North Media Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

North Media Bundle

North Media faces a dynamic market, shaped by the bargaining power of buyers and the intensity of rivalry. Understanding these forces is crucial for navigating its competitive landscape.

The threat of new entrants and the availability of substitutes also present significant challenges North Media must address to maintain its market position.

Suppliers can exert considerable influence, potentially impacting North Media's costs and operational efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore North Media’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of paper and printing services for distribution companies like North Media's FK Distribution often find their bargaining power somewhat limited. This is because large distributors represent a concentrated demand, allowing them to negotiate favorable pricing. For instance, in 2024, the global printing paper market experienced price fluctuations driven by raw material costs and demand shifts, with major buyers like FK Distribution able to leverage their volume to secure better terms.

Furthermore, the overall volume of printed materials continues to decline, intensifying competition among suppliers for the remaining large contracts. This downward trend means suppliers must be more competitive on price to secure business. As an example, industry reports from late 2024 indicated a continued contraction in the demand for commercial printing services, pushing suppliers to offer more aggressive pricing structures.

However, certain suppliers can still wield influence. Those possessing specialized printing capabilities, such as advanced finishing techniques or unique paper stocks, may find a stronger negotiating position. Similarly, suppliers offering sustainably sourced paper or those with a proven track record of environmental compliance can command a premium and gain leverage, especially with distributors prioritizing ESG (Environmental, Social, and Governance) initiatives in 2024.

North Media's Last Mile segment, encompassing FK Distribution and SDR, is significantly dependent on its delivery personnel. In 2024, the cost of employing this essential workforce saw an increase, reflecting broader labor market trends. This reliance, coupled with potential labor shortages, grants these deliverers, whether individuals or through agencies, a notable degree of bargaining power.

The availability and cost of last-mile delivery labor are critical factors for North Media. If demand for delivery services outstrips the supply of available drivers, or if unions become more prevalent in this sector, the bargaining power of these personnel will likely escalate further, impacting operational costs.

North Media's reliance on IT infrastructure and software providers for its online marketplaces, such as BoligPortal.dk, presents a significant factor in its supplier bargaining power. While the general cloud services market is competitive, limiting individual provider leverage, the need for specialized software and sophisticated data analytics tools for their digital transformation initiatives can increase the bargaining power of key suppliers.

For instance, in 2024, the global IT infrastructure market was valued at over $150 billion, showcasing a vast landscape of providers. However, North Media's strategic emphasis on centralized platforms and digital advancement means that providers offering unique, mission-critical solutions or those with deep integration capabilities can command greater influence over pricing and terms.

The company's investment in digital transformation, aiming to enhance user experience and operational efficiency on platforms like BoligPortal.dk, underscores its dependence on these specialized IT partners. This dependence can shift the balance, allowing suppliers of advanced analytics or proprietary software to exert more significant bargaining power, especially if alternative solutions are scarce or costly to implement.

Impact of Fuel and Energy Costs

Fuel costs are a major concern for North Media, particularly for FK Distribution's extensive delivery network. For instance, diesel prices, a key component of transportation expenses, saw significant volatility in 2024, with average prices fluctuating monthly. These fluctuations directly influence North Media's bottom line, giving energy suppliers considerable leverage.

The indirect bargaining power of energy suppliers stems from their ability to impact North Media's operational costs. A sustained rise in oil prices, for example, would inevitably increase transportation expenses for delivering printed publications. This dependency means that while North Media isn't directly negotiating with oil giants, their pricing decisions have a tangible effect on North Media's profitability.

North Media is actively exploring ways to reduce its reliance on traditional energy sources. Initiatives aimed at making printed matter production more sustainable, such as investing in solar power for printing facilities, are underway. These efforts, while still developing, aim to create a buffer against the unpredictable nature of global energy markets and lessen the bargaining power of fuel suppliers over time.

- Significant Operational Expense: Fuel costs for FK Distribution's delivery fleet are a substantial part of North Media's operating budget.

- Indirect Supplier Power: Fluctuations in global energy prices, such as crude oil and natural gas, indirectly empower energy suppliers by increasing North Media's transportation costs.

- Mitigation Strategies: North Media's investments in green initiatives, like solar power for its operations, are designed to reduce dependence on fossil fuels.

- Profitability Impact: The direct correlation between energy costs and distribution expenses means that energy price hikes can significantly squeeze North Media's profit margins.

Specialized Digital Talent

The need for specialized digital talent to build and maintain online platforms like BoligPortal.dk significantly impacts North Media. This includes highly sought-after professionals such as software developers and data scientists, whose expertise is crucial for innovation and platform functionality.

In Denmark's competitive technology job market, these skilled individuals are in high demand. This scarcity allows them to negotiate for higher salaries and more favorable working conditions, effectively giving them substantial bargaining power. As essential contributors, these digital experts act as key 'suppliers' of critical skills to North Media's digital operations.

- Talent Scarcity: The ongoing shortage of qualified software developers and data scientists in Denmark means companies like North Media must compete fiercely for talent.

- Wage Inflation: This competition drives up wages for digital professionals. For example, average gross monthly salaries for IT specialists in Denmark saw an increase in 2024.

- Negotiation Leverage: Professionals with in-demand skills possess significant leverage to dictate terms, impacting North Media's operational costs and project timelines.

- Strategic Importance: The ability to attract and retain this specialized talent is directly linked to the success and competitiveness of North Media's digital service offerings.

Suppliers of paper and printing services for North Media's FK Distribution face limited bargaining power due to the distributor's significant demand, enabling negotiation of favorable pricing. The declining volume of printed materials in 2024 further intensifies supplier competition for contracts, pushing them towards more aggressive pricing strategies.

| Supplier Type | Bargaining Power Factor | Impact on North Media |

|---|---|---|

| Paper & Printing | High volume demand from FK Distribution, declining print volume | Limited supplier power, competitive pricing |

| Delivery Personnel | Labor shortages, increasing employment costs | Significant supplier power, potential cost increases |

| IT & Software | Need for specialized digital talent and platforms | Increased power for niche providers, strategic dependency |

| Fuel Suppliers | Volatility in energy prices impacting transportation costs | Indirect but significant supplier power, cost pressure |

What is included in the product

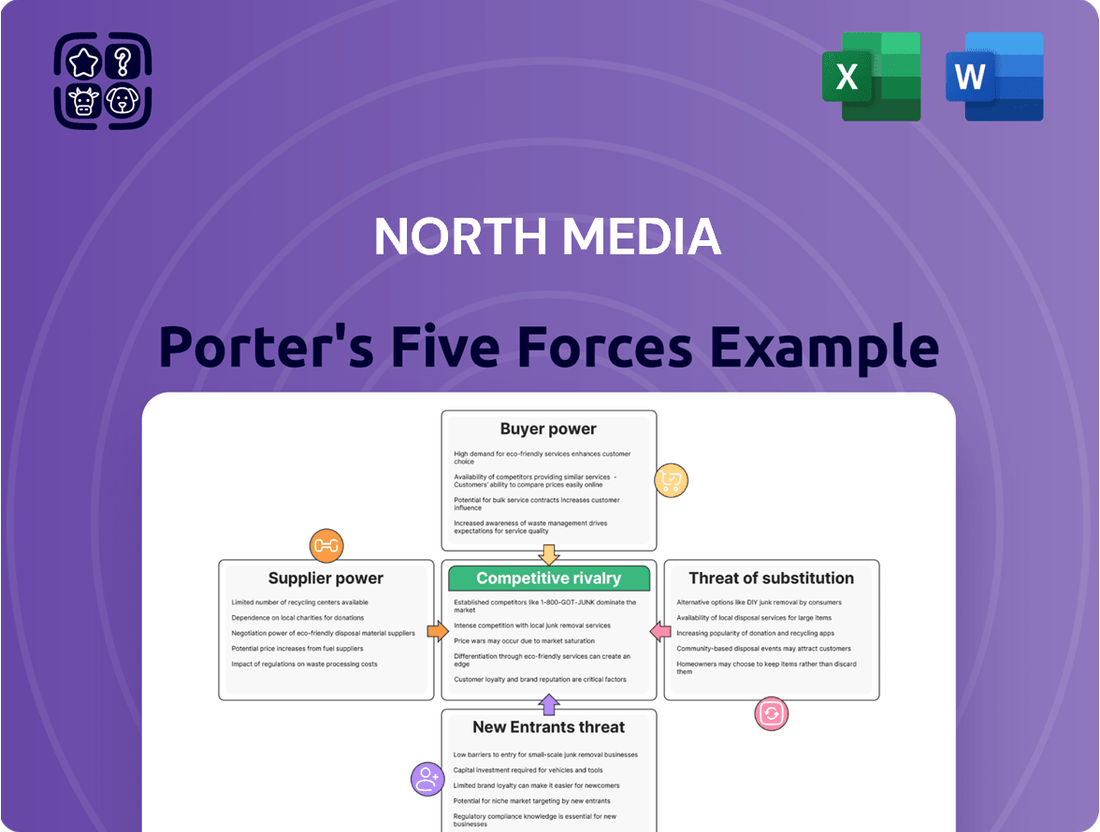

Assesses the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within North Media's specific industry context.

Visualize competitive intensity with a dynamic interactive dashboard, instantly highlighting areas of strategic vulnerability.

Customers Bargaining Power

Customers for unaddressed printed advertising materials, like large retail chains, are increasingly migrating to digital advertising. This shift directly reduces the volume of print advertising materials distributed, impacting the entire print sector. For instance, while specific 2024 figures for North Media's print advertising volume decline are not publicly detailed, industry-wide trends show a significant move to digital, with global digital ad spending projected to reach over $700 billion in 2024.

Consequently, the bargaining power of individual advertisers within this declining print market is diminishing. As print volumes shrink, advertisers seeking cost-efficiency and broader reach are naturally gravitating towards more effective digital channels, lessening their reliance on traditional print distribution. This dynamic forces distributors like FK Distribution to adapt to a smaller, more competitive print landscape.

The digital advertising landscape offers businesses a vast array of choices, meaning customers seeking to advertise on platforms like minetilbud face numerous alternatives. They can easily opt for social media giants, powerful search engines, or a multitude of other online classifieds, each vying for their advertising spend.

This extensive fragmentation and the straightforward process of shifting between these diverse platforms significantly enhance the bargaining power of these business customers. Consequently, they are in a strong position to demand competitive pricing structures and demonstrable, effective reach for their campaigns.

For instance, in 2024, global digital ad spending was projected to reach over $600 billion, with major platforms like Google and Meta capturing substantial shares, indicating a highly competitive environment where customer choice is paramount.

The bargaining power of customers for BoligPortal.dk is influenced by the Danish rental housing market's supply and demand dynamics. In 2024, urban areas continued to see high demand, with average rents in Copenhagen reaching approximately DKK 13,000 per month, giving landlords of desirable properties a stronger position.

Tenants, particularly in competitive markets like Aarhus, where vacancy rates remained low, often face limited choices, reducing their individual bargaining power. However, the sheer volume of tenants seeking housing means collective bargaining power, though not typically exercised through formal channels, is a constant underlying factor.

For landlords, BoligPortal offers access to a broad tenant pool, which can be a significant advantage. This access can be particularly valuable for landlords with properties that might be harder to rent independently, thereby increasing their leverage on the platform.

Conversely, tenants can leverage the availability of multiple rental platforms, although BoligPortal is a dominant player. The ease with which tenants can compare listings and switch between platforms, even if minor, provides a degree of counter-balance to landlord power.

Buyer Power in Online Job Portals (Post-Ofir Sale)

Following the sale of Ofir.dk to Jobindex, North Media's direct influence as a major online job portal operator has lessened. For any remaining digital services that bridge employers and job seekers, the bargaining power of these customers is shaped by the intensity of competition and how distinctive the platform's features are. In the broader Danish online recruitment landscape of 2024, a fragmented market with numerous niche platforms can empower both employers and candidates by offering more choices and negotiating leverage.

The power of buyers, in this context, is influenced by several factors:

- Market Concentration: A highly competitive market with many similar job portals typically gives buyers more power, as they can easily switch to a competitor if pricing or services are unsatisfactory.

- Information Availability: When job seekers and employers have easy access to information about various platforms, their pricing, and their effectiveness, their ability to negotiate or demand better terms increases.

- Switching Costs: If it is easy and inexpensive for employers to post jobs on multiple platforms or for job seekers to apply through various channels, buyer power is amplified. Conversely, high switching costs reduce buyer power.

- Uniqueness of Offering: If North Media's remaining services offer unique features or access to a highly specialized talent pool, this can reduce the bargaining power of customers.

Price Sensitivity Across Segments

Customers for North Media’s print and digital offerings often exhibit significant price sensitivity. This is largely due to the proliferation of alternative advertising and communication platforms available in the market, creating a competitive landscape where pricing becomes a key differentiator. For instance, in 2024, the digital advertising market saw continued growth, with businesses increasingly allocating budgets to platforms offering granular targeting and measurable results, putting pressure on traditional media pricing.

North Media faces a direct challenge in maintaining its pricing power. To remain competitive, the company must consistently offer attractive rates while simultaneously proving the tangible return on investment (ROI) for its advertising solutions. This necessitates a clear demonstration of value, linking campaign performance directly to client business objectives.

- Price Sensitivity: Customers across North Media's print and digital segments are highly attuned to pricing due to abundant alternative advertising channels.

- Competitive Pricing: The company must offer competitive rates to attract and retain clients in a crowded marketplace.

- ROI Demonstration: North Media needs to clearly articulate and prove the return on investment for its services to justify its pricing.

- Market Trends: In 2024, the digital advertising sector continued to emphasize performance-based pricing models, influencing expectations across all media types.

Customers for North Media, particularly advertisers across its print and digital platforms, possess considerable bargaining power. This is driven by the sheer volume of alternative advertising channels available, from social media to search engines, allowing them to easily shift budgets if pricing or perceived value is not met. For example, global digital ad spending was projected to exceed $600 billion in 2024, highlighting the competitive options available.

The ease with which customers can compare offerings and switch between platforms significantly reduces North Media's pricing power. Businesses today demand demonstrable ROI, forcing North Media to justify its rates by showcasing campaign effectiveness, especially as performance-based pricing models gain traction in the 2024 advertising landscape.

Furthermore, the trend of advertisers migrating from print to digital advertising, as seen in the projected over $700 billion global digital ad spend for 2024, weakens the bargaining position of print-focused entities. This shift means customers have more leverage in demanding cost-effective and data-driven solutions from remaining print distributors.

| Factor | Impact on North Media Customer Bargaining Power | Supporting Data/Trend (2024 Focus) |

|---|---|---|

| Availability of Alternatives | High | Global digital ad spend projected >$700 billion, indicating numerous competing channels. |

| Price Sensitivity | High | Customers seek competitive rates and demonstrable ROI due to market options. |

| Switching Costs | Low | Ease of shifting between digital platforms amplifies customer leverage. |

| Information Availability | High | Transparency in platform pricing and performance empowers customer negotiation. |

Preview Before You Purchase

North Media Porter's Five Forces Analysis

This preview shows the exact North Media Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive look at the competitive landscape. You'll gain immediate access to this fully formatted and professionally written document, allowing you to leverage its insights without delay. No placeholders or samples; what you see here is the complete, ready-to-use analysis. Understand the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry within North Media's market. This is your deliverable, ready for immediate application to your strategic planning.

Rivalry Among Competitors

While FK Distribution is a major player in Denmark's unaddressed mail distribution, particularly with PostNord exiting letter delivery by the end of 2025, the broader print market is shrinking. This decline intensifies competition among remaining logistics providers, with companies like DAO poised to absorb PostNord's former letter market share.

The rivalry isn't just about physical delivery; it extends to securing advertising revenue. The persistent digital shift means that print distribution services compete fiercely with digital channels for marketers' budgets, further fragmenting the advertising landscape.

The online marketplace, especially for job and rental listings, is a fiercely competitive arena. BoligPortal.dk, a key player, contends with other specialized rental sites and even general classifieds platforms that can list properties. This means they must constantly innovate and offer superior user experiences to stand out from a crowded field.

In the job market segment, particularly after the sale of Ofir, Jobindex has emerged as a leading force. However, competition remains robust with other prominent national and international job boards actively participating. Workindenmark and Indeed, for instance, are significant players, attracting a large number of job seekers and employers, thereby intensifying the rivalry.

The Danish media landscape is in the throes of a significant digital transformation, intensifying competition. Traditional media outlets are pivoting to digital platforms, while new, digital-native companies are emerging, all vying for consumer eyeballs and advertising dollars. North Media, with its diverse portfolio, finds itself in direct competition with both these evolving traditional players and the pure-play digital disruptors.

This digital shift means that North Media's competitive rivalry extends across a broad spectrum. For instance, in 2023, the Danish advertising market saw digital advertising spend reach approximately DKK 11.5 billion, highlighting the scale of the battleground. North Media's ability to navigate this complex environment, balancing its established print and service offerings with its digital ventures, is crucial for its sustained competitive position.

Consolidation and Strategic Moves

The Danish media landscape is characterized by significant consolidation, a trend that heightens competitive rivalry. A prime example is Amedia's acquisition of the Berlingske news conglomerate, a move designed to bolster digital transformation efforts and create a more robust entity. This strategic consolidation means fewer, but often stronger, competitors remain.

North Media's own strategic decision to divest its job portal, Ofir, to Jobindex further illustrates this market dynamic. By shedding non-core assets and focusing on specialization or divesting to entities that can achieve greater scale, companies are actively reshaping their competitive positions. This leads to intensified rivalry as the remaining players, either through organic growth or acquisition, aim to capture market share.

- Consolidation Examples: Amedia's acquisition of Berlingske news conglomerate.

- Strategic Divestment: North Media's sale of Ofir to Jobindex.

- Impact on Rivalry: Fewer, stronger competitors emerge, intensifying competition.

- Market Focus: Players are either consolidating for scale or specializing, leading to strategic realignments.

Innovation and Service Differentiation

North Media faces intense competitive rivalry, compelling it to constantly innovate and differentiate its offerings. For BoligPortal, this means evolving into a comprehensive 'single universe' for both tenants and landlords, streamlining the rental process. In its print operations, the focus is on enhancing distribution efficiency and seamlessly integrating digital services to stay relevant.

The pressure from competitors directly impacts North Media's strategic imperatives. For instance, by Q1 2024, North Media reported a 2% decline in its digital segment revenue, partly attributed to increased competition in online property portals, underscoring the need for innovation to retain and grow market share.

- Innovation Imperative: Rivals force continuous service improvement, like BoligPortal's 'single universe' concept.

- Print Optimization: Competition drives efficiency in print distribution and digital integration.

- Market Share Risk: Failing to innovate against competitors can lead to a loss of valuable market share.

- Digital Segment Impact: A 2% revenue dip in North Media's digital segment by Q1 2024 highlights competitive pressures.

The competitive rivalry within North Media's operating segments is substantial, driven by market consolidation and a pervasive digital shift. For instance, the Danish advertising market is highly contested, with digital advertising spend projected to reach around DKK 11.5 billion in 2023, forcing companies like North Media to compete vigorously for marketing budgets against both traditional and digital channels.

This intense competition necessitates continuous innovation, as seen with property portals striving to become comprehensive 'single universes' for users. North Media itself experienced this pressure, reporting a 2% decline in its digital segment revenue by Q1 2024, partly due to heightened competition in online property listings.

| Company/Segment | Key Competitor(s) | Competitive Pressure Indication (2023-2024) |

|---|---|---|

| Print Distribution | DAO, PostNord (former market share) | Intensified rivalry as PostNord exits letter delivery by end of 2025. |

| Online Property Portals | BoligPortal.dk, other specialized sites | 2% digital segment revenue decline by Q1 2024 due to competition. |

| Job Boards | Jobindex (post-Ofir sale), Workindenmark, Indeed | Robust competition from national and international platforms. |

| Media Advertising | Digital-native companies, evolving traditional outlets | DKK 11.5 billion digital ad spend in 2023 highlights fierce battle for budgets. |

SSubstitutes Threaten

The most significant substitute for North Media's print distribution operations is the vast landscape of digital advertising. Businesses now frequently choose social media campaigns, search engine marketing, email newsletters, and online display ads to connect with their target audiences.

These digital channels offer advantages such as enhanced measurability and precise targeting, often proving more cost-effective than traditional unaddressed print advertising. For instance, in 2024, digital advertising spending globally was projected to exceed $600 billion, highlighting its dominance.

The shift towards digital is driven by the ability to track return on investment (ROI) more effectively. Companies can analyze click-through rates, conversion rates, and customer acquisition costs with a level of detail that print advertising struggles to match.

Businesses increasingly leverage their own websites, mobile apps, and email newsletters as direct communication channels. These platforms act as substitutes for traditional third-party advertising, allowing companies to bypass intermediaries like FK Distribution and foster a more personal connection with their customers. For instance, by 2024, a significant portion of global advertising spend shifted towards digital channels where direct engagement is paramount.

For BoligPortal.dk, the threat of substitutes is significant, primarily stemming from general online classifieds and social media platforms. Websites like DBA.dk or GulogGratis.dk, and even Facebook Marketplace, offer rental listings without the dedicated focus or associated fees of specialized portals. These alternatives often present a lower or entirely free cost structure for both landlords and tenants, making them attractive options.

Company Career Pages and Professional Networking Sites

Company career pages and professional networking sites present a significant threat of substitutes for traditional digital classifieds in the job market. Even after the sale of platforms like Ofir.dk, these alternatives allow employers to bypass dedicated job portals entirely by showcasing openings and company culture directly on their own websites. This bypasses the need for a third-party platform, potentially saving companies recruitment fees.

Job seekers also benefit from these substitutes, as professional networking sites like LinkedIn offer a vast network and direct access to potential employers and job postings. In 2024, LinkedIn reported over 1 billion members globally, highlighting its reach as a direct channel for talent acquisition and job discovery. This accessibility reduces reliance on specialized job boards.

- Direct Employer Branding: Company career pages allow for direct control over brand messaging and candidate experience, offering a curated view of the organization.

- Network Effects: Professional networking sites leverage social connections and recommendations, often leading to more relevant job matches than broad classified listings.

- Reduced Cost for Employers: Attracting candidates directly can be more cost-effective for businesses compared to paying listing fees on job portals.

- Candidate Self-Service: Job seekers can proactively manage their profiles and search for opportunities on platforms they already frequent for professional development.

Evolving Consumer Behavior

Consumer preferences are rapidly shifting. This evolution presents a significant threat of substitution for traditional media companies like North Media. As people increasingly favor digital channels, the demand for physical mail and print publications diminishes.

The decline in physical mail volume is a stark indicator of this trend. For instance, in many developed nations, the volume of traditional postal services has seen a steady decrease over the past decade. This directly impacts revenue streams reliant on print advertising and distribution.

Digital communication platforms are becoming the primary means of interaction. In Denmark, for example, the widespread adoption of e-Boks, a secure digital mailbox service, has streamlined communication for both individuals and businesses, further reducing the reliance on physical letters and documents. This offers a convenient and often more efficient alternative for information delivery.

- Digital Shift: Consumers are increasingly turning to digital platforms for news, entertainment, and communication, bypassing traditional print media.

- E-Boks Adoption: The significant uptake of digital mailbox services like e-Boks in markets like Denmark exemplifies the move away from physical correspondence.

- Reduced Mail Volume: Declining volumes of physical mail directly impact the viability of services dependent on letter delivery and associated advertising.

The threat of substitutes for North Media's core business is substantial, primarily driven by the pervasive shift to digital channels across various sectors. These digital alternatives offer enhanced targeting, measurability, and often lower costs, directly impacting the value proposition of traditional print distribution and classifieds.

In the advertising realm, digital platforms commanded a significant portion of global spend in 2024, projected to surpass $600 billion, underscoring the move away from print. Similarly, for platforms like BoligPortal.dk, free general online classifieds and social media marketplaces represent direct substitutes, often bypassing associated fees and offering broad reach.

The job market also sees strong substitution effects, with company career pages and professional networking sites like LinkedIn (which had over 1 billion members globally in 2024) allowing direct engagement between employers and job seekers, reducing reliance on traditional job boards.

Furthermore, consumer preferences are rapidly migrating to digital communication, exemplified by the declining volume of physical mail and the rise of digital mailbox services like e-Boks in Denmark, which diminish the need for traditional postal delivery and its associated advertising opportunities.

| Substitute Category | Examples | Key Advantages | Impact on North Media |

|---|---|---|---|

| Digital Advertising | Social media, search engines, email | Measurability, precise targeting, cost-effectiveness | Reduced demand for print advertising space |

| Online Classifieds & Social Media | DBA.dk, Facebook Marketplace | Lower or no cost, broad reach | Threat to specialized rental and classified portals |

| Direct Employer Channels | Company career pages, LinkedIn | Direct branding, cost savings, networking | Reduced need for third-party job boards |

| Digital Communication Platforms | E-Boks, email, mobile apps | Convenience, efficiency, reduced physical mail volume | Diminished reliance on print distribution and mail-based advertising |

Entrants Threaten

Entering the large-scale unaddressed print distribution market presents considerable hurdles for new players. Significant capital is required upfront for essential logistics infrastructure, including depots and a fleet of delivery vehicles. Furthermore, building a comprehensive network of reliable deliverers and securing established relationships with retailers are critical but time-consuming endeavors.

FK Distribution's entrenched market position, bolstered by its extensive existing network, serves as a formidable barrier to entry. This established infrastructure and reach make it exceptionally difficult for newcomers to compete on scale and efficiency, effectively deterring potential entrants from challenging its dominance.

The threat of new entrants for online marketplaces like BoligPortal.dk is significantly dampened by robust network effects. These platforms thrive as more landlords listing properties attract a larger pool of potential tenants, and conversely, a greater number of tenants seeking rentals draws in more landlords. This creates a virtuous cycle that is challenging for newcomers to break into.

For a new entrant, achieving critical mass on both the landlord and tenant sides of the marketplace simultaneously presents a formidable hurdle. Without a substantial existing user base, it's difficult to offer compelling value to either group, making it a steep climb to compete effectively against established players who already benefit from these strong network effects.

North Media benefits from strong brand recognition and established trust, particularly through its subsidiaries like FK Distribution and BoligPortal.dk. These brands have cultivated loyalty over many years in the Danish market, making it challenging for newcomers to replicate this level of consumer and business confidence.

For any new entrant to effectively compete, they would face substantial hurdles in marketing expenditure and the time required to build a similar reputation. This established brand equity acts as a significant barrier, deterring potential new competitors from entering the market.

Regulatory and Legal Hurdles

New entrants to the unaddressed mail distribution sector, like North Media, face significant regulatory and legal challenges. The Danish Competition Council, for instance, has previously examined and ruled on the dominant market position of FK Distribution, a key player. This suggests that any new company entering this space could encounter substantial scrutiny and complex approval processes.

Such regulatory hurdles can significantly increase the cost and time required for market entry. For example, regulations concerning the distribution of unaddressed mail often involve specific licensing, operational standards, and potential antitrust reviews. These are not minor obstacles and can deter potential competitors from even attempting to enter the market.

Furthermore, for online platforms or digital components of a media company, data privacy regulations like the General Data Protection Regulation (GDPR) add another layer of complexity. Compliance with GDPR, which governs how personal data is collected, processed, and stored, is essential and requires significant investment in data security and management systems. Failure to comply can result in hefty fines, adding to the overall risk for new entrants.

- Regulatory Scrutiny: Past rulings by the Danish Competition Council on FK Distribution highlight potential antitrust concerns for new entrants.

- Licensing and Operational Standards: The distribution of unaddressed mail often requires specific permits and adherence to strict operational guidelines.

- Data Privacy Compliance: Regulations like GDPR impose stringent requirements on data handling for digital services, increasing entry barriers.

- Increased Costs: Navigating these legal and regulatory landscapes necessitates substantial investment in legal counsel, compliance infrastructure, and potentially lobbying efforts.

Technological Expertise and Data Acquisition

The technological landscape presents a significant hurdle for newcomers. Building and running advanced digital platforms demands considerable tech know-how and the capacity to gather and interpret vast amounts of data. For instance, in 2024, the global average cost to develop a custom web application ranged from $30,000 to $150,000, a substantial upfront investment.

New entrants must therefore commit substantial resources to technology and data acquisition, acting as a considerable barrier. This is especially true given the ongoing global shortage of skilled tech professionals; in 2024, estimates suggest a deficit of over 1.5 million cybersecurity professionals alone, highlighting the difficulty in securing necessary talent.

- High Investment in Technology: Significant capital is required for platform development and maintenance.

- Data Acquisition Costs: Acquiring and processing large datasets can be expensive.

- Talent Shortage: Finding and retaining skilled tech workers is a major challenge.

- Competitive Tech Landscape: Existing players often have established, cutting-edge systems.

The threat of new entrants for North Media is generally low due to significant capital requirements for logistics and network building, as seen with FK Distribution's established infrastructure. Network effects on platforms like BoligPortal.dk also create substantial barriers, making it difficult for newcomers to gain traction against established players. Furthermore, strong brand recognition and regulatory hurdles, including data privacy laws like GDPR, add further complexity and cost for potential market entrants.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|---|

| Capital Requirements | Establishing logistics, depots, and delivery fleets for print distribution. | High barrier, requires substantial upfront investment. | Average cost to build a distribution network can run into millions of DKK. |

| Network Effects | Virtuous cycle of users on online marketplaces (e.g., landlords and tenants). | Very high barrier, difficult for new platforms to achieve critical mass. | Platforms with millions of active users have a significant advantage. |

| Brand Recognition & Trust | Established reputation and customer loyalty built over years. | Moderate to high barrier, requires significant marketing spend and time to build. | North Media's subsidiaries benefit from long-standing Danish market presence. |

| Regulatory & Legal | Compliance with competition laws, licensing, and data privacy (GDPR). | High barrier, increases costs and time to market. | GDPR fines can reach up to 4% of global annual revenue, deterring non-compliant entrants. |

| Technology & Data Expertise | Developing and maintaining advanced digital platforms and data analytics. | High barrier, demands specialized skills and investment. | Global shortage of tech talent; cybersecurity roles alone had over 1.5 million unfilled positions in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for North Media leverages industry-specific market research reports, company financial statements, and trade association data to provide a comprehensive view of competitive pressures.