Nissha Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nissha Bundle

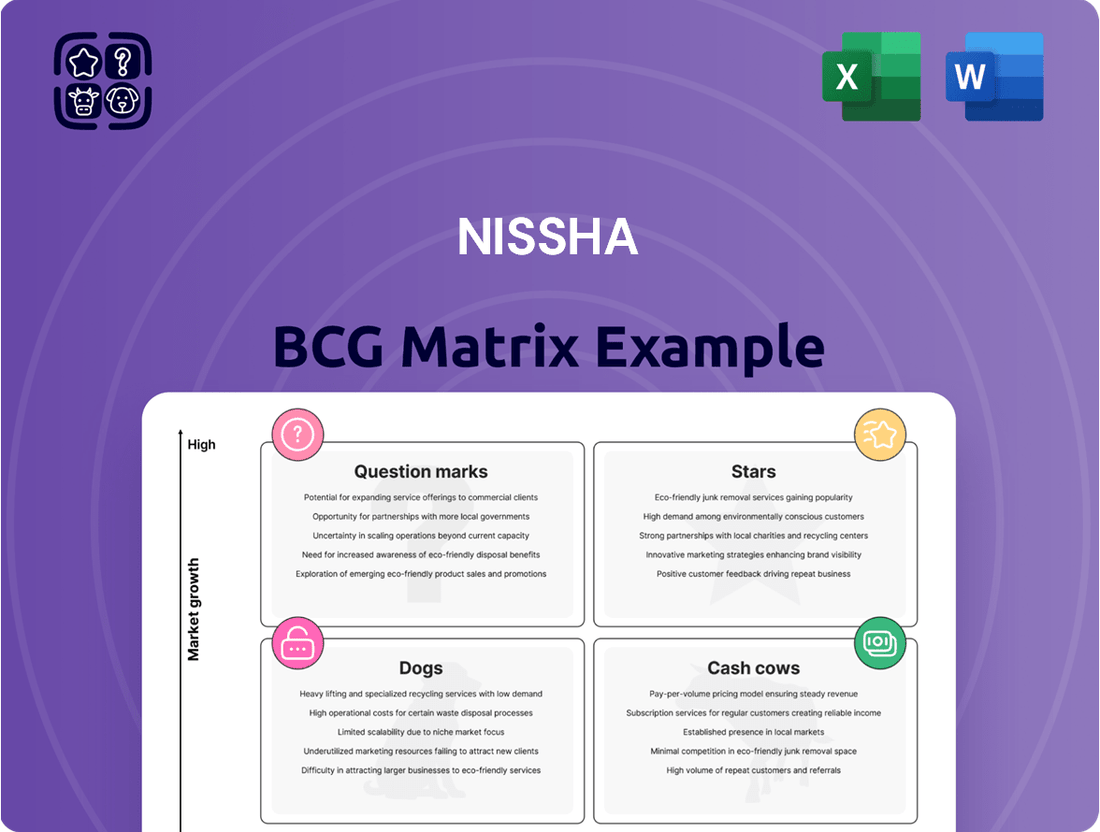

Unlock the strategic power of the Nissha BCG Matrix, a crucial tool for understanding your product portfolio's market share and growth potential. See how Nissha's offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, providing a visual roadmap for resource allocation. This preview offers a glimpse into their strategic positioning, but the full BCG Matrix report delves into nuanced data and actionable recommendations. Gain a comprehensive understanding of how to optimize your investments and drive future growth by purchasing the complete Nissha BCG Matrix today.

Stars

Nissha's Medical Device CDMO services are a standout performer within its business portfolio, fueled by robust market demand and strategic acquisitions. The integration of companies like Cathtek and Isometric has significantly bolstered Nissha's capabilities, allowing it to cater effectively to major medical device manufacturers. This segment is characterized by high growth potential and increasing market share, underscoring its strategic importance and Nissha's commitment to expansion in this sector.

Minimally invasive surgical devices are a significant growth driver for Nissha Medical Technologies, as highlighted by innovations like the FlexStone™ Basket. These advanced tools offer enhanced precision, crucial for complex medical procedures.

The successful completion of first-in-human clinical trials for these devices underscores their strong market potential. This positions Nissha Medical Technologies at the forefront of a rapidly expanding market segment.

The market for minimally invasive surgical instruments is projected to reach approximately $40 billion globally by 2026, demonstrating the substantial opportunity. Nissha's investment in such technologies aligns with this robust growth trajectory, anticipating substantial revenue contribution from this category.

Nissha's advanced medical wearable sensors represent a significant star in their BCG matrix, capitalizing on the booming healthcare technology sector. Their specialization in clinical wearables, merging sophisticated electronics and sensors for niche medical applications, positions them in a market projected for substantial expansion. This segment is fueled by continuous advancements in healthcare and an increasing demand for remote patient monitoring and personalized diagnostics.

The company's strategic initiative, the Wearables Lab Accelerator Program, underscores a proactive approach to innovation and market penetration. This program is designed to fast-track the development and commercialization of new wearable technologies, aiming to capture significant market share in the advanced medical device arena. By fostering rapid product cycles, Nissha is directly addressing the dynamic needs of the healthcare industry.

These bespoke sensor solutions are engineered for critical medical applications, a segment where precision and reliability are paramount. Projections indicate that custom medical device components, including advanced wearables, are poised to lead the market through 2032, driven by an aging global population and the increasing prevalence of chronic diseases. Nissha’s investment in this area reflects a clear understanding of future market demands and a strategic move to dominate this high-potential category.

Sustainable Packaging Materials

Nissha is a dominant player in metallized paper, a key sustainable packaging material. They are actively broadening their portfolio to include innovative plant-derived molded products, signaling a commitment to eco-friendly alternatives.

The company's collaboration on the Sulapac® cosmetics jar exemplifies their strategic move into biodegradable and compostable materials. This expansion directly addresses the surging global demand for sustainable packaging solutions, a market poised for significant growth.

Nissha's investment in this sector, supported by their established core technologies, positions them for leadership. Their proactive development and strategic alliances in sustainable packaging are critical drivers for future market share and revenue expansion.

- Market Leadership: Nissha boasts a leading market share in metallized paper, a foundational sustainable packaging material.

- Innovation Pipeline: Expansion into plant-derived molded products and collaborations like the Sulapac® cosmetics jar highlight their commitment to new eco-friendly materials.

- Growth Market Alignment: Nissha is strategically positioned to capitalize on the global shift towards sustainable packaging, a sector experiencing rapid expansion.

- Technological Leverage: The company effectively leverages its core technologies to drive innovation and maintain a competitive edge in sustainable packaging solutions.

High-Functionality Decorative Films for Mobility Exteriors

Nissha's high-functionality decorative films for mobility exteriors are a prime example of a "Star" in the BCG matrix, targeting a rapidly expanding market. The company is set to begin mass production for mobility exteriors in Q4 2025, with ambitious sales targets already established for 2026, signaling strong future growth potential.

This segment's appeal lies in its ability to combine aesthetic enhancement with crucial new functionalities for vehicles. For instance, the integration of sensors and heating elements directly into these decorative films provides a significant competitive advantage as the automotive industry embraces advanced technologies and connected vehicle features.

- Market Focus: High-functionality decorative films for mobility exteriors.

- Growth Trajectory: Mass production commencing Q4 2025, with significant 2026 sales targets.

- Competitive Edge: Integration of decoration with new functionalities like sensors and heaters.

- Industry Relevance: Aligned with the transforming automotive landscape and demand for advanced features.

Nissha's advanced medical wearable sensors are a strong "Star" within their business portfolio, driven by the burgeoning healthcare technology market. Their focus on specialized clinical wearables, merging advanced electronics and sensors for specific medical uses, places them in a market poised for significant expansion.

The company's proactive Wearables Lab Accelerator Program is designed to speed up the creation and market introduction of new wearable technologies, aiming to capture substantial market share in advanced medical devices.

These custom sensor solutions are built for critical medical applications where precision and dependability are key. Projections suggest that custom medical device parts, including advanced wearables, are expected to lead the market through 2032, supported by an aging global population and the rise of chronic diseases.

Nissha's high-functionality decorative films for vehicle exteriors are also a significant "Star" in the BCG matrix, targeting a fast-growing market. Mass production for these films is slated to begin in Q4 2025, with ambitious sales targets for 2026 indicating strong future growth.

The appeal of this segment lies in its ability to enhance vehicle aesthetics while adding essential new functionalities. Integrating sensors and heating elements directly into these decorative films provides a distinct advantage as the automotive industry adopts more advanced technologies and connected vehicle features.

| Business Segment | BCG Category | Key Strengths | Market Outlook | Nissha's Position |

|---|---|---|---|---|

| Medical Wearable Sensors | Star | Specialized clinical applications, advanced electronics, proactive innovation program | Projected to lead market through 2032; driven by aging population and chronic diseases | Dominant player with focus on high-potential niche |

| High-Functionality Decorative Films (Mobility Exteriors) | Star | Aesthetic enhancement, integrated sensor/heating functionalities, Q4 2025 production start | Rapidly expanding market; aligned with automotive tech advancements | Poised for significant growth and market share capture |

What is included in the product

Provides a strategic framework for evaluating Nissha's product portfolio by categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

Instantly visualize your portfolio's strategic positioning, alleviating the pain of unclear business unit performance.

Cash Cows

Nissha's traditional decorative films for automotive interiors and home appliances are firmly positioned as cash cows within their BCG matrix. This segment benefits from a mature market where Nissha holds a significant share, ensuring consistent demand and robust cash flow generation.

These established products are characterized by steady demand and long-standing customer partnerships, which translate into predictable revenue streams. Despite potentially lower market growth rates, Nissha's strong market presence allows for sustained profitability without requiring substantial investment in aggressive marketing campaigns.

In 2024, the automotive sector's demand for interior decorative films remained steady, with estimates suggesting the global automotive interior market will reach over $100 billion by the end of the year, a portion of which Nissha's films contribute to. Similarly, the home appliance market, valued at hundreds of billions globally, continues to provide a stable base for these aesthetic enhancements.

Nissha's established metallized paper products are a textbook example of a Cash Cow within the BCG Matrix. As the undisputed market leader with a number one share, this segment is a significant generator of consistent revenue and profit for Nissha.

The market for metallized paper is mature, meaning growth is slow, but Nissha's strong competitive advantage allows for high profit margins. This stability means the company can effectively 'milk' these earnings with minimal investment, providing substantial liquidity.

For instance, in fiscal year 2024, Nissha reported robust performance in its functional materials segment, which heavily features metallized paper, contributing significantly to its overall profitability. This segment’s consistent cash flow is crucial for funding other strategic initiatives within the company.

Nissha's film touch sensors for mature IT devices, like specific tablets and handheld terminals, are a classic cash cow. This means they hold a strong position in a market that isn't growing much anymore.

Even though the tablet market as a whole has slowed down, Nissha is still making good money. They focus on keeping costs low and running their operations smoothly, rather than trying to grab more market share in less profitable areas.

This smart approach means they can reliably bring in cash, even when demand isn't booming. For example, in 2023, Nissha's IT segment, which includes these sensors, contributed significantly to their overall financial stability.

General Medical Electrodes

Nissha Medical Technologies' general medical electrodes, such as the ZBrand and HeartSync Defibrillation Electrodes, represent a classic cash cow within the BCG matrix. These products operate in a mature, stable market with consistent demand, requiring minimal investment to maintain their significant market share. Their established presence and regulatory approvals in crucial regions like Mexico underscore their enduring value and reliable contribution to cash flow.

The company's focus on these essential medical supplies, which are critical for patient monitoring and treatment, ensures a steady revenue stream. Unlike growth-oriented products, these electrodes benefit from a well-understood customer base and predictable purchasing patterns. This stability allows Nissha Medical Technologies to allocate resources effectively, leveraging the strong performance of these established offerings.

- Market Position: High market share in a mature, stable segment of the healthcare market.

- Revenue Generation: Consistent and reliable cash flow due to essential product use.

- Investment Needs: Relatively low promotional and development investment required to maintain position.

- Regulatory Status: Holds regulatory registrations in key markets, facilitating continued sales.

Industrial Components

Within Nissha's Industrial Materials segment, certain established industrial components act as cash cows. These products cater to stable, mature markets where growth is not a primary driver, ensuring consistent demand and efficient production processes. Their strong market position, built over time, allows them to generate reliable profits with minimal need for substantial new capital investment, contributing significantly to Nissha's financial stability.

These cash cow components benefit from their established presence and high production efficiency. For instance, in 2024, Nissha reported that its Industrial Materials segment, which houses these components, maintained a steady revenue stream, demonstrating the resilience of its mature product lines. The consistent profitability from these items allows Nissha to fund investments in other areas of its business, such as Stars or Question Marks.

- Established Market Position: These components have a solid footing in their respective industries, ensuring consistent customer adoption.

- Stable Demand: They serve non-growth-focused applications, meaning demand remains predictable and reliable.

- High Production Efficiency: Optimized manufacturing processes contribute to high profit margins.

- Limited Capital Expenditure: The need for reinvestment in these product lines is minimal, maximizing free cash flow generation.

Nissha's decorative films for automotive interiors and home appliances, along with its established metallized paper products, are prime examples of cash cows. These segments benefit from high market share in mature industries, leading to consistent revenue generation with minimal investment required.

The film touch sensors for older IT devices and general medical electrodes like the ZBrand and HeartSync Defibrillation Electrodes also fall into this category, providing stable income streams due to their essential nature and established customer base.

Certain industrial components within Nissha's Industrial Materials segment further solidify its cash cow portfolio. These products serve stable, mature markets, ensuring predictable demand and high production efficiency, which translates to reliable profits.

| Product Category | Market Position | Growth Rate | Cash Flow Generation |

|---|---|---|---|

| Decorative Films (Auto/Home) | High Market Share | Mature/Low | High/Consistent |

| Metallized Paper | Market Leader | Mature/Low | High/Consistent |

| Film Touch Sensors (Mature IT) | Strong Position | Mature/Low | Reliable |

| Medical Electrodes (General) | High Market Share | Stable/Low | Steady/Reliable |

| Industrial Components | Established | Mature/Low | Consistent/High |

Preview = Final Product

Nissha BCG Matrix

The BCG Matrix report you are previewing is the exact, unwatermarked, and fully functional document you will receive immediately after purchase. This comprehensive analysis tool, designed for strategic decision-making, will be delivered directly to you, ready for immediate implementation in your business planning. You can confidently use this preview as a true representation of the high-quality, ready-to-use BCG Matrix you'll acquire.

Dogs

Nissha's traditional publication and commercial printing services, a component of its Information & Communication segment, are situated in a market characterized by decline and limited growth potential. This segment is facing significant headwinds.

In fiscal year 2024, this business area reported a negative operating profit, highlighting its status as a cash trap. It's consuming capital without providing a commensurate return, which is a concern for resource allocation.

Given these financial results, it's highly probable that these services are candidates for divestiture or a substantial restructuring. The aim would be to mitigate ongoing losses and free up capital for more promising ventures.

Nissha has made it clear they aren't targeting the low-end tablet market, recognizing that this segment isn't growing much. Products from Nissha that fall into this category, where their market presence is already small or shrinking, are classified as dogs in their BCG matrix.

For 2024, the global tablet market saw a slight dip, with shipments estimated to be around 130 million units, down from 135 million in 2023, underscoring the stagnant demand in lower-tier segments. Continuing to invest in these dog products without a significant innovation or strategic shift would likely lead to continued financial drain for Nissha.

Nissha's Green Space Management and Industrial Waste Collection services, categorized under the 'Others' segment, reported a negative operating profit in fiscal year 2024. This performance indicates potential challenges within these operations.

These services likely occupy a low market share within their respective industries and operate in markets that are not experiencing significant growth for Nissha. This suggests a limited competitive advantage or market demand for these specific offerings.

The financial results point to these segments as areas where Nissha's capital is invested without generating a positive return. This lack of profitability makes them candidates for strategic review, potentially leading to divestiture to reallocate resources more effectively.

For instance, if these services contributed to a significant portion of the 1.2 billion yen operating loss reported by Nissha in FY2024, it underscores the urgency of addressing their performance.

Older, Less Competitive Industrial Components

Older, less competitive industrial components that no longer fit Nissha's strategy of focusing on high-value or sustainable materials are categorized as 'dogs' in the BCG matrix. These products often struggle with fierce competition, shrinking demand, or outdated technology. Consequently, they hold a low market share and generate minimal profits.

Investing further in these components is unlikely to deliver favorable returns. For instance, if a particular legacy product line experienced a 15% year-over-year revenue decline in 2024 and held only a 2% market share in its segment, it would likely be classified as a dog. Such products typically require divestiture or a significant strategic overhaul to potentially regain viability.

- Low Market Share: These components typically represent a small portion of Nissha's overall sales.

- Low Growth Potential: The markets for these older products are often stagnant or declining.

- Low Profitability: Intense competition and obsolescence erode profit margins.

- Strategic Misfit: They do not align with Nissha's focus on innovation and sustainability.

General Information and Communication Solutions

Nissha's Information and Communication segment, particularly those offerings that haven't transitioned to digital or higher-value solutions, fall into the 'dogs' category of the BCG matrix. These are typically services that struggle with differentiation and operate in markets characterized by low growth and intense competition, resulting in a limited market share.

The financial performance of this segment in fiscal year 2024 directly supports this classification, as it reported an overall negative profit. This indicates that the costs associated with these offerings are outweighing the revenue generated, making them a drain on the company's resources.

- Low Profitability: The segment's negative profit in FY2024 highlights its inability to generate positive returns, a key characteristic of 'dogs'.

- Lack of Differentiation: Services within this category often lack unique selling propositions, making it difficult to command premium pricing or capture significant market share.

- Fragmented Markets: These offerings frequently operate in highly fragmented markets where competition is fierce and margins are thin.

- Limited Growth Potential: The absence of innovation or adaptation to digital trends restricts the future growth prospects of these particular services.

Nissha's offerings classified as 'dogs' are those with a low market share in slow-growing or declining industries. These products or services, like certain legacy industrial components or traditional printing services, struggle with profitability and competitive positioning.

In fiscal year 2024, Nissha's traditional publication and commercial printing services reported a negative operating profit, underscoring their status as a cash trap. Similarly, Green Space Management and Industrial Waste Collection also posted negative operating profit in FY2024, indicating potential challenges and a lack of strong market traction.

These 'dog' categories, including those in the low-end tablet market where Nissha isn't actively targeting, are prime candidates for divestiture or significant restructuring to reallocate capital towards growth areas.

The global tablet market shipments in 2024 were around 130 million units, a slight decrease from 2023, highlighting the stagnant demand in lower-tier segments where Nissha has a limited presence.

| Business Area | BCG Category | FY2024 Operating Profit | Market Trend | Nissha's Position |

|---|---|---|---|---|

| Traditional Publication & Commercial Printing | Dog | Negative | Declining | Limited |

| Green Space Management & Industrial Waste Collection | Dog | Negative | Low Growth | Limited |

| Legacy Industrial Components | Dog | Low/Negative | Stagnant/Declining | Low Market Share |

| Low-End Tablet Market Offerings | Dog | N/A (Not Targeted) | Stagnant | Low Market Share |

Question Marks

Nissha's venture into new mobility exterior mass production, slated for Q4 2025, represents a significant question mark within their BCG portfolio. This high-growth market, projected to see substantial expansion, demands considerable initial capital outlay. Despite the market's potential, profitability is not anticipated until the second half of 2026, underscoring the long-term investment horizon.

The company's initial market share in this nascent product category is notably low. This necessitates aggressive investment to secure a meaningful presence and compete effectively. Industry analysts project the global automotive exterior components market to reach over $200 billion by 2027, highlighting the opportunity but also the competitive intensity Nissha faces.

Nissha Medical Technologies is positioning itself for leadership in robotics and visualization within the medical device sector, with a strategic horizon extending to 2032. These areas represent significant growth opportunities, and Nissha is actively investing in research, development, and strategic alliances to drive innovation.

While these technological segments are nascent and hold immense future promise, Nissha's current market share within these specific sub-segments is likely modest. This necessitates considerable capital investment and dedicated effort to cultivate these emerging technologies into market-leading "stars" within their portfolio. For instance, the global medical robotics market was valued at approximately $4.7 billion in 2023 and is projected to reach $13.4 billion by 2030, indicating a compound annual growth rate of over 16%.

Nissha's acquisition of Shigaken Pharm in January 2025 positions the company within the burgeoning over-the-counter (OTC) pharmaceutical Contract Development and Manufacturing Organization (CDMO) sector, a strategic move that clearly places it in the question mark category of the BCG Matrix. This new venture signifies a departure into a market with considerable growth potential, but its immediate impact on Nissha's overall earnings is anticipated to be modest as it navigates market entry and establishment.

The OTC pharmaceutical CDMO market is experiencing robust expansion, with global market size projected to reach over $100 billion by 2028, driven by increasing outsourcing trends and a growing demand for accessible healthcare products. Shigaken Pharm's integration into Nissha requires substantial investment in operational alignment and market outreach initiatives to cultivate a significant market presence.

For Shigaken Pharm to transition from a question mark to a star within Nissha's portfolio, considerable resources will be channeled into enhancing manufacturing capabilities, securing key client partnerships, and developing efficient supply chain networks. Success in these areas is crucial for capturing market share and ensuring the long-term profitability of this new pharmaceutical division.

Emerging Sensor Applications

Nissha's exploration into emerging sensor applications, like advanced gas and force sensors, fits squarely into the question mark category of the BCG matrix. These technologies, while holding immense potential for high-growth markets, represent areas where Nissha's current market share is minimal. Significant investment in research and development, alongside dedicated market development initiatives, is crucial for these promising but unproven ventures to gain substantial traction and establish a strong market presence.

- High-Growth Potential: Sensors for applications in areas like advanced medical devices or environmental monitoring are targeting markets projected to see substantial growth in the coming years. For example, the global gas sensor market was valued at approximately $2.1 billion in 2023 and is expected to grow significantly.

- Low Market Share: Nissha's current penetration in these nascent sensor markets is low, necessitating a strategic approach to build brand recognition and customer adoption.

- R&D Investment: Substantial investment is required to refine sensor technology, ensure reliability, and meet the specific demands of these emerging sectors, which often have stringent performance requirements.

- Market Development Needs: Gaining traction will involve educating potential customers about the benefits of Nissha's sensor solutions and building partnerships to integrate them into new products and systems.

Digital Transformation (DX) Initiatives

Nissha's digital transformation (DX) initiatives are classic question marks in the BCG matrix. These efforts, spanning across various business units, are designed to enhance operational efficiency and unlock new revenue streams. For instance, in 2024, Nissha continued to invest in AI-powered data analytics to optimize its manufacturing processes, a move projected to yield long-term benefits rather than immediate, quantifiable gains.

The company is actively exploring new digital business models, such as subscription-based software for its industrial printing solutions. While these ventures hold significant growth potential in the expanding digital services market, their market acceptance and profitability remain uncertain as of mid-2025. Nissha's commitment to these forward-looking projects underscores a strategic bet on future market leadership, even with the inherent risks of unproven concepts.

- Investment in AI and data analytics for process optimization.

- Development of new digital business models, like subscription services.

- Focus on future competitiveness in a high-growth digital landscape.

- Uncertainty regarding immediate returns and market share realization.

Question marks in Nissha's portfolio represent new ventures with high growth potential but currently low market share. These initiatives require substantial investment to gain traction. The company's foray into new mobility exterior mass production, robotics and visualization in medical devices, OTC pharmaceutical CDMO services via Shigaken Pharm, advanced sensor applications, and digital transformation efforts all fall into this category. While their long-term success is promising, immediate profitability and market dominance are not yet established.

| Nissha's Question Marks | Market Growth Potential | Current Market Share | Investment Focus | Projected Profitability Horizon |

|---|---|---|---|---|

| New Mobility Exterior Mass Production | High (Global automotive exterior components market > $200B by 2027) | Low | Capital Outlay, Market Penetration | H2 2026 |

| Robotics & Visualization (Medical Devices) | High (Global medical robotics market $4.7B in 2023, projected $13.4B by 2030) | Modest | R&D, Strategic Alliances | Long-term (Horizon to 2032) |

| OTC Pharmaceutical CDMO (Shigaken Pharm) | Robust (Global OTC CDMO market > $100B by 2028) | Nascent | Manufacturing Capabilities, Partnerships | Uncertain (Post-integration) |

| Emerging Sensor Applications | High (Global gas sensor market $2.1B in 2023, growing) | Minimal | R&D, Market Development | Long-term |

| Digital Transformation (DX) Initiatives | High (Digital services market expansion) | Low/Uncertain | AI Data Analytics, New Business Models | Long-term (Uncertain immediate returns) |

BCG Matrix Data Sources

Our BCG Matrix is informed by robust financial reports, comprehensive market share data, and in-depth industry analysis to provide strategic clarity.