NCR Voyix Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NCR Voyix Bundle

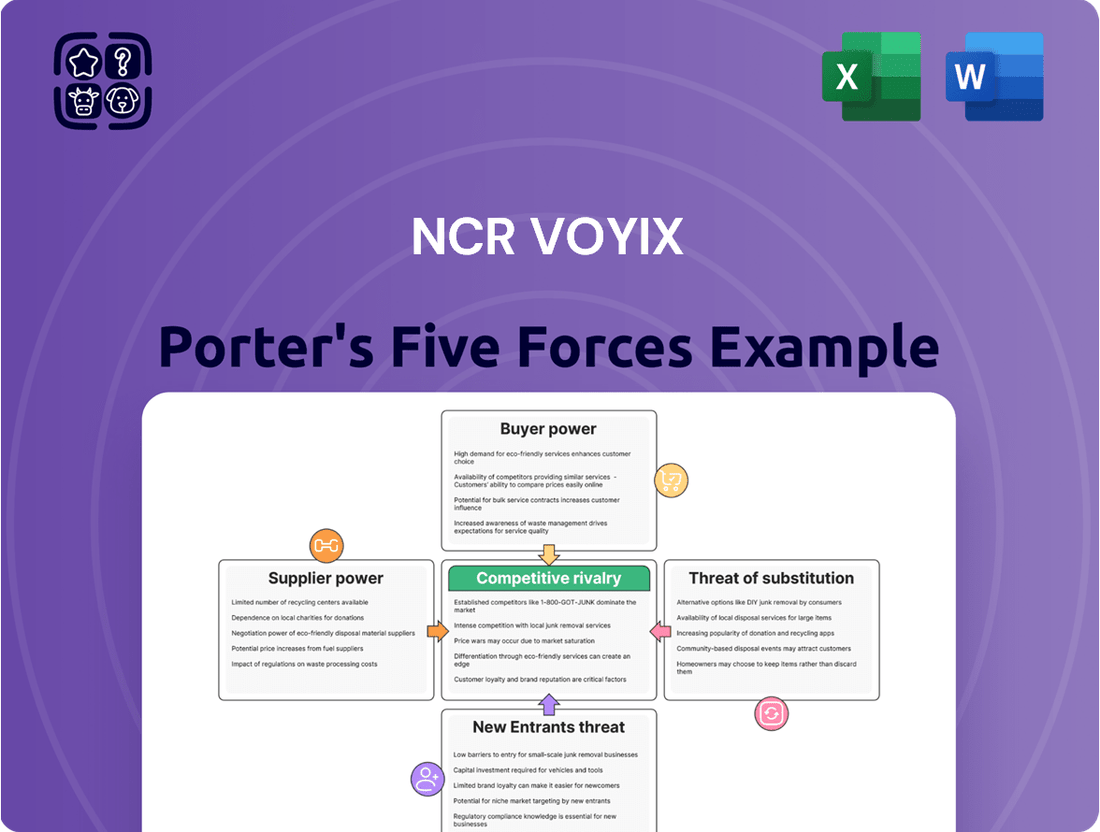

NCR Voyix operates in a dynamic landscape shaped by significant competitive forces. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore NCR Voyix’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

NCR Voyix, a leader in digital transformation solutions for retail and hospitality, depends on a range of suppliers for essential hardware, such as point-of-sale (POS) terminals and self-service kiosks, as well as crucial software licenses and payment network integrations. The concentration of suppliers in these critical areas directly impacts their leverage.

When a small number of suppliers dominate the market for specialized components or unique software, their bargaining power escalates. This is especially pronounced when these suppliers offer proprietary technologies, as the costs and complexities associated with switching to an alternative vendor can be substantial for NCR Voyix, potentially running into millions of dollars in integration and R&D expenses.

The bargaining power of suppliers for NCR Voyix is significantly influenced by switching costs. If NCR Voyix faces high expenses and operational disruptions when changing hardware or software providers, its ability to negotiate favorable terms with existing suppliers diminishes. For instance, integrating new point-of-sale systems or financial software from a different vendor could involve substantial re-engineering, rigorous testing, and extensive employee retraining, thereby empowering current suppliers.

These deeply embedded technological solutions, crucial for NCR Voyix's retail and banking operations, create a lock-in effect. The complexity and cost associated with migrating data, ensuring compatibility, and validating new systems can make switching prohibitively expensive. This reliance on specialized, integrated technology means suppliers of these core components hold considerable leverage in pricing and contract negotiations.

Suppliers might threaten NCR Voyix by moving into its core business, creating their own point-of-sale, kiosk, or payment systems. This forward integration could directly compete with NCR Voyix's offerings.

While component makers are less likely to do this, major software or payment network companies could potentially pose this risk. For instance, if a large cloud provider decided to offer a comprehensive retail management suite, it could challenge NCR Voyix's market position.

This move by suppliers would diminish NCR Voyix's influence over its own value chain and customer relationships. In 2024, the payments industry saw significant investment, with companies like Stripe and Adyen expanding their service portfolios, indicating a trend toward integrated solutions.

Such a strategic shift by a key supplier could force NCR Voyix to adapt its business model or face increased competition, potentially impacting its market share and profitability.

Importance of Supplier Inputs to NCR Voyix's Business

The criticality of the inputs NCR Voyix sources directly influences supplier bargaining power. Essential hardware components for their self-service kiosks, such as specialized screens and processors, along with the core payment processing infrastructure they integrate, are vital to delivering their comprehensive solutions.

Disruptions in the supply chain for these critical components, or significant cost increases from these key suppliers, can directly impact NCR Voyix's operational efficiency and its ability to maintain competitive pricing in the market. For example, a shortage of a specific semiconductor chip used in their kiosks could halt production and delay customer deployments.

NCR Voyix relies on a diverse range of suppliers for its hardware and software solutions, but the concentration of specialized components can shift power. For instance, if only a few manufacturers produce a proprietary chip essential for a particular kiosk model, those suppliers hold considerable leverage.

- Criticality of Inputs: Hardware for self-service kiosks and payment processing infrastructure are indispensable for NCR Voyix's service delivery.

- Supply Chain Vulnerability: Disruptions or cost hikes from these specialized suppliers can materially affect NCR Voyix's operations and pricing strategies.

- Supplier Concentration: Reliance on a limited number of suppliers for unique components amplifies their bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for NCR Voyix. If NCR Voyix can readily find comparable components or software solutions from various providers without a substantial dip in quality or a hike in price, then no single supplier can exert excessive pressure. For instance, in 2024, the widespread adoption of open-source software and modular hardware designs across the retail technology sector means NCR Voyix has a broader array of sourcing options for many of its point-of-sale and back-office systems.

This diversification of input sources directly weakens individual suppliers' leverage. If NCR Voyix can switch between, say, different chip manufacturers or cloud service providers with relative ease, it reduces the risk of a single supplier dictating terms. The market for essential components like processors and memory chips, for example, often features multiple large players capable of meeting demanding specifications, thereby diffusing supplier power.

- Component Availability: In 2024, the semiconductor industry, while facing some supply chain pressures, generally offers multiple vendors for critical components like CPUs and GPUs used in NCR Voyix's hardware solutions.

- Software Alternatives: The growing ecosystem of independent software vendors (ISVs) providing solutions for retail management, payments, and analytics means NCR Voyix isn't solely reliant on proprietary software from a single source.

- Cloud Infrastructure: NCR Voyix's reliance on cloud services can be mitigated by the presence of major providers like AWS, Azure, and Google Cloud, offering competitive pricing and service level agreements.

- Impact on Pricing: A robust market for substitute inputs typically leads to more competitive pricing for NCR Voyix, limiting the ability of any one supplier to command premium rates.

The bargaining power of suppliers for NCR Voyix is moderate, influenced by the critical nature of certain inputs and the presence of substitutes. While proprietary components can increase supplier leverage, the availability of alternatives in areas like cloud services and general hardware components helps to temper this power. In 2024, the tech supply chain saw continued normalization, though geopolitical factors and demand for specific advanced semiconductors still presented occasional challenges.

| Factor | Impact on NCR Voyix | 2024 Trend/Data Point |

|---|---|---|

| Supplier Concentration (Proprietary Tech) | High Leverage for Suppliers | Continued reliance on specialized POS chipsets. |

| Switching Costs | Moderate to High | Integration costs for new payment gateways can exceed $1 million. |

| Availability of Substitutes | Lowers Supplier Leverage | Broad availability of cloud infrastructure providers (AWS, Azure). |

| Forward Integration Threat | Low to Moderate | Major cloud providers expanding into vertical-specific solutions. |

What is included in the product

Tailored exclusively for NCR Voyix, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and address competitive threats with a dynamic, visual representation of all five forces, simplifying strategic planning.

Customers Bargaining Power

NCR Voyix's customer base includes significant players in retail, restaurants, and banking. For instance, Sainsbury's and Golden 1 Credit Union are notable clients, indicating a concentration of business with large enterprises.

When a few of these major customers purchase substantial volumes of NCR Voyix's solutions, they gain considerable bargaining power. This leverage allows them to negotiate for lower prices or request specialized features, particularly if their business represents a significant percentage of NCR Voyix's overall revenue.

While NCR Voyix focuses on integrated solutions, customers experience costs when migrating from one point-of-sale or payment system to another. These switching costs, such as data transfer, staff re-training, and potential business interruptions, can limit a customer's ability to change providers, even if competitors offer lower prices. For example, a restaurant chain upgrading its POS system might face thousands of dollars in data migration and employee training expenses, making them hesitant to switch from NCR Voyix.

Customer price sensitivity is a significant factor influencing NCR Voyix's bargaining power of customers. In sectors like retail and restaurants, where profit margins can be slim, businesses are constantly looking for ways to reduce operational costs. This means they are highly attuned to pricing for point-of-sale systems, payment processing, and other technology solutions.

Given this high price sensitivity, customers are likely to compare offerings from various providers and negotiate aggressively for better terms. For instance, a large retail chain might solicit bids from multiple technology vendors, using the lowest offer as leverage to secure more favorable pricing from NCR Voyix. This competitive landscape directly amplifies the customers' ability to bargain down prices.

In 2024, the ongoing economic pressures and inflation continued to fuel this price sensitivity across NCR Voyix's core markets. Businesses are prioritizing return on investment and operational efficiency, making upfront cost and ongoing service fees critical decision-making factors. This environment empowers customers to demand more value for their money.

Threat of Backward Integration by Customers

Large enterprise customers with substantial IT resources might explore developing their own point-of-sale (POS) or payment processing systems. This potential for backward integration, while a significant undertaking, grants these sophisticated clients increased leverage during negotiations with NCR Voyix. For instance, major retail chains or banking institutions with dedicated technology departments could theoretically build comparable solutions, reducing their reliance on external vendors.

The threat of backward integration by customers is a key aspect of bargaining power. It directly influences pricing and contract terms. Consider that in 2024, many large enterprises are prioritizing digital transformation and may have the internal expertise to develop proprietary solutions, especially if they feel current offerings are not meeting their specific, evolving needs or if they seek greater cost control.

- Significant IT investment by large enterprises can enable them to develop in-house POS and payment solutions.

- This capability provides sophisticated customers with increased negotiation power against vendors like NCR Voyix.

- Retail and financial sectors are prime examples where such in-house development might be considered.

- The ongoing trend of digital transformation in 2024 fuels the potential for customer backward integration.

Availability of Substitute Products/Services

The availability of numerous substitute products and services significantly amplifies customer bargaining power. Businesses seeking Point of Sale (POS) systems, self-service kiosks, or payment processing solutions have a wide array of alternatives. This includes direct competitors offering similar hardware and software, as well as different technological approaches that can fulfill the same core needs.

Customers can easily switch to or adopt simpler, less integrated solutions. For instance, many businesses can opt for basic mobile payment applications or cloud-based POS software that may not offer the full suite of services NCR Voyix provides. This ease of finding comparable functionality from other vendors or entirely different methods puts considerable pressure on NCR Voyix to actively differentiate its offerings, perhaps through superior integration, advanced analytics, or enhanced customer support.

- High Availability of Substitutes: The market for retail technology solutions, including POS and self-service, is highly competitive, with numerous players offering comparable functionalities.

- Low Switching Costs: For many businesses, the cost and effort associated with switching from one POS or payment provider to another are relatively low, especially for less complex solutions.

- Emergence of Niche Providers: Smaller, specialized companies often emerge, offering targeted solutions that can directly compete with specific aspects of NCR Voyix's broader portfolio.

- Digitalization Trends: The increasing adoption of digital payment methods and mobile-first strategies by consumers creates opportunities for alternative payment processing solutions that bypass traditional POS hardware.

NCR Voyix's customers, particularly large enterprises in retail and banking, wield significant bargaining power. This is due to their substantial purchase volumes and the costs associated with switching providers, which, while present, are often outweighed by the potential for better pricing from competitors. In 2024, economic pressures intensified this, making customers highly price-sensitive and driving negotiations for more favorable terms.

The potential for large clients to develop proprietary systems internally, a trend bolstered by digital transformation initiatives in 2024, further enhances their leverage. This threat of backward integration means NCR Voyix must continually demonstrate superior value to retain these key accounts. The ease with which customers can access numerous substitute solutions also compels NCR Voyix to maintain competitive pricing and offer differentiated services to mitigate customer power.

| Factor | Impact on NCR Voyix | 2024 Context |

|---|---|---|

| Customer Concentration | High power for large clients like Sainsbury's. | Major clients' revenue share remains critical for negotiation leverage. |

| Switching Costs | Limits customer power if high, but can be overcome. | Businesses weigh migration costs against long-term savings, especially in a cost-conscious 2024. |

| Price Sensitivity | Customers actively seek lower prices. | Inflation in 2024 amplified the focus on ROI and operational cost reduction. |

| Backward Integration Threat | Customers can potentially build in-house solutions. | Digital transformation efforts in 2024 enable more clients to explore proprietary development. |

| Availability of Substitutes | Customers have many alternatives, increasing power. | A competitive market in 2024 offers diverse options from niche providers to cloud-based solutions. |

What You See Is What You Get

NCR Voyix Porter's Five Forces Analysis

This preview showcases the complete NCR Voyix Porter's Five Forces Analysis, reflecting the exact document you'll receive immediately after purchase. You're viewing the meticulously researched and formatted analysis detailing the competitive landscape, including threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products. This comprehensive report is ready for your immediate use upon completion of your transaction, offering no surprises or placeholders.

Rivalry Among Competitors

The digital commerce solutions market, including point-of-sale (POS) systems, self-service kiosks, and payment processing, is intensely competitive. NCR Voyix contends with a vast array of companies, from global tech giants to niche startups, all vying for market share.

This competitive landscape is characterized by significant diversity, with competitors offering specialized solutions or broader integrated platforms. For instance, companies like Oracle, Square, and Verifone represent different facets of this competitive spectrum, each with distinct strengths and market focuses.

Globally, NCR Voyix faces rivals that range from established payment processors to emerging fintech innovators. This broad mix means that competitive pressures can arise from various angles, whether it's price competition from smaller vendors or technological innovation from larger players.

The sheer number of players ensures a dynamic environment where differentiation and continuous innovation are crucial. In 2024, the market continues to see consolidation and new entrants, highlighting the ongoing intensity of rivalry.

The point-of-sale (POS) terminal and self-service kiosk markets are expanding robustly. Analysts project the global POS terminal market to reach $129.1 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.2% from 2023.

Similarly, the self-service kiosk market is expected to hit $40.5 billion by 2030, with a CAGR of 6.8% between 2023 and 2030. This strong industry growth offers opportunities for players like NCR Voyix.

However, this expansion also attracts new entrants and encourages existing competitors to innovate rapidly. Rapid technological advancements, such as AI integration and contactless payments, and evolving consumer demands for seamless experiences intensify the competition for market share.

Even with a growing market, companies must constantly differentiate themselves through product features, pricing, and customer service to maintain a competitive edge.

Competitive rivalry in the retail technology sector is intense, driven by a constant push for product differentiation and innovation. Companies are vying to offer advanced software features, robust cloud-based platforms, and cutting-edge AI integration. NCR Voyix, for example, is focusing on its platform-led Software-as-a-Service (SaaS) model and strategic partnerships to build unique value propositions for its clients.

The market demands seamless user experiences and comprehensive omnichannel support, pushing all players to invest heavily in research and development. Competitors are not standing still; they are also pouring resources into innovation to capture market share and set themselves apart. This dynamic environment means that staying ahead requires continuous adaptation and the introduction of novel solutions.

Exit Barriers

NCR Voyix faces intense competitive rivalry partly due to high exit barriers within the financial technology and retail solutions sectors. Specialized assets, like proprietary software platforms and extensive hardware installation bases, make it difficult and costly for companies to divest or exit the market gracefully. For instance, the significant investments in developing and maintaining complex payment processing systems and self-checkout hardware represent substantial sunk costs.

These high exit barriers compel even weaker competitors to remain active, often leading to aggressive pricing strategies and promotional activities to simply stay afloat. This prolonged presence of struggling firms intensifies the battle for market share, directly impacting NCR Voyix's profitability and strategic flexibility.

- Specialized Assets: Companies in this space often have unique hardware and software that are not easily transferable or sold off, trapping them in the market.

- Long-Term Contracts: Many clients are tied to multi-year service and support agreements, preventing quick exits for providers.

- R&D and Infrastructure Costs: Billions are invested in research and development for new payment technologies and maintaining global infrastructure, creating significant financial commitment.

Strategic Commitments and Market Dominance

The competitive rivalry within the Point of Sale (POS) and digital commerce solutions market is intense, with NCR Voyix holding a significant global leadership position. As the largest supplier of POS software worldwide, particularly dominant in the grocery and hospitality sectors, NCR Voyix faces constant pressure from rivals seeking to capture market share. This dynamic necessitates continuous strategic maneuvering to maintain its leading edge.

Competitors frequently employ aggressive tactics such as forming strategic partnerships, pursuing acquisitions, and engaging in price wars to challenge NCR Voyix's established dominance. For instance, in 2024, the retail technology landscape saw ongoing consolidation and the emergence of specialized players, intensifying the competitive environment. NCR Voyix must therefore remain agile, investing in innovation and customer retention to defend its market leadership.

- Market Share Defense: NCR Voyix, as the global leader in POS software, particularly strong in grocery and hospitality, actively defends its market position against numerous competitors.

- Aggressive Competitive Tactics: Rivals utilize strategic partnerships, mergers, acquisitions, and competitive pricing to gain ground, forcing NCR Voyix to adapt and innovate continuously.

- Innovation as a Differentiator: To counter competitive pressures, NCR Voyix focuses on developing advanced software solutions and integrated hardware to meet evolving customer demands in digital commerce.

- Evolving Market Landscape: The retail and hospitality technology sectors are characterized by rapid technological advancements and new entrants, demanding constant strategic adjustments from NCR Voyix to maintain its competitive advantage.

NCR Voyix operates in a highly competitive digital commerce and financial solutions market, facing rivalry from global tech giants and specialized startups. This intensity is fueled by rapid technological advancements and evolving consumer expectations for seamless transactions.

The market's growth, with the POS terminal market projected to reach $129.1 billion by 2029 and the self-service kiosk market $40.5 billion by 2030, attracts new entrants and encourages existing players to innovate aggressively. NCR Voyix, as a leader, must continually differentiate through its SaaS model and strategic partnerships.

High exit barriers, including specialized assets and long-term contracts, mean that even struggling competitors remain active, often resorting to aggressive pricing and promotions. This prolongs the battle for market share, impacting profitability and strategic flexibility for NCR Voyix.

| Competitor | Market Focus | 2024 Competitive Actions |

|---|---|---|

| Oracle | Integrated Retail & Hospitality Solutions | Continued expansion of cloud-based offerings and AI-driven analytics. |

| Square (Block) | Small to Medium Business POS & Payment Processing | Focus on ecosystem integration and new financial services for merchants. |

| Verifone | Payment Hardware & Software Solutions | Emphasis on secure, omnichannel payment experiences and new terminal innovations. |

SSubstitutes Threaten

While digital payments are increasingly common, traditional cash and manual processes remain a viable substitute for some businesses, particularly smaller ones or those in less developed areas. These methods, though less efficient and secure, offer a perceived simplicity and lower upfront cost, presenting a low-tech alternative to NCR Voyix's integrated systems.

The persistence of cash transactions, especially in emerging markets, means that a segment of the retail and service industry still operates with these older methods. For instance, in 2024, while digital payment adoption grew, cash still accounted for a significant portion of transactions in certain regions, highlighting the continued presence of this substitute.

These manual systems, while a substitute, lack the data analytics, speed, and integrated inventory management that NCR Voyix provides. The convenience for the business owner is often limited to the initial setup, with operational inefficiencies becoming a drawback compared to modern solutions.

The threat from these substitutes is generally considered low for larger enterprises or those focused on growth and efficiency, as the benefits of digital transformation are clear. However, for niche markets or businesses with very low transaction volumes, the established habit of using cash and manual methods can slow the adoption of more advanced solutions like those offered by NCR Voyix.

Generic payment processing services pose a threat by offering businesses standalone solutions not tied to broader POS or self-service platforms. While these might appear cheaper initially, they often fail to deliver the integrated operational efficiencies and valuable data analytics that NCR Voyix's comprehensive offerings provide. For instance, many smaller merchants might opt for basic payment gateways, potentially impacting the market share of more integrated solutions.

Large enterprises, especially in sectors like banking and retail, may opt for in-house developed solutions. This allows for complete control and tailored customization of point-of-sale (POS) and self-service software. For instance, a major national bank might invest millions in building its own custom ATM software to integrate unique security features and customer experiences, bypassing third-party providers.

While such an undertaking demands significant capital expenditure and specialized talent, it directly competes with NCR Voyix's product suite. This is particularly true for organizations with highly specific operational requirements that off-the-shelf solutions cannot fully address. Developing proprietary systems can cost millions annually in development and maintenance but offers unparalleled operational alignment.

Emerging Technologies and Alternative Payment Methods

The financial services landscape is constantly shifting, with emerging technologies posing a significant threat to traditional payment processing models. Innovations like mobile payment apps, digital wallets such as Apple Pay and Google Pay, and Buy Now, Pay Later (BNPL) services offered by companies like Affirm and Klarna are rapidly gaining traction. These alternatives often provide a more seamless and integrated experience for consumers, potentially diminishing the reliance on physical point-of-sale (POS) systems that NCR Voyix specializes in.

The growing adoption of these digital payment solutions directly challenges the necessity of established hardware and software. For instance, BNPL transactions saw a substantial surge, with reports indicating a significant percentage of consumers using these services for everyday purchases throughout 2024. Cryptocurrencies, while still facing regulatory hurdles, also represent a long-term disruptive force. The ease with which these methods can be integrated into e-commerce platforms and mobile applications means they can bypass traditional payment infrastructure.

- Growth of Digital Wallets: By the end of 2024, it's projected that over 70% of smartphone users in developed markets will utilize mobile payment apps for transactions.

- BNPL Market Expansion: The global Buy Now, Pay Later market was valued in the hundreds of billions of dollars in 2023 and is expected to continue its rapid expansion through 2025.

- E-commerce Integration: Many online retailers are now offering these alternative payment methods as primary checkout options, directly reducing the need for traditional card processing at the point of sale.

- Consumer Preference Shift: Studies in early 2024 indicated a growing preference among younger demographics for frictionless digital payment experiences over traditional methods.

Cloud-Based Software as a Service (SaaS) Alternatives

The threat of substitutes for NCR Voyix's offerings is significant, particularly from cloud-based Software as a Service (SaaS) alternatives. Many businesses, especially small to medium-sized enterprises (SMBs), are gravitating towards purely cloud-based Point of Sale (POS) or commerce software. These solutions often demand minimal upfront hardware investment, making them an attractive, low-barrier-to-entry option. The flexibility and subscription-based nature of these SaaS models, readily available from numerous providers, present a compelling substitute for NCR Voyix's more integrated hardware-software ecosystems.

For instance, the global cloud POS market size was valued at approximately USD 12.1 billion in 2023 and is projected to grow substantially. This highlights the increasing adoption of cloud solutions. These cloud alternatives can often be deployed more rapidly and scaled more easily than traditional, on-premise systems. This agility is a key draw for businesses seeking to adapt quickly to changing market demands.

- Increasing adoption of cloud POS: The global cloud POS market is experiencing robust growth, indicating a strong preference for cloud-native solutions.

- Lower upfront costs: Cloud SaaS alternatives often require less initial hardware expenditure, appealing to budget-conscious businesses.

- Subscription-based models: The flexibility of pay-as-you-go or subscription pricing models makes these substitutes more manageable for many SMBs.

- Ease of deployment and scalability: Cloud solutions can typically be implemented and scaled more efficiently than integrated hardware-software systems.

The threat of substitutes for NCR Voyix stems from a diverse range of alternatives, from basic cash transactions to sophisticated cloud-based SaaS platforms. Traditional cash and manual payment methods persist, especially in smaller businesses or less developed regions, offering a low-tech, perceived low-cost alternative despite their inefficiencies. Generic payment processing services also pose a threat by providing standalone solutions that may appear cheaper but lack the integrated benefits of NCR Voyix's comprehensive offerings. Additionally, large enterprises may opt for in-house developed proprietary systems, offering complete control and tailored customization, albeit at a significant cost.

Emerging digital payment solutions like mobile payment apps, digital wallets, and Buy Now, Pay Later (BNPL) services are rapidly gaining traction, offering consumers a more seamless experience and potentially reducing reliance on traditional POS systems. For instance, BNPL transactions saw substantial growth throughout 2024, with many consumers using these services for everyday purchases. Cloud-based SaaS alternatives are also a significant threat, particularly for SMBs, due to their minimal upfront hardware investment, rapid deployment, and scalability, often utilizing subscription-based models.

| Substitute Category | Key Characteristics | Impact on NCR Voyix | Example/Data Point (2024) |

|---|---|---|---|

| Traditional Cash/Manual | Low tech, perceived low cost, simple | Low for large/growth-focused, moderate for niche/low-volume | Cash still a significant transaction portion in certain regions in 2024 |

| Generic Payment Processors | Standalone, basic functionality | Moderate, especially for smaller merchants | Basic payment gateways offered to smaller merchants |

| Proprietary In-house Solutions | Full control, tailored customization | Moderate for large enterprises with specific needs | Major banks investing millions in custom ATM software |

| Digital Wallets/BNPL | Seamless consumer experience, mobile integration | Significant, growing consumer preference | BNPL transaction surge in 2024; >70% smartphone users in developed markets to use mobile payments by end of 2024 |

| Cloud-based SaaS POS | Low upfront cost, scalability, subscription models | High, especially for SMBs | Global cloud POS market valued at ~$12.1 billion in 2023 |

Entrants Threaten

Entering the digital commerce solutions market, especially for hardware-centric offerings like self-service kiosks and intricate point-of-sale systems, demands significant upfront capital. NCR Voyix, for instance, invests heavily in research and development, manufacturing capabilities, establishing robust distribution networks, and building a comprehensive service infrastructure. These considerable capital requirements act as a substantial deterrent for many aspiring new competitors, effectively raising the barrier to entry.

The significant technological sophistication required for developing advanced point-of-sale (POS), self-service, and payment processing systems presents a formidable barrier to new entrants. Companies like NCR Voyix invest heavily in research and development, possessing proprietary technology and a deep well of specialized knowledge. For instance, the complexity of integrating secure payment gateways with diverse retail environments demands specialized engineering talent, a resource that is both scarce and expensive to acquire.

New players entering the market would need to demonstrate substantial R&D capabilities and attract highly skilled engineers and cybersecurity experts to even begin competing. Without this foundational technological expertise and intellectual property, any attempt to disrupt established players like NCR Voyix would likely falter. The ongoing need for innovation in areas such as AI-driven customer analytics and cloud-based infrastructure further elevates these entry barriers.

Existing customers of NCR Voyix often demonstrate strong loyalty, bolstered by the significant switching costs associated with migrating away from established systems. These costs are not merely financial; they encompass the complexities of integrating new hardware and software, retraining staff, and the potential for operational disruptions during transition periods. For instance, a retail business deeply embedded with NCR Voyix's point-of-sale and back-office systems might face weeks of downtime and extensive retraining if they attempted to switch to a competitor.

Regulatory Hurdles and Compliance

The payment processing and financial technology industries are rife with significant regulatory hurdles. New companies entering this space must comply with a complex web of rules concerning data security, consumer privacy, and financial regulations, such as PCI DSS and GDPR. Navigating these requirements demands substantial investment in legal counsel, compliance technology, and personnel, creating a considerable barrier for potential new entrants. For instance, the ongoing evolution of data privacy laws globally means continuous adaptation and expenditure to maintain compliance.

These regulatory demands translate into tangible costs and time commitments. Establishing the necessary infrastructure and processes to meet these stringent standards can take years and millions of dollars.

- Data Security Standards: Compliance with standards like PCI DSS (Payment Card Industry Data Security Standard) is mandatory for handling cardholder data, requiring significant investment in secure systems and ongoing audits.

- Privacy Regulations: Adherence to regulations such as GDPR in Europe or CCPA in California mandates strict data handling and consent management, adding complexity and operational overhead.

- Financial Compliance: Meeting requirements from bodies like the SEC or FinCEN in the US involves licensing, reporting, and anti-money laundering (AML) protocols, which are resource-intensive.

- Time to Market: The lengthy process of obtaining necessary licenses and approvals can significantly delay a new entrant's ability to launch and compete, giving established players a crucial advantage.

Access to Distribution Channels and Partnerships

Established players like NCR Voyix benefit from deeply entrenched relationships and exclusive agreements with key distribution channels, particularly within the retail, hospitality, and financial sectors. These existing partnerships, cultivated over years, provide immediate access to a vast customer base that new entrants would find incredibly difficult and time-consuming to replicate.

Building a comparable sales force and establishing the necessary trust with major clients requires significant upfront investment and a proven track record, hurdles that new competitors must overcome. For instance, NCR Voyix's extensive network means they can offer integrated solutions to businesses that already rely on their existing infrastructure, a clear advantage over newcomers.

- Established Distribution Networks: NCR Voyix leverages existing, long-term relationships with major retailers, restaurants, and financial institutions, granting immediate market access.

- Sales Team & Partnerships: The company possesses a robust sales infrastructure and strategic alliances that new entrants would struggle to match in terms of reach and credibility.

- Customer Trust: Years of service and successful deployments have built significant trust, making it harder for new entrants to displace incumbent solutions.

The threat of new entrants for NCR Voyix is moderate. While the market for digital commerce solutions is attractive, significant capital investment is required for R&D, manufacturing, and distribution. For instance, developing and maintaining advanced hardware like self-service kiosks and sophisticated POS systems demands substantial financial resources. The complexity of integrating secure payment systems and ensuring compliance with evolving data privacy regulations further raises the barrier to entry.

Porter's Five Forces Analysis Data Sources

Our NCR Voyix Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company financial reports, industry-specific market research, and regulatory filings. This ensures a robust understanding of the competitive landscape.