Nissha PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nissha Bundle

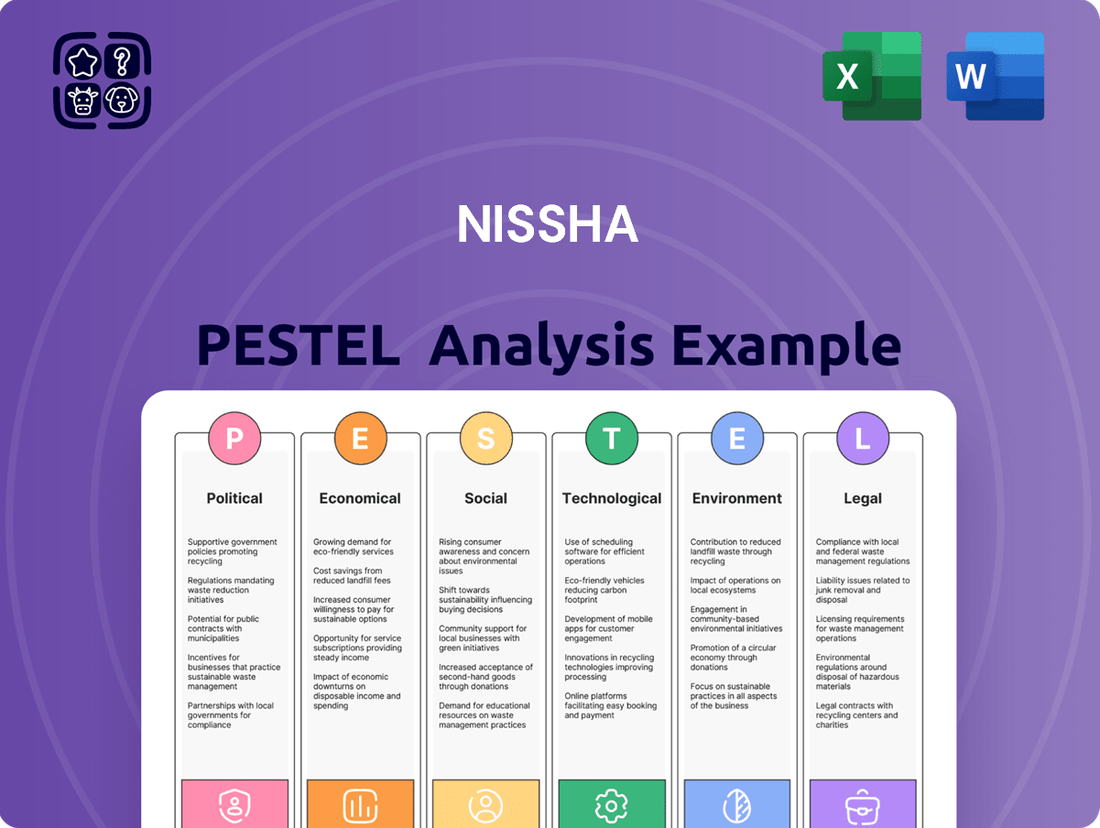

Navigate the complex external forces shaping Nissha's trajectory with our meticulously crafted PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that are influencing the company's operations and strategic direction. This comprehensive report is your essential tool for understanding market dynamics and anticipating future challenges and opportunities. Ready to gain a strategic advantage? Download the full PESTLE analysis now for actionable insights.

Political factors

Nissha, being a Japanese-based global entity, faces considerable risks from escalating geopolitical tensions and ongoing trade disputes, particularly those involving major economies like the United States and China. These international frictions can manifest as punitive tariffs and significant disruptions to established supply chains, directly increasing operational expenses for companies like Nissha. For instance, the US-China trade war, which saw tariffs on billions of dollars worth of goods, has already demonstrated the potential for such conflicts to negatively impact global trade flows and manufacturing costs.

The impact on Nissha's international business, especially within sectors such as consumer electronics and automotive, is particularly pronounced. Increased tariffs can make imported components more expensive, squeezing profit margins or forcing price increases for end products. In 2023, the automotive sector, a key market for Nissha's decorative films and components, continued to grapple with supply chain vulnerabilities exacerbated by geopolitical instability, leading to production delays and increased costs for manufacturers worldwide.

Government policies in key markets, including Japan, significantly influence Nissha's strategic decisions. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has been promoting digital transformation and advanced manufacturing through various initiatives, potentially benefiting Nissha's technological advancements. In 2024, the Japanese government continued to emphasize support for industries adopting AI and IoT, sectors where Nissha's printing technologies can play a role.

Incentives for advanced manufacturing, such as R&D tax credits and subsidies for sustainable practices, can directly impact Nissha's investment in new technologies and environmentally friendly processes. For example, governments worldwide, including those in regions where Nissha operates, are increasingly offering grants for companies investing in green manufacturing technologies, a trend expected to continue through 2025.

Conversely, changes in regulatory frameworks, such as stricter environmental regulations or evolving intellectual property laws, could increase Nissha's compliance burdens or affect its market access. For example, in 2024, the European Union's focus on circular economy principles and chemical safety regulations presented compliance challenges and opportunities for companies like Nissha to innovate its material usage.

Governments worldwide are placing a heightened emphasis on economic security, directly influencing supply chain policies. This trend encourages reshoring or diversifying away from regions perceived as high-risk. For Nissha, a company with a significant global presence, this necessitates a strategic re-evaluation of its supply chain operations.

Nissha must proactively adapt its strategies to align with these evolving national security concerns. This could involve shifting production or sourcing to bolster resilience. For example, as of early 2024, many developed nations have introduced incentives for domestic manufacturing, with the US CHIPS Act alone dedicating over $52 billion to semiconductor production, signaling a clear direction for supply chain reconfiguration.

International Trade Agreements and Protectionism

The global trade environment presents a complex picture for Nissha. Fluctuations in international trade agreements and the increasing prevalence of protectionist policies can significantly influence its cross-border operations. For instance, the World Trade Organization (WTO) reported that the trade-restrictive measures implemented by G20 economies in 2023 affected approximately $740 billion worth of trade, highlighting the potential impact on companies like Nissha that rely on global supply chains and market access.

Changes in free trade agreements (FTAs) or the imposition of new tariffs directly affect the cost of importing raw materials and exporting finished products. Non-tariff barriers, such as complex customs procedures or specific product regulations, can also create hurdles. For example, in early 2024, discussions surrounding potential revisions to trade pacts in key markets could lead to altered import duties for components or finished goods, impacting Nissha's cost structure and competitive pricing strategies.

- Impact of Tariffs: New tariffs can directly increase the cost of imported components or finished goods for Nissha, potentially reducing profit margins or forcing price increases for customers.

- Market Access: Changes in FTAs or the introduction of non-tariff barriers can restrict Nissha's ability to export to certain countries or make it more challenging to compete in those markets.

- Supply Chain Disruptions: Protectionist measures can lead to supply chain disruptions, forcing Nissha to seek alternative, potentially more expensive, suppliers or manufacturing locations.

- Global Trade Volatility: The overall volatility in global trade policies creates uncertainty, making long-term strategic planning and investment decisions more challenging for Nissha.

Political Stability in Key Operating Regions

Political stability in countries where Nissha operates is a critical consideration. For instance, in Japan, Nissha's home base, the political landscape has remained largely stable, contributing to a predictable business environment.

Conversely, other regions where Nissha might have a presence, such as parts of Southeast Asia, can experience varying degrees of political stability. Unforeseen political shifts can disrupt supply chains, impact consumer demand, and even necessitate changes in operational strategies.

For example, any significant geopolitical tensions or changes in government policy in key markets could directly affect Nissha's ability to manufacture and distribute its products efficiently. The company's 2024 annual report highlighted the importance of monitoring political developments in regions contributing to its revenue, particularly in relation to trade agreements and regulatory frameworks.

Nissha's strategy involves diversifying its operational footprint to mitigate risks associated with localized political instability. This approach aims to ensure business continuity and maintain market access even amidst regional political challenges.

Geopolitical tensions and trade disputes, particularly between the US and China, create significant risks for Nissha by potentially increasing tariffs and disrupting supply chains. For example, the ongoing US-China trade frictions have already led to higher manufacturing costs globally.

Government policies, such as Japan's focus on digital transformation and advanced manufacturing, can offer opportunities for Nissha, especially with support for AI and IoT adoption continuing into 2024. Incentives for green manufacturing, including R&D tax credits, are also expected to encourage investment in sustainable practices through 2025.

Changes in regulations, like the EU's stricter environmental and chemical safety laws in 2024, present compliance challenges but also drive innovation in material usage for companies like Nissha.

Economic security initiatives are prompting reshoring and supply chain diversification, necessitating Nissha to re-evaluate its operations, mirroring trends like the US CHIPS Act's $52 billion investment in domestic manufacturing as of early 2024.

What is included in the product

This Nissha PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering actionable insights for strategic decision-making.

Provides a concise, actionable summary of complex external factors, simplifying strategic decision-making and alleviating the pain of information overload.

Economic factors

Global economic health is a major consideration for Nissha. A slowdown in global growth, like the projected moderation in GDP for 2025, can dampen demand for Nissha's products. This slowdown means consumers and businesses might spend less, which directly affects how much Nissha sells in its various business areas.

For instance, if major economies like the United States or China experience a significant contraction, the ripple effect on industrial production and consumer purchasing power will be felt by Nissha. The International Monetary Fund (IMF) has indicated potential headwinds for global growth in 2025, and this uncertainty is a key risk factor.

Recessionary fears can also lead to increased caution from businesses regarding capital expenditures, impacting Nissha's sales of advanced materials used in manufacturing. Likewise, a weaker global consumer sentiment could reduce demand for electronics and other goods that incorporate Nissha's components.

Rising inflation is a major hurdle for Nissha, especially with raw materials and energy costs climbing. For instance, the producer price index for manufactured goods in the US saw a 2.2% increase in the 12 months ending April 2024, indicating broader cost pressures. This directly impacts manufacturers like Nissha, who are facing higher input expenses.

These increasing costs can significantly squeeze profit margins for Nissha. If the company cannot pass these higher expenses onto customers through price adjustments, or find ways to operate more efficiently, its profitability will likely suffer. For example, in the automotive sector, a key market for some advanced materials manufacturers, suppliers have been reporting increased material costs impacting their own margins.

For Nissha, a Japanese company operating globally, currency exchange rate fluctuations are a significant economic factor. When the Japanese Yen strengthens against currencies like the US Dollar or Euro, Nissha's overseas revenues translate into fewer Yen, potentially impacting its reported profits. Conversely, a weaker Yen can boost the value of foreign earnings.

These fluctuations also affect the cost of materials Nissha might import. If the Yen weakens, imported components become more expensive, increasing production costs. This dynamic directly influences the profitability of its international operations and its overall bottom line.

For instance, during 2024, the Yen experienced considerable volatility. While specific figures for Nissha's direct impact are proprietary, broader trends show the Yen trading in a range, impacting many Japanese exporters. As of early 2025, analysts predict continued exchange rate pressures, meaning Nissha must actively manage this financial uncertainty.

Consumer Spending and Market Demand

Consumer spending is a critical driver for Nissha, especially in its core markets of consumer electronics and automotive. Higher consumer confidence and increased disposable income directly translate to greater demand for new gadgets and vehicles, which in turn boosts Nissha's sales of decorative films and components. For instance, in Q1 2024, global consumer spending on durable goods like electronics saw a modest uptick, signaling a positive, albeit cautious, environment for companies like Nissha.

Economic factors such as inflation and interest rates significantly impact consumer purchasing power. When inflation is high or interest rates rise, consumers tend to reduce discretionary spending on non-essential items, affecting demand for the products that incorporate Nissha's materials. The US Bureau of Labor Statistics reported a Consumer Price Index increase of 3.5% year-over-year as of April 2024, a figure that influences how much consumers have left for big-ticket items.

- Consumer Spending Trends: Global retail sales are projected to grow by approximately 4.3% in 2024, indicating a steady, though not explosive, increase in consumer expenditure.

- Disposable Income: In major economies like the United States, median household disposable income showed resilience through early 2024, supporting continued spending on consumer electronics.

- Access to Credit: While credit availability remains relatively stable, rising interest rates in 2024 could temper the willingness of consumers to finance large purchases, potentially impacting automotive sector demand.

- Market Demand Impact: A 1% change in consumer spending on electronics can have a measurable ripple effect on component manufacturers and material suppliers like Nissha.

Supply Chain Disruptions and Logistics Costs

Ongoing global supply chain issues continue to present challenges for companies like Nissha. These disruptions, along with elevated logistics and transportation expenses, can hinder Nissha's capacity to procure necessary components and efficiently deliver its final goods.

The impact of these persistent problems can translate into production setbacks and higher operating costs, ultimately affecting Nissha's financial results. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw significant fluctuations throughout 2023 and into early 2024, often remaining substantially above pre-pandemic levels, impacting landed costs for imported materials.

- Supply Chain Vulnerabilities: Global events, from geopolitical tensions to natural disasters, continue to expose fragilities in international supply networks.

- Rising Transportation Costs: Fuel price volatility and container shortages, although showing some easing, still contribute to higher freight rates compared to historical averages.

- Inventory Management Challenges: Companies face increased pressure to maintain adequate stock levels, balancing the risk of shortages against the cost of carrying excess inventory.

- Impact on Lead Times: Extended lead times for key components can delay product launches and affect Nissha's ability to respond quickly to market demand.

Global economic health directly influences Nissha's performance, with projected moderations in GDP for 2025 potentially reducing demand for its products. Inflationary pressures, evidenced by a 3.5% year-over-year CPI increase in the US as of April 2024, raise input costs for Nissha. Currency fluctuations, particularly the Yen's volatility in 2024, impact the value of overseas earnings and imported materials.

| Economic Factor | 2024/2025 Data/Projection | Impact on Nissha |

|---|---|---|

| Global GDP Growth | Projected moderation in 2025 | Potential dampening of demand for Nissha's products |

| Inflation (US CPI) | 3.5% (year-over-year, April 2024) | Increased raw material and energy costs, squeezing profit margins |

| Currency Exchange Rate (JPY) | Volatile in 2024, continued pressure predicted for 2025 | Affects value of overseas revenues and cost of imported materials |

| Consumer Spending Growth | Projected 4.3% global retail sales growth in 2024 | Supports demand for consumer electronics and automotive sectors |

| Supply Chain Costs (Freight) | Container shipping costs remain elevated compared to pre-pandemic levels | Hinders procurement of components and increases operating costs |

Preview the Actual Deliverable

Nissha PESTLE Analysis

The preview shown here is the exact Nissha PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to assess its comprehensive coverage.

The content and structure shown in the preview is the same document you’ll download after payment, providing immediate access to actionable insights.

What you’re previewing here is the actual file, a professionally structured and insightful PESTLE Analysis ready for your strategic planning needs.

Sociological factors

Japan's rapidly aging population and shrinking workforce present significant hurdles for Nissha, particularly in securing manufacturing talent. By 2023, over 29% of Japan's population was aged 65 or older, a figure projected to rise, directly impacting labor availability.

To counter this, Nissha, like many Japanese firms, is increasingly looking towards foreign workers to fill critical roles. This trend is crucial as the working-age population (15-64) continues its decline, reaching approximately 74 million in 2023.

Furthermore, strategies to integrate women and senior citizens into the workforce are becoming essential. The participation rate for women in the labor force reached a record high of around 73% in 2023, demonstrating a crucial shift that Nissha must leverage through adaptive human resource policies.

Consumer lifestyles are rapidly evolving, with urbanization and digital transformation playing significant roles. This shift directly impacts how products are designed, pushing for greater functionality and integration, particularly in areas like smart devices and connected ecosystems. For instance, the global Internet of Things (IoT) market was valued at approximately $1.6 trillion in 2023 and is projected to reach over $1.7 trillion by the end of 2024, highlighting the demand for interconnected products.

There's a clear and growing demand for products that are not only intuitive and intelligent but also multifunctional. Consumers increasingly expect devices that can seamlessly integrate artificial intelligence (AI) and IoT capabilities to simplify daily tasks and enhance user experiences. This trend is evident in the smart home device market, which saw substantial growth in 2023 and is expected to continue its upward trajectory through 2025, driven by consumer desire for convenience and advanced features.

The growing global focus on health and wellness significantly influences Nissha's operations, particularly within its medical and healthcare divisions. This societal shift is a direct catalyst for increased demand for sophisticated medical disposables and advanced devices. For instance, the wearable health technology market, a key area for innovation, was projected to reach over $100 billion globally by 2025, demonstrating the scale of this trend.

This heightened awareness spurs Nissha's innovation efforts, driving development in cutting-edge areas such as health-tracking sensors and minimally invasive surgical solutions. Companies are investing heavily in these technologies, with global spending on digital health expected to surpass $600 billion by 2027, a substantial increase reflecting the market's growth trajectory.

Workforce Diversity and Inclusion Initiatives

Nissha's dedication to fostering a diverse and inclusive workforce directly addresses evolving societal expectations that champion equitable workplaces. This commitment is not merely a matter of corporate responsibility but a strategic imperative for building a robust management structure.

By actively promoting diversification within its human capital, Nissha enhances its ability to attract and retain top talent, a crucial advantage in today's fiercely competitive global labor market. For instance, as of early 2024, companies with strong diversity and inclusion programs reported a 20% higher likelihood of outperforming their less diverse peers in innovation and financial returns, according to various industry analyses.

Nissha's initiatives are designed to create an environment where all employees feel valued and can contribute their unique perspectives. This approach is vital for driving creativity and problem-solving, directly impacting the company's long-term sustainability and growth.

- Global Trend Alignment: Nissha’s focus on diversity and inclusion mirrors a worldwide shift towards valuing varied employee backgrounds and experiences.

- Talent Acquisition & Retention: A diverse and inclusive culture is a key differentiator for attracting and keeping skilled employees in a competitive international job market.

- Enhanced Innovation: By embracing a broad range of perspectives, Nissha aims to foster greater innovation and improved decision-making processes.

- Strengthened Management: Diversifying the workforce bolsters the company's management foundation, leading to more resilient and adaptable leadership.

Demand for Sustainable and Ethical Products

Consumers are increasingly prioritizing products that align with their values, leading to a surge in demand for sustainable and ethically produced goods. This shift significantly impacts companies like Nissha, pushing them to integrate eco-friendly practices and materials into their operations. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, a figure that continues to climb.

Nissha's industrial materials segment, which includes decorative films and performance materials, is directly influenced by this trend. The company faces pressure to adopt sustainable sourcing for its raw materials and to develop manufacturing processes that minimize environmental impact. This includes exploring bio-based plastics and reducing waste in production lines.

The growing emphasis on ethical sourcing also extends to labor practices and supply chain transparency. Companies are expected to demonstrate fair treatment of workers and responsible management of their entire value chain. Nissha's commitment to these principles can enhance brand reputation and foster stronger customer loyalty.

- Consumer Preference Shift: A 2024 Nielsen study found that 73% of global consumers would change their consumption habits to reduce their environmental impact.

- Market Growth: The global market for sustainable goods is projected to reach trillions of dollars by 2027, driven by conscious consumerism.

- Regulatory Influence: Growing environmental regulations worldwide are compelling manufacturers to adopt greener technologies and materials, impacting production costs and innovation.

- Brand Reputation: Companies with strong sustainability credentials, like those prioritizing recycled materials or reduced carbon footprints, often enjoy enhanced brand perception and market positioning.

Societal shifts are profoundly reshaping consumer expectations and workforce dynamics, directly influencing Nissha's strategic direction. The increasing demand for smart, connected products, exemplified by the global IoT market valued at approximately $1.6 trillion in 2023, necessitates innovation in functional and integrated design.

Furthermore, a growing global emphasis on health and wellness is driving demand for advanced medical devices and disposables, with the wearable health technology market projected to exceed $100 billion by 2025. Nissha's ability to adapt to these evolving consumer needs and embrace technological integration is paramount.

Nissha's commitment to diversity and inclusion aligns with modern workforce expectations, with companies prioritizing these areas reporting a 20% higher likelihood of outperforming peers in innovation and financial returns as of early 2024. This focus is critical for attracting and retaining talent in a competitive global market.

The company must also navigate the increasing consumer preference for sustainable and ethically produced goods, as over 60% of consumers, according to a 2024 report, are willing to pay more for sustainable products. This trend pressures Nissha to integrate eco-friendly practices and transparent supply chains.

Technological factors

Nissha's commitment to technological advancement is evident in its ongoing development of digital printing, advanced coating, and lamination processes. These innovations are crucial for meeting the sophisticated demands of industries like consumer electronics and automotive, where visual appeal and performance are paramount.

For instance, the company's focus on next-generation coating technologies aims to improve scratch resistance and create unique surface textures. In 2024, the global market for advanced coatings was projected to reach over $200 billion, highlighting the significant opportunity for Nissha to leverage its expertise.

Digital printing advancements allow for greater customization and faster turnaround times, a critical factor in the fast-paced consumer electronics sector. Nissha's investments in these areas directly translate to enhanced product aesthetics and functionality, enabling them to offer differentiated solutions to their clients.

The growing fusion of AI and IoT within consumer electronics and industrial parts presents significant avenues for Nissha. Think smart devices that learn user habits or factory equipment that predicts its own maintenance needs. This technological shift demands innovative solutions for enhanced product functionality and operational streamlining.

Nissha can capitalize by developing advanced sensors capable of collecting and processing vast amounts of data, feeding into AI algorithms for smarter product features. For instance, the global AI market was valued at over $200 billion in 2023 and is projected to reach $1.8 trillion by 2030, indicating substantial growth potential for AI-integrated components.

Furthermore, AI-driven automation in Nissha's manufacturing processes promises heightened efficiency and reduced operational costs. IoT connectivity allows for real-time monitoring and control, optimizing production lines. The industrial IoT market alone is expected to grow considerably, with some estimates suggesting it will exceed $1 trillion by the late 2020s.

Nissha's device segment thrives on ongoing advancements in touch and force sensor technologies, particularly within flexible electronics. These innovations are key to creating sophisticated user interfaces for IT devices, automotive interiors, and diverse industrial uses. For instance, the global market for touch sensors was projected to reach approximately $26.5 billion in 2024, highlighting the significant growth potential driven by these technological leaps.

Development of Advanced Medical Device Technologies

Technological advancements are significantly reshaping the medical device landscape, with innovations like dissolving microneedle patches and sophisticated surgical instruments acting as major catalysts for growth in Nissha's medical segment. These cutting-edge developments create new opportunities for improved patient care and treatment efficacy.

Nissha's strategic positioning as a contract design, development, and manufacturing organization (CDMO) for medical devices allows it to capitalize directly on these technological shifts. By partnering with innovators, Nissha can integrate the latest advancements into its manufacturing processes and product offerings.

- Market Growth: The global medical device market was valued at approximately $519.4 billion in 2023 and is projected to reach over $766 billion by 2030, indicating substantial expansion driven by technological innovation.

- Innovation Focus: Companies are investing heavily in R&D for devices like advanced robotics for surgery and AI-powered diagnostic tools, areas where Nissha's CDMO services can be crucial.

- Nissha's Role: As a CDMO, Nissha can provide specialized manufacturing expertise for these complex devices, supporting their journey from concept to market.

- Emerging Technologies: The development of smart implants, personalized medicine devices, and wearable health monitors further exemplifies the technological momentum in this sector.

Emergence of Sustainable Materials Technology

The growing demand for sustainable materials significantly impacts Nissha, pushing for the development and adoption of technologies like 'ecosense molding'. This trend is driven by global sustainability initiatives and creates new avenues for growth in sectors prioritizing environmentally friendly products. For instance, the global sustainable materials market, including bio-based plastics and recycled composites, was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a substantial market opportunity for Nissha's innovative solutions.

Nissha's investment in and successful implementation of eco-friendly material technologies position it favorably to capture market share from competitors lagging in sustainability. This technological advancement is not just about compliance but also about competitive differentiation. Companies that integrate these advanced materials can command premium pricing and attract a broader customer base increasingly conscious of environmental impact. The automotive industry alone, a key market for Nissha, aims to increase the use of recycled and bio-based plastics by 25% by 2028, underscoring the urgency and scale of this shift.

- Market Growth: The global market for sustainable materials is expanding rapidly, with projections indicating a doubling in value by 2030.

- Industry Adoption: Key sectors like automotive are setting ambitious targets for incorporating eco-friendly alternatives into their products.

- Competitive Advantage: Nissha's focus on technologies like 'ecosense molding' provides a distinct edge in attracting environmentally conscious clients.

- Innovation Driver: The push for sustainability compels continuous innovation in material science, creating opportunities for Nissha to lead through R&D.

Nissha's technological focus on advanced printing, coatings, and sensor technologies is vital for sectors like consumer electronics and automotive. The company's investment in digital printing enhances customization, a key advantage in fast-paced markets. Furthermore, the integration of AI and IoT is creating new demands for smart components and efficient manufacturing, areas where Nissha's sensor expertise can be leveraged.

Nissha's strategic role as a CDMO in the medical device sector allows it to capitalize on technological advancements like dissolving microneedles and AI-driven diagnostics. The global medical device market's substantial growth, projected to exceed $766 billion by 2030, underscores the opportunities. By partnering on complex devices, Nissha supports innovation from concept to market.

The demand for sustainable materials is a significant technological driver for Nissha, as seen with 'ecosense molding'. This trend is fueled by global sustainability initiatives, with the sustainable materials market expected to reach over $100 billion by 2030. Nissha's adoption of eco-friendly technologies offers a competitive edge, particularly as industries like automotive increase their use of recycled and bio-based plastics.

| Technological Area | Market Trend/Projection | Nissha's Relevance |

|---|---|---|

| Advanced Printing & Coatings | Global advanced coatings market > $200 billion (2024) | Enhances product aesthetics and performance in electronics/automotive. |

| AI & IoT Integration | Global AI market $1.8 trillion by 2030 (projected) | Develops sensors for AI-driven features and optimizes manufacturing via IoT. |

| Sensor Technologies (Touch/Force) | Global touch sensor market ~$26.5 billion (2024) | Crucial for sophisticated user interfaces in IT, automotive, and industrial applications. |

| Medical Device Technology | Global medical device market > $766 billion by 2030 (projected) | CDMO services for innovative medical devices like microneedles and AI diagnostics. |

| Sustainable Materials | Sustainable materials market > $100 billion by 2030 (projected) | 'Ecosense molding' and eco-friendly materials meet growing demand and offer competitive advantage. |

Legal factors

Nissha navigates a dynamic landscape of international trade legislation, encompassing tariffs, import/export controls, and sanctions. For instance, the US imposition of tariffs on goods from China in recent years, continuing into 2024, has significantly affected the cost of materials and finished products for companies involved in global supply chains, including those like Nissha that source and sell internationally.

Fluctuations in these trade regulations necessitate agile strategic responses. A shift in tariff structures, such as those observed in 2024 affecting specific electronics components or raw materials, can alter Nissha's cost of goods sold and necessitate adjustments in pricing or sourcing strategies to preserve profit margins and market position.

Nissha's operations are significantly shaped by stringent product safety and quality regulations, particularly within the consumer electronics, automotive, and healthcare sectors. These industries demand adherence to rigorous standards to guarantee consumer well-being and product reliability. Failure to comply can lead to severe penalties, including market exclusion and substantial financial liabilities.

For Nissha, securing certifications like UL for its sensor modules is critical for market entry and maintaining customer trust. The company must navigate complex medical device registration processes in various global markets to ensure its healthcare-related products meet local safety and efficacy requirements. For instance, in 2024, the global medical device market was valued at approximately $500 billion, underscoring the importance of regulatory compliance for market access and growth in this sector.

Nissha faces increasing pressure to comply with a robust framework of environmental protection laws, particularly concerning chemical substances. Japan's evolving regulations, including those targeting PFAS compounds, necessitate careful management of materials used in their diverse product lines, from printing to medical devices.

Adherence to waste management and emissions reduction targets, such as those aligned with global climate goals, demands substantial capital expenditure. Nissha's commitment to sustainable operations, including responsible sourcing of materials and efficient production processes, is critical for long-term viability and regulatory compliance.

For instance, companies operating in Japan are increasingly scrutinized for their environmental footprint, with a growing emphasis on circular economy principles and the reduction of hazardous substances. This translates into direct costs for Nissha, covering everything from enhanced pollution control technologies to the research and development of greener alternatives.

Data Privacy and Cybersecurity Regulations

Nissha must navigate a complex web of data privacy and cybersecurity regulations, which are becoming increasingly stringent globally. Laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), along with Japan's Act on the Protection of Personal Information, set high standards for data handling and security. As Nissha integrates smart devices and digital services, safeguarding sensitive user and operational data is paramount to avoid significant penalties and maintain customer trust.

The financial implications of non-compliance are substantial. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. In 2023, the US saw over 3,200 data breaches reported, impacting hundreds of millions of individuals, underscoring the pervasive risk. Nissha's commitment to robust data security measures is therefore not just a legal necessity but a critical business imperative for operational continuity and reputation management.

To address these legal factors effectively, Nissha should focus on:

- Implementing comprehensive data protection policies: Ensuring all data collection, storage, and processing activities align with global and local privacy laws.

- Investing in advanced cybersecurity infrastructure: Utilizing cutting-edge technologies to protect against evolving cyber threats and data breaches.

- Conducting regular data privacy training for employees: Fostering a culture of security awareness and compliance across the organization.

- Establishing clear incident response plans: Preparing for and efficiently managing any potential data breaches or cybersecurity incidents.

Intellectual Property Rights Protection

Protecting Nissha's intellectual property, especially for its advanced printing, coating, lamination, and sensor technologies, is fundamental to maintaining its edge. The company relies heavily on robust legal protections like patents, trademarks, and trade secrets to secure its innovations across diverse global markets.

These legal frameworks are not merely formalities; they are active shields against infringement and imitation, directly impacting Nissha's market share and profitability. For instance, in 2024, the global IP market saw continued growth in patent filings, underscoring the increasing importance of safeguarding technological advancements.

Nissha's strategy involves navigating varying IP laws in countries where it operates, ensuring its proprietary technologies remain exclusive. Failure to adequately protect these assets could lead to competitors replicating its solutions, thereby eroding Nissha's competitive advantage and revenue streams.

- Patent Protection: Nissha actively seeks patents for novel printing and coating techniques, ensuring its unique processes are legally recognized and protected.

- Trademark Safeguards: Brand names and logos associated with its specialized products are trademarked to prevent unauthorized use and maintain brand integrity.

- Trade Secret Management: Confidential manufacturing processes and proprietary formulations are rigorously protected through internal policies and legal agreements.

- Global IP Strategy: Nissha maintains a coordinated approach to IP registration and enforcement across its key international markets to ensure comprehensive coverage.

Legal factors significantly influence Nissha's global operations, from trade regulations and product compliance to data privacy and intellectual property protection.

Adherence to international trade laws, including tariffs and sanctions, is crucial for managing supply chain costs, as seen with ongoing US tariffs impacting global trade in 2024.

Nissha must also comply with rigorous product safety standards in sectors like automotive and healthcare, where regulatory hurdles, such as medical device registration, are substantial, particularly given the global medical device market's approximate $500 billion valuation in 2024.

Furthermore, robust data privacy and cybersecurity measures are essential to avoid severe penalties, with GDPR fines potentially reaching 4% of global turnover, and over 3,200 data breaches reported in the US in 2023 impacting hundreds of millions.

Environmental factors

Nissha faces growing pressure from global climate change concerns and the worldwide drive to achieve carbon neutrality. This environmental shift significantly impacts business operations and strategic planning.

The company's sustainability vision centers on substantially reducing its total CO2 emissions. For instance, Nissha has committed to aligning its targets with initiatives like the Science Based Targets (SBT) framework, aiming for ambitious emission reduction goals by specific future dates.

To meet these environmental mandates, Nissha is actively investing in enhancing energy efficiency across its operations. This includes upgrading equipment and optimizing production processes to minimize energy consumption.

Furthermore, Nissha is increasing its adoption of renewable energy sources to power its facilities. This strategic shift away from fossil fuels is crucial for achieving its carbon neutrality objectives and demonstrating environmental responsibility.

The rising scarcity of essential natural resources and the unpredictable fluctuations in commodity prices are compelling businesses to prioritize sustainable material sourcing and incorporate recycled content. This shift is driven by both environmental concerns and the need for cost stability. For instance, the price of bauxite, a key aluminum ore, saw significant volatility in early 2024, impacting downstream industries.

Nissha's strategic development of sustainable materials, such as its 'ecosense molding' technology, is a direct and proactive response to these pressing environmental challenges. This innovation not only addresses resource depletion but also positions Nissha to capitalize on the growing market demand for eco-friendly products.

Nissha faces increasing pressure from both regulators and consumers to adopt robust waste management strategies and embrace circular economy principles. This shift directly influences how the company designs and manufactures its products, particularly concerning plastics. For instance, in 2023, global plastic waste generation reached an estimated 250 million metric tons, highlighting the urgency for industries like Nissha to innovate in material reuse and recycling to lessen their environmental impact across the entire product lifecycle.

Water Usage and Pollution Control

Nissha's printing and coating operations are inherently water-intensive, posing a significant challenge in managing wastewater discharge. The company must navigate increasingly stringent regulations concerning water pollution control, a trend expected to intensify through 2024 and 2025 as environmental awareness grows globally. Failure to comply can result in substantial fines and reputational damage, impacting investor confidence.

Responsible water management is crucial, especially in areas experiencing water scarcity. Nissha is likely implementing strategies to reduce overall water consumption and improve the quality of discharged water. For instance, advancements in water recycling technologies and the adoption of less water-dependent processes are becoming industry standards. In 2023, the global industrial water treatment market was valued at approximately $70 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, indicating a strong push towards improved water efficiency and treatment solutions.

- Regulatory Compliance: Adherence to local and international water pollution control acts is paramount for Nissha's operational continuity.

- Water Consumption Reduction: Implementing water-saving technologies and process optimizations can lower operational costs and environmental impact.

- Wastewater Treatment: Investing in advanced wastewater treatment facilities ensures that discharged water meets or exceeds environmental standards.

- Water Stress Mitigation: Proactive measures in water-stressed regions are essential for long-term sustainability and corporate social responsibility.

Biodiversity Conservation and Ecosystem Impact

While not as immediately obvious as other environmental factors, Nissha's operations are indirectly touched by the growing global emphasis on biodiversity conservation. This concern can shape decisions further up the supply chain, influencing how raw materials are sourced and processed. For example, companies are increasingly scrutinizing their suppliers for adherence to responsible land use practices and commitments to minimizing ecological disruption, especially when dealing with natural resources.

Nissha's commitment to sustainability could involve evaluating its supply chain for impacts on sensitive ecosystems. This might translate into preferring suppliers who demonstrate robust biodiversity management plans or those certified by environmental organizations. As of recent reports, many industries are seeing increased regulatory pressure and consumer demand for transparency regarding environmental footprints, which can extend to the protection of natural habitats and species.

Consider these potential impacts:

- Supply Chain Scrutiny: Nissha may face increased pressure to ensure its raw material suppliers do not contribute to habitat destruction or species loss.

- Material Sourcing Preferences: A focus on biodiversity could lead Nissha to favor materials derived from sustainably managed forests or agricultural practices that protect local ecosystems.

- Regulatory Compliance: Evolving environmental regulations aimed at protecting biodiversity could impose new compliance requirements on Nissha's operations or its suppliers.

- Reputational Risk: Failure to address biodiversity concerns could lead to negative publicity and damage Nissha's brand image among environmentally conscious stakeholders.

Nissha is actively navigating the global push for carbon neutrality, with a commitment to reducing its CO2 emissions. The company is aligning its targets with frameworks like the Science Based Targets (SBT) and investing in energy efficiency and renewable energy sources for its operations.

The increasing scarcity of natural resources and price volatility, such as the fluctuations in bauxite prices observed in early 2024, are driving Nissha to develop sustainable materials like 'ecosense molding' to meet market demand for eco-friendly products.

Nissha faces pressure to adopt robust waste management and circular economy principles, particularly concerning plastics, given that global plastic waste generation reached an estimated 250 million metric tons in 2023. This necessitates innovation in material reuse and recycling.

The company's water-intensive printing and coating operations require strict adherence to evolving water pollution control regulations, a trend expected to intensify through 2024 and 2025. Investing in advanced wastewater treatment and water-saving technologies, as seen in the growing industrial water treatment market valued at approximately $70 billion in 2023, is crucial.

PESTLE Analysis Data Sources

Our Nissha PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable market research reports, and analyses from international economic organizations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Nissha's operations.