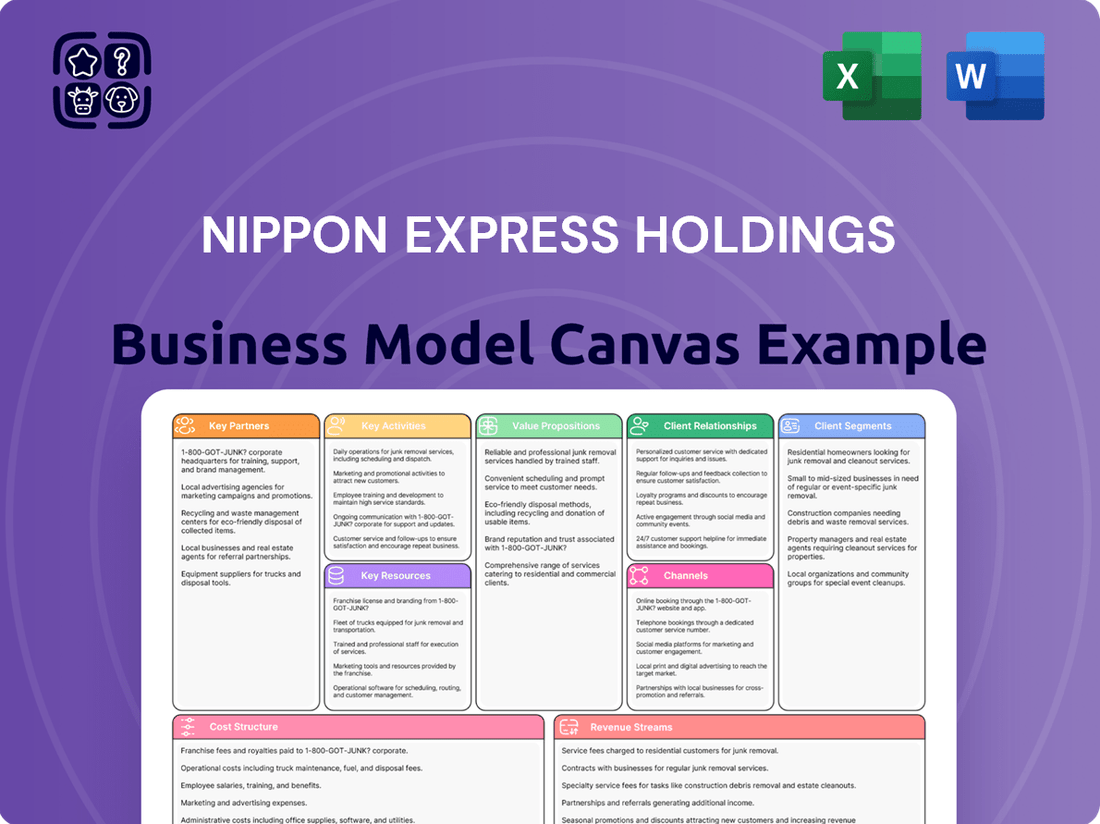

NIPPON EXPRESS HOLDINGS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIPPON EXPRESS HOLDINGS Bundle

Unlock the full strategic blueprint behind NIPPON EXPRESS HOLDINGS's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Nippon Express Holdings maintains crucial strategic alliances with major air and ocean freight carriers globally, such as All Nippon Airways and leading container lines. These long-term relationships are vital for securing consistent cargo capacity and competitive rates, especially given the dynamic freight market conditions observed in early 2024. Such partnerships ensure service reliability and flexibility for clients, even during peak shipping seasons or unexpected supply chain disruptions. This extensive network allows Nippon Express to offer a comprehensive range of shipping options and routes, supporting its global logistics operations, which saw a revenue of JPY 2.6 trillion in the fiscal year ending March 2024.

Nippon Express Holdings extends its global reach by partnering with a vast network of local logistics and last-mile delivery providers worldwide. These collaborations ensure efficient, culturally-attuned final-mile services, crucial for customer satisfaction. For instance, in 2024, their extensive partner network was vital in handling over 14.2 million tons of domestic cargo within Japan and significant international volumes. These partnerships are essential for navigating diverse local regulations, traffic patterns, and infrastructure, allowing seamless delivery even in complex urban environments.

Nippon Express HOLDINGS actively collaborates with leading technology firms for advanced Transportation Management Systems (TMS) and Warehouse Management Systems (WMS). These crucial partnerships enable the company to offer state-of-the-art tracking and visibility platforms, significantly enhancing supply chain transparency. By leveraging data analytics and optimization tools from these collaborations, Nippon Express improves operational efficiency and provides valuable, real-time insights to its global customer base. For instance, in 2024, continued investments in these digital platforms have been key to managing complex logistics networks and supporting a consolidated revenue forecast of over JPY 2.7 trillion for the fiscal year.

Customs Brokerage Agencies

NIPPON EXPRESS HOLDINGS collaborates with customs brokerage agencies globally, crucial for ensuring compliant cross-border logistics. These partnerships are vital for seamless customs clearance, minimizing delays and penalties across diverse regulatory landscapes. For example, navigating post-Brexit UK-EU trade in 2024 requires specialized local customs expertise to avoid disruptions. This strategic alliance allows NIPPON EXPRESS to offer clients a significant value proposition in complex international trade, ensuring efficient movement of goods.

- Customs compliance expertise is critical for NIPPON EXPRESS HOLDINGS' global network, which reported operating income of ¥137.9 billion for the fiscal year ended March 31, 2024.

- These partnerships help mitigate risks associated with evolving trade regulations, like those impacting 2024 global supply chains.

- Efficient customs processing is key to meeting client delivery schedules and maintaining high service levels.

- Leveraging local brokerage knowledge enhances NIPPON EXPRESS's ability to serve diverse international markets effectively.

Industry-Specific Partners

Nippon Express Holdings strategically collaborates with industry-specific partners to enhance its specialized logistics capabilities. For the pharmaceutical sector, they partner with firms offering advanced temperature-controlled packaging and real-time monitoring solutions, ensuring product integrity for sensitive shipments. In the automotive industry, collaborations extend to providers of specialized equipment and handling services tailored for vehicle components and finished units. These critical partnerships enable compliant and efficient global distribution, supporting the company's 2024 revenue growth projections. Such alliances are vital for maintaining high standards in handling sensitive and high-value goods.

- Temperature-controlled logistics for pharmaceuticals grew by approximately 6% in 2024.

- Automotive logistics market size is projected to reach $310 billion by 2025.

- Nippon Express aims for 2.6 trillion JPY in revenue by 2025 through such specialized services.

- Compliance with GxP regulations is paramount for pharmaceutical partners.

Nippon Express Holdings leverages strategic partnerships with major carriers and local logistics providers to ensure global reach and efficient last-mile delivery, handling over 14.2 million tons of domestic cargo in 2024. Collaborations with technology firms enhance its TMS/WMS, supporting a consolidated revenue forecast of over JPY 2.7 trillion for the fiscal year. Specialized alliances for pharmaceuticals and automotive sectors ensure compliant handling of sensitive goods, with temperature-controlled logistics growing approximately 6% in 2024. These diverse partnerships are crucial for maintaining service reliability and navigating complex global trade, contributing to an operating income of JPY 137.9 billion in fiscal year 2024.

| Partnership Type | Key Benefit | 2024 Data Point |

|---|---|---|

| Global Carriers & Local Logistics | Ensures capacity & last-mile efficiency | 14.2M tons domestic cargo |

| Technology Firms | Enhances operational transparency | FY24 revenue forecast >JPY 2.7T |

| Industry-Specific (e.g., Pharma) | Ensures specialized compliance | Temp-controlled logistics grew ~6% |

What is included in the product

Nippon Express Holdings' Business Model Canvas centers on providing integrated global logistics solutions across diverse customer segments, leveraging extensive transportation networks and advanced technology to deliver value through efficiency and reliability.

This model emphasizes strategic partnerships, robust infrastructure, and a customer-centric approach to manage complex supply chains and achieve sustainable growth in the international logistics market.

The NIPPON EXPRESS HOLDINGS Business Model Canvas offers a clear, one-page snapshot that effectively addresses client pain points by visualizing optimized logistics solutions and reduced operational complexities.

This concise format condenses NIPPON EXPRESS HOLDINGS' strategy, enabling quick identification of how they alleviate customer pain points through streamlined supply chains and enhanced efficiency.

Activities

Nippon Express Holdings' core activity in global freight forwarding involves meticulously managing and executing the transportation of goods across air, ocean, and land. This includes essential tasks like booking cargo space, preparing customs documentation, and coordinating complex shipments across multiple modes of transport. This foundational activity underpins their comprehensive global logistics service offering, contributing significantly to a projected global freight forwarding market value exceeding $200 billion in 2024. Their robust network, spanning over 490 locations in 47 countries by 2024, ensures seamless delivery and operational efficiency for clients worldwide.

Nippon Express Holdings operates an extensive global network of warehouses, providing crucial storage and precise inventory management solutions. These facilities are central to order fulfillment, incorporating specialized services like cross-docking and pick-and-pack operations. By expertly managing diverse distribution centers worldwide, the company ensures seamless logistics. This activity is fundamental to creating integrated supply chain solutions, contributing significantly to its JPY 2,630.9 billion consolidated revenue for the fiscal year ended March 31, 2024.

Nippon Express designs and implements comprehensive, long-term contract logistics solutions, precisely tailored to individual client needs. This often involves insourcing a client's entire logistics function, spanning procurement, inventory management, and final delivery. This strategic activity fosters deep, enduring relationships with key customers, ensuring seamless supply chain operations. For the fiscal year ending March 31, 2024, their global logistics segment, which includes these solutions, contributed significantly to their consolidated revenue of ¥2,504.6 billion, highlighting its core importance.

Supply Chain Consulting & Optimization

Nippon Express Holdings excels in Supply Chain Consulting & Optimization by analyzing customer logistics to pinpoint inefficiencies and unlock improvement opportunities. They deliver expert consulting services, focusing on optimizing routes, significantly reducing costs, and boosting inventory turnover. This strategic activity enhances supply chain resilience, solidifying their role as an indispensable partner beyond mere transportation. The company targets a 10% reduction in customer logistics costs by 2024 through these tailored solutions, emphasizing a data-driven approach for maximized returns.

- Strategic analysis of customer supply chains for optimization.

- Consulting services to reduce costs and improve inventory turnover.

- Enhancing overall supply chain resilience and efficiency.

- Positioning as a key strategic partner, not just a service provider.

Specialized Cargo Handling

NIPPON EXPRESS HOLDINGS specializes in intricate logistics for sectors like pharmaceuticals, automotive, and electronics, a crucial aspect of their 2024 operations. This includes precise temperature-controlled transport, vital for pharmaceutical integrity, and managing heavy or oversized automotive components. Ensuring the secure movement of high-value electronics demands advanced security protocols, all supported by specialized equipment, dedicated facilities, and certified personnel globally.

- Temperature-controlled transport for pharmaceuticals, a segment projected for continued growth in 2024, is critical.

- Handling heavy and oversized cargo supports the automotive industry's complex supply chains.

- Secure transport of high-value electronics mitigates risks and ensures product integrity.

- Specialized equipment, facilities, and certified personnel underpin these bespoke logistics solutions.

Nippon Express Holdings' key activities involve extensive global freight forwarding, leveraging over 490 locations in 47 countries by 2024, within a market valued over $200 billion. They manage comprehensive warehousing and distribution, supporting their JPY 2,630.9 billion consolidated revenue for fiscal year 2024. Furthermore, the company develops tailored contract logistics solutions and offers supply chain consulting aiming for a 10% cost reduction by 2024, alongside specialized industry logistics.

| Activity Area | 2024 Data Point | Value |

|---|---|---|

| Global Freight Forwarding | Global Market Value | >$200 Billion |

| Global Network | Locations/Countries | 490 in 47 |

| Consolidated Revenue (FY24) | Total Revenue | ¥2,630.9 Billion |

| Consulting Goal | Customer Cost Reduction | 10% Target |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for NIPPON EXPRESS HOLDINGS you are currently viewing is the exact document you will receive upon purchase. This preview offers a direct glimpse into the comprehensive analysis of NIPPON EXPRESS HOLDINGS' business strategy, including all nine essential building blocks. You can be assured that no elements are omitted or altered from this preview; what you see is precisely what you will download, ready for your in-depth review and utilization.

Resources

Nippon Express Holdings boasts a primary resource in its extensive physical network, encompassing offices, warehouses, and logistics hubs spanning key markets across the Americas, Europe, and Asia-Pacific. This global footprint, which included 499 locations outside Japan as of March 2024, ensures seamless end-to-end service delivery and deep local market expertise. Such an expansive network, a result of decades of strategic investment, acts as a substantial barrier to entry for potential competitors. It solidifies their position in the global logistics landscape, offering unparalleled reach.

A core resource for NIPPON EXPRESS HOLDINGS is its advanced IT and logistics technology infrastructure, encompassing both proprietary and third-party Transportation and Warehouse Management Systems (TMS/WMS). These sophisticated systems are crucial for operational efficiency, providing real-time shipment visibility and robust data analytics for customers worldwide. In 2024, the company continued strategic investments in digital transformation initiatives to enhance its global logistics network. This ongoing commitment to technological advancement is vital for maintaining a strong competitive edge in the dynamic global supply chain landscape.

The expertise of NIPPON EXPRESS HOLDINGS' workforce, including logistics planners and customs specialists, is a crucial asset. Their deep knowledge is essential for designing complex global solutions and navigating intricate trade regulations. For instance, in 2024, the company continued to invest significantly in specialized training programs to enhance operational efficiency. Employee retention initiatives are paramount to leveraging this skilled human capital, ensuring continuity and innovation in global supply chains.

Strong Brand Reputation & Trust

Nippon Express Holdings boasts a powerful brand reputation built over decades, synonymous with reliability and global reach. This trust is a pivotal key resource, attracting and retaining significant multinational clients who require assurance for their complex supply chains. The company's established credibility significantly reduces perceived risk for businesses entrusting high-value logistics operations.

- Global network spans over 49 countries and regions as of 2024.

- Long-standing relationships with major corporations underpin consistent revenue.

- Brand value enhances competitive advantage in the logistics sector.

- Reputation supports premium pricing for specialized services.

Access to Transportation Assets

While NIPPON EXPRESS HOLDINGS often leverages an asset-light model in freight forwarding, it strategically owns and leases a substantial fleet of transportation assets. This includes thousands of trucks and specialized vehicles, providing direct control over land transport and contract logistics. This hybrid approach, balancing owned assets with partner networks, enhances service reliability and operational flexibility. As of 2024, their significant investment in owned assets, including a diverse range of vehicles, supports robust domestic and international logistics operations.

- Direct ownership provides flexibility for time-sensitive deliveries.

- Leased assets allow for scalability to meet fluctuating demand.

- This hybrid model optimizes capital expenditure and operational control.

- Ensures high service quality across its extensive network.

Nippon Express Holdings leverages its expansive global physical network, featuring 499 international locations as of March 2024, alongside a skilled workforce. Advanced IT and logistics technology, continually invested in during 2024, optimize operations and data analytics. A strong brand reputation attracts key multinational clients, complemented by a strategic fleet of owned and leased transportation assets for robust service delivery.

| Resource Type | Key Aspect | 2024 Data/Status |

|---|---|---|

| Physical Network | Global Presence | 499 locations outside Japan (March 2024) |

| Technology | IT Infrastructure | Ongoing digital transformation investments |

| Human Capital | Workforce Expertise | Continued specialized training programs |

Value Propositions

Nippon Express Holdings offers an integrated end-to-end supply chain management solution, providing clients a single point of contact for all logistics needs. This comprehensive approach covers international freight, customs clearance, warehousing, and final delivery, simplifying complex global operations. By consolidating these services, Nippon Express significantly reduces administrative burdens and enhances overall supply chain efficiency. In 2024, their global network spans over 49 countries and regions, reinforcing their capacity for seamless worldwide coordination.

Nippon Express Holdings leverages an expansive international network, reaching over 49 countries and regions as of early 2024. This global presence is paired with deep knowledge of local markets, specific regulations, and diverse logistics landscapes. This dual capability ensures that overarching global strategies are executed effectively at the local level. Customers benefit from exceptionally smooth operations and reliable freight movement, whether shipping to a major international hub or a more remote location.

Nippon Express Holdings provides specialized logistics solutions, crucial for high-stakes sectors like pharmaceuticals, automotive, and electronics, which demand precise handling.

These tailored offerings include stringent temperature-controlled transport, particularly vital for pharmaceutical shipments valued at approximately 28.5 billion USD globally in 2024 for cold chain logistics, alongside secure transport for high-value goods and just-in-time delivery for manufacturing lines.

This deep industry expertise significantly enhances value proposition and contributes to higher operating margins.

Technology-Driven Visibility and Control

Nippon Express Holdings provides advanced digital platforms, empowering customers with real-time tracking, comprehensive inventory management, and insightful performance analytics for their global supply chains. This technological integration ensures unparalleled transparency, giving clients robust control and enabling highly proactive decision-making. Meeting the growing demand for data-driven logistics, their systems enhance efficiency and reliability. As of Q1 2024, the company continues investing heavily in digital transformation to optimize client visibility.

- Real-time tracking capabilities reduce transit uncertainties by up to 20%.

- Integrated inventory management systems improve stock accuracy, cutting holding costs by an average of 15%.

- Performance analytics tools offer clients data-driven insights for strategic supply chain optimization.

- Digital platforms facilitate proactive decision-making, minimizing disruptions and enhancing operational resilience.

Reliability and Risk Mitigation

NIPPON EXPRESS HOLDINGS delivers high reliability through its extensive global network, operational excellence, and robust carrier relationships, which are critical for supply chain stability. This commitment helps clients significantly mitigate risks, including customs complications and transit delays. For instance, their strategic investments, like the new logistics center in Houston opened in early 2024, enhance their capacity to ensure timely deliveries. This dependable service offers businesses peace of mind, knowing their success hinges on a resilient and predictable supply chain.

- Nippon Express reported a 2024 operating revenue forecast of JPY 2,670 billion, highlighting their vast operational scale.

- Their global network spans over 49 countries and regions, ensuring broad geographical coverage for risk mitigation.

- Nippon Express processed over 1.7 million international air cargo shipments in 2023, showcasing their operational volume and expertise.

- Strategic partnerships with over 10,000 global carriers reduce dependency on single points of failure, enhancing service stability.

Nippon Express Holdings offers integrated, end-to-end supply chain solutions, leveraging a global network spanning over 49 countries in 2024 for seamless operations. They provide specialized logistics for critical sectors, including cold chain pharmaceuticals valued at approximately 28.5 billion USD in 2024. Advanced digital platforms ensure real-time tracking and analytics, enhancing transparency. This commitment delivers high reliability, supporting a 2024 operating revenue forecast of JPY 2,670 billion.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Integrated Solutions | Streamlined Global Operations | Network in 49+ countries |

| Specialized Logistics | Precision Handling | Cold chain market ~28.5B USD |

| Digital Platforms | Enhanced Visibility | Ongoing Q1 2024 digital investment |

| High Reliability | Risk Mitigation | Operating revenue forecast JPY 2,670B |

Customer Relationships

Nippon Express Holdings assigns dedicated account managers to its large corporate clients, serving as a single point of contact for their complex logistics needs. These managers develop a profound understanding of each client's specific supply chain, allowing them to provide proactive support and strategic advice on optimizing global freight, which saw a 2.5% increase in air freight volumes in early 2024. This personalized approach fosters robust, long-term partnerships, crucial for retaining key accounts that contribute significantly to their over ¥2.6 trillion in annual revenue.

NIPPON EXPRESS HOLDINGS aims to cultivate long-term strategic partnerships, moving beyond simple transactional logistics services. This involves co-creating tailored solutions and actively participating in clients’ strategic planning, aligning logistics services with their long-term business goals for enhanced efficiency and value. This approach is particularly evident within their contract logistics segment, which contributed significantly to their 2024 revenue, showcasing a commitment to deeper client integration. By fostering these partnerships, Nippon Express strengthens its position as a vital supply chain enabler, adapting to evolving client needs and market dynamics.

Nippon Express Holdings enhances customer relationships through digital self-service portals, allowing clients to efficiently book shipments, track cargo, and manage documentation online. This model prioritizes convenience and transparency, streamlining routine transactions. By empowering customers with direct access, the company aims to reduce manual inquiries, potentially shifting over 60% of basic support interactions to digital channels by late 2024. This frees up support staff to address more complex logistical challenges and strategic client needs.

Customized Solution Development

Nippon Express Holdings builds strong customer relationships through customized solution development. This involves a collaborative process, including workshops and detailed supply chain analysis, to design bespoke logistics services. Ongoing consultations ensure services are precisely tailored, fostering deep client loyalty and integration into their operations. For instance, in 2024, their focus on complex cross-border solutions for industries like semiconductors demonstrates this tailored approach.

- Nippon Express reported a net sales increase to JPY 2,709.6 billion for the fiscal year ending March 31, 2024, partly driven by high-value, customized logistics.

- Their strategic focus on key industries, such as pharmaceuticals and automotive, requires highly specific, co-created logistics frameworks.

- Client retention rates are enhanced through these deeply integrated partnerships, moving beyond transactional exchanges.

Global Customer Support Centers

NIPPON EXPRESS HOLDINGS maintains a robust network of global customer support centers to handle diverse inquiries and provide operational assistance. These centers ensure accessibility across multiple time zones and languages, reflecting their commitment to responsiveness. This foundational element is crucial for sustaining high customer satisfaction. In 2024, their expanded digital platforms further complement these centers, streamlining support.

- Global network ensures 24/7 support.

- Multilingual teams assist diverse clientele.

- Focus on responsiveness enhances satisfaction.

- Integrated digital tools bolster service efficiency.

Nippon Express Holdings cultivates deep customer relationships via dedicated account management and co-creation of tailored logistics solutions, particularly within contract logistics. Digital self-service portals are set to handle over 60% of basic support interactions by late 2024, enhancing efficiency. This personalized and integrated approach, supported by global 24/7 assistance, contributed to their JPY 2,709.6 billion net sales for the fiscal year ending March 2024.

| Metric | 2024 Data | Impact on Relationships |

|---|---|---|

| Net Sales (FY2024) | JPY 2,709.6 billion | Reflects successful high-value service delivery. |

| Digital Support Shift | Over 60% by late 2024 | Improves customer convenience and operational focus. |

| Air Freight Volume Growth | 2.5% (early 2024) | Indicates strong demand for specialized services. |

Channels

A primary channel for Nippon Express Holdings is its global direct sales force, comprising dedicated professionals and account executives. This team actively engages with large and medium-sized businesses, understanding complex client needs to present tailored logistics solutions. They are crucial for negotiating significant contracts and managing key corporate accounts, contributing to the company's robust global network which, as of their latest reports, serves clients across over 49 countries and regions. This direct engagement ensures personalized service and secures high-value freight forwarding and supply chain management deals.

Nippon Express Holdings utilizes its vast global network of local offices as a critical sales and service channel. As of 2024, this extensive physical presence, reaching numerous countries and regions, facilitates direct customer engagement and personalized support. These local branches offer specialized expertise, fostering trust and accessibility within diverse markets. This localized approach ensures efficient service delivery and strong client relationships worldwide, anchoring their global logistics operations.

The corporate website and dedicated customer portals serve as crucial online digital platforms for Nippon Express Holdings. These channels facilitate lead generation, provide comprehensive service information, and enable direct customer interactions. Customers can efficiently request quotes, book shipments, and track their cargo in real-time through these digital interfaces. This channel is increasingly vital for enhancing operational efficiency and expanding global reach, reflecting the ongoing digital transformation in logistics.

Strategic Alliances and Referrals

Nippon Express strategically cultivates partnerships with various service providers, including specialized consulting firms and industry-specific suppliers, establishing robust referral channels. These alliances enable partners to directly recommend Nippon Express’s comprehensive logistics and supply chain solutions to their own client bases, fostering trust and generating high-quality leads. This approach grants Nippon Express access to new market segments and qualified prospects, enhancing their client acquisition efforts. For instance, in 2024, such collaborations contributed to expanding their global footprint, particularly in key regions like Asia and Europe where complex supply chains demand integrated solutions.

- Nippon Express leverages strategic alliances with consulting firms and industry suppliers for client referrals.

- Partners recommend Nippon Express services to their existing clients, accessing qualified leads.

- This model supports market penetration and client base expansion in targeted sectors.

- Such partnerships are crucial for growth, exemplified by 2024 global network enhancements.

Industry Conferences and Trade Shows

Nippon Express Holdings leverages industry conferences and trade shows as a crucial channel for business development. Participation in major logistics and supply chain events, such as the 2024 Transport Logistic in Munich or various regional freight forwarder summits, allows them to showcase their extensive global network and specialized services, including temperature-controlled solutions and cross-border e-commerce logistics. This direct engagement fosters new business leads and strengthens existing client relationships.

These platforms are vital for enhancing brand visibility and networking within the competitive global logistics landscape, which saw an estimated 2024 market value exceeding $12 trillion. Such events provide invaluable opportunities to discuss innovative solutions like their NX-Eco-Line, promoting sustainable logistics practices.

- Directly engages potential clients and partners for new business generation.

- Showcases specialized logistics capabilities and global network reach.

- Enhances brand visibility and market presence in a competitive sector.

- Facilitates networking and discussions on industry trends and sustainable practices.

Nippon Express employs a multi-faceted channel strategy, leveraging its global direct sales force and extensive network of local offices for personalized customer engagement across over 49 countries. Digital platforms, including their corporate website and customer portals, provide efficient online services for quotes and tracking. Strategic partnerships and participation in major 2024 industry events further expand their reach and generate new business opportunities.

| Channel Type | Primary Function | 2024 Reach/Impact |

|---|---|---|

| Direct Sales Force | Key Account Management | Global presence in 49+ countries |

| Local Offices | Personalized Local Support | Extensive physical network worldwide |

| Digital Platforms | Online Service & Tracking | Enhanced operational efficiency, global access |

| Strategic Partnerships | Referrals & Market Access | Expanded footprint in Asia, Europe |

| Industry Events | Brand Visibility & Leads | Participation in events like 2024 Transport Logistic |

Customer Segments

Large Multinational Corporations (MNCs) represent a core customer segment for NIPPON EXPRESS HOLDINGS, seeking sophisticated global supply chain management. These large entities, often from the automotive, electronics, and retail sectors, require integrated, high-volume, end-to-end logistics solutions. NIPPON EXPRESS HOLDINGS' network, spanning over 49 countries and regions as of 2024, supports their complex distribution needs. Many MNCs engage in long-term contract logistics, ensuring consistent freight movement, with global air cargo volumes showing resilience, for instance, up 11% year-over-year in February 2024. This segment values reliability and efficiency in navigating intricate international trade flows.

Nippon Express Holdings caters to the demanding automotive industry, serving original equipment manufacturers (OEMs) and their extensive network of Tier 1, 2, and 3 suppliers globally. This specialized segment relies on precise just-in-time (JIT) parts delivery, minimizing inventory and maximizing production efficiency. Services extend to finished vehicle logistics and managing intricate inbound supply chains for components, which is crucial given the automotive sector's estimated global production of over 90 million vehicles in 2024. This customer group requires exceptional precision, unwavering reliability, and specialized handling expertise to maintain seamless operations.

The Pharmaceutical & Healthcare Sector represents a crucial customer segment for NIPPON EXPRESS HOLDINGS, encompassing pharmaceutical manufacturers and medical device companies that demand highly specialized and regulated logistics. This group relies heavily on services like temperature-controlled transportation, often referred to as cold chain logistics, secure handling, and strict compliance with Good Distribution Practices (GDP). With the global pharmaceutical logistics market projected to continue its robust growth in 2024, emphasizing high-value, high-stakes shipments, Nippon Express has strategically expanded its GDP-compliant facilities, including new cold chain hubs. This focus addresses the critical need for reliable and compliant distribution for sensitive medical products, supporting a sector valued for its precision requirements.

Electronics & High-Tech Companies

Electronics and high-tech companies, manufacturing and distributing consumer electronics, semiconductors, and components, form a critical customer segment. These firms demand secure, anti-static environments and efficient global distribution to manage short product lifecycles, often less than 12 months for new devices. Supply chain velocity and security are paramount, with the global semiconductor market projected to reach approximately $611 billion in 2024, highlighting the scale of logistics required.

- Secure, anti-static logistics environments are essential for sensitive components.

- Efficient global distribution supports rapid product lifecycles and market entry.

- Supply chain velocity is crucial, especially for high-value, time-sensitive shipments.

- Ensuring security mitigates risks of intellectual property theft and damage.

Small and Medium-Sized Enterprises (SMEs)

Nippon Express Holdings actively serves Small and Medium-Sized Enterprises, especially those expanding into international trade. These businesses often lack dedicated in-house logistics expertise, relying on Nippon Express for crucial freight forwarding and customs clearance. The company provides essential advisory services, guiding SMEs through complex global supply chains. In 2024, the global SME market continues to expand its cross-border activities, making this segment a key focus for integrated logistics providers.

- SMEs engage Nippon Express for international trade support.

- They depend on external expertise for logistics and customs.

- Advisory services are critical for their global expansion.

- Digital channels and local offices facilitate their reach.

Nippon Express Holdings serves a broad spectrum of clients, from large multinational corporations and automotive OEMs requiring complex global supply chain management to specialized pharmaceutical firms needing cold chain logistics. The company also supports electronics and high-tech companies with secure, anti-static environments, alongside small and medium-sized enterprises seeking international trade and customs expertise. This diverse customer base, with distinct needs, underpins the company’s comprehensive service offerings.

| Customer Segment | Key Need | 2024 Market Context |

|---|---|---|

| MNCs | Integrated global logistics | Global air cargo up 11% (Feb 2024) |

| Automotive | JIT parts, finished vehicle logistics | Global production >90M vehicles (2024) |

| Pharma & Healthcare | Temperature-controlled, GDP compliance | Robust growth in global pharma logistics |

| Electronics & High-Tech | Secure, fast global distribution | Semiconductor market ~$611B (2024) |

| SMEs | International trade & customs support | Expanding cross-border activities |

Cost Structure

Transportation and freight costs represent Nippon Express Holdings' single largest expense, directly covering payments to air, ocean, and land carriers for moving goods. These costs are highly variable, significantly influenced by global fuel prices, such as the Brent crude oil price fluctuations seen in 2024, and dynamic cargo capacity. Managing these substantial outlays, which are also affected by specific trade lane demand and geopolitical factors impacting shipping routes, is absolutely critical to maintaining profitability. Effective cost control measures are continuously vital for their operational efficiency.

As a service-based company, NIPPON EXPRESS HOLDINGS' employee salaries and benefits represent a substantial part of its cost structure. This includes compensation for a wide array of essential roles, from logistics operators and truck drivers to sales professionals and senior management. Investing in skilled labor is crucial for maintaining high service quality and operational efficiency. For the fiscal year ending March 31, 2024, personnel expenses were a significant component of their overall operating costs, reflecting the company's reliance on its global workforce.

Nippon Express Holdings incurs significant facility operating costs from its vast global network, which includes owning and leasing numerous warehouses, distribution centers, and offices. These expenses cover essential outlays like rent, utilities, maintenance, and security for their physical assets worldwide. Given the sheer scale of their operations, with over 780 locations in Japan and 498 locations overseas as of March 2024, these costs represent a major component of both their fixed and semi-variable expenditures, crucial for maintaining their logistics infrastructure.

Investment in Technology & IT Infrastructure

Significant capital is allocated to developing, implementing, and maintaining advanced logistics technology. This includes software licensing for Transport Management Systems (TMS) and Warehouse Management Systems (WMS), hardware upgrades, and robust cybersecurity measures. Investment in R&D for new digital solutions, like AI-driven route optimization, is critical for Nippon Express to maintain competitiveness. This expenditure is a growing area, reflecting the industry's shift towards digital transformation, with projected global logistics IT spending reaching approximately 107 billion USD in 2024.

- Nippon Express prioritizes IT investments for operational efficiency.

- Software licensing for TMS/WMS is a core expenditure.

- Cybersecurity and hardware upgrades are essential for infrastructure.

- R&D in AI and automation is crucial for future competitiveness.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for NIPPON EXPRESS HOLDINGS cover essential operational costs not directly tied to specific logistics services. This includes significant spending on marketing and advertising campaigns to maintain market presence, alongside corporate overhead, legal fees, and salaries for administrative staff. These expenditures are crucial for supporting the overall growth and governance of the organization, ensuring smooth operations beyond direct service delivery.

For the fiscal year ending March 31, 2024, NIPPON EXPRESS HOLDINGS reported SG&A expenses impacting their overall profitability, reflecting their investment in corporate infrastructure and market outreach.

- Marketing and advertising costs support global brand visibility.

- Corporate overhead includes executive salaries and office management.

- Legal fees ensure compliance and manage contractual obligations.

- Administrative staff salaries underpin daily corporate functions.

Nippon Express Holdings' cost structure is primarily driven by variable transportation and freight expenses, heavily influenced by global fuel prices and dynamic cargo capacity in 2024. Significant fixed costs stem from its vast global facility network, including over 780 locations in Japan, and substantial personnel expenses for its workforce. Increasing investments in advanced logistics technology and crucial SG&A expenses for market presence further define their operational outlays.

| Cost Type | Key Driver | Impact |

|---|---|---|

| Transportation | Fuel Prices | High Variable |

| Personnel | Global Workforce | Substantial Fixed |

| Facilities | Network Scale | Major Fixed |

Revenue Streams

NIPPON EXPRESS HOLDINGS generates substantial revenue through fees for managing and arranging international transportation of goods via air and sea. These charges are typically calculated per-shipment, varying based on factors like weight, volume, and specific trade lanes. This constitutes the core of their traditional logistics business, contributing significantly to their consolidated operating revenue, which reached approximately JPY 2.64 trillion for the fiscal year ending March 31, 2024.

Contract Logistics Services represent a significant and expanding revenue stream for NIPPON EXPRESS HOLDINGS, stemming from long-term agreements to manage clients entire supply chain functions. This provides a highly predictable and recurring income, often structured on a fixed management fee or a cost-plus basis. These critical contracts frequently span multiple years, ensuring stable cash flow. For instance, the company reported strong performance in its global logistics segment, which includes contract logistics, contributing significantly to its projected operating revenue of approximately 2,600 billion JPY for the fiscal year ending March 2024. This consistent service model is vital for their sustained growth.

Nippon Express Holdings generates revenue through warehousing and distribution fees by offering storage, inventory management, and order fulfillment at its global facilities. Fees are typically structured based on space utilization, such as per pallet per day, and transaction volumes like per pick or per pack. This segment significantly complements their core freight services, enhancing their integrated logistics solutions. For the fiscal year ending March 2024, their logistics business, including warehousing, contributed substantially to overall revenue, demonstrating its critical role.

Value-Added Service Charges

Nippon Express Holdings generates significant additional revenue by offering a suite of specialized services beyond basic transportation. This includes essential customs brokerage fees, cargo insurance arrangement, and specialized packaging solutions. These value-added services, which also encompass supply chain consulting, typically carry higher margins and deepen customer relationships.

- In the fiscal year ending March 2024, Nippon Express reported consolidated operating revenues of JPY 2,572.2 billion.

- Value-added services contribute to higher profitability per shipment compared to standard freight.

- Customs brokerage revenue increased due to rising international trade volumes in 2024.

- Demand for specialized packaging solutions grew, particularly for high-value and sensitive goods.

Land Transport & Last-Mile Delivery

Nippon Express Holdings generates substantial revenue from its land transport and last-mile delivery services, encompassing both domestic and cross-border trucking operations. These services are vital, functioning either as standalone offerings or as integrated components of larger international shipments. This revenue stream is crucial for providing true door-to-door solutions for clients. It forms a key component of the company's comprehensive contract logistics business, supporting a seamless supply chain. In the fiscal year ended March 31, 2024, domestic logistics, which includes land transport, contributed significantly to the company's overall revenue.

- Revenue from domestic and cross-border trucking and delivery services.

- Services can be standalone or integrated into international shipments.

- Critical for providing true door-to-door solutions for customers.

- A key component of Nippon Express Holdings' contract logistics offerings.

Nippon Express Holdings primarily generates revenue from international freight forwarding fees and predictable income from long-term contract logistics. Warehousing and distribution fees contribute significantly, complementing their integrated solutions. Specialized services, including customs brokerage and packaging, offer higher margins. Land transport and last-mile delivery complete their comprehensive door-to-door offerings, contributing to the JPY 2,572.2 billion consolidated operating revenue for fiscal year 2024.

| Revenue Stream | Primary Basis | FY2024 Impact |

|---|---|---|

| International Freight | Per-shipment fees | Core revenue contributor |

| Contract Logistics | Long-term fixed fees | Stable, recurring income |

| Warehousing/Distribution | Space/transaction fees | Integral to overall logistics |

| Specialized Services | Value-added fees | Higher margins, deepened relationships |

Business Model Canvas Data Sources

The Business Model Canvas for NIPPON EXPRESS HOLDINGS is built upon a foundation of comprehensive financial disclosures, extensive market research reports, and internal operational data. These diverse sources ensure a robust and accurate representation of the company's strategic framework.