National Bank of Kuwait Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Bank of Kuwait Bundle

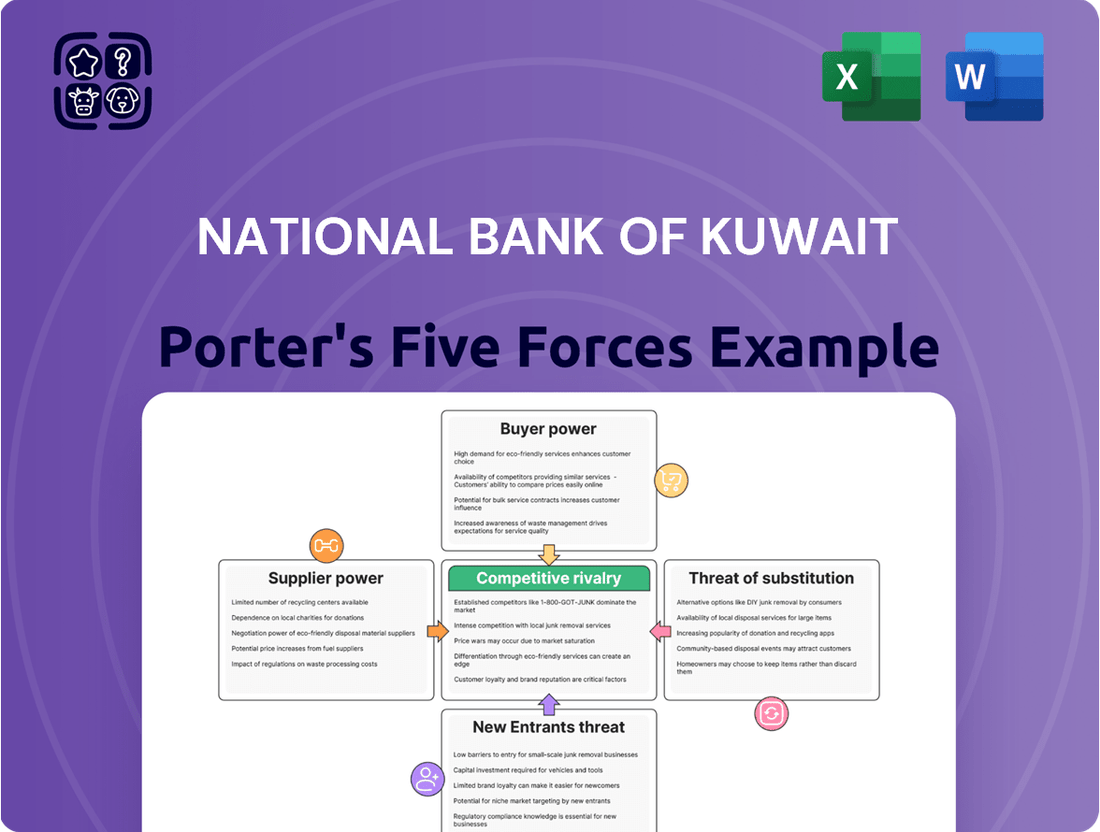

The National Bank of Kuwait operates within a dynamic banking sector, facing moderate bargaining power from both customers and suppliers. While new entrants pose a manageable threat due to high capital requirements and regulatory hurdles, the intensity of rivalry among existing players is significant. The threat of substitutes, such as fintech solutions, is a growing concern that requires strategic adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore National Bank of Kuwait’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of key suppliers significantly impacts the bargaining power within the banking sector, including for institutions like the National Bank of Kuwait. Banks often depend on a limited number of providers for critical technology infrastructure, specialized software like core banking systems, and even highly skilled labor in areas such as cybersecurity and data analytics. This reliance on a few specialized vendors, especially for proprietary or advanced solutions, gives those suppliers considerable leverage.

When these suppliers are few and possess unique or essential offerings, their ability to dictate terms and pricing intensifies. For example, the market for advanced cybersecurity solutions or cutting-edge core banking platforms might be dominated by a handful of companies. In 2023, global IT spending in the financial services sector was projected to reach over $300 billion, with a significant portion allocated to software and infrastructure, highlighting the financial weight of these supplier relationships.

The bargaining power of suppliers for National Bank of Kuwait (NBK) is significantly influenced by the switching costs associated with core banking systems and IT infrastructure. These costs, encompassing not only financial outlays but also the complexity of migration and potential operational disruptions, create a substantial lock-in effect for existing technology partners. For example, a major bank like NBK might spend millions of dollars and face years of implementation challenges to replace its primary core banking platform, a system that underpins virtually all its operations.

The sheer magnitude of these switching costs grants considerable leverage to incumbent suppliers of essential banking technologies and data services. Banks are therefore hesitant to change providers unless the benefits clearly outweigh the immense disruption and expense. This inherent stickiness in the supplier relationship means that NBK, like its peers, must carefully consider long-term partnerships and the potential for price increases or less favorable terms from suppliers who understand the difficulty of replacement.

The availability of substitute inputs significantly impacts the bargaining power of suppliers for the National Bank of Kuwait (NBK). While readily available commodities like basic IT hardware or general office supplies offer numerous alternatives, limiting supplier leverage, the situation changes dramatically for specialized inputs. For instance, advanced financial technology platforms, particularly those enabling digital transformation and robust cybersecurity, often lack readily available substitutes. This scarcity directly amplifies the bargaining power of the few suppliers capable of providing these critical services.

In 2024, the financial sector's reliance on bespoke digital solutions and highly specialized talent, especially in areas like AI-driven analytics and advanced cybersecurity protocols, means that banks like NBK face suppliers with considerable pricing power. The cost of acquiring and implementing these cutting-edge technologies is substantial, often requiring significant upfront investment and ongoing licensing fees. For example, custom-built banking software or specialized fintech integrations can represent a significant portion of a bank's IT budget, underscoring the supplier's leverage when few alternatives exist.

Importance of Supplier's Input to NBK's Business

The input from specialized technology and data providers is vital for National Bank of Kuwait (NBK). For instance, advanced digital platforms and robust data analytics are essential for delivering competitive banking services and ensuring operational efficiency. NBK's reliance on these critical inputs, particularly in areas like cybersecurity and regulatory technology (RegTech), significantly enhances the bargaining power of these suppliers. In 2024, the global market for financial technology solutions saw substantial growth, with banking institutions investing heavily in digital transformation initiatives, underscoring the critical nature of these supplier relationships.

NBK's dependence on suppliers for core technological infrastructure and specialized software, such as core banking systems and sophisticated fraud detection tools, creates a strong supplier position. Without access to reliable and up-to-date technology, NBK's ability to innovate and maintain its market edge would be compromised. This reliance is particularly pronounced in areas requiring specialized expertise, where few alternative suppliers exist. The increasing complexity of financial regulations further amplifies the need for specialized compliance software, strengthening supplier leverage.

- Criticality of Digital Platforms: NBK's operational and strategic success hinges on sophisticated digital platforms for customer service, transactions, and internal operations.

- Data Analytics Dependency: Access to advanced data analytics tools is crucial for risk management, customer insights, and personalized product offerings.

- Regulatory Compliance Software: The need for specialized software to navigate complex and evolving regulatory landscapes enhances the bargaining power of RegTech providers.

- Limited Alternatives for Specialized Services: In niche areas like advanced cybersecurity or specific AI-driven banking solutions, the number of capable suppliers is often limited, increasing their influence.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge, particularly from technology and data providers within the financial sector. These entities could leverage their expertise and infrastructure to offer financial services directly, effectively becoming competitors to institutions like the National Bank of Kuwait (NBK) rather than mere suppliers.

While this was historically less of a concern for traditional banks, the burgeoning landscape of Banking as a Service (BaaS) and embedded finance models is fundamentally changing the dynamics. Powerful technology firms are increasingly capable of bypassing established banks for specific financial functions, thereby amplifying the bargaining power of these tech-centric suppliers.

- Tech firms entering BaaS: Companies like Stripe and Adyen are already offering payment processing and other financial services directly to businesses, demonstrating a clear path for forward integration.

- Embedded finance growth: The market for embedded finance is projected to reach substantial figures, with some estimates suggesting it could grow to over $7 trillion globally in the coming decade, highlighting the potential scale of this threat.

- Data as a competitive asset: Suppliers with access to vast amounts of customer data could potentially use this information to develop and offer tailored financial products, directly competing with banks' existing offerings.

The bargaining power of suppliers for National Bank of Kuwait (NBK) is elevated due to the critical nature of specialized IT infrastructure and software, coupled with high switching costs. For instance, core banking systems are essential, and replacing them can cost millions and disrupt operations for years, making banks hesitant to switch. In 2024, the financial sector's investment in digital transformation, including advanced cybersecurity and AI analytics, further solidifies the leverage of providers in these niche markets.

The concentration of suppliers for advanced financial technology and data analytics solutions significantly empowers them. These providers, often few in number, offer unique or essential services that banks like NBK rely on for competitive advantage and regulatory compliance. The scarcity of viable alternatives for cutting-edge solutions means these suppliers can dictate terms and pricing, a trend amplified by the increasing complexity of financial regulations requiring specialized RegTech.

Limited substitutes for critical banking technologies and specialized expertise grant considerable leverage to suppliers. While basic IT hardware has many alternatives, advanced platforms for digital transformation or robust cybersecurity often have very few, if any, direct substitutes. This scarcity, combined with the substantial investments banks make in these technologies, strengthens the suppliers' negotiating position, allowing them to command premium pricing and favorable terms.

The threat of forward integration by technology suppliers into areas like Banking as a Service (BaaS) or embedded finance directly increases their bargaining power. As tech firms can increasingly offer financial services directly, they shift from being mere suppliers to potential competitors. This dynamic, evident in the growth of embedded finance which could reach trillions globally, means banks like NBK must carefully manage these supplier relationships, as they hold the potential to disintermediate traditional banking functions.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the National Bank of Kuwait's operating environment in the Kuwaiti banking sector.

Easily identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis for the National Bank of Kuwait, allowing for proactive strategic adjustments.

Customers Bargaining Power

NBK’s customer base is broad, encompassing individuals, businesses, and large institutions. While individual customers typically have minimal leverage due to their smaller transaction volumes, significant corporate and institutional clients, particularly those with substantial deposits or complex banking requirements, can wield considerable bargaining power. For instance, in 2024, large corporate clients often sought personalized service packages and preferential rates, directly impacting NBK’s pricing strategies.

Customers in Kuwait and NBK's international markets have a wealth of banking alternatives. This includes traditional banks, Islamic financial institutions, and an expanding landscape of fintech companies. For example, by the end of 2023, the number of digital banking users in the MENA region was projected to exceed 270 million, highlighting the shift towards accessible digital financial services.

The availability of digital-only banks and specialized payment providers further amplifies customer choice. This ease of access to diverse financial solutions means customers can readily switch to competitors offering more attractive interest rates, superior service quality, or greater convenience. This competitive environment inherently boosts the bargaining power of the customer.

Customer switching costs for banking services are significantly declining. Historically, changing banks meant a cumbersome process of updating direct debits, standing orders, and informing multiple parties, creating a strong lock-in effect. However, the rise of digital banking and open banking APIs, which allow easier data sharing and account aggregation, has dramatically lowered these barriers.

This reduction in switching costs directly enhances customer bargaining power. With less friction involved in moving their accounts, customers are more inclined to shop around for better interest rates, lower fees, or superior digital experiences. For instance, in 2024, many fintech solutions are making account portability a matter of a few clicks, directly challenging traditional bank customer retention strategies.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for the National Bank of Kuwait (NBK), especially within its retail and small to medium-sized enterprise (SME) segments. These customers are keenly aware of fees, interest rates on loans, and the returns offered on their deposits.

In Kuwait's competitive banking landscape, NBK must carefully calibrate its pricing strategies. Offering attractive rates and competitive fees is crucial for both retaining existing customers and attracting new ones. This balancing act directly impacts NBK's profitability while ensuring market share.

- Fee Sensitivity: Retail customers often compare banking fees, making transparency and competitive pricing essential for NBK.

- Interest Rate Sensitivity: Loan and deposit rates are key decision factors for both individuals and SMEs, influencing borrowing and saving decisions.

- Digitalization Impact: The rise of digital banking platforms has amplified price comparison capabilities, increasing customer bargaining power.

- Market Competition: With numerous local and international banks operating in Kuwait, customers have ample alternatives, heightening price sensitivity.

Information Availability and Digital Literacy

Customers are increasingly digitally savvy and have access to a wealth of financial information, significantly boosting their bargaining power. This heightened awareness allows them to readily compare offerings from various financial institutions and fintech companies. For instance, by mid-2024, reports indicated a significant uptick in users actively comparing banking products online, with over 60% of consumers in key markets using comparison websites before making financial decisions.

This easy access to data empowers customers to negotiate better terms and demand more competitive rates and services. They can efficiently research loan interest rates, account fees, and investment performance, putting pressure on banks like National Bank of Kuwait to offer superior value propositions to retain their business. The proliferation of financial comparison tools and readily available customer reviews further amplifies this trend.

- Increased Online Comparison: Customers widely utilize digital platforms to compare financial products, leading to greater price transparency.

- Informed Decision-Making: Enhanced digital literacy empowers consumers to understand complex financial products and demand better value.

- Fintech Competition: The rise of fintechs offering competitive rates and user-friendly interfaces further intensifies customer demands on traditional banks.

- Negotiating Power: Access to market data gives customers leverage to negotiate fees, interest rates, and service levels.

The bargaining power of customers for the National Bank of Kuwait (NBK) is substantial, driven by increased market competition and the ease with which customers can access information and switch providers. With numerous banking alternatives, including digital-only options, customers can readily compare rates and services, forcing NBK to offer competitive pricing and enhanced value to retain its client base.

| Factor | Impact on NBK | 2024 Data/Trend |

|---|---|---|

| Availability of Alternatives | Increases customer leverage to seek better terms. | MENA digital banking users projected over 270 million by end of 2023. |

| Switching Costs | Lowered by digital banking, enabling easier customer movement. | Fintech solutions in 2024 simplify account portability. |

| Customer Price Sensitivity | High, especially for retail and SMEs, impacting fee and rate strategies. | Over 60% of consumers in key markets use comparison websites for financial decisions (mid-2024). |

| Digital Savvy & Information Access | Empowers customers to negotiate and demand better value. | Significant uptick in online financial product comparison by mid-2024. |

Preview the Actual Deliverable

National Bank of Kuwait Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the National Bank of Kuwait, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will receive this exact, professionally formatted analysis, offering critical insights into NBK's competitive landscape and strategic positioning within the banking sector.

Rivalry Among Competitors

The Kuwaiti banking landscape is characterized by a concentrated market structure, with National Bank of Kuwait (NBK) facing intense rivalry from other prominent local institutions. Key competitors include Kuwait Finance House (KFH), Gulf Bank, and Commercial Bank of Kuwait, all vying for market share through diverse product offerings and customer engagement strategies.

This competition isn't limited to traditional banks. NBK also contends with the presence of international banks operating within Kuwait, bringing global expertise and financial muscle. Furthermore, the rise of agile fintech companies presents a growing challenge, as they innovate rapidly in areas like digital payments and lending, potentially disrupting established banking models.

The Kuwaiti banking sector is expected to see moderate growth in 2025, fueled by ongoing economic diversification efforts and increased government spending. For instance, the Kuwaiti government has allocated significant funds towards infrastructure projects, which directly benefits the banking industry through increased lending and transactional activity.

Despite this positive outlook, banks are not solely relying on organic expansion. There's a notable trend towards inorganic growth, with mergers and acquisitions becoming a key strategy for gaining market share and enhancing competitive positioning. This pursuit of consolidation highlights an underlying intensity in the rivalry among financial institutions.

Banks traditionally offer a similar suite of core products like savings accounts and loans. However, the battle for customers is increasingly won through distinct digital innovations, highly personalized customer service, and niche product development. Think about specialized areas such as green finance initiatives or dedicated support programs for small and medium-sized enterprises (SMEs).

The National Bank of Kuwait (NBK) actively pursues differentiation. A prime example is its significant investment in digital transformation, aiming to provide a seamless and modern banking experience. This strategy is further bolstered by unique ventures like Weyay, NBK’s digital-only bank, designed to capture a specific segment of the market and stand out in a crowded financial sector.

Exit Barriers

Exit barriers in Kuwait's banking sector are notably high, primarily due to substantial capital investments required to establish and maintain operations. These high upfront costs and ongoing operational expenditures make it economically challenging for any bank to simply cease operations without significant financial loss. This situation forces competitors to stay engaged in the market, even during periods of lower profitability.

Furthermore, regulatory complexities add another layer of difficulty to exiting the Kuwaiti banking market. Navigating the intricate web of regulations set by the Central Bank of Kuwait (CBK) for winding down operations is a demanding and time-consuming process. The strategic importance of banking to the national economy also means that regulators are keen to ensure an orderly exit, which can further complicate and prolong the process.

The strategic importance of banking to the national economy means that competitors are likely to remain in the market, intensifying long-term rivalry. Instead of exiting, existing players must continue to fight for market share, especially given that the banking sector is crucial for economic stability and growth in Kuwait. This persistence among competitors contributes to a more competitive landscape.

For instance, as of early 2024, the total assets of Kuwaiti banks collectively reached over KWD 90 billion, underscoring the significant capital commitment within the sector. This immense scale of assets makes a swift exit practically impossible without substantial divestment challenges.

- High Capital Requirements: Banks must maintain significant capital reserves, often exceeding KWD 100 million for commercial banks, as mandated by the CBK.

- Regulatory Hurdles: Obtaining approval for mergers, acquisitions, or liquidations involves extensive due diligence and compliance with CBK directives.

- Systemic Importance: The banking sector's role in facilitating trade, investment, and monetary policy means regulators scrutinize any potential exit closely to prevent economic disruption.

- Reputational Risk: A poorly managed exit can damage a bank's reputation and that of its stakeholders, making competitors hesitant to pursue such a path.

Market Concentration and Leadership

The competitive rivalry within Kuwait's banking sector is notably high, with National Bank of Kuwait (NBK) and Kuwait Finance House (KFH) holding a dominant position. These two giants, along with a few other mid-sized institutions, shape the market landscape.

Despite this concentration, the intensity of competition is significant. Banks are actively pursuing consolidation strategies, while simultaneously investing heavily in digital transformation. This push towards digital capabilities is a key battleground for gaining market share and maintaining existing customer bases.

- Market Dominance: NBK and KFH collectively command a substantial portion of the Kuwaiti banking market.

- Intense Competition: Despite market concentration, rivalry remains fierce among all players.

- Digitalization Race: Significant investments in digital offerings are a primary driver of competitive advantage.

- Consolidation Trend: Larger banks are exploring consolidation as a strategic move.

Competitive rivalry in Kuwait's banking sector is intense, with National Bank of Kuwait (NBK) and Kuwait Finance House (KFH) leading the charge. This concentration, however, doesn't diminish the fierce competition, as banks vie for market share through digital innovation and customer service. As of early 2024, Kuwaiti banks collectively held over KWD 90 billion in assets, highlighting the significant capital committed by players who are unlikely to exit due to high capital requirements and regulatory hurdles.

| Competitor | Market Share (Estimated 2024) | Key Strategy |

|---|---|---|

| National Bank of Kuwait (NBK) | 30-35% | Digital transformation, international expansion, SME focus |

| Kuwait Finance House (KFH) | 25-30% | Islamic finance specialization, digital services, regional growth |

| Gulf Bank | 10-15% | Digital channels, customer experience enhancement, retail banking |

| Commercial Bank of Kuwait | 8-12% | Corporate banking, digital solutions, personalized services |

SSubstitutes Threaten

The proliferation of digital payment platforms and mobile wallets, many originating from non-bank technology firms, directly challenges traditional bank-led transaction methods. These alternatives provide enhanced convenience and speed, often at a reduced cost, which is particularly attractive to younger, digitally native consumers.

For instance, by the end of 2023, global mobile payment transaction volume was projected to reach over $14 trillion, demonstrating a clear consumer shift away from traditional methods. This trend suggests a growing threat of substitution as customers increasingly opt for these streamlined, accessible digital solutions over conventional bank services.

Peer-to-peer (P2P) lending platforms and crowdfunding initiatives represent emerging substitutes for traditional banking services. These platforms allow individuals and businesses to borrow and invest directly, bypassing intermediaries like the National Bank of Kuwait. While still developing in Kuwait, these alternatives could gain traction, particularly for small and medium-sized enterprises (SMEs) seeking capital and for individual investors looking for different returns.

Non-bank investment platforms and robo-advisors pose a significant threat by offering direct market access and automated wealth management, bypassing traditional bank services. These digital alternatives often boast lower fee structures, making them highly attractive to cost-conscious investors. For example, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow significantly, indicating a clear shift in investor preference.

Cryptocurrencies and Blockchain-based Finance

The rise of cryptocurrencies and blockchain technology poses a significant long-term threat of substitution for traditional banking services. These decentralized systems offer alternative avenues for transactions, investments, and even lending, potentially bypassing established financial intermediaries. For instance, the global cryptocurrency market capitalization reached approximately $2.6 trillion in early 2024, indicating substantial adoption and a growing alternative financial ecosystem. This trend challenges the very foundation of how financial institutions like the National Bank of Kuwait operate.

These innovations provide decentralized alternatives for:

- Transactions: Cryptocurrencies enable peer-to-peer transfers, reducing reliance on traditional payment networks.

- Asset Management: Blockchain platforms facilitate the tokenization of assets, offering new ways to hold and trade ownership.

- Lending and Borrowing: Decentralized Finance (DeFi) protocols provide access to credit and yield generation without traditional banks.

Embedded Finance and Brand-led Financial Services

The rise of embedded finance presents a significant threat of substitutes for traditional banks like National Bank of Kuwait. This trend integrates financial services directly into non-financial platforms, effectively making banking invisible to the end-user. For instance, e-commerce sites offering 'Buy Now, Pay Later' options or ride-sharing apps facilitating in-app payments bypass traditional banking channels.

Brands outside the financial sector can now offer credit or payment solutions directly to consumers. This disintermediation reduces the reliance on banks for everyday financial transactions. By 2024, the global embedded finance market was projected to reach hundreds of billions of dollars, highlighting the scale of this shift. For example, companies like Klarna, offering embedded 'Buy Now, Pay Later' services, processed billions in transactions in 2023, directly competing with traditional credit offerings.

- Embedded Finance Growth: The global embedded finance market is expected to see substantial growth, with some estimates suggesting it could reach over $7 trillion by 2030.

- Brand-Led Credit: Non-financial brands are increasingly offering their own credit lines and payment solutions, capturing market share previously held by banks.

- Reduced Bank Engagement: As consumers increasingly utilize these integrated financial services, their direct engagement with traditional banking institutions for these needs diminishes.

- Competitive Landscape Shift: This shift redefines competition, with tech companies and retailers becoming direct rivals to banks in specific financial service areas.

The threat of substitutes for National Bank of Kuwait (NBK) is amplified by the increasing adoption of digital payment solutions and mobile wallets, often provided by fintech companies. These alternatives offer greater convenience and lower costs, attracting a growing segment of consumers, especially younger demographics. By the close of 2023, global mobile payment transaction volumes were estimated to exceed $14 trillion, signaling a substantial shift away from traditional banking transaction methods.

Emerging platforms like peer-to-peer lending and crowdfunding also present viable substitutes by enabling direct borrowing and investment, bypassing intermediaries such as NBK. While their presence in Kuwait is still developing, these alternatives are poised to gain traction, particularly for SMEs seeking capital. Furthermore, non-bank investment platforms and robo-advisors offer direct market access with lower fees, attracting cost-sensitive investors. The global robo-advisor market, valued at around $2.5 billion in 2023, demonstrates this trend.

Cryptocurrencies and blockchain technology represent a significant long-term threat, offering decentralized alternatives for transactions and investments, potentially circumventing traditional financial institutions. The global cryptocurrency market capitalization reached approximately $2.6 trillion in early 2024. Embedded finance, where financial services are integrated into non-financial platforms like e-commerce sites, further reduces reliance on banks for everyday transactions. The global embedded finance market was projected to reach hundreds of billions of dollars by 2024.

| Substitute Category | Key Characteristics | Examples | Market Trend/Data (Approximate) | Impact on NBK |

|---|---|---|---|---|

| Digital Payments & Mobile Wallets | Convenience, Speed, Lower Cost | Apple Pay, Google Pay, Local Fintech Wallets | Global mobile payment transaction volume > $14 trillion (end of 2023) | Reduces transaction fee income, customer loyalty |

| P2P Lending & Crowdfunding | Direct Access to Capital/Investment, Disintermediation | Global P2P Lending Platforms, Crowdfunding Sites | Growing sector, particularly for SMEs | Loss of loan origination and deposit business |

| Non-Bank Investment Platforms & Robo-Advisors | Lower Fees, Automated Management, Direct Market Access | Robo-advisors, Online Brokerages | Global robo-advisor market ~$2.5 billion (2023) | Loss of wealth management and advisory fees |

| Cryptocurrencies & Blockchain | Decentralization, Alternative Transactions/Investments | Bitcoin, Ethereum, DeFi Protocols | Global crypto market cap ~$2.6 trillion (early 2024) | Potential disruption of core banking functions |

| Embedded Finance | Integrated Services, Invisible Banking, Brand-Led Credit | BNPL services (Klarna), In-app payments | Global market projected to reach hundreds of billions by 2024 | Erosion of direct customer relationships for financial services |

Entrants Threaten

The banking sector in Kuwait is significantly shaped by robust regulatory and licensing requirements, acting as a substantial deterrent to new entrants. The Central Bank of Kuwait (CBK) mandates stringent licensing processes, demanding substantial initial capital investment. For instance, as of early 2024, the minimum capital requirement for establishing a new commercial bank in Kuwait remains a considerable hurdle, discouraging smaller or less capitalized entities.

These regulations extend beyond initial capital, encompassing ongoing compliance obligations and adherence to strict prudential standards. Banks must maintain high capital adequacy ratios, manage liquidity effectively, and comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations. These continuous compliance burdens require significant resources and expertise, further elevating the barriers for potential new players looking to enter the Kuwaiti banking market.

The threat of new entrants into the banking sector is significantly mitigated by the immense capital required to establish a competitive presence. Launching a new bank, particularly one aiming to rival an incumbent like the National Bank of Kuwait (NBK), necessitates enormous upfront investment in physical branches, advanced IT systems, and skilled personnel. For instance, in 2024, setting up even a digital-only bank often involves millions of dollars for regulatory compliance, cybersecurity infrastructure, and customer acquisition strategies.

Brand loyalty is a formidable barrier for new entrants targeting the Kuwaiti banking sector, with established institutions like National Bank of Kuwait (NBK) enjoying deep-rooted customer trust. NBK, for instance, has cultivated a reputation for stability and reliability over decades, a sentiment echoed by its consistent performance and market share. In 2023, NBK maintained a leading position in Kuwait's banking landscape, demonstrating the enduring strength of its brand. Newcomers must invest heavily in marketing and service differentiation to even begin chipping away at this established loyalty, a task made more difficult by regulatory hurdles and the sheer inertia of customer banking relationships.

Economies of Scale and Network Effects

Established banks, like the National Bank of Kuwait (NBK), possess significant advantages due to economies of scale. These scale benefits translate into lower per-unit costs for operations, technology investments, and marketing efforts. For instance, NBK's extensive branch network and large customer base allow for more efficient service delivery, making it harder for new, smaller players to compete on cost.

Network effects further solidify the position of incumbents. A larger customer base often means more interconnectedness and value for all users, such as in payment systems or digital banking platforms. In 2023, NBK reported total assets of KWD 37.4 billion, illustrating the substantial scale it operates at. This scale and established network create high barriers to entry, as new entrants would need substantial capital and time to build comparable reach and trust.

- Economies of Scale: NBK leverages its size for cost efficiencies in operations, technology, and marketing.

- Network Effects: An extensive branch network and large customer base create a self-reinforcing value proposition difficult for newcomers to match.

- 2023 Financials: NBK's total assets reached KWD 37.4 billion, underscoring its significant operational scale.

- Barrier to Entry: These factors combine to make it challenging and costly for new banks to enter the market and gain traction.

Rise of Digital-Only Banks and Fintechs

While traditional banking entry barriers remain significant due to capital requirements and regulatory hurdles, the landscape is evolving. The rise of digital-only banks and nimble fintech companies presents a more sophisticated threat. These new players can bypass the extensive physical infrastructure of traditional banks.

These digital entrants, like NBK's own Weyay, can operate with substantially lower overheads. They leverage technology to offer specialized financial services, often focusing on specific customer needs or niche markets. This allows them to compete effectively without necessarily requiring a full, traditional banking license, making market entry more accessible.

For instance, as of late 2024, the global fintech market is projected to reach over $300 billion, showcasing the significant investment and growth in this sector. Many of these fintechs are not directly competing on all fronts but are carving out profitable segments, such as payments, lending, or wealth management, by offering superior digital experiences and competitive pricing.

- Digital Banks' Lower Overhead: Fintechs and digital banks often avoid the costs associated with physical branches, significantly reducing operating expenses compared to incumbent banks.

- Specialized Service Offerings: These new entrants frequently focus on specific financial products or customer segments, allowing for tailored solutions and potentially higher customer satisfaction.

- Technological Agility: Their reliance on modern technology enables faster innovation and adaptation to changing customer preferences and market dynamics.

- Targeted Customer Acquisition: Digital channels allow for efficient and cost-effective acquisition of specific customer demographics, often those underserved by traditional banking models.

The threat of new entrants in Kuwait's banking sector, particularly concerning an established player like the National Bank of Kuwait (NBK), is significantly dampened by substantial regulatory hurdles and the immense capital required for market entry. These factors, including stringent licensing and high capital adequacy ratios, deter many potential competitors. For example, in early 2024, the minimum capital requirements for new commercial banks in Kuwait remained a considerable barrier.

Economies of scale and strong brand loyalty further protect incumbents like NBK. NBK's extensive branch network and decades of cultivated trust, evidenced by its leading market position in 2023, make it difficult for newcomers to gain a foothold. Achieving cost efficiencies and building comparable customer relationships requires massive investment, a challenge exacerbated by established players' scale advantages.

While traditional barriers are high, digital-only banks and fintech firms present a more nuanced threat. These entities can operate with lower overheads and offer specialized services, potentially bypassing some traditional entry requirements. The global fintech market's projected growth to over $300 billion by late 2024 highlights the increasing influence of these agile players.

| Factor | Impact on New Entrants | NBK's Position |

| Regulatory Requirements | High barrier, demanding significant capital and compliance resources. | Established compliance infrastructure and strong regulatory relationships. |

| Capital Requirements | Substantial initial investment needed, especially for full-service banks. | Well-capitalized, meeting and exceeding all regulatory capital needs. |

| Economies of Scale | New entrants struggle to match operational efficiencies and cost advantages. | Leverages extensive branch network and large customer base for cost savings. |

| Brand Loyalty & Trust | Difficult and costly to build customer trust against established brands. | Decades of proven stability and reliability foster deep customer loyalty. |

| Digital/Fintech Competition | Offers lower overhead and specialized services, posing a niche threat. | Adapting through digital offerings like Weyay to compete in evolving market. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the National Bank of Kuwait leverages data from the bank's annual reports, investor relations disclosures, and Kuwait's Central Bank regulatory filings. We also incorporate industry-specific reports from reputable financial research firms and macroeconomic data to provide a comprehensive view of the competitive landscape.