National Bank of Kuwait PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Bank of Kuwait Bundle

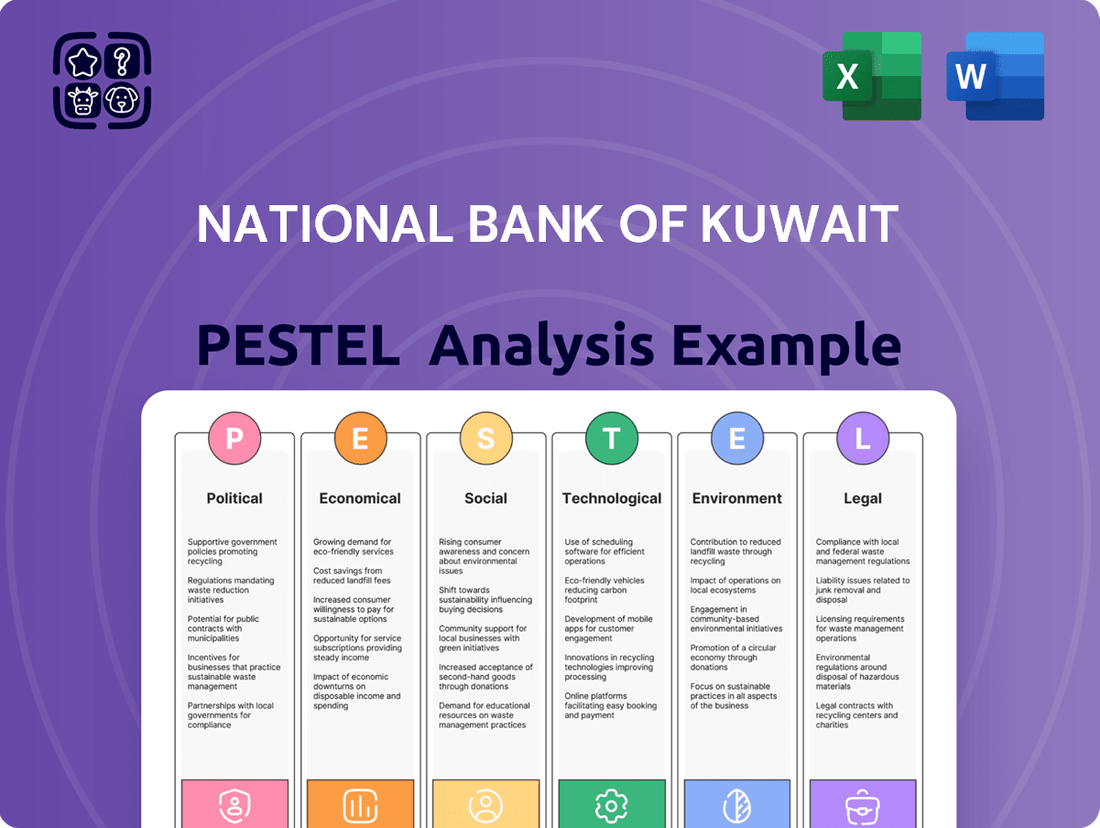

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping the National Bank of Kuwait's landscape. This analysis provides a comprehensive overview of how global shifts and local dynamics influence their operations and strategic direction. Gain a competitive edge by understanding these external forces and their potential impact on market opportunities and risks. Download the full PESTLE analysis now to access actionable intelligence and refine your own market strategy.

Political factors

Kuwait's government stability and its policy direction, especially regarding economic diversification and development under Vision 2035, significantly shape the operational landscape for the National Bank of Kuwait (NBK).

Accelerated reforms, particularly following political shifts, are anticipated to boost economic growth prospects and the banking sector, which should translate to increased lending opportunities for NBK. For instance, Kuwait's non-oil GDP growth was projected to reach 4.5% in 2024, up from 3.2% in 2023, indicating a positive economic trajectory.

The potential suspension of the National Assembly for periods up to four years could facilitate smoother execution of government projects and reforms, potentially mitigating political impasses that might otherwise hinder economic progress and banking sector development.

This stable, reform-oriented political environment is crucial for NBK's strategic planning and its ability to capitalize on growth opportunities within the Kuwaiti economy.

Geopolitical stability in the Middle East remains a critical influence on the National Bank of Kuwait's (NBK) international activities and the confidence of its investors. Despite ongoing regional tensions, Kuwait's banking sector, including NBK, generally demonstrates resilience, supported by robust capital adequacy ratios, with NBK maintaining a capital adequacy ratio well above regulatory requirements. For instance, as of the first quarter of 2024, NBK reported a capital adequacy ratio of approximately 17.5%, exceeding the 13% minimum set by Basel III.

While the banking system is structured to absorb potential escalations, significant and unforeseen surges in geopolitical risk could still exert downward pressure on the creditworthiness of regional entities and negatively affect the broader economic outlook, potentially impacting lending portfolios and investment returns. The economic diversification efforts within Kuwait and the Gulf Cooperation Council (GCC) are key to mitigating some of these risks, aiming to reduce reliance on oil prices which can be volatile and influenced by geopolitical events.

The Kuwaiti government demonstrates a steadfast commitment to supporting its banking sector, a critical pillar of the national economy. This backing is evident in the substantial capital reserves held by the state and the implementation of robust regulatory frameworks designed to ensure financial stability. For instance, Kuwait's banking sector assets reached approximately KWD 78.7 billion (USD 257 billion) by the end of 2023, reflecting its significant scale and importance.

This governmental support acts as a vital safety net, significantly bolstering the resilience of major Kuwaiti banks against potential economic downturns or unforeseen financial shocks. Such a strong state endorsement fosters greater confidence among investors and depositors alike, contributing to the sector's overall stability and reputation.

International Relations and Trade Agreements

The National Bank of Kuwait's (NBK) extensive international footprint makes its performance highly sensitive to Kuwait's diplomatic relations and the global network of trade agreements. Fluctuations in trade policies, the imposition of international sanctions, or alterations in diplomatic alliances can directly impact the bank's cross-border dealings, its capacity to attract foreign investment, and its operational reach across different geographical markets.

NBK's strategic positioning across Europe, Asia, and North America means that shifts in the broader international economic and political climate have a direct bearing on its diverse range of financial services. For instance, recent trade dynamics, such as the ongoing adjustments in global supply chains and the evolving trade relationships between major economic blocs, present both opportunities and challenges for NBK's international operations.

- Global Trade Policy Impact: Changes in tariffs or trade barriers, like those seen in trade relations between major economies in 2024, can affect the volume and cost of international transactions facilitated by NBK.

- Sanctions and Diplomatic Ties: The imposition or lifting of international sanctions, as observed with certain geopolitical events in early 2025, can significantly alter NBK's ability to conduct business in affected regions.

- Regional Economic Stability: The economic health of regions where NBK has a presence, influenced by political stability and regional trade pacts, is crucial for its asset growth and profitability. For example, the economic performance of the GCC, a key region for NBK, is closely tied to regional cooperation agreements.

- Foreign Direct Investment (FDI) Flows: Kuwait's international relations influence FDI into the country, which in turn impacts the liquidity and investment opportunities available to NBK.

Regulatory Stability and Central Bank Independence

The Central Bank of Kuwait (CBK) is pivotal in ensuring the nation's financial system remains robust, leveraging its regulatory power and operational independence. Recent regulatory shifts, including the CBK's assumption of supervision for money exchange businesses and the introduction of sustainable finance directives, underscore a dynamic yet stable regulatory landscape. This consistent monetary policy and banking oversight framework offers predictability for the National Bank of Kuwait's strategic planning.

The CBK’s commitment to independence shields monetary policy decisions from short-term political pressures, fostering a stable economic environment. For instance, Kuwait's banking sector, overseen by the CBK, has demonstrated resilience, with total assets of the banking sector reaching approximately KWD 79.2 billion (around $257 billion USD) by the end of 2023, reflecting the effectiveness of the regulatory framework.

- Regulatory Stability: The CBK's established regulatory framework provides a consistent operating environment for banks like NBK.

- Central Bank Independence: The CBK's autonomy in monetary policy decisions contributes to economic predictability.

- Evolving Regulations: Updates like the supervision of money exchange shops and sustainable finance guidelines show adaptability without compromising stability.

- Financial System Oversight: The CBK's diligent banking supervision supports the overall health and trustworthiness of Kuwait's financial sector.

Kuwait's government stability and its policy direction, especially regarding economic diversification and development under Vision 2035, significantly shape the operational landscape for the National Bank of Kuwait (NBK). Accelerated reforms, particularly following political shifts, are anticipated to boost economic growth prospects and the banking sector, which should translate to increased lending opportunities for NBK. For instance, Kuwait's non-oil GDP growth was projected to reach 4.5% in 2024, up from 3.2% in 2023, indicating a positive economic trajectory.

The potential suspension of the National Assembly for periods up to four years could facilitate smoother execution of government projects and reforms, potentially mitigating political impasses that might otherwise hinder economic progress and banking sector development. This stable, reform-oriented political environment is crucial for NBK's strategic planning and its ability to capitalize on growth opportunities within the Kuwaiti economy.

Geopolitical stability in the Middle East remains a critical influence on NBK's international activities and investor confidence. Despite regional tensions, Kuwait's banking sector, including NBK, demonstrates resilience, supported by robust capital adequacy ratios. For example, NBK maintained a capital adequacy ratio of approximately 17.5% in Q1 2024, exceeding the Basel III minimum of 13%.

The Kuwaiti government's commitment to supporting its banking sector, a critical pillar of the national economy, is evident in substantial capital reserves and robust regulatory frameworks. This governmental support acts as a vital safety net, bolstering the resilience of major Kuwaiti banks against potential economic downturns or financial shocks.

| Political Factor | Description | Impact on NBK | Supporting Data (2023-2024) |

| Government Stability & Reforms | Kuwait's Vision 2035 and reform initiatives | Facilitates economic growth and banking sector expansion | Non-oil GDP growth projected at 4.5% in 2024 (up from 3.2% in 2023) |

| Geopolitical Stability | Regional stability and its effect on investor confidence | Influences international operations and investor sentiment | NBK's Capital Adequacy Ratio ~17.5% (Q1 2024), exceeding Basel III minimum (13%) |

| Government Support for Banking Sector | State backing and regulatory oversight | Enhances resilience against economic shocks | Total banking sector assets ~KWD 79.2 billion (end of 2023) |

What is included in the product

This PESTLE analysis thoroughly examines the macro-environmental forces impacting the National Bank of Kuwait across political, economic, social, technological, environmental, and legal domains.

It provides actionable insights for strategic decision-making by identifying key trends, risks, and opportunities within Kuwait's banking sector.

The PESTLE analysis for the National Bank of Kuwait offers a structured framework that simplifies complex external factors, enabling stakeholders to quickly grasp potential risks and opportunities, thus alleviating the pain of information overload during strategic planning.

Economic factors

Oil price fluctuations are a critical economic factor for Kuwait, given its deep reliance on oil exports for revenue. In 2024, the national economy experienced a contraction, partly due to OPEC+ decisions to manage oil production. However, projections indicate a potential economic rebound in 2025 as these production restrictions are anticipated to ease.

For most countries in the Gulf Cooperation Council (GCC), including Kuwait, oil prices hovering around $75 per barrel are generally considered beneficial. This price point typically supports fiscal stability and fosters conditions conducive to economic growth, directly influencing the banking sector's performance and operational capacity.

The Central Bank of Kuwait's (CBK) interest rate policies, which often align with the US Federal Reserve's actions, directly influence the National Bank of Kuwait's (NBK) profitability and its lending margins. Higher interest rates, as seen in 2023, generally boost profitability by widening the spread between lending income and funding costs.

Looking ahead to 2025, projections suggest potential interest rate cuts. While this might lead to a modest contraction in lending margins, it's crucial to consider the offsetting factors. Lower funding costs for NBK and the possibility of increased lending volumes due to a more favorable borrowing environment could mitigate the impact of reduced rates.

As of the close of 2024, the discount rate in Kuwait was 4.00%. This figure is anticipated to see a gradual reduction throughout 2025, reflecting a shift towards a potentially less restrictive monetary policy stance.

Kuwait's Vision 2035 is a strategic roadmap designed to steer the nation away from its heavy reliance on oil, encouraging robust growth in non-oil sectors and accelerating the execution of ambitious development projects. This national initiative presents a fertile ground for financial institutions like the National Bank of Kuwait (NBK).

NBK is positioned to capitalize on Vision 2035 by providing crucial financing for major infrastructure undertakings. Projects such as the development of Mubarak Al-Kabeer Port and the establishment of new residential cities represent substantial financing opportunities that align directly with the vision's objectives.

The anticipated expansion of Kuwait's non-oil economy under Vision 2035 is projected to fuel increased demand for banking services. This trend will likely translate into greater opportunities for NBK to expand its loan portfolio and support the broader credit needs of businesses and individuals within the diversifying economy.

In 2023, Kuwait's non-oil GDP growth was approximately 4.3%, a positive indicator for the sectors targeted by Vision 2035. This growth underscores the potential for increased demand for financial services, including project financing and corporate loans, which NBK is well-equipped to provide.

Inflation Rates and Consumer Purchasing Power

Inflation rates directly impact consumer spending habits and the real value of assets and liabilities held by the National Bank of Kuwait (NBK). High inflation erodes purchasing power, leading consumers to delay discretionary purchases, which can affect NBK's loan and deposit growth. Conversely, stable or declining inflation supports consumer confidence and spending.

Kuwait's inflation has demonstrated a generally downward trend. Projections for 2025-2026 indicate an average inflation rate settling around 2.5%. This level is considered beneficial as it helps to stabilize consumer purchasing power, allowing for more predictable spending patterns and potentially increasing demand for financial products.

The Central Bank of Kuwait actively manages inflation as a core objective of its monetary policy. Decisions regarding interest rates and liquidity are influenced by inflation trends, aiming to maintain price stability. This management directly affects the cost of borrowing and the returns on savings, which are critical considerations for NBK's operational environment and profitability.

- Inflation Trend: Kuwait's inflation rate is projected to average around 2.5% in 2025-2026, down from previous periods.

- Consumer Impact: Stable inflation supports consumer purchasing power, encouraging spending on goods and services.

- NBK's Exposure: Inflation affects the real value of NBK's asset and liability portfolios, influencing lending and deposit strategies.

- Monetary Policy: Central Bank actions to control inflation directly shape the interest rate environment NBK operates within.

Global Economic Growth and Trade Volumes

National Bank of Kuwait's (NBK) international operations are significantly influenced by global economic growth and trade volumes. A robust global economy generally translates to higher lending volumes and increased fee income for NBK's overseas branches, supporting a positive trajectory. However, potential headwinds like slower global economic expansion or escalating trade disputes pose risks to these non-domestic revenue streams, impacting the bank's overall performance. NBK's diversified international footprint across various continents means its financial results are directly tied to the health of economies worldwide.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.1% for 2024, a slight slowdown from previous years, highlighting the sensitivity of international banking operations to macroeconomic shifts. Similarly, the World Trade Organization (WTO) data indicated that global trade growth slowed in 2023, a trend that could directly affect NBK's trade finance and cross-border transaction revenues.

- Global Economic Growth: The IMF's forecast for 3.1% global growth in 2024 suggests a moderate but potentially uneven recovery, impacting NBK's international revenue streams.

- Trade Volumes: A slowdown in global trade, as indicated by WTO reports for 2023, can directly reduce income from trade finance and international transaction services for NBK.

- GCC Banking Sector: While the GCC banking sector generally benefits from rising lending and fee income, global economic slowdowns and trade tensions represent significant external risks.

- Diversified Operations: NBK's presence in multiple continents means that varied economic conditions globally directly shape its non-domestic profitability.

Oil price fluctuations are paramount for Kuwait's economy, with prices around $75 per barrel historically supporting fiscal stability and economic growth. Projections for 2025 anticipate a potential economic rebound as OPEC+ production management policies are expected to ease, positively impacting the banking sector.

Central Bank of Kuwait's interest rate policies, mirroring the US Federal Reserve, directly influence National Bank of Kuwait's (NBK) profitability. While 2023 saw higher rates boosting margins, potential cuts in 2025 might narrow spreads but could be offset by lower funding costs and increased lending volumes.

Kuwait's inflation rate is forecast to stabilize around 2.5% in 2025-2026, a level that supports consumer purchasing power and predictable spending. This stability is crucial for NBK, as inflation impacts the real value of its assets and liabilities, influencing lending and deposit strategies.

| Economic Factor | 2024 Projection/Observation | 2025 Projection/Outlook |

| Oil Prices | Around $75/barrel generally beneficial | Expected stability or slight improvement |

| Interest Rates (Discount Rate) | 4.00% (end of 2024) | Gradual reduction anticipated |

| Inflation Rate | Downward trend | Around 2.5% average |

| Global Economic Growth | IMF projected 3.1% | Moderate but potentially uneven |

| Global Trade Growth | Slowed in 2023 | Potential for continued moderation |

Preview Before You Purchase

National Bank of Kuwait PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the National Bank of Kuwait. This in-depth report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic direction. You'll find detailed insights into market trends, regulatory landscapes, and competitive pressures, all presented in a clear, actionable format. What you see is what you’ll be working with to understand NBK's external environment.

Sociological factors

Kuwait's demographic profile is dynamic, with a significant youth bulge. Projections indicate continued population growth, which directly impacts banking needs. For instance, a substantial portion of the population is under 30, creating a strong demand for digital banking solutions and consumer credit.

This evolving demographic landscape means a larger potential customer base for retail banking services. NBK must anticipate the needs of this growing, younger demographic, focusing on accessible digital platforms and products like personal loans and mortgages. By aligning services with these generational preferences, NBK can effectively capture a larger market share.

Kuwaiti consumers are increasingly embracing digital channels for their banking needs, with a strong preference for convenience and personalized experiences. A recent survey indicated that over 70% of banking transactions in Kuwait are now conducted digitally, highlighting a significant shift away from traditional branch visits.

To stay competitive, the National Bank of Kuwait (NBK) must prioritize ongoing investment in digital transformation. This means enhancing its mobile app and online platform to offer seamless, intuitive services, including streamlined account management and secure, user-friendly digital payment options.

This evolving preference extends to innovative financial solutions. NBK's strategy should incorporate features like personalized financial advice through AI-powered tools and convenient access to a wider range of digital products, mirroring global trends where customer satisfaction is closely tied to digital engagement.

The availability of skilled talent in Kuwait's financial sector, especially in emerging areas like FinTech, cybersecurity, and sustainable finance, is a key driver for National Bank of Kuwait's (NBK) expansion. As of early 2025, reports indicate a growing demand for professionals with expertise in digital banking solutions and environmental, social, and governance (ESG) frameworks, placing emphasis on NBK's need to secure these specialized skills.

NBK's success hinges on its capacity to attract, retain, and develop a top-tier workforce. Initiatives like Kuwaitization, which aims to increase the proportion of Kuwaiti nationals in the workforce, are crucial for national compliance and for fostering a stable, locally-rooted talent pool. This focus supports NBK's competitive positioning and its ability to innovate within the domestic market.

Investing in human capital through continuous learning and specialized training programs is paramount for NBK. By equipping its employees with the latest skills in areas such as advanced analytics and digital transformation, the bank ensures it remains at the forefront of financial services, ready to adapt to evolving market demands and technological advancements.

Cultural Aspects Influencing Financial Product Adoption

Cultural norms in Kuwait significantly shape how financial products are adopted. Islamic banking principles, for instance, are deeply ingrained, driving demand for Sharia-compliant solutions. NBK's strategic investment in Boubyan Bank, its Islamic banking subsidiary, directly addresses this, reflecting a keen understanding of Kuwaiti societal values. This focus is crucial for market penetration and building trust.

Societal values extend to investment preferences. Kuwaiti investors may favor tangible assets or specific types of funds that align with traditional wealth preservation methods. NBK must tailor its product offerings and marketing communications to resonate with these prevailing attitudes, ensuring financial products are perceived as culturally relevant and trustworthy. For example, in 2023, Islamic finance assets in the GCC region, including Kuwait, continued to see robust growth, indicating strong cultural alignment.

- Cultural Alignment: NBK's strategy of bolstering its Islamic banking arm, Boubyan Bank, directly caters to the strong preference for Sharia-compliant financial services in Kuwait.

- Investment Preferences: Understanding that Kuwaiti investors often lean towards tangible assets and specific investment vehicles is key for NBK's product development.

- Market Acceptance: Tailoring marketing messages to reflect cultural nuances is essential for gaining widespread acceptance of new financial products.

- Growth in Islamic Finance: The continued expansion of Islamic finance in the GCC, a trend evident in 2023, underscores the importance of cultural factors in financial product adoption.

Financial Literacy Levels

Financial literacy significantly shapes how consumers interact with banking services. When people understand financial concepts better, they are more likely to seek out and effectively use a wider array of products, including more complex investment and wealth management tools. This trend directly influences the demand for services offered by institutions like the National Bank of Kuwait (NBK).

NBK actively works to boost financial awareness. Their programs, like the 'Bankee' initiative aimed at students, are designed to equip younger generations with essential financial knowledge. A more financially literate populace means a customer base better prepared to engage with sophisticated banking solutions, from digital platforms to investment advisory services.

The impact of improved financial literacy is substantial. For instance, studies from 2024 indicate a correlation between higher financial literacy scores and increased participation in long-term savings and investment plans. This suggests that as NBK's educational efforts take root, they can anticipate a more engaged customer base ready to utilize advanced financial products and services.

- Demand for Sophisticated Products: Higher financial literacy correlates with increased demand for wealth management and complex financial instruments.

- NBK's Educational Role: Initiatives like the 'Bankee' program aim to cultivate a more informed customer base for NBK.

- Customer Engagement: Enhanced financial understanding empowers customers to utilize a broader spectrum of banking services effectively.

- Market Potential: A financially literate population unlocks greater potential for advanced financial product adoption and market growth.

Kuwait's society is deeply influenced by religious and cultural norms, with a strong adherence to Islamic banking principles. This societal value drives significant demand for Sharia-compliant financial products, as demonstrated by the continued robust growth of Islamic finance assets across the GCC region, including Kuwait, throughout 2023. NBK's strategic investment in its Islamic banking subsidiary, Boubyan Bank, directly addresses this cultural preference, solidifying its market position.

Technological factors

National Bank of Kuwait (NBK) is aggressively pursuing digital transformation, investing heavily in IT infrastructure and smart banking applications to improve customer experiences and operational efficiency. This aligns with Kuwait's Vision 2035, which emphasizes a digital economy. NBK's commitment is evident in its development of advanced mobile banking features and its exploration of partnerships with FinTech firms for innovative solutions like digital payments and streamlined electronic loan processing.

The regulatory environment is also supportive, with the Central Bank of Kuwait enacting a digital banking law designed to foster this technological shift. This legal framework encourages innovation and the adoption of new financial technologies, creating a fertile ground for NBK's digital initiatives. For instance, by 2024, the bank aims to see a significant increase in transactions processed through its digital channels, reflecting the growing customer preference for online services.

As banking increasingly moves online, NBK faces growing cybersecurity risks and the critical need for strong data protection. The Kuwaiti government's launch of a National Cybersecurity Strategy in 2024 underscores the urgency for financial institutions to enhance their defenses. NBK must invest in advanced security protocols to protect sensitive customer information and prevent breaches, which could severely damage its reputation and customer trust.

AI and machine learning are poised to revolutionize banking operations, offering substantial boosts to decision-making accuracy, profitability, and crucially, fraud detection and risk management. Kuwaiti banks, including NBK, are actively integrating these advanced analytics to craft more personalized customer experiences and streamline their internal processes. For example, by mid-2024, many financial institutions globally reported significant reductions in false positives for fraud alerts, sometimes by as much as 30%, due to AI-driven systems. NBK's strategic investments in technology are geared towards harnessing these capabilities, aiming to gain a competitive edge by capitalizing on data-driven insights and operational efficiencies.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technologies (DLT) present significant opportunities for transforming banking operations, though widespread adoption is still in its early stages. NBK, aiming to stay ahead, is actively investigating how these technologies can boost security, transparency, and efficiency across its services, particularly in payments and trade finance. The bank is engaged in research and pilot projects to assess the feasibility of integrating DLT for enhanced record-keeping and transaction processing.

The global market for blockchain in financial services was projected to reach over $10 billion by 2024, indicating substantial growth potential. NBK's strategic exploration aligns with this trend, focusing on areas like faster cross-border payments and more secure digital identity management.

- Enhanced Security: DLT’s inherent cryptographic features can reduce fraud and cyber threats.

- Increased Transparency: Shared, immutable ledgers offer greater visibility into transactions.

- Operational Efficiency: Streamlining processes in trade finance and payments can cut costs and settlement times.

- Regulatory Compliance: DLT can aid in meeting Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Infrastructure Development for Digital Banking

The quality and availability of digital infrastructure, such as 5G and fiber optic networks, are vital for the broad adoption of digital banking services. Kuwait's telecommunications sector is well-developed, with high internet penetration rates, creating a favorable environment for the National Bank of Kuwait (NBK) to enhance its digital offerings. For instance, by the end of 2023, Kuwait reported a mobile broadband subscription rate exceeding 90%, a testament to its robust telecom infrastructure, which directly supports the expansion of digital banking services. Continued investment in and maintenance of this infrastructure are crucial for ensuring smooth and reliable digital banking experiences for customers.

NBK can leverage Kuwait’s advanced digital infrastructure to further innovate and deliver seamless banking experiences. The bank’s strategic focus on digital transformation is well-aligned with the nation’s technological advancements. In 2024, NBK reported a significant increase in digital transactions, highlighting the growing reliance on and effectiveness of its digital platforms, which are underpinned by the country's strong connectivity. This trend is expected to continue as 5G deployment expands, offering faster speeds and lower latency for mobile banking applications.

- Digital Infrastructure Quality: Kuwait's investment in fiber optics and 5G networks directly supports the delivery of advanced digital banking solutions.

- Internet Penetration: High internet penetration rates in Kuwait, exceeding 90% for mobile broadband subscriptions as of late 2023, provide a large addressable market for digital banking.

- NBK's Digital Growth: NBK's increasing volume of digital transactions demonstrates the successful integration of digital services with robust infrastructure.

- Future Expansion: Ongoing infrastructure development is essential for NBK to maintain and enhance its competitive edge in the digital banking landscape.

Technological advancements are reshaping the banking landscape, with NBK at the forefront of digital innovation in Kuwait. The bank's aggressive investment in IT infrastructure and smart banking applications, driven by Kuwait's Vision 2035, is enhancing customer experience and operational efficiency. By mid-2024, AI integration is expected to significantly improve fraud detection, with some institutions reporting up to a 30% reduction in false positives.

NBK is also exploring blockchain technology for enhanced security and efficiency in areas like payments and trade finance. This aligns with the global blockchain in financial services market, projected to exceed $10 billion by 2024. Furthermore, Kuwait's robust digital infrastructure, with mobile broadband subscriptions over 90% by late 2023, provides a strong foundation for NBK's digital growth, evidenced by its increasing digital transaction volumes in 2024.

| Technology Area | NBK's Focus/Investment | Impact/Opportunity | Relevant Data (2023-2024) |

|---|---|---|---|

| Digital Transformation | IT infrastructure, Smart banking apps | Improved customer experience, operational efficiency | Kuwait Vision 2035 alignment |

| Artificial Intelligence (AI) | Advanced analytics for personalization, fraud detection | Enhanced decision-making, risk management | Up to 30% reduction in false fraud positives reported globally (mid-2024) |

| Blockchain/DLT | Research and pilot projects for payments, trade finance | Increased security, transparency, efficiency | Global blockchain in financial services market projected over $10 billion by 2024 |

| Digital Infrastructure | Leveraging 5G, fiber optics | Seamless digital banking experiences | Kuwait mobile broadband subscriptions >90% (late 2023); Increasing digital transactions for NBK (2024) |

Legal factors

National Bank of Kuwait (NBK) operates under a robust regulatory environment, guided by international standards like Basel III and IFRS. These frameworks dictate capital adequacy, liquidity management, and financial reporting, ensuring the bank's stability and transparency. For instance, Basel III's focus on strengthening bank capital requirements aims to mitigate systemic risk, a crucial aspect for a major financial institution like NBK.

The Central Bank of Kuwait (CBK) plays a vital role in overseeing the banking sector, regularly updating regulations to align with global best practices and maintain financial sector resilience. Staying compliant with these dynamic regulations is paramount for NBK's continued financial health and its reputation on the international stage, particularly as the bank expands its global footprint.

The National Bank of Kuwait (NBK) must strictly adhere to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, a critical legal obligation given its extensive domestic and international reach.

The Central Bank of Kuwait (CBK) and other supervisory bodies mandate stringent regulations designed to thwart financial crimes, necessitating the implementation of strong internal controls and comprehensive reporting systems. For instance, in 2023, Kuwait implemented updated regulations for financial institutions, aligning with global standards to combat financial crime more effectively.

Recent ministerial decisions, such as those targeting money exchange companies, underscore the government's commitment to bolstering oversight within the financial sector, directly impacting NBK's compliance framework.

Consumer protection and data privacy laws are paramount for the National Bank of Kuwait (NBK), especially with the ongoing expansion of digital banking. Regulations like Kuwait’s Personal Data Protection Law (PDPL) mandate stringent controls over how customer information is collected, processed, and stored, directly influencing NBK's operational frameworks.

Compliance not only safeguards NBK from potential fines, which can be significant, but also cultivates essential customer trust. In 2023, global data breaches cost an average of $4.35 million, underscoring the financial and reputational risks of non-compliance. NBK's commitment to transparent data handling and robust cybersecurity measures is therefore critical for maintaining its market position and customer loyalty.

Taxation Policies and Corporate Tax Rates

Changes in taxation policies, such as the proposed 15% minimum tax on banks with significant international operations, directly affect National Bank of Kuwait's (NBK) bottom line. For instance, if implemented globally, this could reduce the net income of banks that currently benefit from lower tax jurisdictions. NBK operates in multiple countries, each with its own corporate tax structure, necessitating constant monitoring and adaptation to ensure compliance and optimize its financial strategy.

Navigating diverse corporate tax rates across its international markets is a key challenge for NBK. For example, corporate tax rates can vary significantly, with some Gulf Cooperation Council (GCC) countries, like Saudi Arabia, having rates around 20% for certain industries, while others might have lower or no corporate income tax. Adapting to these fiscal landscapes is vital for NBK's financial planning and maintaining its competitive edge.

- Global Minimum Tax Impact: The OECD's Pillar Two initiative, aiming for a 15% global minimum corporate tax, could increase NBK's tax burden in jurisdictions where its effective tax rate is lower.

- Regional Tax Variations: NBK faces differing corporate tax rates across its operating regions, from Kuwait's generally favorable tax environment for financial institutions to potentially higher rates in other markets it serves.

- Regulatory Compliance Costs: Adhering to varying tax regulations and reporting requirements in each country adds to operational complexity and compliance expenses for NBK.

- Strategic Tax Planning: Effective tax planning is crucial for NBK to manage its global tax liabilities efficiently, ensuring it remains competitive while meeting all legal obligations.

International Sanctions and Cross-Border Regulations

As a major international bank, the National Bank of Kuwait (NBK) is significantly influenced by international sanctions and cross-border regulations. Compliance with sanctions imposed by entities like the United Nations, the United States, and the European Union is paramount, directly affecting NBK's ability to conduct transactions globally. For instance, in 2023, the US Treasury's Office of Foreign Assets Control (OFAC) continued to update its Specially Designated Nationals (SDN) list, requiring constant vigilance from financial institutions like NBK to avoid facilitating prohibited transactions.

Navigating the intricate web of financial regulations across diverse jurisdictions demands a robust and adaptable compliance framework. Failure to adhere to these rules can result in severe penalties, including hefty fines and significant reputational damage. NBK's proactive monitoring of evolving geopolitical landscapes and sanctions regimes is crucial for mitigating these risks and maintaining its international standing.

- Sanctions Compliance: NBK must adhere to sanctions lists from major global bodies like the UN, US OFAC, and EU, impacting cross-border financial flows.

- Regulatory Complexity: Operating globally requires NBK to manage varying financial regulations in numerous countries, necessitating a strong internal compliance infrastructure.

- Geopolitical Monitoring: Staying abreast of international political shifts and potential new sanctions is essential for proactive risk management and operational continuity.

- Reputational Risk: Non-compliance with international regulations can lead to substantial fines and severe damage to NBK's global reputation.

NBK must navigate a complex legal landscape, including stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, reinforced by Kuwaiti ministerial decisions in 2023 aimed at enhancing financial sector oversight.

Consumer protection and data privacy are critical, with Kuwait's Personal Data Protection Law (PDPL) impacting how NBK handles customer information; global data breaches averaged $4.35 million in 2023, highlighting the financial and reputational risks of non-compliance.

Environmental factors

Kuwait's commitment to sustainable development is gaining momentum, with a target of net-zero emissions by 2060. The National Bank of Kuwait (NBK) is actively supporting this national agenda, positioning itself as a leader in environmental, social, and governance (ESG) practices within the region.

NBK has rolled out a comprehensive Sustainable Financing Framework, signaling its dedication to integrating sustainability into its core operations. This framework guides the bank's efforts to mobilize capital for environmentally beneficial projects, responding to a clear market demand for green financial products.

A key initiative is NBK's issuance of green bonds, a significant step in attracting investment for climate-friendly ventures. These bonds allow the bank to tap into a growing pool of capital specifically allocated for sustainability, demonstrating a proactive approach to climate finance.

The bank's green financing extends to tangible consumer products, including green mortgage loans for energy-efficient homes and financing options for electric vehicles. These offerings directly support individuals and businesses in transitioning to more sustainable lifestyles and operations, aligning with Kuwait's broader environmental goals.

The increasing global emphasis on Environmental, Social, and Governance (ESG) factors significantly shapes the operational landscape for financial institutions like the National Bank of Kuwait (NBK). This heightened focus translates into a growing demand for robust and transparent ESG reporting.

In line with this trend, the Central Bank of Kuwait has actively engaged in establishing a framework for sustainable finance, issuing guidelines that set clear ESG standards for domestic banks. These directives are crucial for ensuring consistency and accountability within the sector.

NBK demonstrates its commitment to these principles through its detailed annual Sustainability Reports. These reports meticulously outline the bank's progress and contributions across its core ESG pillars, serving to bolster its corporate reputation and appeal to a growing segment of socially responsible investors.

For instance, NBK's 2023 Sustainability Report highlighted a 15% reduction in its operational carbon footprint compared to 2022, alongside a 10% increase in financing for green projects, underscoring tangible progress in its environmental stewardship.

National Bank of Kuwait's (NBK) brand image is significantly influenced by its environmental stewardship. Concerns about climate change and sustainability are growing, directly impacting how customers and investors perceive financial institutions.

A perceived lag in environmental initiatives or negative publicity surrounding NBK's environmental footprint could alienate a growing segment of environmentally aware clientele and potential investors. For instance, in 2023, global ESG (Environmental, Social, and Governance) investment funds saw continued inflows, highlighting investor preference for sustainable businesses.

To counter this, NBK's proactive engagement in environmental protection, such as supporting renewable energy projects or reducing its operational carbon emissions, is crucial. Transparently communicating these efforts and their impact is key to bolstering its reputation and mitigating reputational damage from environmental concerns.

Resource Scarcity and Energy Transition Policies

Policies addressing resource scarcity and the shift to cleaner energy sources directly influence industries that the National Bank of Kuwait (NBK) finances, potentially reshaping its loan portfolios and investment outlook. For instance, a global push towards renewables might reduce demand for financing fossil fuel projects, while increasing opportunities in green infrastructure.

NBK is proactively integrating climate risk into its broader enterprise risk management, acknowledging the financial implications of environmental shifts. This strategic move helps the bank anticipate and mitigate potential losses stemming from climate-related events or policy changes affecting its clients.

The bank is actively supporting its clients through their transition to a low-carbon economy, recognizing that this shift is crucial for long-term business sustainability. This could involve offering specialized financing for green technologies or advisory services for companies developing sustainable business models.

NBK is also committed to reducing its own environmental impact. As of 2024, the bank has been installing solar panels across its branches, a tangible step towards lowering its operational carbon footprint and demonstrating leadership in sustainability practices.

Key initiatives and data points include:

- Climate Risk Integration: NBK's commitment to embedding climate risk within its enterprise risk management framework is a significant step in aligning its operations with global sustainability goals.

- Client Support for Transition: Providing financial and advisory services to help clients navigate the energy transition is a core strategy, fostering resilience across NBK's financed sectors.

- Renewable Energy Adoption: The installation of solar panels in NBK branches by 2024 highlights a direct effort to decrease the bank's operational carbon footprint.

- Global Energy Trends: The International Energy Agency (IEA) reported in its 2024 outlook that renewable energy capacity additions are set to grow by over 30% globally, underscoring the momentum of the energy transition that NBK's policies must address.

Physical Risks from Climate Change

While Kuwait is primarily known for its arid climate, the National Bank of Kuwait (NBK) must still acknowledge the indirect physical risks stemming from global climate change. For instance, extreme weather events in other regions could disrupt global supply chains, impacting Kuwait's import-reliant economy and, consequently, the financial health of NBK's corporate clients. Rising sea levels, a more direct threat to coastal nations, could also indirectly affect regional stability and trade routes crucial for Kuwait's economic activity.

NBK's strategic planning and risk management frameworks should incorporate assessments of how these long-term environmental shifts might influence its asset base and the broader economic landscape in which it operates. This involves evaluating the potential for climate-induced disruptions to affect the resilience of its physical infrastructure, such as data centers or branches, and more importantly, the vulnerability of its diverse client portfolios to climate-related economic shocks.

Consider the following potential impacts:

- Supply Chain Disruptions: Extreme weather events in key agricultural or manufacturing hubs could lead to increased commodity prices and reduced availability of goods, impacting businesses that rely on imports.

- Regional Economic Instability: Climate-induced migration or resource scarcity in neighboring countries could create geopolitical and economic instability, potentially affecting cross-border investments and trade.

- Insurance and Reinsurance Costs: Increased frequency and severity of weather-related events globally could lead to higher insurance premiums for businesses and individuals, potentially increasing loan default risks for NBK.

- Infrastructure Vulnerability: While not directly in Kuwait, climate-related damage to critical global infrastructure (e.g., shipping lanes, energy grids) could have ripple effects on international trade and financial markets.

Kuwait's commitment to net-zero emissions by 2060 positions the National Bank of Kuwait (NBK) to lead in ESG practices regionally. NBK's Sustainable Financing Framework guides capital mobilization for environmental projects, responding to market demand for green financial products, exemplified by their green bond issuances.

The bank's 2023 Sustainability Report showcased a 15% reduction in operational carbon footprint and a 10% increase in green project financing. As of 2024, NBK is installing solar panels across its branches to further reduce its environmental impact.

NBK actively integrates climate risk into its enterprise risk management, anticipating financial implications of environmental shifts and supporting clients in their transition to a low-carbon economy. This includes offering specialized financing for green technologies and advisory services.

Global energy trends, such as the International Energy Agency's 2024 outlook projecting over a 30% growth in renewable energy capacity additions, underscore the momentum NBK's policies must address.

| Environmental Factor | NBK's Action/Impact | Data Point/Example |

|---|---|---|

| Climate Change & Emissions | Commitment to net-zero by 2060, operational carbon footprint reduction | 15% reduction in operational carbon footprint (2023 Report) |

| Green Financing | Sustainable Financing Framework, green bond issuance | 10% increase in financing for green projects (2023 Report) |

| Renewable Energy | Installation of solar panels in branches | Ongoing installation across branches (2024) |

| Climate Risk Management | Integration into enterprise risk management | Proactive assessment of environmental shifts' financial implications |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the National Bank of Kuwait is grounded in comprehensive data from official Kuwaiti government ministries, the Central Bank of Kuwait, and reputable international financial institutions like the IMF and World Bank. This ensures a robust understanding of the political, economic, and legal landscapes affecting the bank.