NIPPON EXPRESS HOLDINGS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIPPON EXPRESS HOLDINGS Bundle

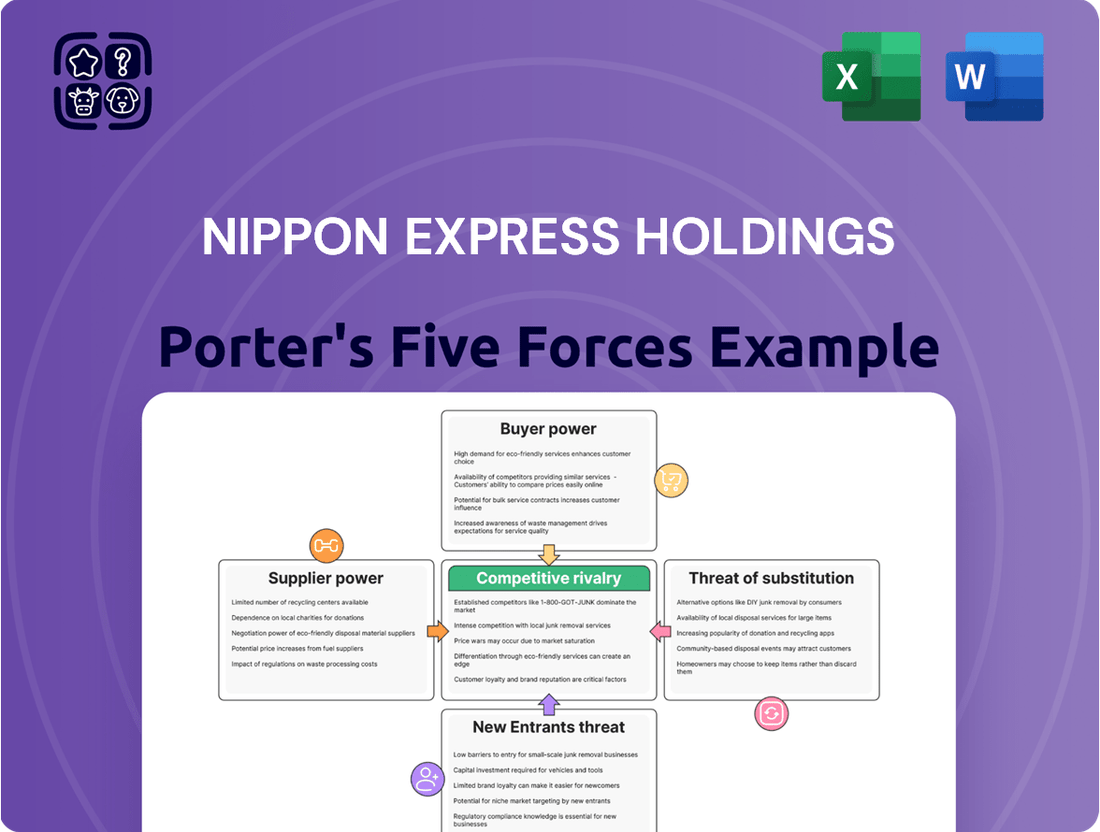

NIPPON EXPRESS HOLDINGS navigates a complex landscape shaped by intense competition and evolving customer demands. Understanding the underlying forces, from the bargaining power of its suppliers to the constant threat of new entrants, is crucial for strategic success.

Our comprehensive Porter's Five Forces Analysis delves into the nuances of NIPPON EXPRESS HOLDINGS's operating environment, revealing the true intensity of each competitive pressure. Discover how buyer power and the availability of substitutes impact its market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore NIPPON EXPRESS HOLDINGS’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Nippon Express Holdings, like many logistics giants, depends on a diverse network of carriers – airlines, ocean liners, and trucking firms. When the supply side for a particular transportation service, such as air cargo on a key transpacific route, is highly concentrated, with only a handful of dominant carriers, those suppliers gain significant leverage.

This concentration means a limited number of providers can significantly influence pricing and service terms. For instance, in early 2024, freight rates for certain air cargo lanes saw upward pressure due to capacity constraints and a strong demand, directly impacting the costs for forwarders like Nippon Express.

If a few major airlines or shipping companies control a substantial portion of the available capacity for critical routes, they can more easily dictate higher prices or less favorable contract terms. This puts Nippon Express in a position where they have fewer alternatives, thus increasing the bargaining power of these concentrated suppliers.

Suppliers providing highly specialized logistics services, like temperature-controlled transport for sensitive pharmaceuticals, wield significant leverage. Nippon Express's reliance on these niche providers, who require unique infrastructure and expertise, increases their bargaining power. For instance, the global cold chain market was valued at over USD 160 billion in 2023 and is projected to grow substantially, indicating the increasing importance and potential cost of these specialized services.

The high barriers to switching for Nippon Express when dealing with these specialized suppliers are a key factor. Transitioning to a new provider for cold chain or heavy haulage operations often involves substantial costs related to new equipment, training, and potential disruptions to service continuity. This difficulty in switching strengthens the hand of existing specialized suppliers, allowing them to command better terms.

The bargaining power of suppliers for Nippon Express Holdings is significantly influenced by the criticality of their inputs to the company's product quality. Suppliers who provide services or materials essential for maintaining Nippon Express's reputation for reliability, especially for high-value or sensitive cargo like pharmaceuticals or advanced electronics, possess considerable leverage. This is because any disruption or compromise in these supplier inputs directly impacts Nippon Express's service delivery and customer satisfaction.

For instance, the timely and secure transportation of semiconductor components, a key sector for global supply chains, relies heavily on the efficiency and integrity of logistics partners and specialized handling services. A failure in these supplier-provided services can lead to production delays for Nippon Express's clients, directly affecting their business operations and potentially damaging Nippon Express's own standing in the market. In 2023, the global logistics sector experienced ongoing challenges with capacity constraints and rising operational costs, which would have empowered suppliers in critical niches.

Threat of Forward Integration

The threat of forward integration by suppliers, while less prevalent for raw material providers, poses a consideration for Nippon Express Holdings. Larger transportation or technology firms could potentially bypass freight forwarders by offering integrated logistics services directly to end consumers.

This potential shift, though currently a distant concern, could impact supplier negotiation leverage, particularly for high-volume or specialized shipping lanes. For instance, a major technology provider with a significant global footprint might consider developing its own in-house logistics capabilities to control the entire supply chain, from manufacturing to final delivery.

- Forward Integration Threat: While not a primary concern for typical raw material suppliers, larger logistics or technology companies could integrate forward to offer end-to-end services.

- Impact on Negotiation: This threat, even if low, can influence supplier negotiation power, especially for critical or high-volume shipping segments.

- Industry Examples: Major e-commerce players have been observed building out their own logistics networks, demonstrating a trend towards greater control. In 2024, Amazon's continued investment in its delivery infrastructure highlights this strategy.

- Strategic Consideration: Nippon Express must monitor the evolving capabilities of its partners and potential competitors to anticipate and mitigate this risk.

Availability of Substitutes for Suppliers

The bargaining power of suppliers for Nippon Express Holdings is somewhat tempered by the presence of numerous providers for standard freight services. This allows Nippon Express to diversify its options, choosing from various airlines, shipping lines, and trucking companies, particularly for less specialized cargo. This competitive landscape limits the leverage any single supplier can wield.

For instance, in 2024, the global air cargo market saw a significant number of carriers operating, providing ample choice for freight forwarders like Nippon Express. Similarly, the shipping industry, despite consolidation, still offers a wide array of carriers for container and breakbulk services. This availability means that if one supplier attempts to unduly increase prices or impose unfavorable terms, Nippon Express has viable alternatives.

- Availability of Alternatives: Nippon Express can select from a broad spectrum of transport providers for general cargo.

- Reduced Supplier Leverage: The competitive nature of the logistics market limits the pricing power of individual suppliers.

- Cost Optimization: Access to multiple providers enables Nippon Express to negotiate more favorable rates and terms.

- Operational Flexibility: The ability to switch suppliers enhances operational agility and risk management.

When suppliers offer highly specialized or critical services that Nippon Express Holdings cannot easily replicate, their bargaining power increases significantly. This is particularly true for niche segments like cold chain logistics or heavy haulage, where unique infrastructure and expertise are essential. The global cold chain market alone was valued at over USD 160 billion in 2023, underscoring the value and potential cost associated with these specialized services.

High switching costs for Nippon Express, due to the investment in new equipment or potential service disruptions, further cement the leverage of these specialized suppliers. The threat of forward integration by larger logistics or technology firms also looms, potentially altering negotiation dynamics in key shipping lanes. For instance, e-commerce giants continue to invest heavily in their own logistics networks, a trend evident in 2024.

Conversely, the bargaining power of suppliers for standard freight services is moderated by the availability of numerous providers. This competitive landscape allows Nippon Express to diversify its options and negotiate more favorable terms, enhancing operational flexibility. The global air cargo market in 2024, for example, offered a wide array of carriers, limiting the power of any single provider.

| Factor | Impact on Nippon Express | Data Point/Example |

| Supplier Concentration | High leverage for few dominant carriers on key routes | Upward pressure on air cargo rates in early 2024 due to capacity constraints |

| Service Specialization | Significant leverage for niche providers (e.g., cold chain) | Global cold chain market valued over USD 160 billion in 2023 |

| Switching Costs | Strengthens existing specialized suppliers' position | Substantial costs for new equipment, training, and service continuity |

| Forward Integration Threat | Potential impact on negotiation for high-volume segments | Amazon's continued investment in its delivery infrastructure in 2024 |

| Availability of Alternatives | Moderates supplier leverage for standard services | Numerous carriers in global air cargo market in 2024 |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to NIPPON EXPRESS HOLDINGS' global logistics operations.

Understand the competitive landscape for NIPPON EXPRESS HOLDINGS with a pre-built Porter's Five Forces model, eliminating the need for manual data gathering and analysis to quickly identify and address strategic vulnerabilities.

Customers Bargaining Power

Nippon Express Holdings serves a global clientele, encompassing major corporations within sectors such as automotive, pharmaceuticals, and electronics. This broad customer base includes significant players who can leverage their market presence and order volume to negotiate better terms.

Customers with substantial purchasing power, particularly those placing large volume orders, can exert considerable influence. They may demand lower pricing or more advantageous contract conditions, directly impacting Nippon Express's profitability and operational flexibility.

For instance, a major automotive manufacturer, a significant client for Nippon Express, might secure preferential rates due to the consistent high volume of parts and finished vehicles they ship. This concentration of demand from key accounts amplifies their bargaining leverage.

The bargaining power of customers is a critical factor in the logistics industry, where scale and efficiency are paramount. Nippon Express must balance securing large contracts with maintaining profitable pricing structures in the face of such customer demands.

The global logistics market is highly competitive, featuring a multitude of international and regional companies. This abundance of providers means customers have numerous choices for freight forwarding, warehousing, and distribution services. This competitive landscape significantly lowers switching costs for customers, empowering them to negotiate more favorable terms with Nippon Express Holdings. For instance, in 2024, the freight forwarding market alone was valued at over $270 billion, indicating the vast number of players customers can choose from.

Nippon Express Holdings operates in a sector where customers often exhibit significant price sensitivity, particularly for common logistics services. This is especially true when providers offer similar capabilities, leading buyers to focus heavily on cost. For instance, in the freight forwarding market, price is frequently a primary decision factor.

This customer behavior directly translates into pressure on Nippon Express to maintain competitive pricing structures. According to industry reports from 2024, the global logistics market saw intense competition, with freight rates fluctuating based on demand and capacity, reinforcing the need for cost-efficiency. Such an environment can indeed squeeze profit margins if cost management isn't rigorously maintained.

Customer's Threat of Backward Integration

Large multinational corporations, especially those with complex global supply chains, might explore bringing logistics in-house. This potential for backward integration serves as leverage. For instance, a major e-commerce retailer could invest in its own fleet and warehousing to reduce reliance on third-party providers.

This threat compels logistics companies like Nippon Express to offer competitive pricing and superior service to retain clients. The capital expenditure required for a company to develop its own logistics infrastructure is substantial, often running into billions of dollars for large-scale operations, making it a credible, albeit significant, threat.

- Customer Leverage: The ability of large customers to develop their own logistics capabilities puts pressure on Nippon Express to maintain competitive pricing and service levels.

- Capital Intensity of Integration: The significant capital investment required for backward integration deters many customers, but the threat remains for very large, resource-rich firms.

- Strategic Option: For some global enterprises, controlling logistics is a strategic imperative to ensure supply chain reliability and efficiency, not just a cost-saving measure.

Information Availability and Transparency

The increasing availability of information and transparency significantly bolsters customer bargaining power. Digital platforms and freight marketplaces now allow shippers to readily compare pricing and service details from numerous logistics providers. This ease of comparison puts considerable downward pressure on prices, compelling companies like Nippon Express Holdings to be more competitive and transparent in their own offerings.

For instance, in 2024, the global freight forwarding market saw a surge in digital adoption, with platforms reporting a 15% year-over-year increase in user-generated quotes. This heightened transparency means customers can easily identify the most cost-effective options, forcing Nippon Express to justify its pricing and service levels more rigorously. Consequently, customers can negotiate better rates or switch to providers offering more favorable terms, directly impacting Nippon Express's revenue and profit margins.

- Enhanced Price Comparison: Customers can now access real-time pricing data across multiple logistics providers, enabling them to identify the most competitive offers.

- Digital Freight Marketplaces: The proliferation of online platforms facilitates easy bidding and comparison, directly challenging established pricing structures.

- Demand for Transparency: Shippers increasingly expect clear breakdowns of costs and service inclusions, pushing providers to be more open about their operations.

- Negotiating Power: Greater information parity empowers customers to negotiate more effectively on price and service terms with logistics companies like Nippon Express.

Customers possess significant bargaining power due to the highly competitive nature of the global logistics market, where numerous providers offer similar services, leading to lower switching costs. In 2024, the global freight forwarding market, valued at over $270 billion, exemplifies the vast array of choices available to shippers, allowing them to negotiate more favorable terms with companies like Nippon Express Holdings.

Price sensitivity is a key driver for many customers in logistics, especially when services are comparable, forcing Nippon Express to maintain competitive pricing. Intense competition in the global logistics sector in 2024 meant fluctuating freight rates, underscoring the need for rigorous cost management to protect profit margins.

The increasing transparency afforded by digital platforms and freight marketplaces in 2024, with a 15% year-over-year increase in user-generated quotes, empowers customers to easily compare pricing and service details. This heightened visibility compels Nippon Express to justify its pricing more rigorously and offer competitive terms.

| Factor | Impact on Nippon Express | Customer Action |

|---|---|---|

| Market Competition | Price pressure, need for differentiation | Switching providers, demanding lower rates |

| Price Sensitivity | Margin erosion if costs aren't managed | Focusing on cost as a primary decision factor |

| Digital Transparency | Increased need for competitive pricing and service justification | Easy comparison of offers, negotiation for better terms |

Same Document Delivered

NIPPON EXPRESS HOLDINGS Porter's Five Forces Analysis

This preview displays the complete NIPPON EXPRESS HOLDINGS Porter's Five Forces Analysis, mirroring the exact, professionally formatted document you will receive immediately after purchase. You are viewing the final version, ensuring no surprises or placeholder content, and it's ready for your immediate strategic insights.

Rivalry Among Competitors

The global logistics arena is a crowded space, featuring a mix of giants and smaller, specialized operators. NIPPON EXPRESS HOLDINGS operates within this dynamic, facing competition from numerous international, regional, and niche providers across air, ocean, and land freight services. This fragmentation, while offering choice, fuels a highly competitive environment where market share is constantly contested.

In 2024, major players like DHL Group, FedEx, and UPS continue to hold significant sway, but the landscape is further shaped by the presence of companies such as Kuehne+Nagel and DSV. These competitors offer a broad spectrum of services, mirroring NIPPON EXPRESS HOLDINGS' own diverse portfolio, thereby intensifying direct rivalry for contracts and routes.

The sheer number of entities, from massive multinational corporations to agile local haulers, means that NIPPON EXPRESS HOLDINGS must continually innovate and optimize its offerings to maintain its competitive edge. This includes adapting to evolving customer needs and technological advancements across all modes of transportation.

The logistics industry, while generally expanding due to e-commerce and globalization, faces varying growth rates across its segments. For instance, while express delivery might see robust expansion, less dynamic sectors could experience slower uptake, amplifying rivalry. This dynamic forces companies like NIPPON EXPRESS HOLDINGS to compete more fiercely for market share, especially in slower-growing areas.

Logistics companies like NIPPON EXPRESS HOLDINGS operate with substantial fixed costs, including massive investments in warehouses, transportation fleets, and advanced IT systems. For instance, in 2023, the global logistics market saw significant capital expenditure in automated warehousing and fleet upgrades. These high upfront costs create pressure to maintain high utilization rates.

The inherent perishability of transport capacity means that unsold space on a truck or plane represents lost revenue that can never be recovered. This economic reality often drives intense competition, pushing companies to offer lower prices to fill capacity, especially during off-peak periods. This dynamic can lead to price wars within the industry, impacting profitability.

Differentiation and Switching Costs

While Nippon Express Holdings strives for differentiation through specialized services and integrated supply chain solutions, the core freight forwarding market remains highly competitive and can be viewed as commoditized. This is particularly true for standard, less complex shipments.

The low switching costs for many customers, especially those with routine transportation needs, significantly fuel this intense rivalry. Competitors can readily attract clients by offering marginal improvements in pricing or service, making customer retention a constant challenge.

- Commoditization of Core Services: Many fundamental freight forwarding services lack unique characteristics, leading to price-based competition.

- Low Switching Barriers: Customers can easily transition between providers for standard shipments without significant disruption or cost.

- Price Sensitivity: A significant portion of the market prioritizes cost-effectiveness, making it easier for competitors to lure clients with slightly lower rates.

- Industry Data: In 2023, the global freight forwarding market was valued at approximately $260 billion, with growth driven by e-commerce and global trade, but also characterized by intense competition and pressure on margins for standard services.

Strategic Acquisitions and Global Expansion

Nippon Express Holdings' pursuit of strategic acquisitions and global expansion, exemplified by recent deals like the acquisition of cargo-partner and Simon Hegele, significantly heightens competitive rivalry within the logistics sector. This aggressive growth strategy, aimed at broadening service portfolios and market reach, forces other major players to respond in kind. Companies are increasingly looking to acquire competitors or establish presences in new territories to maintain or enhance their competitive standing.

The logistics industry is witnessing a consolidation trend, with substantial investments being made by key players. For instance, Nippon Express Holdings’ acquisition of cargo-partner in 2023 was valued at approximately €300 million, signaling a strong commitment to expanding its European operations. This move, along with others like the acquisition of Simon Hegele, directly intensifies competition as these expanded capabilities and networks are deployed against rivals.

- Strategic Acquisitions: Nippon Express Holdings acquired cargo-partner (Europe) and Simon Hegele (Germany) in 2023, bolstering its capabilities in air and ocean freight, and specialized logistics respectively.

- Global Footprint Expansion: These acquisitions, alongside organic growth initiatives, are designed to strengthen Nippon Express’s presence in key international markets, increasing direct competition with established global logistics providers.

- Service Capability Enhancement: By integrating acquired companies, Nippon Express enhances its end-to-end service offerings, creating a more formidable competitor across various logistics segments.

- Industry Response: The aggressive expansion by Nippon Express pressures competitors like Kuehne+Nagel, DHL Supply Chain, and DSV to also consider strategic M&A and market penetration to avoid losing market share.

The competitive rivalry for NIPPON EXPRESS HOLDINGS is intense, driven by a fragmented market with numerous global and regional players. Companies like DHL, FedEx, and UPS are significant competitors, offering similar comprehensive services. This broad competition means NIPPON EXPRESS HOLDINGS must constantly innovate to maintain its market position.

High fixed costs in logistics, such as investments in fleets and warehouses, push companies to maximize capacity utilization, often leading to price competition. Furthermore, the nature of transport capacity, which is perishable, encourages aggressive pricing strategies to fill space, especially during off-peak times. This can result in price wars that affect overall industry profitability.

NIPPON EXPRESS HOLDINGS' strategic acquisitions, such as cargo-partner and Simon Hegele in 2023, aim to expand its service offerings and global reach. These moves intensify rivalry by creating stronger, more integrated competitors, prompting other major players to respond with similar expansion or consolidation strategies to protect their market share.

| Key Competitors | Service Breadth | 2023/2024 Market Dynamics |

| DHL Group | Air, Ocean, Land Freight, Supply Chain Solutions | Continued dominance in express and integrated logistics; strong focus on sustainability initiatives. |

| FedEx | Express Delivery, Freight, E-commerce Solutions | Navigating integration of TNT Express and adapting to e-commerce shifts; significant investment in technology. |

| UPS | Express Delivery, Freight, Supply Chain Solutions | Focus on global network optimization and expanding specialized services like healthcare logistics. |

| Kuehne+Nagel | Sea Logistics, Air Logistics, Road Logistics, Contract Logistics | Strong performance in seafreight and airfreight; emphasis on digital solutions and customer-centricity. |

| DSV | Air & Sea, Road, Logistics | Aggressive growth through acquisitions; expanding global network and integrated service capabilities. |

SSubstitutes Threaten

Large manufacturers and retailers possess the financial muscle and operational expertise to develop in-house logistics capabilities, acting as a significant substitute for third-party providers like Nippon Express Holdings. Companies such as Amazon have heavily invested in their own delivery networks, including planes, trucks, and fulfillment centers, to control costs and customer experience. This self-sufficiency allows them to bypass external logistics firms entirely, particularly when their scale justifies the capital expenditure. In 2023, Amazon's logistics and transportation costs exceeded $30 billion, demonstrating the substantial investment required but also the potential to absorb logistics functions internally.

The threat of substitutes, particularly through direct shipping by manufacturers or retailers, presents a significant challenge for NIPPON EXPRESS HOLDINGS. For specific goods or geographic areas, companies can bypass traditional logistics providers by using e-commerce or their own distribution channels for direct delivery. This bypasses the need for freight forwarders for final-mile or even broader regional distribution.

This trend is amplified by the growth of online retail. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, demonstrating a massive shift towards direct-to-consumer models. For instance, a clothing brand might leverage its own warehouses and delivery fleet to ship directly to customers, cutting out the need for a third-party logistics (3PL) provider like Nippon Express for that specific transaction. This directly impacts Nippon Express's revenue streams for those particular services.

Digital freight platforms and online marketplaces are increasingly offering shippers alternative channels to source transportation. These platforms provide greater price transparency and can streamline the booking process, potentially bypassing traditional freight forwarders for standard shipments. For instance, by mid-2024, the global digital freight forwarding market was projected to reach over $30 billion, indicating significant adoption.

Technological Advancements enabling Self-Management

Technological advancements are increasingly enabling businesses to take greater control of their logistics operations. Sophisticated supply chain management software, coupled with real-time tracking and predictive analytics, empowers companies to manage their own freight more efficiently. This shift can reduce the reliance on comprehensive third-party logistics (3PL) providers if a firm believes it can effectively handle many functions internally through technology investments.

For instance, the global supply chain management software market was valued at approximately $25.5 billion in 2023 and is projected to grow significantly in the coming years. This growth indicates a strong trend towards in-house capabilities. Companies are investing in these tools to gain better visibility and control, which directly addresses a core value proposition of traditional 3PLs.

- Increased adoption of AI and machine learning in logistics software aids in route optimization and demand forecasting.

- Real-time visibility platforms provide end-to-end tracking, diminishing the need for external monitoring services.

- The rise of user-friendly, integrated logistics platforms lowers the barrier to entry for self-management.

- Data analytics capabilities allow businesses to identify cost-saving opportunities and improve operational efficiency without outsourcing.

Shift to Localized or Regional Supply Chains

The increasing trend towards localized or regional supply chains poses a significant threat of substitution for global logistics providers like Nippon Express Holdings. Heightened geopolitical risks and a strong emphasis on supply chain resilience are prompting many businesses to nearshore or reshore production. This strategic shift directly reduces the reliance on extensive international freight forwarding services, a core business for Nippon Express.

For instance, in 2024, many manufacturing sectors are actively exploring options to bring production closer to their end markets. This move could potentially substitute the need for long-haul transportation and complex international logistics networks. Companies are re-evaluating their global footprints, favoring shorter, more predictable supply routes. This means fewer large-scale international shipments, directly impacting the volume of business for companies heavily invested in global freight.

- Reduced Demand for Global Freight: Localization directly cuts into the need for international shipping, a primary service offering for Nippon Express.

- Increased Regional Competition: The shift may foster the growth of smaller, regional logistics players better equipped to serve these localized chains, acting as substitutes.

- Supply Chain Resilience Focus: Businesses prioritizing resilience over cost may opt for regional solutions, even if less efficient, to mitigate global disruptions.

- Impact on Ancillary Services: Beyond freight, services like customs brokerage and warehousing for international movements also face reduced demand.

The threat of substitutes for NIPPON EXPRESS HOLDINGS is substantial, driven by companies developing in-house logistics and the rise of digital platforms. Large corporations, like Amazon, are investing billions into their own delivery networks, effectively bypassing third-party providers. In 2023, Amazon's logistics and transportation costs exceeded $30 billion, a clear indicator of this trend.

Furthermore, the booming e-commerce sector, projected to surpass $6.3 trillion in global sales in 2024, facilitates direct-to-consumer models. This allows businesses to manage their own distribution, directly impacting Nippon Express's traditional revenue streams. Digital freight platforms also offer alternative, transparent, and streamlined booking channels, with the global market expected to exceed $30 billion by mid-2024.

The increasing focus on localized supply chains further substitutes the need for global logistics. Geopolitical risks are pushing companies to nearshore or reshore production, reducing reliance on extensive international freight forwarding. This shift impacts not only freight volumes but also ancillary services like international warehousing and customs brokerage.

Entrants Threaten

Entering the global logistics arena, particularly for a player like Nippon Express Holdings, demands an immense upfront capital commitment. Establishing a comprehensive infrastructure, encompassing vast warehouse networks, efficient distribution centers, and a worldwide presence with offices and agents, requires billions of dollars. For instance, major logistics firms often invest hundreds of millions annually in fleet expansion and technology upgrades, making it exceptionally challenging for newcomers to match this scale.

Nippon Express Holdings leverages its extensive global network, operating in 57 countries and regions with over 3,000 locations, a testament to decades of strategic development.

This vast infrastructure, combined with a strong, trusted brand reputation, presents a significant barrier to entry for potential new competitors.

Replicating such an established logistical and service network, along with the inherent customer trust, would require immense capital investment and considerable time for any new player.

For instance, in fiscal year 2023, Nippon Express Holdings reported consolidated revenue of ¥2,220.4 billion, reflecting the scale and market penetration of its operations.

The logistics sector faces significant regulatory challenges, acting as a substantial barrier to new entrants. Companies must meticulously navigate a complex web of customs procedures, international trade agreements, and stringent security mandates that vary considerably across different nations.

For instance, in 2024, compliance with evolving data privacy regulations like GDPR and similar frameworks in other regions adds another layer of complexity and cost for any new player. Failure to adhere to these rules can result in hefty fines and operational disruptions, deterring potential competitors.

The sheer cost and expertise required to maintain compliance globally mean that only well-established firms with dedicated legal and operational teams can effectively manage these demands. This creates a high barrier to entry, protecting incumbent companies like Nippon Express Holdings.

Economies of Scale and Scope

Nippon Express Holdings and its peers in the logistics sector leverage substantial economies of scale. This scale allows them to negotiate highly favorable rates with carriers, such as airlines and shipping lines, significantly reducing their per-unit transportation costs. For instance, in 2023, global air cargo rates saw fluctuations, but the sheer volume handled by major players like Nippon Express provides a consistent cost advantage that smaller entrants cannot easily match.

Furthermore, Nippon Express benefits from economies of scope by offering a comprehensive suite of services, from freight forwarding and warehousing to customs brokerage and supply chain management. This integrated approach creates a one-stop shop for clients, making it difficult for new entrants to replicate the same breadth and depth of service. The ability to bundle these services often results in more attractive pricing and streamlined operations for customers.

The capital investment required to establish a logistics network with comparable scale and scope is a considerable barrier. Building out a global infrastructure, acquiring or leasing a fleet, and developing sophisticated IT systems demand immense financial resources.

- Economies of Scale: Nippon Express can achieve lower per-unit costs in procurement due to its vast operational volume.

- Economies of Scope: Offering a full range of integrated logistics services creates a competitive advantage in service breadth.

- Procurement Power: Significant negotiating leverage with transportation providers (e.g., airlines, shipping lines) translates to cost savings.

- Capital Intensity: High upfront investment in infrastructure and technology deters new, smaller competitors.

Technological Investment and Expertise

The threat of new entrants into the logistics sector, particularly for companies like NIPPON EXPRESS HOLDINGS, is significantly shaped by the substantial technological investments and expertise required. Modern logistics operations are no longer just about moving goods; they are intricate, data-driven ecosystems. New players must commit considerable capital to acquire and implement cutting-edge technologies such as artificial intelligence for route optimization, Internet of Things (IoT) sensors for real-time tracking, and blockchain for enhanced transparency and security in supply chains. Without this advanced technological infrastructure and the skilled personnel to manage it, a new entrant would struggle to offer competitive services.

The barrier to entry is amplified by the need for specialized knowledge. Developing and maintaining sophisticated supply chain management systems, integrating AI-driven analytics, and ensuring cybersecurity for vast amounts of data demand a highly skilled workforce. This includes data scientists, AI specialists, cybersecurity experts, and logistics engineers. For instance, companies investing in autonomous vehicle technology for delivery fleets or advanced robotics for warehouse automation face not only high upfront costs but also the ongoing expense of training and retaining specialized talent. This technological and expertise hurdle can deter many potential new entrants, thus protecting established players like NIPPON EXPRESS HOLDINGS.

Consider the financial commitment:

- AI and Machine Learning Platforms: Investments can range from millions to tens of millions of dollars for enterprise-level solutions.

- IoT Infrastructure: Deploying sensors across fleets and warehouses requires significant hardware and connectivity costs.

- Blockchain Implementation: Developing secure and scalable blockchain solutions for supply chain visibility can incur substantial R&D and integration expenses.

- Talent Acquisition and Training: The demand for skilled logistics technology professionals drives up salaries, making it an ongoing operational cost.

The threat of new entrants for NIPPON EXPRESS HOLDINGS is considerably low due to immense capital requirements and established economies of scale. Building a global logistics network comparable to Nippon Express's, which operates in 57 countries, necessitates billions in infrastructure investment. For example, in 2023, major logistics players continued significant capital expenditures on fleet modernization and technology, often in the hundreds of millions annually, creating a substantial financial hurdle for newcomers. This scale allows Nippon Express to negotiate favorable rates with carriers, a cost advantage that is difficult for new entrants to replicate.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Establishing global infrastructure, fleets, and IT systems requires billions of dollars. | High; deters new entrants due to prohibitive upfront costs. |

| Economies of Scale | Lower per-unit costs through high operational volume and procurement power. | Significant; new entrants cannot match cost efficiencies. |

| Brand Loyalty & Reputation | Decades of service build trust, making customers reluctant to switch. | High; new entrants struggle to gain customer confidence. |

| Regulatory Compliance | Navigating complex international customs, trade, and data privacy laws (e.g., GDPR in 2024) requires specialized expertise and resources. | High; costly and time-consuming to manage effectively. |

| Technological Sophistication | Investment in AI, IoT, and blockchain for optimized operations demands significant capital and skilled personnel. | High; new entrants lack advanced tech and specialized talent. |

Porter's Five Forces Analysis Data Sources

Our NIPPON EXPRESS HOLDINGS Porter's Five Forces analysis is built upon data from their official annual reports, investor relations disclosures, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.