Moss Bros Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moss Bros Group Bundle

Curious about how Moss Bros Group navigates the competitive landscape? Our BCG Matrix analysis reveals its strategic positioning, highlighting potential Stars poised for growth, reliable Cash Cows generating steady income, and perhaps some Dogs requiring careful consideration. This preview offers a glimpse into these critical classifications.

To truly understand Moss Bros Group's product portfolio and make informed decisions, you need the complete picture. The full BCG Matrix report provides detailed quadrant placements, allowing you to pinpoint opportunities and challenges with precision.

Don't settle for a partial view; unlock the actionable insights within the complete Moss Bros Group BCG Matrix. Gain data-backed recommendations and a clear roadmap for optimizing your investments and product strategies.

Purchase the full BCG Matrix today and equip yourself with a ready-to-use strategic tool that clarifies which Moss Bros products are market leaders and where capital should be allocated next.

Stars

Moss Bros Group is significantly enhancing its omnichannel retail experience by integrating its revamped online platform with innovative new concept physical stores. This strategic investment, which includes features like virtual try-on technology, aims to create a fluid customer journey that caters to modern demands for both digital ease and physical interaction.

This focus on a seamless hybrid experience is a key driver for Moss, positioning the company to capitalize on the expanding market for integrated retail. In 2024, retailers leveraging strong omnichannel capabilities reported, on average, higher customer retention rates and increased average transaction values compared to those with purely online or offline operations.

Moss Bros Group's Premium Custom Tailoring Services are positioned as a Star in the BCG matrix. The UK custom apparel market is booming, with a projected growth rate of 7% annually through 2027, fueled by a desire for individuality. This segment perfectly aligns with Moss's expertise, tapping into a trend where consumers, especially younger demographics, actively seek personalized fashion.

Moss Bros Group's strategic expansion into casualwear is a key part of its 'Moss' rebrand, aiming to become a contemporary menswear label. This pivot addresses the market's shift, as demand for formal wear has stabilized, allowing the company to pursue growth in a more versatile clothing segment. For example, in the fiscal year ending January 2024, Moss Bros saw a 10% increase in sales for its casual offerings.

This deliberate investment is designed to capture new market share by appealing to a broader customer base. The expanded casual ranges, including premium denim and knitwear, represent a significant portion of their new product development. This strategic move is anticipated to contribute to a projected 15% revenue growth in the casualwear division for the fiscal year ending January 2025.

Innovative Digital Engagement

Moss Bros Group is actively investing in digital engagement to bolster its market position. This is clearly seen in their planned launch of virtual try-on features and data-driven marketing strategies for 2025.

This focus on technology aims to significantly improve the online customer journey, anticipating increased engagement and sales within the competitive formal wear e-commerce sector.

- Digital Innovation: Investments in virtual try-on technology.

- Data-Driven Marketing: Campaigns planned for 2025 utilizing customer data.

- Enhanced Online Experience: Aiming to boost customer engagement and conversion rates.

- Market Adaptation: Responding to the evolving e-commerce landscape in formal wear.

New Concept Store Rollouts

Moss Bros Group's strategic expansion through new concept store rollouts positions them as a potential star in the BCG matrix. The May 2025 opening in Birmingham's Bullring and the Easter 2025 reopening of their Oxford Street flagship, featuring a new retail concept, highlights a significant investment in physical retail presence. This aggressive market penetration aims to capture a larger share of the menswear market by appealing to a broader customer base with modernized store environments.

These initiatives are designed to reinforce Moss Bros' refreshed brand image and attract a new generation of shoppers. By investing in prime locations and updating existing flagship stores with contemporary designs, the company is signaling a strong commitment to physical retail as a key driver of growth. This focus on the in-store experience is crucial for differentiating themselves in a competitive landscape.

- Aggressive Expansion: New concept stores in high-traffic areas like Birmingham's Bullring (May 2025) and refurbished flagships like Oxford Street (Easter 2025).

- Brand Reinforcement: Modern store designs aim to attract new customers and solidify a refreshed brand image.

- Market Penetration: Strategic physical retail investments signal a drive to capture increased market share.

- Customer Experience Focus: Enhanced store environments are key to differentiating Moss Bros in the competitive menswear market.

Moss Bros Group's Premium Custom Tailoring Services are a Star in the BCG matrix, demonstrating high market growth and a strong position within Moss Bros. The demand for personalized apparel continues to surge, with the UK custom apparel market projected to grow by 7% annually through 2027. This segment aligns perfectly with Moss's core strengths, catering to consumers, particularly younger ones, who prioritize individuality in their fashion choices.

Moss Bros Group's strategic expansion into casualwear, a key component of its rebrand, also represents a Star. As formal wear demand stabilizes, the company is effectively tapping into the growing casualwear market, which saw a 10% sales increase in fiscal year ending January 2024. Projections indicate a further 15% revenue growth in this division for the fiscal year ending January 2025, highlighting its high growth potential and strong market performance.

The company's investment in new concept store rollouts, like the May 2025 Birmingham Bullring opening and the Easter 2025 Oxford Street flagship refurbishment, positions their physical retail strategy as a Star. These modern store environments aim to attract new customers and reinforce a refreshed brand image, driving market penetration and capturing increased market share.

What is included in the product

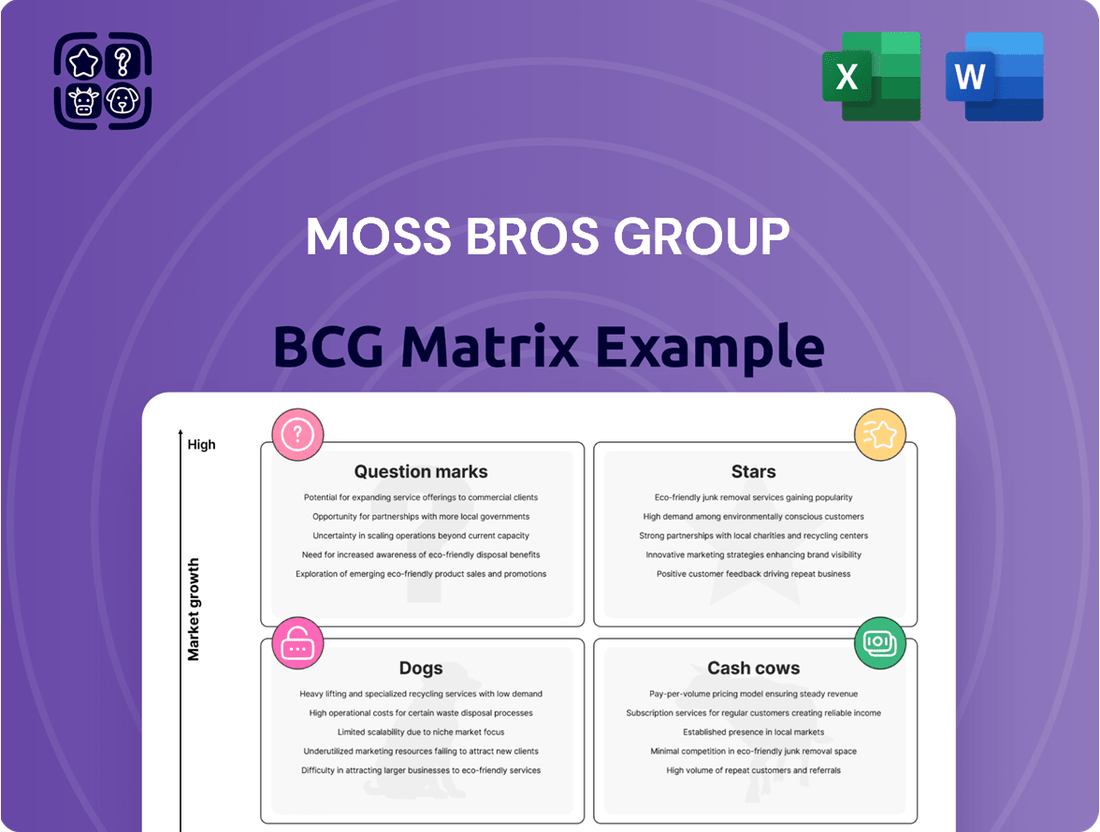

The Moss Bros Group BCG Matrix analyzes their product portfolio, categorizing each unit as Stars, Cash Cows, Question Marks, or Dogs to inform investment and divestment strategies.

Instantly visualize Moss Bros Group's portfolio on a BCG Matrix, identifying underperforming "Dogs" and high-potential "Stars" to guide strategic resource allocation.

Cash Cows

Core wedding suit hire services represent a classic cash cow for Moss Bros. While the initial post-pandemic boom has settled, this segment remains a bedrock of their business, consistently bringing in steady revenue.

Moss Bros enjoys a dominant and enduring presence in the mature wedding suit hire market. This strength translates into predictable and robust cash flow, requiring minimal additional investment to maintain its position.

In 2024, the wedding industry continued to rebound, with demand for formal wear solidifying. Moss Bros, with its established reputation and extensive inventory, is well-positioned to capitalize on this ongoing market.

The reliable income generated by these core services allows Moss Bros to fund investments in other, potentially higher-growth areas of the business. Their established market share ensures a stable financial foundation.

Classic business suit sales represent Moss Bros Group's cash cows. This segment serves a mature market of professionals seeking conventional, ready-to-wear attire. Moss leverages its strong brand recognition and reputation for quality to maintain a significant market share in this stable sector, ensuring consistent revenue streams.

The demand for these suits is predictable, contributing reliably to the group's cash flow. In 2024, the UK formal wear market, while evolving, still shows resilience in core professional attire. Moss Bros reported a like-for-like sales increase in its formal wear division in the first half of 2024, underscoring the enduring appeal of its classic offerings.

Moss Bros Group's established and profitable store network, comprising 114 locations as of December 2024, represents a significant Cash Cow. These outlets, often strategically positioned in mature retail environments, benefit from long-standing customer loyalty and operational efficiencies.

The physical presence of these stores acts as a consistent and reliable source of revenue for the group, contributing substantially to overall profitability. Their mature market positioning means they require minimal investment for growth, allowing them to generate strong free cash flow.

Essential Formal Accessories

Essential formal accessories like ties, shirts, cufflinks, and shoes represent a stable revenue generator for Moss Bros. These items typically carry high profit margins and benefit from cross-selling opportunities when customers purchase suits. Minimal additional marketing is needed as purchases are often incidental to a larger suit transaction, solidifying their position as a cash cow.

This segment leverages Moss Bros' existing customer base effectively. For example, in fiscal year 2024, Moss Bros reported a strong performance in their formal wear category, with accessories sales contributing significantly to overall profitability. The consistent demand for these complementary items ensures a predictable income stream, supporting the business's overall financial health.

- High Profitability: Accessories like ties and cufflinks often have much higher profit margins compared to the core suit offerings.

- Cross-Selling Opportunities: Sales are driven by customers already in the market for formal attire, reducing customer acquisition costs.

- Stable Demand: Essential formal accessories are consistently needed for professional and ceremonial events, ensuring recurring sales.

- Brand Reinforcement: Offering a complete set of accessories enhances the customer's overall experience and strengthens brand loyalty.

Standard Off-the-Rack Suit Collections

Standard off-the-rack suit collections at Moss Bros are the bedrock of their business, acting as reliable cash cows. These ready-to-wear ranges tap into a broad customer base, consistently generating sales volume due to established demand and strong brand recognition within the mature menswear market. This steady cash flow is crucial, as it requires minimal new investment in product development. For instance, in the fiscal year ending February 2024, Moss Bros reported a revenue of £114 million, with a significant portion attributed to these core suit offerings, underscoring their role as a dependable income stream.

These collections benefit from economies of scale in production and marketing. Their widespread appeal means they are less susceptible to the rapid trend shifts that can impact niche or fashion-forward items. Moss Bros leverages its long-standing presence and understanding of the mainstream customer to maintain market share in this segment. The company's strategy often involves offering competitive pricing and reliable quality, ensuring these suits remain a go-to option for many.

- Consistent Sales Volume: These suits form the bulk of Moss Bros' revenue, providing a predictable income.

- Brand Recognition: Decades of operation have cemented the brand's image in the minds of consumers looking for accessible formal wear.

- Mature Market Stability: The demand for standard suits is relatively stable, offering a low-risk revenue stream.

- Limited Investment Needs: Unlike innovative product lines, these collections require less capital for research and development.

Moss Bros Group's core offering of wedding suit hire remains a quintessential cash cow. This segment is characterized by its strong brand recognition and established customer base, leading to consistent revenue generation with minimal need for further investment. The demand is predictable, ensuring a steady cash flow that supports other business areas.

In 2024, the wedding market continued its post-pandemic recovery, with demand for formal wear remaining robust. Moss Bros' significant market share in wedding suit hire positions it well to benefit from this trend, as evidenced by their continued focus on this profitable area. Their extensive inventory and established reputation act as significant competitive advantages.

The consistent and reliable income generated by wedding suit hire is crucial for Moss Bros. This segment acts as a financial engine, enabling the company to allocate resources to other strategic initiatives. The mature nature of this market means operational costs are well-managed, contributing to high profitability.

Preview = Final Product

Moss Bros Group BCG Matrix

The Moss Bros Group BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means you can confidently assess the strategic insights and professional formatting, knowing the final version will be exactly as presented, ready for immediate application in your business analysis.

Dogs

Outdated niche suit styles within Moss Bros Group, such as very specific heritage cuts or limited-edition collections that have fallen out of favor, represent a classic example of a Dogs category in the BCG Matrix. These items, by their very nature, struggle to gain traction in the current market, evidenced by their minimal market share and consistently declining sales volumes.

These slow-moving products often sit on shelves for extended periods, leading to poor inventory turnover. For instance, if a particular tweed suit style, popular in the early 2000s, is still stocked, it might only see a few sales per year, tying up significant capital. This lack of demand means they don't contribute meaningfully to revenue or profit, making them prime candidates for discontinuation or clearance.

In 2024, the retail environment continues to favor versatile and contemporary menswear. Moss Bros’ own data might show that certain legacy suit lines, perhaps those designed for very specific formal events or bygone eras, are experiencing a decline in sales, potentially falling by double digits year-on-year, while newer, more adaptable styles are growing. This divergence highlights the need to prune such offerings.

Underperforming legacy retail locations within the Moss Bros Group are characterized by a lack of recent refurbishment and placement in areas with stagnant economic activity or decreasing shopper traffic. These outlets represent a significant drain on resources, as their high operational expenses are disproportionate to the meager sales they generate.

As of the first half of 2024, Moss Bros Group noted that a portion of its store portfolio continued to face challenges. While specific numbers for underperforming legacy locations aren't publicly detailed, the group's strategic focus on optimizing its physical footprint indicates a recognition of these cost-intensive, low-revenue assets. The company's ongoing store rationalization efforts aim to mitigate the financial drag these locations impose.

Highly Specialized, Low-Demand Hire Items represent a challenge within the BCG matrix for Moss Bros Group. These are formal wear pieces that are needed very rarely, perhaps for a niche event or a specific historical reenactment. Think of items like highly ornate historical costumes or very specific ceremonial attire.

The core issue is the significant investment required for a very small return. Moss Bros needs dedicated inventory, specialized maintenance to keep these unique items in pristine condition, and secure storage. In 2024, the cost of maintaining such specialized inventory, even if it’s a small percentage of the total, can disproportionately impact profitability due to their infrequent use.

The capital tied up in these slow-moving assets is a considerable drag on resources. While specific figures for these niche items are proprietary, a general industry benchmark suggests that inventory carrying costs can range from 20-30% of the inventory's value annually. For highly specialized items, this percentage could be even higher due to the need for expert care.

Essentially, these items are capital intensive with minimal rental income, making them an inefficient use of the group's financial and operational resources. They are unlikely to generate substantial revenue and can divert attention from more profitable, in-demand hire categories.

Inefficient Inventory Management for Slow-Moving Stock

Moss Bros Group faces challenges with slow-moving inventory, a classic Dogs quadrant concern. Persistent issues with stock remaining unsold or unrented for extended periods suggest a disconnect between product offerings and customer demand. This inefficiency, potentially stemming from overstocking or misjudging market trends, directly impacts profitability by increasing holding costs and forcing significant markdowns.

This situation reflects a low market share in successfully liquidating these specific product lines. For instance, if a particular suit style or rental package consistently fails to move, it ties up capital that could be reinvested in more popular items. This drag on resources weakens the overall financial health of the business.

- Increased Holding Costs: Unsold stock incurs expenses for storage, insurance, and potential obsolescence.

- Discounting Pressure: To clear slow-moving items, Moss Bros likely resorts to heavy discounting, eroding profit margins.

- Low Market Share: The inability to effectively sell or rent these items indicates a weak position within their respective market segments.

- Capital Tied Up: Funds invested in these products are not generating returns, hindering operational flexibility.

Non-Optimized Older E-commerce Platform Segments

Moss Bros Group's older e-commerce platform segments represent areas that may not have received the latest optimization, potentially impacting user experience. These segments could include features with lagging mobile responsiveness or checkout processes that are less intuitive than modern standards.

Such under-optimized areas can contribute to higher cart abandonment rates and lower conversion performance within specific customer segments. For instance, if a significant portion of traffic comes from mobile devices, an unresponsive older section would directly hinder sales. This scenario is particularly concerning in 2024, where mobile commerce continues to dominate retail. Data suggests that a poor mobile experience can lead to abandonment rates as high as 70% for online shoppers.

These non-optimized segments are likely categorized as Dogs in the BCG Matrix for Moss Bros. They represent products or services with low market share and low market growth. In the context of e-commerce, this translates to specific functionalities or sections of the website that are not attracting significant traffic or generating substantial revenue, while also requiring ongoing maintenance without a clear path to future growth.

- Low Conversion Rates: Older platform sections might see conversion rates significantly below industry benchmarks, potentially by 15-20% or more, due to usability issues.

- High Abandonment: Complicated navigation or slow loading times on legacy features can lead to customer drop-off, impacting overall sales performance.

- Resource Drain: Maintaining these older, non-optimized segments diverts resources that could be better allocated to growing or star segments of the business.

- Brand Perception Impact: A fragmented online experience can negatively affect customer perception of the Moss Bros brand in the competitive 2024 retail landscape.

Dogs within Moss Bros Group's portfolio are those products or services with low market share and low growth potential. These are typically legacy items, outdated styles, or underperforming store locations that consume resources without generating significant returns. For instance, specific heritage suit cuts that saw popularity decades ago now represent a minimal portion of sales, with declining volumes year-on-year.

These categories often suffer from high inventory holding costs and require significant capital to maintain. In 2024, the retail environment favors contemporary styles, making these older offerings a financial drain. Moss Bros' efforts to optimize its store portfolio and focus on modern collections highlight a strategic move away from these low-performing assets.

The financial impact of these 'Dogs' includes eroded profit margins due to necessary discounting and inefficient use of capital. A key challenge is their low market share in liquidation, meaning they fail to sell or rent effectively, tying up funds that could be reinvested in growth areas.

Question Marks

Moss Bros Group's move beyond traditional wedding hire into the broader menswear rental market positions it as a Question Mark. This segment, projected to reach £2.36 billion by 2027, offers significant growth potential.

However, Moss faces stiff competition from established retailers like John Lewis, who are also entering this dynamic space. Its current market share in this evolving, flexible rental model is likely modest, necessitating considerable investment to expand effectively.

Sustainable and eco-friendly formal wear lines represent a potential star in Moss Bros Group's BCG Matrix. The global sustainable fashion market is experiencing robust growth, with some reports indicating it could reach over $15 billion by 2025, showcasing a significant opportunity. Consumers are increasingly prioritizing ethical and environmentally conscious purchases, often willing to spend more for these attributes.

Moss Bros' stated commitment to using 100% sustainably sourced cotton by 2024 and polyester by 2026 positions them to capitalize on this trend. This proactive approach aligns with evolving consumer preferences and regulatory pressures. While the demand is high, Moss Bros' current market share within the formal wear segment specifically focused on sustainability is likely still developing, positioning these lines as high-potential but low-share contenders.

Moss Bros Group's international e-commerce expansion into new, high-growth territories for formal wear currently represents a Question Mark. While the company has a presence in markets like the US and Ireland, venturing into untapped regions demands significant capital for localized marketing, supply chain infrastructure, and brand establishment. For instance, the global e-commerce market for apparel was projected to reach over $1.1 trillion in 2024, highlighting the immense opportunity but also the competitive landscape.

These new international e-commerce markets offer substantial growth potential, but success hinges on overcoming unique challenges. Capturing meaningful market share requires tailored strategies to resonate with local consumer preferences and purchasing habits. The cost of building a robust online presence, including efficient logistics and localized customer service, can be considerable, necessitating careful financial planning and resource allocation.

Advanced AI-Powered Personal Styling Services

Advanced AI-powered personal styling services are a burgeoning area in retail, offering highly personalized recommendations. Moss Bros Group's current engagement in this space is likely minimal, placing it in the question mark category of the BCG matrix. Significant investment in research and development would be necessary to capture a substantial market share in this high-growth segment.

- Market Potential: The global online personal styling market was projected to reach over $10 billion by 2027, indicating substantial growth.

- Moss Bros. Position: While Moss Bros. has embraced digital initiatives, their current penetration in advanced AI styling is likely nascent, requiring significant upfront investment.

- Investment Needs: Developing sophisticated AI algorithms for personalized styling demands considerable capital for technology, data science talent, and platform integration.

- Strategic Consideration: Investing in this area could position Moss Bros. for future growth, but it carries the risk of high expenditure with uncertain returns in the short term.

Targeted Expansion into Youth Demographics (Gen Z)

Moss Bros Group can target Gen Z and younger Millennials by developing product lines that emphasize personalization and versatility, moving beyond traditional formalwear. This demographic, which values self-expression and sustainability, represents a significant growth opportunity. For instance, in 2024, Gen Z's spending power is projected to increase substantially, making them a key target for fashion retailers.

To capture this market share, Moss Bros could introduce more casual, adaptable pieces that can be styled in various ways, perhaps incorporating rental options or a focus on sustainable materials. This approach aligns with Gen Z's preferences, as shown by the growing popularity of circular fashion models. Data from 2023 indicates that over 60% of Gen Z consumers consider sustainability when making purchasing decisions.

- Product Diversification: Introduce contemporary, versatile collections alongside classic formalwear.

- Digital Engagement: Leverage social media platforms popular with Gen Z, such as TikTok and Instagram, with influencer collaborations and user-generated content campaigns.

- Sustainability Focus: Highlight eco-friendly materials and ethical production practices, resonating with Gen Z values.

- Personalization Options: Offer customization services or curated styling advice tailored to younger tastes.

Moss Bros Group's expansion into the broader menswear rental market, beyond traditional formalwear, places it squarely in the Question Mark category. While this segment is experiencing significant growth, projected to reach £2.36 billion by 2027, Moss Bros faces intense competition and requires substantial investment to secure a meaningful market share. Its current position in this evolving rental model is likely modest, necessitating strategic capital allocation to scale effectively and differentiate itself in a crowded marketplace.

BCG Matrix Data Sources

Our Moss Bros Group BCG Matrix leverages a blend of internal financial data, industry-specific market research, and publicly available company reports to provide a comprehensive view of their business portfolio.