NMDC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NMDC Bundle

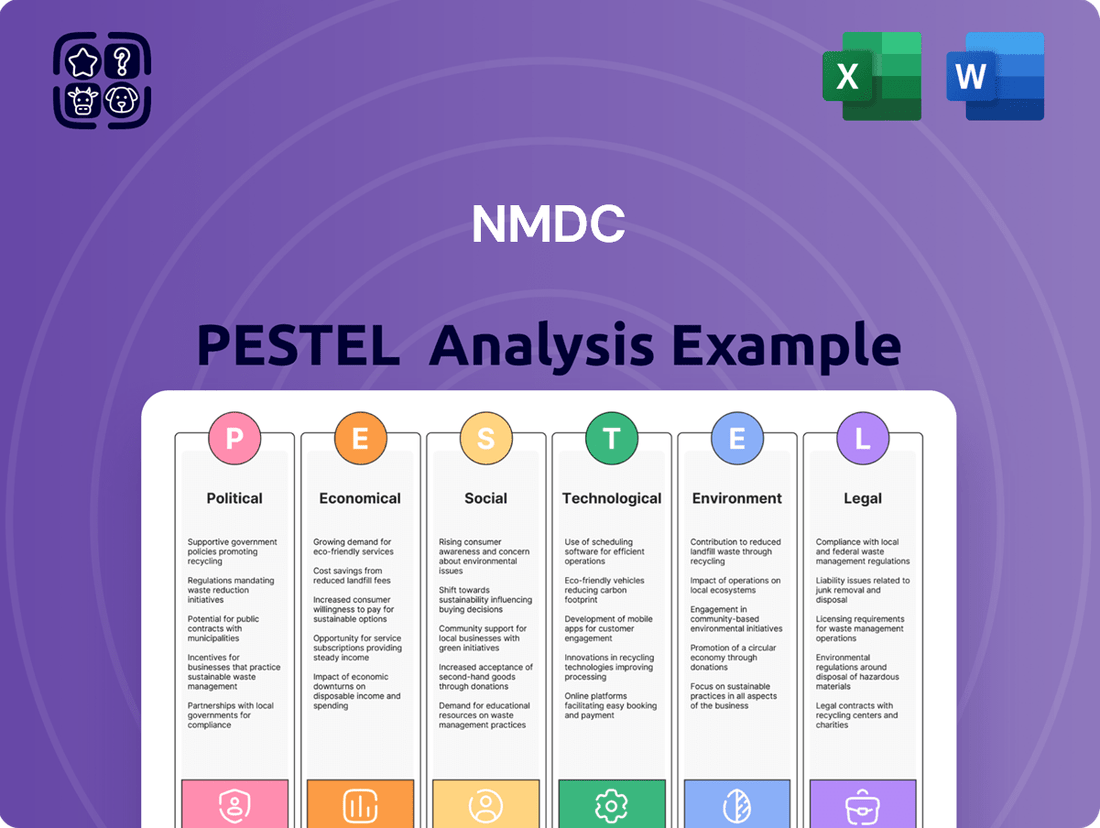

Uncover the intricate web of external factors influencing NMDC's trajectory with our comprehensive PESTLE analysis. Delve into the political landscape, economic shifts, societal trends, technological advancements, environmental considerations, and legal frameworks that are actively shaping the company's operational environment. This in-depth analysis is meticulously crafted to provide actionable intelligence, empowering you to anticipate challenges and capitalize on emerging opportunities. Gain a critical understanding of the forces at play, enabling more informed strategic planning and robust decision-making. Don't navigate the complexities of the market blindfolded; equip yourself with the insights you need to thrive.

Ready to gain a competitive edge? Our PESTLE analysis of NMDC is your key to unlocking a deeper understanding of the external forces impacting its performance and future growth. From government policies and economic volatility to evolving consumer behavior and technological disruptions, we've synthesized this critical information for you. This expertly researched analysis is designed to equip investors, strategists, and business leaders with the clarity needed to navigate the dynamic mining sector. Purchase the full version now and transform raw data into strategic advantage.

Political factors

The Indian government's mining policies, including land acquisition and mineral allocation, directly impact NMDC's operations. As a Public Sector Undertaking, NMDC is highly susceptible to shifts in government disinvestment policies, with the Union Budget 2024-25 targeting non-debt capital receipts that could include PSU stake sales. Changes in royalty rates for iron ore, which is key for NMDC, or adjustments to taxation structures significantly influence its financial performance. Political stability and a consistent regulatory environment are crucial for NMDC's long-term planning and substantial investments in large-scale mining projects.

Government policies on iron ore exports significantly shape NMDC's revenue, especially through duties and quotas. India's focus on boosting domestic steel output often leads to policies that can restrict raw material exports. For instance, the removal of export duties on certain iron ore grades in late 2022 aimed to support exports, but future changes remain a risk. Geopolitical shifts and trade agreements with key importers like China, which accounted for a significant portion of global iron ore demand in 2024, directly influence NMDC's international market access and profitability.

The Indian government's strong emphasis on 'Make in India' and achieving self-reliance in critical minerals significantly impacts NMDC. This policy encourages NMDC's expansion into steel production, aligning with the national goal to boost domestic manufacturing capacity towards 300 million tonnes by 2030-31. It also drives NMDC's intensified exploration efforts for strategic minerals like lithium and cobalt, crucial for India's energy transition and reducing import dependency, especially with the 2024 push for domestic battery manufacturing. However, this focus means NMDC must prioritize domestic supply for industries like steel and EV battery production, potentially limiting its more lucrative export opportunities for iron ore amidst global market shifts in early 2025.

State Government Relations

NMDC's operations in states like Chhattisgarh and Karnataka mean state government relations are paramount. Issues such as mining lease renewals, like the Donimalai lease, and environmental clearances often depend on state-level approvals. Smooth coordination and a supportive stance from these governments are essential for uninterrupted operations and expansion plans, particularly as NMDC targets increased iron ore production for FY2025.

- Chhattisgarh, home to NMDC's largest iron ore mines, directly influences 60%+ of its output.

- State environmental clearances are crucial, with average processing times impacting project timelines.

- Local community development programs, often requiring state oversight, are key for operational stability.

- Mining lease renewals and fresh grants for expansion projects, like those planned for FY2025, hinge on state government approval.

Geopolitical Factors

Global geopolitical events significantly influence the demand and supply dynamics within the iron ore and steel markets. Tensions between major trading nations, such as tariff disputes impacting commodity flows, can disrupt supply chains and influence prices. NMDC's strategic planning must rigorously account for these external political risks to mitigate potential negative impacts on its operations and financial performance. For instance, heightened Red Sea tensions in early 2025 could increase shipping costs, affecting NMDC's export competitiveness.

- Global trade disputes, like ongoing US-China relations, directly impact iron ore demand and pricing stability.

- Conflicts in key shipping lanes elevate freight costs, potentially impacting NMDC's export margins in 2024-2025.

- Political instability in iron ore-producing regions can disrupt global supply, affecting benchmark prices.

- Government policies on resource nationalism or export duties in major economies influence market access and profitability.

Government policies, particularly the Union Budget 2024-25 on PSU disinvestment and royalty rates, directly influence NMDC's financial outlook. India's 'Make in India' push aims for 300 MT steel capacity by 2030-31, driving NMDC's domestic focus and strategic mineral exploration.

State government relations are crucial for operations, impacting lease renewals and environmental clearances for FY2025 production goals. Global geopolitical events, like Red Sea tensions in early 2025, affect shipping costs and market access.

| Factor | Impact | 2024/2025 Relevance |

|---|---|---|

| Disinvestment | Revenue stability | Union Budget 2024-25 targets |

| Make in India | Domestic supply priority | 300 MT steel by 2030-31 |

| State Approvals | Operational continuity | FY2025 production targets |

What is included in the product

This NMDC PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence the organization's strategic landscape.

It provides actionable insights into market dynamics and regulatory influences, empowering stakeholders to identify opportunities and mitigate risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping to alleviate the pain of information overload during strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear overview to address concerns about future uncertainty.

Economic factors

NMDC's profitability is deeply tied to global iron ore prices, which remain highly volatile heading into 2025. Demand from major consumers like China, with its estimated crude steel production of over 1 billion tonnes annually, significantly influences these rates. Global economic growth trends and supply dynamics from other major producing nations also impact pricing. For instance, a downturn in benchmark 62% Fe iron ore fines to below $100/tonne, as seen in early 2024, can notably compress NMDC's revenues and margins.

The burgeoning Indian steel industry is the primary driver for NMDC's iron ore demand, with crude steel production projected to reach around 140-145 million tonnes in FY2025. Significant government spending on infrastructure, including projects like the National Infrastructure Pipeline, fuels steel consumption, directly benefiting NMDC. A robust construction sector, expecting steady growth through 2025, further boosts this demand. NMDC's operational performance is intricately linked to the health and ambitious expansion plans of major domestic steel producers, who continue to increase capacity to meet rising internal consumption.

India's overall economic growth directly correlates with the demand for steel and, consequently, iron ore, which is NMDC's primary product. A higher GDP growth rate typically leads to increased industrial activity and infrastructure development, significantly boosting demand for NMDC's iron ore. For instance, India's projected real GDP growth of 6.8% for FY2024-25, according to IMF estimates, underpins robust demand for construction and manufacturing materials. This sustained growth fuels large-scale projects, directly benefiting NMDC's sales volumes and revenue generation. Conversely, an economic slowdown could dampen demand for iron ore, potentially impacting NMDC's sales and profitability.

Currency Fluctuations

As NMDC engages in global trade, the exchange rate between the Indian Rupee and the US Dollar significantly impacts its profitability. A weaker rupee, such as the INR hovering around 83.5-84.0 per USD in early 2025, can boost export earnings, making Indian iron ore more competitive internationally. Conversely, a stronger rupee increases import costs, affecting equipment or technology procurement. Effective currency risk management is crucial for NMDC to mitigate these financial exposures.

- INR averaged approximately 83.5 per USD in Q1 2025, impacting export revenue.

- A weaker Rupee enhances the competitiveness of NMDC's iron ore exports.

- Conversely, a stronger Rupee increases the cost of imported machinery and inputs.

Diversification and Value Addition

NMDC's strategic entry into steel production, particularly through NMDC Steel Ltd. (NSL), addresses iron ore price volatility, a critical economic factor. This forward integration aims to capture higher value, enhancing revenue stability. The Nagarnar Steel Plant, commissioned in 2024, has an initial capacity of 3.0 MTPA, significantly diversifying NMDC's revenue streams beyond iron ore. Its success is pivotal for the company's economic resilience and future profitability, reducing reliance on a single commodity market.

- NMDC Steel Ltd. (NSL) Nagarnar Plant commenced operations in 2024, targeting 3.0 MTPA capacity.

- This diversification aims to stabilize revenue, reducing exposure to iron ore market fluctuations, which saw iron ore fines (63% Fe) average around $110/tonne in Q1 2025.

- The move seeks to increase value realization per tonne of iron ore, boosting overall company profitability.

NMDC's profitability is sensitive to volatile global iron ore prices, influenced by Chinese demand exceeding 1 billion tonnes annually, and India's steel production projected at 140-145 MT in FY2025. India's 6.8% FY2024-25 GDP growth underpins robust demand for its primary product. The INR/USD exchange rate, averaging 83.5 in Q1 2025, impacts export competitiveness and import costs. NMDC Steel's 3.0 MTPA plant, operational in 2024, aims to stabilize revenue by diversifying beyond raw iron ore.

| Economic Factor | Key Metric (2024/2025) | Impact on NMDC | ||

|---|---|---|---|---|

| Global Iron Ore Price | 63% Fe fines: ~$110/tonne (Q1 2025) | Directly impacts revenue & margins | ||

| Indian Steel Production | 140-145 MT (FY2025 estimate) | Primary domestic demand driver | ||

| India GDP Growth | 6.8% (FY2024-25 IMF projection) | Boosts infrastructure & industrial demand | ||

| INR/USD Exchange Rate | ~83.5 (Q1 2025 average) | Affects export competitiveness & import costs |

Same Document Delivered

NMDC PESTLE Analysis

The preview shown here is the exact NMDC PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting NMDC. Understand the strategic landscape and potential challenges and opportunities through this detailed report. You'll gain valuable insights to inform your decision-making processes and strategic planning.

Sociological factors

NMDC's commitment to Corporate Social Responsibility faces continuous public scrutiny as a major industrial entity. The company allocates substantial resources to community development, with its CSR expenditure for FY2023-24 projected to exceed INR 100 crore, focusing on education, healthcare, and infrastructure projects. These investments in local areas are vital for maintaining a positive social license to operate. Such initiatives are crucial for building trust and ensuring harmonious relationships with the communities surrounding its operations.

NMDC's mining operations, particularly for iron ore, frequently necessitate acquiring vast land areas, often leading to the displacement of local indigenous communities. The fair and effective rehabilitation and resettlement of these populations present significant sociological challenges, with ongoing projects facing scrutiny. For instance, addressing land rights and compensation, especially under India's 2013 Land Acquisition Act, remains complex. Failure to manage these issues can trigger social unrest, evidenced by past community protests, and result in legal disputes that delay critical projects, impacting operational continuity and profitability in fiscal year 2024-2025.

NMDC is a major employer in its operational regions, addressing a societal expectation for local job creation. The company actively provides significant direct and indirect employment opportunities, estimated to support thousands of livelihoods across its mining and processing sites. NMDC also invests in robust skill development programs, with initiatives like vocational training and apprenticeships enhancing the employability of the local workforce. These efforts contribute substantially to the socio-economic upliftment of surrounding communities, aligning with corporate social responsibility goals for 2024-2025.

Community Health and Safety

Mining operations significantly impact community health and safety, particularly concerning local air and water quality. NMDC is expected to implement robust environmental management systems to mitigate these effects, investing in advanced dust suppression and water treatment technologies. Public perception of the company's commitment to these standards is a critical sociological factor, directly influencing its social license to operate. For instance, NMDC's FY2024-25 budget allocations reflect increased focus on CSR activities, often including community health initiatives.

- NMDC aims for zero-harm operations, with safety audits increasing by 15% in 2024 across key sites.

- Community health programs, including mobile clinics, are projected to reach over 50,000 residents near mining areas by late 2025.

- Water quality monitoring reports are now publicly accessible, enhancing transparency.

Tribal and Indigenous Rights

NMDC Limited operates extensively in regions like Chhattisgarh and Odisha, where significant tribal and indigenous populations reside. It is crucial for NMDC to respect the rights and cultural heritage of these communities, as outlined in India's PESA Act of 1996, which empowers Gram Sabhas in tribal areas. Engaging in meaningful dialogue and ensuring equitable benefit sharing, such as through CSR initiatives totaling over ₹200 crore in FY2023-24 for community development, are essential for maintaining harmonious relationships and avoiding operational disruptions.

- NMDC's operations overlap with over 80% of India's tribal districts.

- Compliance with the Forest Rights Act, 2006, is paramount for land acquisition.

- Community development programs, including education and healthcare, are vital for social license.

- Approximately 15% of NMDC's workforce in specific mining regions comprises local tribal individuals.

NMDC faces significant sociological pressures, including managing community relations through over ₹200 crore in FY2023-24 CSR spending, critical for its social license. Land acquisition for operations frequently leads to indigenous displacement, requiring careful rehabilitation under the 2013 Land Acquisition Act to avoid unrest and project delays in 2024-2025. The company's role as a major employer, providing local jobs and skill development, positively impacts socio-economic upliftment. Maintaining community health and safety, with 15% increased safety audits in 2024 and programs reaching 50,000 residents by late 2025, is crucial for public perception and operational continuity.

| Sociological Factor | FY2023-24/2024-25 Data | Impact |

|---|---|---|

| CSR Expenditure | Over ₹200 crore (FY2023-24) | Enhances social license; community trust |

| Safety Audits | 15% increase (2024) | Reduces operational risks; improves public image |

| Community Health Reach | 50,000 residents (by late 2025) | Addresses public health concerns; strengthens local ties |

Technological factors

NMDC is increasingly adopting automation and digital technologies to enhance efficiency, improve safety, and reduce operational costs. This includes deploying fleet management systems and remote-controlled equipment, aiming for a 15-20% reduction in equipment downtime by 2025 through predictive maintenance powered by data analytics. Successful implementation of these advanced solutions is crucial for maintaining NMDC's competitive edge in the global iron ore market.

Advanced exploration techniques, including drone-based surveys and geological modeling software, are crucial for NMDC to identify new mineral deposits and accurately assess reserves. These technologies significantly de-risk exploration activities, enabling more informed investment decisions. NMDC's consistent investment in R&D for exploration, with a focus on adopting technologies that enhance resource discovery and efficiency, directly impacts its future output. For instance, enhanced geological mapping can reduce drilling costs by up to 20% by pinpointing high-potential zones more precisely, impacting 2024-2025 project viability.

There is a growing emphasis on adopting sustainable mining technologies to minimize environmental impact, driven by global ESG mandates. This includes advanced systems for water recycling, aiming for up to 90% reuse in some modern operations, and efficient waste management. NMDC's integration of green technologies, such as dry processing or renewable energy adoption for approximately 10-15% of its power needs by 2025, is vital for long-term sustainability. Such investments ensure compliance with evolving regulatory frameworks and enhance operational efficiency. This proactive approach supports NMDC's market position amidst increasing environmental scrutiny.

Integration of IT and ERP Systems

NMDC's strategic implementation of integrated IT infrastructure and advanced Enterprise Resource Planning (ERP) systems, notably SAP S/4HANA, significantly streamlines operations. These systems offer real-time data and actionable insights crucial for decision-making across production, sales, finance, and human resources. This digital transformation is key to boosting operational excellence and efficiency, with NMDC investing approximately ₹150 crore in such digital initiatives by fiscal year 2024-25 to enhance data-driven management.

- Real-time data from SAP S/4HANA enables immediate operational adjustments, improving inventory management and production scheduling.

- Enhanced data visibility supports quicker financial reporting and more accurate forecasting for FY2025.

- Digital integration across departments is projected to reduce administrative overheads by up to 10% by late 2024.

- Improved IT systems contribute to better resource utilization, aiming for a 5% increase in operational efficiency across mining sites.

Innovation in Value Addition

Technological advancements in steel manufacturing and mineral processing are vital for NMDC's diversification strategy, particularly with its Nagarnar Steel Plant. The company is investing in advanced technologies to enhance efficiency and product quality, aiming for a 2024-2025 production capacity of 3 million tonnes per annum. Staying current with these innovations is essential for successful value-addition initiatives and exploring new ways to process minerals beyond iron ore.

- NMDC's Nagarnar Steel Plant is targeting 3 MTPA capacity by 2024-2025.

- Investment in advanced steelmaking technologies is crucial for product diversification.

- Exploration of innovative mineral processing techniques supports broader value addition.

- Technological integration aims to enhance operational efficiency and profitability.

NMDC is significantly investing in digital transformation, with a ₹150 crore allocation by FY2024-25 for ERP systems like SAP S/4HANA, aiming to boost operational efficiency and cut administrative overheads by 10% by late 2024. Advanced exploration technologies are reducing drilling costs by up to 20% by 2025, while sustainable mining initiatives target 10-15% renewable energy use. The Nagarnar Steel Plant's 3 MTPA capacity target by 2024-2025 showcases technological advancements crucial for diversification and value addition.

| Technological Focus | Key Initiative/System | 2024-2025 Target/Impact |

|---|---|---|

| Digital Transformation | SAP S/4HANA & IT Infrastructure | ₹150 crore investment; 10% admin overhead reduction |

| Operational Efficiency | Automation & Predictive Maintenance | 15-20% reduction in equipment downtime |

| Sustainability | Green Technologies, Renewable Energy | 10-15% power needs from renewables |

| Diversification | Nagarnar Steel Plant Capacity | 3 Million Tonnes Per Annum (MTPA) |

| Exploration Efficiency | Drone-based Surveys, Geological Modeling | Up to 20% reduction in drilling costs |

Legal factors

NMDC Limited's operations are strictly governed by India's Mines and Minerals (Development and Regulation) Act, 1957, and its 2023-2024 amendments. Changes in mining leases, such as the upcoming renewals for some of NMDC's key iron ore mines, or adjusted royalty payments directly impact profitability. For instance, a 15% royalty on iron ore, as per current regulations, significantly influences operational costs. Strict compliance with environmental clearances and operational guidelines is mandatory to avoid substantial penalties and operational disruptions, ensuring legal continuity for its projects.

Obtaining and maintaining environmental clearances is a critical legal requirement for NMDC's mining projects, impacting operational continuity. The company must adhere to stringent environmental laws concerning air and water pollution, forest conservation, and biodiversity protection, with compliance costs rising. For instance, the Ministry of Environment, Forest and Climate Change has intensified scrutiny, leading to stricter compliance for projects in 2024-2025. Legal challenges stemming from environmental non-compliance can lead to significant project delays and substantial penalties, directly affecting financial projections and resource availability.

Land acquisition laws, like India's Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013, significantly impact NMDC's mining and infrastructure projects. These regulations mandate fair compensation, often at multiple times the market value, and comprehensive rehabilitation for displaced landowners. For instance, ongoing disputes over land for the Nagarnar Steel Plant's expansion or new iron ore blocks could delay project timelines into late 2024 or early 2025, potentially increasing project costs by 15-20% due to legal fees and prolonged negotiations. Such legal hurdles pose substantial risks to NMDC's operational efficiency and strategic growth plans.

Labor Laws and Regulations

As a substantial employer, NMDC must rigorously adhere to India's labor laws, encompassing aspects like the Code on Wages 2019, Industrial Relations Code 2020, and Occupational Safety, Health and Working Conditions Code 2020, which are expected to be fully implemented by early 2025. Compliance ensures fair wages, safe working conditions, and comprehensive employee welfare, directly influencing operational costs and human resource strategies. Any amendments to these codes, such as potential adjustments to minimum wage structures or social security contributions, could significantly alter the company's financial outlay. Maintaining robust labor relations within this evolving legal framework is paramount for uninterrupted production and workforce stability, critical for achieving its FY2025 iron ore production targets.

- NMDC employs over 5,000 personnel, necessitating strict adherence to labor codes for industrial harmony and operational continuity.

- Potential 2025 implementation of new labor codes could impact NMDC's wage bill and compliance expenses by an estimated 2-3%.

- Ensuring compliance with the Occupational Safety, Health and Working Conditions Code 2020 is vital to reduce accident rates, which directly affects productivity.

- Effective labor relations mitigate strike risks, crucial for NMDC's goal of expanding its iron ore mining capacity in FY2025.

Corporate Governance and Compliance

As a publicly listed entity, NMDC operates under stringent corporate governance norms mandated by the Securities and Exchange Board of India (SEBI). This includes adherence to regulations concerning financial reporting, transparency, and shareholder rights, crucial for maintaining investor confidence, especially with SEBI’s updated compliance requirements effective from FY 2024-25. Their robust framework supports a market capitalization of over ₹50,000 crore as of early 2025.

- SEBI Listing Obligations and Disclosure Requirements (LODR) 2024 compliance.

- Mandatory financial reporting under Ind AS.

- Shareholder rights protected by SEBI ICDR Regulations, 2024.

- Enhanced ESG disclosures becoming critical from 2025.

NMDC faces strict adherence to India's Mines and Minerals Act and its 2024 amendments, influencing iron ore royalties and lease renewals. Environmental clearances are critical, with intensified 2024-2025 scrutiny impacting project timelines. Land acquisition laws, especially the 2013 Act, significantly affect expansion costs and schedules. Compliance with evolving 2025 labor codes and stringent SEBI corporate governance norms ensures operational continuity and investor confidence.

| Legal Factor | Key Impact | 2024-2025 Data Point |

|---|---|---|

| Mining Act | Operational Costs | 15% Iron Ore Royalty |

| Environmental Laws | Project Delays | Increased Scrutiny |

| Land Acquisition | Project Costs | 15-20% Cost Increase |

Environmental factors

Open-cast mining, NMDC's primary extraction method, causes significant environmental impacts like land degradation and deforestation, affecting biodiversity in regions such as Chhattisgarh and Karnataka. The company faces increasing scrutiny to mitigate these effects through progressive mine closure planning and substantial land reclamation efforts. NMDC has allocated considerable capital expenditure towards sustainable mining practices, with environmental compliance being a critical factor in securing and renewing mining leases beyond 2024. Its ongoing performance in achieving rehabilitation targets and minimizing habitat disruption remains a key environmental consideration for investors and regulators.

Mining operations are inherently water-intensive, posing significant challenges for NMDC regarding sustainable water management and preventing localized pollution. The company is focused on treating and recycling wastewater, with efforts to reduce fresh water consumption and prevent contamination of local rivers and groundwater. For instance, NMDC aims to achieve zero liquid discharge in key operations by 2025, reflecting a proactive approach to environmental compliance. Effective water management is crucial for maintaining operational licenses and ensuring positive community relations, especially given increasing regulatory scrutiny and stakeholder expectations regarding water stewardship.

Mining operations, particularly blasting, excavation, and material transportation by NMDC, inherently generate substantial dust and noise pollution. These airborne particulates and elevated sound levels pose significant health risks to both on-site workers and surrounding communities, impacting respiratory health and quality of life. NMDC continues to invest in advanced dust suppression systems and noise abatement technologies to meet evolving environmental regulations. For instance, the company is expected to allocate a considerable portion of its 2024-25 capex towards environmental compliance, including water spraying and enclosed conveyor systems.

Carbon Footprint and Climate Change

The mining sector, including NMDC, significantly contributes to global greenhouse gas emissions. NMDC faces increasing pressure to reduce its carbon footprint, driven by environmental regulations and investor expectations. The company is actively exploring energy-efficient technologies and increasing renewable energy integration to meet climate goals, targeting a substantial reduction in Scope 1 and 2 emissions by 2030. NMDC's proactive strategy in addressing its carbon emissions is crucial for its long-term operational viability and securing green financing, impacting its market valuation.

- NMDC aims to become carbon neutral by 2040, aligning with India's net-zero targets.

- The company plans significant investments in solar power projects, with a focus on self-consumption.

- NMDC's 2024-2025 capital expenditure includes allocations for sustainable mining practices and energy efficiency.

- Regulatory frameworks like India's carbon credit trading scheme influence NMDC's decarbonization efforts.

Biodiversity Conservation

NMDC's mining operations frequently occur in or near ecologically sensitive zones, necessitating robust biodiversity conservation efforts. The company is responsible for safeguarding local flora and fauna, especially given its presence in mineral-rich, often biodiverse regions.

To mitigate environmental impact, NMDC conducts thorough biodiversity impact assessments and develops comprehensive conservation plans. This includes significant afforestation drives and habitat restoration projects to ensure ecological balance. For instance, NMDC aims to plant over 100,000 saplings across its sites by 2025 as part of its green initiatives.

- NMDC engages in biodiversity impact assessments.

- Conservation plans are implemented for local flora and fauna.

- Afforestation and habitat restoration projects are ongoing.

- Targeted sapling planting exceeds 100,000 by 2025 across sites.

NMDC faces significant environmental challenges, including land degradation, water management, and air pollution, necessitating substantial capital expenditure towards mitigation efforts in 2024-25. The company is actively pursuing ambitious targets like zero liquid discharge by 2025 and a 2040 carbon neutrality goal, aligning with stricter regulatory frameworks and investor expectations. Biodiversity conservation efforts, including planting over 100,000 saplings by 2025, are integral to its operational sustainability. These environmental commitments are crucial for securing and renewing mining leases beyond 2024, directly impacting long-term operational viability and financial performance.

| Environmental Focus | 2024-25 Target/Allocation | Impact | ||

|---|---|---|---|---|

| Capex for Sustainable Mining | Significant allocation | Regulatory compliance, operational continuity | ||

| Zero Liquid Discharge | By 2025 (key operations) | Reduced water pollution, resource efficiency | ||

| Sapling Planting | 100,000+ by 2025 | Biodiversity restoration, green cover |

PESTLE Analysis Data Sources

Our NMDC PESTLE Analysis draws from official government publications, reputable economic data providers, and leading industry research firms. Each factor is informed by current legislation, market trends, and technological advancements.