nVent Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

nVent Electric Bundle

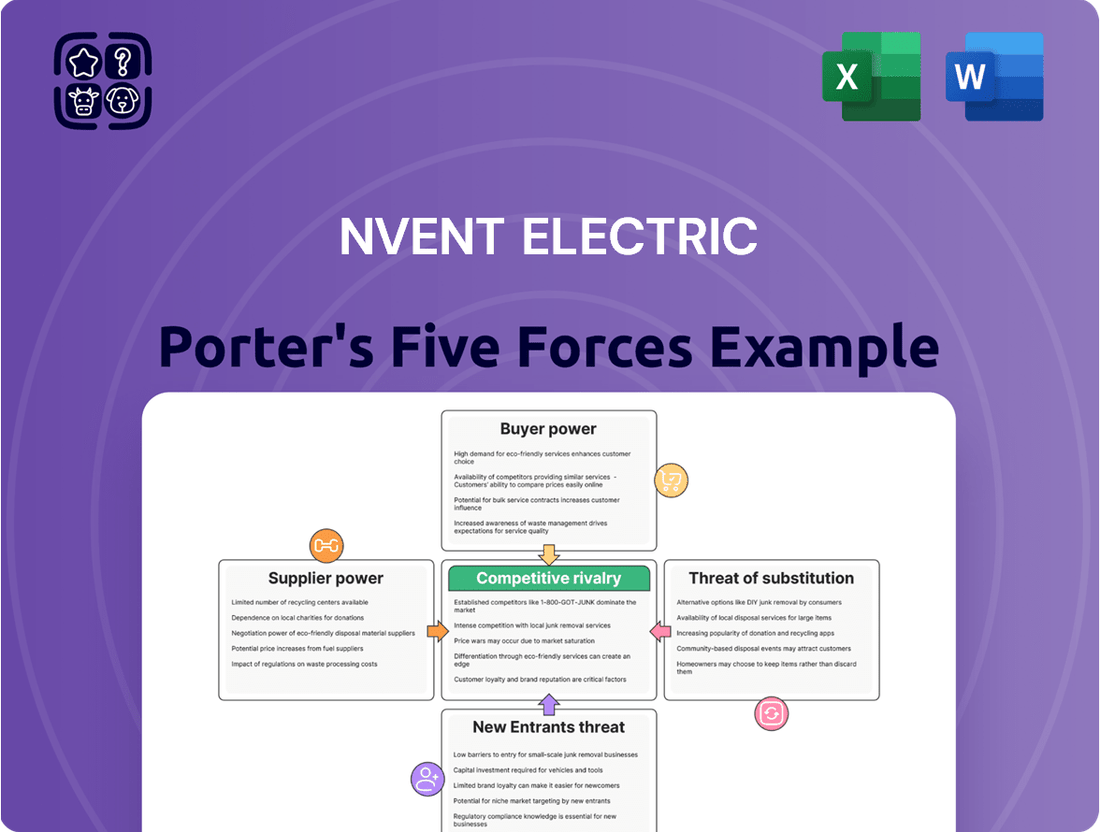

nVent Electric operates within a dynamic industrial landscape where supplier power, buyer bargaining, and the threat of substitutes significantly shape its market. Understanding the intensity of rivalry among existing competitors and the constant pressure from potential new entrants is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore nVent Electric’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration for nVent Electric can significantly influence their bargaining power. When only a few suppliers can provide essential, highly specialized components or raw materials, like advanced insulation or specific metal alloys for enclosures, their leverage increases. This is particularly true for proprietary technologies where nVent has limited alternative sources.

The complexity of the global electrical equipment supply chain means that disruptions can shift power towards suppliers of critical materials. For instance, in 2024, ongoing geopolitical tensions and localized labor shortages in certain regions impacted the availability and cost of key electronic components, granting more negotiating power to those suppliers who could consistently deliver.

Switching costs for nVent can be substantial, particularly when suppliers offer highly integrated or custom-designed components. If nVent needs to re-tool its own manufacturing processes or undergo extensive re-qualification for new parts, the expense and potential disruption can significantly increase the bargaining power of those suppliers. This would make it costly and time-consuming for nVent to change its supply base, potentially leading to higher input prices or less favorable contract terms.

For instance, if a key supplier's components are deeply embedded in nVent's product designs, the cost and complexity of finding and integrating an alternative could be prohibitive. This integration risk is a major factor influencing supplier leverage. Conversely, for more standardized or commoditized inputs, nVent likely faces lower switching costs, which in turn diminishes the bargaining power of those suppliers.

The availability of substitute inputs significantly impacts nVent Electric's bargaining power. When nVent can easily switch to alternative suppliers or materials for its components, its leverage over existing suppliers increases. This is because suppliers face competition not just from each other, but also from the availability of alternatives for nVent.

Conversely, if the inputs nVent requires are highly specialized, proprietary, or have a limited global supply, the suppliers of these inputs hold greater power. This situation can force nVent to accept less favorable terms, potentially impacting its cost structure and profitability. For instance, the electrical equipment sector has experienced periodic shortages of key materials, highlighting instances where substitutes were scarce, thereby strengthening supplier bargaining power.

In 2024, the ongoing geopolitical landscape and disruptions to global supply chains continued to affect the availability of certain raw materials essential for electrical equipment manufacturing. Companies like nVent have had to actively manage relationships with suppliers and explore dual-sourcing strategies to mitigate the risks associated with limited substitutes and potential price hikes.

Importance of Input to nVent's Product

Suppliers wield significant bargaining power when their products are crucial to nVent’s high-value offerings. This is evident in nVent’s specialized liquid cooling systems for data centers, where the performance of cooling components directly impacts the reliability and efficiency of the entire system. Similarly, suppliers of advanced protection systems for critical infrastructure, such as substations or renewable energy facilities, gain leverage due to the mission-critical nature of these applications.

The growing demand across various sectors amplifies supplier influence. For instance, the surge in electronics and automotive industries necessitates sophisticated cooling technologies, thereby empowering the suppliers of these specialized components. In 2023, the global data center cooling market was valued at approximately $11.5 billion and is projected to grow, indicating a strong market for nVent's cooling solutions and, consequently, for their suppliers.

- Critical Components: Suppliers of specialized cooling or protection technologies become more powerful when these inputs are indispensable for nVent’s premium product lines.

- Market Trends: Rising demand for advanced cooling in sectors like automotive and electronics enhances the bargaining position of technology providers.

- Industry Growth: The expanding data center market, valued in the billions, underscores the importance of reliable cooling solutions and the suppliers who provide them.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into nVent Electric's market is typically low. This is because nVent serves a wide array of complex industries, each with unique needs and established distribution channels. For instance, nVent's diverse product lines, including enclosures, electrical components, and thermal management solutions, cater to sectors ranging from industrial automation to data centers.

Forward integration by a supplier would necessitate substantial investment and a significant shift in business strategy. A component manufacturer would need to develop nVent's extensive product breadth, build sophisticated sales and support networks, and manage relationships across multiple, often specialized, end markets. For example, a supplier specializing in a single type of connector would struggle to replicate nVent's comprehensive offering, which includes everything from power distribution units to advanced thermal solutions.

While some suppliers might offer more integrated solutions or custom assemblies, these rarely represent a direct threat to nVent's core business. These offerings typically target niche applications and lack the scale and scope of nVent's established market presence. nVent's ability to provide a complete package of electrical and fastening solutions, supported by strong customer relationships and a global distribution footprint, makes it a formidable competitor.

Consider nVent's 2023 revenue of approximately $3.3 billion. This scale highlights the considerable barrier to entry for any supplier attempting to match its market penetration and product diversity through forward integration.

- Low Threat: Suppliers face high barriers to entry due to nVent's diverse end markets and complex distribution needs.

- Investment Required: Forward integration demands significant capital for product development, sales, and customer support.

- Business Model Shift: Suppliers would need to transition from component manufacturing to a broad-based solutions provider.

- nVent's Scale: nVent's substantial revenue, over $3 billion annually, underscores the difficulty for suppliers to compete directly.

Suppliers of critical, specialized components for nVent Electric, particularly those tied to advanced cooling or protection systems, hold significant bargaining power. This leverage is amplified when these inputs are indispensable for nVent's high-value product lines, such as solutions for data centers or critical infrastructure. The rising demand in sectors like automotive and electronics further empowers these technology providers.

The bargaining power of nVent's suppliers is influenced by factors like supplier concentration, switching costs, and the availability of substitutes. When nVent faces limited alternative sources for proprietary or highly integrated components, suppliers gain considerable leverage. For example, in 2024, geopolitical tensions and localized labor shortages impacted the availability of key electronic components, strengthening the hand of suppliers who could ensure consistent delivery.

The threat of suppliers integrating forward into nVent's market is low due to the company's diverse end markets and complex distribution needs. A supplier attempting forward integration would face substantial investment hurdles in replicating nVent's broad product portfolio, sales networks, and customer relationships. nVent's 2023 revenue of approximately $3.3 billion highlights the significant barriers to entry for such a move.

| Factor | Impact on Supplier Bargaining Power | Example for nVent Electric |

| Supplier Concentration | High when few suppliers offer specialized inputs | Suppliers of proprietary cooling technologies for data centers |

| Switching Costs | High when components are deeply integrated or require re-tooling | Custom-designed enclosures with embedded electronics |

| Availability of Substitutes | Low when inputs are specialized or have limited global supply | Key materials for advanced surge protection systems |

| Importance of Input | High when input is critical to nVent's high-value offerings | Performance-critical components for thermal management solutions |

| Forward Integration Threat | Low due to nVent's scale and market diversity | Component manufacturers attempting to offer nVent's full product range |

What is included in the product

nVent Electric's Five Forces Analysis dissects the competitive intensity within its electrical enclosure, connection, and thermal management markets. It examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly visualize competitive threats and opportunities with a dynamic, interactive Porter's Five Forces model for nVent Electric.

Customers Bargaining Power

nVent Electric caters to a broad spectrum of industries, including commercial, industrial, infrastructure, and energy. This diversification generally dilutes the bargaining power of any single customer, as no one client represents an overwhelming portion of nVent's total sales. For instance, in 2023, nVent reported total sales of approximately $3.1 billion, with its diverse end markets contributing to this revenue.

However, the potential for significant customer leverage exists with large-scale infrastructure projects or major industrial clients. These entities often procure goods in substantial volumes, granting them considerable sway in price negotiations and contract terms. Such high-volume purchasers can more easily threaten to switch suppliers or demand concessions, thereby increasing their bargaining power.

Customers of nVent Electric often face significant switching costs when considering alternative suppliers for their electrical connection and protection needs. These costs arise because nVent's products are typically integrated into complex, mission-critical systems where reliability and performance are non-negotiable. For instance, a data center or a heavy industrial facility cannot afford disruptions caused by untested or incompatible components, making the initial investment in a trusted supplier like nVent a long-term commitment.

The high stakes involved in maintaining operational continuity and regulatory compliance mean that customers are generally reluctant to frequently change their electrical component providers. This reluctance stems from the potential for compatibility issues, the need for extensive re-testing and certification processes, and the risk of unforeseen performance degradation. In 2024, industries like renewable energy and advanced manufacturing, where nVent has a strong presence, are prioritizing system stability, further solidifying customer loyalty and diminishing their immediate bargaining power through a reduced propensity to switch.

The availability of substitute electrical protection and connection solutions significantly bolsters customer bargaining power. Customers can readily explore offerings from direct competitors like Legrand or Schneider Electric, particularly for more commoditized products, forcing nVent to remain competitive on price and features.

In 2024, the electrical equipment market saw continued robust demand, yet the presence of numerous suppliers meant customers had a wide array of choices. For instance, in the enclosure market, while nVent is a leader, alternative solutions exist that can meet basic protection needs, thereby limiting nVent's pricing flexibility.

Customer Price Sensitivity

Customer price sensitivity significantly impacts nVent Electric's bargaining power of customers, varying across its diverse end markets. In competitive commercial and industrial segments, price often plays a crucial role, thereby enhancing customer leverage. For instance, in markets where multiple suppliers offer comparable products, customers are more likely to switch based on price alone. This can put pressure on nVent to maintain competitive pricing strategies to retain market share.

Conversely, in critical infrastructure and data center solutions, the emphasis shifts from price to reliability and performance. Here, the high cost of failure or downtime makes customers prioritize robust solutions over minor price concessions. This means that for these specific applications, nVent's customers have less bargaining power related to price, as their decision-making is driven by other critical factors. nVent's ability to deliver on these performance metrics allows it to command higher prices and reduces the direct price-based bargaining power of these customers.

- Price Sensitivity in Industrial Markets: Customers in general industrial applications may exhibit higher price sensitivity due to readily available alternatives.

- Performance-Driven Data Centers: In data center markets, the cost of system failure often outweighs price differences, reducing customer price sensitivity.

- Critical Infrastructure Needs: For solutions supporting essential services, reliability and uptime are paramount, limiting price-based negotiations.

- nVent's Value Proposition: nVent leverages its reputation for quality and performance in certain segments to mitigate direct price competition.

Customer's Threat of Backward Integration

The threat of nVent Electric's customers integrating backward to produce their own electrical connection and protection solutions is generally low. This is primarily due to the significant capital investment, specialized manufacturing expertise, and rigorous regulatory compliance required. Most of nVent's diverse customer base, which includes electrical contractors, industrial manufacturers, and data center operators, are unlikely to possess or prioritize these capabilities. For example, developing the intricate processes for producing specialized enclosures or connectors demands advanced engineering and a deep understanding of material science, resources typically focused on their core businesses rather than vertical integration into nVent's specialized product lines.

Consider the example of a data center operator; their primary expertise lies in IT infrastructure and data management, not in the precision manufacturing of metal fabrication or plastic injection molding necessary for electrical components. The cost and complexity of establishing such manufacturing facilities, coupled with the need to maintain quality standards and navigate industry certifications, present a significant barrier. In 2024, the global electrical equipment market continues to see consolidation and specialization, reinforcing the advantages of outsourcing these complex manufacturing processes to established players like nVent, rather than attempting in-house production.

This low threat of backward integration is a key strength for nVent, allowing them to maintain pricing power and customer loyalty by offering specialized, high-quality products that are difficult and costly for customers to replicate. nVent's ability to innovate and adapt to evolving electrical standards and technologies further solidifies this position.

- Low Capital Requirement for Customers: Most customers lack the substantial capital needed to establish competing manufacturing operations.

- Specialized Expertise Gap: Customers typically do not possess the manufacturing know-how for complex electrical components.

- Regulatory Hurdles: Navigating industry-specific certifications and compliance is a significant barrier for potential integrators.

- Focus on Core Competencies: Customers prioritize their own business operations over backward integration into electrical product manufacturing.

The bargaining power of nVent Electric's customers is generally moderate, influenced by market segmentation and product type. While broad industry diversification limits individual customer leverage, large-scale projects and high-volume buyers can exert significant pressure on pricing and terms.

Switching costs for customers are often substantial due to the integration of nVent's products into critical systems, fostering loyalty and reducing immediate price-driven negotiation power, especially in sectors prioritizing reliability like data centers in 2024.

The availability of substitutes for commoditized products and varying customer price sensitivity across segments, from industrial applications to critical infrastructure, shape the overall customer bargaining power dynamics for nVent.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024 Context) |

| Customer Diversification | Lowers individual customer power | nVent's 2023 revenue of ~$3.1 billion spread across diverse industries |

| Switching Costs | Lowers customer power | High integration into mission-critical systems, reliability focus in 2024 |

| Availability of Substitutes | Increases customer power for commoditized products | Presence of competitors like Legrand, Schneider Electric |

| Price Sensitivity | Varies by segment; higher in general industrial | Data centers prioritize performance over minor price differences |

| Threat of Backward Integration | Very low | High capital, expertise, and regulatory barriers for customers |

Same Document Delivered

nVent Electric Porter's Five Forces Analysis

This preview showcases the complete nVent Electric Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely what you will receive instantly after purchase, providing a comprehensive understanding of threats and opportunities. You can expect the same professionally formatted and insightful analysis, ready for immediate application without any hidden elements or placeholders. This ensures you get the exact, high-quality strategic information you need to assess nVent Electric's market position and competitive landscape.

Rivalry Among Competitors

The markets where nVent Electric competes, specifically electrical enclosures and thermal management, are showing robust expansion. This growth is fueled by significant global shifts towards automation, increased digitalization across industries, and the ongoing electrification of everything from transportation to infrastructure. These are powerful tailwinds for companies like nVent.

Looking ahead, the electrical enclosure market is anticipated to expand at a compound annual growth rate (CAGR) of 6.78% between 2025 and 2030. Simultaneously, the thermal management market is projected to achieve an even more impressive CAGR of 10.3% from 2025 through 2032. Such healthy growth rates can somewhat temper the intensity of competitive rivalry.

When an industry is growing rapidly, there's often more than enough business for everyone. This means that even with many competitors, the pressure to constantly steal market share from each other might be less severe. The expanding pie provides opportunities for all participants to grow their revenue and operations without necessarily engaging in cutthroat price wars.

The electrical connection and protection market, where nVent Electric operates, is characterized by a moderate level of fragmentation. This means there are a good number of companies vying for market share.

Key players like Schneider Electric SE, ABB Ltd, Emerson Electric Co., Hubbell Inc., and Eaton are well-established giants with broad product portfolios. Their significant scale and resources mean they are formidable competitors for nVent.

Beyond these large entities, nVent also contends with numerous smaller, more specialized companies. These often focus on niche segments or specific geographic regions, adding another layer of competitive pressure. For instance, companies specializing in particular types of enclosures or thermal management solutions can pose a threat in their specific areas.

This blend of large, diversified competitors and smaller, focused players creates a dynamic and often intense competitive environment. The sheer number and variety of companies mean that rivalry is a significant factor influencing nVent's strategic decisions and market positioning.

nVent Electric actively combats competitive rivalry through its robust product differentiation and innovation strategy. In 2024, the company introduced roughly 90 new products, underscoring a commitment to staying ahead of market demands.

This innovation drive is particularly evident in high-growth sectors such as data solutions and liquid cooling, which experienced an impressive approximate 30% growth in 2024. By concentrating on these advanced, high-performance offerings, nVent aims to lessen the pressure of price-driven competition, especially in critical infrastructure markets.

Switching Costs for Customers

Switching from nVent Electric's established electrical connection and protection solutions can be a substantial undertaking for customers. The costs aren't just financial; they often involve intricate system redesigns, rigorous re-certification processes, and the very real threat of operational downtime during the transition. These factors create a significant barrier to entry for competitors looking to lure away nVent's existing client base.

These high switching costs directly impact the competitive rivalry within the industry. They act as a sticky element, making it more challenging for rivals to poach customers who are deeply integrated into nVent's ecosystem. For instance, a company heavily reliant on nVent's specialized grounding solutions might face tens of thousands, if not hundreds of thousands, in costs to re-engineer and re-certify their entire electrical infrastructure with a new provider. This inertia significantly dampens the intensity of direct competition for established accounts.

- High Re-certification Expenses: Many industries require strict electrical system certifications, and switching providers necessitates a costly and time-consuming re-certification process, often costing upwards of $50,000 for complex industrial facilities.

- System Redesign Costs: Adapting existing infrastructure to new, potentially incompatible products can lead to significant engineering and labor expenses, easily reaching six figures depending on the scale of the operation.

- Operational Downtime: The period required for a complete system switch can result in lost production, estimated to cost businesses millions of dollars per day depending on their output.

- Integration Complexity: Ensuring seamless integration with existing control systems and safety protocols adds another layer of complexity and cost, further solidifying customer loyalty to established, proven solutions.

Exit Barriers

nVent Electric faces significant competitive rivalry due to high exit barriers within the electrical equipment sector. The substantial capital required for advanced manufacturing facilities, specialized machinery, and intricate distribution networks makes exiting the market a financially daunting prospect. This locks companies into the industry, even during periods of reduced profitability, thereby intensifying ongoing competition.

These substantial upfront investments, often running into millions of dollars for state-of-the-art production lines, mean that a company like nVent cannot easily pivot away from its core operations. For instance, the specialized tooling and automated assembly lines for their electrical enclosures and thermal management solutions represent assets that are not readily transferable to other industries, effectively raising the cost of departure.

- High Capital Investment: Companies in the electrical equipment industry, including nVent, must invest heavily in sophisticated manufacturing plants and specialized machinery, creating a significant financial hurdle to exit.

- Specialized Equipment: The need for highly specialized equipment tailored to electrical component production means these assets have limited resale value or alternative uses, increasing exit costs.

- Established Distribution Channels: Building and maintaining extensive distribution networks, essential for reaching diverse customer segments, represents another sunk cost that discourages companies from leaving the market.

- Sustained Competitive Intensity: The reluctance to abandon these significant investments, even when facing market challenges, leads to a persistent and often fierce level of competition among existing players.

The competitive rivalry for nVent Electric is substantial, stemming from a fragmented market populated by both large, established players and smaller, specialized firms. nVent's introduction of approximately 90 new products in 2024 highlights its strategy to differentiate through innovation, particularly in fast-growing areas like data solutions and liquid cooling which saw about 30% growth in the same year.

High customer switching costs, driven by re-certification expenses (potentially over $50,000 for industrial facilities) and system redesign needs (easily reaching six figures), act as a significant deterrent for rivals attempting to poach nVent's existing client base, thereby dampening direct competition for established accounts.

Furthermore, high exit barriers, including millions in capital investment for specialized manufacturing and distribution networks, keep companies invested in the sector, ensuring sustained and often intense competition among existing players.

SSubstitutes Threaten

The threat of substitutes for nVent Electric's offerings, primarily electrical connection and protection solutions, is generally considered moderate. While there aren't many direct one-to-one replacements for the core functions nVent provides, emerging technologies could disrupt certain market segments. For example, advancements in wireless power transmission, although still developing for widespread industrial use, could eventually lessen the demand for traditional wired connections in some scenarios.

Furthermore, the increasing integration and miniaturization of electronic components might reduce the need for bulky, standalone enclosures in certain niche applications. However, the critical need for robust electrical safety, reliable connections, and environmental protection in harsh or demanding industrial environments remains a strong barrier to widespread substitution. nVent's significant investment in R&D, evident in their focus on innovative solutions like their enhanced thermal management products, aims to stay ahead of potential disruptive technologies.

The threat of substitutes for nVent Electric is moderate, largely due to the critical nature of its applications. If alternative solutions offer similar or better performance at a lower price point, this threat intensifies. However, in nVent's core markets like industrial, infrastructure, and data centers, the cost associated with system failure is exceptionally high. This often leads customers to prioritize proven reliability and certified performance over less expensive, unproven substitutes, thereby mitigating the immediate impact of price-performance trade-offs.

Customer propensity to substitute is a key factor for nVent Electric. This is shaped by how aware customers are of other options, how risky they feel switching is, and any rules they must follow. For instance, in critical sectors like energy and industrial applications, strict safety standards and certifications often make it hard to adopt new, untested alternatives, which keeps the threat of substitutes lower for nVent.

Technological Advancements

Rapid technological advancements present a significant threat of substitutes for nVent Electric. Innovations in smart grid technology, for instance, are creating new ways to manage and distribute electricity, potentially bypassing or reducing the reliance on nVent's traditional electrical infrastructure components. Consider the growing adoption of distributed energy resources (DERs) like solar panels and battery storage, which fundamentally alter grid architecture and the demand for certain nVent products.

Furthermore, the development of advanced materials with superior conductivity, insulation, or durability could offer alternative solutions that outperform or are more cost-effective than current offerings. Imagine new composite materials that can replace traditional metal components in high-voltage applications, offering lighter weight and improved performance. This is a trend that has seen significant investment, with the global advanced materials market projected to reach over $130 billion by 2024.

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is also fostering substitutes. AI-driven predictive maintenance systems, coupled with advanced sensors, can anticipate equipment failures and optimize performance, potentially reducing the need for reactive replacements or certain types of monitoring equipment that nVent currently provides. For example, embedded thermal management systems using AI could proactively address heat issues, diminishing the demand for some traditional thermal management solutions.

- Smart Grid Integration: New grid architectures may reduce reliance on traditional copper conductors and switchgear.

- Advanced Materials: Lightweight, high-performance composites could replace metal components in electrical transmission.

- AI and IoT Solutions: Predictive maintenance platforms can act as substitutes for traditional diagnostic and monitoring equipment.

- Energy Efficiency Innovations: Novel energy-saving technologies might decrease the overall demand for power distribution components.

Regulatory and Safety Standards

Strict regulatory and safety standards in the electrical and industrial sectors significantly limit the threat of substitutes for nVent Electric. New products entering the market must meet rigorous compliance requirements, acting as a substantial hurdle for uncertified alternatives.

nVent's commitment to adhering to stringent standards, such as NEMA and IP ratings, underscores the reliability and safety of its offerings. These certifications are crucial for market acceptance, making it challenging for substitutes lacking such credentials to compete effectively.

- Compliance Barrier: For example, UL certification, a common benchmark in North America, requires extensive testing and adherence to specific safety protocols, which substitutes must also pass to be considered viable alternatives.

- Market Acceptance: Industries like data centers and hazardous locations demand products with proven safety records, often mandated by regulations, inherently favoring established, certified players like nVent.

- Product Differentiation: nVent's ability to meet and exceed these standards provides a distinct advantage, as substitutes struggle to achieve the same level of trust and compliance necessary for widespread adoption.

The threat of substitutes for nVent Electric is moderate, influenced by the critical nature of its electrical connection and protection products. While innovative technologies like advanced materials and AI-driven systems offer potential alternatives, the high cost of failure in sectors like industrial and data centers favors proven, certified solutions. For instance, the global market for advanced materials, projected to exceed $130 billion by 2024, highlights the innovation potential that could yield substitutes.

| Factor | Impact on nVent | Supporting Data/Examples |

| Technological Advancements | Moderate to High | Smart grid integration and advanced materials offer potential alternatives. Global advanced materials market projected to exceed $130 billion by 2024. |

| Cost of Switching | Low to Moderate | High cost of system failure in critical industries discourages adoption of unproven substitutes. |

| Customer Propensity to Substitute | Low | Strict safety standards and certifications (e.g., UL) create significant barriers for new entrants. |

| Performance of Substitutes | Varies | Emerging solutions may offer comparable or improved performance, but often lack established reliability. |

Entrants Threaten

The electrical connection and protection industry, a key area for companies like nVent Electric, demands significant upfront capital. This investment is crucial for research and development, establishing state-of-the-art manufacturing facilities, and acquiring specialized machinery essential for producing enclosures, components, and thermal management systems. For instance, building a new, fully automated manufacturing plant for electrical components can easily run into tens of millions of dollars. This substantial financial hurdle makes it difficult for newcomers to enter the market and compete effectively.

Established players like nVent Electric benefit significantly from economies of scale in their operations. This allows them to achieve lower per-unit costs in manufacturing, raw material procurement, and distribution networks, a crucial advantage in the competitive electrical enclosure and connection market.

New entrants would face a substantial hurdle in matching these cost efficiencies. Without the established volume and years of operational experience, they would likely struggle to secure favorable pricing from suppliers or optimize their supply chains, placing them at an immediate disadvantage compared to nVent.

For instance, in 2023, nVent reported a revenue of $3.3 billion, indicating a substantial operational footprint that underpins their economies of scale. A new entrant would need to invest heavily to reach comparable production volumes and thereby begin to offset the cost advantages nVent already enjoys.

nVent Electric benefits significantly from its extensive portfolio of well-established electrical product brands, many with legacies exceeding a century. This deep history fosters considerable brand recognition and cultivates strong customer loyalty, making it challenging for newcomers to replicate that level of trust and reputation.

The significant investment and time required for new entrants to build comparable brand equity and market penetration represent a substantial barrier. For instance, nVent's ENCLOSURE segment, a key area of brand strength, reported net sales of $1.1 billion in 2023, underscoring the scale of its established market presence.

Access to Distribution Channels

New companies entering the electrical equipment market face significant hurdles in accessing established distribution channels. nVent Electric, for instance, relies on a complex network of direct sales, distributors, and agents to serve its broad customer base across critical sectors like commercial buildings, industrial manufacturing, infrastructure projects, and the energy industry. Building such a reach from scratch requires substantial investment and time, making it difficult for newcomers to compete effectively.

To overcome this, new entrants might need to replicate nVent's strategy of developing robust partnerships or consider acquiring existing distributors. This process is often capital-intensive and time-consuming, presenting a considerable barrier to entry. For example, a new player would need to establish relationships with electrical wholesalers, contractors, and specifiers, a task that can take years to cultivate trust and market penetration.

The challenge is amplified by the need to cater to diverse customer needs and regulatory environments across different geographical regions. nVent's ability to navigate these complexities through its established channels provides a competitive advantage.

Key challenges for new entrants include:

- Building a comprehensive sales and support infrastructure.

- Securing shelf space and mindshare with existing distributors.

- Navigating complex supply chains and logistics.

- Establishing credibility and trust with key stakeholders.

Regulatory Hurdles and Intellectual Property

The threat of new entrants into the electrical equipment industry, particularly concerning nVent Electric, is significantly mitigated by substantial regulatory hurdles and the robust protection of intellectual property. Companies like nVent operate within a landscape demanding adherence to numerous safety standards and certifications. For instance, UL certification, a common requirement for electrical products, involves rigorous testing and compliance processes that can be costly and time-consuming for newcomers. Navigating this complex web of regulations presents a formidable barrier to entry, requiring significant investment in expertise and product development to meet stringent quality and safety benchmarks.

Furthermore, established players like nVent possess valuable intellectual property in the form of patents and proprietary designs. These protected innovations, covering everything from connection technologies to advanced enclosure systems, create a significant competitive advantage. For example, nVent holds numerous patents related to its core product lines, making it difficult and expensive for new entrants to develop comparable or superior offerings without infringing on existing intellectual property rights. Successfully entering the market necessitates either developing truly novel technologies or investing heavily in licensing and legal counsel to avoid patent disputes, further raising the entry cost.

- Regulatory Compliance Costs: New entrants must budget for extensive testing, certification fees, and ongoing compliance with standards like IEC, UL, and CSA, which can run into hundreds of thousands of dollars.

- Intellectual Property Landscape: nVent's patent portfolio, covering areas like grounding and bonding solutions, presents a significant barrier, requiring extensive research and potentially costly licensing for competitors.

- R&D Investment: Developing products that meet the high technical specifications and safety requirements of the electrical industry demands substantial upfront investment in research and development, often exceeding millions of dollars.

- Market Access and Distribution: Gaining access to established distribution channels and customer relationships, often built over decades by incumbents like nVent, is another significant challenge for new entrants.

The threat of new entrants in the electrical equipment sector, where nVent Electric operates, is considerably low due to high capital requirements for manufacturing and R&D. For instance, establishing a new, compliant manufacturing facility can easily cost tens of millions of dollars.

Economies of scale enjoyed by established players like nVent, evidenced by their 2023 revenue of $3.3 billion, create significant cost advantages. Newcomers would struggle to match nVent's per-unit cost efficiency, making it difficult to compete on price.

Brand loyalty and established distribution networks present further barriers. nVent's strong brand equity, with segments like ENCLOSURE generating $1.1 billion in net sales in 2023, requires substantial time and investment for new entrants to replicate.

Stringent regulatory compliance and a landscape protected by intellectual property, including nVent's numerous patents, add considerable cost and complexity for potential new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for nVent Electric is built upon a foundation of comprehensive data, including nVent's own annual reports and investor presentations, alongside industry-specific market research reports from firms like IBISWorld and Frost & Sullivan. We also incorporate insights from financial databases such as S&P Capital IQ and Bloomberg to assess financial health and market trends.