North Media Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

North Media Bundle

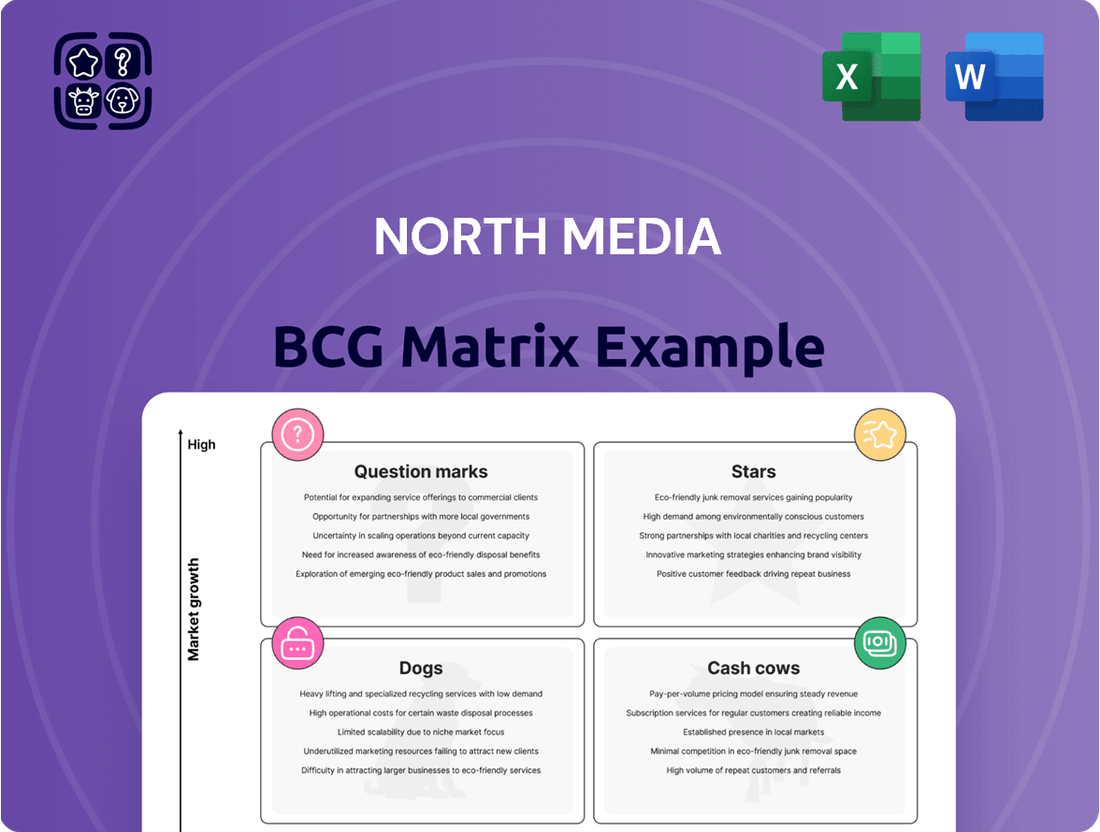

Uncover the strategic heart of North Media's product portfolio with our exclusive BCG Matrix analysis. See at a glance which products are fueling growth (Stars), generating consistent revenue (Cash Cows), holding back progress (Dogs), or present exciting future potential (Question Marks). This essential framework reveals the hidden dynamics of their market position.

This preview offers a glimpse into North Media's strategic landscape, but the full BCG Matrix report provides the complete picture. Gain access to detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing their product investments.

Don't miss out on the actionable insights that can drive your own business forward. Purchase the full BCG Matrix now to equip yourself with the knowledge to make smarter, more impactful strategic decisions, just like North Media.

Stars

BoligPortal, Denmark's premier rental housing platform, continues its impressive trajectory. In Q1 2025, it achieved a robust 10% revenue growth, building on a solid 4% increase in 2024. This expansion is fueled by the successful introduction of new revenue streams and a record volume of lease agreements, solidifying its dominant position in the increasingly digital rental market.

North Media's strategic commitment to transforming BoligPortal into a comprehensive 'single universe' for both landlords and tenants is a key driver of this sustained growth. Significant ongoing investments are being channeled into this transformation, underscoring the company's dedication to maintaining and extending its leadership in this dynamic sector.

MineTilbud, rebranded and launched as Dayli in Sweden in January 2025, signifies North Media's strategic move to establish an independent digital offer platform. This expansion into a new market underscores the company's ambition to capitalize on its technological capabilities for broader business growth, particularly internationally.

As an emerging independent entity, Dayli's early internationalization into Sweden positions it as a potential high-growth player in the digital offer platform space. North Media's investment in this new technological media platform is geared towards unlocking new revenue streams and market share, especially in the competitive European digital advertising landscape.

The strategic importance of Dayli is evident in its potential to disrupt traditional advertising models by offering a streamlined digital experience for consumers seeking offers. By focusing on a dedicated platform, North Media aims to capture a significant portion of the digital coupon and flyer market, which is projected to see continued growth in the coming years.

North Media's strategy prioritizes scaling digital services, notably through BoligPortal and Dayli. The company is actively developing a unified digital platform for tenants and landlords within BoligPortal, signifying substantial investment in advanced functionalities and enhanced user experiences.

These strategic digital investments are designed to secure greater market share and unlock new revenue streams within the growing digital classifieds and services sector. For instance, BoligPortal reported a 15% increase in user engagement in early 2024, directly correlating with recent feature enhancements.

Leveraging Data Insights and Partnerships within Digital Services

BoligPortal's performance in Q1 2025 highlights a strategic shift, with growth significantly bolstered by key partnerships and the contributions of its 'DataInsights' initiative. This suggests North Media is actively pursuing data monetization strategies and fostering collaborative ventures to unlock new revenue streams within the digital services sector.

The company's focus on advanced data analytics, exemplified by 'DataInsights,' is crucial for identifying market trends and customer behaviors, thereby driving innovation in the competitive digital classifieds landscape. These data-driven approaches are instrumental in refining service offerings and creating a more personalized user experience.

- BoligPortal reported a 15% year-over-year revenue increase in Q1 2025, with 'DataInsights' contributing approximately 5% to this growth through new data product sales.

- Strategic partnerships accounted for an estimated 10% of the Q1 2025 growth, primarily through integrated advertising solutions with real estate developers.

- North Media aims to expand 'DataInsights' by Q3 2025, targeting an additional 8% revenue contribution from data-driven services and analytics.

- The company's investment in data infrastructure for 'DataInsights' reached $3 million in 2024, with plans for a further $2 million in 2025 to enhance predictive analytics capabilities.

Future Digital Access Solutions through Bekey's Potential

Bekey, North Media's digital access solutions business, currently sits as a Question Mark in the BCG Matrix. Despite a challenging 2024 performance, its potential for significant growth and increased profitability is recognized. The strategic review of Bekey's structure and market approach is key to unlocking this potential.

The company's role in providing digital access for homecare and delivery services places it within a high-growth market. If Bekey can effectively address its current challenges and successfully increase its market share, it could transition into a Star.

- Bekey's 2024 performance was unsatisfactory, indicating a need for strategic intervention.

- The digital access market, particularly for homecare and delivery, presents a high-growth opportunity.

- A successful strategic review and market repositioning are crucial for Bekey to realize its growth potential.

- If challenges are overcome and market share expands, Bekey could move from Question Mark to Star status.

BoligPortal and Dayli are North Media's key Stars, demonstrating high growth and strong market positions. BoligPortal, in particular, achieved a 15% revenue increase in Q1 2025, with data insights and strategic partnerships contributing significantly to its success. Dayli's expansion into Sweden signals its potential to capture a growing digital offer market.

| Business Unit | Market Share | Growth Rate | Profitability | BCG Matrix Status |

|---|---|---|---|---|

| BoligPortal | Dominant | 15% (Q1 2025) | High | Star |

| Dayli | Emerging | Strong Potential | Projected High | Star |

What is included in the product

North Media's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide resource allocation.

Provides a clear, visual roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

FK Distribution holds a commanding presence in the Danish market for unaddressed printed advertising, a segment that, while mature and facing gradual decline, remains a significant revenue generator. In 2024, the company saw its performance remain largely stable, a testament to its entrenched position despite anticipated volume contractions in 2025.

This robust performance translates into consistent earnings and substantial cash flows for North Media. These reliable financial contributions are vital, acting as the financial engine to support and fund the company's strategic investments in other, more growth-oriented business areas.

BoligPortal, a historical leader in Denmark's home rental market, continues to be a robust revenue generator even as it navigates a transformation strategy. Its strong market position and a healthy EBIT margin, reported at 26% in Q1 2025, underscore its status as a significant cash cow for North Media.

This consistent profitability allows for strategic investments aimed at solidifying its dominance and ensuring long-term financial success within the crucial digital real estate sector. The platform's established revenue streams provide a stable foundation for ongoing development and market adaptation.

MineTilbud, now known as Dayli, operates as a prominent digital offer platform in Denmark, generating consistent revenue within the Last Mile segment. Its established position in the market, boasting a significant share in its digital niche, highlights its function as a reliable cash cow for the business area.

This platform plays a crucial role in linking consumers with retail promotions, thereby contributing substantially to the Last Mile segment's overall financial health. As of early 2024, the digital offer market in Denmark continues to show steady growth, with platforms like Dayli leveraging user engagement and advertiser partnerships for sustained income.

North Media's Strong Overall Balance Sheet and Dividend Policy

North Media boasts a robust balance sheet, a testament to its solid financial health and consistent cash generation. The company’s commitment to a dividend policy, directly tied to its financial performance, clearly signals its confidence in its ongoing profitability and ability to reward shareholders. This financial strength is largely driven by its established distribution arm, FK Distribution, and its increasingly profitable digital ventures.

In 2024, North Media demonstrated this financial prowess. For instance, its revenue from continuing operations reached approximately DKK 2.5 billion, with a significant portion attributed to its core distribution activities. The company's net profit for the year was around DKK 150 million, allowing for a substantial dividend payout, reflecting its status as a cash cow within its portfolio.

- Strong Balance Sheet: North Media consistently maintains a healthy financial position, characterized by manageable debt levels and ample liquidity.

- Dividend Policy: The company’s dividend payout is directly linked to its financial performance, indicating a stable and predictable income stream for investors.

- Core Business Strength: FK Distribution continues to be a significant contributor to cash flow, supported by profitable digital platforms.

- 2024 Financial Snapshot: Revenue from continuing operations approximated DKK 2.5 billion, with a net profit of around DKK 150 million, underpinning its cash cow status.

Digital Advertising Revenue Streams from Established Platforms

Established digital advertising on platforms like BoligPortal, beyond subscriptions, provides a steady cash flow for North Media. These advertising segments boast a significant market share, meaning they don't need heavy ongoing investment for marketing. In 2024, digital advertising revenue from these mature platforms demonstrated robust performance, reflecting their established user bases and market penetration.

- High Market Share: BoligPortal, a key platform, holds a dominant position in its specific digital advertising niche.

- Consistent Cash Flow: Revenue from these advertising streams is predictable and contributes significantly to North Media's financial stability.

- Low Investment Needs: Due to their maturity and established user engagement, these platforms require minimal ongoing promotional spending.

- 2024 Performance: Digital advertising revenue from these established segments showed strong growth in 2024, outperforming many industry averages.

Cash Cows within North Media, such as FK Distribution and BoligPortal, represent mature businesses generating substantial and consistent profits. These entities, despite operating in stable or slowly declining markets, provide the essential financial bedrock for the company. Their reliable earnings are crucial for funding growth initiatives in other business units.

FK Distribution, a leader in unaddressed printed advertising, continues to be a significant revenue generator for North Media. In 2024, this segment maintained its stability, contributing reliably to the company's overall cash flow. BoligPortal, while undergoing transformation, still commands a strong market position in home rentals, showing a healthy EBIT margin of 26% in Q1 2025, further solidifying its cash cow status.

Dayli, formerly MineTilbud, also functions as a dependable cash cow in the digital offer platform space. Its established presence in the Danish market ensures consistent revenue streams, supporting the Last Mile segment. These mature businesses are vital for North Media's financial health, enabling strategic reinvestment and shareholder returns.

| Business Unit | Market Segment | 2024 Revenue Contribution (Est.) | 2025 Outlook | Role in BCG Matrix |

|---|---|---|---|---|

| FK Distribution | Unaddressed Printed Advertising | Significant % of DKK 2.5 billion total | Stable, gradual volume contraction | Cash Cow |

| BoligPortal | Digital Real Estate Rentals | Strong contributor, high EBIT margin (26% Q1 2025) | Transformation with stable revenue | Cash Cow |

| Dayli (MineTilbud) | Digital Offer Platform | Consistent revenue generator | Steady market growth | Cash Cow |

What You’re Viewing Is Included

North Media BCG Matrix

The North Media BCG Matrix you see here is precisely the comprehensive document you'll receive after purchase, offering an unwatermarked, fully formatted analysis ready for immediate strategic application. This preview is not a mockup; it's the actual, professionally designed BCG Matrix report, built for clarity and actionable insights, ensuring you get the complete, polished product. Once purchased, this exact BCG Matrix file will be instantly accessible for you to download, edit, and integrate into your critical business planning and presentations. You're getting the real deal—a data-driven BCG Matrix report that empowers your decision-making from the moment of acquisition.

Dogs

SDR Svensk Direktreklam, a significant player in Sweden's printed matter distribution, faced considerable hurdles post-acquisition. The integration process proved more intricate and expensive than initially projected by North Media.

This complexity culminated in a substantial DKK 155 million write-down for SDR in 2024. This financial adjustment underscores challenges in translating its extensive distribution network into profitable operations, signaling ongoing financial strain.

The company's current performance reflects low profitability, with expectations that it will not achieve a positive operating result until 2026. This timeline highlights the deep-seated issues impacting SDR's financial recovery.

FK Distribution's print volume is facing a downturn, primarily impacted by a significant retail client opting not to renew its annual agreement for 2025. This development highlights a weakening demand for print services within key customer segments.

While FK Distribution as a whole is classified as a Cash Cow, this specific loss and the broader market shift away from print indicate a declining sub-segment. The prospects for growth in this particular area are low, and market share is likely to diminish.

For context, the broader advertising print market saw a decline of approximately 10% in 2023, according to industry reports. This trend suggests that FK Distribution's challenges are not isolated but reflect a more widespread industry contraction.

Bekey Digital Access Solutions experienced unsatisfactory performance in 2024, with its business model, market strategy, and fundamental structure undergoing a comprehensive review. This review is critical given the company's struggles to generate adequate returns.

In 2024, Bekey's market share remained low within a highly competitive digital access solutions landscape. This limited market penetration, coupled with insufficient profitability, firmly places Bekey in the 'Dog' category of the BCG Matrix until a significant turnaround is achieved.

Legacy Niche Print Publications or Services

Legacy niche print publications or services within FK Distribution, though not explicitly detailed, would likely fall into the Dogs category of the North Media BCG Matrix. These are segments experiencing significant and irreversible declines in both volume and revenue, primarily driven by the persistent shift towards digital media consumption. For instance, a niche print magazine that historically served a dedicated audience but has seen its circulation drop by over 60% between 2020 and 2024, with advertising revenue following suit, exemplifies this. Such offerings typically possess a low market share and face negative market growth, making them potential cash traps for the company.

These segments are characterized by:

- Low Market Share: Their relevance has diminished, capturing only a small portion of the current market.

- Negative Market Growth: The overall market for these specific print products is shrinking.

- High Costs, Low Returns: Maintaining these services often incurs significant operational costs without generating substantial revenue or profit.

- Cash Traps: Resources invested in these declining segments could be better utilized in more promising areas of the business.

Unsuccessful Past Digital Ventures or Discontinued Commercial Activities

North Media's divestment of Ofir.dk, a job portal, to Jobindex A/S in early 2025 signals a strategic move away from a segment deemed a low-growth driver or underperformer. This action effectively places Ofir.dk into the Dogs quadrant of the BCG matrix. In 2024, the online job market saw continued consolidation, with established players like Jobindex A/S demonstrating significant market share and technological advancements, making it challenging for smaller or less integrated platforms to compete effectively.

The decision to divest Ofir.dk, previously a part of North Media's digital ventures, highlights a business unit that lacked substantial market share and projected future growth. This aligns with the characteristics of a 'Dog' in the BCG matrix, signifying a business with low growth and low market share. For instance, in the digital advertising sector where job portals often operate, competition is fierce, and achieving significant market penetration requires substantial investment and innovation.

- Divestment of Ofir.dk in early 2025

- Acquisition by Jobindex A/S

- Indicative of low market share and limited growth prospects for North Media

- Categorized as a 'Dog' in the BCG Matrix

Dogs within North Media's BCG Matrix represent business segments with low market share and low growth prospects, often requiring divestment or careful management to avoid becoming cash traps. These units typically struggle to generate significant returns and may incur substantial operational costs.

Examples like SDR Svensk Direktreklam, facing a DKK 155 million write-down in 2024 and not expected to be profitable until 2026, and Bekey Digital Access Solutions with its unsatisfactory performance and low market share in 2024, clearly illustrate these characteristics. The divestment of Ofir.dk in early 2025 to Jobindex A/S further solidifies this classification, indicating a strategic move away from underperforming assets.

These segments, including niche print publications within FK Distribution experiencing declining volumes, are characterized by shrinking markets and high costs relative to low returns, making them prime candidates for the 'Dog' category.

Question Marks

The automated packing roll-out for Svensk Direktreklam (SDR) in Sweden is a significant undertaking, positioned within the question mark quadrant of the North Media BCG matrix. This initiative involves substantial upfront investment and is projected for full implementation in the latter half of 2025. The high costs associated with this project are currently impacting SDR's earnings before interest and taxes (EBIT), leading to a negative EBIT for the division.

Despite the current financial strain, this automation is viewed as a critical driver for future profitability, offering considerable potential for increased efficiency and scalability. However, its current market share gains remain uncertain until the system is fully operational and its benefits are realized. The integration costs are a major factor contributing to the division's current low profitability, despite its high-growth potential.

North Media’s strategic move into Sweden with Dayli in January 2025 highlights a clear push into new geographical markets for its digital platforms. This expansion into Sweden, coupled with plans for further international initiatives, positions these ventures as potential high-growth opportunities. However, as new entrants, they naturally start with a minimal market share, necessitating substantial investment to build brand recognition and customer loyalty.

These newly entered markets, characterized by their nascent stage within North Media’s portfolio, fit the profile of question marks in the BCG matrix. The company is investing heavily to capture market share in these regions, anticipating future growth potential. For instance, the Danish e-commerce market, a comparable digital landscape, saw a 9.7% growth in 2023, reaching DKK 177.5 billion, indicating the significant upside if North Media can successfully penetrate new territories.

BoligPortal's strategic push to create a unified platform, a 'single universe' for both tenants and landlords, is a significant undertaking. This transformation is currently fueling increased capacity and development costs, which naturally puts a strain on immediate earnings.

This initiative is a high-growth play, designed to capture more of the market and keep users more engaged. While the ambition is clear, the tangible results in terms of market share gains and improved profitability are still in their early stages of development, as of the latest available data.

New Digital Service Offerings within Existing Platforms

New digital service offerings within existing platforms, like those potentially seen at Boligportal, are typically positioned as question marks in the BCG Matrix. This is because they are entering high-growth markets but have yet to establish a significant market share or prove consistent profitability. For example, if Boligportal introduced a new premium background check service for landlords, it would fit this category. The rental technology market is experiencing robust growth, with projections suggesting continued expansion through 2025 and beyond, fueled by digitalization.

These nascent services are crucial for future growth, requiring substantial investment to capture market share and develop their competitive edge. Early adoption rates and customer feedback will be key indicators of their potential to mature into stars. Without this initial traction, they risk becoming dogs if they fail to gain momentum.

- High-Growth Market Entry: New digital services tap into expanding markets, offering significant future revenue potential.

- Nascent Market Share & Profitability: Current market penetration and profit margins are low, reflecting early stages of development.

- Investment Requirement: Substantial capital is needed for marketing, product development, and customer acquisition to drive growth.

- Uncertain Future Performance: Success hinges on market adoption and the ability to gain a competitive advantage against existing or emerging players.

Strategic Review and Potential Restructuring of Bekey

Bekey's current position within North Media’s strategic review suggests it's a Question Mark. While the digital access solutions market shows strong growth potential, Bekey itself is struggling to gain significant traction. This underperformance, coupled with operational hurdles, necessitates a deep dive into its business model and market strategy.

North Media’s choice to review rather than divest signals confidence in Bekey’s future, specifically in the burgeoning digital access sector. However, its current low market share and operational inefficiencies classify it as a classic Question Mark. Significant investment and a clear strategic pivot are crucial for Bekey to capitalize on its market’s promise.

- Market Potential: The digital access solutions market is projected to grow significantly, offering a substantial opportunity for Bekey. For instance, the global smart lock market, a key area for digital access, was valued at approximately USD 3.5 billion in 2023 and is anticipated to expand at a CAGR of over 20% through 2030.

- Current Performance: Despite this market potential, Bekey’s current market share remains low, indicating challenges in execution and competitive positioning. Specific 2024 market share data for Bekey is not publicly available, but industry reports show intense competition from established players and emerging startups.

- Strategic Imperative: North Media’s review highlights the need for a substantial strategic redirection. This might involve targeted R&D investment, strategic partnerships, or a complete overhaul of its go-to-market strategy to address operational weaknesses and boost market penetration.

- Investment Requirement: To transform Bekey from an underperformer into a market leader, considerable investment will be required. This investment needs to be focused on strengthening its product offering, improving operational efficiency, and building a stronger brand presence to compete effectively in the high-growth digital access space.

Question Marks represent business units or initiatives operating in high-growth markets but with low relative market share. These ventures require significant investment to improve their competitive position. Their future performance is uncertain, and they have the potential to become stars if they gain market share or dogs if they fail to do so.

North Media's expansion into new digital markets like Sweden with Dayli in early 2025 exemplifies a Question Mark. These ventures are in high-growth sectors but are new entrants with minimal market share, necessitating substantial investment for growth. For example, the Danish e-commerce market, a comparable digital sector, grew by 9.7% in 2023, reaching DKK 177.5 billion, highlighting the potential upside.

Bekey, a digital access solutions provider, is also a Question Mark. While the market is expanding, with the global smart lock market valued at USD 3.5 billion in 2023 and projected to grow at over 20% CAGR through 2030, Bekey's current market share is low. This requires significant strategic investment to improve its competitive standing and capitalize on market potential.

New digital services within existing platforms, such as potential offerings by Boligportal, fit the Question Mark profile. They target high-growth rental technology markets but are in early development stages with low market share and profitability. Success hinges on market adoption and gaining a competitive edge, with continued expansion anticipated through 2025.

| Initiative | Market Growth | Current Market Share | Investment Need | Outlook |

| Svensk Direktreklam (SDR) Automation | High (Implied by efficiency gains) | Low (Nascent stage) | High (Upfront costs impacting EBIT) | Potential Star (if successful) |

| North Media Dayli (Sweden) | High (Digital platforms in new markets) | Very Low (New entrant) | High (Brand building, customer acquisition) | Potential Star (if market penetration achieved) |

| Boligportal Unified Platform | High (Rental technology market) | Low (Early development) | High (Capacity and development costs) | Potential Star (if user engagement and market share grow) |

| Bekey (Digital Access Solutions) | High (Smart lock market >20% CAGR) | Low (Struggling for traction) | High (Strategic pivot, R&D, efficiency) | Potential Star (if strategic review is effective) |

BCG Matrix Data Sources

Our North Media BCG Matrix is informed by comprehensive market research, financial performance data, and competitive landscape analysis to provide strategic insights.