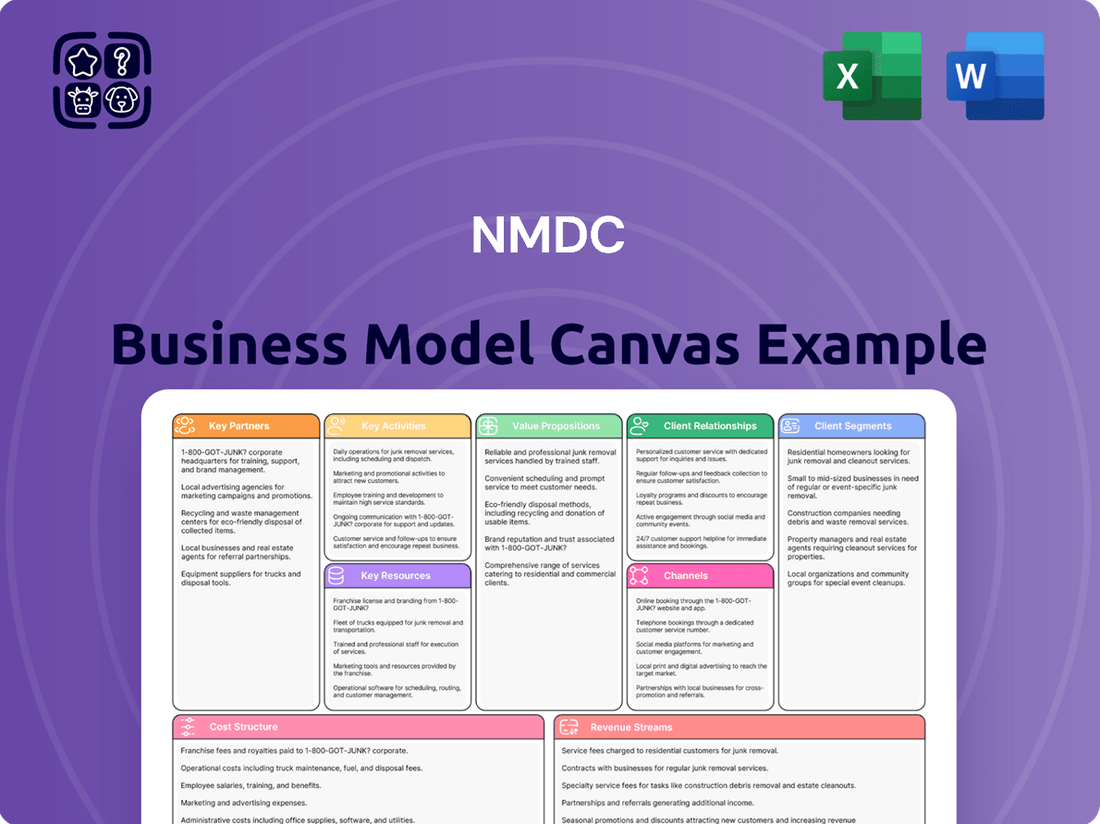

NMDC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NMDC Bundle

Unlock the complete strategic blueprint behind NMDC's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape, offering a clear, professionally written snapshot of its success. Ideal for entrepreneurs, consultants, investors, and business students looking for actionable insights and proven industry strategies.

Dive deeper into NMDC’s real-world operations with the full Business Model Canvas, available in both Word and Excel formats. This comprehensive, editable document breaks down customer segments, key partnerships, revenue strategies, and more, perfect for benchmarking, strategic planning, or investor presentations.

Want to see exactly how NMDC operates and scales its business? Get the full Business Model Canvas for NMDC and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform your own business thinking.

Partnerships

The Government of India, through the Ministry of Steel, is NMDC’s most crucial partner as a Public Sector Undertaking, directly shaping its strategic direction and ensuring regulatory adherence. This partnership grants NMDC essential access to mining leases and provides significant sovereign backing. For instance, government initiatives like the 2024 push for infrastructure development and the ongoing 'Make in India' campaign directly support NMDC's core business of iron ore production. This strong alignment ensures policy support and a stable operational environment for NMDC's continued growth.

Partnerships with global leaders like Komatsu, Caterpillar, and BEML are vital for NMDC, ensuring access to advanced heavy machinery essential for its large-scale iron ore mining operations. These collaborations provide the latest mining technology, enhancing operational efficiency and guaranteeing critical after-sales support. Such strategic alliances are crucial for NMDC to meet its ambitious production targets, which for FY2024 were projected around 49 million tonnes of iron ore, while effectively managing escalating operational costs. This ensures the sustained high-volume output necessary for the company’s revenue generation.

Collaborating with Indian Railways is crucial for NMDC, enabling the transport of millions of tons of iron ore from land-locked mines like Chhattisgarh to domestic steel plants. This partnership ensures efficient dispatch, with rail freight being a primary mode for NMDC's significant volumes, which stood at 45.01 million tonnes of iron ore production in FY2024. Additionally, partnerships with major port authorities, such as the Visakhapatnam Port Trust, are essential for managing export logistics and facilitating global market access. These robust logistical networks provide a significant competitive advantage in the bulk commodity sector, streamlining the supply chain.

Joint Venture (JV) Partners

NMDC actively engages in Joint Ventures (JVs) for mineral exploration within India and globally, sharing critical risks, investments, and specialized expertise. A prime example is its ongoing partnership with Hancock Prospecting for the Legacy Iron Ore project in Australia, underscoring its strategy to secure resources worldwide. These alliances are fundamental to NMDC's diversification efforts and its long-term growth trajectory, aiming to enhance its mineral footprint beyond domestic operations.

- NMDC's Q4 FY24 results highlighted continued strategic focus on resource security through such partnerships.

- The Legacy Iron Ore project in Australia, a key JV, continues to be a strategic asset.

Steel Plant Technology Providers

NMDC has forged essential partnerships with global engineering and technology firms to facilitate the construction and operation of its Nagarnar Steel Plant, now known as NMDC Steel Ltd. These collaborations are vital for accessing state-of-the-art steel-making technology, critical process knowledge, and advanced operational expertise. Such alliances enable the production of high-quality steel and ensure competitiveness in the value-added products market, aligning with the plant's 2024 production ramp-up targets. The plant, commissioned in early 2024, aims for an initial capacity of 3 million tonnes per annum (MTPA).

- Nagarnar Steel Plant, now NMDC Steel Ltd., commenced commercial operations in Q1 2024.

- Initial capacity target is 3 million tonnes per annum (MTPA) of hot rolled coils.

- Partnerships provide access to advanced technologies like blast furnace and basic oxygen furnace processes.

- Strategic alliances are key for achieving operational efficiency and product quality benchmarks.

NMDC’s partnerships with global engineering firms were vital for commissioning its Nagarnar Steel Plant, now NMDC Steel Ltd., in Q1 2024. These collaborations provide essential state-of-the-art steel-making technology and operational expertise. This strategy supports the plant’s 3 million tonnes per annum hot rolled coils target for 2024, enhancing its market competitiveness. Such alliances are crucial for achieving high-quality steel production and operational efficiency.

| Partner Focus | Key Benefit | 2024 Impact |

|---|---|---|

| Engineering Firms | Advanced Steel Tech | Nagarnar Plant Commissioned Q1 2024 |

| Operational Experts | Process Knowledge | 3 MTPA Hot Rolled Coils Target |

| Technology Providers | Efficiency & Quality | Enhanced Competitiveness |

What is included in the product

A comprehensive business model canvas for NMDC, detailing its operational structure, revenue streams, and strategic partnerships.

This canvas outlines NMDC's key resources, activities, and cost structure, providing a clear roadmap for its mining and mineral development endeavors.

A clear, structured framework that helps identify and address operational inefficiencies and market gaps.

Facilitates a systematic approach to uncovering and resolving strategic challenges within the business.

Activities

Iron ore mining and processing represent NMDC's core operational activity, spanning from blasting and excavation to crushing, screening, and beneficiation of the ore.

The efficiency and scale of operations at major mines like Bailadila and Donimalai directly determine the company's output and profitability.

A primary focus remains on continuous improvement in mining techniques to enhance productivity.

For instance, NMDC achieved its highest-ever annual iron ore production of 45.17 million tonnes in the financial year ending March 2024, demonstrating robust operational execution.

NMDC is actively engaged in scientific exploration for new mineral deposits, vital for ensuring long-term resource security and sustainable growth. This involves comprehensive geological surveys, advanced drilling, and meticulous sample analysis for iron ore, diamonds, and limestone. These efforts are crucial for replenishing existing reserves and diversifying the company's mineral portfolio, supporting future production targets. For 2024, NMDC continues to prioritize exploration, with ongoing projects aimed at discovering new high-grade iron ore reserves in regions like Chhattisgarh and Karnataka, aligning with their strategic expansion plans.

Steel manufacturing has become a core activity for NMDC with the commissioning of the Nagarnar Steel Plant, marking a significant strategic shift towards vertical integration.

This involves operating advanced facilities like blast furnaces, steel melt shops, and rolling mills to transform iron ore into finished steel products.

For the fiscal year 2023-2024, the Nagarnar Steel Plant, operating at an initial capacity of 3 million tonnes per annum, has been ramping up production.

This strategic move aims to capture higher margins in the value chain and effectively de-risk the business from the volatility inherent in iron ore prices, enhancing overall profitability.

Logistics & Supply Chain Management

Managing the end-to-end movement of raw materials and finished goods is a critical, large-scale activity for NMDC, ensuring its iron ore reaches customers efficiently. This includes coordinating with Indian Railways for rake allocation, which transported over 1500 million tonnes of freight in FY2024, essential for domestic dispatches. Seamless port-side operations, particularly at Visakhapatnam Port, are vital for exports, with NMDC aiming for enhanced global reach. An optimized supply chain is essential for cost control and maintaining customer satisfaction, driving consistent operational performance.

- FY2024 iron ore production for NMDC reached 45.47 million tonnes, heavily reliant on efficient logistics.

- Indian Railways plays a pivotal role, handling significant bulk freight for NMDC's dispatches.

- Port operations, especially for exports, are crucial for accessing international markets.

- Supply chain optimization directly impacts cost efficiency and timely customer delivery.

Research & Development (R&D)

NMDC’s Research & Development center is crucial, focusing on advanced mineral processing and beneficiation techniques to enhance ore quality, particularly for iron ore. This R&D effort is vital for maximizing resource utilization from existing mines, ensuring efficiency, and developing processes for new minerals, supporting future expansion. It also plays a significant role in environmental management, aiming to minimize ecological impact and effectively utilize mining waste. For 2024, NMDC continues to invest in sustainable mining practices, aligning with a projected increase in demand for beneficiated iron ore products.

- R&D focuses on optimizing iron ore beneficiation, crucial as NMDC aims for higher value products.

- It supports resource maximization from key operations like Kirandul and Bacheli, which produced 40.54 million tonnes of iron ore in FY2024.

- Emphasis is placed on environmental stewardship and waste utilization, reducing operational footprint.

- R&D initiatives are key to developing capabilities for new mineral exploration and processing technologies.

NMDC's core activities involve large-scale iron ore mining and processing, achieving 45.17 million tonnes in FY2024, alongside continuous scientific exploration for new deposits. Steel manufacturing at the Nagarnar Steel Plant, ramping up in FY2023-2024, marks a strategic shift. Efficient logistics, crucial for moving over 1500 million tonnes of freight via Indian Railways in FY2024, ensures timely delivery. Research & Development enhances ore quality and supports sustainable practices for future growth.

| Key Activity | FY2024 Data | Impact |

|---|---|---|

| Iron Ore Production | 45.17 million tonnes | Core revenue driver |

| Steel Plant Operations | 3 MTPA (initial capacity) | Vertical integration, value addition |

| Logistics & Freight | >1500 million tonnes | Ensures market reach, cost efficiency |

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the exact NMDC Business Model Canvas you will receive upon purchase. It's not a generic template or a simplified example, but a direct representation of the comprehensive document. Once your order is processed, you'll gain full access to this complete, professionally formatted Business Model Canvas, ready for your strategic planning needs.

Resources

NMDC's most valuable assets are its mining leases, granted by the Indian government, providing exclusive rights to extract minerals. These leases encompass vast, high-quality iron ore reserves, primarily in Chhattisgarh and Karnataka, which are central to the company's valuation and long-term operational viability. For example, NMDC's Donimalai mine in Karnataka, operational in 2024, is a key contributor. These finite resources necessitate continuous exploration and development to ensure future supply and sustain production levels, supporting its strong market position.

NMDC relies on extensive large-scale mining infrastructure, including heavy earth-moving machinery, advanced crushers, efficient conveyor systems, and modern processing plants at its key iron ore sites. This substantial capital equipment base, essential for operations like those at Bailadila, allows the company to achieve massive economies of scale in production, processing over 40 million tonnes of iron ore annually as of fiscal year 2024. The operational efficiency and high output are directly tied to the condition and technological sophistication of this infrastructure, which is critical for maximizing returns and maintaining its position as India's largest iron ore producer.

The 3 MTPA Nagarnar Integrated Steel Plant is a pivotal strategic resource for NMDC, representing a substantial capital investment in downstream value addition. This facility, now part of NMDC Steel Ltd. where NMDC holds a 60.79% stake as of early 2024, enables the internal consumption of NMDC’s own iron ore. It transforms raw material into high-margin finished steel products, enhancing the company’s revenue streams. This plant is critical for NMDC's future growth and diversification strategy, moving beyond solely iron ore mining. Its operationalization in 2024 further solidifies this strategic shift.

Skilled Human Capital

NMDC's core operations hinge on its specialized workforce, including expert geologists, seasoned mining engineers, metallurgists, and skilled plant operators. Their collective technical expertise and extensive operational experience are vital for efficient exploration, responsible mining, and the company's nascent steel production capabilities.

Retaining and continuously developing this critical talent pool is fundamental for NMDC's sustained operational efficiency and future growth, especially as the company targets enhanced mineral output and diversified operations.

- NMDC employed over 16,000 personnel as of March 2024.

- Specialized roles are crucial for maintaining its annual iron ore production, which exceeded 45 million tonnes in FY2024.

- Ongoing training programs are key to adapting to new mining technologies and sustainability practices.

- Talent retention mitigates risks associated with operational continuity and project execution.

Strong Financial Position & PSU Status

NMDC’s robust balance sheet and consistent profitability, reporting a net profit of ₹1,492.65 crore in Q3 FY24, are significantly strengthened by its Navratna PSU status.

This government backing provides a substantial financial cushion, enabling the company to fund large capital expenditure projects and effectively navigate volatile commodity cycles.

Such stability ensures favorable access to capital markets, enhancing its ability to invest in future growth.

This strong financial position is a critical competitive advantage for NMDC in the mining sector.

- Net Profit (Q3 FY24): ₹1,492.65 crore

- Total Income (Q3 FY24): ₹4,020.65 crore

- Navratna PSU Status: Government-backed financial stability

- Credit Access: Favorable terms due to sovereign backing

NMDC's core resources are its extensive iron ore mining leases, like the Donimalai mine operational in 2024, and large-scale infrastructure processing over 40 million tonnes annually as of FY2024. The 3 MTPA Nagarnar Integrated Steel Plant, operational in 2024, is a pivotal strategic asset for value addition. A specialized workforce of over 16,000 personnel as of March 2024, coupled with its Navratna PSU status, underpins its robust financial position. This strong foundation ensures sustained operations and future growth, evidenced by a Q3 FY24 net profit of ₹1,492.65 crore.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Mining Leases | Exclusive rights to iron ore reserves | Donimalai mine operational in 2024 |

| Mining Infrastructure | Equipment and processing plants | Processing >40 MT iron ore annually (FY2024) |

| Nagarnar Steel Plant | Downstream value addition | Operational in 2024 (3 MTPA capacity) |

| Workforce | Specialized personnel | >16,000 employees (March 2024) |

| Financial Strength | Balance sheet, PSU status | Net Profit ₹1,492.65 Cr (Q3 FY24) |

Value Propositions

NMDC supplies high-grade iron ore, often exceeding 63% Fe content, which is crucial for steelmakers to achieve higher efficiency.

This superior quality, characterized by low impurities, directly improves furnace productivity and output quality for customers.

The company's consistent and reliable ore quality significantly reduces processing costs for steel producers.

For example, in fiscal year 2024, NMDC’s consistent supply underpinned efficient operations for major domestic steel plants, highlighting this core value.

As India's largest iron ore producer, NMDC offers unmatched scale and reliability of supply to the domestic steel industry. In fiscal year 2024, NMDC achieved a record iron ore production of 45.02 million tonnes, showcasing its robust capacity. This consistent, large-volume supply is vital for steel plants requiring predictable raw material inputs. Such reliable positioning makes NMDC a strategic partner, not merely a supplier, ensuring critical raw material security for India's steel sector.

NMDC plays a strategic role by ensuring a steady supply of iron ore, a key raw material for India's steel sector. This sector is foundational, supporting national infrastructure and manufacturing growth, with India's crude steel production reaching 125.32 million tonnes in FY2024. This alignment with national priorities provides NMDC a stable operating environment and implicit government backing. The company's value extends beyond direct customers to significantly contribute to the nation's overall economic development.

Emerging Supplier of Value-Added Steel

Through its newly operational Nagarnar Integrated Steel Plant, NMDC has emerged as a key supplier of value-added steel products. The plant, which began hot metal production in 2024, now delivers hot-rolled coils, sheets, and plates to the market. This offers customers a new, high-quality source of finished steel, benefiting from NMDC's integrated operations that ensure quality control from iron ore extraction to the final metal product. This strategic move significantly elevates NMDC's position within the steel value chain, diversifying its revenue streams beyond raw iron ore.

- Nagarnar Integrated Steel Plant commenced operations in 2024, adding 3 MTPA capacity.

- Offers hot-rolled coils, sheets, and plates, expanding NMDC's product portfolio.

- Integrated production ensures quality control from mine to finished steel.

- Diversifies revenue beyond iron ore, enhancing long-term value.

Diversified and Responsible Miner

NMDC is evolving beyond its core iron ore operations, actively exploring minerals like diamonds and limestone to become a diversified mining entity. This expansion is evident in its diamond mining at Panna, India's only mechanized diamond mine, and limestone projects enhancing its portfolio.

The company also prioritizes sustainable and responsible mining, appealing to environmentally and socially conscious investors who increasingly value ESG factors. This commitment, including initiatives like extensive afforestation and water conservation efforts, enhances its corporate reputation and secures its long-term social license to operate, crucial for ongoing projects and future growth in 2024.

- NMDC targets 100 MTPA iron ore capacity by 2030, alongside diversification.

- Panna Diamond Mine, operated by NMDC, produced over 38,000 carats in FY2024.

- ESG focus aligns with global investment trends, attracting sustainable capital.

- The company maintains ISO 14001 certification for environmental management.

NMDC delivers high-grade iron ore, consistently ensuring quality for steelmakers, and achieved a record 45.02 million tonnes production in fiscal year 2024. Its strategic role supports India's steel sector, with the nation's crude steel output reaching 125.32 million tonnes in FY2024. The newly operational Nagarnar Integrated Steel Plant, commencing hot metal production in 2024, now offers value-added steel products like hot-rolled coils. Additionally, NMDC diversifies into minerals such as diamonds, with Panna producing over 38,000 carats in FY2024, while maintaining strong ESG commitments.

| Value Proposition | FY2024 Data | Impact |

|---|---|---|

| High-Grade Ore & Reliability | 45.02 MT iron ore production | Ensures efficient steelmaking |

| Strategic National Contribution | 125.32 MT India's crude steel | Supports national infrastructure |

| Value-Added Products | Nagarnar Plant operational 2024 | Diversifies revenue streams |

| Diversification & ESG | 38,000+ carats Panna Diamond | Broadens portfolio, enhances reputation |

Customer Relationships

NMDC secures its market position through long-term supply agreements with major Indian steel producers like JSW Steel and Tata Steel, alongside key export markets such as Japan and South Korea.

These contracts ensure predictable revenue streams for NMDC, which reported iron ore production of 43.15 million tonnes in FY2024, and guarantee raw material security for its customers.

Such agreements are foundational to managing key account relationships and maintaining stability in the volatile global iron ore market.

NMDC provides dedicated account management teams for its largest institutional clients, ensuring a single point of contact. These teams streamline coordination on logistics, quality, and scheduling for significant orders. This approach cultivates strong, collaborative relationships, crucial for retaining major buyers. Such dedicated support contributes to high customer retention, supporting NMDC's consistent sales volumes, which saw robust iron ore production exceeding 45 million tonnes in fiscal year 2024.

As a Public Sector Undertaking, NMDC maintains a formal and continuous relationship with the Ministry of Steel and other government departments. This critical liaison is managed through regular reporting, policy consultations, and strategic alignment meetings. For instance, NMDC's operational plans for 2024 are closely aligned with national iron ore production targets. This relationship is crucial for navigating India's complex regulatory landscape and aligning with national objectives, ensuring compliance with evolving mining laws and environmental norms.

Transparent E-Auction Platform

NMDC leverages a transparent e-auction platform for a portion of its domestic iron ore sales, primarily serving smaller buyers and traders. This digital approach ensures a market-driven mechanism for price discovery, enhancing fairness and expanding the customer base beyond traditional bulk purchasers. The relationship remains largely transactional, dictated by the clear rules and real-time bidding visible on the platform. NMDC’s e-auction volumes contribute to its overall sales, with the company reporting strong iron ore production and sales figures in Q4 FY2024, reaching 14.15 MT production and 13.62 MT sales.

- E-auction portal facilitates transparent, market-driven price discovery.

- Broadens customer base to include smaller traders.

- Relationship is transactional, governed by clear platform rules.

- NMDC reported iron ore production of 14.15 MT and sales of 13.62 MT in Q4 FY2024.

Active Investor Relations

NMDC maintains a proactive relationship with its stakeholders via its investor relations department, fostering transparency and trust. This involves regular earnings calls, such as those following the Q4 FY2024 results where net profit reached ₹1,415 crore, alongside investor presentations and comprehensive annual reports. Timely disclosures ensure the market is well-informed of the company's strategic direction and financial performance. This consistent communication builds confidence and supports a clear understanding of NMDC's market position.

- Q4 FY2024 net profit reported at ₹1,415 crore.

- Total revenue from operations in Q4 FY2024 stood at ₹5,915 crore.

- Regular investor presentations detail operational milestones and future outlook.

- Annual reports provide in-depth financial and operational overviews.

NMDC nurtures long-term, collaborative relationships with major steel producers like JSW Steel and Tata Steel, supported by dedicated account management teams ensuring high retention and stable iron ore sales, which exceeded 45 million tonnes in fiscal year 2024. For smaller domestic buyers, a transparent e-auction platform facilitates transactional, market-driven sales. Additionally, NMDC engages formally with government bodies and maintains proactive investor relations, reporting a net profit of ₹1,415 crore in Q4 FY2024.

| Key Relationship Type | Primary Focus | FY2024 Data Point |

|---|---|---|

| Long-Term Contracts | Strategic Partnerships & Stability | Iron Ore Production: >45 MT |

| E-Auction Sales | Market-Driven Transactions | Q4 FY2024 Sales: 13.62 MT |

| Investor Relations | Transparency & Trust | Q4 FY2024 Net Profit: ₹1,415 Cr |

Channels

NMDC primarily reaches major domestic and international steel producers through its direct sales force. This team negotiates long-term supply contracts, which are crucial as they manage the bulk of the company’s iron ore sales volume. For instance, NMDC's iron ore production for the fiscal year 2024 was approximately 45.47 million tonnes. These agreements allow for customized terms regarding pricing, volume, and specific quality requirements, ensuring stable revenue streams and client relationships.

The Indian Railways network serves as the principal physical channel for NMDC, delivering iron ore from its central Indian mines, such as those in Chhattisgarh and Karnataka, to customer locations and ports nationwide. The efficiency of this vast network is absolutely critical to NMDC’s entire business model, especially considering their 2024 iron ore production target of 49 million tonnes. NMDC actively collaborates with Indian Railways to manage wagon allocation and ensure smooth freight movement, leveraging the network's capacity, which saw over 1.5 billion tonnes of freight loaded in fiscal year 2024.

Seaports are a critical channel for NMDC's international iron ore sales, with Visakhapatnam Port being a primary hub for shipments. Through this channel, iron ore is loaded onto vessels destined for key customers in countries such as Japan and South Korea. NMDC meticulously manages the logistics from its mines, like those in Chhattisgarh, to the port stockyards and then directly onto the ships. This ensures efficient delivery, supporting NMDC's significant export revenue stream, which remains crucial for its overall financial performance in 2024.

Digital E-Auction Portals

NMDC utilizes digital e-auction portals to broaden its reach to a diverse array of domestic customers, including smaller steel mills and sponge iron producers, beyond its large long-term contract clients. This digital channel significantly enhances transparency, allowing market forces to determine prices for a portion of its iron ore sales, complementing traditional long-term contracts. In fiscal year 2024, a notable volume of iron ore was successfully sold through these online platforms, reflecting their growing importance in NMDC's sales strategy.

- Expands customer base beyond major integrated steel plants.

- Promotes transparent, market-driven pricing for iron ore.

- Complements long-term contracts for sales diversification.

- Contributed to significant sales volumes in FY2024.

Direct-to-Customer Steel Sales Network

NMDC is establishing a direct-to-customer steel sales network for its new Nagarnar Steel Plant, targeting key end-users in sectors like construction, automotive, and manufacturing. This strategic channel aims to sell finished steel products directly, bypassing intermediaries. The approach involves setting up a dedicated sales team, a network of distributors, and stockyards across India to facilitate efficient delivery. This direct engagement is crucial for the success of NMDC's vertical integration strategy, especially with the plant's initial production capacity expected to reach 3 million tonnes per annum (MTPA) of hot rolled coils by 2024.

- Targeted sectors include construction, automotive, and manufacturing.

- Developing a network of distributors and stockyards for direct sales.

- Crucial for vertical integration and maximizing value from the Nagarnar Steel Plant.

- Plant's capacity is 3 MTPA of hot rolled coils, operational by 2024.

NMDC leverages a multi-channel strategy, primarily using its direct sales force for long-term contracts with major steel producers, supported by Indian Railways and seaports for logistics, handling iron ore production of approximately 45.47 million tonnes in FY2024. Digital e-auctions expand reach to smaller domestic clients, contributing to significant sales volumes in 2024. Furthermore, NMDC is establishing a direct-to-customer network for its Nagarnar Steel Plant, targeting sectors like construction with its 3 MTPA hot rolled coil capacity by 2024.

| Channel Type | Primary Focus | 2024 Relevance |

|---|---|---|

| Direct Sales Force | Major Steel Producers | 45.47 MT Iron Ore Production |

| Indian Railways | Domestic Logistics | 1.5+ Billion Tonnes Freight Loaded |

| Seaports | International Exports | Crucial for Export Revenue |

| Digital E-auctions | Smaller Domestic Clients | Significant Sales Volume |

| Direct Steel Sales | Finished Steel Products | 3 MTPA Hot Rolled Coils Capacity |

Customer Segments

This is NMDC's largest and most crucial customer segment, including major players like JSW Steel, Tata Steel, and Rashtriya Ispat Nigam Ltd (RINL).

These integrated steel producers require massive, consistent volumes of high-grade iron ore for their blast furnaces to maintain production schedules.

India's crude steel production reached approximately 143.6 million tonnes in FY2023-24, driving significant demand for iron ore.

NMDC typically engages these customers through long-term contracts, ensuring stable revenue streams and consistent supply to meet their substantial requirements.

Sponge iron and pellet manufacturers form a vital customer segment for NMDC, utilizing iron ore as their primary raw material to produce intermediate products crucial for steelmaking. These companies represent a significant portion of domestic demand for iron ore, with their requirements often met through a mix of direct contracts and competitive e-auctions. In 2024, the Indian sponge iron sector continued to be a key consumer, driving demand for specific grades of ore. Their needs for iron ore can differ significantly from those of integrated steel producers, often requiring particular specifications or beneficiated products.

A crucial customer segment for NMDC includes international steel mills, particularly in nations like Japan and South Korea, where the company maintains robust, long-standing relationships. These export markets are primarily served through annual supply contracts, ensuring consistent demand for NMDC’s iron ore. For example, NMDC’s iron ore exports reached 2.91 million tonnes in the fiscal year 2024, demonstrating significant international engagement. This segment contributes vital geographical revenue diversification, reducing reliance on the domestic market.

Pig Iron Producers

Pig Iron Producers are a vital customer segment for NMDC, encompassing smaller foundries and specialized pig iron manufacturers. Though individually smaller than integrated steel plants, their collective demand forms a stable and consistent customer base for NMDC's iron ore. These producers often procure material through the e-auction channel, which, as of 2024, remains a significant avenue for NMDC to distribute its output beyond long-term contracts. This ensures broad market access for NMDC's products.

- E-auction sales contribute significantly to NMDC's revenue from this segment.

- This segment provides demand stability despite individual buyer size.

- Smaller foundries rely on NMDC for consistent raw material supply.

- NMDC's iron ore sales to this segment support diverse industrial needs.

Future End-Users of Steel Products

As NMDC increases steel production, a new customer segment is emerging, focusing on companies in construction, infrastructure, automotive, and general engineering. These entities will procure finished steel products, such as Hot Rolled Coils, directly from NMDC’s Nagarnar Steel Plant. This represents a strategic diversification of NMDC’s customer base beyond iron ore, aligning with India’s projected steel demand growth. For 2024, the Indian steel sector anticipates robust demand, driven by government infrastructure spending.

- Construction and Infrastructure: Key consumers for structural steel and rebars.

- Automotive Sector: Requires specialized steel grades for vehicle manufacturing.

- General Engineering: Diverse industries utilizing various steel products for machinery and components.

- India's crude steel production reached 12.1 million tonnes in February 2024, indicating strong market activity.

NMDC primarily serves large integrated steel producers like JSW Steel, requiring consistent, high-volume iron ore for their operations.

Key domestic segments also include sponge iron, pellet, and pig iron manufacturers, often procuring through e-auctions.

International steel mills in Japan and South Korea form a vital export market, contributing to revenue diversification.

An emerging segment involves consumers of finished steel products from NMDC’s Nagarnar plant, targeting construction and automotive sectors.

| Segment | Key Data (2024) | Relevance |

|---|---|---|

| Integrated Steel Producers | India's crude steel production: 143.6 MT (FY2023-24) | Largest, consistent demand for high-grade ore. |

| International Steel Mills | NMDC iron ore exports: 2.91 MT (FY2024) | Ensures global revenue diversification. |

| Finished Steel Consumers | India's Feb 2024 crude steel production: 12.1 MT | New market for Nagarnar plant, diversified revenue. |

Cost Structure

Mining operations and production costs represent NMDC's most substantial expense category, driven by the intricate processes of excavation, drilling, blasting, and ore processing. These include significant outlays for labor, power, and fuel, which directly impact operational efficiency. As variable costs, they are intrinsically linked to the volume of iron ore produced; for instance, the cost of materials consumed and power and fuel expenses were a major component of NMDC's total expenses, reflecting the direct correlation with output for fiscal year 2024.

As a large Public Sector Undertaking, employee salaries and benefits form a substantial fixed cost for NMDC. These expenses, including wages, post-retirement provisions, and other staff welfare, are a key component of their operational outlay. For the financial year ending March 2024, employee remuneration significantly impacted profitability. Managing the costs associated with its large workforce of engineers, technicians, and administrative staff remains a critical focus area.

The cost of transporting millions of tons of iron ore via rail from NMDC's mines to customers and ports represents a significant expenditure. These freight costs are heavily influenced by railway tariffs, which saw revisions, and fluctuating fuel prices throughout 2024. For instance, Indian Railways' freight loading for iron ore continued to be substantial in the fiscal year 2023-24, highlighting this ongoing cost. Optimizing logistics, including efficient wagon utilization and route planning, is critical for NMDC to maintain its cost competitiveness and profitability in the market.

Government Royalties, Taxes & Levies

NMDC faces substantial government royalties, District Mineral Foundation (DMF) contributions, and other statutory levies directly tied to its mineral extraction volume and pricing. These payments represent a significant portion of the company's cost of sales, essential for maintaining its operational license. For instance, NMDC's total royalty and cess payments were substantial in recent fiscal periods, reflecting their direct impact on profitability. This cost structure is fundamental to NMDC's business model.

- Royalties on mineral extraction are a direct production-linked cost.

- District Mineral Foundation (DMF) contributions are mandatory levies.

- These costs are a major share of NMDC's cost of sales.

- Government levies are crucial for the company's license to operate.

Capital Expenditure & Depreciation

NMDC’s cost structure heavily features capital expenditure and depreciation, reflecting its capital-intensive mining operations. This includes significant depreciation of heavy mining machinery and extensive infrastructure. Immense capital investment continues for new projects and mine development, such as the ongoing efforts to expand iron ore production capacity. While CAPEX represents a substantial cash outflow, the resulting depreciation is a significant non-cash cost impacting the income statement.

- For the fiscal year 2024, NMDC’s capital expenditure was projected to be substantial, supporting production targets.

- The company reported depreciation and amortization expenses in the range of ₹1,000-₹1,200 crore annually in recent fiscal years.

- A major historical CAPEX was directed towards the Nagarnar Steel Plant, which was demerged in October 2023.

NMDC's cost structure is dominated by variable mining and production expenses, including power and fuel, directly tied to iron ore output. Significant fixed costs include employee salaries and benefits, impacting profitability in 2024. Substantial freight costs, influenced by railway tariffs, and mandatory government levies like royalties are also key. Capital expenditure for expansion and depreciation from heavy machinery remain core components.

| Cost Category | Nature | FY2024 Impact |

|---|---|---|

| Mining Operations | Variable | Major expense, linked to output |

| Employee Costs | Fixed | Significant profitability impact |

| Depreciation | Non-cash | ₹1,000-₹1,200 Cr annually |

| Capital Expenditure | Investment | Substantial for expansion |

Revenue Streams

The domestic sale of iron ore represents NMDC's primary and largest revenue stream, generated through sales to steel plants and other manufacturers across India. Pricing for this essential commodity is determined by a strategic mix of long-term contracts and transparent e-auctions. This revenue stream is the bedrock of the company's financial performance, ensuring consistent cash flow. For instance, NMDC reported iron ore production of 45.03 million tonnes in FY24, highlighting the scale of this core business. This consistent domestic demand underpins its market dominance.

The export sale of iron ore to international customers, primarily in Japan and South Korea, forms a vital revenue stream for NMDC. These sales are largely underpinned by long-term agreements, ensuring stable demand and revenue predictability. For the fiscal year 2023-24, NMDC maintained significant export volumes, contributing to its overall revenue. This strategic diversification through exports helps mitigate dependency on the domestic market, providing valuable foreign exchange earnings and enhancing financial resilience.

The sale of finished steel products is emerging as a significant new revenue stream for NMDC, driven by the Nagarnar Steel Plant. This strategic shift into higher-value Hot Rolled Coils, Plates, and Sheets provides more stable margins than traditional raw iron ore sales. For example, the plant began commercial production in August 2023, and its output is projected to contribute substantially to NMDC's revenue growth in 2024 and beyond. This diversification into value-added steel products is crucial for enhancing overall profitability and reducing reliance on volatile iron ore prices, positioning it as a major future growth driver.

Sale of Diamonds and Other Minerals

NMDC diversifies its revenue streams through the sale of diamonds from its Panna mine in Madhya Pradesh. While this constitutes a smaller portion compared to iron ore, it highlights the company's efforts towards broader mineral exploration. This segment, including potential future contributions from minerals like limestone, showcases NMDC's strategy to reduce reliance on a single commodity. It represents an evolving source of non-iron ore income, adding resilience to its financial model.

- Diamond production from Panna mine was 38,067 carats in FY24.

- Diamond sales contributed ₹116.89 crore to revenue in FY24.

- This stream is key to diversification beyond iron ore.

- Exploration for other minerals like limestone continues for future revenue.

Interest Income and Other Income

NMDC generates substantial revenue from its interest income and other financial assets, reflecting its robust cash reserves. This stream includes earnings from treasury investments, providing a consistent contribution to the company's bottom line. For instance, NMDC reported other income of ₹1,617.91 crore for the nine months ending December 31, 2023, showcasing its significance. This also encompasses miscellaneous income from various non-core activities.

- Interest income from cash reserves and investments.

- Stable contributor to the bottom line as a cash-rich PSU.

- Includes miscellaneous income from non-core operations.

- Other income was ₹1,617.91 crore for the nine months ending December 31, 2023.

NMDC primarily generates revenue from extensive domestic and export iron ore sales, foundational to its market position. A significant new stream is emerging from the Nagarnar Steel Plant, which commenced commercial production in August 2023, contributing to finished steel product sales and 2024 revenue growth. Further diversification includes diamond sales from the Panna mine, totaling ₹116.89 crore from 38,067 carats in FY24, and substantial interest income from robust cash reserves, amounting to ₹1,617.91 crore for the nine months ending December 31, 2023. These streams collectively ensure financial stability and future growth.

| Revenue Stream | Key Contribution | FY24 Data |

|---|---|---|

| Domestic Iron Ore | Primary revenue, stable cash flow | 45.03 MT production |

| Finished Steel | New high-value segment | Nagarnar Plant commenced Aug 2023 |

| Diamond Sales | Mineral diversification | ₹116.89 Cr, 38,067 carats |

| Interest Income | Financial asset earnings | ₹1,617.91 Cr (9M FY24) |

Business Model Canvas Data Sources

The NMDC Business Model Canvas is built using a combination of internal financial data, market research reports, and operational insights. These sources ensure that each block of the canvas is informed by accurate, relevant, and actionable information.