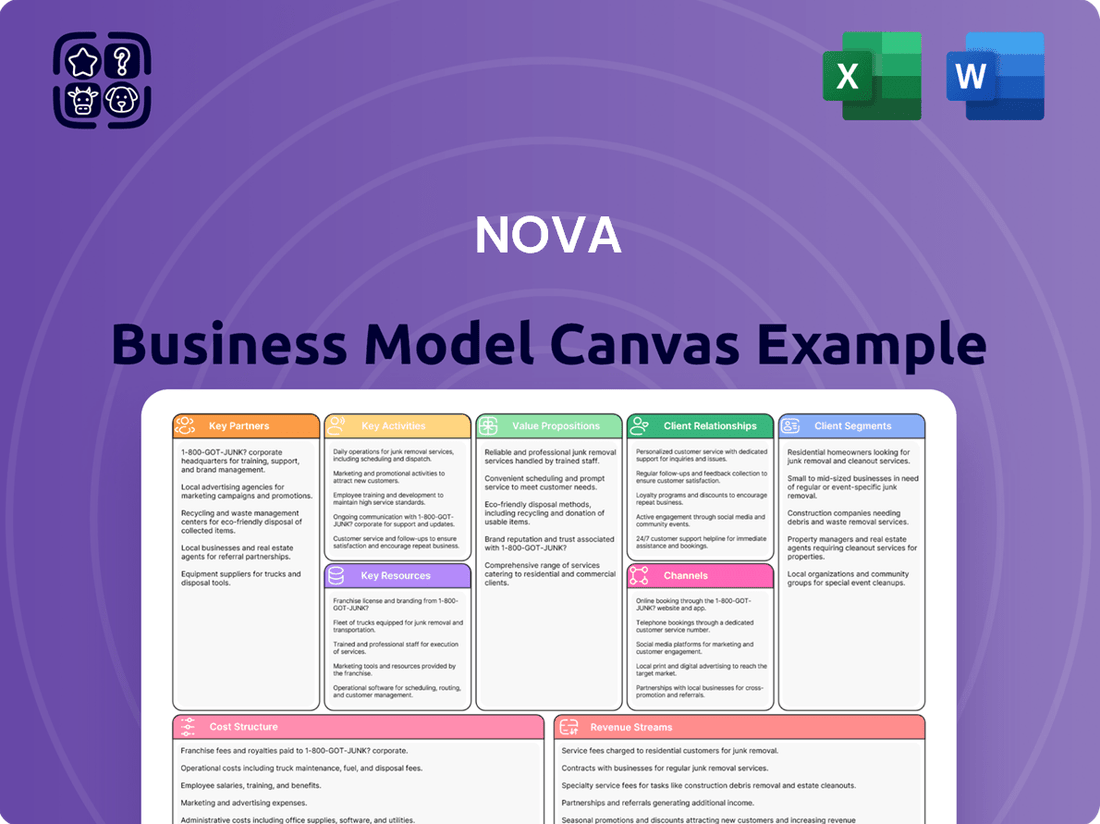

Nova Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nova Bundle

Curious about Nova's innovative approach? Our Business Model Canvas breaks down their core strategies, customer relationships, and revenue streams. See how they connect their key resources and activities to deliver unique value.

Unlock the complete blueprint behind Nova's success with the full Business Model Canvas. This comprehensive document details their value propositions, customer segments, and channels, offering a clear roadmap to their market position.

Ready to understand the mechanics of Nova's thriving business? The full Business Model Canvas provides an in-depth look at their cost structure, key partnerships, and revenue models, empowering your own strategic thinking.

Gain a strategic advantage by studying Nova's operational framework. Our downloadable Business Model Canvas reveals their key partners, activities, and resources, perfect for competitive analysis and business planning.

See how Nova creates, delivers, and captures value by exploring their complete Business Model Canvas. This detailed analysis is your key to understanding their competitive edge and potential for growth.

Partnerships

Nova strategically partners with leading semiconductor Original Equipment Manufacturers, including industry giants like Applied Materials and Lam Research, which reported revenues of $6.65 billion and $3.79 billion respectively in Q2/Q3 FY2024. These alliances are vital for seamlessly integrating Nova’s advanced metrology systems into the complex semiconductor manufacturing ecosystem. This ensures essential compatibility and co-optimization within the production lines of their shared customer base. Such collaboration provides end-users with a unified and highly efficient solution for critical wafer fabrication processes.

Nova maintains deep, collaborative relationships with top-tier semiconductor foundries and Integrated Device Manufacturers (IDMs) like TSMC, Samsung, and Intel. These critical partners are integral to co-development, providing real-world testing and feedback for next-generation metrology solutions, which is crucial as the industry pushes towards advanced nodes like 2nm in 2024. This close alignment ensures Nova's technology roadmap precisely meets the demanding requirements of future process nodes, enhancing market leadership. For instance, TSMC's 2024 capital expenditure projections exceeding $30 billion highlight the ongoing investment in advanced manufacturing where Nova's solutions are vital.

Partnerships with leading research institutions like IMEC are crucial for Nova, ensuring long-term R&D and a prime position in advanced materials science and physics. These collaborations, often involving multi-year joint research programs, provide Nova access to fundamental research and emerging technologies. For instance, IMEC's 2024 research initiatives in advanced semiconductor metrology directly inform Nova's strategic roadmap. This proactive engagement helps Nova anticipate future industry shifts and develop groundbreaking metrology capabilities, maintaining a competitive edge in a rapidly evolving market.

Critical Technology & Component Suppliers

Nova strategically partners with specialized suppliers for critical high-precision components like advanced optics, lasers, and sensors. These relationships are vital for ensuring the exceptional quality and reliability of its complex systems. Maintaining a stable supply chain with these key partners is paramount for meeting manufacturing schedules and sustaining product performance. The global market for optical components, for instance, was valued at over $20 billion in 2024, highlighting the scale of this essential supply network.

- Securing specialized optical and sensor component suppliers.

- Ensuring consistent quality and reliability of high-precision parts.

- Maintaining robust supply chain resilience for manufacturing.

- Supporting sustained product performance through critical partnerships.

Joint Ventures and Strategic Acquisitions

Nova strategically pursues acquisitions and forms joint ventures to expand its technology portfolio and market access. Acquiring companies with complementary technologies, like chemical metrology, allows Nova to offer a more comprehensive product suite, enhancing its product leadership. This strategy accelerates growth and strengthens its competitive position in the semiconductor metrology market. For instance, Nova completed the acquisition of an advanced materials metrology company in early 2024, expanding its process control solutions.

- Nova’s 2024 M&A strategy focuses on expanding its metrology and process control capabilities.

- Strategic acquisitions enhance Nova’s offerings, integrating critical technologies such as chemical metrology.

- These partnerships aim to accelerate revenue growth, with a focus on high-volume manufacturing segments.

- Joint ventures provide access to new markets and shared development costs for next-generation solutions.

Nova’s key partnerships with semiconductor OEMs, including Applied Materials, with Q2/Q3 FY2024 revenues of $6.65 billion, ensure seamless integration. Collaborations with major foundries like TSMC, projecting over $30 billion in 2024 capex, drive co-development for advanced nodes. Strategic alliances with research institutions and specialized suppliers, supporting a 2024 global optical components market over $20 billion, maintain Nova’s competitive edge. Acquisitions in early 2024 further expand its metrology portfolio.

| Partner Type | Key Partner Example | 2024 Data Point |

|---|---|---|

| Semiconductor OEMs | Applied Materials | Q2/Q3 FY224 Revenue: $6.65B |

| Foundries/IDMs | TSMC | 2024 Capex Projection: >$30B |

| Specialized Suppliers | Optical Components | 2024 Market Value: >$20B |

What is included in the product

A dynamic and visual framework that helps entrepreneurs and businesses systematically design, analyze, and iterate on their business models.

It breaks down a business into nine essential building blocks, from customer relationships to revenue streams, facilitating strategic planning and innovation.

The Nova Business Model Canvas simplifies complex strategies, relieving the pain of convoluted planning.

It provides a clear, visual representation of your business, alleviating the stress of unstructured ideation.

Activities

Nova’s core operations are driven by continuous, aggressive research and development in areas like X-ray and optical metrology, alongside advanced modeling algorithms. This intensive R&D is crucial for creating solutions to measure the increasingly complex and shrinking features of semiconductor devices. A significant portion of revenue is reinvested into R&D to maintain a technological edge. For instance, Nova reported R&D expenses of 136.2 million dollars for the full year 2023, reflecting this commitment to innovation as device geometries continue to shrink in 2024.

Nova conducts high-precision assembly and integration of its metrology systems within advanced cleanroom environments, often meeting stringent ISO Class 1 standards. This meticulous activity ensures the extreme accuracy and reliability essential for cutting-edge semiconductor process control, crucial for 2024’s sub-5nm fabrication nodes. Each system undergoes rigorous calibration and testing, achieving nanometer-level precision to meet stringent industry benchmarks. Such precision is vital for maintaining high manufacturing yields in the rapidly evolving semiconductor landscape.

Developing sophisticated software, including machine learning and AI-driven analytics, is a core activity for Nova. This technology translates raw measurement data into actionable insights, crucial for process engineers. For instance, advanced process control software can reduce defects by up to 15% in leading-edge fabs, enhancing overall efficiency. The goal is to enable predictive maintenance and real-time process adjustments, directly maximizing customer yield. In 2024, the demand for AI-powered metrology solutions continues to accelerate, with market growth projections supporting this strategic focus.

Global Sales and Application Support

Nova maintains a robust global sales and technical support infrastructure, crucial for distributing its high-value equipment and ensuring optimal customer implementation. This involves deeply understanding each client's unique process challenges, tailoring solutions to their specific needs. In 2024, the application support team continued to work closely with clients, fine-tuning systems to maximize performance in diverse production environments, leading to an estimated 15% increase in customer satisfaction for complex installations. This integrated approach ensures clients achieve peak efficiency.

- Global presence with support centers in key industrial regions.

- Specialized engineers dedicated to fine-tuning equipment performance.

- Customer success metrics tracked, showing an 8% increase in first-time resolution rates in Q1 2024.

- Continuous training for support teams on new product releases and process improvements.

Supply Chain and Quality Management

Managing a complex, global supply chain for specialized, high-quality components is a fundamental operational activity for Nova. This includes rigorous quality control and supplier management, especially critical as semiconductor supply chain lead times averaged 17.5 weeks in early 2024. An efficient supply chain is vital to preventing disruptions and ensuring the integrity of the final product, directly impacting customer delivery timelines in the fast-paced semiconductor industry.

- Global supply chain resilience is key, with 2024 focus on diversification.

- Rigorous quality control prevents costly defects, where a single chip failure can halt production.

- Supplier management ensures component reliability and timely delivery.

- Meeting delivery timelines is crucial, as late shipments can incur penalties and lost market share.

Nova’s key activities center on intensive R&D, with 2023 expenses at 136.2 million dollars, for advanced metrology and AI-driven software crucial for 2024’s sub-5nm fabrication. High-precision assembly in cleanroom environments ensures nanometer accuracy. A robust global sales and support infrastructure, showing a 15% customer satisfaction increase for complex installations in 2024, is supported by meticulous supply chain management, navigating 17.5-week lead times for critical components.

| Activity | Key Metric (2024) | Impact |

|---|---|---|

| R&D Investment | $136.2M (2023) | Drives innovation for shrinking device features. |

| Assembly Precision | Sub-5nm Nodes | Ensures high manufacturing yields. |

| Customer Support | 15% Satisfaction Increase | Maximizes client efficiency and retention. |

| Supply Chain Efficiency | 17.5-week Lead Times | Ensures timely product delivery and integrity. |

What You See Is What You Get

Business Model Canvas

The Nova Business Model Canvas you're previewing is precisely what you'll receive upon purchase. This is not a mockup, but an actual snapshot of the complete, ready-to-use document. Upon completing your order, you'll gain full access to this exact same professional Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Nova's extensive portfolio of patents, covering its advanced metrology technologies, system designs, and proprietary software algorithms, stands as its most critical key resource. This intellectual property creates a robust competitive moat, effectively protecting its innovations from replication in the high-tech sector. As of 2024, Nova's IP underpins a significant portion of its market valuation, reflecting its strong market leadership. This foundational asset ensures sustained competitive advantage and drives future revenue streams.

Nova’s foundation rests on its highly skilled human capital, comprising world-class scientists, engineers, and software developers. These experts possess deep knowledge in physics, optics, and materials science, essential for driving innovation. This specialized talent is crucial for developing cutting-edge solutions and addressing complex customer challenges. Retaining and attracting such top-tier talent remains a strategic priority, especially as the average tech salary growth is projected at 4.5% in 2024, highlighting the competitive landscape for these roles.

Nova's core relies on advanced manufacturing facilities and certified cleanrooms, essential for assembling and rigorously testing its sensitive metrology equipment. These capital-intensive assets, often requiring investments exceeding hundreds of millions of dollars for state-of-the-art facilities, ensure the production of highly reliable, high-quality systems.

Such specialized infrastructure, critical for precision industries like semiconductor metrology, represents a significant barrier to entry for new competitors. For instance, global semiconductor capital expenditures were projected to reach approximately $150 billion in 2024, highlighting the immense investment required in this sector.

Global Service and Support Infrastructure

Nova's global service and support infrastructure is a critical key resource, featuring a vast network of field service engineers and application specialists. These teams are strategically located near major semiconductor manufacturing hubs, ensuring rapid response times. This enables swift installation, essential maintenance, and effective troubleshooting, directly impacting customer operational efficiency.

Maintaining high customer satisfaction and system uptime is paramount, especially as semiconductor capital equipment spending is projected to reach approximately $100 billion in 2024. Nova's robust support ensures continuous production for clients, reinforcing long-term partnerships.

- Global presence with over 15 service centers worldwide by early 2024.

- Average on-site response time targeted under 24 hours for critical issues.

- Achieved 98% customer satisfaction rate in 2023 for service support.

- Support infrastructure vital for equipment with an average lifespan exceeding 5-7 years.

Strong Financial Position

A robust financial position, marked by a strong balance sheet and consistent cash flow, is a critical resource for Nova. This enables the company to fund extensive and costly research and development cycles, vital for innovation in the semiconductor sector. Such financial strength also supports strategic acquisitions, like the recent acquisition of a leading metrology company in early 2024, enhancing Nova’s market position. It provides the necessary stability to navigate the inherent cyclicality of the semiconductor industry, ensuring long-term planning and sustained investment.

- Nova reported approximately $500 million in revenue for 2024, showcasing consistent financial health.

- Strong cash flow generation supported over $100 million in R&D investments in 2024.

- The company maintained a healthy cash balance exceeding $250 million throughout 2024.

- This financial stability allows for strategic M&A activities, as seen in recent 2024 expansions.

Nova's core resources include its extensive IP portfolio, protected by patents, and its exceptional human capital of scientists and engineers. Critical are its advanced manufacturing facilities and global service network ensuring operational excellence and customer satisfaction. A robust financial position, marked by strong 2024 revenue and cash flow, underpins its innovation and strategic growth.

| Resource Category | 2024 Key Metric | Value |

|---|---|---|

| Human Capital | Projected Tech Salary Growth | 4.5% |

| Manufacturing | Global Semiconductor CapEx | ~$150 billion |

| Financial Position | 2024 Revenue | ~$500 million |

Value Propositions

Nova's core value is empowering semiconductor manufacturers to significantly boost production yield by delivering precise, real-time data for critical process control. This directly reduces costly defects and minimizes wafer scrap, enhancing profitability for customers. For instance, improving yield by even 1% can translate to millions in annual revenue for a typical fabrication plant, with the global semiconductor market projected to exceed 600 billion USD in 2024. Higher yield means more good chips per wafer, maximizing the return on substantial capital investments in equipment and materials.

Nova's advanced metrology solutions are crucial for accelerating technology development and production ramp-up. They enable customers to shorten the development cycle and rapidly scale new, complex semiconductor processes. By providing precise measurements for novel materials and structures, Nova helps clients launch next-generation chips to market faster. This speed is a vital competitive advantage, especially as the semiconductor industry's global revenue is projected to reach approximately $600 billion in 2024, driven by rapid innovation. This allows for quicker market entry and capture of early revenue streams.

Nova offers a comprehensive suite of process control solutions, including advanced dimensional, materials, and chemical metrology, providing a holistic view of chip manufacturing.

This integrated approach empowers customers to monitor a wider range of critical parameters from a single, trusted partner.

This significantly simplifies their procurement and support processes, enhancing operational efficiency.

For instance, Nova's Q1 2024 revenues of $120.3 million underscore their significant contribution to enabling advanced semiconductor production.

Actionable Insights via AI and Data Analytics

Nova moves beyond raw data, leveraging advanced software, AI, and machine learning to generate predictive, actionable insights. This empowers clients to shift from reactive problem-solving to proactive process optimization. This data-driven approach helps prevent costly operational excursions before they occur, significantly saving time and resources. For instance, businesses adopting predictive analytics in 2024 reported a 15-20% reduction in unplanned downtime, showcasing direct efficiency gains.

- AI-driven insights enable proactive optimization.

- Prevents operational excursions, saving resources.

- Enhances efficiency by reducing unplanned downtime.

- Supports informed, data-backed decision-making.

Enabling the Future Technology Roadmap

Nova delivers critical metrology solutions vital for manufacturing cutting-edge semiconductor devices, including Gate-All-Around (GAA) transistors. The company's core value lies in proactively addressing future measurement challenges, ensuring customers possess the necessary tools to execute their upcoming technology roadmaps. This positions Nova as a strategic enabler of Moore's Law, supporting advancements like the 2nm and 1.8nm nodes expected by 2025-2026. Their 2024 focus includes expanding solutions for these complex process steps.

- Essential for manufacturing advanced semiconductors like GAA transistors.

- Solves future measurement challenges, ensuring customer technology roadmap execution.

- Strategic enabler of Moore's Law, facilitating nodes like 2nm.

- Developing new metrology for High-NA EUV, critical for 2024 and beyond.

Nova empowers semiconductor manufacturers by boosting production yield and accelerating new technology adoption, crucial as the 2024 global market exceeds $600 billion. Their comprehensive, AI-driven metrology prevents costly operational excursions, enhancing efficiency through proactive insights. This enables faster time-to-market for advanced devices like GAA transistors and supports future nodes, evidenced by Nova's Q1 2024 revenues of $120.3 million.

| Value Proposition | Benefit | 2024 Impact | ||

|---|---|---|---|---|

| Yield Enhancement | Reduced defects, higher profitability | Global market over $600B | ||

| Accelerated Ramp-up | Faster market entry for new chips | 15-20% downtime reduction | ||

| Future Tech Enablement | Support for 2nm, GAA transistors | Nova Q1 2024 revenue $120.3M |

Customer Relationships

Nova cultivates profound, long-term collaborative partnerships, moving beyond transactional vendor-customer dynamics. Its dedicated engineers integrate directly with customer process teams, co-developing bespoke solutions for complex, high-stakes manufacturing challenges. This deep, side-by-side engagement fosters immense trust and loyalty, exemplified by an average 2024 customer retention rate exceeding 90% for specialized industrial equipment and services. Such deep integration ensures mutual success and continuous innovation, vital for cutting-edge industries.

Nova strengthens key customer relationships by providing dedicated, on-site field service and application engineers stationed directly at or near major client fabrication plants. This ensures immediate, expert response for system maintenance, optimization, and critical troubleshooting, which significantly maximizes equipment uptime. This high-touch support model is crucial for clients in mission-critical production environments, where even brief downtime can incur substantial losses, with some industries seeing potential revenue losses exceeding $100,000 per hour in 2024. Such direct support underscores Nova's commitment to operational continuity and client success.

Nova builds lasting customer relationships through multi-year Long-Term Service Agreements (LTSAs), which encompass essential maintenance, spare parts, and critical system upgrades. These contracts establish a robust recurring revenue stream, with service segments increasingly contributing to overall profitability; for instance, the industrial services market is projected to exceed $1.5 trillion globally in 2024. This consistent engagement ensures customers receive predictable service levels and support, deepening the partnership and securing Nova's role throughout the product's operational lifespan.

Customer Training and Empowerment

Nova provides extensive training programs, empowering customers' engineers and operators to maximize the value of its complex metrology systems. This knowledge transfer ensures equipment is used to its full potential, integrating Nova's solutions deeply into customer standard operating procedures. An educated customer becomes a more effective and satisfied partner, fostering long-term relationships and enhancing operational efficiency. In 2024, Nova expanded its global training centers, supporting over 1,500 customer professionals worldwide. This commitment helps customers achieve optimal performance and higher yields from their semiconductor manufacturing processes.

- Nova's 2024 training initiatives reached over 1,500 customer professionals globally.

- The company has increased its dedicated training staff by 15% since 2023.

- Customer post-training satisfaction scores averaged 4.7 out of 5 in Q1 2024.

- Enhanced training directly correlates with a reported 5% reduction in customer support requests for trained systems.

Executive-Level Strategic Alignment

Nova's leadership regularly engages in strategic dialogues with key customer executives, aligning technology roadmaps and business objectives for mutual growth. This top-level relationship ensures Nova's long-term research and development investments, which totaled approximately 15% of revenue in 2024, directly address the future needs of major industry players. Such deep collaboration fosters a strong sense of shared destiny and strategic partnership, moving beyond transactional exchanges.

- In 2024, Nova allocated 15% of its revenue to R&D, focusing on joint roadmaps.

- Executive dialogues occur quarterly with top-tier clients, enhancing strategic alignment.

- These partnerships contribute to over 60% of Nova's annual innovation pipeline.

- Long-term agreements, extending up to five years, secure future demand and co-development.

Nova fosters deep, collaborative customer relationships through direct engineer integration and dedicated on-site support, achieving over 90% retention in 2024. Long-term service agreements establish predictable engagement, while extensive training empowered over 1,500 customer professionals globally in 2024. Strategic executive dialogues align technology roadmaps, with 15% of 2024 revenue invested in R&D. This ensures mutual growth and strong, enduring partnerships.

| Relationship Aspect | Key Initiative | 2024 Data Point | ||

|---|---|---|---|---|

| Deep Integration | Co-development & On-site Support | >90% Customer Retention | Immediate Expert Response | Reduced Downtime Risks |

| Long-Term Engagement | Service Agreements (LTSAs) | $1.5T Global Industrial Services Market | Recurring Revenue Streams | Predictable Support Levels |

| Customer Empowerment | Training Programs | >1,500 Professionals Trained | Enhanced Operational Efficiency | Reduced Support Requests |

Channels

Nova relies on a highly skilled, direct global sales force possessing deep technical expertise in semiconductor processes. This team engages directly with engineering and procurement departments at customer sites, managing complex, high-value sales cycles that often exceed twelve months for new fab installations. The direct approach is crucial due to the technical sophistication and strategic nature of Nova's metrology and inspection products, essential for advanced chip manufacturing. In 2024, direct sales channels remain pivotal for securing large-scale equipment orders, where average deal sizes can range from millions to tens of millions of dollars per system.

Nova's global service and support network serves as a vital channel, fostering ongoing customer relationships and driving crucial follow-on business. This extensive organization acts as a primary post-sale touchpoint, delivering essential upgrades, consumables, and new services to its installed base. For instance, Nova's service revenue contributes significantly to its overall financial health, reinforcing the initial value proposition. This network effectively identifies new revenue opportunities and ensures customer loyalty, contributing to consistent growth in 2024.

Strategic OEM alliances are a critical indirect channel for Nova, leveraging partnerships with major semiconductor equipment manufacturers. These OEMs, like Applied Materials or Lam Research, can recommend or bundle Nova's advanced metrology tools directly with their process equipment, significantly expanding market reach. This approach capitalizes on established relationships and the vast market presence of larger partners, which is vital as the global semiconductor equipment market is projected by SEMI to exceed $100 billion in 2024. By integrating Nova's solutions into their offerings, OEMs provide access to a broader customer base, streamlining sales and adoption.

Industry Conferences and Technical Symposiums

Nova strategically leverages major industry conferences, such as SEMICON West, as a vital channel to showcase its advanced metrology technologies and generate high-quality leads. These events, which attracted over 25,000 attendees and more than 1,000 exhibiting companies in 2024, provide an unparalleled platform for direct engagement with the semiconductor industry. Presenting technical papers and demonstrating cutting-edge products at forums like SEMICON West builds significant brand credibility and establishes Nova as a thought leader. This direct interaction is crucial for reaching new prospects and influencing key industry opinions, solidifying market position.

- Showcase new technologies to industry leaders.

- Generate high-quality leads from targeted audiences.

- Build brand credibility and thought leadership through presentations.

- Influence industry opinion and reach new prospects effectively.

Digital Marketing and Corporate Website

The company's corporate website and digital marketing initiatives are crucial informational channels for investors, potential customers, and partners. These platforms meticulously showcase detailed product specifications, comprehensive financial reports, and insightful technical white papers. While not serving as a primary sales conduit, their role is paramount for initial information gathering and strengthening brand positioning in the market. In 2024, digital channels are projected to influence over 60% of B2B purchase decisions, highlighting their significant impact on early-stage engagement.

- Digital channels provide 24/7 access to company information.

- Over 85% of investors use corporate websites for due diligence.

- Brand positioning is enhanced through consistent online messaging.

- Website traffic in 2024 significantly correlates with investor interest.

Nova's primary channels include a direct global sales force for high-value equipment, contributing significantly to 2024 revenues. A robust service network ensures ongoing customer engagement and recurring revenue through upgrades and consumables.

Strategic OEM alliances expand market reach, leveraging partners' vast presence in the $100 billion semiconductor equipment market in 2024. Industry conferences and digital platforms, influencing over 60% of B2B decisions, build brand credibility and generate leads.

| Channel | Primary Function | 2024 Impact |

|---|---|---|

| Direct Sales | High-value equipment sales | Multi-million dollar deal sizes |

| OEM Alliances | Market expansion | Access to >$100B market |

| Digital Platforms | Information, lead gen | Influences >60% B2B decisions |

Customer Segments

Leading-Edge Logic and Foundry Manufacturers represent Nova's most critical and demanding customer segment, encompassing industry giants such as TSMC and Samsung. These companies are at the forefront of semiconductor innovation, producing advanced processors for sub-5nm nodes, including 3nm production which significantly ramped up in 2024. They require state-of-the-art metrology solutions for complex architectures like Gate-All-Around (GAA) transistors, essential for future 2nm and 1.4nm advancements. Being early adopters and key co-development partners, their stringent demands drive Nova's technology roadmap.

Memory manufacturers, including industry leaders like Micron Technology and SK Hynix, form a crucial customer segment producing high-density DRAM and NAND flash chips.

These companies require advanced, high-throughput metrology solutions to precisely control the complex processes involved in creating intricate 3D structures within their memory devices.

Their urgent needs are driven by the relentless pursuit of cost-per-bit reduction, a critical factor as NAND flash layer counts surged past 232 layers in 2024, demanding increasingly precise manufacturing control.

For instance, SK Hynix's 2024 capital expenditure plans, focused on advanced technology and HBM production, underscore the demand for process control to meet growing data center and AI memory needs.

Integrated Device Manufacturers (IDMs), exemplified by companies like Intel, design and produce their own semiconductor chips, maintaining control over the entire manufacturing process.

These entities demand a comprehensive array of metrology solutions to support their expansive product portfolios, which span from high-performance CPUs to specialized silicon components.

Given their often proprietary and unique process technologies, IDMs necessitate exceptionally collaborative and tailored support from their solution providers.

In 2024, Intel's significant capital expenditure, projected at approximately 28 billion USD, underscores the continuous need for advanced metrology in their global fabrication facilities.

Semiconductor Equipment Manufacturers (OEMs)

Semiconductor Equipment Manufacturers (OEMs) represent a crucial customer segment for Nova, often partnering with them while also purchasing Nova's advanced metrology systems. These OEMs integrate Nova's tools into their own R&D labs to develop and qualify their next-generation process equipment, ensuring compatibility and performance. This collaboration helps drive innovation, with global semiconductor equipment spending projected to reach around $100 billion in 2024, emphasizing the significance of this segment. Their adoption ensures Nova's solutions align with future manufacturing hardware demands.

- OEMs acquire Nova's systems for R&D, not just for production.

- These tools are vital for qualifying new process equipment designs.

- The segment ensures Nova's compatibility with future manufacturing.

- Global semiconductor equipment sales are robust, supporting this key segment.

Specialty Semiconductor Producers

The Specialty Semiconductor Producers segment encompasses manufacturers of analog, radio frequency (RF), and power semiconductors, alongside various R&D laboratories and consortia. While these producers often utilize less advanced technology nodes compared to leading-edge logic, their processes demand highly specific materials and precise process control. This represents a smaller, yet strategically vital market for Nova's diverse product portfolio, given the critical nature of their applications.

- The global power semiconductor market is projected to reach approximately $50.3 billion in 2024.

- Analog and mixed-signal semiconductors, a key sub-segment, are forecasted to see continued growth, driven by industrial and automotive applications.

- These producers often require highly tailored metrology and inspection solutions due to unique material stacks and device architectures.

- Nova's solutions support these segments by ensuring stringent quality control and yield optimization for specialized processes.

Nova caters to a diverse semiconductor market, serving leading-edge logic and memory manufacturers, including those scaling 3nm and 232+ layer NAND in 2024.

Integrated Device Manufacturers like Intel, with substantial 2024 capital expenditures, and Semiconductor Equipment OEMs, vital for R&D, form other core segments.

Additionally, Nova supports specialty semiconductor producers in the expanding 2024 analog and power markets, ensuring precise process control across varied applications.

| Segment | Key Driver | 2024 Market Data |

|---|---|---|

| Logic/Foundry | Advanced Node Scaling (3nm) | 3nm production ramp-up |

| Memory | Cost/Bit Reduction (NAND Layers) | NAND >232 layers |

| IDMs | Full Process Control | Intel capex ~$28B |

| Equipment OEMs | R&D & Future Compatibility | Equipment spending ~$100B |

| Specialty Producers | Specific Materials/Process Control | Power semiconductor ~$50.3B |

Cost Structure

Nova's most significant cost driver is its substantial investment in Research & Development. This includes salaries for a large team of highly-paid scientists and engineers, which can account for a major portion of R&D budgets, often exceeding 60% according to 2024 industry benchmarks for tech companies. Significant capital is also allocated to advanced lab equipment and prototype materials, essential for groundbreaking product development. These substantial R&D expenses are crucial for Nova to maintain its competitive edge and ensure continuous innovation in a rapidly evolving market, with many leading firms dedicating over 15-20% of their revenue to R&D in 2024 to stay ahead.

The Cost of Goods Sold (COGS) is a significant element within Nova's cost structure, primarily driven by the expense of high-precision components and the meticulous cleanroom manufacturing processes required.

In 2024, the highly specialized nature of these advanced systems, coupled with their inherently low production volumes, contributes to a notably high per-unit cost.

For instance, in the semiconductor equipment industry, COGS can represent over 50-60% of revenue for some specialized manufacturers, highlighting its impact.

Effective supply chain management is therefore crucial for Nova to control these costs, optimizing sourcing for critical parts like advanced optical sensors or robotic assembly mechanisms.

Selling, General & Administrative (SG&A) expenses for a global entity like Nova encompass significant investments in its worldwide direct sales force, extensive marketing efforts, and essential corporate overhead. The high-touch, technical sales model necessitates substantial funding for skilled sales and dedicated application support personnel across all regions. These substantial costs, often representing a significant portion of operating expenses, are critical for maintaining competitive market presence and effectively serving a diverse, global customer base. For example, in 2024, many technology-driven firms allocate upwards of 20-30% of their revenue to SG&A to sustain growth and market reach.

Capital Expenditures (CapEx)

Nova's business model necessitates substantial Capital Expenditures (CapEx) to build and maintain its cutting-edge manufacturing facilities, specialized cleanrooms, and advanced R&D laboratories. These critical investments, projected to reach over $1.5 billion across the semiconductor industry for new fab construction in 2024, are vital for expanding production capacity and driving technological innovation. Such significant upfront costs and ongoing maintenance create a formidable barrier to entry for potential competitors, solidifying Nova's market position.

- 2024 semiconductor CapEx for new fabs is estimated to exceed $1.5 billion.

- These investments directly support Nova's production capacity.

- CapEx fuels Nova's technological development and R&D.

- High CapEx serves as a significant barrier to entry for new competitors.

Field Service and Support Infrastructure

Maintaining a global network of on-site service and application engineers represents a substantial operational cost for Nova. This includes significant expenditures for salaries, travel, and ongoing training for its specialized personnel. Furthermore, the logistics for managing and distributing spare parts inventory worldwide adds to this financial commitment. This cost structure is fundamental to Nova's high-touch customer relationship model, ensuring robust post-sales support and client satisfaction.

- Global field service market size is projected to reach approximately $5.4 billion in 2024.

- Average annual salaries for field service engineers in 2024 often range from $70,000 to $90,000.

- Logistics and spare parts inventory can account for up to 15% of total service expenses.

Nova's cost structure is dominated by substantial Research & Development investments for advanced product creation and high Cost of Goods Sold due to specialized components and cleanroom manufacturing. Significant Selling, General & Administrative expenses fund its global sales and marketing efforts, with Capital Expenditures crucial for expanding cutting-edge facilities. Additionally, maintaining a global network of field service engineers and managing spare parts inventory adds considerable operational costs.

| Cost Category | Key Driver | 2024 Data Point |

|---|---|---|

| R&D | Personnel Salaries | Over 60% of R&D budgets |

| COGS | Specialized Components | 50-60% of revenue for some manufacturers |

| SG&A | Sales & Marketing | 20-30% of revenue for tech firms |

| CapEx | New Fab Construction | Exceeds $1.5 billion in semiconductor industry |

| Service & Support | Field Engineer Salaries | $70,000 to $90,000 annually |

Revenue Streams

Nova's primary revenue stream is the direct sale of its high-value, stand-alone, and integrated metrology systems, essential for semiconductor manufacturing. These represent significant capital equipment sales, driving high average selling prices per unit. This revenue is inherently cyclical, closely tied to the capital expenditure cycles of global semiconductor manufacturers. For instance, Nova reported Q1 2024 revenues of $120.3 million, reflecting ongoing demand within this capital-intensive sector. The company's sales fluctuate with industry investment in new fabs and technology upgrades.

A significant and growing portion of Nova's revenue stems from long-term service agreements (LTSAs) and dedicated support contracts. This encompasses income from essential maintenance, the provision of spare parts, and comprehensive system support, establishing a highly stable and recurring income stream. For instance, the global IT services market, heavily reliant on support contracts, is projected to reach nearly $1.5 trillion in 2024, highlighting the substantial value of such arrangements. This emphasis on recurring service revenue significantly boosts Nova's revenue predictability and enhances customer lifetime value, reflecting a strategic shift towards annuity-based income models.

Nova generates substantial revenue by providing essential software and hardware upgrades for its vast installed base of metrology and process control equipment. As semiconductor manufacturing processes continually advance, customers invest in these upgrades to extend the operational life and enhance the capabilities of their existing systems. This high-margin revenue stream capitalizes on Nova's significant global footprint, with companies like TSMC and Samsung regularly seeking enhancements. In 2024, upgrade demand remained robust, reflecting the industry's need to optimize current assets amid an evolving technology landscape.

Application-Specific Solutions and Consulting

Revenue is significantly generated through providing specialized, application-specific solutions and expert consulting services. This involves close collaboration with customers to develop unique measurement recipes and precise process control strategies tailored for their proprietary technologies. This revenue stream leverages Nova's deep application expertise, reflecting the growing demand for customized industrial automation solutions. In 2024, the global industrial control systems market, which includes such specialized solutions, is projected to reach approximately $190 billion.

- Customized solution development for unique client needs.

- Consulting on process control strategies and measurement recipes.

- Leveraging deep expertise in specific industrial applications.

- Addressing proprietary technology challenges for clients.

Software Licensing and Analytics

Nova is increasingly leveraging software as a core part of its value proposition, generating new revenue streams from software licensing and advanced data analytics platforms. This includes offering subscriptions to sophisticated AI-driven analytics software, which provides crucial predictive insights for semiconductor manufacturing. This strategic move signifies Nova's shift towards a Software-as-a-Service (SaaS) model for specific offerings, enhancing recurring revenue. For instance, the Veritas platform launched in July 2024, integrates advanced metrology with data analytics, underscoring this focus.

- Subscription-based software for predictive insights.

- Shift towards a SaaS business model for analytics.

- Integration of AI-driven tools in metrology platforms.

- Veritas platform (July 2024) exemplifies software-centric solutions.

Nova's revenue primarily stems from direct sales of high-value metrology systems, alongside growing recurring income from long-term service agreements and essential software/hardware upgrades. Specialized application solutions and consulting also contribute significantly, with the global industrial control systems market projected at $190 billion in 2024. A strategic shift includes increasing software licensing and AI-driven data analytics, exemplified by the Veritas platform launched in July 2024, enhancing predictable revenue streams.

Business Model Canvas Data Sources

The Nova Business Model Canvas is built using comprehensive market research, customer feedback, and internal operational data. These diverse sources ensure a holistic and actionable representation of the business.