NMDC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NMDC Bundle

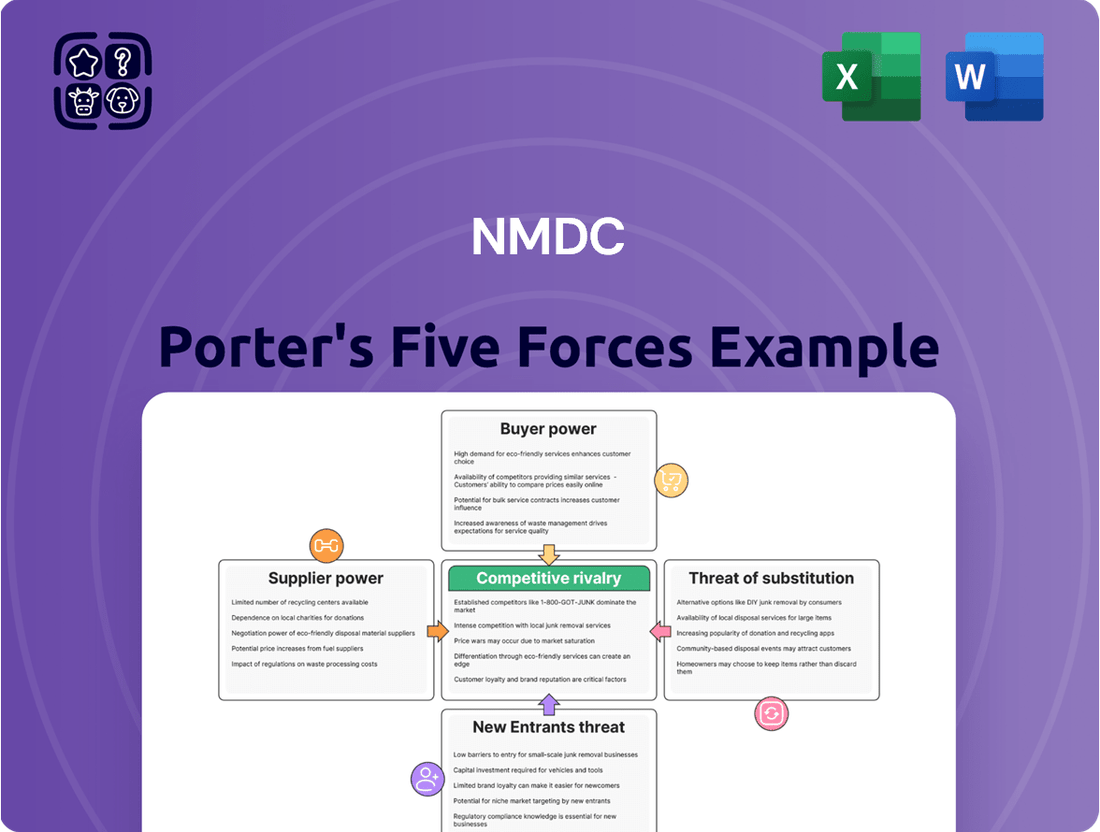

NMDC, a major player in the iron ore sector, faces a dynamic competitive landscape shaped by Porter's Five Forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore NMDC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The mining sector, including NMDC, heavily relies on technologically advanced and specialized heavy machinery, such as large excavators and haul trucks, crucial for iron ore extraction. This essential equipment is typically sourced from a highly concentrated global supplier base, including companies like Caterpillar and Komatsu, who hold significant market share and pricing power. NMDC's dependence on these few suppliers for both procurement and ongoing maintenance of its core operational assets, valued at billions globally, directly elevates their bargaining strength. For instance, global mining equipment market revenue was projected to reach over 150 billion USD by 2024, highlighting the scale and limited supplier influence.

As a public sector undertaking, NMDC significantly relies on government bodies for critical inputs like mining leases, environmental clearances, and land acquisition. Delays or unfavorable policy changes from these governmental entities can substantially impact operations, giving them considerable power over NMDC. This reliance was evident in past delays for mining license renewals. In 2024, the continuity of these dependencies means governmental decisions remain a key factor influencing NMDC's operational stability and production capacity.

NMDC's reliance on specialized technology providers, like the five-year lifecycle agreement with Wärtsilä for its dredger fleet, significantly enhances supplier bargaining power. These long-term contracts for operational efficiency create high switching costs and a degree of vendor lock-in. Such partnerships, often including performance guarantees and advanced digital solutions, embed suppliers deeply into NMDC's core operations. This integration means that as of 2024, disengaging from these key providers without substantial disruption or cost is challenging, solidifying their influential position.

Labor Unions and Workforce Power

A skilled and organized workforce, often represented by powerful labor unions, holds significant bargaining power over NMDC. Negotiations around wages, benefits, and working conditions directly impact operational costs and continuity.

Any labor disputes or strikes could halt production, giving the workforce substantial leverage over the company. For instance, in 2024, ongoing discussions regarding revised wage agreements for public sector undertakings, including NMDC, highlight this influence.

- Labor unions actively negotiate wage hikes, impacting NMDC's 2024 operating expenses.

- Potential strikes pose a direct threat to production volumes and revenue streams.

- Skilled mining labor scarcity in regions can empower workers further.

- Worker demands for improved safety and benefits raise compliance costs.

Energy and Fuel Costs

NMDC's mining operations are highly energy-intensive, requiring substantial fuel and electricity. Fluctuations in global energy prices, like the volatile crude oil prices seen in early 2024, significantly impact operating costs. Reliance on state-owned power distribution companies further amplifies supplier influence over NMDC’s financial performance. To mitigate this, NMDC is actively shifting towards eco-friendly ore transportation, reducing dependence on road transport and its associated fuel costs.

- Global energy price volatility directly impacts NMDC's operational expenditures.

- Reliance on a limited number of state-owned power suppliers increases their bargaining power.

- NMDC is investing in sustainable logistics to decrease fuel consumption.

- Strategic shifts aim to enhance cost stability and operational resilience.

NMDC faces significant supplier power from a concentrated global market for specialized mining machinery and technology, leading to high switching costs.

Government bodies hold considerable influence through critical clearances and land acquisition, impacting 2024 operational stability.

Powerful labor unions negotiate wages, directly affecting operational costs, while volatile energy prices from limited state-owned suppliers add to cost pressures.

| Supplier Group | Key Influence | 2024 Impact |

|---|---|---|

| Machinery/Tech | Concentrated market, high switching costs | Global mining equipment market >$150B |

| Government | Policy, clearances, land acquisition | Operational stability, license renewals |

| Labor Unions | Wage negotiations, potential strikes | Ongoing wage agreement discussions |

| Energy | Price volatility, limited suppliers | Crude oil price volatility early 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to NMDC's position in the iron ore industry.

Instantly identify and quantify competitive threats with a visual, easy-to-understand framework.

Streamline strategic analysis by pinpointing where NMDC faces the most significant competitive pressures.

Customers Bargaining Power

NMDC faces significant customer bargaining power due to a concentrated domestic customer base. A substantial portion of its iron ore sales in 2024 is directed towards a few major steel producers, including Rashtriya Ispat Nigam Ltd (RINL) and JSW Steel. This limited number of large buyers grants them considerable leverage in negotiating iron ore prices and supply terms. While long-term supply agreements ensure revenue stability, they can also restrict NMDC's pricing flexibility by locking in predetermined rates.

The international demand for iron ore, especially from major markets like China, significantly influences prices and thus customer bargaining power. Weaker demand from China, as observed in late 2024 through early 2025, directly led to downward pressure on global iron ore prices. This trend impacted the prices NMDC could command from its domestic and international customers. For instance, Indian iron ore exports saw a decline in volume during early 2025 due to subdued Chinese demand.

The Indian government, a major end-user of steel for infrastructure and 'Made in India' initiatives, significantly influences domestic demand. Policies prioritizing locally produced steel in government procurement, a trend continuing into 2024, directly bolster demand for NMDC's iron ore. The government's ambitious target to produce 300 million tonnes of steel by 2030 underscores this customer segment's critical long-term importance. This consistent, large-scale demand reduces the overall bargaining power of customers.

Availability of Alternative Suppliers

Even though NMDC is India's largest iron ore producer, domestic steel mills possess significant bargaining power due to the availability of alternative suppliers. Customers can opt to source iron ore from numerous smaller domestic miners, or they can import it. India's finished steel imports reached approximately 8.3 million tonnes in the fiscal year 2023-24, indicating a reliance on international supply options. This flexibility allows customers to switch suppliers, particularly for specific ore grades, thereby enhancing their negotiating leverage over NMDC.

- NMDC is India's largest iron ore producer.

- Customers can source from smaller domestic miners.

- India imported approximately 8.3 million tonnes of finished steel in FY 2023-24.

- Availability of alternatives strengthens customer bargaining power.

Price Sensitivity of Steel Producers

Steel producers' profitability is closely tied to the cost of raw materials, primarily iron ore, making them highly sensitive to price changes. Their reliance on this key input means even slight fluctuations significantly impact their margins. When steel prices are under pressure, as seen with global steel price indices showing declines in early 2025, customers like steel mills aggressively negotiate for lower iron ore prices. This aggressive stance is crucial, as iron ore can constitute a substantial portion of their production costs, often exceeding 30% for integrated steel producers in 2024.

- Global crude steel production in 2024 hovered around 1.85 billion tonnes.

- Iron ore typically represents 30-40% of steel production costs.

- Steel prices faced downward pressure in early 2025, impacting mill profitability.

- Major steel producers reported tighter margins in late 2024 due to input costs.

NMDC's customers, primarily a concentrated base of large steel producers like JSW Steel, wield significant bargaining power due to the availability of alternative suppliers and imports, with India importing 8.3 million tonnes of finished steel in FY 2023-24. Steel mills are highly price-sensitive, as iron ore constituted over 30% of their production costs in 2024. While government demand for steel for infrastructure in 2024 provides some stability, global price pressures from weaker demand, notably from China in late 2024, empower buyers to negotiate aggressively.

| Factor | Data Point | 2024 Impact |

|---|---|---|

| Finished Steel Imports (India) | 8.3 million tonnes (FY23-24) | Increased alternatives for customers |

| Iron Ore Cost % of Steel Production | >30% | High price sensitivity for steel mills |

| Global Crude Steel Production | ~1.85 billion tonnes | Influences overall demand dynamics |

Full Version Awaits

NMDC Porter's Five Forces Analysis

This NMDC Porter's Five Forces Analysis preview showcases the exact, comprehensive document you'll receive immediately after purchase. It meticulously details the competitive landscape of the mining industry by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. You're looking at the actual, professionally formatted analysis, ensuring you get precisely what you need for strategic decision-making without any surprises.

Rivalry Among Competitors

NMDC encounters stiff competition from both public and private sector iron ore miners across India. While NMDC remains the largest domestic producer, the competitive landscape is intensified by numerous private players, which accounted for approximately 70% of India's total mineral production value in fiscal year 2024. The presence of many smaller operational mines further fragments the market, adding to the overall competitive pressure in the iron ore industry.

On the global stage, NMDC faces intense competition from major international iron ore exporters, notably from Australia and Brazil.

Giants like Rio Tinto and Vale possess significantly larger scales of operation, with their combined iron ore shipments often exceeding 600 million tonnes annually, influencing global iron ore prices.

This massive scale allows them to dictate market dynamics, directly affecting NMDC's competitiveness in vital export markets.

China, a primary iron ore importer, predominantly sources from these key international rivals, limiting NMDC's export opportunities and pricing power.

NMDC's forward integration into steel production directly intensifies competitive rivalry, as the company now competes with its former customers, the steel manufacturers.

This strategic shift forces NMDC to vie for market share in the finished steel products segment, rather than solely supplying iron ore.

The commissioning of its 3-million-tonne per annum steel plant, Nagarnar Steel Plant, significantly increases competitive pressure within India's domestic steel market.

This move, especially prominent in 2024, transforms the competitive landscape for NMDC, demanding new market strategies.

Government Policies and Auction-based Allocation

The government's policy of auction-based allocation for mineral blocks has intensified competitive rivalry within India's mining sector. This transparent system, fully operational for key minerals, enables a wider array of new and existing players to bid for critical mining rights. In 2024, the Ministry of Mines continued to offer various mineral blocks through auctions, including iron ore, directly increasing the pool of potential competitors for NMDC. This policy is part of a broader governmental effort to foster a more business-friendly and competitive regulatory environment.

- By mid-2024, numerous mineral blocks, including iron ore, were slated for auction or had concluded their bidding processes, drawing diverse participants.

- The auction mechanism ensures that mining rights are allocated based on competitive bidding, attracting both large conglomerates and smaller entrants.

- This system allows entities like JSW Steel and Vedanta to secure captive mines, potentially reducing their dependence on external suppliers like NMDC.

- The transparent auction process aims to mitigate previous opaque allocation methods, fostering a level playing field for all bidders.

Price-Based Competition

The iron ore market operates largely as a commodity, making price a paramount competitive factor. NMDC benefits from a significant competitive advantage due to its remarkably low cost of production, which stood at approximately $20 per tonne in early 2024. However, the company continuously faces intense price pressure from both domestic players like JSW Steel and international giants such as Rio Tinto. Fluctuations in global steel demand and iron ore prices, which saw volatility around $110-120 per tonne in Q2 2024, directly impact NMDC's revenue and profitability.

- NMDC's production cost was around $20/tonne in early 2024.

- Global iron ore prices fluctuated between $110-120/tonne in Q2 2024.

- Domestic competitors include JSW Steel and Vedanta.

- International rivals include Rio Tinto and BHP.

NMDC faces fierce rivalry from domestic private miners, who captured approximately 70% of India's mineral production value in fiscal year 2024, and global giants like Rio Tinto. Its new Nagarnar Steel Plant, operational in 2024, intensifies competition by directly challenging steel manufacturers in the finished products segment. Government mineral block auctions in 2024 further increase the pool of competitors for mining rights. Despite a low production cost of around $20 per tonne in early 2024, NMDC navigates a volatile commodity market, with Q2 2024 iron ore prices around $110-120 per tonne.

| Rivalry Factor | Key Data (2024) | Impact |

|---|---|---|

| Domestic Competition | Private miners: 70% of India's mineral production value FY2024 | Market fragmentation, increased pressure |

| Global Competition | Rio Tinto/Vale: >600M tonnes annual shipments | Price influence, limited export opportunities |

| Forward Integration | Nagarnar Steel Plant: 3M TPA, operational 2024 | Direct competition with steel manufacturers |

| Auction Policy | Mineral block auctions ongoing 2024 | Increased competitor pool for mining rights |

| Price Volatility | NMDC cost: ~$20/tonne (early 2024); Global price: $110-120/tonne (Q2 2024) | Revenue/profitability impact, intense price pressure |

SSubstitutes Threaten

Scrap steel presents a notable substitute for iron ore, especially for Electric Arc Furnaces (EAFs) which comprised over 30% of global steel production in 2023. The increasing availability and competitive pricing of scrap directly influence the demand for primary iron ore from companies like NMDC. Government policies, such as India's continued removal of import duty on ferrous scrap through fiscal year 2024-25, actively encourage its use. This trend could reduce the overall demand for newly mined iron ore, impacting NMDC's market position.

Technological advancements are fostering alternative iron-making processes that could lessen the direct dependence on high-grade iron ore. While not yet widespread, technologies like hydrogen-based steelmaking, such as H2 Green Steel’s efforts aiming for 2024 production, could emerge as long-term substitutes. These innovations are part of a broader trend toward more sustainable and efficient industrial processes. The global steel industry's increasing focus on decarbonization further accelerates the research and adoption of these methods.

Steel, integral to NMDC's operations, faces competition from materials like aluminum, plastics, and composites. The automotive industry's shift towards lightweight solutions for fuel efficiency, with aluminum content increasing, could temper long-term steel demand. However, steel’s cost-effectiveness and superior performance in many structural applications, like its continued dominance in vehicle body structures, mean the overall threat remains low to moderate. As of 2024, steel maintains significant advantages in large-scale infrastructure projects and many industrial applications.

Direct Reduced Iron (DRI)

Direct Reduced Iron, or sponge iron, serves as a significant substitute for iron ore, primarily utilized as feedstock in electric arc furnaces for steel production. India stands as the world's largest producer of DRI, with an output exceeding 45 million tonnes in 2023-2024. This widespread adoption and production of DRI can directly impact the demand for traditional lump ore and fines from mining operations like NMDC, posing a competitive threat. The increasing preference for DRI due to its lower carbon footprint in certain steelmaking processes further intensifies this substitute threat.

- India's DRI production surpassed 45 million tonnes in the fiscal year 2023-2024.

- DRI's use in electric arc furnaces offers an alternative to blast furnace iron.

- The rising global focus on decarbonization favors DRI production methods.

- Demand for traditional iron ore can be reduced by increased DRI consumption.

Limited Direct Substitutes for Iron Ore

Despite ongoing material advancements, there are currently no large-scale, cost-effective direct substitutes for iron ore as the primary raw material for blast furnace-based steel production. Steel remains a fundamental material for infrastructure and industrial development, ensuring sustained demand. India's National Steel Policy targets 300 million tonnes of crude steel capacity by 2030, underscoring this continued reliance on iron ore. While alternatives like recycled scrap are crucial, they do not fully replace virgin iron ore in primary steelmaking processes as of 2024.

- Primary steelmaking largely dependent on iron ore.

- No cost-effective direct substitutes exist for large-scale production.

- Steel demand remains robust for infrastructure development.

- India's 2030 steel capacity target reinforces reliance on iron ore.

Scrap steel and Direct Reduced Iron (DRI) pose significant substitute threats to NMDC's iron ore, especially for Electric Arc Furnaces. India's DRI production exceeded 45 million tonnes in 2023-2024, intensifying competition. While materials like aluminum compete with steel, iron ore remains critical for primary steelmaking, with no large-scale direct substitutes for blast furnace processes as of 2024.

| Substitute Type | 2023-2024 Data | Impact on NMDC |

|---|---|---|

| Scrap Steel (EAFs) | 30%+ global steel production (2023) | Reduced primary ore demand |

| Direct Reduced Iron (DRI) | India: >45M tonnes production (2023-2024) | Competitive pressure on ore sales |

| Alternative Materials (Steel) | Automotive shift to lightweighting | Moderate long-term steel demand impact |

Entrants Threaten

The mining industry demands extremely high capital, with new iron ore projects often requiring investments exceeding $1 billion, as seen in 2024. New entrants must commit substantial upfront capital for exploration, mine development, and heavy equipment. Established players like NMDC benefit significantly from economies of scale, having already absorbed these massive costs. This financial barrier, exemplified by the multi-billion dollar investments needed for a competitive mining operation, strongly deters potential new competitors from entering the market.

The Indian mining sector, a core area for NMDC, faces stringent government regulations and licensing requirements that significantly deter new entrants. Obtaining necessary permits, including mining leases and environmental clearances, is a complex and often protracted process. For example, securing all approvals for a new mining project can realistically take several years, with environmental impact assessments often extending beyond 24 months. This extensive regulatory framework, reinforced by the Mines and Minerals (Development and Regulation) Act, makes market entry prohibitively difficult for prospective companies in 2024, limiting competition for established players like NMDC.

Established players like NMDC control significant high-grade iron ore reserves, posing a formidable barrier to new entrants. As of 2024, securing new mining blocks in India primarily occurs through competitive auctions, making direct acquisition challenging for newcomers. The scarcity of readily available, high-quality deposits further compounds this difficulty, requiring substantial capital and long gestation periods. This entrenched control over prime resources effectively limits new players from gaining a meaningful foothold in the iron ore mining sector.

Required Technical Expertise and Experience

Mining is a highly specialized field demanding extensive technical and operational expertise. Established entities like NMDC, operational since 1958, possess decades of accumulated knowledge in iron ore extraction, beneficiation, and logistics. A new entrant would face immense challenges replicating this deep-seated experience swiftly, especially given the complexities of large-scale projects and regulatory compliance in 2024. This significant barrier to entry protects NMDC's market position, hindering potential competitors from quickly gaining a foothold.

- NMDC's operational history spans over 65 years, offering unparalleled expertise.

- Developing new mines requires substantial capital and a highly skilled workforce.

- Access to specialized equipment and proprietary processes is a significant hurdle.

- Regulatory clearances for mining projects can take several years to secure.

Government Initiatives to Encourage Private Participation

While barriers to entry in the Indian mining sector remain high, the government is actively encouraging private participation to boost domestic production. Reforms introduced in 2024, such as those improving the ease of doing business and ensuring the transferability of mining concessions, aim to gradually lower these hurdles. Despite these efforts, the substantial capital requirements and long gestation periods mean the overall threat of new major entrants to established players like NMDC remains low to moderate in the immediate future.

- Government initiatives target increased domestic mineral output.

- Reforms in 2024 simplify mining operations and concession transfers.

- High capital investment deters rapid entry of new large players.

- Threat of new major entrants is currently low to moderate.

The mining industry's immense capital needs, often exceeding $1 billion for new projects in 2024, coupled with lengthy regulatory clearances (multiple years), severely deter new entrants. Established players like NMDC benefit from decades of operational expertise and control over prime iron ore reserves. While 2024 reforms aim to ease entry, the substantial investment and specialized knowledge required keep the threat of major new competitors low to moderate.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital | High | >$1B |

| Regulation | Time | >24 months |

| Expertise | Specialized | 65+ yrs |

Porter's Five Forces Analysis Data Sources

Our NMDC Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry expert interviews, government statistics, and market research reports from leading firms.

This comprehensive approach ensures a thorough understanding of the competitive landscape, supplier leverage, buyer influence, threat of new entrants, and the intensity of substitute products within the industry.