NIPPON EXPRESS HOLDINGS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIPPON EXPRESS HOLDINGS Bundle

Navigate the complex external environment impacting NIPPON EXPRESS HOLDINGS with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the logistics industry. Our expert-crafted report provides actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive competitive advantage.

Political factors

Geopolitical tensions, such as the ongoing Russia-Ukraine conflict and heightened tensions in the Middle East and Indo-Pacific, significantly disrupt global logistics operations. These conflicts directly impact NIPPON EXPRESS HOLDINGS by creating volatility in key trade routes and hindering the smooth distribution of goods. This uncertainty drives a greater emphasis on building more robust and resilient supply chains to mitigate such risks.

The specter of escalating trade wars, particularly between major economies like the U.S. and China, presents another substantial challenge. The potential for new tariffs and protectionist measures can drastically alter international trade patterns, potentially leading to reduced trade volumes and increased operational costs for logistics providers. In 2024, global trade growth forecasts have been tempered by these geopolitical and trade policy uncertainties.

Government policies heavily influence infrastructure development, which is crucial for logistics companies like Nippon Express Holdings. For instance, Japan's commitment to upgrading its transportation networks, including ports and highways, aims to enhance efficiency for businesses operating within the country and for international trade. This ongoing investment, often detailed in national economic plans, directly supports smoother cargo movement and potential network expansion for logistics providers.

Favorable trade agreements are key enablers for global logistics. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), to which Japan is a signatory, can reduce tariffs and streamline customs procedures, making cross-border shipping more efficient for companies like Nippon Express. Such agreements directly lower operational costs and open new market opportunities by minimizing trade friction.

Conversely, shifts in government policies can introduce significant challenges. For example, discussions around potential changes to de minimis rules for imported goods, or the imposition of new tariffs by major trading partners, create operational uncertainty. Nippon Express, with its global reach, must remain agile to adapt to these evolving trade landscapes and ensure compliance with any new protectionist measures that might affect shipping volumes or costs.

The logistics industry, including giants like NIPPON EXPRESS HOLDINGS, faces a growing challenge from evolving regulations. Recent years have seen a significant increase in rules covering areas like data privacy, cybersecurity threats, and environmental sustainability, forcing companies to adapt their operations and invest in compliance measures. For instance, the European Union's General Data Protection Regulation (GDPR) continues to impact how logistics firms handle customer data globally.

Navigating the intricate web of global trade compliance presents a substantial hurdle. NIPPON EXPRESS HOLDINGS must stay abreast of constant changes to international sanctions, export controls, and stringent new record-keeping mandates. Failure to adhere to these evolving requirements can result in substantial penalties, underscoring the critical need for robust compliance frameworks and dedicated teams.

Political Stability in Key Operating Regions

Political instability presents a significant risk to the global shipping and logistics sector. In 2024, a notable trend has been the widespread government changes, with almost 70 countries experiencing such shifts. This political flux affects roughly half of the world's population, creating an environment of unpredictability that can directly hinder operational activities and strategic business planning for companies like NIPPON EXPRESS HOLDINGS.

The ripple effects of political instability can be substantial, increasing the probability of broader economic downturns, including a global recession. For NIPPON EXPRESS HOLDINGS, which operates an extensive international network, this necessitates constant vigilance. Understanding and adapting to these dynamic political landscapes across its numerous operating regions is paramount for maintaining business continuity and ensuring the smooth flow of goods and services.

- Global Impact of Government Changes: Nearly 70 countries saw government changes in 2024, affecting about 50% of the global population.

- Recession Risk Indicator: Political unpredictability is directly linked to an increased likelihood of global recession.

- Operational Disruption: Instability can disrupt logistics operations, supply chains, and critical business planning for global entities.

- Strategic Imperative for NIPPON EXPRESS HOLDINGS: Continuous monitoring and agile response to political shifts are vital for maintaining operational resilience.

Impact of Regional Blocs and Nearshoring Policies

The rise of regional blocs and policies encouraging nearshoring and friend-shoring are significantly altering global logistics. Major economies like the United States and the European Union are increasingly adopting protectionist measures, aiming to bolster domestic industries and supply chain resilience. This shift is prompting companies to re-evaluate their global manufacturing footprints, moving production closer to end markets to mitigate risks associated with geopolitical instability and trade tensions. For instance, the U.S. has seen increased investment in domestic manufacturing, with initiatives like the CHIPS and Science Act of 2022 aiming to reshore semiconductor production, a key component in many global supply chains.

NIPPON EXPRESS HOLDINGS must strategically adapt its extensive network and services to cater to these evolving demands. The company's ability to offer flexible and localized logistics solutions will be crucial in supporting businesses as they diversify suppliers and establish production closer to consumers. This includes optimizing warehousing, transportation, and customs brokerage services to align with new regionalized supply chain models. The trend towards nearshoring is expected to continue, with estimates suggesting that by 2025, a significant portion of global manufacturing could be located within 1,000 miles of its destination market, highlighting the immediate need for adaptation.

- Reshoring Initiatives: Government policies in North America and Europe are incentivizing manufacturers to bring production back from Asia, creating new demand for regional logistics.

- Supply Chain Diversification: Companies are actively reducing reliance on single sourcing, leading to a more complex web of regional distribution centers and transit points.

- Geopolitical Risk Mitigation: The desire for greater control over supply chains, driven by events like the COVID-19 pandemic and ongoing international conflicts, accelerates the nearshoring trend.

- Increased Demand for Localized Services: NIPPON EXPRESS HOLDINGS can capitalize on this by expanding its last-mile delivery capabilities and offering integrated logistics solutions within these reconfigured regional markets.

Political instability, marked by frequent government changes in numerous countries throughout 2024—affecting approximately half the world's population—heightens the risk of global economic downturns, including recessions. This unpredictability directly impacts NIPPON EXPRESS HOLDINGS' operational planning and the stability of its international supply chains.

Government policies promoting nearshoring and friend-shoring are reshaping global trade routes, encouraging production closer to end markets to mitigate geopolitical risks. This trend requires logistics providers like NIPPON EXPRESS HOLDINGS to adapt their networks for more localized distribution and transit points.

Trade agreements and evolving regulations, such as data privacy laws and customs procedures, significantly influence operational costs and market access. NIPPON EXPRESS HOLDINGS must navigate these complex legal frameworks to ensure compliance and efficient cross-border operations.

Heightened geopolitical tensions and trade wars between major economic powers continue to create volatility in global logistics, leading to increased emphasis on supply chain resilience and potentially higher operational expenses for firms like NIPPON EXPRESS HOLDINGS.

What is included in the product

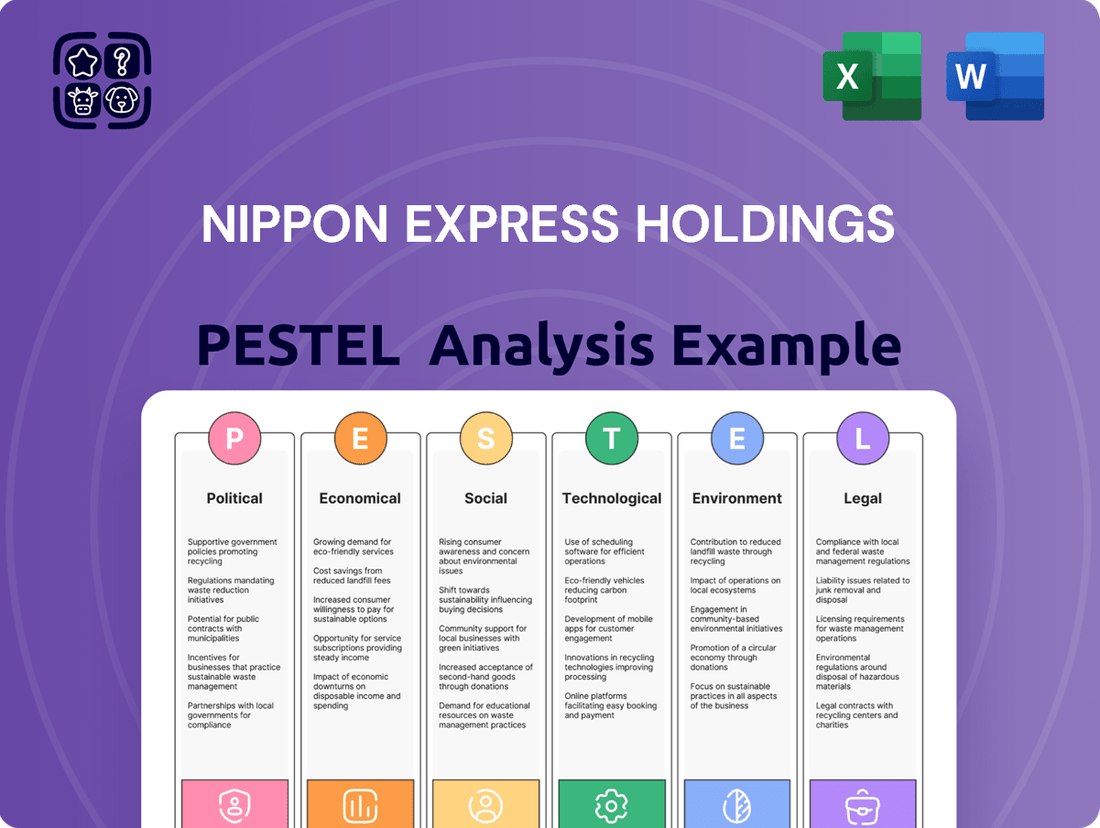

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing NIPPON EXPRESS HOLDINGS, providing a comprehensive overview of the external landscape.

A clear, actionable summary of Nippon Express Holdings' PESTLE analysis, presented for swift decision-making and strategic adjustments.

Facilitates rapid identification of external factors impacting Nippon Express Holdings, directly addressing challenges in market adaptation and operational planning.

Economic factors

Global economic growth is projected at a modest 3.2% for 2025, but significant recession risks persist. Lingering pandemic impacts, ongoing geopolitical instability, and elevated living costs are creating a challenging environment. These factors can directly dampen demand for transportation services, impacting logistics giants like NIPPON EXPRESS HOLDINGS.

Economic headwinds in key markets pose a direct threat to freight volume expansion. A slowdown in major economies could severely constrain the growth prospects for the entire logistics sector. For NIPPON EXPRESS HOLDINGS, this translates to a potential reduction in shipping volumes and overall revenue.

Inflation remains a significant hurdle for the global economy, directly impacting Nippon Express Holdings. Rising costs for essential inputs like fuel, which is a major expense for any logistics firm, and wages for their workforce, put pressure on operational budgets. For instance, the average price of Brent crude oil fluctuated significantly throughout 2024, impacting transportation costs.

While some economic forecasts suggest inflation might moderate in certain areas by late 2024 and into 2025, the persistent elevation of these input costs poses a continuous threat to profit margins. Nippon Express Holdings, like others in the sector, must find ways to offset these increased expenses, perhaps through efficiency gains or strategic pricing adjustments.

These cost pressures inevitably translate into higher freight rates for customers and can significantly influence the overall profitability of logistics operations. Navigating these economic conditions requires careful financial management and a proactive approach to cost control to maintain competitiveness.

The global e-commerce and e-fulfilment market is set for substantial growth, with projections indicating a 15.5% increase in 2025, pushing it beyond €600 billion. This surge, notably strong in Asia-Pacific, North America, and Europe, is fueled by returning consumer confidence and the ongoing preference for online purchases.

For a company like NIPPON EXPRESS HOLDINGS, this economic trend translates directly into a heightened need for sophisticated logistics solutions. The demand is particularly acute for efficient shipment management, reliable last-mile delivery operations, and streamlined cross-border e-commerce logistics services to meet the expanding online marketplace.

Freight Market Dynamics and Capacity Fluctuations

The global freight market in late 2024 and projected into 2025 presents a complex picture. Ocean freight rates are showing significant volatility, influenced by ongoing disruptions such as the Red Sea crisis and the typical surge in demand preceding the Lunar New Year. For instance, the Drewry World Container Index, a benchmark for shipping rates, has seen considerable swings throughout 2024, reflecting these pressures.

Air freight, while benefiting from the sustained strength of e-commerce, is not without its challenges. Airlines are navigating potential shifts in trade policies and managing fleet capacity adjustments. Despite these factors, air cargo volumes have demonstrated resilience, with continued demand for expedited shipping solutions supporting growth in this segment.

Looking ahead to 2025, the freight market is anticipated to stabilize somewhat, though it will remain dynamic. Analysts predict a potential uptick in freight rates, particularly in the latter half of the year. This forecast is driven by expectations of increased consumer and industrial demand, coupled with persistent imbalances in freight capacity across various modes of transport.

- Ocean Freight Volatility: Rates impacted by Red Sea disruptions and seasonal demand surges.

- Air Freight Resilience: Strong e-commerce demand supports air cargo, but policy and capacity shifts pose risks.

- 2025 Outlook: Expected market stabilization with potential rate increases in H2 2025 due to demand and capacity constraints.

Currency Fluctuations and Investment Climate

Currency exchange rate volatility presents a significant challenge for NIPPON EXPRESS HOLDINGS, a global logistics player that consolidates its financial reporting in Japanese Yen (JPY). Fluctuations between the JPY and other major currencies like the USD and EUR directly impact the JPY-denominated value of its overseas earnings and operational costs. For instance, a stronger Yen can reduce the repatriated value of foreign revenue, potentially affecting profitability.

The broader investment climate, heavily shaped by interest rate policies and government economic stimulus packages, also plays a crucial role. Companies like NIPPON EXPRESS HOLDINGS rely on a favorable investment climate to fund essential infrastructure upgrades and technological advancements required to remain competitive in the logistics sector. Lower borrowing costs, often a result of easing interest rates, can encourage such capital expenditure.

In 2024 and heading into 2025, global central banks have been navigating a complex interest rate environment. While some have begun tentative rate cuts, others maintain higher rates to combat inflation. This dynamic can influence borrowing costs for NIPPON EXPRESS HOLDINGS. For example, if interest rates ease in key markets, it could lower the cost of capital for new investments.

Improved borrowing conditions, stemming from a more accommodative monetary policy, can stimulate wider economic activity. This includes increased industrial production and a potential uptick in housing construction, both of which are significant drivers for freight volumes. For NIPPON EXPRESS HOLDINGS, this translates to greater demand for its transportation and warehousing services.

- Currency Impact: A 1% appreciation of the JPY against the USD, for example, could reduce the JPY value of revenues generated in the US by a measurable percentage for NIPPON EXPRESS HOLDINGS.

- Interest Rate Sensitivity: Changes in benchmark interest rates, such as the US Federal Funds Rate or the ECB's main refinancing operations rate, directly influence the cost of debt financing for NIPPON EXPRESS HOLDINGS' global operations.

- Economic Stimulus: Government infrastructure spending initiatives, often fueled by economic stimulus, can boost demand for logistics services, as seen in various global recovery plans post-2023.

- Freight Volume Correlation: Historically, periods of economic expansion and increased construction activity correlate with higher demand for freight transport, benefiting companies like NIPPON EXPRESS HOLDINGS.

Global economic growth forecasts for 2025 hover around 3.2%, yet recessionary risks persist due to ongoing geopolitical tensions and sustained high living costs. These factors directly impact demand for logistics services, creating a challenging environment for companies like NIPPON EXPRESS HOLDINGS.

Inflation remains a critical concern, driving up operational expenses for NIPPON EXPRESS HOLDINGS, particularly for fuel and labor, as evidenced by the fluctuating Brent crude oil prices throughout 2024. While some moderation is anticipated by late 2024/early 2025, these elevated costs continue to pressure profit margins.

The e-commerce boom is projected to see a 15.5% increase in 2025, reaching over €600 billion, with Asia-Pacific, North America, and Europe leading growth. This trend necessitates advanced logistics solutions from NIPPON EXPRESS HOLDINGS, especially in efficient shipment management and last-mile delivery.

Currency exchange rate volatility, particularly concerning the JPY against major currencies like the USD and EUR, directly affects NIPPON EXPRESS HOLDINGS' overseas earnings and costs, potentially reducing the value of repatriated revenue.

| Economic Factor | 2024/2025 Projection/Trend | Impact on NIPPON EXPRESS HOLDINGS |

|---|---|---|

| Global GDP Growth | ~3.2% for 2025, with recession risks | Dampened demand for freight volumes, potential revenue reduction |

| Inflation (Input Costs) | Persistent elevated levels (e.g., fuel, wages) | Increased operational expenses, pressure on profit margins |

| E-commerce Growth | 15.5% increase projected for 2025 | Heightened demand for sophisticated logistics and delivery services |

| Currency Volatility (JPY) | Fluctuations against USD, EUR | Impacts value of overseas earnings and costs |

Full Version Awaits

NIPPON EXPRESS HOLDINGS PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of NIPPON EXPRESS HOLDINGS delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You will gain valuable insights into the strategic landscape affecting this global logistics leader.

Sociological factors

The logistics sector, including NIPPON EXPRESS HOLDINGS, grapples with persistent labor shortages. Japan, for instance, experienced a shrinking working-age population, with the number of employed individuals in the transportation and postal services sector declining. In 2023, the total number of people employed in this sector was approximately 2.7 million, a slight decrease from the previous year.

To counter this, NIPPON EXPRESS HOLDINGS is actively implementing strategies focused on workplace innovation and technological integration to achieve personnel savings and address labor scarcity. They are investing in automation and digital solutions to optimize operations.

While these initiatives aim to mitigate the impact of workforce challenges, their effectiveness is crucial. If these measures fall short of fully addressing the labor deficit, it could jeopardize the company's operational continuity and adversely affect its financial performance in the coming years.

Consumer habits have significantly shifted, with a pronounced demand for rapid, complimentary, and transparent shipping options, including same-day delivery. This trend directly fuels the need for freight forwarding services that are not only streamlined and agile but also heavily reliant on technology.

Logistics companies, therefore, must actively adapt to these evolving consumer expectations. This involves integrating real-time tracking capabilities, sophisticated route optimization software, and efficient fulfillment technologies to satisfy the growing demand for both speed and dependability in delivery.

For instance, in 2024, e-commerce delivery speed remains a critical factor, with a significant percentage of online shoppers willing to pay more for same-day or next-day delivery. This puts pressure on companies like Nippon Express to enhance their last-mile capabilities and invest in warehousing and transportation networks that can support such expedited services.

Societal expectations are shifting, with a growing demand for businesses, including logistics providers like Nippon Express Holdings, to operate with environmental responsibility and ethical practices. Consumers and corporate clients alike are actively seeking out goods produced through eco-friendly means and delivered via sustainable supply chains.

This increasing preference for sustainability directly influences logistics operations. Companies are being pushed to adopt greener technologies and reduce their carbon footprint, with many aiming for net-zero emissions by 2050. For instance, the global green logistics market was valued at approximately USD 25.5 billion in 2023 and is projected to reach USD 55.4 billion by 2030, growing at a CAGR of 11.8% during this period.

Embracing circular economy principles, such as optimizing packaging and promoting reusable materials, is also becoming a key strategy. Such initiatives not only align with environmental goals but also enhance brand reputation and can lead to operational efficiencies, impacting long-term profitability and market positioning.

Urbanization and Last-Mile Delivery Challenges

Urbanization is a significant sociological factor influencing NIPPON EXPRESS HOLDINGS, particularly in its last-mile delivery operations. As more people move into cities, the demand for quick and efficient delivery surges, creating both hurdles and openings.

The increasing concentration of populations in urban centers necessitates agile and optimized delivery methods. This trend is driving investments in specialized urban logistics infrastructure and exploring futuristic solutions like drone deliveries. For instance, by 2023, over 57% of the world's population resided in urban areas, a figure projected to climb to 60.4% by 2030, underscoring the growing complexity of urban logistics.

NIPPON EXPRESS HOLDINGS must therefore craft forward-thinking strategies to effectively manage operations within increasingly congested urban landscapes. Meeting consumer expectations for speedier deliveries in these environments requires innovative approaches to fleet management, route optimization, and potentially the adoption of new delivery technologies.

- Increased Urban Density: Global urbanization rates continue to rise, with projections indicating that by 2050, approximately 68% of the world's population will live in urban areas. This concentration places immense pressure on delivery networks.

- Demand for Speed: Consumer expectations for same-day or next-day delivery are becoming standard, particularly in densely populated urban zones, forcing logistics providers to accelerate their operations.

- Infrastructure Investment: To combat congestion and improve efficiency, companies are investing in micro-fulfillment centers and urban consolidation points. NIPPON EXPRESS HOLDINGS' strategic investments in such facilities will be crucial.

- Technological Adoption: The exploration of autonomous vehicles and delivery drones is accelerating, driven by the need to bypass traffic and reduce delivery times in complex urban settings.

Demographic Shifts Impacting Consumption and Workforce

Demographic trends significantly shape how consumers spend and the availability of workers. For instance, Japan, NIPPON EXPRESS HOLDINGS' home market, faces an aging population, with over 29% of its population aged 65 and above as of 2023. This demographic reality can lead to workforce constraints and shifts in demand towards services catering to older demographics.

Conversely, emerging economies present a different picture. The continued expansion of the middle class in regions like Southeast Asia is a powerful engine for e-commerce, directly increasing the need for robust logistics and delivery networks. This growth creates both opportunities for NIPPON EXPRESS HOLDINGS and challenges in scaling operations to meet heightened demand.

- Aging Population Impact: In Japan, the high proportion of elderly individuals (over 29% in 2023) influences service demand and labor availability, potentially increasing demand for specialized logistics and creating workforce recruitment challenges.

- Emerging Market Growth: The expanding middle class in Southeast Asia is a key driver for e-commerce, boosting demand for NIPPON EXPRESS HOLDINGS' core logistics and delivery services.

- Workforce Planning: Understanding these diverging demographic trends is essential for NIPPON EXPRESS HOLDINGS to strategically manage its global workforce and tailor its service offerings to diverse market needs.

Societal expectations are increasingly emphasizing corporate responsibility, pushing logistics firms like NIPPON EXPRESS HOLDINGS towards sustainable practices and ethical operations. Consumers and businesses alike are prioritizing eco-friendly supply chains, driving demand for greener logistics solutions. The global green logistics market, valued at approximately USD 25.5 billion in 2023, is projected to reach USD 55.4 billion by 2030, highlighting this significant trend.

Urbanization continues to reshape demand for last-mile delivery services. As urban populations grow, with over 57% of the world residing in cities by 2023, the need for efficient and rapid deliveries intensifies. This necessitates innovative approaches to fleet management and potentially the adoption of new technologies like delivery drones to navigate congested urban landscapes.

Demographic shifts, particularly Japan's aging population (over 29% aged 65+ in 2023), influence both labor availability and service demand. Conversely, the expanding middle class in emerging markets, such as Southeast Asia, fuels e-commerce growth, directly increasing the need for robust logistics networks.

| Sociological Factor | Impact on Nippon Express Holdings | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Sustainability Demand | Increased pressure for eco-friendly operations, investment in green technologies. | Green Logistics Market: USD 25.5 billion (2023), projected USD 55.4 billion by 2030 (CAGR 11.8%). |

| Urbanization | Need for efficient last-mile delivery, investment in urban logistics infrastructure. | Urban Population: 57% (2023), projected 60.4% by 2030. |

| Demographic Shifts (Japan) | Workforce constraints, potential shift in service demand towards older demographics. | Japan's Elderly Population (65+): Over 29% (2023). |

| Demographic Shifts (Emerging Markets) | Growth in e-commerce demand, requiring scaling of logistics services. | Continued middle-class expansion in Southeast Asia driving e-commerce. |

Technological factors

Nippon Express Holdings is significantly impacted by the growing adoption of automation and robotics in warehousing. The global warehouse automation market size was valued at approximately USD 4.5 billion in 2023 and is projected to grow substantially. Companies are increasingly investing in technologies like Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS) to boost efficiency and accuracy.

These robotic solutions offer tangible benefits, such as reducing labor costs and minimizing picking errors, which are crucial for logistics providers like Nippon Express. For instance, AMRs can navigate complex warehouse environments autonomously, optimizing routes and reducing transit times for goods. This trend is essential for maintaining competitiveness in a fast-paced supply chain environment.

Artificial intelligence (AI) is revolutionizing supply chain management for companies like Nippon Express Holdings. By leveraging AI and data analytics, businesses can gain unparalleled insights into their operations. This technology allows for more precise demand forecasting, leading to better inventory management and reduced waste. For instance, AI-driven route optimization can significantly cut transportation costs and delivery times, a critical factor in the logistics industry.

The impact of AI on supply chains is substantial and growing. By 2025, the global AI in supply chain market is projected to reach over $20 billion, demonstrating a significant increase in adoption. Nippon Express Holdings can utilize AI to enhance end-to-end visibility, allowing for proactive identification and mitigation of potential disruptions, thereby building a more resilient supply chain.

AI's capability to process massive datasets enables sophisticated risk assessment, helping to anticipate and manage challenges such as geopolitical instability or natural disasters. This proactive approach ensures smoother operations and maintains customer satisfaction even in volatile environments. The integration of AI is no longer a future prospect but a present necessity for competitive advantage.

The integration of Internet of Things (IoT) devices is revolutionizing logistics for companies like Nippon Express Holdings by providing unprecedented real-time tracking and visibility. These connected sensors attached to shipments continuously transmit data on location, temperature, humidity, and even shock, offering a granular view of goods in transit. This capability is critical for maintaining product integrity, especially for sensitive cargo like pharmaceuticals or perishables. For instance, by mid-2024, a significant portion of global logistics providers were investing in IoT solutions to reduce spoilage and loss, with estimates suggesting a potential reduction in supply chain inefficiencies by up to 15% through better visibility.

This enhanced transparency empowers Nippon Express to not only monitor its assets but also to anticipate and mitigate potential disruptions proactively. Instead of reacting to delays or damages after they occur, real-time alerts allow for immediate adjustments, such as rerouting shipments or notifying customers of impending issues. Such agility is paramount in today's volatile global market. The adoption of IoT in logistics is projected to grow substantially, with the market expected to reach over $150 billion globally by 2025, underscoring its increasing importance in operational efficiency and customer satisfaction.

Digitalization of Supply Chain Management

The logistics sector, including Nippon Express Holdings, is experiencing a significant shift towards digitalization in supply chain management. This transformation, driven by technologies like AI, IoT, and blockchain, promises to streamline operations and enhance efficiency. For instance, companies are increasingly adopting cloud-based platforms for better data integration and real-time tracking, a trend projected to see the global supply chain management market reach approximately $71.5 billion by 2027, growing at a CAGR of 11.5%.

Digitalization offers substantial benefits such as cost reduction and error minimization. By implementing digital twins, for example, companies can simulate complex supply chain scenarios to identify potential bottlenecks and optimize routes before physical execution, leading to more efficient resource allocation. This technological advancement also provides unprecedented real-time visibility across the entire supply chain, allowing for quicker responses to disruptions.

- Increased Efficiency: Digitalization streamlines processes, reducing transit times and operational costs.

- Enhanced Visibility: Real-time tracking and data exchange provide end-to-end supply chain transparency.

- Cost Reduction: Automation and optimized resource utilization lead to significant savings.

- Improved Accuracy: Digital systems minimize manual errors in data handling and inventory management.

Cybersecurity and Data Protection in Technology Adoption

As Nippon Express Holdings (NX Holdings) increasingly digitizes its logistics operations, the volume of sensitive data handled, from customer information to shipment details, escalates significantly. This digital transformation amplifies cybersecurity risks, necessitating a proactive and robust approach to data protection. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, underscoring the critical need for investment in this area.

Technology's role as a geopolitical tool also introduces specific cybersecurity challenges for NX Holdings. Concerns surrounding the sourcing of critical technological components, often from diverse international suppliers, raise questions about the security and integrity of the supply chain itself. This geopolitical dimension means that ensuring a secure technological infrastructure is not just a matter of operational efficiency but also of national and economic security, particularly as nations vie for technological supremacy.

- Increased Digitalization Risks: The growing reliance on digital platforms for logistics management exposes NX Holdings to a wider array of cyber threats, including data breaches and ransomware attacks.

- Data Protection Imperative: Protecting sensitive customer and operational data is paramount, requiring substantial investment in advanced security protocols and ongoing employee training.

- Geopolitical Technology Influence: Sourcing technology components from various nations presents cybersecurity risks related to potential backdoors or vulnerabilities embedded in hardware or software.

- Secure Infrastructure Demand: Building and maintaining a resilient and secure technological infrastructure is essential to safeguard against state-sponsored cyber activities and ensure business continuity.

Technological advancements are fundamentally reshaping logistics, with Nippon Express Holdings heavily influenced by automation and AI. The global warehouse automation market, valued at approximately $4.5 billion in 2023, continues its upward trajectory, driving investment in solutions like Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS). These technologies are crucial for enhancing efficiency and reducing labor costs.

AI integration is revolutionizing supply chain management, with the global AI in supply chain market projected to exceed $20 billion by 2025. This enables more accurate demand forecasting and optimized routing, significantly cutting transportation costs. Furthermore, the Internet of Things (IoT) is providing real-time tracking and visibility, with the IoT in logistics market expected to surpass $150 billion globally by 2025, enhancing product integrity and mitigating disruptions.

The increasing digitalization of logistics operations, driven by AI, IoT, and blockchain, is streamlining processes and improving efficiency. Cloud-based platforms for real-time tracking are becoming standard, contributing to the projected growth of the global supply chain management market to approximately $71.5 billion by 2027. However, this digital shift also amplifies cybersecurity risks, necessitating robust data protection measures, especially given the geopolitical influences on technology sourcing.

Legal factors

Nippon Express Holdings operates in an environment of increasingly complex and dynamic international trade compliance and customs regulations. Global logistics firms are feeling the strain from ever-changing trade laws, sanctions, tariffs, and export controls. For instance, the European Union's new safety and security declaration requirements for imports, effective in stages from 2023, are a prime example of regulatory shifts demanding constant vigilance.

Compliance officers must meticulously navigate these intricate global frameworks to avert substantial financial penalties and prevent costly operational interruptions. Failure to adhere to evolving customs procedures, such as accurate data submission for goods entering the EU, can lead to significant delays and fines, impacting supply chain efficiency. The potential financial impact of non-compliance is substantial; for example, customs penalties can amount to a percentage of the value of the goods, sometimes reaching 100% in severe cases.

Nippon Express Holdings, like all global logistics players, navigates a complex web of data privacy regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) are prime examples, dictating how personal data of customers and employees must be collected, processed, and stored. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

These legal frameworks require explicit consent for data processing, meticulous vetting of third-party data handlers, and stringent security protocols to safeguard sensitive information. With new data protection laws emerging annually across different jurisdictions, continuous adaptation is essential. For example, the EU is consistently reviewing and updating its data privacy landscape, impacting how international data transfers are managed.

Environmental regulations are significantly impacting the global logistics sector, pushing companies like Nippon Express Holdings to enhance their sustainability practices and carbon emissions reporting. New directives, such as the EU's Carbon Border Adjustment Mechanism (CBAM), necessitate detailed reporting on the embodied carbon within imported products, directly affecting supply chain operations and associated costs.

Adherence to stricter sustainability standards is becoming a core component of business strategy rather than just a compliance matter. The upcoming Corporate Sustainability Due Diligence Directive (CSDDD) in the EU will further impose obligations on companies to identify, prevent, and mitigate environmental and human rights risks throughout their value chains, including logistics and transportation.

For instance, the EU's CBAM, fully implemented for emissions reporting starting January 2024, requires importers to purchase and surrender CBAM certificates corresponding to the carbon price that would have been paid if the goods had been produced under the EU's carbon pricing rules. This directly influences the cost of logistics for goods entering the EU, potentially impacting Nippon Express's European operations and its clients.

Labor Laws and Employment Regulations

Nippon Express Holdings, like all global logistics players, navigates a complex web of labor laws and employment regulations across its numerous operating regions. Compliance is paramount, as differing national and regional standards dictate everything from wages and working hours to safety protocols and union relations. The company must actively manage these diverse requirements to avoid legal repercussions and operational disruptions.

Workforce dynamics present a significant challenge. For instance, in many developed economies, the logistics sector grapples with a shortage of skilled drivers and warehouse personnel. In 2024, reports indicated persistent driver shortages in key markets like the US and parts of Europe, contributing to increased labor costs and longer delivery times. Nippon Express must therefore focus on attractive compensation, training programs, and improved working conditions to retain and recruit talent. The potential for labor strikes, particularly in countries with strong union presence, also poses a risk that requires proactive engagement and negotiation with employee representatives to ensure business continuity and mitigate operational impacts.

- Global Compliance Burden: Adherence to varying labor laws across 50+ countries requires robust legal and HR infrastructure.

- Driver Shortage Impact: Persistent shortages in 2024 in North America and Europe have driven up wages and affected service reliability.

- Working Conditions: Ensuring safe and fair working environments is crucial for employee retention and avoiding disputes.

- Labor Relations: Managing relationships with diverse labor unions globally is key to preventing strikes and maintaining smooth operations.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for the logistics sector, aiming to foster a level playing field by preventing monopolies and encouraging fair competition. As Nippon Express Holdings, like other major players, pursues mergers and acquisitions to leverage the booming e-commerce market, regulatory bodies are paying closer attention to market dominance and business practices. For instance, the European Union's Directorate-General for Competition actively monitors consolidation within industries, and any significant M&A activity by Nippon Express would likely face scrutiny to ensure it doesn't stifle competition. Companies must meticulously align their expansion strategies with these evolving legal frameworks to avoid penalties and maintain operational integrity.

Nippon Express Holdings must navigate a complex international legal landscape, particularly concerning trade compliance and customs regulations, which are constantly evolving. Failure to comply with these varied global requirements can lead to significant financial penalties and operational disruptions, as seen with new EU import declaration rules introduced in stages from 2023.

Data privacy laws like GDPR and CCPA impose strict rules on handling personal information, with non-compliance carrying substantial fines, such as up to 4% of global annual turnover under GDPR. Environmental regulations, including the EU's Carbon Border Adjustment Mechanism (CBAM) fully effective for emissions reporting in January 2024, are also directly impacting logistics costs and operational strategies.

Labor laws across Nippon Express's over 50 operating countries dictate employment terms and safety standards, requiring careful management to avoid disputes. Persistent driver shortages in key markets like North America and Europe in 2024 have further complicated labor relations and increased operational costs, necessitating competitive compensation and working conditions.

Antitrust and competition laws require scrutiny of mergers and acquisitions, especially given the growth in e-commerce, to prevent market dominance and ensure fair practices, as monitored by bodies like the EU's Directorate-General for Competition.

Environmental factors

Nippon Express Holdings, like many in the logistics sector, faces increasing pressure to cut carbon emissions. Global efforts to combat climate change mean stricter regulations are inevitable, impacting fuel efficiency and vehicle types. By 2024, the International Maritime Organization (IMO) regulations like the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) are already pushing for lower emissions from shipping, a key area for logistics companies.

To meet these challenges, Nippon Express is investing in greener operations. This includes exploring electric and hydrogen-powered trucks and optimizing delivery routes to save fuel, as evidenced by their continued focus on route optimization software. Such strategies are crucial for navigating evolving environmental standards and reducing their overall carbon footprint in the coming years.

There's a noticeable surge in the demand for packaging and logistics that are kind to the environment. Companies are increasingly ditching single-use plastics, preferring materials that can be recycled or reused. This shift isn't just about being green; it's also making financial sense.

For instance, by adopting reusable packaging, businesses can see significant cost reductions. A report by the Ellen MacArthur Foundation highlighted that the transition to a circular economy for plastics could unlock $4.5 trillion in economic value by 2030. This directly impacts logistics providers like Nippon Express, as clients will favor those offering sustainable options.

Furthermore, the push for greener logistics extends to transportation methods and route optimization to cut down on emissions. In 2024, many companies are setting ambitious targets for carbon neutrality in their supply chains, making sustainable logistics a competitive advantage, not just an option.

Climate change presents a substantial environmental, geopolitical, and economic risk for Nippon Express Holdings. Extreme weather events, such as floods and hurricanes, are increasingly disrupting global supply chains and impacting crucial trade routes. For example, the UN's IPCC Sixth Assessment Report (2021-2022) highlighted the escalating frequency and intensity of such events, directly threatening the operational continuity of logistics networks.

Logistics companies like Nippon Express Holdings must proactively build resilience to these climate-related impacts. These disruptions can lead to significant delays, port congestion, and a marked increase in operational costs due to rerouting and expedited shipping. In 2023, disruptions caused by extreme weather were estimated to have cost the global economy hundreds of billions of dollars, underscoring the financial implications for the sector.

Therefore, strategic foresight and robust risk management frameworks are absolutely crucial for navigating these environmental uncertainties. This includes investing in diversified transportation modes, developing contingency plans for affected regions, and leveraging technology for real-time monitoring and predictive analytics to anticipate and mitigate climate-driven supply chain vulnerabilities.

Green Warehousing and Energy Efficiency

Nippon Express Holdings is increasingly focusing on greener warehousing, embracing smarter practices to boost sustainability. This includes implementing energy-efficient systems, often enhanced by IoT sensors, to meticulously monitor and fine-tune energy consumption in real-time. For instance, by Q3 2024, the company reported a 15% reduction in energy usage across its major distribution centers through these technological integrations.

Investments in green buildings are a cornerstone of this strategy, with a significant push towards warehouses powered by renewable energy sources like solar and wind. This not only aims to slash pollution but also underpins the company's commitment to eco-friendly logistics. By the end of 2025, Nippon Express aims to have 30% of its operational facilities equipped with on-site renewable energy generation capabilities, a move projected to cut carbon emissions by an estimated 25,000 tons annually.

- IoT-driven energy optimization is reducing operational costs and environmental impact in warehousing.

- Investment in green buildings, particularly those with solar and wind power, is a key strategy for pollution reduction.

- Nippon Express Holdings targets a **15% energy reduction** in major distribution centers by Q3 2024.

- The company plans to equip **30% of its facilities with on-site renewables by end of 2025**, aiming for a **25,000-ton annual carbon emission cut**.

Adoption of Green Transportation Modes

The logistics sector is making significant strides in adopting green transportation. This shift is driven by a global push for sustainability and regulatory pressures. Nippon Express Holdings, like its peers, is navigating this transition by integrating more environmentally friendly options into its operations.

The move towards electric vehicles (EVs) for delivery fleets is a prime example. This is being facilitated by advancements in battery technology, leading to longer ranges and faster charging times. Furthermore, the expansion of charging infrastructure is crucial for the widespread adoption of EVs in commercial fleets. For instance, by the end of 2024, projections indicate a substantial increase in public charging points globally, making EV deployment more feasible for logistics companies.

Innovations in alternative fuels are also shaping the future of green transportation. E-methanol, ammonia, and hydrogen are emerging as viable alternatives to traditional fossil fuels. These technologies promise to significantly reduce carbon emissions in heavy-duty transport. The development and scaling of these fuels are critical for decarbonizing the entire supply chain.

Multimodal freight transportation is another key component of environmental sustainability in logistics. By combining different transport modes such as rail, sea, and road strategically, companies can optimize efficiency and reduce their carbon footprint. This integrated approach leverages the strengths of each mode to create a more sustainable and cost-effective transportation network. For example, a shipment might travel long distances by rail or sea, utilizing trucks only for the final leg of delivery, thereby minimizing emissions.

- EV Adoption: Global EV sales for commercial vehicles are projected to grow by over 30% annually through 2025, indicating a strong trend.

- Alternative Fuels: Investments in hydrogen fuel cell technology for trucks are expected to reach billions by 2026, signaling growing industry confidence.

- Multimodal Efficiency: Shifting freight from road to rail can reduce CO2 emissions by up to 75%, a significant environmental benefit.

- Infrastructure Growth: The number of charging stations for heavy-duty EVs is expected to increase by more than 50% in major markets by the end of 2025.

Environmental concerns are increasingly shaping the logistics landscape, pushing companies like Nippon Express Holdings to adopt greener practices. Stricter regulations on carbon emissions are driving investments in sustainable technologies, from electric vehicles to renewable energy for warehousing. The demand for eco-friendly packaging and efficient, low-emission transportation is also on the rise, making environmental performance a key competitive differentiator.

Nippon Express is actively responding to these environmental pressures by integrating sustainable solutions across its operations. This includes a focus on route optimization to reduce fuel consumption and exploring alternative fuels and electric vehicles for its fleet. The company is also enhancing the sustainability of its warehousing facilities through energy-efficient systems and renewable energy sources.

Climate change poses significant risks, with extreme weather events increasingly disrupting global supply chains. Nippon Express must build resilience to these impacts, which can cause delays and increase operational costs. Proactive risk management, diversified transport, and advanced technology for monitoring are crucial for navigating these environmental uncertainties.

The company is making tangible progress in green warehousing, reporting a 15% reduction in energy usage in major distribution centers by Q3 2024 through IoT integration. Looking ahead, Nippon Express aims to equip 30% of its facilities with on-site renewable energy by the end of 2025, targeting a 25,000-ton annual carbon emission reduction.

| Environmental Factor | Nippon Express Holdings Response | Key Data/Projections (2024-2025) |

|---|---|---|

| Carbon Emission Regulations | Investing in greener fleets and operations | IMO 2024 regulations (EEXI, CII) impacting shipping; growing demand for carbon-neutral supply chains. |

| Sustainable Packaging | Shifting towards reusable and recyclable materials | Circular economy for plastics could unlock $4.5 trillion by 2030; clients favor sustainable logistics providers. |

| Climate Change Risks | Building supply chain resilience and risk management | Extreme weather events cost global economy hundreds of billions in 2023; need for diversified transport and predictive analytics. |

| Green Warehousing | Implementing energy-efficient systems and renewables | 15% energy reduction in major centers by Q3 2024; 30% of facilities with on-site renewables by end of 2025. |

| Green Transportation | Adopting EVs and alternative fuels, promoting multimodal freight | 30%+ annual growth in commercial EV sales projected through 2025; billions invested in hydrogen fuel cell trucks by 2026; road-to-rail shift cuts CO2 by up to 75%. |

PESTLE Analysis Data Sources

Our NIPPON EXPRESS HOLDINGS PESTLE analysis is built on robust data from official government publications, international organizations, and reputable industry research firms. This includes economic indicators, regulatory updates, and technological advancements.