NCR Voyix SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NCR Voyix Bundle

NCR Voyix, a leader in digital transformation, possesses significant strengths in its diversified service offerings and established customer base. However, it faces challenges from intense market competition and the need for continuous technological innovation to maintain its edge.

Understanding these dynamics is crucial for anyone looking to invest, partner, or compete in this space. Our comprehensive SWOT analysis delves deeper into these factors, providing a clear picture of NCR Voyix's strategic landscape.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NCR Voyix boasts strong brand recognition and market leadership across retail, restaurant, and banking sectors, leveraging over 140 years of experience. This deep history establishes the company as a premier expert in enterprise technology solutions. Their strategic go-to-market approach helps maintain a vast customer base, including a significant portion of top global retailers and financial institutions. As of early 2025, this reputation continues to attract high-value engagements, cementing their position in the enterprise technology landscape.

NCR Voyix is successfully transitioning towards a robust software-as-a-service (SaaS) and recurring revenue model. In the first quarter of 2025, recurring revenue impressively constituted 66% of total revenue, demonstrating a strategic shift away from volatile hardware sales. This focus on platform-led growth is highlighted by a 27% year-over-year increase in platform sites. This provides greater revenue stability and predictability, enhancing long-term financial performance. The company's pivot to subscription-based services strengthens its market position.

NCR Voyix offers comprehensive solutions, including point-of-sale systems, self-service kiosks, and payment processing, supported by robust service offerings across retail and hospitality. The company demonstrates a strong commitment to innovation, with R&D investments totaling approximately $180 million in 2023, expected to continue into 2024. This focus includes significant advancements in artificial intelligence to meet evolving consumer demands for efficiency and personalization. Such strategic investment enhances its market position, delivering integrated and future-ready platforms.

Strong Position in Key Growth Verticals

NCR Voyix maintains a strong leadership position within the restaurant and retail technology markets, serving a significant majority of top global restaurant brands. Its platform processes an immense volume of transactions, showcasing deep industry expertise to deliver tailored solutions for core sector challenges and opportunities. For instance, the company reported over 2.5 billion consumer transactions processed annually through its point-of-sale systems as of early 2024, highlighting its pervasive market penetration.

- Dominates restaurant and retail tech, supporting over 100,000 retail sites globally.

- Processes billions of transactions yearly, demonstrating robust platform scale.

- Provides specialized solutions, leveraging extensive industry knowledge.

Strategic Partnerships and Integrations

NCR Voyix actively builds strategic partnerships to enhance its market reach and solution portfolio. Collaborations, like the integration with GRUBBRR for the Aloha Kiosk, allow NCR Voyix to deliver advanced self-ordering and payment solutions, expanding capabilities for quick-service restaurants. These alliances are crucial for addressing diverse customer needs and fostering innovation. Such partnerships contribute significantly to NCR Voyix's ecosystem, which served over 100,000 retail and hospitality sites globally as of early 2025.

- Expanded solution set: Partnerships integrate new functionalities, like AI-driven ordering.

- Increased market penetration: Access to new customer segments and industries is facilitated.

- Enhanced R&D efficiency: Collaborations reduce internal development costs and time.

- Strengthened competitive position: A broader, more integrated offering attracts and retains clients.

NCR Voyix maintains a solid financial position, reflected by its strong cash flow generation and strategic capital allocation. For fiscal year 2024, the company projected adjusted free cash flow between $200 million and $225 million, demonstrating robust operational efficiency. This financial strength supports ongoing investments in innovation and market expansion, reinforcing its long-term viability.

| Metric (FY 2024 Proj.) | Value | Significance |

|---|---|---|

| Adjusted Free Cash Flow | $200M - $225M | Supports reinvestment & growth |

| Recurring Revenue (Q1 2025) | 66% of total | Enhances revenue predictability |

| Platform Sites (YoY Growth) | +27% | Indicates strong adoption |

What is included in the product

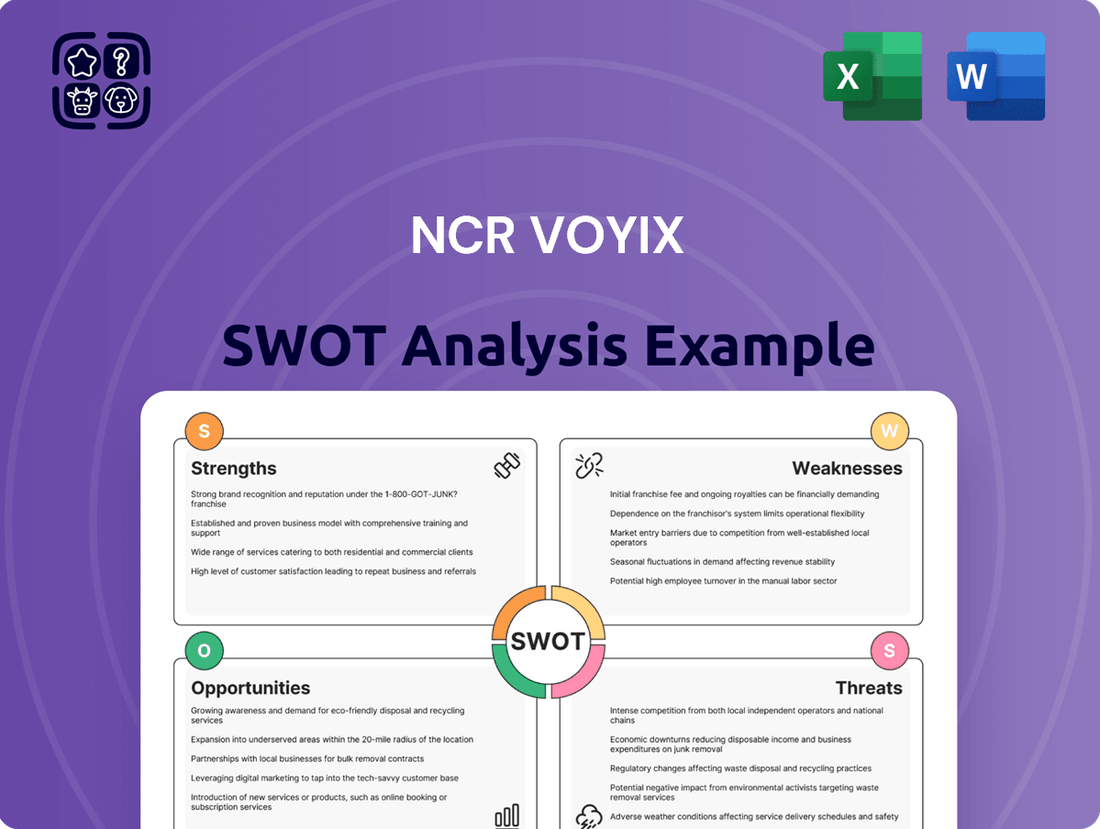

Delivers a strategic overview of NCR Voyix’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines complex competitive analysis by consolidating NCR Voyix's strengths, weaknesses, opportunities, and threats into a single, digestible view.

Weaknesses

NCR Voyix has experienced a notable decline in its total revenue, primarily driven by a sharp fall in hardware sales. For the full year 2024, the company's revenue decreased by 11%. This downward trend continued into the first quarter of 2025, showing a further 13% drop in revenue. This highlights significant challenges in its strategic transition away from legacy hardware. The persistent decline indicates a hurdle in maintaining financial stability during this pivotal shift.

Despite a strategic pivot, NCR Voyix’s business remains significantly tied to its hardware segment, which faces ongoing market pressures. The company is actively outsourcing its hardware design and manufacturing, a transition carrying inherent risks, including uncertainties around future revenue recognition. This dependency creates vulnerability to competitive dynamics and broader market fluctuations in 2024. Hardware sales are still projected to contribute a notable portion of total revenue, impacting overall financial stability.

NCR Voyix has undergone substantial restructuring, including the sale of its Digital Banking division, which was completed in October 2023, generating significant capital. While these efforts have improved profitability, contributing to a reported 2024 adjusted EBITDA outlook of $740 million to $780 million, they also highlight persistent operational challenges. The company continues to streamline its core business and transition towards an outsourced hardware model, which introduces new operational complexities. This ongoing transformation, while strategic, reflects the need for greater internal efficiencies.

Geographic and Macroeconomic Sensitivities

As a global entity, NCR Voyix is highly exposed to risks stemming from geopolitical instability and macroeconomic factors. Elevated inflation, which saw U.S. CPI at 3.4% year-over-year in December 2023, and currency fluctuations directly impact consumer spending and business investment in its key markets. These pressures are particularly evident in the restaurant and retail sectors, where rising prices can curb discretionary spending. A 2024 outlook suggests continued caution in consumer behavior due to persistent inflationary environments, potentially affecting NCR Voyix's transaction volumes and software subscriptions.

- Inflationary pressures: U.S. CPI at 3.4% year-over-year (December 2023) directly impacts consumer and business spending.

- Currency volatility: Fluctuations against the USD can reduce reported international revenues and profitability.

- Geopolitical instability: Conflicts or trade disputes in key regions disrupt supply chains and market demand.

- Consumer spending caution: Expected continued caution in 2024 due to economic uncertainties affects retail and hospitality segments.

Integration Challenges of New Platforms

While NCR Voyix's push towards new cloud-native platforms and payment initiatives is a key opportunity, analysts voice concern over the timeline and financial impact of these integrations. Ensuring a seamless transition and demonstrating a clear return on significant investments, potentially exceeding $100 million in 2024-2025 for platform modernization, will be critical.

The inherent complexity of integrating advanced technologies across a diverse global customer base presents a notable challenge to achieving projected efficiencies and timely deployment.

- Projected integration timelines often extend 12-18 months, impacting immediate revenue recognition.

- Potential for increased operational expenditures due to parallel system maintenance during transitions.

- Risk of customer disruption during migrations, affecting client retention metrics.

NCR Voyix faces persistent revenue decline, with total revenue down 11% in 2024 and 13% in Q1 2025, driven by hardware sales. Its ongoing hardware outsourcing introduces revenue recognition uncertainties and operational complexities. Significant investments, potentially over $100 million in 2024-2025, for platform modernization pose integration and timeline risks.

| Metric | 2024 | 2025 (Q1) |

|---|---|---|

| Total Revenue Change | -11% | -13% |

| Platform Modernization Investment | >$100M | >$100M |

| US CPI (Dec 2023) | 3.4% | N/A |

What You See Is What You Get

NCR Voyix SWOT Analysis

This preview reflects the real NCR Voyix SWOT analysis document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout. This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

The global demand for digital commerce and integrated payment solutions presents a significant opportunity for NCR Voyix. The company is well-positioned to capitalize on this trend by expanding its platform-based SaaS and payment services. Projections indicate the digital payments market could reach $19.89 trillion by 2025, underscoring this growth. NCR Voyix plans to launch new cloud-native platforms and payment initiatives later in 2025, which are expected to drive substantial future revenue growth and market share.

The increasing consumer preference for self-service options, such as self-checkout and kiosks, presents a significant opportunity for NCR Voyix. A 2025 report highlights that 77% of shoppers now favor self-checkout for its speed and convenience. NCR Voyix can capitalize on this trend by expanding its innovative portfolio of self-service and automation technologies. This directly addresses the rising demand from retailers and restaurants seeking efficient, customer-centric solutions to enhance operational flow and reduce labor costs.

NCR Voyix can significantly leverage the vast data volume generated across its retail and hospitality platforms. This presents a prime opportunity to offer advanced analytics and AI-driven insights, meeting the growing demand from retailers. By 2025, the global retail analytics market is projected to reach approximately $11.5 billion, as businesses prioritize data for true omnichannel experiences and customer personalization. This empowers clients to optimize operations, enhance customer loyalty, and drive sales effectively. Implementing AI for demand forecasting or personalized promotions, for instance, can yield tangible revenue growth.

International Market Expansion

NCR Voyix, with its significant global footprint, has a strong opportunity to expand further into burgeoning emerging markets. By tailoring its digital commerce and banking solutions to specific local needs and regulatory frameworks, such as those in Southeast Asia or Latin America which project substantial digital transformation growth through 2025, the company can unlock new revenue streams. This strategic geographic diversification lessens dependence on mature markets, mitigating regional economic volatility and strengthening its global market share. Focusing on regions expected to see significant fintech and retail tech adoption, NCR Voyix can capitalize on unaddressed demand.

- Emerging markets like India and Brazil are forecasted to experience robust growth in digital payments and retail technology adoption, exceeding 15% annually through 2025.

- Customized solutions for localized payment methods and regulatory compliance can significantly boost market penetration.

- Diversification reduces exposure to economic downturns in any single geographic area, enhancing overall resilience.

- Expanding into new regions offers access to a larger customer base, potentially increasing NCR Voyix's total addressable market by over 20%.

Strategic Acquisitions and Alliances

NCR Voyix can strategically pursue acquisitions and partnerships to broaden its technology portfolio, particularly in areas like AI-driven commerce solutions and digital payment platforms. Collaborations with fintech innovators, for instance, can accelerate the development of new offerings, enhancing its competitive stance in the evolving digital commerce landscape. This strategy provides access to new customer bases and drives innovation. For example, expanding its partner ecosystem could target a 15-20% increase in recurring revenue streams by late 2025.

- Potential 2024-2025 acquisitions could target companies specializing in unified commerce platforms or advanced analytics.

- Strategic alliances may focus on expanding into new regional markets, leveraging local expertise and customer networks.

- Partnerships with emerging tech firms could introduce cutting-edge solutions, boosting NCR Voyix's market share in specific segments.

NCR Voyix is positioned to capitalize on the digital payments market, projected to reach $19.89 trillion by 2025, and increasing demand for self-service options, favored by 77% of shoppers. Expansion into high-growth emerging markets like India and Brazil, which are forecasted to exceed 15% annual growth through 2025, offers significant revenue diversification. Furthermore, leveraging data for AI-driven insights, with the retail analytics market reaching $11.5 billion by 2025, presents a major opportunity for enhanced client value.

| Opportunity | Market Size (2025) | Growth Driver |

|---|---|---|

| Digital Payments | $19.89 Trillion | Platform-based SaaS expansion |

| Self-Service Solutions | 77% shopper preference | Increased automation adoption |

| Emerging Markets | >15% Annual Growth | Geographic diversification, new revenue |

Threats

NCR Voyix navigates a highly competitive landscape, facing pressure from specialized technology firms like Toast and Clover, alongside large global players such as Fiserv and Verifone. Competitors aggressively vie for market share in the retail and restaurant technology sectors, particularly in point-of-sale and digital payment solutions. This intense competition necessitates continuous innovation, impacting pricing strategies and potentially eroding market share. For instance, the global POS market, valued at over $19 billion in 2023, is projected to expand, intensifying the battle for new client acquisitions through 2025.

NCR Voyix's performance is highly sensitive to economic conditions, particularly consumer spending in the retail and restaurant sectors. A significant economic downturn, like the cautious consumer sentiment noted in early 2024 with the University of Michigan Consumer Sentiment Index hovering around 69, directly reduces demand for their payment and ATM solutions. High inflation, with the US Consumer Price Index at 3.3% year-over-year in May 2024, compels consumers to cut back on discretionary spending such as dining out. This shift directly impacts transaction volumes and software subscriptions, potentially hindering NCR Voyix's projected 2025 revenue growth and operational efficiency.

As a leading provider of digital commerce and payment solutions, NCR Voyix faces significant cybersecurity threats, making it a prime target for malicious actors.

A major data breach could lead to substantial financial losses, potentially exceeding tens of millions in remediation and fines, alongside severe reputational damage and legal liabilities. For instance, the average cost of a data breach globally reached $4.45 million in 2023, a figure projected to rise in 2024 due to increasing sophistication of attacks.

The company must continually invest heavily in robust security infrastructure and advanced threat detection systems, with cybersecurity spending expected to climb to $215 billion globally in 2024, to protect its sensitive systems and vast customer data against evolving cyber risks.

Dependence on Third-Party Suppliers

NCR Voyix's dependence on third-party suppliers for essential components and software presents a notable threat. Disruptions, such as those seen with global chip shortages impacting 2024 production outlooks, can severely impede product and service delivery. Geopolitical events or trade disputes, like potential tariff escalations, could further increase operational costs and strain supply chains. This reliance necessitates robust risk mitigation strategies to ensure continuity and manage potential tariff-related expenses.

- Global supply chain volatility remains a key concern for tech companies through 2025.

- Potential new tariffs on imported components could elevate hardware costs by 5-10%.

- Geopolitical tensions, particularly in Asia, pose ongoing risks to component availability.

Rapid Technological Change

The technology landscape is characterized by rapid and continuous innovation, posing a significant threat to NCR Voyix. The company must consistently invest in research and development to keep pace with emerging technologies and evolving customer expectations. Failure to innovate or adapt to new trends, such as the accelerating shift away from legacy on-premise systems to cloud-native solutions, could result in a substantial loss of market share. For instance, global IT spending on enterprise software is projected to grow by 13.9% in 2024, emphasizing the rapid pace of digital transformation.

- Cloud migration accelerated, with 2024 seeing heightened demand for SaaS solutions over traditional models.

- R&D investment remains critical; NCR Voyix allocated approximately $130 million in Q1 2024 to enhance its software and services portfolio.

- Customer expectations increasingly favor AI-driven personalization and seamless digital experiences across retail and banking.

- The market for self-service kiosks and POS systems is experiencing disruption from mobile-first solutions and integrated platforms by 2025.

Intense competition and economic sensitivity, evidenced by May 2024 US CPI at 3.3%, pose significant threats to NCR Voyix's market share and 2025 revenue. Cybersecurity risks remain critical, with average breach costs exceeding $4.45 million in 2023, demanding continuous security investment. Supply chain reliance and rapid technological shifts, including the accelerating cloud migration, necessitate substantial R&D (Q1 2024 R&D at ~$130 million) to avoid market share erosion.

| Threat Category | Key Metric/Data (2024/2025) | Potential Impact |

|---|---|---|

| Competitive Pressure | Global POS Market >$19B (2023, expanding 2025) | Market share erosion, pricing pressure |

| Economic Sensitivity | US CPI 3.3% (May 2024), Consumer Sentiment ~69 (early 2024) | Reduced transaction volumes, hindered revenue growth |

| Cybersecurity Risks | Avg. Data Breach Cost $4.45M (2023), Global Cybersecurity Spending $215B (2024) | Financial losses, reputational damage, legal liabilities |

| Technological Disruption | IT Spending on Enterprise Software +13.9% (2024), NCR Voyix R&D ~$130M (Q1 2024) | Loss of relevance, market share if innovation lags |

SWOT Analysis Data Sources

This NCR Voyix SWOT analysis is constructed using verified financial statements, comprehensive market intelligence reports, and expert industry analyses to provide a robust and data-driven perspective.