North Media SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

North Media Bundle

North Media boasts a strong brand reputation and a loyal customer base, key strengths in a competitive landscape. Their innovative digital strategies also position them well for future growth, but potential regulatory changes could pose a significant threat.

Want the full story behind North Media's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

North Media’s market leadership in key segments is a significant strength. In Denmark, FK Distribution is the undisputed leader in distributing unaddressed printed advertising materials, a segment North Media has dominated for decades. This leadership translates into substantial market share and a reliable revenue stream.

Furthermore, BoligPortal.dk stands as the premier online platform for rental housing in Denmark. Its leading position ensures a continuous flow of users and advertisers, reinforcing North Media's strong foothold in the digital real estate market. This dual dominance in print distribution and digital housing platforms provides a robust foundation for the company.

The company's extensive history, beginning in 1965, has allowed North Media to cultivate deep market expertise and build a resilient infrastructure. This long-standing presence has fostered strong brand recognition and customer loyalty, particularly in its core Danish market, giving it a distinct advantage over newer entrants.

North Media's hybrid business model, blending print distribution with digital classifieds and services, is a significant strength. This diversification provides a stable earnings base from its Last Mile segment, which is crucial for consistent cash flow. For instance, in the first quarter of 2024, the company reported that its distribution services continued to be a reliable revenue driver.

The digital segment, notably BoligPortal, presents substantial growth opportunities and scalability, catering to evolving consumer preferences. This dual approach allows North Media to effectively navigate changing market dynamics and capitalize on emerging digital trends, ensuring adaptability and future revenue streams.

BoligPortal.dk is a standout performer within North Media, consistently delivering robust revenue growth and significantly boosting the Digital Services segment. This online property portal is a key driver of the company's digital expansion, as evidenced by its 10% year-on-year revenue increase in Q1 2025, fueled by strategic partnerships, tenant engagement, and its DataInsights offering.

The platform's financial success is further underscored by its impressive profitability, having surpassed DKK 100 million in profits in 2023. This strong financial footing positions BoligPortal as a vital asset for North Media's future growth and market leadership in the digital real estate space.

Financial Stability and Capital Resources

North Media demonstrates considerable financial stability, bolstered by strong capital resources. This financial health allows the company to actively pursue strategic goals and capitalize on emerging market opportunities, while also providing a buffer against competitive challenges.

Despite facing some financial headwinds in the first quarter of 2025, North Media's management has reaffirmed their full-year financial outlook. This steadfast guidance underscores the company's confidence in its underlying financial resilience and its ability to execute long-term strategic initiatives.

The company's commitment to generating stable returns on invested capital and distributing annual dividends is a key indicator of its financial strength and shareholder-focused approach.

- Strong Balance Sheet: North Media's robust capital position supports strategic growth and market competitiveness.

- Resilient Guidance: Management's reaffirmation of full-year guidance post-Q1 2025 setbacks signals financial fortitude.

- Shareholder Returns: Commitment to stable returns on capital and annual dividends highlights financial discipline.

Strategic Digital Transformation and Innovation

North Media's strategic focus on digital transformation is a significant strength, evidenced by substantial investments in platforms like BoligPortal, aiming to create a comprehensive ecosystem for tenants and landlords. This initiative is designed to enhance user experience and capture a larger share of the digital property market. In 2024, BoligPortal reported continued growth in user engagement and transaction volume, underscoring the success of its 'single universe' strategy.

The company's establishment of Dayli (formerly MineTilbud) as a standalone digital offer platform further highlights its commitment to innovation in the retail sector. This move allows for specialized development and market penetration, targeting a growing consumer demand for digital savings and promotions. Dayli is projected to see a 15% increase in active users by the end of 2025, driven by targeted marketing and platform enhancements.

Further demonstrating a forward-thinking approach, North Media is integrating automated packing technologies within its distribution segment. This technological advancement is crucial for improving operational efficiency, reducing costs, and ensuring faster delivery times, which are critical competitive advantages in today's market. These automation efforts are expected to yield a 10% improvement in processing speed by early 2025.

- Digital Ecosystem Development: BoligPortal's 'single universe' concept is strengthening its market position in the Danish property technology sector.

- Independent Digital Platform: The spin-off of Dayli allows for focused growth and innovation in the digital offers market.

- Operational Efficiency Gains: Automation in distribution is set to boost productivity and reduce operational expenditures.

- Future-Proofing Operations: Continuous investment in technology ensures North Media remains competitive and adaptable to market changes.

North Media's market leadership in Denmark, particularly with FK Distribution in unaddressed print advertising and BoligPortal.dk in online rentals, provides a significant competitive edge and stable revenue streams. This dual dominance, combined with a long history dating back to 1965, has fostered deep market expertise and strong brand loyalty.

The company's hybrid business model, balancing the consistent cash flow from its Last Mile distribution segment with the high growth potential of digital platforms like BoligPortal, offers resilience. BoligPortal, in particular, saw a 10% year-on-year revenue increase in Q1 2025, reaching over DKK 100 million in profits in 2023, showcasing its value as a digital growth engine.

North Media's commitment to digital transformation, exemplified by BoligPortal's expanding ecosystem and the standalone development of Dayli, positions it for future growth. Investments in automation within its distribution segment are also enhancing operational efficiency, with processing speeds expected to improve by 10% by early 2025.

Financially, North Media maintains a strong balance sheet and a shareholder-focused approach, evidenced by its commitment to stable returns and annual dividends. Despite minor Q1 2025 financial setbacks, management's reaffirmed full-year outlook underscores the company's underlying financial resilience and strategic execution capabilities.

| Segment | Key Strength | 2023/2024/2025 Data/Projections |

|---|---|---|

| FK Distribution | Market Leadership (Denmark) | Dominant in unaddressed print distribution. |

| BoligPortal.dk | Digital Real Estate Dominance | 10% YoY revenue increase (Q1 2025); DKK 100M+ profit (2023). |

| Digital Services | Ecosystem Development | BoligPortal's 'single universe' strategy driving user engagement. |

| Dayli | Digital Offers Platform | Projected 15% active user increase by end of 2025. |

| Distribution Operations | Operational Efficiency | 10% processing speed improvement expected by early 2025 via automation. |

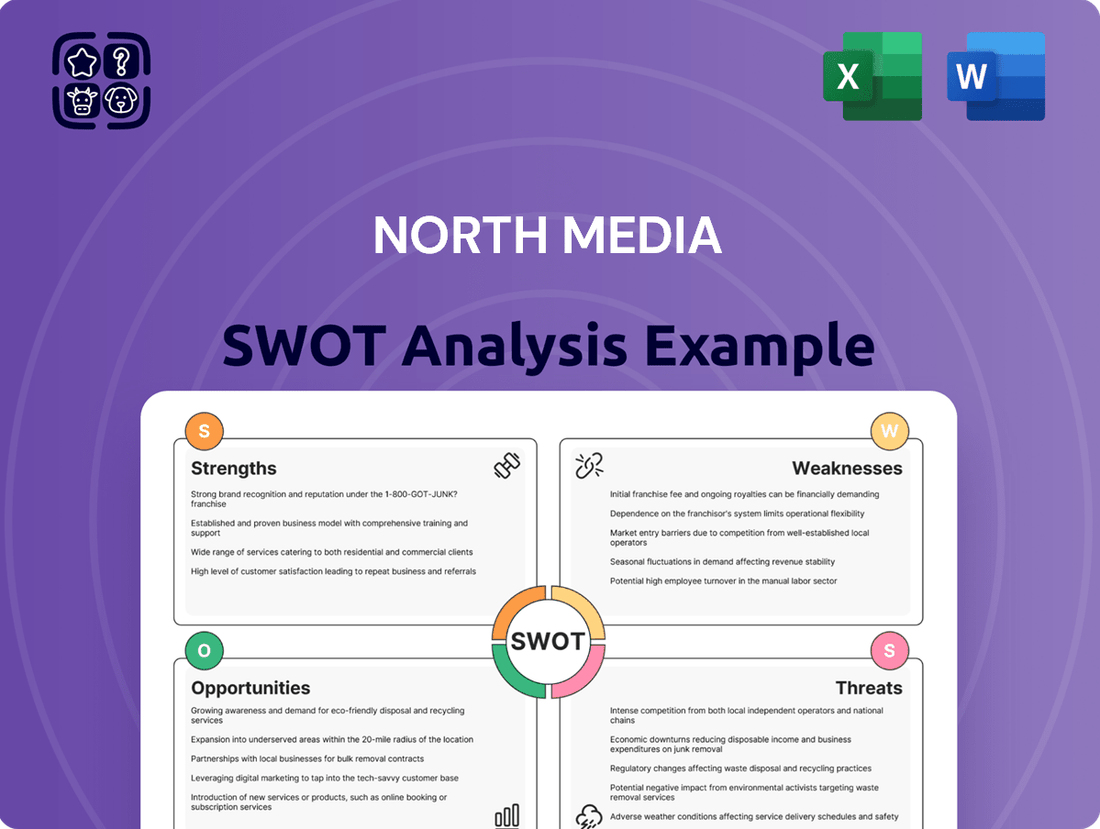

What is included in the product

Analyzes North Media’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic weaknesses, turning potential threats into opportunities.

Weaknesses

North Media's core Last Mile distribution segment, despite its market leadership, is confronting a significant headwind: a projected decrease in the volume of printed materials. This decline directly translates into revenue pressure, as the business model heavily relies on the sheer quantity of items distributed.

A concrete example of this vulnerability was seen in FK Distribution's Q1 2025 performance, which experienced a volume reduction. This dip was attributed to a key customer discontinuing the use of printed matter and the seasonal impact of the Easter holiday, highlighting the sensitivity of their volumes to client decisions and external factors.

This ongoing trend points to a more fundamental, structural challenge within North Media's traditional distribution business. The shift away from printed materials represents a long-term threat that requires strategic adaptation beyond simply optimizing current operations.

Integrating SDR Svensk Direktreklam, acquired in late 2023, has presented greater complexity and higher costs than originally planned. This integration difficulty, combined with a notable decrease in print volume for 2025 annual agreements, resulted in a DKK 155 million write-down on SDR's value during 2024, negatively affecting North Media's profitability.

The full rollout of automated packing in Sweden is now projected for the second half of 2025, indicating ongoing operational adjustments and potential delays in realizing expected efficiencies from the SDR acquisition.

While BoligPortal continues to be a star performer, other digital ventures within North Media have struggled to gain traction. Bekey, for instance, is currently undergoing a significant review of its business model and market strategy due to a noticeable decline in its earnings. This situation highlights a broader challenge in optimizing the performance of certain digital assets within the group.

The difficulties are not isolated to Bekey. Ofir's commercial activities were divested in early 2025. This decision stemmed from several years of weak results and stagnant revenue, indicating a persistent underperformance that necessitated a strategic exit. These instances point to a need for more robust performance across the entire digital services portfolio, beyond the success of BoligPortal.

Negative Impact of Securities Portfolio Volatility

North Media's financial performance is heavily tied to its securities portfolio, which can introduce significant volatility. For instance, in the first quarter of 2025, a negative net return of DKK 152 million from this portfolio directly contributed to a DKK 115 million net loss for the period. This demonstrates a clear weakness where external market movements, beyond the company's direct control, can substantially impact its bottom line.

This reliance on investment returns makes North Media susceptible to broader economic downturns or sector-specific shocks. The DKK 152 million negative return in Q1 2025 is a stark example of this vulnerability, showcasing how market fluctuations can overshadow operational successes. Consequently, the company faces a challenge in maintaining stable and predictable financial results when a significant portion of its earnings is derived from investments subject to market sentiment and economic conditions.

- Significant impact of securities portfolio on financial results.

- Q1 2025 saw a DKK 152 million negative net return from the securities portfolio.

- This portfolio performance contributed to a DKK 115 million net loss in Q1 2025.

- Vulnerability to market fluctuations outside core operations.

Increased Operating Costs

North Media has been grappling with rising operating expenses, notably within its Last Mile delivery operations. These increased costs are a direct result of significant investments made in integrating new systems, such as the SDR platform, and accommodating higher payroll expenses for delivery personnel following pay adjustments implemented in 2024. Furthermore, the company is investing heavily in developing innovative technical platforms, including MineTilbud/Dayli, which are contributing to the upward pressure on overall expenditures.

These escalating costs are directly impacting North Media's financial performance, placing a strain on both its earnings and overall profitability. For instance, the company reported that operating expenses in the Last Mile segment saw a notable increase, directly attributable to these integration and development initiatives. This situation underscores the challenge of balancing growth investments with maintaining healthy profit margins.

- Integration Costs: Expenses associated with integrating the SDR platform have added to the company's operating cost burden.

- Payroll Adjustments: Increased payroll for deliverers, following pay adjustments in 2024, represent a significant cost increase.

- New Platform Development: Investments in new technical platforms like MineTilbud/Dayli are contributing to higher operational expenditures.

- Profitability Pressure: The combination of these factors is creating pressure on North Media's earnings and profitability.

North Media faces challenges with underperforming digital ventures outside of BoligPortal. Bekey's business model and market strategy are under review due to declining earnings, and Ofir's commercial activities were divested in early 2025 due to persistent weak results and stagnant revenue.

The acquisition and integration of SDR Svensk Direktreklam has proven more complex and costly than anticipated. This, coupled with a decrease in print volume for 2025 annual agreements, led to a DKK 155 million write-down on SDR's value in 2024, impacting profitability, with the full automated packing rollout in Sweden now expected in the latter half of 2025.

Rising operating expenses, particularly in Last Mile delivery, are a significant weakness. These costs are driven by investments in system integrations like SDR, increased payroll from 2024 pay adjustments, and development of new technical platforms such as MineTilbud/Dayli, all of which are pressuring earnings and profitability.

| Weakness | Specifics | Impact | Timeline/Data |

|---|---|---|---|

| Digital Venture Underperformance | Bekey review, Ofir divestment | Struggling to gain traction, stagnant revenue | Ofir divested early 2025 |

| SDR Integration Costs & Delays | Complexity, higher costs than planned | DKK 155 million write-down in 2024 | Automated packing rollout H2 2025 |

| Rising Operating Expenses | System integration, payroll, new platforms | Pressure on earnings and profitability | Increased expenses in Last Mile segment |

Full Version Awaits

North Media SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This professional document provides a clear and actionable overview of North Media's strategic position. You'll gain immediate access to the complete, structured analysis upon completing your purchase. Expect no hidden content or altered information; what you see is precisely what you get.

Opportunities

North Media has a prime opportunity to deepen the reach and revenue streams of its digital assets. BoligPortal, a key player in the Danish property market, is not standing still; it's actively introducing new services like Data Insights, which taps into valuable market trends. This strategic move follows the successful integration of Danish functionalities into its Swedish counterpart, BostadsPortal, demonstrating a clear path for replicating success across borders.

Simultaneously, MineTilbud (Dayli) is being strategically repositioned as an exposure business, hinting at significant potential for international rollout. This expansion into new markets, coupled with the ongoing development of its existing platforms, positions North Media for substantial digital growth in the coming years. For instance, in 2023, BoligPortal saw continued user engagement, with an average of 1.6 million visits per month, showcasing the robust foundation for further monetization efforts.

BoligPortal's extensive and growing dataset is a significant asset. This is clearly demonstrated by their agreement with Nykredit, a major player in the Danish real estate market, for market analysis and property valuation. This collaboration highlights the inherent value and potential for new revenue streams derived from BoligPortal's unique data insights.

By expanding its data insights services, North Media, through BoligPortal, can unlock further value across its digital platforms. Forming strategic partnerships, similar to the Nykredit agreement, will be crucial in leveraging this data more effectively and reaching a wider audience with valuable property market intelligence.

North Media's SDR Svensk Direktreklam business is set to see major efficiency boosts with the ongoing implementation of automated packing and sorting for printed materials. This technology is slated for full rollout in the second half of 2025.

Once integration hurdles are cleared, these advancements are expected to substantially cut costs within the Last Mile segment, potentially improving the profitability of this key business area.

The company anticipates that by the end of 2025, the efficiency gains from these automated systems could lead to a reduction in operational costs by as much as 15% in the distribution process.

Potential for International Expansion

North Media's existing success in Denmark, particularly with its property portal BoligPortal, presents a clear pathway for international expansion. The company's strategic development of MineTilbud/Dayli into a platform with international scalability indicates a readiness to explore new markets. This isn't just theoretical; their progress with BostadsPortal in Sweden serves as a tangible early success and a strong indicator of this potential. The company is actively pursuing this by aiming to replicate its successful business models in neighboring Nordic and broader European regions.

The opportunity lies in leveraging established digital marketplace expertise. North Media's experience in Denmark, a market with similar consumer behaviors to other European nations, provides a solid foundation. Their strategic investments in technology to ensure platform scalability directly support international growth. Early traction in Sweden, with BostadsPortal, confirms the viability of their approach in new territories.

- Target Markets: Initial focus on Nordic countries (e.g., Norway, Finland) and then expanding into other accessible European markets.

- Scalability: The MineTilbud/Dayli platform's architecture is designed for international deployment, allowing for adaptation to local languages and regulations.

- Revenue Streams: Replicating successful subscription and advertising models from Denmark in new markets, potentially offering premium features for broader reach.

- Synergies: Potential for cross-promotion and shared operational efficiencies between existing and new international ventures.

Consolidation in the Danish Media Market

The Danish media landscape is actively consolidating, marked by a rise in mergers and acquisitions. North Media, as a diversified player, has the strategic opportunity to engage in this trend. This could involve acquiring businesses that complement its existing operations or divesting assets that are not performing optimally, thereby fortifying its market standing and streamlining its business portfolio.

A notable instance of this strategy is North Media's divestment of its job portal, Ofir, to Jobindex. This move exemplifies a proactive approach to portfolio management within a consolidating market. By shedding Ofir, North Media can redirect resources towards core or more promising ventures, enhancing overall efficiency and competitive edge.

- Market Consolidation: The Danish media sector is undergoing significant consolidation, creating opportunities for strategic M&A.

- Portfolio Optimization: North Media can enhance its market position by acquiring synergistic businesses or divesting underperforming units.

- Divestment Example: The sale of Ofir to Jobindex demonstrates North Media's active portfolio management strategy.

- Strategic Focus: Consolidation allows North Media to concentrate on its core strengths and potentially acquire complementary services to bolster its offerings.

North Media has a clear opportunity to leverage its digital expertise for international expansion, building on the success of BoligPortal in Denmark and the strategic development of MineTilbud/Dayli. The company's focus on expanding its data insights services, exemplified by the Nykredit agreement, promises new revenue streams and deeper market penetration. Furthermore, the ongoing automation of processes within SDR Svensk Direktreklam, expected to yield significant cost reductions by late 2025, will bolster profitability in the distribution segment.

The company is actively exploring expansion into Nordic countries, with Sweden already showing promising results via BostadsPortal. By replicating its successful digital marketplace models, North Media aims to capture new markets and diversify its revenue base. This strategy is further supported by the ongoing consolidation within the Danish media sector, presenting opportunities for strategic acquisitions or divestitures to optimize its portfolio and strengthen its competitive position.

Threats

A significant threat facing North Media is the ongoing and accelerating decline in demand for traditional print media, particularly unaddressed printed advertising materials and local newspapers. This shift is largely fueled by the pervasive move towards digitalization and growing environmental consciousness among consumers and advertisers alike.

This fundamental change in media consumption habits poses a direct risk to FK Distribution, a segment that still represents a substantial part of North Media's overall revenue. The continued erosion of print readership and advertising spend could therefore lead to a sustained decrease in profitability for this key business unit.

For instance, data from the Audit Bureau of Circulations (ABC) in the UK for the period ending December 2023 showed a continued year-on-year decline in the average circulation of national newspapers by over 8%, a trend mirrored in many other developed markets. This highlights the persistent challenge print media faces against digital alternatives.

The online marketplace, especially in job and rental segments, is seeing fierce competition from both long-standing companies and emerging digital businesses. For instance, BoligPortal, while a strong contender, operates in a landscape where maintaining market share, as evidenced by the sale of Ofir to a dominant player like JobIndex, remains a significant challenge. This dynamic necessitates ongoing investment in new features and technologies to stay ahead of rivals. In 2024, the digital advertising spend in Denmark was projected to reach approximately DKK 10.5 billion, underscoring the substantial revenue pools that attract and sustain this intense competition.

North Media is navigating a complex regulatory landscape, as shown by their planned appeal of a Danish Maritime and Commercial High Court decision concerning FK Distribution's tied sales practices between 2018 and 2019. This legal battle highlights the potential for increased scrutiny from competition authorities.

Such regulatory oversight could lead to significant operational adjustments and financial penalties. For instance, a shift in how media support systems are structured could directly affect North Media's revenue streams and overall profitability.

Economic Downturn and Consumer Restraint

Economic downturns and periods of consumer restraint, especially in Sweden, pose a significant threat by potentially reducing advertising volumes and consumer spending on key services. This was a notable challenge for SDR in Q1 2025, directly impacting printed matter volumes and the profitability within the crucial retail grocery sector.

The impact of such economic pressures can be seen in the broader market trends. For instance, a slowdown in consumer spending might lead to reduced marketing budgets for businesses, directly affecting media companies reliant on advertising revenue.

- Reduced Advertising Spend: Economic uncertainty often prompts businesses to cut marketing and advertising budgets, impacting revenue streams for media companies.

- Lower Consumer Spending: Consumers facing economic hardship tend to reduce discretionary spending, affecting sales of services and products advertised by North Media.

- Impact on Retail Sector: A slowdown in the retail grocery industry, as observed in Q1 2025, directly translates to lower advertising volumes for publications serving this sector.

Technological Disruption and AI Impact

The rapid evolution of technology, particularly the rise of AI-powered search and innovative digital advertising, presents a significant threat to North Media's established business models. For instance, advancements in generative AI could fundamentally alter how consumers discover and consume content, potentially bypassing traditional media channels. This ongoing technological disruption necessitates constant adaptation to remain competitive.

North Media faces the challenge of staying relevant in a media landscape that is continuously reshaped by new digital platforms and advertising techniques. Failing to adapt could lead to obsolescence, as seen with the decline of certain legacy media formats. The company must proactively invest in and integrate emerging technologies to counter these threats.

- AI-driven search engines are redefining content discovery, potentially reducing reliance on traditional media platforms.

- New digital advertising models are emerging that may offer more targeted and cost-effective solutions than current approaches.

- The **media industry's rapid digital transformation** requires continuous innovation to avoid losing market share.

- North Media's **ability to adapt its digital strategies** will be crucial for its long-term survival and growth.

North Media faces intense competition from established and new digital players in online marketplaces, particularly impacting its job and rental segments. The Danish digital advertising market, projected at DKK 10.5 billion in 2024, highlights the lucrative nature and fierce competition within this space, with companies like JobIndex actively consolidating market share.

Regulatory scrutiny remains a significant threat, as evidenced by North Media's planned appeal of a court decision regarding FK Distribution's past sales practices, indicating potential future compliance costs and operational adjustments.

Economic downturns, particularly in Sweden, have directly impacted North Media's printed matter volumes and profitability in the retail grocery sector, demonstrating the vulnerability of its revenue streams to broader economic slowdowns.

The rapid advancement of technology, especially AI-powered search and new digital advertising models, poses a fundamental threat to North Media's existing business models, necessitating continuous innovation and adaptation to remain competitive.

SWOT Analysis Data Sources

This North Media SWOT analysis is built on a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded view of both internal capabilities and external market dynamics, ensuring an accurate and actionable strategic assessment.