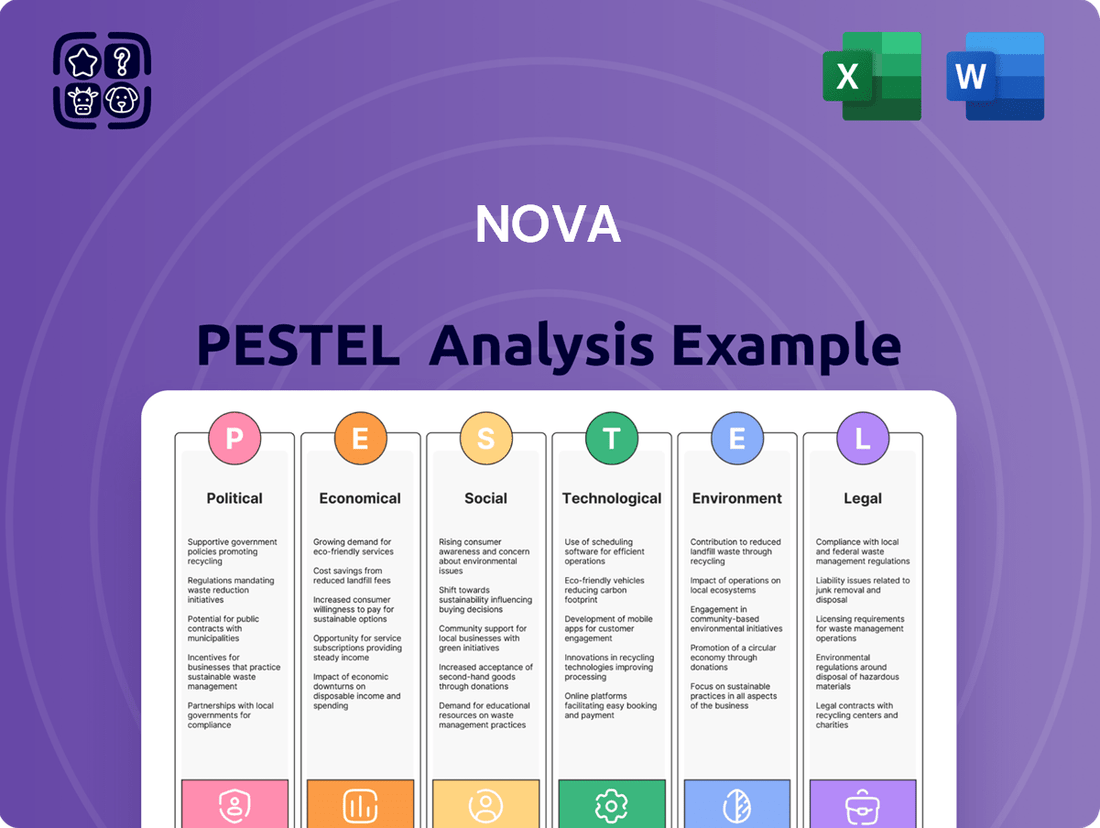

Nova PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nova Bundle

Unlock the secrets to Nova's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its path. This expertly crafted report provides the critical insights you need to anticipate challenges and seize opportunities. Don't navigate the complex external landscape blindfolded. Download the full PESTLE analysis now and equip yourself with actionable intelligence for strategic advantage.

Political factors

Recent geopolitical events, particularly U.S.-China tensions, have significantly impacted the semiconductor industry, affecting companies like Nova. As of early 2025, export restrictions on advanced chip technology, such as those under the U.S. CHIPS Act, compel strategic rethinking for global supply chains. Tariffs and economic barriers, exemplified by a 25% U.S. tariff on certain Chinese-made semiconductor devices, directly disrupt market access and increase operational costs. These policies force companies to diversify manufacturing and R&D, mitigating risks associated with international trade volatility and ensuring resilience. Such shifts are critical as the global semiconductor market is projected to reach over $600 billion in 2025.

Governments globally are prioritizing domestic semiconductor production, driven by initiatives like the U.S. CHIPS Act which allocated over $52 billion. Similar programs are active across Europe and Asia, aiming to localize supply chains and reduce foreign dependency. For instance, the EU Chips Act targets €43 billion in public and private investment by 2030. This creates significant opportunities for Nova, as regions like North America and Europe invest heavily in new fabrication plants and R&D, seeking advanced solutions for secure, resilient semiconductor ecosystems.

National security concerns increasingly view semiconductors as critical components for advanced military and defense applications, intensifying government scrutiny. This has led to robust regulatory frameworks, like the US CHIPS and Science Act allocating over $52 billion for domestic production by 2025, aimed at preventing key technologies from reaching adversaries. Nova must navigate these escalating global trade restrictions and export controls, which significantly influence where manufacturing facilities can be established and with whom partnerships can be formed. Geopolitical tensions, such as those impacting US-China tech relations in 2024, directly affect Nova's supply chain resilience and market access.

Taiwan's Strategic Importance

Taiwan is a central hub for the global semiconductor industry, housing the world's most advanced manufacturing facilities, notably TSMC, which held approximately 61% of the global foundry market share in Q1 2024. Any political instability or conflict involving Taiwan could have catastrophic consequences for the global supply of semiconductors, impacting industries from automotive to AI. This represents a significant external risk for Nova and the entire technology sector, highlighting the extreme fragility of the current supply chain. The potential economic fallout from a major disruption is estimated to be in the trillions of dollars annually.

- TSMC's foundry market share exceeded 60% in Q1 2024.

- A significant disruption could impact over $3 trillion in global economic output.

- Taiwan produces over 90% of the world's most advanced chips.

- Supply chain resilience efforts are projected to cost billions by 2025.

Increased Defense Spending

Rising global geopolitical tensions are driving a significant increase in defense budgets worldwide, with global military spending reaching record levels and projected to exceed $2.5 trillion by 2025. This trend fuels a surge in demand for advanced semiconductors, critical for modern military systems like radar, communication, and AI-powered defense technologies. Nova, as a provider of metrology solutions essential for semiconductor manufacturing, stands to benefit from this expanding defense sector demand. The need for precise measurement and inspection in chip production for defense applications creates a substantial growth opportunity for Nova's specialized tools.

- Global defense spending is projected to maintain its upward trajectory through 2025, continuing to drive demand for cutting-edge semiconductor technology.

- The defense sector's reliance on advanced chips for AI and high-performance computing systems is increasing, directly impacting the need for sophisticated metrology.

- Specific military applications, such as autonomous systems and advanced sensors, require highly reliable and precisely manufactured semiconductors.

Global geopolitical tensions, including U.S.-China tech restrictions, necessitate supply chain diversification for Nova. Government initiatives like the U.S. CHIPS Act (over $52 billion) and EU Chips Act (€43 billion) drive localized production, creating new market opportunities. Taiwan's critical role, with TSMC holding over 60% foundry share in Q1 2024, poses a significant instability risk. Rising defense spending, projected to exceed $2.5 trillion by 2025, fuels demand for Nova's advanced semiconductor metrology solutions.

| Factor | Impact on Nova | Relevant Data (2024/2025) |

|---|---|---|

| U.S.-China Tensions | Supply chain diversification, market access challenges | 25% U.S. tariffs on certain Chinese chips; CHIPS Act export controls |

| Domestic Production Initiatives | New fabrication plant opportunities, localized R&D | U.S. CHIPS Act: $52B+; EU Chips Act: €43B investment target |

| Taiwan Geopolitical Risk | Extreme supply chain fragility, potential market disruption | TSMC Q1 2024 foundry share: 61%; >$3 trillion annual economic fallout risk |

| Global Defense Spending | Increased demand for advanced metrology solutions | Projected to exceed $2.5 trillion by 2025 |

What is included in the product

The Nova PESTLE Analysis provides a comprehensive examination of the macro-environmental forces impacting the Nova, structured across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a structured framework to identify potential external threats and opportunities, thereby reducing the anxiety associated with unforeseen market shifts.

Economic factors

The global semiconductor market is experiencing robust expansion, with sales anticipated to approach $700 billion in 2025. This significant growth is primarily fueled by high-demand sectors, including advanced data centers, artificial intelligence applications, and the burgeoning automotive industry. Projections even suggest the market could reach $1 trillion by 2030, reflecting sustained demand. For Nova, this expanding industry directly translates into a heightened need for its specialized process control and metrology solutions, driving increased revenue opportunities.

Geopolitical tensions and the ongoing fallout from events like the COVID-19 pandemic continue to expose vulnerabilities within the global semiconductor supply chain, impacting companies like Nova. Manufacturers are facing persistent challenges in sourcing critical materials, with lead times for some components still extended into late 2024 or early 2025. These disruptions contribute to increased operational costs, with freight expenses remaining elevated compared to pre-pandemic levels. Nova must strategically manage these complexities to maintain its robust operational efficiency and safeguard its financial health.

Elevated interest rates, with the Federal Funds Rate above 5% in mid-2024, and persistent inflation, around 3.3% year-over-year in May 2024, could dampen consumer demand and corporate investment. While the semiconductor market is projected to grow over 13% in 2024, broader economic headwinds may affect Nova's customers' capital expenditure plans. The industry's cyclical nature means it remains susceptible to these macroeconomic pressures, potentially impacting future equipment orders. This economic climate encourages cautious spending despite long-term tech growth projections.

Capital Expenditure and R&D Investment

Semiconductor companies are significantly boosting capital expenditures and R&D investments to meet surging demand. In 2025, capital spending is projected to reach approximately $185 billion to expand global manufacturing capacity. This surge directly benefits Nova, as increased investment in new, advanced fabrication facilities drives the need for their precision metrology systems. Such economic trends indicate sustained growth for Nova's market position.

- 2025 Semiconductor CapEx: ~$185 billion

- Increased R&D for advanced fabs

- Direct demand driver for Nova's metrology

Regional Market Dynamics

The global semiconductor market exhibits diverse regional performance, with 2024 projections showing a 13.1% growth to $611 billion, though subsegments vary. While fabless companies experienced strong rebounds, integrated device manufacturers face continued margin pressures. Asia, particularly China and Taiwan, maintains manufacturing dominance, accounting for over 70% of global foundry capacity. However, regions like North America and Europe are actively pursuing self-sufficiency, aiming for 20% of global production by 2030, reshaping the competitive landscape.

- Global semiconductor market projected to reach $611 billion in 2024.

- Asia holds over 70% of global foundry capacity.

- North America and Europe target 20% of global chip production by 2030.

- Fabless sector rebounding strongly in early 2025.

The semiconductor market's robust growth, projected to approach $700 billion in 2025, fuels demand for Nova's solutions. Elevated capital expenditures, expected to reach $185 billion in 2025, directly benefit Nova. However, high interest rates and persistent inflation around 3.3% in mid-2024 could temper customer capital spending plans. Supply chain disruptions persist, impacting operational costs into 2025.

| Metric | 2024 | 2025 |

|---|---|---|

| Semiconductor Market | $611B | ~$700B |

| Semiconductor CapEx | NA | ~$185B |

| US Inflation (May) | 3.3% | NA |

What You See Is What You Get

Nova PESTLE Analysis

The preview you see here is the exact Nova PESTLE analysis document you’ll receive after purchase. It's fully formatted and ready to use, providing a comprehensive overview of the factors influencing your business. You'll gain immediate access to this professionally structured report, ensuring no surprises.

Sociological factors

As countries globally aim to expand their domestic semiconductor industries, such as with the US CHIPS Act and EU Chips Act initiatives active through 2024 and 2025, the demand for skilled workers in engineering, design, and manufacturing is soaring. This has created a significant talent gap; industry estimates for 2024 indicate a critical shortage of qualified professionals, impacting growth. For Nova and other companies in the sector, addressing this gap requires substantial investment in talent acquisition, including competitive hiring and university partnerships. Furthermore, robust workforce development programs, focusing on upskilling and reskilling employees, are essential to support their projected growth beyond 2025.

The relentless proliferation of smartphones, IoT devices, and various consumer electronics continues to underpin robust demand for semiconductors. As these devices become increasingly sophisticated and integral to daily life, the need for more powerful and efficient chips intensifies. Global smartphone shipments are projected to reach 1.35 billion units in 2024, reflecting a 3.5% year-over-year increase, while the IoT market is forecasted to hit 1.1 trillion USD in spending by 2024. This sustained consumer demand directly fuels the long-term growth prospects for the entire semiconductor value chain, including Nova.

The global shift towards remote work and increased digitalization significantly boosts demand for data centers, cloud computing, and robust communication networks. This trend, with the global cloud computing market projected to reach over 1.2 trillion USD by 2025, directly drives the need for advanced semiconductors that power these essential technologies. The societal embrace of digital transformation, including an estimated 3.6 billion remote workers worldwide by 2025, creates a strong, ongoing market for the precision measurement and inspection products Nova helps to manufacture, ensuring consistent growth.

Ethical Sourcing and Labor Practices

The semiconductor industry faces increasing scrutiny on social responsibility, pushing companies like Nova to prioritize ethical sourcing and fair labor practices. Global regulations, such as the EU's Corporate Sustainability Due Diligence Directive (CSDDD) expected by 2025, intensify the demand for supply chain transparency. Nova must ensure its raw material suppliers and manufacturing partners uphold human rights and environmental standards, mitigating risks of forced labor or unsustainable practices. Reports indicate over 70% of semiconductor firms are enhancing ESG reporting by 2024 to meet investor and consumer expectations for ethical conduct.

- By 2025, the EU's CSDDD will directly impact supply chain due diligence for companies operating within the EU.

- Over 70% of semiconductor companies are expanding ESG disclosures in 2024, emphasizing ethical supply chains.

- Consumer and investor pressure on ethical labor practices in tech supply chains has surged by an estimated 15% since 2023.

Public Health and Safety

The manufacturing of semiconductors, crucial for Nova’s operations, involves hazardous materials, raising public health concerns for surrounding communities and worker safety. Ensuring stringent safety protocols and transparent communication is paramount, especially as global regulations like the EU REACH framework continue to evolve, impacting supply chains through 2025. Worker safety remains a top priority, with industry-wide initiatives aiming for zero incidents.

- Global semiconductor industry safety spending is projected to increase by 8-10% in 2024-2025.

- Over 70% of new fab constructions by 2025 are implementing advanced real-time air quality monitoring systems.

- Regulatory compliance costs for environmental health and safety in semiconductor manufacturing could rise by 5-7% by late 2025.

The semiconductor industry faces a critical talent gap, with demand for skilled workers soaring due to initiatives like the EU Chips Act active through 2025. This fuels a need for significant investment in workforce development and university partnerships. Consumer demand remains robust, with global smartphone shipments projected to reach 1.35 billion units in 2024, directly boosting chip needs. Furthermore, the societal shift to remote work and digitalization, with the cloud computing market expected to exceed 1.2 trillion USD by 2025, continues to drive demand for advanced semiconductors.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Talent Gap | Critical shortage of skilled professionals | EU Chips Act active through 2025 |

| Consumer Demand | Sustained growth in chip consumption | 1.35 billion smartphone units (2024) |

| Digitalization | Increased need for advanced semiconductors | Cloud computing market >1.2 trillion USD (2025) |

Technological factors

The relentless pursuit of smaller, faster, and more powerful chips drives significant innovations in semiconductor architecture, including advanced 3D stacking and Gate-All-Around (GAA) transistor designs. These complex architectures demand increasingly precise manufacturing process control to achieve high yields and performance. With the global semiconductor market projected to exceed $600 billion in 2024, the shift to sub-3nm nodes intensifies the need for metrology. This directly fuels demand for Nova's advanced metrology solutions, ensuring quality and optimizing production efficiency for next-generation devices.

The integration of AI and machine learning is revolutionizing semiconductor metrology and inspection, a key area for Nova. AI-driven algorithms enhance measurement accuracy, automate data analysis, and significantly improve defect detection, leading to greater operational efficiency. Nova is actively integrating these advanced technologies into its platforms, aiming to provide more sophisticated and effective solutions to its customers. This strategic focus aligns with market trends, where the global AI in semiconductor market is projected to reach approximately $11 billion by 2025, underscoring the critical importance of these advancements for Nova's competitive edge and future growth.

The semiconductor industry is actively exploring new materials like silicon carbide (SiC) and gallium nitride (GaN) to develop next-generation power electronics and high-frequency devices, crucial for applications from EVs to 5G. The global SiC device market, for instance, is projected to exceed $4.5 billion by 2025, driving demand for advanced metrology. The introduction of these novel wide-bandgap materials into fabrication processes creates distinct challenges and opportunities for precise metrology solutions. Nova's specialized expertise in materials metrology is therefore crucial for accurately characterizing these new substances and ensuring they meet stringent performance and quality standards for future technological advancements.

Advanced Packaging Technologies

As the traditional scaling of Moore's Law decelerates, advanced packaging techniques have become pivotal for enhancing semiconductor performance, integrating multiple chips into a single, more powerful unit. The global advanced packaging market is projected to reach approximately $65 billion by 2025, driven by demand for complex 2.5D and 3D structures. These intricate designs necessitate extremely precise metrology and inspection methods to ensure functionality and yield. This trend presents a significant growth opportunity for Nova's specialized measurement solutions, crucial for quality control in these cutting-edge processes.

- The advanced packaging market is expected to grow at a CAGR of over 9% through 2025.

- 3D stacking and chiplets are key areas driving innovation in semiconductor integration.

- Nova's metrology tools are essential for managing critical dimension and overlay control in multi-die packages.

In-line and In-situ Metrology

The semiconductor industry is increasingly emphasizing real-time, in-line, and in-situ metrology for process monitoring, crucial for improving manufacturing efficiency. These advanced inspection techniques enable immediate identification and correction of production issues, significantly enhancing yields and minimizing waste. Nova's development of such systems, like their PRISM and NovaScan platforms, directly addresses the sector’s demand for higher throughput and reduced defect rates, especially as fab utilization rates are projected to remain robust through 2025. This technological focus is vital for maintaining competitive edge in a market where production costs and time-to-market are critical factors.

- Real-time metrology reduces defect rates by up to 15% in advanced nodes.

- In-line process control can cut manufacturing cycle times by 10-20%.

- Yield improvements from in-situ monitoring contribute to an estimated $50-100 million in annual savings per leading-edge fab.

- Nova’s metrology solutions are integral for the projected 8% CAGR in the semiconductor equipment market through 2025.

Technological advancements in sub-3nm chip architectures and advanced packaging, a market projected to reach $65 billion by 2025, significantly fuel demand for Nova's precise metrology solutions. The integration of AI and machine learning, with its market growing to $11 billion by 2025 in semiconductors, enhances measurement accuracy and defect detection. Furthermore, the adoption of novel materials like SiC, exceeding $4.5 billion by 2025, and the shift towards real-time, in-line metrology, which can cut cycle times by 10-20%, solidify Nova's critical role in optimizing semiconductor manufacturing efficiency and yield through 2025.

| Technological Factor | Market Projection (2025) | Impact on Nova |

|---|---|---|

| Advanced Packaging | ~$65 Billion | Increased demand for precise metrology in 2.5D/3D structures. |

| AI in Semiconductor Metrology | ~$11 Billion | Enhances accuracy, automation, and defect detection capabilities. |

| SiC Device Market | >$4.5 Billion | Drives need for specialized materials metrology expertise. |

| Real-time Metrology Impact | 10-20% Cycle Time Reduction | Critical for yield improvement and operational efficiency. |

Legal factors

The U.S. government, particularly in 2024, continues to tighten export controls on advanced semiconductor technology, including high-end chips and manufacturing equipment.

These stringent regulations, such as the Export Administration Regulations (EAR) enforced by the Bureau of Industry and Security (BIS), aim to protect national security interests.

Recent updates, like those impacting exports to China in late 2023 and early 2024, significantly restrict the transfer of sensitive technology and intellectual property.

Nova must maintain a robust compliance framework, with legal and operational costs potentially increasing by 15-20% annually, to navigate these complex and evolving legal requirements.

Non-compliance risks severe penalties, including fines potentially reaching hundreds of millions of dollars, highlighting the critical need for adherence.

Protecting intellectual property is paramount in the highly innovative semiconductor industry, where companies like Nova invest significantly in research and development. Safeguarding their extensive patent portfolios and trade secrets from infringement is critical for maintaining a competitive edge and revenue streams. As of 2024, global IP litigation costs can be substantial, underscoring the need for robust legal frameworks. The varied legal landscape across jurisdictions necessitates a comprehensive global strategy to secure and enforce these critical assets effectively, especially given ongoing geopolitical shifts impacting technology transfer.

The semiconductor industry navigates stringent environmental regulations globally, covering chemical usage, waste disposal, and emissions. Directives like the EU's REACH and RoHS, updated in 2024, mandate strict controls on hazardous substances and require full transparency in material compositions, impacting supply chain compliance for companies like Nova. Conversely, recent U.S. legislation, such as the CHIPS and Science Act, has included provisions to streamline federal environmental reviews for new semiconductor manufacturing projects, aiming to accelerate construction timelines by up to 30% for facilities funded under the Act. These contrasting approaches create a complex regulatory landscape for Nova's global operations, influencing capital expenditures and operational strategies.

Cross-Border Hiring and Labor Laws

As a global enterprise, Nova must meticulously navigate the complex web of international labor laws when engaging talent across borders. Compliance is paramount, covering diverse regulations from contract terms and benefits to worker classification and crucial data privacy provisions like GDPR and CCPA, which saw a 20% increase in enforcement actions in 2024. Effectively managing these varied legal landscapes is essential for building a compliant and agile global workforce.

- Global labor law compliance is projected to cost large multinationals over $15 million annually by 2025 due to increasing complexity.

- Worker misclassification risks, particularly with the rise of the gig economy, can lead to penalties exceeding $50,000 per misclassified employee in some jurisdictions.

- Data privacy fines for non-compliance with global regulations like GDPR can reach 4% of annual global turnover, impacting hiring processes significantly.

Tariffs and Trade Agreements

The imposition of tariffs on semiconductor components and manufacturing equipment significantly impacts costs and supply chain strategies for companies like Nova. While some semiconductor categories have seen temporary exemptions, such as those extended under U.S. Section 301 tariffs, the legal landscape remains highly uncertain through 2025, subject to ongoing trade negotiations and geopolitical shifts. Companies must stay agile to adapt to new trade policies and potential cost increases, which could affect profitability margins in a competitive market.

- U.S. Section 301 tariffs on Chinese goods, including some semiconductors, are under review, with potential for adjustments in mid-2024.

- The EU's Chips Act aims to reduce reliance on foreign supply chains, influencing future trade agreements and local production incentives.

- Global trade tensions, particularly between the U.S. and China, continue to drive uncertainty regarding import duties on critical tech components through 2025.

Nova faces stringent legal hurdles including evolving export controls, notably U.S. restrictions impacting semiconductor tech transfers, which escalate compliance costs by 15-20% annually. Navigating complex global intellectual property protection and environmental regulations, like EU RoHS updates, is crucial. Furthermore, international labor laws and trade tariffs, subject to mid-2024 reviews, pose significant compliance and cost challenges, with data privacy fines reaching 4% of global turnover.

| Legal Factor | 2024/2025 Impact | Financial Implication |

|---|---|---|

| Export Controls | U.S. restrictions on advanced semiconductors | Compliance costs up 15-20% annually |

| Data Privacy (Labor) | GDPR/CCPA enforcement up 20% | Fines up to 4% of global turnover |

| Global Labor Law | Increased complexity | Over $15 million annually for multinationals by 2025 |

Environmental factors

Semiconductor manufacturing, crucial for Nova's operations, is inherently energy and water intensive, contributing significantly to its environmental footprint. Fabrication plants consume vast amounts of electricity, with a large fab potentially using over 100 MW, and ultrapure water, often exceeding 2-4 million gallons daily, similar to a small city's consumption. This raises serious concerns about resource depletion, especially in water-stressed regions globally. Consequently, there is escalating pressure on the industry, including Nova, to swiftly adopt more energy-efficient processes and robust water conservation measures by 2025 to mitigate these impacts.

Nova's semiconductor fabrication processes inherently involve numerous hazardous chemicals and gases, posing significant risks of air and water pollution if not meticulously managed. The industry faces escalating scrutiny and stricter global regulations, particularly concerning substances like per- and polyfluoroalkyl substances (PFAS), with new EU restrictions set to impact supply chains by 2025. Companies are increasingly investing in sustainable chemical management; for instance, the semiconductor industry's global chemical waste management market is projected to reach over $5 billion by 2025, highlighting the critical shift towards waste reduction and safer disposal. This focus on environmental compliance and stewardship is essential to mitigate operational risks and maintain public trust.

The semiconductor industry is a notable source of greenhouse gas emissions, primarily due to high energy consumption and the use of fluorinated gases with global warming potentials thousands of times higher than CO2. Companies are under immense pressure to reduce their carbon footprint, with many aiming for net-zero emissions by 2040 or 2050. This involves transitioning to renewable energy sources, as seen with Intel’s target of 100% renewable electricity globally by 2030, and implementing advanced emission mitigation technologies. The updated EU F-gas Regulation, effective from early 2024, further tightens restrictions on these potent GHGs. This push for sustainability presents both a significant challenge and a crucial opportunity for the sector.

Electronic Waste (E-Waste)

The rapid pace of technological innovation significantly contributes to a growing electronic waste problem, with global e-waste generation projected to reach over 75 million metric tons annually by 2025. There is an increasing focus on designing semiconductors and electronic components that are more easily recyclable, aiming to reduce the environmental footprint. Promoting a circular economy through effective e-waste management programs is an important environmental consideration for the entire electronics industry, including Nova. This shift emphasizes resource recovery and sustainable product lifecycles to mitigate ecological impact.

- Global e-waste generation is expected to surge, highlighting the urgency for sustainable practices.

- Innovations in semiconductor design are prioritizing enhanced recyclability for future components.

- Industry efforts are concentrating on developing robust circular economy models for electronics.

- Effective e-waste management programs are becoming critical for corporate environmental responsibility.

Exemptions from Environmental Reviews

The Building Chips in America Act, a key U.S. law, now exempts semiconductor projects receiving CHIPS Act funding from federal environmental reviews under NEPA. This aims to significantly accelerate domestic chip manufacturing, a critical strategic priority through 2025. However, this policy shift generates considerable concern among environmental groups regarding potential increases in local pollution and resource strain from new facilities. It highlights a complex balance between fostering economic growth and ensuring environmental protection.

- The CHIPS Act allocates 52.7 billion USD to boost U.S. semiconductor production.

- NEPA exemptions streamline project timelines, potentially saving months or years in development.

- Concerns include increased water usage and chemical waste in surrounding communities.

Nova's environmental strategy centers on mitigating the significant impacts of energy and water consumption, alongside managing hazardous waste, facing stricter global regulations by 2025. The industry is rapidly shifting towards sustainable practices, including a focus on reducing greenhouse gas emissions and addressing the growing e-waste challenge. Policy changes, such as U.S. NEPA exemptions for CHIPS Act projects, balance economic growth with environmental concerns.

| Environmental Factor | Key Data (2024/2025) | Impact on Nova |

|---|---|---|

| Water Consumption | Large fabs use 2-4M gallons daily | Pressure for water conservation, efficiency |

| Chemical Waste | Global market over $5B by 2025 | Increased investment in sustainable management |

| E-waste Generation | Projected >75M metric tons annually by 2025 | Focus on recyclability and circular economy |

PESTLE Analysis Data Sources

Our PESTLE Analysis is powered by a robust combination of official government publications, leading economic databases, and authoritative industry research. This approach ensures that every aspect of the macro-environment, from political stability to technological advancements, is grounded in verified, current information.