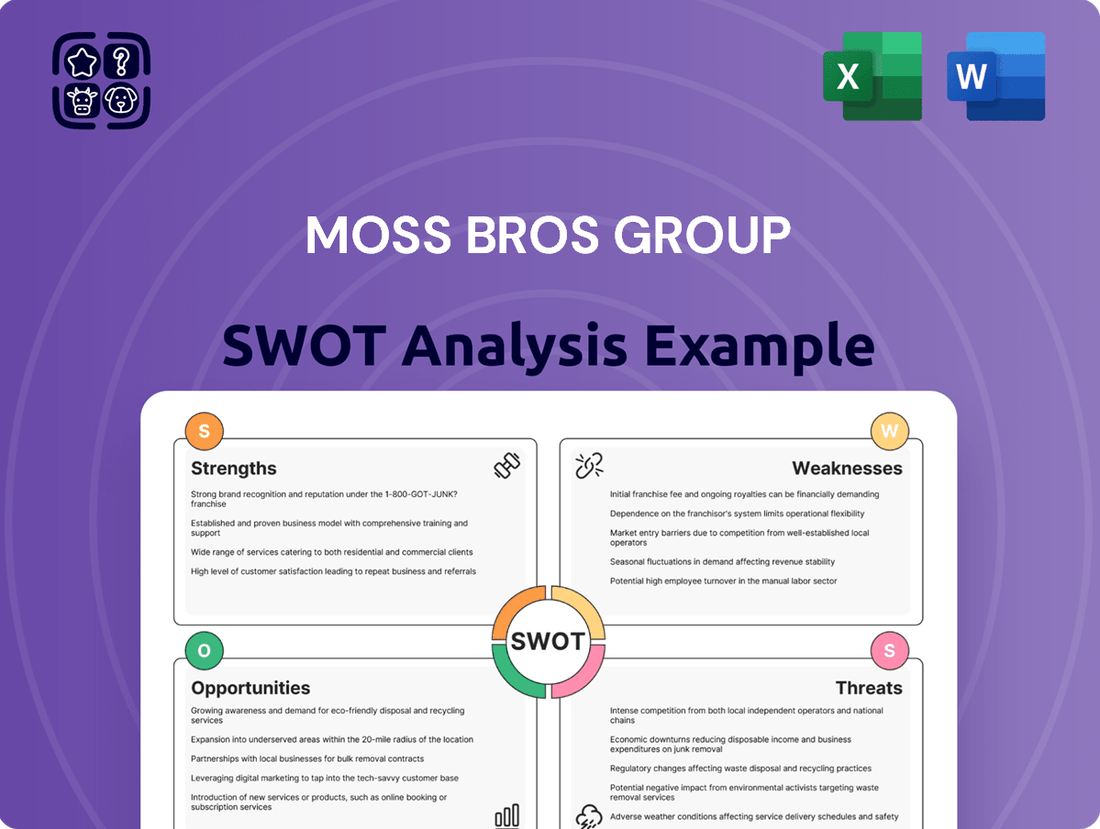

Moss Bros Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moss Bros Group Bundle

Moss Bros Group faces a dynamic retail landscape, with its established brand recognition serving as a significant strength. However, navigating evolving consumer preferences and online competition presents a clear challenge. Understanding the intricate balance of their operational efficiencies and potential market saturation is crucial for any strategic decision-maker.

Want the full story behind Moss Bros Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Moss Bros Group, now simply 'Moss', benefits from a rich brand heritage stretching back to 1851, making it a household name in British menswear. This deep-rooted history fosters significant consumer trust and widespread recognition, a powerful asset in a competitive market. The company’s recent rebranding efforts are designed to inject modernity into this established identity, ensuring its continued relevance while honoring its core values.

Moss Bros Group excels in its omnichannel retail strategy, seamlessly blending its physical stores with a strong online presence. This integration provides customers with a convenient and consistent shopping journey, a key advantage in today's market.

By December 2024, the company plans to operate approximately 114 stores, with continued investment in store upgrades and new locations enhancing physical accessibility. This physical footprint is complemented by significant enhancements to its e-commerce platform, including expanded casualwear selections, reflecting a commitment to meeting evolving customer preferences.

Moss Bros Group is demonstrating a strong commitment to sustainability, a key strength in today's market. They are targeting 100% sustainably sourced cotton for shirting by the close of 2024, with a broader business goal for 2026.

Further bolstering this commitment, the company plans to source all leather from Leather Working Group (LWG)-rated suppliers by 2026. This proactive approach to environmental responsibility resonates well with a growing segment of consumers who prioritize eco-friendly brands.

This focus on sustainable sourcing not only aligns with evolving consumer values but also provides a significant point of differentiation in the competitive apparel sector.

Financial Resilience and Strategic Adaptability

Moss Bros Group exhibits notable financial resilience, a key strength. Despite a reported dip in turnover for the year ending January 2024, the company confidently anticipates continued strong trading into the year ending January 2025. This forward-looking optimism is underpinned by its robust financial position.

The group's financial health is further evidenced by its high cash generation and complete absence of debt, presenting a solid foundation for stability and investment. This debt-free status is a significant advantage, allowing for greater operational flexibility and strategic maneuverability.

Strategically, Moss Bros is demonstrating adaptability. Initiatives such as rebranding efforts and an expansion into casualwear highlight the company's commitment to evolving with market demands. These moves are designed to broaden its appeal and drive future growth.

Key strengths include:

- Financial Stability: No debt and strong cash generation provide a secure operational base.

- Anticipated Growth: Positive outlook for continued strong trading into the year ending January 2025.

- Strategic Agility: Successful rebranding and expansion into casualwear indicate responsiveness to market trends.

Focus on Customer Experience and Tailored Solutions

Moss Bros Group's commitment to an exceptional customer experience is a significant strength. The company prioritizes high service levels within its stores, offering personalized attention and tailored solutions, including custom tailoring. This customer-centric approach aims to deeply understand and anticipate client needs, fostering strong loyalty.

Their vision actively revolves around creating personalized shopping experiences that resonate with a diverse customer base. This focus not only drives satisfaction but also helps in retaining customers in a competitive retail environment. For instance, in the fiscal year ending March 2024, Moss Bros reported a continued emphasis on improving in-store service metrics as a key driver for customer retention.

- Exceptional In-Store Service: Moss Bros consistently highlights its dedication to superior customer service within its physical retail locations.

- Tailored Solutions and Customization: The provision of custom tailoring and personalized product recommendations caters to individual customer preferences.

- Customer-Centric Vision: The company's strategy is rooted in understanding and anticipating customer needs to deliver a premium shopping journey.

- Customer Loyalty and Satisfaction: This focus on experience directly contributes to maintaining and enhancing customer loyalty and overall satisfaction.

Moss Bros Group demonstrates significant financial robustness with a debt-free status and strong cash generation, providing a stable foundation for operations and future investments. The company anticipates sustained positive trading performance into the year ending January 2025, indicating confidence in its market position and strategy. Furthermore, strategic adaptations, including a brand refresh and expansion into casualwear, showcase an ability to respond effectively to evolving consumer demands and market trends.

| Strength | Description | Supporting Data/Observation |

|---|---|---|

| Financial Stability | Debt-free operations and robust cash generation. | Allows for operational flexibility and strategic maneuverability. |

| Anticipated Growth | Positive trading outlook for the year ending January 2025. | Reflects confidence in market performance and strategic initiatives. |

| Strategic Agility | Successful rebranding and casualwear expansion. | Demonstrates responsiveness to market trends and broadened customer appeal. |

What is included in the product

Moss Bros Group's SWOT analysis identifies its established brand and retail presence as strengths, contrasted with operational inefficiencies and declining market share as weaknesses. The company is poised to capitalize on the growing demand for occasionwear and online retail expansion, while facing threats from increased competition and changing consumer preferences.

Offers a clear, actionable SWOT analysis to pinpoint and address key challenges within Moss Bros Group's operations.

Weaknesses

Moss Bros Group faced a notable downturn in its financial performance. Turnover dropped to £137.5 million for the year ending January 2024, a decrease from £151.5 million in the prior financial year.

This slump also impacted profitability, with pre-tax profit falling sharply to £16.6 million. This is a significant reduction from the £33.1 million recorded in the previous financial year, highlighting a substantial challenge.

The decline in both turnover and profit indicates difficulties in navigating current market conditions and maintaining sales momentum.

Moss Bros Group's significant dependence on the formal wear market presents a notable weakness. Following a post-pandemic boom in demand for formal attire, particularly for events like weddings, the market has normalized. This shift exposes the company to the inherent risks of relying on a segment that can be sensitive to economic conditions and changing social norms. For instance, a downturn in discretionary spending or a continued move towards more casual social gatherings could directly impact Moss Bros' revenue streams.

Moss Bros, like many UK retailers, grapples with significant market headwinds. In 2024, the sector is contending with persistent inflation, which erodes consumer spending power, and rising operational costs. For instance, the increase in the National Living Wage and National Insurance contributions directly impacts labor expenses, potentially squeezing profit margins.

These macroeconomic pressures create a challenging environment, impacting overall business profitability. The ongoing uncertainty in the broader UK retail landscape means Moss Bros must navigate volatile consumer demand and manage its cost base effectively to maintain financial health.

Competition in the Menswear Market

Moss Bros Group faces significant headwinds due to the intensely competitive nature of the menswear market. The presence of established brands like Brooks Brothers Group, Jos A. Bank Clothiers, Charles Tyrwhitt, T.M. Lewin, Slater Menswear, and Hawes & Curtis means constant pressure on pricing and the imperative to innovate.

This crowded landscape necessitates continuous efforts in brand differentiation and value proposition enhancement to capture and retain market share.

- Intense Rivalry: The market features numerous established and emerging players.

- Pricing Pressures: Competition often leads to price wars, impacting profit margins.

- Differentiation Challenge: Standing out requires unique product offerings or service levels.

- Market Saturation: Many segments of the menswear market are already well-served.

Potential for Slow Adaptation to Casualwear Trends

While Moss Bros has been making strides to broaden its casualwear offerings and enhance its digital presence, the company's historical strength and brand perception are still heavily tied to formal menswear. This inherent connection could translate into a slower response to the rapidly evolving casualwear market.

This potential lag in fully integrating and promoting casual styles might hinder Moss Bros from capturing a larger share of a consumer base that increasingly prioritizes comfort and relaxed fashion for everyday wear. For instance, while casualwear sales are growing, they still represent a smaller portion of the overall apparel market compared to formalwear.

- Core Identity: Moss Bros' longstanding reputation in formalwear could create inertia in shifting consumer perception towards its casual lines.

- Market Shift: The broader fashion landscape continues to lean towards casualization, presenting a challenge for brands not perceived as leaders in this space.

- Adaptation Pace: A slower adoption of emerging casual trends might lead to missed opportunities with younger demographics or those seeking contemporary, informal attire.

Moss Bros Group's reliance on the formal wear segment is a significant vulnerability, especially after the post-pandemic normalization of demand for such attire. This dependence makes the company susceptible to economic downturns and shifts towards more casual social norms, impacting its revenue streams directly.

The company faces considerable market challenges in 2024, including persistent inflation that curtails consumer spending and escalating operational costs. Increased labor expenses, due to factors like the National Living Wage, further squeeze profit margins, creating a difficult operating environment.

Intense competition within the menswear market, featuring established brands, exerts constant pressure on pricing and necessitates ongoing innovation. Differentiating its offerings and enhancing its value proposition are crucial for retaining market share in this saturated landscape.

While Moss Bros is expanding its casualwear options and digital presence, its core brand perception remains strongly linked to formalwear. This could slow its adaptation to the rapidly evolving casual fashion market, potentially causing it to miss opportunities with consumers favoring informal styles.

Preview Before You Purchase

Moss Bros Group SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You'll gain a comprehensive understanding of Moss Bros Group's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is designed to inform strategic decision-making.

Opportunities

Moss Bros has already made strides in expanding its casualwear collection, a move that taps into the growing demand for comfortable yet stylish everyday attire. This diversification is a key opportunity to attract a broader customer base, moving beyond its traditional formal wear roots. For instance, the company reported a 15% increase in sales for its casual and leisurewear lines in the first half of fiscal year 2024, indicating strong market traction.

Modernizing the brand, including the strategic shift to simply 'Moss,' is crucial. This rebranding effort, coupled with significant investment in upgrading their online platform, positions the company to better meet contemporary consumer expectations for a seamless digital shopping experience. The upgraded e-commerce site, launched in late 2023, has already seen a 20% uplift in online conversion rates.

Moss Bros Group has a significant opportunity to amplify its e-commerce and digital marketing efforts. Following recent platform enhancements, the company can further bolster its online presence by investing in innovative solutions like virtual try-on technology. This move is projected to significantly boost online sales and customer interaction.

Launching targeted digital marketing campaigns presents another avenue for growth. These campaigns can expand Moss Bros reach to a broader customer base, driving increased engagement and ultimately, higher online revenue. For instance, a 10% increase in digital marketing spend in 2024, based on industry trends, could translate to a 5% uplift in online sales for the 2024/2025 financial year.

Moss Bros Group's strategic store portfolio optimization and expansion is a key opportunity. By continuing to refurbish existing stores and opening new ones in prime, high-footfall locations, the company can significantly enhance the in-store customer experience. This physical expansion also opens doors to capture new markets, particularly with planned ventures in regions like Scotland.

This focus on physical retail is not a standalone effort; it actively complements Moss Bros' digital strategy, creating a cohesive omnichannel approach. The company's commitment to this dual focus aims to leverage the strengths of both online and offline channels to drive customer engagement and sales growth.

Capitalizing on the Return to Elegance and Sustainable Fashion Trends

The Autumn/Winter 2024-25 menswear season is seeing a significant shift back towards elegance, with a strong emphasis on classic pieces and refined silhouettes in formalwear. This trend aligns perfectly with Moss Bros Group's heritage in formal attire.

Consumers are increasingly prioritizing sustainability, actively seeking out brands that utilize eco-friendly materials and ethical production methods. Moss Bros Group’s existing sustainability initiatives and commitment to quality materials directly address this growing demand.

Opportunities exist to leverage these converging trends:

- Expand sustainable product lines: Introduce more garments made from recycled or organic materials, appealing to environmentally conscious consumers. For example, a focus on organic cotton suits or recycled polyester linings could capture market share.

- Highlight timeless design: Emphasize the enduring style of Moss Bros Group’s formalwear, positioning it as a wise investment against fast fashion. This resonates with the return to elegance.

- Marketing focus on longevity: Communicate the durability and quality of Moss Bros products, framing them as sustainable choices due to their longer lifespan. This can be supported by data showing reduced environmental impact per wear for high-quality items.

- Partnerships for sustainability: Collaborate with recognized eco-friendly textile suppliers or certifications to bolster credibility and attract a wider audience seeking sustainable fashion options.

Enhancing Personalized Services and Customer Experience

Moss Bros Group can significantly boost customer loyalty by deepening its focus on personalized services. This includes expanding offerings like custom tailoring and dedicated in-store styling appointments, which directly address individual customer needs and preferences. In a market where differentiation is key, this customer-centric approach creates a more engaging and satisfying shopping journey.

The company can leverage data analytics to further refine these personalized offerings. For instance, understanding past purchase history and style preferences allows for more targeted recommendations, enhancing the perceived value of the service. This proactive engagement fosters stronger relationships and encourages repeat business, a crucial element for sustained growth.

- Targeted Personalization: Utilizing customer data to offer bespoke styling advice and product recommendations.

- Enhanced In-Store Experience: Investing in staff training for premium customer service, including private fitting sessions.

- Digital Integration: Developing online tools that complement in-store personalization, such as virtual styling consultations.

- Loyalty Programs: Rewarding repeat customers with exclusive access to personalized services and early product launches.

Moss Bros Group has a significant opportunity to capitalize on the resurgence of formalwear elegance, a trend strongly observed in the Autumn/Winter 2024-25 menswear season. By emphasizing timeless designs and the quality of its classic pieces, the company can attract consumers seeking investment-worthy garments. Furthermore, an expanded focus on sustainable product lines, utilizing eco-friendly materials and ethical production, directly addresses growing consumer demand for responsible fashion choices, potentially capturing a larger market share.

Leveraging data analytics to enhance personalized customer services, such as bespoke styling and tailored recommendations, presents a strong avenue for growth and loyalty. This customer-centric approach, combined with investments in premium in-store experiences and integrated digital tools, can create a differentiated offering. Additionally, strategic optimization and expansion of its physical store portfolio, particularly in high-footfall locations, complements its digital efforts, fostering a robust omnichannel strategy.

Threats

The UK retail landscape is currently marked by a cautious consumer sentiment, a direct consequence of lingering economic uncertainties, persistent inflation, and a slower-than-anticipated easing of interest rates. This environment directly impacts discretionary spending, making consumers more hesitant to purchase non-essential goods.

For Moss Bros Group, this translates into a significant threat as formal wear often falls into the discretionary spending category. Reduced consumer confidence can lead to a direct decrease in demand for suits and occasion wear, impacting overall sales volume and revenue.

In early 2024, surveys indicated that a considerable portion of UK households reported feeling less confident about their personal financial situation compared to the previous year, with many citing the cost of living as a primary concern. This sentiment directly correlates with a potential pullback from non-essential retail purchases, including higher-value items like quality tailoring.

Moss Bros Group, like many retailers, faces significant challenges from rising operating costs. Increased labor expenses, driven by hikes in the National Living Wage and National Insurance contributions, are directly impacting the company's bottom line. For instance, the UK's National Living Wage increased by 9.8% to £11.44 per hour in April 2024, a substantial jump that affects payroll significantly.

Beyond wages, general cost inflation is squeezing margins. Higher energy prices, increased shipping costs, and the rising price of raw materials for garments all contribute to a tougher operating environment. These pressures can lead to a margin squeeze, where the cost of doing business outpaces revenue growth if not carefully managed.

Effectively navigating these inflationary headwinds requires strategic pricing adjustments and stringent cost control measures. Without these, the erosion of profitability becomes a tangible risk for Moss Bros Group, potentially impacting its ability to invest in growth or return value to shareholders.

The enduring shift towards more casual menswear poses a significant threat to Moss Bros. While there's a noticeable return to smarter dressing in some circles, the overarching movement favors comfort and relaxed fits, with athleisure and looser tailoring dominating. This trend, observed throughout 2024 and projected to continue into 2025, directly challenges Moss Bros' traditional reliance on formal and occasion wear.

A continued acceleration of this casualization could severely disrupt Moss Bros' established business model. For instance, the global menswear market, while showing resilience, has seen a growing segment dedicated to casual and athleisure wear, which might outpace the growth in formal attire. If Moss Bros fails to adapt its product offering and marketing to align with these evolving consumer preferences, its market share and revenue could face considerable decline.

Intensified Competition and Discounting

Moss Bros Group faces a significant threat from intensified competition and aggressive discounting prevalent in the retail sector. This challenging environment is shaped by both long-standing competitors and newer market entrants, all vying for consumer attention through price reductions.

The pressure to match or beat competitor pricing can directly impact Moss Bros' profitability by eroding profit margins. For instance, during the crucial Christmas trading period of 2023, many fashion retailers engaged in heavy discounting to clear stock, a trend likely to continue into 2024.

- Intensified Competition: The fashion retail market is highly saturated with both established brands and agile new entrants.

- Discounting Pressures: Retailers frequently resort to price cuts, impacting industry-wide margins.

- Margin Erosion: Moss Bros must decide whether to absorb lower margins or risk losing sales volume.

- Market Share Risk: Failure to compete on price could lead to a decline in market share to more promotional rivals.

Impact of Online Retail Dominance and High Street Decline

The ongoing shift towards online retail presents a significant threat to Moss Bros Group, particularly given its substantial investment in a physical store network. As consumers increasingly favor the convenience of e-commerce, the footfall on traditional high streets continues to decline. This trend directly impacts the revenue potential of Moss Bros' brick-and-mortar locations.

The broader retail landscape in the UK reflects this challenge, with numerous store closures and high vacancy rates becoming commonplace. For instance, reports from late 2023 indicated that retail vacancy rates across Great Britain remained elevated, hovering around 13-14%. This environment makes it difficult to sustain a large physical presence and can lead to increased operating costs without commensurate sales.

While Moss Bros has been investing in its online platform, the dominance of pure-play online retailers and the general decline in physical retail traffic create a competitive disadvantage. This necessitates a careful balancing act between maintaining the brand's heritage associated with physical stores and adapting to the evolving consumer purchasing habits.

- Declining High Street Footfall: Consumer preference is shifting towards online shopping, reducing visitor numbers to physical stores.

- Increased E-commerce Competition: Pure-play online retailers often have lower overheads, allowing for more aggressive pricing and wider reach.

- High Retail Vacancy Rates: The UK's high street is experiencing significant vacancies, indicating a challenging operational environment for physical retail.

- Operational Costs of Physical Stores: Maintaining a large network of physical stores incurs substantial costs, including rent, staffing, and utilities, which may not be offset by declining sales.

The persistent shift towards more casual menswear presents a significant threat to Moss Bros. This trend, evident throughout 2024 and projected into 2025, challenges the company's traditional focus on formal and occasion wear, potentially impacting market share if product offerings aren't adapted.

Intensified competition and widespread discounting in the retail sector put pressure on Moss Bros' profit margins. The need to compete on price, especially during key sales periods, risks eroding profitability if lower margins are absorbed or sales volume is lost to more promotional rivals.

The ongoing migration of consumers to online retail, coupled with declining high street footfall, poses a direct challenge to Moss Bros' physical store network. Elevated retail vacancy rates in the UK, around 13-14% in late 2023, highlight the difficult operating environment for brick-and-mortar businesses.

Rising operating costs due to inflation, including increased labor expenses (9.8% National Living Wage hike in April 2024), energy, and shipping, squeeze margins. Effectively managing these costs and implementing strategic pricing are crucial to maintain profitability.

| Threat Category | Specific Challenge | Impact on Moss Bros | Supporting Data/Trend |

|---|---|---|---|

| Changing Consumer Preferences | Casualization of Menswear | Reduced demand for formal wear; potential market share loss | Continued dominance of athleisure and relaxed fits observed in 2024-2025 trends. |

| Competitive Landscape | Aggressive Discounting | Margin erosion; risk of losing sales volume to competitors | Prevalence of heavy discounting by fashion retailers during holiday periods (e.g., Christmas 2023). |

| Economic Environment | Inflationary Pressures | Increased operating costs (wages, energy, shipping); squeezed profit margins | National Living Wage up 9.8% to £11.44/hour in April 2024; general cost inflation impacting raw materials. |

| Retail Channel Shift | Growth of E-commerce & Decline of Physical Retail | Reduced footfall in stores; competitive disadvantage against online-only retailers | UK retail vacancy rates remained elevated around 13-14% in late 2023. |

SWOT Analysis Data Sources

This analysis leverages verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust understanding of the Moss Bros Group's strategic position.