Moss Bros Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moss Bros Group Bundle

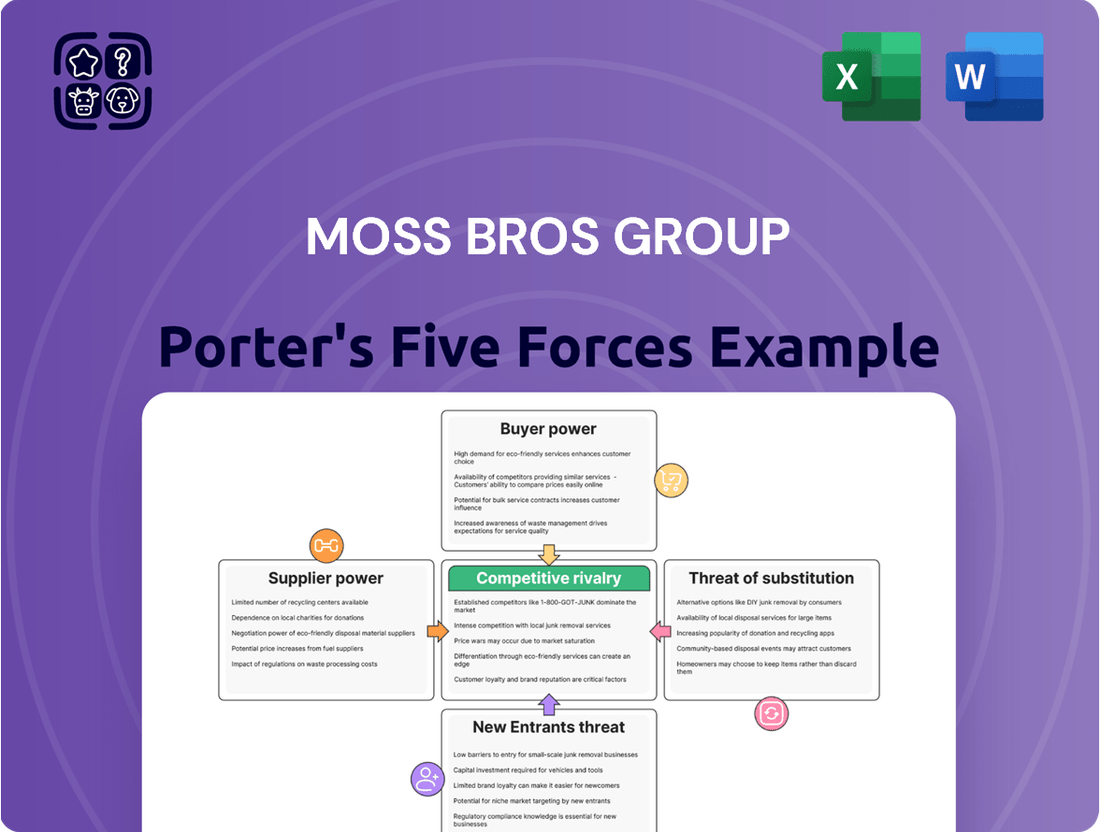

Moss Bros Group operates within a dynamic retail landscape shaped by intense competition and evolving consumer preferences.

Understanding the bargaining power of buyers and suppliers is crucial, as is assessing the threat of new entrants and the constant pressure from substitute products.

The competitive rivalry within the formal wear and menswear sector significantly impacts Moss Bros Group's strategic positioning and profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Moss Bros Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The formal menswear market, including companies like Moss Bros, depends heavily on a limited number of specialized fabric manufacturers and skilled tailoring services. If there are few suppliers providing high-quality wools, silks, or unique finishing techniques, these suppliers gain significant leverage. This concentration allows them to dictate terms and potentially increase input costs for Moss Bros, impacting profitability.

Moss Bros can counter this supplier power by diversifying its sourcing. For instance, actively seeking relationships with a broad spectrum of international and local suppliers for fabrics and tailoring ensures they are not overly reliant on any single entity. This strategy can help secure more favorable pricing and terms, thereby mitigating the impact of supplier concentration.

Switching suppliers in the fashion industry, particularly for formal wear like that offered by Moss Bros, can be a costly endeavor. These costs can include anything from re-tooling manufacturing equipment to adapting designs and implementing new quality control procedures. Furthermore, establishing entirely new logistical chains for sourcing materials adds another layer of expense and complexity.

For Moss Bros, the presence of high switching costs when dealing with their suppliers directly translates into increased supplier power. If it becomes expensive and disruptive for Moss Bros to move to a different supplier, then existing suppliers are in a stronger negotiating position. This leverage allows them to potentially dictate terms or prices, impacting Moss Bros' profitability and operational flexibility.

Suppliers offering unique designs, patented fabrics, or highly skilled artisan tailoring services possess significant leverage over Moss Bros. For instance, if a particular fabric supplier for Moss Bros developed an exclusive, moisture-wicking material in 2024 that no other competitor could replicate, their bargaining power would be considerably high. This reliance on specialized inputs, difficult to source elsewhere, directly impacts Moss Bros's ability to differentiate its offerings and manage its cost of goods sold.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a critical consideration for Moss Bros. If suppliers of essential components, such as high-quality fabrics or even fully manufactured formal wear, possess the capability and the motivation to enter the retail market themselves, they could directly compete with Moss Bros. This scenario would significantly diminish Moss Bros's leverage within its supply chain and introduce a new layer of competitive pressure.

While this threat exists, it's generally less pronounced in the niche market of specialized formal wear manufacturing. The intricate processes, design expertise, and established brand recognition required to succeed in formal menswear retail present significant barriers to entry for many fabric mills or garment manufacturers. However, for suppliers of more standardized components, the possibility of moving into direct sales, perhaps through online channels, remains a potential concern.

For instance, a large textile manufacturer with strong relationships across the fashion industry might consider launching its own branded line of suits or accessories. Such a move would not only capture retail margins but also potentially control the distribution of its own materials. This could lead to a dual impact: reduced sourcing options for Moss Bros and increased competition on the high street and online. In 2024, the increasing digitization of retail could lower the barriers for suppliers looking to establish direct-to-consumer channels.

- Forward Integration Risk: Suppliers entering the retail market directly poses a significant threat, potentially reducing Moss Bros's market share and supply chain control.

- Market Specialization: The highly specialized nature of formal wear manufacturing generally acts as a deterrent to widespread forward integration by suppliers.

- Digitalization Impact: The ongoing trend of e-commerce in 2024 may provide suppliers with new, lower-cost avenues to pursue direct retail sales.

- Competitive Landscape: If a major fabric supplier or garment manufacturer were to integrate forward, it would intensify competition for Moss Bros, impacting both sourcing and sales.

Importance of Moss Bros to Suppliers

The bargaining power of suppliers for Moss Bros is influenced by the volume of business Moss Bros represents to them. Generally, when Moss Bros accounts for a larger portion of a supplier's sales, that supplier's leverage diminishes due to their increased reliance on Moss Bros's consistent orders. This dynamic shifts the power balance, making suppliers more amenable to Moss Bros's terms.

For smaller, specialized suppliers, Moss Bros might be a crucial client, thereby granting Moss Bros some degree of influence over pricing and terms. Conversely, for major global fabric manufacturers, Moss Bros could represent a relatively small account, limiting Moss Bros's ability to negotiate favorable terms with these larger entities. For instance, in 2024, the global textile market saw continued consolidation among large suppliers, potentially increasing their pricing power over smaller retail clients.

- Supplier Dependence: Moss Bros's purchasing volume directly impacts a supplier's dependence, reducing the supplier's bargaining power when dependence is high.

- Niche vs. Global Suppliers: While Moss Bros may hold leverage with niche suppliers, global fabric mills often possess greater power due to their scale and market reach.

- Market Conditions: Broader market trends, such as raw material costs and global supply chain dynamics in 2024, can significantly affect supplier pricing power.

The bargaining power of suppliers for Moss Bros is moderate, influenced by the specialized nature of formalwear materials and tailoring services. While a few key suppliers can command higher prices due to unique offerings, Moss Bros's diversification of sourcing and the potential for establishing long-term relationships can mitigate this power. The threat of forward integration by suppliers is present but generally limited by the high barriers to entry in the formal retail market.

In 2024, the fashion industry continued to see fluctuations in raw material costs, impacting supplier pricing. For example, the price of high-quality wool, a staple for formalwear, can be volatile, directly affecting Moss Bros's cost of goods sold. Suppliers who can offer consistent quality and reliability, even at a premium, often hold a stronger negotiating position.

Moss Bros's ability to manage supplier power is also tied to its own purchasing volume and the availability of alternative suppliers. If Moss Bros represents a significant portion of a supplier's business, it has greater leverage. Conversely, for large, global fabric mills, Moss Bros might be a smaller client, granting the supplier more pricing power.

| Factor | Impact on Moss Bros | Mitigation Strategies |

|---|---|---|

| Supplier Concentration | High dependence on few suppliers can lead to increased costs. | Diversify sourcing, build strong supplier relationships. |

| Switching Costs | Significant expenses and disruption when changing suppliers. | Standardize processes, maintain flexible supply chain agreements. |

| Uniqueness of Offering | Suppliers with proprietary materials or skills have strong leverage. | Invest in R&D for alternative materials, develop in-house expertise. |

| Forward Integration Risk | Suppliers entering retail can create direct competition. | Focus on brand differentiation and customer loyalty. |

| Purchasing Volume | Larger orders increase Moss Bros's leverage with suppliers. | Consolidate purchasing, explore bulk discounts. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Moss Bros Group's position in the formalwear market.

Quickly identify and address competitive threats with a simplified Porter's Five Forces analysis, highlighting key areas of pressure for Moss Bros Group.

Customers Bargaining Power

Customers for formal menswear, particularly for events like weddings, often exhibit price sensitivity, weighing quality against their budget. Moss Bros caters to this by offering both rental and purchase options, effectively addressing varied price points. However, the UK menswear market, experiencing a slight uptick in consumer spending in 2024, remains highly competitive, pushing customers to actively seek value for their money.

The bargaining power of customers for Moss Bros Group is significantly influenced by the wide array of substitutes and alternatives available. Customers can easily find similar formal wear from numerous high-street retailers, online-only brands, and department stores, diluting Moss Bros' unique selling proposition.

Furthermore, the growing popularity of second-hand clothing and the general casualization of dress codes in many professional environments present alternative ways for consumers to meet their clothing needs without resorting to traditional formal wear retailers like Moss Bros.

This abundance of choice means customers hold considerable sway, as they can readily switch to a competitor if Moss Bros does not meet their price expectations or other purchasing criteria. For instance, the online fashion market, which saw substantial growth in 2023 and is projected to continue expanding, offers a vast selection of formal wear at competitive price points.

Moss Bros' customer base is largely composed of individual consumers. This means that typically, no single customer holds enough sway to significantly impact pricing or terms. While group orders, such as those for wedding parties, might offer a slight increase in collective purchasing power, the overall dispersed nature of their clientele limits the bargaining leverage of any one buyer.

The UK menswear market is showing signs of expansion, with a notable trend indicating that consumers are increasingly prioritizing quality. For the fiscal year ending March 2024, Moss Bros reported a revenue of £135.1 million, demonstrating the scale of their operations. This market dynamic, where quality is a key driver, can sometimes mitigate the bargaining power of individual customers who are focused on value.

Customer Information and Transparency

The increasing availability of information, particularly through e-commerce platforms and online review sites, has significantly boosted customer power. Shoppers can now effortlessly compare prices, product quality, and a wider array of alternatives from different retailers. This transparency compels businesses like Moss Bros to remain highly competitive in their pricing and service delivery to retain customer loyalty.

For instance, in 2024, the online retail sector continued its robust growth, with consumers increasingly relying on digital channels for purchasing decisions. This trend means that detailed product information and customer feedback are readily accessible, directly influencing purchasing behavior and placing greater pressure on brands to offer value. Moss Bros, operating in the competitive fashion retail market, must actively manage its online presence and customer reviews to mitigate this heightened bargaining power.

- Enhanced Information Access: Customers in 2024 have unprecedented access to pricing, quality comparisons, and product reviews online.

- Increased Price Sensitivity: This transparency leads to greater customer price sensitivity, forcing retailers to maintain competitive pricing strategies.

- Demand for Superior Service: Beyond price, customers expect excellent service and product quality, as alternatives are easily discoverable.

- Impact on Retailers: Businesses like Moss Bros must invest in customer experience and transparent communication to address this evolving power dynamic.

Switching Costs for Customers

For customers looking to switch menswear retailers, the financial and psychological costs are generally quite low. This means they can easily move from one brand or store to another if they find better prices, styles, or service. For instance, Moss Bros Group operates in a competitive retail environment where a customer might simply try on a suit at one location and then purchase it online from a competitor if the price is more attractive.

The primary switching costs for consumers in the menswear sector are mainly related to the time and effort involved in searching for new items and trying them on. With the rise of e-commerce and readily available fitting rooms in physical stores, this process is streamlined. A report from Statista in late 2023 indicated that online clothing sales continued to grow, with a significant portion of consumers citing convenience as a key driver for their purchasing decisions, further lowering the barrier to switching retailers.

The widespread availability of formal wear and the increasing number of brands offering similar styles and quality levels also contribute to low switching costs. Customers can easily compare offerings from various retailers like Next, Marks & Spencer, or even online specialists without significant commitment. This ease of comparison empowers customers, giving them substantial bargaining power as they can readily shift their patronage to whichever retailer best meets their immediate needs and budget.

- Low Financial Switching Costs: Customers face minimal financial penalties or extra expenses when changing menswear providers.

- Minimal Effort Required: The time and effort to browse, compare, and try on clothing are easily managed, reducing friction in switching.

- E-commerce Convenience: Online platforms simplify the shopping process, allowing customers to switch retailers with just a few clicks.

- Broad Product Availability: The market offers a wide array of formal wear options, making it simple for customers to find alternatives if unsatisfied with a current retailer.

Customers for Moss Bros possess considerable bargaining power due to the low cost of switching and the readily available alternatives in the competitive UK menswear market. The ease with which consumers can compare prices and styles online, coupled with minimal financial barriers to changing retailers, forces Moss Bros to remain highly competitive. This dynamic is underscored by the continued growth of online retail, with consumers in 2024 increasingly prioritizing value and convenience, as evidenced by the significant portion of clothing purchases made online. Moss Bros' revenue of £135.1 million for the fiscal year ending March 2024 reflects its market presence, but this figure also highlights the need to cater to price-sensitive customers amidst plentiful options.

| Factor | Impact on Moss Bros | Supporting Data/Trend (2024 Focus) |

|---|---|---|

| Information Access | Increases customer price sensitivity and demand for quality. | Continued robust growth in online retail sectors in 2024. |

| Switching Costs | Low, empowering customers to easily shift to competitors. | Streamlined online shopping and physical store fitting processes. |

| Availability of Substitutes | Dilutes Moss Bros' unique selling proposition and pricing power. | Expansion of online-only brands and high-street retailers in formal wear. |

Preview Before You Purchase

Moss Bros Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis of Moss Bros Group, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes, is fully presented here. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing you with a thorough understanding of the competitive landscape for Moss Bros Group.

Rivalry Among Competitors

The UK formal menswear market presents a diverse competitive landscape for Moss Bros. It includes established high-street names such as Marks & Spencer, which offers a broad range of formal wear, and department stores like John Lewis, providing curated selections.

Online-only retailers, often with lower overheads, also pose a significant challenge. These pure-play e-commerce businesses can react quickly to market trends and offer competitive pricing.

Furthermore, luxury brands and specialist occasionwear providers compete for a segment of the market, particularly for higher-value purchases. This multi-faceted competition means Moss Bros must continually differentiate itself across product, price, and customer experience.

The UK menswear market is anticipated to expand at a compound annual growth rate of 4.3% between 2024 and 2032. This growth presents a fertile ground for increased competition as more players are drawn to the expanding market.

Within this broader trend, the formal wear segment is particularly robust, with a projected growth rate of 35% over the next five years. This surge is partly fueled by a 7.50% increase in online formal wear purchases, indicating a shift in consumer behavior that rivals will undoubtedly seek to capitalize on.

Moss Bros distinguishes itself in the competitive retail landscape primarily through its specialization in suits and formal wear. They offer a dual approach, catering to both rental needs through their hire service and outright purchase options. This focus is further strengthened by their provision of tailored solutions and intricate custom tailoring, allowing customers to achieve a precise fit and personalized style.

While Moss Bros emphasizes these specialized services, the broader market for formal wear includes numerous competitors who also offer tailoring and a wide array of styles. This necessitates a commitment to continuous innovation in product design and an unwavering dedication to service excellence to maintain a distinct market position and attract discerning customers.

Exit Barriers

Moss Bros Group, like many in the formal menswear sector, faces significant exit barriers. These are largely driven by the substantial fixed costs tied to its physical retail presence, including lease obligations, store maintenance, and staffing. For instance, maintaining a network of stores requires ongoing investment that can be difficult to recoup quickly if a business decides to exit.

Furthermore, the company's investment in specialized tailoring equipment and a considerable inventory of formal wear represents another layer of exit barrier. Divesting these assets at a favorable price is often challenging, especially if the market for such specialized items is limited or declining. This ties capital to the business, making it less liquid and harder to liquidate efficiently.

These entrenched costs mean that businesses like Moss Bros may continue operating even when profitability is low, rather than incurring further losses through an exit. This can prolong competitive intensity, particularly during economic downturns when demand for formal wear might contract. The inability to easily exit the market can therefore contribute to a more crowded and competitive landscape for an extended period.

- High Fixed Costs: Significant investment in physical retail infrastructure and specialized tailoring equipment makes exiting the market financially burdensome.

- Inventory Investment: Holding a substantial stock of formal wear represents capital that is difficult to liquidate quickly or at full value upon exit.

- Prolonged Competition: The difficulty in exiting the market can lead to companies remaining operational longer than otherwise, thereby sustaining competitive pressure.

Brand Identity and Loyalty

Moss Bros is actively reinforcing its brand identity by rebranding to simply 'Moss', aiming to blend its rich heritage with a forward-looking vision. This strategic move is designed to cultivate stronger customer loyalty.

A well-established brand identity, like that of Moss, can act as a buffer against intense competitive rivalry. However, the retail fashion landscape, particularly menswear, is dynamic, with trends and quality expectations constantly shifting.

- Heritage Leverage: Moss Bros' long history provides a foundation for brand recognition and trust.

- Rebrand Impact: The transition to 'Moss' signifies a modernization effort, potentially attracting new customer segments while retaining existing ones.

- Loyalty as a Shield: Strong customer loyalty, fostered by consistent quality and brand messaging, can reduce price sensitivity and the impact of competitor promotions.

- Market Dynamics: The menswear market is subject to rapid changes in fashion trends and a growing consumer emphasis on fabric quality and ethical sourcing, necessitating ongoing brand investment.

The competitive rivalry within the UK formal menswear market is intense, with Moss Bros Group facing established retailers like Marks & Spencer and John Lewis, alongside agile online-only brands. These competitors leverage various strategies, from broad product ranges to competitive pricing and rapid trend adaptation, creating a challenging environment for Moss Bros. The market's projected 4.3% compound annual growth rate between 2024 and 2032, with formal wear specifically growing by 35% over five years, will likely intensify this rivalry as more players are drawn to the expanding sector. The increasing online purchase of formal wear, up 7.50%, further fuels this competitive dynamic by opening new channels for rivals.

| Competitor | Key Offerings | Competitive Strength |

|---|---|---|

| Marks & Spencer | Broad range of formal wear, accessible pricing | Brand recognition, extensive store network |

| John Lewis | Curated selections, quality focus | Reputation for quality, strong customer service |

| Online-only Retailers | Competitive pricing, rapid trend response | Lower overheads, agility |

| Luxury & Specialist Brands | High-end formal wear, occasionwear | Premium brand image, exclusivity |

SSubstitutes Threaten

The increasing casualization of dress codes presents a significant threat to Moss Bros Group. In 2024, many companies continued to relax their workplace attire policies, leading to a diminished need for formal suits among professionals. This trend extends to social events, which are also embracing more informal styles, directly impacting the demand for traditional formal wear.

Customers are increasingly exploring alternatives to traditional suits, like stylish separates or elevated smart casual ensembles. This trend directly challenges Moss Bros's reliance on full suit sales and rentals, as seen in the broader retail market where athleisure and versatile pieces have gained significant traction. For instance, by 2024, the global smart casual wear market is projected to continue its expansion, offering consumers more adaptable options for events previously requiring formal attire.

The rise of the second-hand market presents a significant threat to traditional retailers like Moss Bros. In 2024, the global second-hand apparel market was valued at over $140 billion, with projections indicating continued strong growth. This trend means consumers seeking value or a more sustainable wardrobe might opt for pre-owned formal wear, bypassing new purchases.

Furthermore, the expansion of general clothing rental services, moving beyond just formal occasions, offers another alternative. While Moss Bros. has a strong heritage in suit hire, the increasing accessibility and variety of rental platforms for everyday and occasion wear could divert consumer spending. This broadens the competitive landscape, as consumers may choose to rent rather than buy for various needs.

DIY and Tailoring Services

The rise of DIY tailoring and accessible independent alteration services presents a significant threat of substitutes for Moss Bros Group. Customers can opt for more affordable off-the-rack suits from mass-market retailers, subsequently investing in personalized fitting from local tailors. This approach allows consumers to achieve a customized fit without engaging Moss Bros's full-service tailoring, potentially eroding demand for their integrated offerings.

This unbundling of the suit purchasing and fitting process diminishes the perceived necessity of a specialist formal wear retailer like Moss Bros. For instance, the UK market for clothing alterations and repairs is robust, with many independent businesses offering competitive pricing. By the end of 2023, it was estimated that the UK's textile repair and alteration sector, while niche, continued to grow, fueled by sustainability trends and a desire for personalized apparel.

- Cost Savings: Off-the-rack suits from general retailers combined with independent tailoring can be significantly cheaper than a fully tailored suit from a specialist.

- Accessibility: Independent tailors are often more numerous and geographically convenient than a specialist's in-house services.

- Customization Focus: Consumers seeking specific alterations can achieve them through independent services, negating the need for a premium integrated offering.

- Market Trends: Growing interest in sustainable fashion and extending garment life also supports the use of independent alteration services.

Economic Shifts and Consumer Spending Priorities

Economic shifts significantly impact consumer spending on formal wear. During times of economic uncertainty, like the cost-of-living pressures seen in 2024, consumers often cut back on discretionary items. This means less spending on formal attire as people prioritize essential goods and services.

Consumers are increasingly seeking value and versatility. Instead of purchasing specialized formal garments, they might opt for more adaptable clothing that serves multiple purposes. This trend directly affects Moss Bros Group, as it suggests a reduced demand for their core offering of formal and occasion wear.

The shift in consumer priorities can be substantial. For instance, reports from late 2023 and early 2024 indicated a noticeable slowdown in retail spending on non-essential fashion categories. This suggests that consumers are actively re-evaluating their purchasing decisions, with formal wear often being deferred or replaced with more casual or functional alternatives.

- Consumer Spending Trends: A 2024 survey indicated that 65% of consumers were actively looking for ways to reduce discretionary spending, with fashion being a primary target.

- Demand for Versatility: The market for multi-functional apparel saw a 15% growth in 2024, highlighting a clear consumer preference away from single-use formal wear.

- Impact on Formal Wear Market: The formal wear segment of the apparel market experienced an estimated 10% contraction in demand in early 2024 compared to the previous year.

The threat of substitutes for Moss Bros Group is amplified by the increasing casualization of dress codes and the growing popularity of versatile clothing options. Consumers are shifting away from single-purpose formal wear, opting for adaptable pieces that serve multiple occasions and everyday use. This trend, evident in 2024, directly reduces the demand for traditional suits and formal attire.

The rise of the second-hand market and general clothing rental services further diversifies consumer choices, offering more budget-friendly and sustainable alternatives to purchasing new formal wear. Additionally, the accessibility of DIY tailoring and independent alteration services allows consumers to achieve personalized fits at a lower cost, bypassing the integrated offerings of specialist retailers.

| Threat of Substitutes | Description | 2024 Data/Trend |

| Casualization of Dress Codes | Reduced need for formal attire due to relaxed workplace and social norms. | Continued relaxation of workplace policies; social events embracing informal styles. |

| Versatile Apparel | Consumer preference for multi-functional clothing over specialized formal wear. | 15% growth in the multi-functional apparel market; 65% of consumers seeking to reduce discretionary spending. |

| Second-Hand Market | Availability of pre-owned formal wear as a cost-effective alternative. | Global second-hand apparel market valued over $140 billion. |

| Rental Services | Broader rental platforms offering alternatives to suit hire. | Expansion of rental services beyond formal occasions. |

| DIY Tailoring & Independent Alterations | Consumers opting for off-the-rack suits with local tailoring. | Robust UK market for clothing alterations; growing sustainability trend supports garment longevity. |

Entrants Threaten

The formal menswear retail sector, particularly for businesses offering custom tailoring and a physical store presence like Moss Bros, demands significant upfront capital. Newcomers must finance substantial inventory, create appealing store environments, and hire experienced personnel, creating a formidable barrier to entry.

For instance, establishing a new retail location in the UK, including leasehold improvements, stock, and initial marketing, could easily run into hundreds of thousands of pounds. This high capital requirement deters many potential competitors from entering the market, thereby protecting established players.

Moss Bros Group benefits from a strong brand loyalty and reputation built over decades, making it challenging for new entrants to establish themselves. For instance, in 2024, the company continued to leverage its heritage and customer relationships, a factor that new competitors would need significant investment to overcome. Capturing market share requires not just product but also trust, which takes considerable time and resources to cultivate.

Moss Bros' established network of physical retail stores and a well-developed e-commerce platform presents a significant barrier for new entrants. Securing prime retail locations is a costly and competitive endeavor, requiring substantial capital outlay and negotiation expertise. Furthermore, building an efficient online distribution and logistics network demands considerable investment in technology, infrastructure, and operational know-how. As of early 2024, the retail property market continues to see high rental costs in desirable high-street locations, making it difficult for newcomers to compete on physical presence alone.

Economies of Scale

Economies of scale present a significant barrier to entry for new retailers looking to compete with established players like Moss Bros Group. Existing large retailers often leverage their considerable size to achieve cost advantages in sourcing materials, manufacturing garments, and executing marketing campaigns. This allows them to offer more competitive pricing, which can be a crucial factor for consumers. For instance, in the UK menswear market, larger retailers can negotiate bulk discounts from suppliers, reducing their per-unit cost of goods sold, a benefit that smaller, newer entrants would find difficult to replicate initially.

New entrants, by their nature, begin operations at a much smaller scale. This inherent difference makes it challenging to match the cost efficiencies enjoyed by larger, more established businesses. Without the purchasing power and operational efficiencies of scale, new businesses may struggle to compete on price, potentially impacting their market penetration and profitability. For example, a new online suit retailer would likely face higher per-item costs for fabric and manufacturing compared to a company like Moss Bros, which has long-standing relationships with suppliers and high-volume production capabilities.

- Economies of Scale in Sourcing: Larger retailers can negotiate better terms and prices due to higher order volumes.

- Manufacturing Efficiencies: High-volume production leads to lower per-unit manufacturing costs.

- Marketing Cost Advantages: Established brands can spread marketing expenses over a larger customer base and sales volume.

- Price Competitiveness: Lower costs enable larger firms to offer more attractive pricing, a key challenge for new entrants.

Specialized Knowledge and Supply Chain Relationships

The formal menswear sector, particularly for a brand like Moss Bros, demands deep expertise. This includes intricate knowledge of fabric sourcing, the nuances of design and tailoring, and a keen understanding of customer preferences for different events, from weddings to business functions. New businesses entering this space must invest significant time and resources to cultivate this specialized knowledge. For instance, establishing robust relationships with high-quality fabric suppliers and skilled tailors is crucial, a process that can take years to mature and build trust.

Building reliable supply chain relationships is another significant barrier. Moss Bros, with its long history, has likely cultivated strong, long-term partnerships with manufacturers and fabric mills. These relationships often come with preferential pricing, guaranteed quality, and flexible production schedules. A new entrant would need to replicate this network, which is not easily or quickly achieved. In 2024, the textile industry faced ongoing supply chain disruptions, making the establishment of stable, dependable sourcing even more challenging for newcomers.

- Specialized Expertise: Formal menswear requires in-depth knowledge of fabrics, design, tailoring, and occasion-specific customer needs.

- Supply Chain Development: New entrants must establish reliable relationships with fabric suppliers and manufacturers, a process that takes considerable time and effort.

- Brand Reputation and Trust: Moss Bros benefits from decades of established trust and brand recognition, which new entrants must painstakingly build.

- Investment in Skills: Acquiring and retaining skilled tailors and design professionals is essential and represents a significant upfront investment for new competitors.

The threat of new entrants in the formal menswear sector, particularly for businesses like Moss Bros, is significantly mitigated by high capital requirements and established brand loyalty. New players face substantial costs for inventory, store setup, and marketing, with initial investments often running into hundreds of thousands of pounds. For instance, securing prime retail spaces in 2024 continued to demand significant capital outlay due to high rental costs.

Economies of scale enjoyed by established firms like Moss Bros, stemming from bulk purchasing and efficient marketing, create a cost advantage that new entrants struggle to match. Furthermore, the deep expertise required in fabric sourcing, design, and tailoring, along with the cultivation of trust and reliable supply chain relationships, represents a considerable time and resource investment for newcomers, making it difficult to quickly gain market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Moss Bros Group is built on a foundation of data from their annual reports, investor presentations, and financial statements. We supplement this with industry research from reputable sources like Statista and IBISWorld, as well as news articles and competitor announcements.