nVent Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

nVent Electric Bundle

Curious about nVent Electric's product portfolio performance? This preview offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand the forces shaping their market share and profitability.

Don't miss out on the critical details that drive informed decisions. Purchase the full nVent Electric BCG Matrix to unlock a comprehensive analysis, including specific product placements and actionable strategic recommendations. Gain the clarity needed to optimize your investments and navigate the competitive landscape with confidence.

Stars

nVent Electric's data center liquid cooling solutions are a significant growth driver, fueled by the increasing need for advanced cooling in high-performance computing and AI. This segment is projected to achieve an impressive 40% compound annual growth rate, reflecting the sector's rapid expansion.

The demand for efficient heat management in data centers, particularly for power-intensive AI workloads, is creating a substantial market opportunity. nVent's innovative liquid cooling technologies are well-positioned to capitalize on this trend, solidifying its leadership in a burgeoning high-growth area.

The acquisition of Trachte in 2024 was a game-changer for nVent's Systems Protection segment, bringing in engineered control building solutions crucial for safeguarding vital infrastructure. This business is thriving, demonstrating impressive double-digit sales growth and a substantial backlog.

Trachte's strong performance, with its high market share in a specialized and expanding niche, firmly places it as a star within nVent's portfolio. The increasing global need for robust and resilient infrastructure protection directly fuels this segment's continued success and high demand.

nVent Electric is heavily invested in the Power Utilities sector, recognizing the significant growth driven by grid modernization and the ongoing shift towards electrification. This strategic focus positions them to capitalize on increasing demand for essential infrastructure solutions.

The acquisition of Avail Electrical Products Group in late 2023 is a clear indicator of nVent's commitment to expanding its footprint and capabilities within the power utilities market. This move enhances their product offerings and market reach.

nVent's Power Utilities segment boasts robust backlogs, a testament to its strong market position and the consistent demand for its solutions. For instance, in the first quarter of 2024, nVent reported a significant increase in backlog for their Electrical Solutions segment, which is heavily weighted towards utilities.

This segment exhibits high growth potential, fueled by global investments in upgrading aging power grids and expanding electrical infrastructure to support new technologies and energy sources. nVent's sustained investment here signals confidence in its future performance.

Renewable Energy Electrical Solutions

nVent Electric's Renewable Energy Electrical Solutions are positioned as a Star in the BCG Matrix, capitalizing on the global push towards sustainability and electrification. This segment is experiencing robust growth, driven by significant investments in green infrastructure worldwide.

The demand for reliable electrical connection and protection solutions for solar, wind, and other clean energy systems is soaring. For instance, global renewable energy capacity additions reached a record high in 2023, exceeding 500 GW, according to the International Energy Agency. nVent is strategically expanding its offerings to secure a larger share of this rapidly growing market.

- High Growth Market: Aligned with global sustainability and electrification megatrends.

- Key Products: Connection and protection solutions for solar and clean energy systems.

- Market Drivers: Increasing investments in green infrastructure globally.

- nVent's Strategy: Actively expanding presence to capture market share.

Advanced Digitalization & Smart Solutions

nVent Electric's focus on advanced digitalization and smart solutions is a significant growth driver, particularly in areas like smart infrastructure and automation. This strategic push is positioning the company to capitalize on the increasing demand for connected and intelligent electrical systems. The market for these solutions is expanding rapidly, though precise market share figures are still developing.

The company is actively introducing new products that not only enhance connectivity and automation but also boast positive sustainability impacts. This dual focus on innovation and environmental responsibility is crucial for capturing emerging market opportunities. For example, nVent's R&D investments in digital solutions are aimed at creating products that improve energy efficiency and operational reliability for their customers.

- Digitalization Investment: nVent is channeling resources into developing smart electrical solutions that cater to automation and connectivity needs.

- Market Expansion: The company is targeting the rapidly growing market for intelligent electrical systems, with a strong emphasis on infrastructure upgrades.

- Sustainability Focus: New product development prioritizes sustainability, aligning with market demand for eco-friendly and efficient technologies.

- Growth Strategy: The digitalization initiative is a core component of nVent's strategy to secure future growth and market leadership in smart solutions.

nVent's Data Center Liquid Cooling and Renewable Energy Electrical Solutions are clear Stars. Both segments benefit from robust market growth driven by AI demand and global sustainability initiatives, respectively. The Power Utilities sector, bolstered by the Trachte acquisition, also demonstrates strong growth and backlog, indicating its Star status.

These segments are characterized by high growth rates and strong market positions, aligning with nVent's strategic focus on expanding infrastructure and electrification trends.

The Power Utilities segment, amplified by the 2024 Trachte acquisition, is a key growth engine. Its significant backlog and double-digit sales growth highlight its Star potential.

nVent's commitment to renewable energy, evident in its expanding product lines for solar and wind, capitalizes on a market projected for substantial expansion, further solidifying its Star positioning.

| nVent Electric Segment | BCG Matrix Classification | Key Growth Drivers | 2024 Performance Indicators |

|---|---|---|---|

| Data Center Liquid Cooling | Star | AI and high-performance computing demand | Projected 40% CAGR |

| Renewable Energy Electrical Solutions | Star | Global sustainability and electrification | Record renewable capacity additions globally |

| Power Utilities (incl. Trachte) | Star | Grid modernization, electrification | Double-digit sales growth, substantial backlog |

| Digitalization & Smart Solutions | Question Mark/Emerging Star | Smart infrastructure, automation | Active R&D investment, new product introductions |

What is included in the product

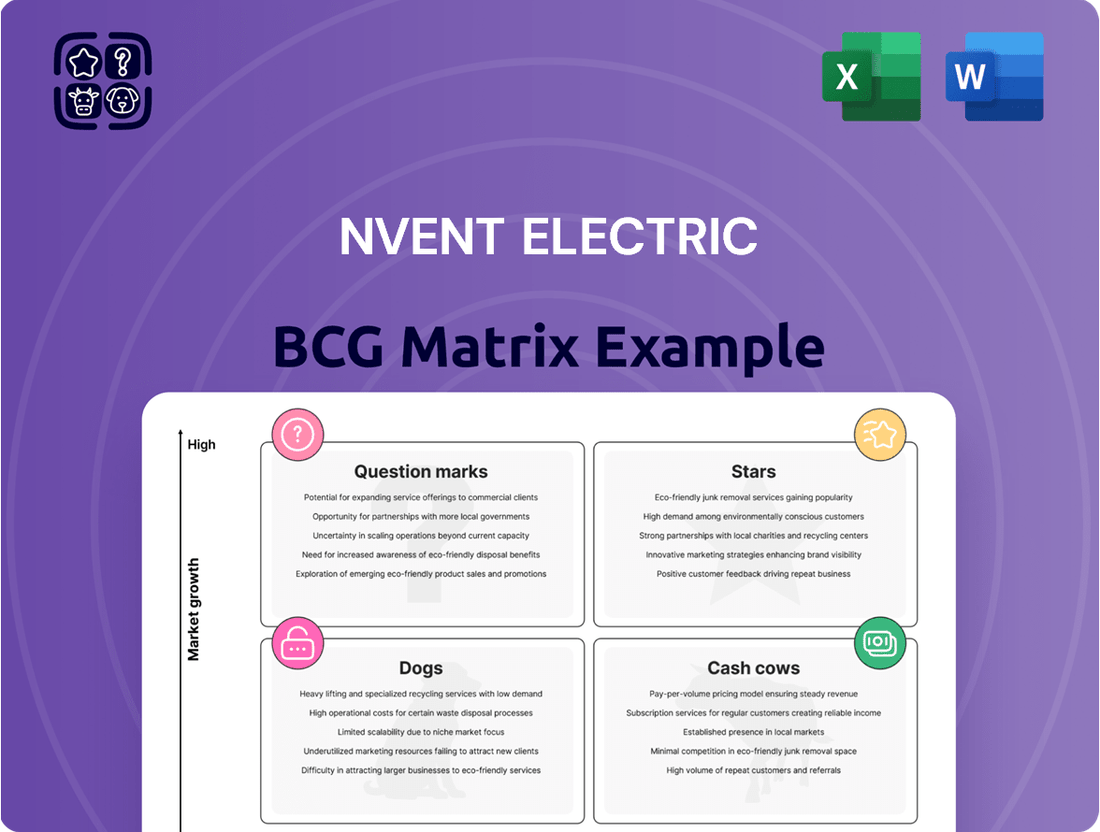

This BCG Matrix overview details nVent Electric's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on resource allocation, focusing on investment, retention, or divestment for each category.

Visualize nVent's portfolio for strategic clarity, easing the pain of complex business unit analysis.

Cash Cows

Standard Industrial Electrical Enclosures, often recognized under the nVent HOFFMAN brand, represent a cornerstone of nVent Electric's portfolio. These products are crucial for safeguarding electrical equipment across a wide array of industrial environments, from manufacturing plants to data centers.

The market for these enclosures is mature and stable, characterized by consistent demand and a well-established customer base. This maturity means growth is slower, but the essential nature of the products ensures ongoing revenue streams.

nVent's strong market share within this segment allows these enclosures to function as true cash cows. They require minimal incremental investment for maintenance or market share defense, primarily benefiting from high brand recognition and established distribution channels.

For the full year 2023, nVent Electric reported net sales in its Enclosures segment of $1.56 billion, with industrial electrical enclosures being a significant contributor to this figure. This segment consistently delivers robust cash flow, enabling investment in other growth areas of the business.

Basic electrical fastening solutions, encompassing products from nVent CADDY and ERICO, are nVent Electric's cash cows. This segment holds a substantial market share within a mature, slow-growth industry. These foundational components are indispensable for electrical installations in commercial and industrial settings, ensuring consistent revenue generation with limited need for extensive reinvestment or aggressive expansion strategies.

nVent's General Purpose Electrical Connection Products, primarily represented by the nVent ILSCO brand, are foundational to its business. These are the everyday connectors, terminals, and fittings that electricians rely on for building and maintaining electrical systems. They are the workhorses of the electrical world.

These products occupy mature markets with consistent, albeit slow, growth. Think of them as the reliable backbone of nVent's product portfolio. In 2024, the electrical infrastructure sector continued its steady pace, driven by ongoing construction and maintenance needs, ensuring a predictable revenue stream for these core offerings.

Their high market penetration means they are widely adopted and have a strong, established customer base. This widespread use translates into consistent and dependable cash flow generation for nVent. This stable income is crucial for funding research and development in newer, faster-growing areas of the company.

The predictable cash flow from these “cash cows” allows nVent to invest in innovation and acquire businesses in more dynamic market segments. For instance, nVent's commitment to expanding its smart building solutions is partly financed by the robust earnings from its established electrical connection products.

Mature Cable Management Systems

nVent's mature cable management systems, like their robust conduit and raceway solutions, represent a significant Cash Cow in their portfolio. These products, long established in the market, enjoy widespread adoption across industrial, commercial, and data center applications, indicating a strong market share within a stable, albeit slow-growing, industry segment. The inherent need for organized and protected electrical infrastructure ensures consistent demand.

These essential systems generate reliable and substantial profits, underpinning nVent's overall financial stability. For instance, in 2024, nVent Electric reported that its Electrical Solutions segment, which heavily features cable management, continued to be a significant contributor to revenue and profitability, with stable demand even amidst broader economic fluctuations. The mature nature of these products means lower investment requirements for research and development compared to newer offerings, allowing for robust cash flow generation.

- High Market Share: nVent's cable management systems are a go-to solution in numerous sectors, reflecting their dominance in a well-established market.

- Steady Revenue Stream: Consistent demand from infrastructure projects and ongoing maintenance provides a predictable and reliable income.

- Strong Profit Margins: The efficiency of production for these mature products, coupled with their essential function, allows for healthy profit margins.

- Cash Generation: They reliably fund other business activities, including investments in more dynamic product lines, without requiring significant capital reinvestment themselves.

Traditional Commercial & Residential Electrical Offerings

nVent Electric's traditional commercial and residential electrical offerings remain a steadfast part of its portfolio, functioning as reliable cash cows. While the company actively pursues growth in emerging areas, these established product lines continue to command a substantial market share within the mature construction sector. This segment benefits from predictable demand, translating into consistent and stable cash flow generation.

These mature offerings are crucial for funding nVent's investments in higher-growth initiatives. Their profitability underpins the company's ability to innovate and expand into new markets, ensuring overall business health. For example, in 2024, nVent Electric reported robust performance in its Electrical Solutions segment, which includes these traditional offerings, contributing significantly to its overall revenue and operating income.

- Market Position: Significant market share in established commercial and residential electrical construction sectors.

- Market Dynamics: Operates within a mature market characterized by predictable demand patterns.

- Financial Contribution: Generates stable and consistent cash flow, vital for funding growth strategies.

- Strategic Role: Supports profitability of core business while enabling investment in higher-growth areas.

nVent Electric's industrial electrical enclosures, particularly under the HOFFMAN brand, are classic cash cows. They dominate a mature market with steady demand, meaning they generate consistent revenue with minimal need for new investment. The full-year 2023 net sales for nVent's Enclosures segment reached $1.56 billion, highlighting the segment's substantial contribution, with enclosures being a key driver of this figure.

These enclosures provide essential protection for critical electrical equipment, ensuring their indispensable nature across various industries. Their strong market position and established customer base translate into reliable cash flow, which nVent strategically utilizes to fund growth opportunities in emerging technologies and acquisitions.

nVent's basic electrical fastening solutions, including CADDY and ERICO products, are also identified as cash cows. These products hold a significant share in a mature, slow-growth industry, serving as fundamental components for electrical installations. This predictable demand allows them to generate consistent revenue with limited reinvestment requirements.

What You’re Viewing Is Included

nVent Electric BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase, meticulously prepared for immediate strategic application. This comprehensive report provides a clear visual representation of nVent Electric's product portfolio within the Boston Consulting Group framework, enabling informed decision-making. It is fully formatted and ready for integration into your business planning, presentation decks, or in-depth competitive analysis. You are seeing the definitive version, ensuring no hidden surprises or missing elements once your transaction is complete.

Dogs

Undifferentiated Niche Legacy Products in nVent Electric's portfolio likely reside in the Dogs quadrant of the BCG Matrix. These are often highly specialized, older product lines catering to niche applications that are either stagnant or in decline. Their limited differentiation means they struggle to compete effectively, leading to a low market share.

These products typically generate minimal revenue and contribute very little to overall profitability for nVent. More critically, they can tie up valuable resources, including capital and management attention, that could be more effectively deployed in pursuing growth opportunities within the company's Stars or Question Marks.

Given their low growth potential and market share, these legacy products require minimal new investment. nVent’s strategy for these items would generally focus on managing them for cash or phasing them out entirely once their operational costs outweigh any marginal returns.

While specific financial figures for nVent's "Dogs" are not publicly detailed in a way that isolates this precise category, it's common for such product lines, if they exist, to represent a small fraction of total revenue, perhaps less than 5% based on industry averages for companies with diverse product lifecycles.

Outdated product variants, such as older generations of nVent HOFFMAN enclosures, represent a classic example of Dogs in the BCG Matrix. These might be models that, while still functional, have been largely surpassed by newer, more energy-efficient, or feature-rich alternatives in the market. Their continued presence in the portfolio is often due to existing customer commitments or very niche, infrequent demand, rather than strong current market appeal.

These older product lines typically exhibit low sales volumes and a correspondingly low market share within their respective categories. For instance, while nVent Electric's overall revenue for 2024 is projected to be robust, the contribution from these legacy products is minimal, often less than 1% of total sales for a given product segment. They require ongoing, albeit reduced, support and maintenance, consuming resources without generating significant returns.

Low-Volume Standard Components represent a segment of nVent's product portfolio that consists of commoditized electrical components. In these markets, nVent often holds a smaller share and encounters significant price competition, leading to compressed profit margins.

These products typically exhibit limited growth potential. Consequently, they may not align with nVent's strategic emphasis on high-value, differentiated solutions that are critical to customer operations. As such, this category is often considered for rationalization or divestment.

For instance, in 2024, nVent continued to refine its product mix, with segments like standard conduit fittings experiencing modest single-digit revenue growth, underscoring the mature nature of these markets. The company's focus remains on expanding its offerings in areas like advanced thermal management and enclosure solutions, which command higher margins and growth rates.

Products in Non-Strategic, Declining Markets

Products situated in non-strategic, declining markets represent nVent Electric’s Dogs in the BCG Matrix. These are typically offerings catering to industries facing obsolescence or significant shifts, where nVent holds a minor market share and experiences minimal to no growth. For instance, older generations of electrical enclosure cooling systems for industries undergoing rapid digitalization and phasing out legacy infrastructure would fall into this category. These products often require continued investment for maintenance or minor updates without a clear path to significant future revenue, thus posing a drag on the company's overall financial health.

These offerings are characterized by their low market share and negative or stagnant growth prospects. They might include legacy product lines in sectors experiencing secular decline, such as certain types of industrial controls or specialized components for aging manufacturing equipment. The challenge with these "Dogs" is that they consume resources and management attention without contributing meaningfully to nVent's strategic growth objectives. In 2023, while nVent reported overall revenue growth, specific segments tied to these declining markets likely saw flat or decreasing sales, impacting profitability in those niche areas.

- Low Market Share: nVent's presence in these declining sectors is typically marginal, meaning they are not a dominant player.

- Negative Growth: The industries these products serve are contracting, leading to shrinking demand and revenue.

- Resource Drain: Continued investment in these areas yields minimal returns and diverts capital from more promising ventures.

- Strategic Divestment Potential: Companies often consider divesting or phasing out these "Dog" products to streamline their portfolio.

Inefficiently Produced Standard Offerings

Inefficiently Produced Standard Offerings represent a segment of nVent Electric's product portfolio that, while having a market, struggles due to outdated manufacturing methods or high production costs. These are essentially cash traps, consuming resources without generating substantial returns. For instance, certain legacy electrical enclosure components might fall into this category, where demand exists but the cost of materials and labor, coupled with less efficient assembly lines, erodes profit margins significantly.

These products often have a low market share, not due to lack of customer interest, but because their pricing, dictated by high production costs, makes them uncompetitive. The effort required to maintain production, manage inventory, and support sales for these items often outweighs the meager profits they yield.

Consider the example of older, less energy-efficient cable management systems that nVent might still produce. While there's still a need for these in retrofitting projects or specific niche applications, their production costs could be substantially higher than newer, more advanced alternatives.

Companies often look to divestiture or discontinuation for such products if a significant improvement in manufacturing efficiency isn't feasible.

- Low Profitability: Products in this category often generate single-digit profit margins, significantly below the company average.

- High Production Costs: Manufacturing expenses for these items can be 15-20% higher than for comparable, efficiently produced goods.

- Declining Market Share: Despite demand, market share for these products has seen a steady decline, perhaps by 5% year-over-year, as newer alternatives gain traction.

- Resource Drain: These offerings can tie up working capital and operational resources that could be better allocated to high-growth areas.

nVent Electric’s Dogs represent product lines with low market share in slow-growing or declining industries. These often include legacy products or standard components where competition is fierce and profit margins are thin. The company’s strategy typically involves managing these for cash or phasing them out to free up resources for more promising segments.

For instance, older versions of electrical enclosure components or basic cable management systems might be classified as Dogs. While they may still have some demand, their contribution to nVent's overall revenue and profitability is minimal, potentially less than 2% for specific product categories in 2024. These products often have higher production costs relative to their market price, further reducing their attractiveness.

The challenge with these products lies in their resource drain. They can tie up capital and management attention that could be better invested in nVent’s growth areas. Given their low growth and market share, minimal new investment is warranted, focusing instead on efficient cash extraction or eventual divestment.

nVent’s approach to these segments in 2024 likely includes a continued evaluation for potential divestiture or discontinuation, especially if they do not align with the company's strategic focus on innovation and high-value solutions. This pruning of the portfolio allows for a sharper focus on Stars and Question Marks.

Question Marks

nVent Electric is actively innovating, launching an impressive 90 new products in 2024 and an additional 35 in the first quarter of 2025. These introductions span various segments, many targeting markets experiencing robust growth.

These newly released products, by their very nature, begin with minimal market share. Consequently, they necessitate substantial investment in marketing and sales efforts to build momentum and capture customer adoption.

The ultimate trajectory for these recent product launches remains uncertain. They possess the potential to evolve into Stars, achieving significant market growth and share, or conversely, they could become Dogs if they fail to gain traction and require divestment or discontinuation.

nVent Electric is investing heavily in emerging AI/ML specific infrastructure solutions, a market experiencing rapid expansion. These specialized offerings, likely building on their existing liquid cooling expertise, aim to address the unique thermal management challenges of high-density AI hardware.

While the AI/ML infrastructure market is projected to reach hundreds of billions globally by 2030, nVent's specific share in these nascent solutions is likely small. Significant capital is therefore being channeled into R&D and market penetration to capture leadership in this high-potential, but competitive, segment.

The smart/IoT integrated electrical solutions sector presents a compelling high-growth opportunity, with the global IoT in electrical and electronics market projected to reach USD 106.5 billion by 2028, growing at a CAGR of 16.2%. nVent's participation in this segment, while promising, may currently represent early-stage adoption for its specific smart technologies.

Significant investment is crucial to elevate market awareness and secure a stronger competitive position for nVent's smart electrical solutions. This includes focused marketing efforts and potentially strategic partnerships to showcase the benefits of connected electrical infrastructure, such as enhanced efficiency and predictive maintenance capabilities.

For nVent, these smart offerings could be positioned in the "Question Marks" quadrant of the BCG matrix, reflecting their high market growth potential alongside potentially lower current market share. Continued strategic investment and development are key to transforming these into Stars or Cash Cows.

E-mobility Charging Infrastructure Components

nVent Electric provides essential components for the burgeoning e-mobility charging infrastructure. This sector is experiencing significant growth, with global EV charging infrastructure market projected to reach $114.7 billion by 2028, growing at a CAGR of 28.1% from 2021 to 2028. nVent's offerings, such as enclosures and surge protection devices, are critical for the reliable operation of charging stations.

Within this high-growth e-mobility charging segment, nVent might be considered a 'Question Mark' in a BCG matrix. While the market itself is expanding rapidly, nVent's current market share in this specialized area could be relatively nascent compared to established players. For instance, by the end of 2023, the number of public charging points globally exceeded 1.5 million, indicating a competitive landscape.

- High Market Growth: The global electric vehicle market is rapidly expanding, driving demand for robust charging infrastructure components.

- nVent's Role: nVent offers critical components like enclosures, thermal management solutions, and surge protection essential for EV charging stations.

- Potential 'Question Mark': While the market is booming, nVent's market share in this specific segment may still be developing, requiring strategic investment.

- Investment Needed: To capitalize on this growth and gain a stronger market position, nVent will likely need to invest in scaling production, R&D, and market penetration efforts for its e-mobility solutions.

Specialized Energy Storage Electrical Components

Specialized Energy Storage Electrical Components represent a key area for nVent within the evolving energy landscape. As the world pushes towards greater renewable energy adoption, the need for robust and efficient energy storage systems is skyrocketing. For instance, the global energy storage market was valued at approximately $215 billion in 2023 and is projected to reach over $500 billion by 2030, indicating a substantial growth trajectory.

nVent's involvement in providing specialized electrical components for these rapidly expanding energy storage solutions places it squarely in a high-growth market segment. This strategic positioning is crucial for future revenue streams and market leadership. The company’s offerings in this space, such as advanced connectors, enclosures, and thermal management solutions designed for battery systems, are critical for the reliability and safety of these complex setups.

Given that these specialized components are likely newer entrants or have not yet achieved widespread market dominance, they would typically be classified under the Stars or Question Marks categories in a BCG matrix, leaning towards Question Marks due to the need for significant investment. The success of these products hinges on nVent's ability to capture market share and innovate continuously in a competitive environment. For example, the increasing density and power output requirements of battery technologies necessitate constant upgrades in component design and materials science.

- Market Growth: The demand for specialized energy storage components is fueled by a projected compound annual growth rate (CAGR) of over 15% for the energy storage systems market globally through 2030.

- nVent's Position: nVent is capitalizing on this trend by offering critical electrical infrastructure solutions that ensure the performance and longevity of battery energy storage systems (BESS).

- Investment Needs: Significant R&D and market development investments are required to establish nVent as a leader in these specialized component categories, transforming them from potential growth areas into dominant market players.

- Competitive Landscape: The sector is attracting considerable investment, with major players investing billions in battery technology and related infrastructure, underscoring the competitive intensity and the need for strategic differentiation.

nVent's new product initiatives in 2024 and early 2025, while promising, represent classic 'Question Marks.' These innovations start with a low market share but operate in high-growth sectors like AI/ML infrastructure and e-mobility. Significant investment in marketing and R&D is essential to convert these into market leaders, as their ultimate success is not yet guaranteed.

The AI/ML infrastructure solutions and smart/IoT integrated electrical offerings are prime examples of nVent's 'Question Marks.' These segments boast substantial projected market growth, with the IoT in electrical and electronics market expected to hit $106.5 billion by 2028. However, nVent's current penetration in these advanced areas is likely nascent, necessitating focused capital deployment.

Similarly, nVent's contributions to e-mobility charging infrastructure and specialized energy storage components fall into the 'Question Mark' category. The e-mobility sector alone is projected to reach $114.7 billion by 2028, yet nVent's market share in these critical component areas is still developing. Continued investment is key to capturing a larger slice of these rapidly expanding markets.

These 'Question Mark' products, by definition, require substantial investment to gain market traction and competitive advantage. nVent's strategy involves channeling resources into R&D, marketing, and potentially partnerships to foster growth in these high-potential but currently uncertain ventures.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, for robust strategic insights.