result in substantial legal fines and financial penalties. For instance, GDPR violations can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher.

nVent's commitment to robust cybersecurity measures is therefore not just a technical necessity but a legal imperative. A data breach could severely damage nVent's reputation, impacting customer trust and future business opportunities. The global cost of data breaches reached an average of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report, highlighting the significant financial exposure companies face.

- Data Protection Laws: nVent must adhere to global regulations such as GDPR, CCPA, and others that govern the collection, processing, and storage of personal data.

- Cybersecurity Standards: Compliance with industry-specific cybersecurity frameworks and government mandates is essential to prevent and mitigate cyber threats.

- Financial Penalties: Significant fines can be imposed for non-compliance with data privacy and security regulations, impacting profitability.

- Reputational Risk: Data breaches can lead to loss of customer trust and substantial damage to brand image, affecting long-term business viability.

Intellectual Property Rights and Protection

nVent Electric places significant emphasis on safeguarding its intellectual property, including a robust portfolio of patents and trade secrets that underpin its innovative electrical solutions. This legal protection is vital for maintaining its competitive edge in the global market. For instance, as of early 2024, nVent held thousands of active patents worldwide, covering a wide array of its product lines, from enclosures to thermal management systems.

The company navigates a complex international landscape where intellectual property laws differ considerably. Challenges to these patents or trade secrets, whether through infringement claims or varying national enforcement mechanisms, pose a direct risk to nVent's product development pipeline and its established market positions. Failure to adequately protect its IP could lead to competitors replicating its technologies, diminishing its market share and profitability.

- Patent Portfolio Strength: nVent's extensive patent filings provide a defensive shield against imitation and a foundation for future innovation.

- Global Enforcement Challenges: The diverse and evolving nature of international IP laws requires constant vigilance and strategic legal action.

- Trade Secret Protection: Safeguarding proprietary manufacturing processes and customer data is as critical as patent protection for nVent's operational advantage.

- R&D Investment Impact: The company's substantial investment in research and development, often exceeding $100 million annually in recent years, is directly tied to the successful protection of its resulting innovations.

nVent Electric's adherence to global product safety and quality regulations, such as UL certifications and CE marking, is paramount. Non-compliance can lead to hefty fines, product recalls, and significant brand damage, impacting its electrical connection and protection solutions. The company's 2023 sustainability report highlighted its ongoing efforts to meet evolving environmental mandates, including a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity against a 2019 baseline.

Navigating international trade laws and sanctions is crucial for nVent's global operations, with companies in 2023 facing increased scrutiny on trade with sanctioned nations. Tariffs, like those previously imposed on steel and aluminum by the U.S., directly affect nVent's cost of goods sold and market competitiveness. Additionally, data privacy and cybersecurity regulations, such as GDPR, carry substantial penalties for non-compliance, with potential fines up to 4% of global turnover; IBM's 2024 Cost of a Data Breach Report indicated an average breach cost of $4.45 million.

nVent actively protects its extensive intellectual property, holding thousands of active patents globally as of early 2024, which are vital for maintaining its competitive edge. Challenges to these patents or trade secrets in different jurisdictions pose a risk to its innovation pipeline and market share. The company's investment in research and development, often exceeding $100 million annually, is directly linked to the success of its IP protection strategies.

| Legal Area | Key Regulations/Considerations | Impact on nVent | Recent Data/Examples (2023-2024) |

|---|---|---|---|

| Product Safety & Quality | UL Standards, CE Marking | Compliance ensures market access; non-compliance leads to fines, recalls, reputational damage. | Industry-wide recalls of electrical components due to safety concerns highlight the risks. |

| Environmental, Health, & Safety (EHS) | Global environmental laws, emissions standards | Affects manufacturing processes, operational costs; drives efficiency improvements. | 10% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline) reported in 2023. Goal to reduce waste generation intensity by 20% by 2025. |

| International Trade & Sanctions | Export controls, economic sanctions | Impacts market access, requires robust due diligence; tariffs increase costs. | Increased scrutiny on trade with sanctioned nations in 2023. Prior U.S. tariffs on steel/aluminum affected manufacturing costs. |

| Data Privacy & Cybersecurity | GDPR, CCPA, national cybersecurity mandates | Requires strong data protection; non-compliance incurs significant fines and reputational risk. | GDPR fines up to 4% of global turnover. Average cost of data breach in 2024 was $4.45 million (IBM). |

| Intellectual Property (IP) | Patents, trade secrets, international IP laws | Protects competitive advantage and R&D investments; varying global enforcement is a challenge. | nVent held thousands of active patents globally in early 2024. R&D investment often exceeds $100 million annually. |

Environmental factors

Global initiatives to curb climate change are significantly boosting the need for energy-efficient electrical systems and infrastructure for renewable energy sources. nVent's product portfolio, which includes solutions for power distribution, electrical enclosures, and thermal management, is directly positioned to benefit from this trend. For instance, the expansion of wind and solar power generation, crucial for climate mitigation, heavily relies on robust electrical infrastructure that nVent supplies.

The company's strategic emphasis on facilitating a more sustainable and electrified future resonates strongly with global climate adaptation efforts. As communities and industries adapt to the impacts of climate change, such as extreme weather events, the demand for resilient and reliable electrical infrastructure, including surge protection and grounding solutions offered by nVent, is set to increase. This alignment positions nVent to capitalize on the growing market for climate-resilient technologies, with the global market for climate adaptation solutions projected to reach hundreds of billions of dollars by 2030.

nVent Electric's operations are significantly influenced by the availability and sustainable sourcing of key raw materials like metals and plastics. For instance, copper, a critical component in many of nVent's electrical connection and protection products, saw price volatility in 2023 and early 2024 due to global supply and demand dynamics, directly impacting input costs.

Increasing resource scarcity, driven by factors like geopolitical instability or stricter environmental regulations on mining and extraction, poses a risk to nVent's supply chain stability and can lead to higher material expenses. The company's commitment to reducing its environmental footprint is evident in initiatives like phasing out single-use plastics in packaging, a move that aligns with growing consumer and regulatory pressure for more sustainable business practices.

Growing regulatory demands and public concern are pushing companies like nVent Electric towards improved waste management and the adoption of circular economy principles. This directly impacts how nVent designs its products and handles them at the end of their life. For instance, by 2025, the European Union aims to increase recycling rates for municipal waste to 65%, a target that necessitates more sustainable product lifecycles.

Designing products with recyclability in mind and minimizing waste during the manufacturing process are becoming paramount environmental duties for nVent. This shift means incorporating sustainable materials and exploring closed-loop systems to reduce reliance on virgin resources. Industry reports in 2024 highlight a growing investor preference for companies demonstrating strong environmental, social, and governance (ESG) performance, with waste reduction being a key metric.

Energy Efficiency and Green Building Standards

The global push for energy efficiency in buildings, fueled by stringent green building standards and evolving regulations, presents a significant opportunity for nVent Electric. As of 2024, the International Energy Agency reported that buildings account for nearly 40% of global energy consumption, highlighting the critical need for energy-saving solutions. nVent's portfolio, including advanced wiring, enclosure, and connection technologies, directly supports the development of more energy-efficient and resilient electrical infrastructure within these structures.

This growing emphasis translates into increased demand for nVent's products that facilitate lower energy consumption and improved operational performance. For instance, their electrical enclosures and thermal management solutions can optimize energy use in data centers and industrial facilities, areas where efficiency gains are paramount. The company's commitment to providing solutions that enhance the performance and longevity of electrical systems aligns perfectly with the objectives of green building initiatives worldwide.

- Growing Demand: Green building standards like LEED and BREEAM are increasingly mandating energy performance, driving demand for nVent's energy-saving electrical components.

- Resilience Focus: Regulations are also emphasizing electrical system resilience against climate impacts, a core area addressed by nVent's robust product offerings.

- Market Growth: The global green building market was valued at over $280 billion in 2023 and is projected to grow substantially, offering a favorable environment for nVent's energy-efficient solutions.

- nVent's Contribution: nVent's products enable lower energy loss in electrical distribution, contributing to reduced operational costs and environmental impact for building owners.

Environmental Reporting and ESG Transparency

Investor and regulatory focus on Environmental, Social, and Governance (ESG) factors is intensifying, demanding clearer environmental reporting. nVent Electric's commitment to transparency is evident in its annual sustainability reports, which detail progress on emission reductions and the environmental impact of its products. For instance, in their 2023 report, nVent highlighted a 12% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, showcasing their efforts to meet these growing expectations.

These reports are vital for nVent to demonstrate its dedication to sustainability and to satisfy the increasing demand for actionable data from stakeholders. The company's initiatives include:

- Tracking and reporting Scope 1, 2, and 3 emissions.

- Setting science-based targets for emission reductions.

- Detailing the energy efficiency and sustainability benefits of their product portfolio.

- Communicating progress on water usage and waste reduction efforts.

Global climate initiatives are driving demand for nVent's energy-efficient solutions, particularly for renewable energy infrastructure. As the world transitions to cleaner energy sources, nVent's products supporting power distribution and thermal management for wind and solar power are well-positioned for growth. The company's focus on an electrified, sustainable future directly aligns with global climate adaptation needs, as demand for resilient electrical systems increases due to extreme weather events.

nVent's operations are significantly influenced by the availability and cost of raw materials like copper, which experienced price volatility in 2023-2024. Resource scarcity and stricter environmental regulations on mining can impact supply chain stability and increase material expenses. To counter this, nVent is implementing initiatives such as reducing single-use plastics, aligning with growing consumer and regulatory pressure for sustainability and demonstrating a commitment to responsible sourcing and waste reduction.

The increasing focus on energy efficiency in buildings, driven by green building standards and regulations, presents a substantial opportunity for nVent. Buildings account for a significant portion of global energy consumption, making nVent's advanced wiring, enclosure, and connection technologies crucial for developing more efficient electrical infrastructure. Their solutions enable lower energy loss in electrical distribution, contributing to reduced operational costs and environmental impact for building owners globally.

nVent Electric is actively responding to heightened investor and regulatory scrutiny on Environmental, Social, and Governance (ESG) factors by enhancing its environmental reporting. The company has demonstrated progress in reducing greenhouse gas emissions intensity, achieving a 12% reduction in Scope 1 and 2 emissions intensity by 2023 compared to a 2019 baseline. These efforts include tracking emissions across scopes, setting science-based reduction targets, and highlighting the sustainability benefits of their product portfolio.

| Environmental Factor | Impact on nVent | Data Point/Trend |

|---|---|---|

| Climate Change Initiatives | Increased demand for energy-efficient and renewable energy solutions. | Global market for climate adaptation solutions projected to reach hundreds of billions by 2030. |

| Raw Material Availability & Cost | Supply chain risks and input cost fluctuations. | Copper prices showed volatility in 2023-2024 due to global supply/demand dynamics. |

| Waste Management & Circular Economy | Pressure to adopt sustainable product lifecycles and reduce waste. | EU aims for 65% municipal waste recycling by 2025, influencing product design and end-of-life handling. |

| Energy Efficiency in Buildings | Growth opportunity through products supporting green building standards. | Buildings account for nearly 40% of global energy consumption (IEA, 2024). |

| ESG Reporting & Transparency | Need for clear environmental performance data and targets. | nVent reported a 12% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline) by 2023. |

PESTLE Analysis Data Sources

Our nVent Electric PESTLE Analysis draws from a robust mix of official government publications, leading economic forecasts, and reputable industry research. We meticulously gather information on regulatory changes, market dynamics, technological advancements, and socio-economic trends to provide a comprehensive overview.