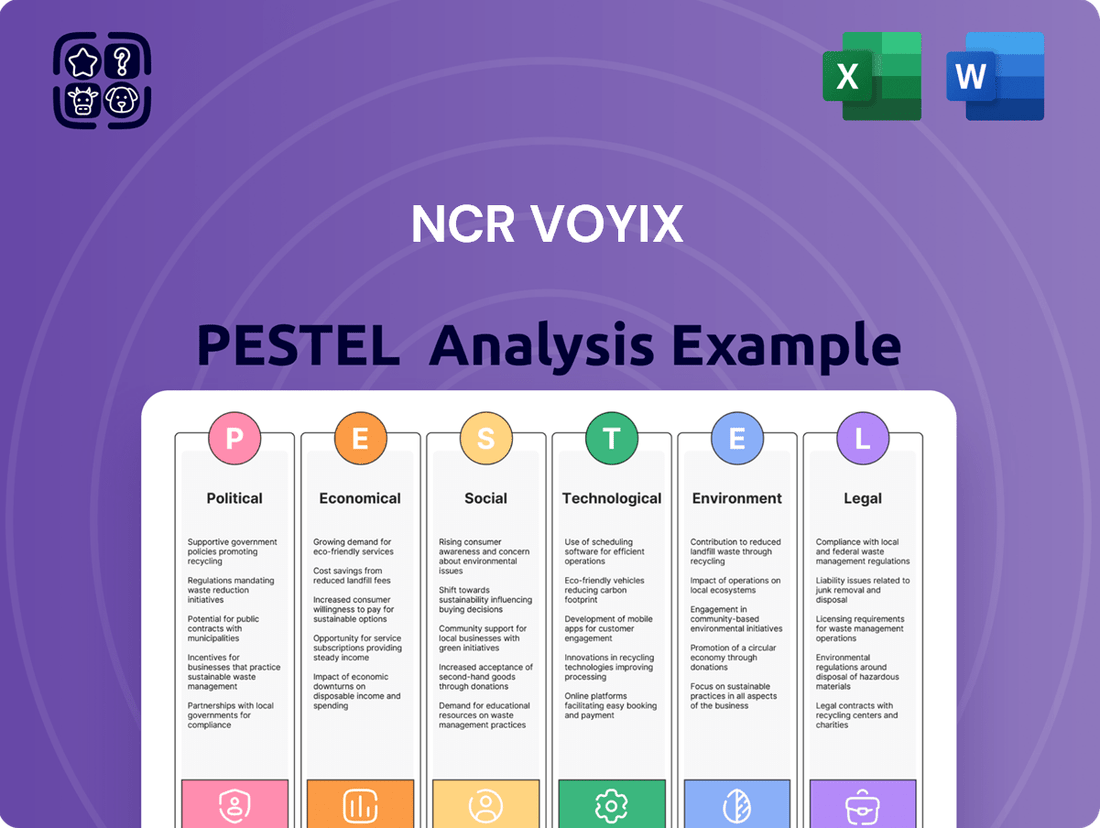

NCR Voyix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NCR Voyix Bundle

Gain a critical edge by understanding the external forces shaping NCR Voyix's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities.

This comprehensive report provides actionable intelligence, perfect for investors, strategists, and anyone looking to forecast market trends and mitigate risks associated with NCR Voyix.

Don't get left behind; uncover the vital insights needed to strengthen your market strategy and make informed decisions.

Download the full PESTLE analysis now and equip yourself with the knowledge to navigate the complex landscape affecting NCR Voyix.

Political factors

Government regulations, especially concerning digital payment processing and data security, significantly shape NCR Voyix's business across retail, restaurants, and banking. Staying compliant with evolving rules like PCI DSS and anti-money laundering (AML) laws is vital for market access and customer trust, directly impacting how NCR Voyix develops and deploys its payment solutions.

Adherence to these ever-changing regulatory environments often requires substantial financial commitment for system upgrades and robust compliance protocols. For instance, the global digital payments market was valued at over $2.5 trillion in 2023 and is projected to grow, making regulatory compliance a continuous operational necessity for companies like NCR Voyix to participate in this expanding sector.

Data privacy laws are becoming stricter worldwide, impacting how companies like NCR Voyix handle customer information. Regulations such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) require robust data protection measures. NCR Voyix must ensure its point-of-sale systems, kiosks, and software comply with these evolving standards, which often involves investing in advanced cybersecurity and clear data handling policies.

Compliance with these stringent data privacy regulations is not just about avoiding penalties; it's crucial for building and maintaining customer trust. For instance, the average cost of a data breach in 2024 reached an estimated $4.73 million, underscoring the financial implications of non-compliance. NCR Voyix's ability to demonstrate secure and transparent data practices will be a key differentiator in the market.

International trade policies significantly influence NCR Voyix's global operations. For instance, the ongoing evolution of trade agreements, like potential shifts in US-China trade relations impacting technology components, directly affects supply chain costs and market access for NCR Voyix, which serves customers in over 30 nations. The imposition of tariffs on critical hardware inputs can increase production expenses, potentially affecting pricing strategies and competitiveness. Conversely, favorable trade agreements can open new markets and reduce barriers to entry, supporting the company's international growth objectives.

Industry-Specific Regulations

NCR Voyix operates within a complex regulatory landscape, particularly in the retail, restaurant, and banking sectors. For instance, the banking industry faces stringent financial reporting requirements and consumer protection laws that directly impact the design and functionality of payment processing and core banking solutions. In 2024, the U.S. Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices and data privacy, necessitating robust compliance features within financial technology offerings.

The retail and restaurant industries are also heavily regulated, with mandates covering food safety, labor practices, and data security. For example, the Food Safety Modernization Act (FSMA) in the U.S. places significant responsibility on food retailers and restaurants to ensure product safety throughout the supply chain. NCR Voyix’s point-of-sale and inventory management systems must therefore incorporate features that facilitate compliance with such regulations, including detailed tracking and reporting capabilities. By the end of 2024, the Payment Card Industry Data Security Standard (PCI DSS) remained a critical compliance hurdle for any business handling cardholder data, a core area for NCR Voyix.

Adapting to evolving standards is crucial for NCR Voyix’s continued success. This includes staying abreast of new accessibility mandates, such as those introduced or updated by governmental bodies to ensure technology is usable by individuals with disabilities. Furthermore, increasing demands for transaction transparency, driven by consumer advocacy and regulatory bodies, require clear and auditable record-keeping within their solutions. For example, as of early 2025, discussions around enhanced data breach notification laws were ongoing in several key markets, prompting technology providers to build in more proactive security and reporting functionalities.

- Financial Reporting: Strict adherence to regulations like Sarbanes-Oxley (SOX) impacts how NCR Voyix's software handles financial data for banking clients.

- Consumer Protection: Laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. dictate how customer data is managed, affecting NCR Voyix's software design.

- Food Safety Compliance: For the restaurant sector, systems must support traceability and recall management, aligning with food safety standards.

- Payment Security: Ongoing updates and enforcement of PCI DSS compliance are paramount for all NCR Voyix payment solutions.

Government Support for Digital Transformation

Governments worldwide are actively promoting digital transformation, recognizing its economic benefits. For instance, in 2024, the U.S. government continued to allocate significant funding towards initiatives like the Broadband Equity, Access, and Deployment (BEAD) program, which indirectly supports the digital infrastructure necessary for businesses to adopt new technologies. These efforts aim to bridge the digital divide and encourage widespread adoption of digital solutions.

Policies specifically designed to assist small and medium-sized businesses (SMBs) in digitizing their operations present a direct market opportunity for NCR Voyix. Many countries are offering grants and tax incentives to encourage SMBs to upgrade their point-of-sale (POS) systems and embrace digital payment methods. For example, programs launched in the UK in late 2023 and continuing through 2024 offer grants of up to £5,000 for technology adoption, directly benefiting companies like NCR Voyix.

The acceleration of digital payments and the demand for modern, integrated retail solutions are being further fueled by government mandates and support. As governments push for greater financial inclusion and efficiency, they often create regulatory environments that favor the adoption of advanced payment processing and customer management systems. This trend is visible across the European Union, where initiatives like PSD2 continue to drive innovation in digital financial services, creating fertile ground for NCR Voyix's offerings.

- Increased SMB Digitization: Government grants and tax incentives, like those seen in the US and UK in 2024, directly encourage SMBs to invest in digital POS and payment solutions.

- Infrastructure Development: Programs focused on broadband expansion, such as the BEAD program, lay the groundwork for widespread adoption of NCR Voyix's cloud-based and connected services.

- Regulatory Tailwinds: Evolving financial regulations, exemplified by PSD2 in the EU, create a demand for compliant and innovative digital payment and commerce platforms.

Government policies actively promote digital transformation, with initiatives like the US BEAD program supporting infrastructure crucial for NCR Voyix's services. In 2024, government grants, such as the UK's £5,000 technology adoption grants, directly incentivize small businesses to upgrade their POS systems, creating a significant market opportunity for NCR Voyix.

Evolving financial regulations, like the EU's PSD2, create a demand for compliant digital payment solutions, benefiting companies such as NCR Voyix. These regulatory tailwinds, coupled with a global push for financial inclusion, foster an environment where advanced payment and customer management systems are increasingly adopted.

| Regulatory Focus | Impact on NCR Voyix | Example (2023-2025) |

| SMB Digitization Incentives | Increased adoption of POS and digital payment systems | UK grants up to £5,000 for technology upgrades (2024) |

| Digital Infrastructure Development | Enhanced connectivity for cloud-based services | US BEAD program funding broadband expansion (ongoing) |

| Financial Services Regulation | Demand for compliant payment processing solutions | EU's PSD2 driving innovation in digital finance |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing NCR Voyix, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It equips stakeholders with actionable insights into market dynamics and potential strategic advantages or risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategic discussions.

Economic factors

Inflationary pressures significantly shape consumer spending, directly affecting the retail and restaurant industries that NCR Voyix supports. As prices climb, consumers are prioritizing value and actively using loyalty programs, boosting the need for personalized offers and streamlined checkout processes.

NCR Voyix's 2025 Commerce Experience Report highlights that more than half of consumers anticipate higher grocery prices. This trend is pushing shoppers to actively search for the best deals and promotions, a demand NCR Voyix addresses through its technology solutions.

Interest rates significantly shape the investment climate for businesses that are potential clients of NCR Voyix. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate range between 5.25% and 5.50%, reflecting an ongoing effort to control inflation. This environment can make borrowing more expensive, potentially causing businesses to reconsider or postpone significant capital outlays on technology upgrades, such as new point-of-sale (POS) systems or self-service kiosks.

Higher borrowing costs directly impact a company's capacity to fund new projects. If interest rates remain elevated, as they have been through much of 2024, businesses may opt to delay investments in digital transformation initiatives. This could translate into slower sales cycles and reduced demand for NCR Voyix's hardware solutions and the associated revenue from large-scale system deployments.

Conversely, a scenario with declining interest rates, such as potential cuts anticipated by many economists for late 2024 or 2025, could invigorate the market. Lower borrowing costs would likely encourage businesses to increase their capital expenditures, making technology investments more attractive. This could boost NCR Voyix's prospects for hardware sales and new project revenue as companies accelerate their digital transformation efforts.

The economic health of NCR Voyix's target sectors—retail, restaurants, and banking—is a critical driver of its performance. For instance, the US retail sector saw sales grow by an estimated 3.7% in 2024, indicating a positive environment for increased transaction volumes, which directly benefits NCR Voyix's digital commerce solutions.

Robust economic growth fuels consumer spending and encourages businesses within these sectors to invest in technology upgrades and expansion. This translates to higher demand for NCR Voyix's point-of-sale systems, payment processing, and customer engagement software.

Conversely, economic slowdowns, such as a potential dip in consumer confidence or rising interest rates impacting business investment, can lead to reduced technology budgets in retail, restaurant, and banking. This could dampen demand for NCR Voyix's services.

For example, if the banking sector experiences slower loan growth due to economic uncertainty, it might delay technology investments in digital transformation, impacting NCR Voyix's pipeline for financial services solutions.

Foreign Exchange Rate Fluctuations

As a global entity with operations spanning more than 30 countries, NCR Voyix is inherently susceptible to the volatility of foreign exchange rates. These currency shifts can significantly affect the company's reported revenue and overall financial performance, particularly when international profits are repatriated into its primary reporting currency. For instance, a strengthening US dollar against other currencies could reduce the reported value of overseas sales. This exposure is a constant element in NCR Voyix's financial management strategy, requiring ongoing attention and mitigation efforts to safeguard its financial stability and profitability against unpredictable market movements.

Managing these currency risks is a critical aspect of NCR Voyix's financial operations. The company likely employs various hedging strategies, such as forward contracts or currency options, to lock in exchange rates for future transactions. This proactive approach aims to minimize the impact of adverse currency movements on its earnings and cash flows. For example, if NCR Voyix anticipates significant revenue from Europe in the coming quarter, it might enter into a forward contract to sell Euros at a predetermined USD rate. This ensures a predictable revenue stream regardless of how the Euro performs against the dollar in the interim.

The financial reporting of NCR Voyix in 2024 and projections for 2025 will undoubtedly reflect the impact of these currency fluctuations. Analysts closely monitor the company's hedging effectiveness and its exposure to major currency pairs. For example, in Q4 2023, companies with substantial international sales often reported impacts from a strong dollar. As of early 2024, while currency markets have shown some stabilization, ongoing geopolitical events and differing monetary policies globally continue to create an environment where exchange rate volatility remains a significant factor for multinational corporations like NCR Voyix.

- Global Footprint Exposure: NCR Voyix operates in over 30 countries, making it directly exposed to the financial impact of fluctuating exchange rates on its consolidated financial statements.

- Revenue Translation Risk: When earnings from foreign subsidiaries are converted back to the company's reporting currency (likely USD), a stronger USD can lead to lower reported revenues.

- Hedging Strategies: NCR Voyix likely utilizes financial instruments such as forward contracts and options to mitigate the risk of adverse currency movements on its international transactions.

- 2024-2025 Financial Impact: Currency volatility in the 2024-2025 period could significantly influence NCR Voyix's reported profitability and cash flows, necessitating careful financial planning and risk management.

Shift to Recurring Revenue Models

NCR Voyix is strategically repositioning its business to emphasize software and services, moving away from its historical reliance on hardware. This economic shift is designed to build more stable and predictable revenue streams, which typically carry higher profit margins than hardware. The company anticipates this transition will significantly enhance its overall profitability.

This focus on recurring revenue is a core financial objective for NCR Voyix. By increasing the proportion of income derived from ongoing subscriptions and service contracts, the company aims to achieve greater financial stability and shareholder value. Projections for 2025 indicate a substantial increase in software and services revenue, underscoring the success of this strategic pivot.

- Recurring Revenue Growth: NCR Voyix is prioritizing software and services, aiming for increased recurring revenue.

- Profitability Enhancement: The shift is expected to boost profit margins by moving away from lower-margin hardware.

- Financial Stability: Predictable revenue streams from subscriptions and services are key to the company's financial strategy.

- 2025 Projections: The company anticipates a significant rise in software and services revenue in 2025, reflecting this transition.

Economic conditions significantly influence NCR Voyix's client base, especially in retail and restaurants where consumer spending is directly tied to inflation and interest rates. The US retail sector's projected 3.7% growth in 2024 suggests a positive environment for transaction volumes, benefiting NCR Voyix's digital commerce solutions.

Interest rate policies, like the Federal Reserve's maintained 5.25%-5.50% range in early 2024, impact business investment in technology upgrades, potentially slowing demand for hardware. However, anticipated rate cuts in late 2024 or 2025 could stimulate capital expenditures, boosting NCR Voyix's prospects.

NCR Voyix's strategic shift towards software and services aims to create more stable, higher-margin recurring revenue, with 2025 projections indicating a substantial increase in this segment, enhancing overall profitability and financial stability.

Preview Before You Purchase

NCR Voyix PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This NCR Voyix PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview to inform strategic decision-making.

Sociological factors

Consumers increasingly favor self-service for its speed and autonomy, a trend particularly evident in retail and quick-service dining. This preference translates directly into a need for efficient self-service technology.

NCR Voyix's 2025 Commerce Experience Report underscores this shift, revealing that a significant 77% of shoppers opt for self-checkout to expedite their experience. Furthermore, 83% of consumers reported using self-checkout within the last six months, indicating widespread adoption.

This strong consumer demand directly benefits NCR Voyix, as it fuels the market for their self-service kiosks and associated software. The company is well-positioned to capitalize on this ongoing behavioral change in how people shop and interact with businesses.

Consumers now demand effortless digital and omni-channel interactions, from browsing online to paying at the counter. This societal expectation means businesses need strong digital platforms and connected payment systems, areas where NCR Voyix is a key player.

The rise of e-commerce, with global online retail sales projected to reach $7.4 trillion by 2025, underscores this shift. Companies that fail to offer these integrated experiences risk losing customers to more digitally adept competitors.

This evolving consumer behavior directly fuels the need for advanced digital transformation tools and services. NCR Voyix's solutions are designed to help businesses meet these growing demands for seamless, modern customer journeys.

The ongoing shift towards remote and hybrid work models significantly reshapes how businesses operate and where consumers spend their time. This evolution directly impacts commercial real estate, potentially reducing foot traffic in traditional business districts. For NCR Voyix, this means clients might re-evaluate their physical presence and investment in brick-and-mortar solutions.

While NCR Voyix's primary business isn't directly tied to physical retail foot traffic, the changing work habits influence client spending priorities. Businesses adapting to distributed workforces may shift investments towards digital transformation, cloud infrastructure, and employee enablement tools, areas where NCR Voyix's solutions are relevant.

For example, a 2024 survey indicated that over 60% of U.S. workers now have access to hybrid or remote work options, a substantial increase from pre-pandemic levels. This trend forces businesses to invest in technology that supports seamless operations regardless of employee location, a core strength of NCR Voyix's digital offerings.

NCR Voyix's focus on digital transformation, including cloud-based point-of-sale systems and customer engagement platforms, positions it to capitalize on these changing work habits. By enabling businesses to serve customers effectively through various channels, NCR Voyix helps clients navigate the new landscape shaped by evolving consumer and employee behaviors.

Privacy and Trust Concerns

Societal concerns about data privacy and the responsible use of technology, especially with advanced tools like AI, are significantly shaping consumer trust in digital commerce solutions. NCR Voyix needs to actively manage these concerns by implementing strong data protection measures and being transparent about its practices to retain customer confidence. For instance, a late 2023 survey indicated that over 60% of consumers are hesitant to share personal data online if they don't fully trust a company's privacy policies.

NCR Voyix's commitment to safeguarding personal information is detailed in its privacy policy, which was updated in January 2024. This policy aims to build trust by clearly stating how customer data is handled and protected. Demonstrating a proactive approach, NCR Voyix has also invested in enhanced cybersecurity protocols throughout 2024, responding to an industry-wide increase in data breach attempts targeting financial and retail sectors.

The company's efforts to build trust are crucial, as a lack of confidence can directly impact the adoption of its digital commerce solutions. Consumers are increasingly aware of data breaches and demand accountability from the companies they engage with. By prioritizing transparency and robust data security, NCR Voyix can mitigate these sociological risks.

- Data Privacy Influence: A 2024 report by Gartner suggests that over 70% of consumers consider a company's data privacy practices when making purchasing decisions.

- AI Trust: Public trust in AI applications for financial transactions remains a developing area, with many consumers expressing caution about algorithmic decision-making.

- Transparency Value: Companies with clear and accessible privacy policies tend to see higher customer engagement rates in digital platforms.

Generational Adoption of Technology

Generational differences significantly shape technology adoption in retail. Younger generations, particularly Gen Z and Millennials, are leading the charge in embracing self-checkout systems and digital payment options. For instance, a 2024 study indicated that over 70% of Gen Z consumers prefer using their smartphones for payments, a trend that continues to grow.

NCR Voyix must design its offerings to be intuitive and accessible for a wide range of users, from tech-savvy youth to those who may be less comfortable with digital interfaces. This includes ensuring clear instructions and multiple support channels for all customers interacting with retail technology.

Understanding these generational preferences is crucial for NCR Voyix's product innovation and market strategy. By tailoring solutions to meet the diverse needs of different age groups, the company can enhance customer satisfaction and capture a broader market share.

Key generational technology adoption trends include:

- Gen Z (born 1997-2012): High adoption of mobile payments and self-service options, expecting seamless digital experiences.

- Millennials (born 1981-1996): Comfortable with digital tools, often seeking convenience and efficiency in checkout processes.

- Gen X (born 1965-1980): Increasingly adopting digital payments but may still prefer traditional methods for certain transactions.

- Baby Boomers (born 1946-1964): Show a growing interest in digital convenience but often require more support and simpler interfaces.

Societal expectations for seamless digital and omni-channel interactions are paramount, driving demand for integrated payment systems and robust digital platforms. NCR Voyix's solutions are engineered to meet these evolving needs, ensuring businesses can provide modern customer journeys.

Consumer trust in data privacy is a significant factor, with a majority of shoppers considering a company's data protection practices. NCR Voyix is actively addressing this by enhancing cybersecurity protocols and maintaining transparent privacy policies to build and retain customer confidence.

Generational differences heavily influence technology adoption, with younger demographics leading the way in embracing self-service and digital payments. NCR Voyix must continue to innovate, creating intuitive solutions that cater to a broad spectrum of users, from digitally native Gen Z to Baby Boomers seeking convenience.

Technological factors

The rapid advancements in Artificial Intelligence (AI) and machine learning are profoundly reshaping NCR Voyix's product development. These technologies are crucial for enhancing self-checkout systems, optimizing inventory management, and delivering truly personalized customer experiences across the retail and restaurant sectors.

AI's ability to streamline operations, significantly reduce shrink, and boost overall efficiency is a major driver for businesses adopting NCR Voyix solutions. For instance, AI-powered predictive analytics can anticipate stock needs, minimizing out-of-stock situations and waste, which directly impacts profitability.

NCR Voyix is actively integrating AI-driven analytics with its Internet of Things (IoT) solutions to create more engaging and seamless customer journeys. This synergy allows for real-time data collection and analysis, enabling businesses to respond instantly to customer behavior and preferences, thereby redefining the in-store experience.

By 2025, the retail analytics market, heavily influenced by AI, is projected to reach over $10 billion globally, highlighting the significant opportunity for companies like NCR Voyix that are at the forefront of these technological integrations. This growth underscores the increasing reliance on intelligent systems for competitive advantage.

NCR Voyix is heavily leaning into cloud computing and Software-as-a-Service (SaaS) as a core part of its business strategy. This industry-wide trend means companies are moving away from traditional on-premise software to more flexible, scalable cloud-based solutions.

The company's own Voyix Commerce Platform (VCP) is a prime example of this, transitioning to a cloud-native architecture. This shift is designed to boost scalability, offering greater flexibility for customers and creating more predictable, recurring revenue for NCR Voyix. By 2024, the global public cloud market was projected to reach over $600 billion, highlighting the significant demand for these services.

This focus on cloud infrastructure is essential for updating older systems and ensuring NCR Voyix can keep innovating and offering new features consistently. In 2023, SaaS revenue represented a substantial portion of many technology companies' earnings, a trend expected to continue and grow, with cloud services adoption by businesses showing no signs of slowing.

The payment processing landscape is rapidly changing, with technologies like contactless payments, mobile wallets, and integrated solutions becoming standard. NCR Voyix's business is directly impacted by this evolution, as they need to support these modern transaction methods. For instance, by the end of 2024, it's projected that over 80% of global retail transactions will be digital.

NCR Voyix is strategically enhancing its payment offerings, including partnerships with companies like Worldpay. This allows them to provide businesses with robust, omnichannel payment acceptance, ensuring seamless transactions across various customer touchpoints. This integration is crucial for maintaining competitiveness in a market where customers expect flexibility.

Supporting the latest transaction methods and adhering to stringent security standards is paramount. NCR Voyix's investment in these areas ensures their clients' systems are not only up-to-date but also secure against emerging threats, a critical factor given the increasing volume of cyberattacks targeting financial data. In 2023 alone, payment fraud losses were estimated to exceed $48 billion globally.

Cybersecurity and Data Security Innovations

Cybersecurity and data security innovations are increasingly vital for NCR Voyix, especially with the rising sophistication of cyber threats. Protecting the sensitive financial and personal data processed through their point-of-sale (POS) systems and payment platforms is absolutely critical for maintaining customer trust and adhering to regulatory requirements. NCR Voyix needs to continually invest in advanced security measures to defend against data breaches and the ever-evolving landscape of cyber risks. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial incentive for attackers and the corresponding need for robust defenses.

The company's commitment to security directly impacts its reputation and ability to operate within a highly regulated financial technology sector. Innovations in areas like AI-powered threat detection, zero-trust architecture, and advanced encryption are essential for staying ahead of these threats. As of 2024, businesses are allocating significant budgets to cybersecurity, with global spending expected to exceed $200 billion, underscoring the industry's focus on these technological advancements.

- AI-driven threat detection: Implementing machine learning to identify anomalous behavior and potential breaches in real-time.

- Zero-trust security models: Verifying every access request, regardless of origin, to minimize the attack surface.

- Enhanced data encryption: Utilizing state-of-the-art encryption protocols to protect sensitive customer information at rest and in transit.

- Regular security audits and penetration testing: Proactively identifying and addressing vulnerabilities within their systems.

IoT and Connected Devices in Retail/Restaurant

The increasing prevalence of Internet of Things (IoT) devices and connected equipment within retail and restaurant sectors opens significant avenues for NCR Voyix. Integrating its offerings with this expanding ecosystem promises deeper operational intelligence, enabling proactive maintenance and a smoother flow of data across all customer and operational touchpoints. This connectivity is key to building more efficient and smarter commerce experiences.

By leveraging IoT, businesses can gain real-time insights into inventory, customer behavior, and equipment performance. For instance, smart shelves can automatically reorder stock, and connected kitchen equipment can alert staff to potential malfunctions before they impact service. This data-driven approach not only optimizes operations but also enhances the overall customer journey.

NCR Voyix's strategy can capitalize on this trend by developing robust integration capabilities for a wide array of IoT devices. This includes point-of-sale (POS) systems, smart sensors, digital signage, and self-checkout kiosks, all designed to work in concert. The company can offer platforms that consolidate data from these disparate sources, providing actionable analytics.

- Market Growth: The global IoT in retail market was valued at approximately $25.7 billion in 2023 and is projected to reach $107.9 billion by 2028, growing at a CAGR of 32.5%.

- Operational Efficiency: Studies indicate that IoT implementation in retail can lead to a 10-15% reduction in operational costs through better inventory management and predictive maintenance.

- Customer Experience: Connected devices can personalize customer interactions, with beacons used in stores to send targeted promotions, boosting engagement and sales.

- Data Utilization: The ability to collect and analyze vast amounts of data from connected devices allows retailers and restaurants to make more informed decisions, from staffing to product placement.

Technological advancements, particularly in AI and cloud computing, are central to NCR Voyix's strategic direction. The company is leveraging AI for enhanced operational efficiency and personalized customer experiences, with the global retail analytics market, driven by AI, expected to surpass $10 billion by 2025. This focus on intelligent systems is crucial for competitive advantage.

Legal factors

Global data protection laws like GDPR and CCPA significantly impact NCR Voyix's operations, dictating how customer data is handled. These regulations require strict adherence to data collection, processing, and storage protocols. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, emphasizing the financial risk of non-compliance. NCR Voyix's updated privacy policy, effective January 2024, underscores their commitment to safeguarding this sensitive information.

NCR Voyix navigates a complex regulatory landscape within the payment industry. Adherence to standards such as the Payment Card Industry Data Security Standard (PCI DSS) is not optional, it's a foundational requirement for secure transaction processing. Failure to comply can lead to significant penalties and loss of trust.

These compliance mandates demand ongoing vigilance and investment. NCR Voyix must continually update its payment processing solutions to meet evolving security protocols and regional payment regulations. For instance, the global expansion of digital payments in 2024 and 2025 necessitates understanding and integrating diverse local compliance frameworks.

Maintaining certifications like PCI DSS is critical for NCR Voyix's operational integrity and market access. The company’s commitment to these standards underpins its ability to offer secure and reliable payment solutions to its diverse client base, from large enterprises to smaller businesses.

NCR Voyix operates within a stringent regulatory environment governed by anti-trust and competition laws across the globe. These regulations are designed to prevent market dominance and ensure a level playing field for all businesses. For instance, the European Union's competition policy, enforced by the European Commission, closely scrutinizes mergers and acquisitions that could reduce competition, a factor critical for NCR Voyix's strategic growth plans.

Failure to comply with these laws can result in significant penalties, including hefty fines. In 2023, the European Commission imposed €1.1 billion in fines on companies for violating competition rules in the digital sector, highlighting the financial risks associated with non-compliance. NCR Voyix must therefore ensure its business practices, including any potential mergers or partnerships within the digital commerce solutions space, adhere strictly to these global competition frameworks to avoid legal repercussions and maintain its market standing.

Consumer Protection Laws

Consumer protection laws are crucial for NCR Voyix, as they govern the fairness and transparency of its self-service kiosks and point-of-sale (POS) systems. Regulations concerning accurate pricing, clear refund processes, and accessibility for all users directly impact how these technologies function and are perceived. For instance, in the US, the Federal Trade Commission (FTC) enforces rules like the Truth in Savings Act, which mandates clear disclosure of fees and terms for financial transactions processed through NCR Voyix systems.

Compliance with these consumer safeguards is not just about avoiding penalties; it's a key driver of customer trust and brand reputation. By ensuring their systems adhere to regulations on data privacy and transaction security, such as those outlined in the California Consumer Privacy Act (CCPA), NCR Voyix can mitigate risks of legal challenges and build stronger relationships with its clientele. In 2023, consumer protection agencies worldwide reported a significant increase in complaints related to digital transactions, highlighting the importance of robust compliance frameworks for companies like NCR Voyix.

- Pricing Accuracy: Laws mandate clear and truthful pricing displays on self-service and POS systems.

- Refund Policies: Regulations dictate the clarity and fairness of refund processes offered to consumers.

- Accessibility: Standards ensure that systems are usable by individuals with disabilities, complying with laws like the Americans with Disabilities Act (ADA).

- Data Privacy: Adherence to data protection laws is essential for safeguarding consumer information processed through NCR Voyix's technology.

Intellectual Property Rights

Protecting its intellectual property, encompassing patents, trademarks, and software copyrights, is fundamental to NCR Voyix's sustained competitive edge. The company must actively safeguard its existing IP while also ensuring its product development and offerings do not infringe upon the intellectual property rights of third parties. This necessitates ongoing legal review and strategic patent filings for its technological advancements.

NCR Voyix's commitment to IP protection is underscored by its significant investment in research and development, a key driver for innovation and market differentiation. For instance, in the first quarter of 2024, the company reported R&D expenses of $49 million, indicating a strong focus on developing proprietary technologies. This investment aims to secure future revenue streams and maintain its technological leadership in the financial and retail technology sectors.

The company actively monitors the legal landscape for potential IP disputes and proactively seeks to resolve them through licensing agreements or litigation when necessary. This vigilance is critical in an industry characterized by rapid technological change and intense competition. NCR Voyix's legal strategy involves both defensive measures to protect its innovations and offensive measures to leverage its IP portfolio.

- Active IP Portfolio Management: NCR Voyix maintains a portfolio of patents and trademarks designed to protect its core technologies and brand identity.

- Infringement Monitoring: The company employs legal and technical teams to monitor for potential infringements of its intellectual property by competitors.

- Strategic Patenting: NCR Voyix continues to file new patents for its innovations, particularly in areas like cloud-based payment solutions and retail automation.

- Legal Defense: The company is prepared to defend its IP rights through legal channels if necessary to protect its market position and revenue.

NCR Voyix operates under a complex web of global and local legal frameworks that shape its business operations and market conduct. Adherence to data protection laws like GDPR and CCPA is paramount, with significant financial penalties for non-compliance, such as fines up to 4% of global annual revenue. Furthermore, the company must navigate stringent regulations within the payment industry, including PCI DSS, to ensure secure transaction processing and maintain customer trust.

Antitrust and competition laws globally influence NCR Voyix's strategic growth, including mergers and acquisitions, with regulatory bodies like the European Commission actively scrutinizing market dominance. Consumer protection laws, enforced by agencies like the FTC, dictate the fairness and transparency of its self-service kiosks and POS systems, impacting pricing, refunds, and accessibility, as seen with the Truth in Savings Act. Protecting its intellectual property through patents and trademarks is also crucial, with significant R&D investments, such as $49 million in Q1 2024, underpinning its innovation and market differentiation.

Environmental factors

Environmental regulations, particularly those surrounding electronic waste (e-waste), significantly shape NCR Voyix's approach to product design and lifecycle management. Stricter rules in regions like the European Union, with directives such as the Waste Electrical and Electronic Equipment (WEEE) Directive, compel manufacturers to consider the recyclability and material content of their Point-of-Sale (POS) systems and kiosks. For instance, the global e-waste generated reached an estimated 62 million metric tons in 2020, highlighting the scale of the issue and the growing pressure for responsible handling. This necessitates NCR Voyix to explore more sustainable materials and develop robust end-of-life recycling programs to ensure compliance and minimize its environmental footprint, a trend that will only intensify leading into 2025.

Businesses and consumers increasingly want technology that's good for the planet. This means NCR Voyix might need to focus on energy-efficient hardware and cloud services that use less power. They could also face expectations for greener supply chains, with 73% of consumers in a 2024 survey stating they consider sustainability when making purchasing decisions.

Meeting this demand for eco-friendly tech solutions can really boost NCR Voyix's image. It can help them stand out and attract customers who prioritize environmental responsibility. For instance, offering solutions that reduce a client's carbon footprint directly addresses this growing market need.

NCR Voyix's dedication to Corporate Social Responsibility (CSR) and sustainability significantly shapes its public perception and appeal to investors, employees, and customers alike. By adopting environmentally conscious operational methods, actively reducing its carbon footprint, or championing environmental causes, the company can effectively meet the escalating stakeholder demand for ethical corporate conduct.

While specific, up-to-the-minute details on NCR Voyix's current environmental programs might be sparse, the overarching trend towards robust CSR is undeniable across industries. For instance, in 2023, companies within the technology sector, where NCR Voyix operates, saw a notable increase in ESG (Environmental, Social, and Governance) investments, reaching approximately $3.7 trillion globally according to some market analyses.

Supply Chain Ethics and Environmental Impact

NCR Voyix faces significant environmental considerations within its supply chain, encompassing everything from the extraction of raw materials for hardware components to the final transportation of finished products. The company's commitment to sustainability is directly tied to the environmental footprint of its global network of suppliers, particularly those in hardware manufacturing.

Ensuring ethical and environmentally sound practices among these suppliers is crucial for mitigating reputational damage and avoiding potential regulatory penalties. This necessitates robust due diligence processes to assess supplier adherence to environmental standards and may involve active collaboration to foster shared sustainability objectives.

- Supply Chain Scope: Environmental impact spans raw material sourcing, manufacturing, and logistics for NCR Voyix's technology solutions.

- Supplier Responsibility: Ethical and environmental oversight of hardware manufacturers is critical to managing risks.

- Mitigation Strategies: Due diligence and collaborative efforts with suppliers on sustainability goals are key.

- Regulatory & Reputational Risk: Non-compliance by suppliers can lead to significant brand damage and legal challenges.

Energy Consumption of Data Centers and Cloud Services

NCR Voyix's increasing reliance on cloud infrastructure means that the energy consumption of data centers is a significant environmental consideration. The tech industry's growing demand for computing power directly impacts global energy use and carbon emissions. For instance, data centers are estimated to consume 1% to 1.5% of global electricity, a figure projected to rise as digital services expand.

To mitigate this impact, NCR Voyix might explore partnerships with cloud providers committed to renewable energy sources. Companies like Microsoft and Google have made substantial investments in green data centers, aiming for 100% renewable energy usage. Additionally, optimizing software for greater energy efficiency can reduce the computational resources needed, thereby lowering the overall energy footprint.

- Data Center Energy Consumption: Global data centers account for approximately 1% to 1.5% of worldwide electricity consumption.

- Carbon Footprint: The energy used by data centers contributes to a significant portion of the IT sector's carbon emissions.

- Renewable Energy Initiatives: Major cloud providers are increasingly investing in and sourcing renewable energy to power their operations.

- Software Optimization: Improving code efficiency can lead to reduced processing power requirements and lower energy usage.

Environmental regulations, particularly those concerning e-waste and carbon emissions, directly influence NCR Voyix's product design and operational strategies. Growing consumer and business demand for sustainable technology solutions is a key driver, with 73% of consumers in a 2024 survey indicating sustainability influences their purchasing decisions.

NCR Voyix's supply chain, especially hardware manufacturing, faces scrutiny regarding raw material sourcing and transportation. The company must ensure its suppliers adhere to environmental standards to avoid reputational and regulatory risks. In 2023, ESG investments in the technology sector reached approximately $3.7 trillion globally, reflecting increased investor focus on environmental performance.

The energy consumption of data centers, a critical component of NCR Voyix's cloud infrastructure, presents another environmental challenge. Data centers are estimated to consume 1% to 1.5% of global electricity, underscoring the importance of partnering with renewable energy providers. This trend aligns with the broader push for greener IT operations.

| Environmental Factor | Impact on NCR Voyix | Key Data/Trends (2024-2025) |

| E-waste Regulations | Product design, lifecycle management, recycling programs | Global e-waste reached 62 million metric tons in 2020; increasing regulatory pressure |

| Sustainability Demand | Product features, supply chain practices, brand perception | 73% of consumers consider sustainability in purchases (2024 survey) |

| Data Center Energy Use | Cloud infrastructure efficiency, partnerships with green providers | Data centers consume 1-1.5% of global electricity; growth in renewable energy sourcing by cloud providers |

| Supply Chain Responsibility | Supplier vetting, ethical sourcing, risk mitigation | Significant ESG investment growth in tech sector (approx. $3.7 trillion in 2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for NCR Voyix is built on a robust foundation of data sourced from leading financial news outlets, government regulatory bodies, and reputable technology industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and well-supported.