Banca MPS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca MPS Bundle

Uncover the intricate web of external forces shaping Banca MPS's trajectory with our meticulously crafted PESTLE analysis. From shifting political landscapes to evolving economic indicators and technological advancements, this report provides a critical overview of the factors influencing the bank's strategic decisions and market position. Understand the socio-cultural nuances and environmental considerations that present both challenges and opportunities for Banca MPS. Gain a competitive edge by leveraging these expert insights to refine your own market approach.

Don't miss out on the comprehensive understanding of the external environment impacting Banca MPS. Our PESTLE analysis is your essential guide to navigating the complexities of the modern financial sector. Secure your copy today and unlock the actionable intelligence needed to make informed strategic choices.

Political factors

The Italian government's role as a significant shareholder in Banca Monte dei Paschi di Siena (MPS) is undergoing a notable transformation. As of November 2024, the state's ownership has been reduced to around 11.7%, a considerable decrease from the 64% stake held in November 2023.

This reduction is part of a strategic privatization plan, fulfilling commitments made to the European Union following MPS's 2017 bailout. The objective is to lower the government's stake to below 20% by the close of 2024.

This ongoing divestment signals a clear move towards a more market-oriented operational framework for Banca MPS. Such a shift could influence the bank's strategic decisions and its integration into the broader financial landscape.

Banca MPS operates under the stringent gaze of the European Central Bank (ECB) and the Bank of Italy, reflecting its status as a major Italian financial institution. The ECB's Supervisory Review and Evaluation Process (SREP) sets vital annual benchmarks, including minimum capital ratios, directly impacting the bank's operational framework. Failure to meet these ECB-mandated requirements, such as the Pillar 1 capital requirements which for the banking sector generally hover around 8% of risk-weighted assets, can lead to significant supervisory actions and penalties.

Political stability in Italy directly shapes the economic policy landscape, which in turn significantly impacts its banking sector, including Banca Monte dei Paschi di Siena (MPS). A stable political environment generally fosters more predictable economic conditions, benefiting financial institutions.

Government priorities often steer strategic decisions within the banking industry. For instance, a government focused on fostering competition among Italian banks could accelerate the privatization process of MPS, as was a key objective in recent years, aiming to reduce state ownership and enhance market efficiency.

Shifts in government or significant changes in policy direction can profoundly alter the operational environment for banks like MPS. This includes potential impacts on merger and acquisition (M&A) activities, as well as the evolution of the regulatory frameworks governing their operations and capital requirements.

As of early 2025, discussions around the Italian government's stake in MPS continue to be a key political consideration. The ultimate goal remains to fully exit the state's ownership, a process that is heavily influenced by the political will and economic strategy of the ruling administration, with the Italian Treasury holding a substantial portion of the bank's capital.

EU Banking Union and Resolution Frameworks

Banca MPS, as a participant in the EU Banking Union, is subject to a unified regulatory and resolution regime. This means the bank must comply with directives designed to bolster the stability of the Eurozone's financial sector. Key among these is the implementation of Basel 3.1 standards, which are scheduled to take effect from January 2025. These new capital requirements are expected to significantly impact how banks manage risk and hold capital.

The Bank of Italy acts as the National Resolution Authority, playing a crucial role in overseeing Banca MPS and other Italian banks. This authority is responsible for managing the orderly winding down of failing institutions, preventing taxpayer bailouts. The overarching goal of these frameworks is to ensure a stable financial system across the entire Eurozone, protecting depositors and maintaining market confidence.

The CRR III (Capital Requirements Regulation III) directive is a cornerstone of this harmonized approach. It translates the Basel 3.1 standards into EU law, dictating capital adequacy, liquidity requirements, and leverage ratios for banks. For instance, CRR III introduces revised approaches for calculating credit risk-weighted assets, which could affect Banca MPS's capital ratios.

Key aspects of these EU frameworks include:

- Harmonized Capital Requirements: Adherence to Basel 3.1 standards from January 2025 via CRR III, impacting capital adequacy.

- Resolution Authority Oversight: The Bank of Italy's role in managing bank failures and ensuring financial stability.

- Orderly Resolution Mechanisms: Frameworks designed to prevent systemic risk and protect depositors in case of bank distress.

- Cross-Border Cooperation: Enhanced collaboration among EU supervisory authorities for a more robust banking sector.

Geopolitical Tensions and Trade Policies

Heightened geopolitical tensions, particularly between major economic blocs, present a significant risk for Italy and, by extension, Banca MPS. These tensions can disrupt global supply chains and dampen international trade, directly impacting Italy's export-driven economy. For instance, the ongoing trade friction between the EU and China, coupled with the conflict in Eastern Europe, contributed to a projected slowdown in global GDP growth for 2024.

Such global economic headwinds can translate into a more challenging operating environment for Banca MPS. We could see reduced demand for credit, an increase in non-performing loans as businesses struggle with higher input costs and weaker demand, and greater volatility in financial markets. For example, increased uncertainty often leads to wider credit spreads, making it more expensive for businesses and individuals to borrow.

Banca MPS must actively monitor these geopolitical and trade policy shifts. The bank's risk management framework needs to account for potential downturns stemming from these external factors. This includes stress-testing portfolios against scenarios of prolonged trade disputes or geopolitical instability, which could significantly impact asset valuations and profitability.

- Global trade tensions can directly affect Italian exports, a key driver of economic growth.

- Geopolitical uncertainties can lead to increased financial market volatility and wider credit spreads.

- A slowdown in economic growth could result in higher insolvency rates for businesses, impacting loan portfolios.

- Banca MPS must integrate geopolitical risk into its strategic planning and risk assessment processes.

The Italian government's strategic divestment from Banca Monte dei Paschi di Siena (MPS) is a pivotal political factor. By November 2024, the state's ownership had decreased to approximately 11.7%, a significant drop from the previous year's 64% stake, fulfilling EU commitments related to the 2017 bailout.

This reduction is part of a broader plan to privatize MPS, with the aim of lowering state ownership below 20% by the end of 2024, signaling a move towards a more market-driven operational model for the bank.

Political stability in Italy directly influences economic policy, which in turn impacts the banking sector. Government priorities, such as fostering competition, can accelerate privatization efforts, while shifts in policy can alter the operational environment and regulatory framework for banks like MPS.

What is included in the product

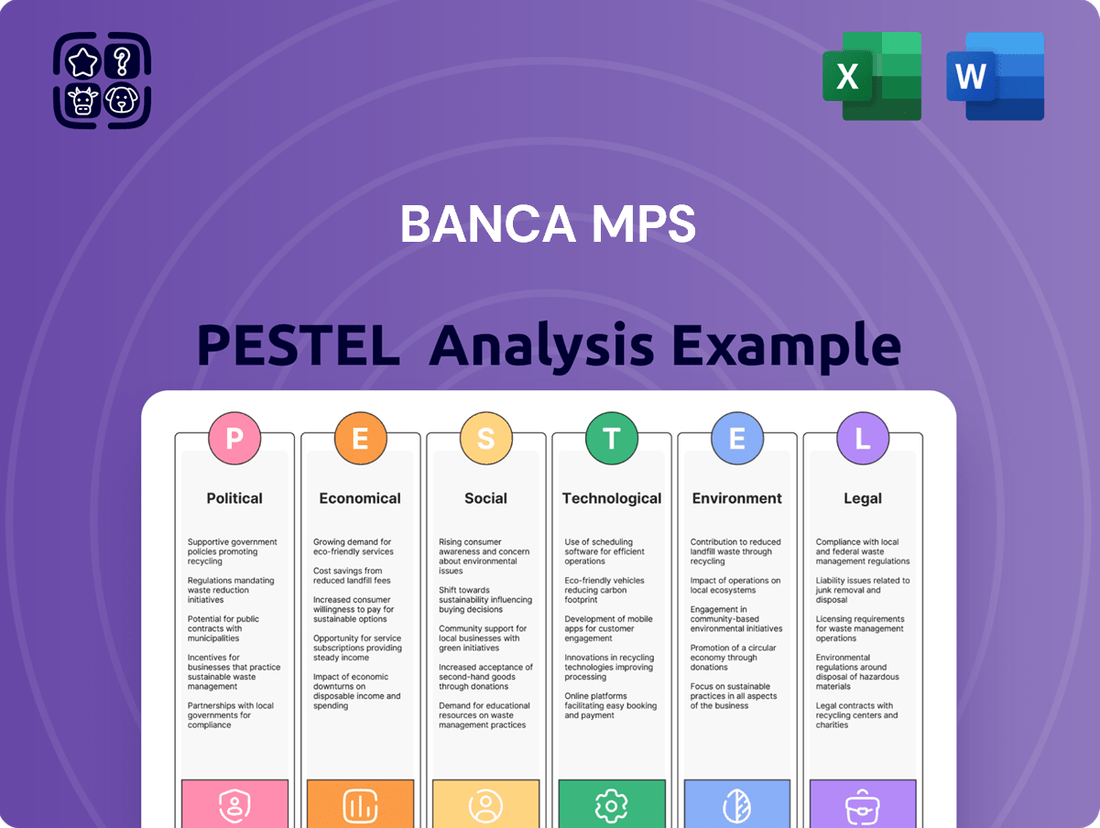

This Banca MPS PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors, offering a comprehensive view of external forces shaping the bank's strategic landscape.

It provides actionable insights to identify potential risks and capitalize on emerging opportunities within the Italian banking sector and beyond.

A PESTLE analysis for Banca MPS offers a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

Italy's Gross Domestic Product (GDP) growth is anticipated to be modest, with forecasts for 2025 hovering between 0.8% and 1%. This represents a slight improvement from the projected 0.5% growth in 2024.

This moderate economic expansion is largely expected to be fueled by robust domestic demand and a significant acceleration in spending related to Italy's ambitious Recovery and Resilience Plan (RRP).

A stronger economic environment typically translates to increased demand for loans and a reduced credit risk profile for financial institutions such as Banca MPS.

For instance, the RRP aims to inject substantial investment into key sectors, potentially boosting business activity and consumer spending throughout 2025.

The European Central Bank's (ECB) anticipated rate cuts throughout 2024 and into 2025 present a significant factor for Banca MPS. Forecasts indicate a gradual downward trend in interest rates, a move intended to invigorate the European economy and bolster borrowing activity.

While this policy shift could spur loan demand, it also poses a direct challenge to bank profitability. Specifically, lower interest rates typically compress the net interest margin, the difference between interest income generated and interest paid out, which is a core revenue driver for institutions like Banca MPS.

In the first quarter of 2025, Banca MPS experienced a modest dip in its net interest income. This decline, however, was strategically managed, with the impact largely mitigated by robust performance from alternative revenue sources, showcasing a degree of resilience within the bank's diversified income streams.

Italy's non-performing exposures (NPEs) experienced a minor uptick in the first half of 2024, marking an end to a decade of consistent reduction, yet the Italian banking sector as a whole continues to demonstrate robustness.

Banca MPS has notably tackled its non-performing loans, significantly improving its gross NPL ratio and bolstering its coverage ratios through proactive management strategies.

This aggressive reduction in NPLs by Banca MPS has strengthened its balance sheet considerably, making it more attractive to potential investors.

The bank's ongoing commitment to managing its asset quality, particularly its NPL portfolio, is a vital component for ensuring financial stability and fostering investor confidence.

Credit Demand and Lending Trends

Credit demand in Italy showed a mixed picture through early 2025. Business lending continued to be subdued throughout 2024, largely due to a general lack of appetite from firms. However, a positive shift occurred in the first quarter of 2025, with household borrowing, especially for mortgages, beginning to expand.

Banca MPS has capitalized on this trend, reporting a significant uplift in its lending operations. The bank has seen a robust increase in new retail mortgages, indicating a successful revival of its lending activities. This resurgence in mortgage lending is a key driver for the bank's overall loan growth strategy.

Looking ahead, the Italian banking sector's loan growth is projected to remain measured. Analysts anticipate an overall expansion of approximately 1% to 2% for the sector in 2025. This forecast reflects a cautious but gradually improving credit environment.

- Italian firms' credit demand remained weak in 2024.

- Household lending, particularly for mortgages, grew in Q1 2025.

- Banca MPS experienced a notable rise in new retail mortgages.

- The Italian banking sector is expected to see 1%-2% loan growth in 2025.

Inflation and Fiscal Targets

Inflation is expected to ease considerably in Italy, with headline inflation projected to fall to 1.1% in 2025. This decline in price pressures could provide a more stable economic environment.

Meeting fiscal targets is crucial for Italy's economic health and its standing within the European Union. The nation is working to ensure its deficit remains below the EU's 3% of GDP limit by 2026, a target that requires consistent economic expansion.

Sustained economic growth is fundamental for Italy to achieve these deficit and debt reduction goals. The government's fiscal performance, particularly its ability to manage and reduce the deficit, directly impacts overall financial stability and can significantly influence investor confidence.

- Headline Inflation Forecast (2025): 1.1%

- EU Deficit Target: Below 3% of GDP

- Target Year for Deficit Reduction: By 2026

- Key Economic Driver for Fiscal Targets: Sustained economic growth

Italy's economic outlook for 2025 suggests a modest GDP growth between 0.8% and 1%, an uptick from the projected 0.5% in 2024, largely driven by domestic demand and the Recovery and Resilience Plan. This improved economic climate is beneficial for banks like Banca MPS, potentially increasing loan demand and reducing credit risk. However, the European Central Bank's anticipated interest rate cuts throughout 2024-2025, while stimulating borrowing, could compress net interest margins for financial institutions, as seen with a slight dip in Banca MPS's net interest income in Q1 2025, which was offset by other revenue streams.

Despite a minor increase in non-performing exposures in early 2024, the Italian banking sector remains robust, with Banca MPS having significantly improved its asset quality by reducing non-performing loans. Household borrowing, particularly for mortgages, began expanding in Q1 2025, a trend Banca MPS has leveraged with a notable increase in new retail mortgages, contributing to the sector's projected 1%-2% loan growth in 2025. Inflation is forecast to ease to 1.1% in 2025, aiding Italy's efforts to meet its fiscal targets, including keeping the deficit below 3% of GDP by 2026, which hinges on sustained economic growth.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Banca MPS |

|---|---|---|---|

| GDP Growth | 0.5% | 0.8%-1% | Potentially higher loan demand, lower credit risk |

| Headline Inflation | (Not specified) | 1.1% | More stable economic environment |

| Italian Banking Sector Loan Growth | (Not specified) | 1%-2% | Moderate expansion in lending activities |

| ECB Interest Rates | (Not specified) | Anticipated cuts | Risk of compressed net interest margins |

Full Version Awaits

Banca MPS PESTLE Analysis

The preview you see here is the exact Banca MPS PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Banca MPS.

Understand the external forces shaping the bank's strategic landscape, from regulatory changes to evolving consumer behaviors.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Consumer preferences are rapidly shifting towards digital channels for banking services, compelling institutions like Banca MPS to invest heavily in digital transformation. This trend is evident globally, with reports indicating a substantial increase in mobile banking adoption rates, especially among younger demographics. For instance, by the end of 2024, it's projected that over 75% of banking interactions for many institutions will occur digitally.

Banca MPS is actively addressing this by reinforcing its digital strategy, notably through its online banking platform, Widiba. This initiative is crucial for supporting its commercial activities and meeting the evolving expectations of its customer base. Banks that fail to adapt risk losing market share to more digitally agile competitors.

The ongoing digital adoption is not just about convenience; it's also about efficiency and cost reduction for the banks. By migrating more services online, Banca MPS can streamline operations and potentially offer more competitive pricing. This strategic pivot is essential for long-term relevance and competitiveness in the Italian banking sector.

The financial literacy level among Italians is a key sociological factor impacting how easily they adopt sophisticated financial products and engage with banking institutions. Lower literacy can lead to hesitance in utilizing services, affecting Banca MPS's product adoption rates. Surveys in 2023 indicated that a significant portion of the Italian population still finds financial topics challenging, potentially limiting the market for specialized investment vehicles.

Banca MPS's strategic focus on sustainable finance directly addresses social inclusiveness by aiming to broaden access to credit and financial services. This initiative is crucial for integrating underserved populations into the formal financial system, thereby fostering greater economic participation and potentially increasing the customer base for the bank's offerings.

Public trust in banking institutions, especially in Italy with its past banking sector vulnerabilities, remains a key sociological consideration for Banca MPS. Recent bond issuances by Banca MPS, raising €3 billion in 2024 and achieving a significant reduction in borrowing costs, suggest a growing market confidence. This positive trend indicates that investors are increasingly viewing the bank more favorably.

Maintaining and further building this trust hinges on a continued commitment to transparency and sound, responsible banking practices. For instance, clear communication about financial health and adherence to regulatory standards are vital. The bank's strategic focus on strengthening its capital base and improving operational efficiency are also crucial elements in reassuring the public and stakeholders.

Demographic Shifts and Regional Needs

Italy's demographic landscape, marked by an aging population, directly shapes consumer demand for financial products. As the median age in Italy continues to rise, there's an increasing need for retirement planning, healthcare financing, and wealth management solutions. Banca MPS is strategically responding to these trends by expanding its portfolio of financing products tailored for both households and small and medium-sized enterprises (SMEs), aiming to capture this evolving market.

The bank's commitment to regional economic development, particularly its focus on supporting SMEs in Southern Italy, highlights an awareness of diverse demographic and geographic needs. By prioritizing initiatives in regions with historically lower GDP, Banca MPS aims to foster financial inclusion and stimulate economic activity where it's most needed, aligning its business objectives with societal well-being.

- Aging Population: Italy's population is aging, with the median age projected to reach 47.7 years by 2030, influencing demand for specific financial services.

- SME Support: Banca MPS is enhancing its financing offerings for SMEs, a critical segment for job creation and economic growth, especially in less developed regions.

- Regional Focus: Initiatives targeting Southern Italy address the unique economic and demographic characteristics of these areas, promoting equitable development.

- Product Diversification: The bank's strategy includes developing new financial products to meet the changing needs of Italian households and businesses.

Employee Engagement and Welfare

Employee well-being and engagement are crucial sociological factors for Banca MPS. The bank's ongoing discussions with trade unions concerning company bonuses and welfare platforms demonstrate a commitment to employee compensation and benefits. This focus is essential for fostering a positive work environment, especially in light of reported efforts to streamline operations and adapt to market changes. For example, in 2024, employee satisfaction surveys will likely be a key metric to track the impact of these initiatives.

Recognizing employee efforts is vital for morale and productivity. Banca MPS's approach to managing its workforce, particularly during periods of strategic restructuring, will significantly influence its social capital. A motivated workforce is more likely to adapt to new technologies and customer service expectations, which are paramount in the evolving financial sector. In 2025, reports on employee retention rates will offer further insight into the effectiveness of these engagement strategies.

- Banca MPS is actively negotiating with trade unions on bonus structures and welfare programs.

- Employee engagement is directly linked to productivity and the bank's ability to adapt to market shifts.

- Recognition of employee contributions is a key driver of a positive workplace culture.

- Employee retention rates in 2025 will serve as an indicator of successful engagement strategies.

The Italian banking sector is experiencing a significant shift towards digital channels, with consumer preferences increasingly leaning towards online and mobile banking. This trend, projected to see over 75% of banking interactions becoming digital by the end of 2024, requires institutions like Banca MPS to prioritize digital transformation initiatives, such as enhancing its Widiba online platform.

Financial literacy remains a crucial sociological factor, as lower levels can hinder the adoption of complex financial products. Banca MPS's strategic focus on sustainable finance and financial inclusion aims to address this by broadening access to financial services for underserved populations.

Public trust in banks, particularly in Italy, is paramount, and recent positive market sentiment towards Banca MPS, evidenced by a successful €3 billion bond issuance in 2024, indicates growing confidence. Maintaining this trust necessitates continued transparency and sound banking practices.

Italy's aging demographic is driving demand for retirement planning and wealth management services, prompting Banca MPS to expand its product offerings for households and SMEs. The bank's commitment to regional development, especially in Southern Italy, further underscores its adaptation to diverse demographic and geographic needs.

Technological factors

Banca MPS is heavily focused on digital transformation, pouring resources into its digital bank, Widiba, as a cornerstone of its commercial relaunch and operational efficiency. This strategy involves a deliberate 'best-of-breed' IT approach, meaning they're cherry-picking top-tier market technology solutions to enhance their infrastructure.

The primary aim of these digital investments is to boost commercial productivity and create more engaging customer interactions through advanced digitalization. This focus is crucial for staying competitive in a rapidly evolving financial landscape, with Italian banks, for instance, seeing digital channel usage climb significantly, reaching over 60% for some services by late 2023.

As Banca MPS navigates increasing digitalization, cybersecurity and data protection are paramount. Cyber threats are a significant risk, demanding constant vigilance and robust security. In 2024, the financial sector continued to see a rise in sophisticated cyberattacks, with data breaches costing businesses billions globally. Banca MPS must invest heavily in advanced ICT security to protect sensitive customer information and ensure operational continuity.

Regulatory frameworks like the Digital Operational Resilience Act (DORA) are sharpening supervisory focus on the financial industry's digital defenses. DORA, which became fully applicable in January 2025, mandates stringent requirements for ICT risk management, incident reporting, and third-party risk. This means Banca MPS faces intensified scrutiny and must demonstrate compliance to avoid penalties and maintain trust, especially as digital transactions grow.

Banca MPS, like many in the banking sector, is significantly increasing its investment in data analytics and artificial intelligence (AI). This push aims to boost performance, create better customer experiences, and streamline operations. For example, the global AI in banking market was valued at approximately $15 billion in 2023 and is projected to reach over $40 billion by 2028, highlighting the industry's commitment.

However, the adoption of AI brings new regulatory considerations. The EU Artificial Intelligence Act categorizes AI systems used for evaluating creditworthiness and assessing risk as 'high risk'. This means Banca MPS must navigate these new rules carefully as it integrates AI into its core functions.

Banca MPS can strategically employ AI to offer more personalized products and services to its customers. Real-time fraud detection is another key area where AI can provide substantial benefits, enhancing security. The bank’s challenge will be to harness these AI capabilities while rigorously adhering to the evolving regulatory landscape, particularly the EU AI Act's stipulations for high-risk applications.

Fintech Competition and Collaboration

The Italian financial landscape is increasingly shaped by fintech innovation, presenting a dual challenge and opportunity for established institutions like Banca MPS. Fintech firms and new digital-first challenger banks are rapidly gaining market share by offering streamlined, user-friendly services, forcing traditional banks to adapt or risk being left behind. This competitive pressure, however, also opens doors for strategic partnerships and the integration of new technologies to improve customer experience and operational efficiency. Indeed, Banca MPS is actively positioning its digital bank, Widiba, as a 'challenger bank/best in class' to bolster its own business model and compete more effectively in this evolving market. By mid-2024, fintech investments in Europe continued to show resilience, with significant funding rounds supporting companies focused on digital payments, lending, and wealth management, directly impacting how incumbent banks must strategize.

The broader Italian banking sector is undergoing significant strategic realignments, including consolidation, partly fueled by the imperative to embrace technological advancements and build more robust, digitally capable entities. As of early 2025, reports indicate that Italian banks are prioritizing digital transformation initiatives, allocating substantial capital towards improving online platforms and mobile banking capabilities to meet customer expectations shaped by fintech offerings. This technological push is essential for Italian banks to remain competitive not only domestically but also within the broader European financial market.

- Fintech Disruption: The proliferation of agile fintechs and challenger banks is intensifying competition in Italy, forcing traditional players to accelerate their digital transformation.

- Banca MPS Strategy: Leveraging Widiba as a digital frontrunner is a key move by Banca MPS to enhance its competitive edge and business model in response to fintech advancements.

- Sector Consolidation: Technological shifts are a significant driver behind ongoing consolidation within the Italian banking sector, as institutions seek scale and technological parity.

- Digital Investment: Italian banks are making substantial investments in digital infrastructure and services, aiming to match the user experience and efficiency offered by fintech competitors.

IT Infrastructure and Investment

Banca MPS is making significant strides in its technological advancement, with its 2024-2028 business plan earmarking a substantial EUR 500 million for IT development. This investment is strategically directed towards high-return projects designed to modernize and streamline the bank's core technological systems. A strong IT infrastructure is absolutely critical for Banca MPS to effectively deliver its digital services, enhance operational efficiency across the board, and lay the groundwork for sustained future growth in an increasingly digital banking landscape.

The bank's commitment to IT is not just about maintaining current operations; it's about future-proofing. This substantial allocation reflects a clear understanding that technological capabilities are a key differentiator in the competitive financial services sector. By focusing on renewing and optimizing its platforms, Banca MPS aims to improve customer experience, reduce operational costs, and increase agility in responding to market changes.

- IT Investment: EUR 500 million allocated for IT development in the 2024-2028 business plan.

- Strategic Focus: Emphasis on high-return IT projects for platform renewal and optimization.

- Core Objectives: Enhancing digital service delivery, improving operational efficiency, and supporting future growth.

- Industry Relevance: Robust IT infrastructure is a fundamental requirement for competitiveness in the modern banking sector.

Banca MPS's technological strategy centers on digital transformation, with its digital bank, Widiba, playing a crucial role. The bank is adopting a 'best-of-breed' IT approach, selectively integrating leading market technologies to bolster its infrastructure. This digital push aims to elevate commercial productivity and customer engagement, a necessary step given that Italian banks saw digital channel usage exceed 60% for some services by late 2023.

Cybersecurity and data protection are critical concerns as Banca MPS embraces digitalization. The bank must invest heavily in advanced ICT security to counter sophisticated cyber threats, which posed a significant risk in 2024, costing businesses globally billions. Furthermore, regulations like DORA, fully applicable from January 2025, impose stringent ICT risk management and reporting requirements, increasing supervisory scrutiny.

The bank is also significantly increasing its investment in data analytics and AI, with the global AI in banking market projected to grow from approximately $15 billion in 2023 to over $40 billion by 2028. While AI offers personalization and fraud detection benefits, Banca MPS must navigate the EU AI Act, which classifies AI for creditworthiness and risk assessment as high-risk, demanding careful integration.

Fintech innovation is reshaping the Italian financial landscape, pushing traditional banks like Banca MPS to adapt. The bank's strategic positioning of Widiba as a 'challenger bank/best in class' reflects this competitive pressure, especially as fintech investments in Europe remained resilient through mid-2024. This technological imperative is also a driver for sector consolidation, as Italian banks prioritize digital transformation to enhance online and mobile banking capabilities and remain competitive.

Banca MPS has allocated EUR 500 million for IT development within its 2024-2028 business plan, focusing on high-return projects to modernize its core systems. This investment is crucial for delivering digital services, improving operational efficiency, and ensuring future growth, underscoring the foundational role of robust IT infrastructure in today's competitive banking environment.

| Technological Factor | Banca MPS Approach | Industry Trend/Data |

| Digital Transformation | Focus on Widiba, 'best-of-breed' IT adoption | Digital channel usage in Italian banks > 60% (late 2023) |

| Cybersecurity | Heavy investment in advanced ICT security | Cyberattacks cost businesses billions globally (2024) |

| AI and Data Analytics | Strategic integration for personalization and fraud detection | AI in banking market: ~$15B (2023) to >$40B (2028) |

| Fintech Competition | Leveraging Widiba as a digital frontrunner | Fintech investments in Europe resilient (mid-2024) |

| IT Infrastructure Investment | EUR 500 million for IT development (2024-2028) | Modernization and optimization of platforms |

Legal factors

Italian banks, including Banca Monte dei Paschi di Siena (MPS), operate within a stringent regulatory landscape defined by Basel III/IV standards and European directives like CRD V. The Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD IV), with CRR III actively implementing Basel 3.1 standards from January 2025, set the benchmarks for capital and liquidity. Banca MPS has demonstrated robust capital ratios, notably exceeding the minimum requirements stipulated by the European Central Bank (ECB), showcasing its preparedness for these evolving regulatory demands.

The Bank of Italy is actively refining its anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, with recent public consultations aiming to bolster the effectiveness of these policies and reinforce internal governance at financial institutions. Banca MPS, like all banks, is under a legal obligation to implement robust AML/CTF compliance measures.

Failure to adhere to these stringent requirements can expose Banca MPS to significant penalties, including substantial fines and reputational damage, underscoring the critical importance of proactive and thorough compliance to prevent illicit financial activities.

Compliance with data protection and privacy laws, such as the General Data Protection Regulation (GDPR), is paramount for Banca MPS. This means the bank must handle customer data with the utmost security and transparency. For instance, in 2023, the European Union continued to emphasize strict enforcement of data privacy, with significant fines levied against companies for non-compliance, underscoring the importance for financial institutions like Banca MPS.

Banca MPS's privacy policy, which details its approach to customer data, including the use of cookies on its digital platforms, directly reflects its commitment to these stringent regulations. This policy serves as a public declaration of how the bank adheres to legal requirements and builds trust with its clientele by being upfront about data handling practices.

Maintaining robust data privacy practices is not merely a legal obligation but a cornerstone of customer trust and the bank's reputation. In a landscape where data breaches are a constant concern, Banca MPS's dedication to secure data management is essential for retaining customer loyalty and avoiding reputational damage and significant financial penalties.

Consumer Protection Laws and Fair Practices

Consumer protection laws are a cornerstone of the banking sector, ensuring that institutions like Banca MPS engage in fair practices when it comes to lending and selling financial products. These regulations aim to safeguard individuals from predatory or deceptive practices. For instance, in 2024, the European Union continued to emphasize robust consumer protection frameworks across its member states, with Italy, as a key market for Banca MPS, actively implementing and enforcing these standards.

The Bank of Italy plays a crucial role by issuing specific provisions, particularly concerning emerging financial services such as crowdfunding. These provisions often detail stringent information requirements designed to protect consumers who utilize these platforms. This focus on transparency and informed consent is vital for building trust and ensuring responsible financial intermediation.

Banca MPS must meticulously align its product offerings and customer service protocols with these evolving consumer protection mandates. This includes ensuring clear disclosure of terms and conditions, fair interest rates, and accessible complaint resolution mechanisms. Failure to comply can result in significant penalties and reputational damage.

- Consumer Protection Focus: Italian banking regulations, influenced by EU directives, mandate transparency in loan agreements and product sales.

- Crowdfunding Oversight: The Bank of Italy has issued specific rules for crowdfunding service providers, enhancing consumer information requirements in 2024.

- Banca MPS Compliance: The bank must ensure all its financial products and services adhere to these consumer protection laws to avoid regulatory action and maintain customer trust.

- Market Trends: Increased digitalization in banking services necessitates continuous updates to consumer protection measures to address new forms of financial interaction.

NPL Resolution and Credit Servicing Regulations

Italy's regulatory landscape for Non-Performing Loans (NPLs) has seen significant evolution, particularly with the implementation of the Secondary Market Directive (SMD). Legislative Decree no. 116, enacted in July 2024, specifically governs credit servicers and purchasers of NPLs, establishing a clearer framework for their operations. This decree is crucial as it directly impacts how institutions like Banca Monte dei Paschi di Siena (Banca MPS) can manage and resolve their NPL portfolios.

Further refining these directives, the Bank of Italy released its own implementing rules in February 2025. These guidelines are designed to ensure consistent application of the SMD across the sector, affecting everything from servicing standards to capital requirements for credit servicers. For Banca MPS, adherence to these new regulations is paramount for optimizing its NPL resolution strategies and maintaining robust asset quality management.

- NPL Servicer Regulation: Legislative Decree no. 116 of July 2024 transposes the SMD, bringing Italian NPL servicers under a more standardized regulatory regime.

- Bank of Italy Guidance: February 2025 saw the Bank of Italy issue detailed rules for the practical implementation of the SMD, impacting operational procedures for NPL management.

- Impact on Banca MPS: These legal factors directly shape Banca MPS's approach to NPL recovery and portfolio servicing, influencing operational efficiency and compliance costs.

- Market Implications: The enhanced regulatory framework aims to foster a more transparent and efficient secondary market for NPLs, potentially leading to improved recovery rates across the Italian banking system.

New regulations, such as the implementation of Basel 3.1 standards from January 2025, are reshaping capital and liquidity requirements for Italian banks. Banca MPS has demonstrated strong capital ratios, exceeding ECB minimums, indicating its readiness for these stricter prudential standards. The ongoing refinement of anti-money laundering (AML) and counter-terrorist financing (CTF) regulations by the Bank of Italy places a critical emphasis on robust internal governance and compliance for institutions like Banca MPS.

Consumer protection laws, reinforced by EU directives and Italian implementations in 2024, mandate transparency in financial product sales and lending practices. The Bank of Italy's specific rules for crowdfunding in 2024 further enhance consumer information requirements, necessitating that Banca MPS ensures clear disclosures and fair practices across all its services.

The legal framework governing Non-Performing Loans (NPLs) has been significantly updated, with Legislative Decree no. 116 in July 2024 standardizing NPL servicer operations, and the Bank of Italy issuing detailed implementing rules in February 2025. These changes directly impact Banca MPS's strategies for NPL portfolio management and recovery, demanding strict adherence to new operational and capital standards.

Environmental factors

Banca MPS is actively weaving Environmental, Social, and Governance (ESG) principles into its core business strategy, from policy definition to risk management. This commitment signifies a move towards greater accountability for environmental and social impacts, aiming to solidify the bank's position as a responsible financial institution. For instance, by 2024, the bank aims to have at least 50% of its new corporate lending portfolio aligned with ESG criteria, demonstrating tangible progress in this area.

This integration isn't just about policy; it's about embedding ESG considerations into credit and commercial decisions, and crucially, into how the bank manages its risks. By 2025, Banca MPS plans to have a dedicated ESG risk assessment framework fully operational for all new loan origination, enhancing its ability to identify and mitigate climate-related and social risks. This long-term vision underscores a dedication to sustainable growth and responsible business practices.

The European Central Bank (ECB) is pushing financial institutions, including Banca MPS, to integrate climate change risks into their internal capital adequacy assessment processes (ICAAP) and stress testing. This means MPS needs to evaluate how physical risks, like extreme weather events, and transition risks, such as policy changes impacting carbon-intensive industries, could affect its loan book.

While specific figures for MPS's climate risk integration aren't publicly detailed, the broader European banking sector is increasingly focused on these assessments. For instance, by the end of 2023, a significant portion of European banks had started to map their climate-related financial exposures, a trend that will undoubtedly influence MPS's strategic planning and risk management frameworks through 2024 and 2025.

Banca MPS must proactively manage its exposure to both physical and transition risks. This involves understanding how climate events could impair borrowers' ability to repay and how evolving regulations or market sentiment towards sustainability might impact the value of assets held as collateral or the performance of companies within its portfolios.

Banca MPS is actively engaged in developing and supporting sustainable financial instruments. This includes initiatives like green bonds and loans explicitly linked to Environmental, Social, and Governance (ESG) criteria. These financial products are designed to channel capital towards projects with positive environmental or social impacts.

A significant move in this direction was Banca MPS’s issuance of its first Social Covered Bond in July 2024. The funds raised from this bond were earmarked for refinancing loans that have a demonstrable social impact. Examples of these loans include those supporting affordable housing initiatives and providing financial assistance to small and medium-sized enterprises (SMEs) located in regions with lower Gross Domestic Product (GDP).

Looking ahead, Banca MPS has set an ambitious target: by 2028, the bank aims for 30% of its new financing activities to incorporate specific ESG objectives. This strategic push underscores a commitment to integrating sustainability into its core lending practices and supporting a more responsible financial ecosystem.

Environmental Footprint and Operational Sustainability

Banca MPS is actively working to minimize its environmental impact through various initiatives. The bank has implemented green practices in its property management and is focused on optimizing energy consumption across its operations. This commitment to reducing its ecological footprint is a core part of its broader sustainability strategy.

A key objective for Banca MPS is the progressive reduction of its direct emissions. The bank has set an ambitious target to achieve a 60% reduction in direct emissions compared to its 2017 levels. This focus on operational sustainability directly supports its overarching environmental goals.

- Environmental Policies: Implementation of green practices in property management.

- Energy Optimization: Focus on reducing energy consumption across all operations.

- Emissions Reduction Target: Aiming for a 60% decrease in direct emissions from a 2017 baseline.

- Sustainability Integration: Operational environmental efforts are integral to the bank's overall sustainability plan.

ESG Reporting and Disclosure Requirements

Banca MPS is committed to aligning with international ESG reporting standards, making its progress and performance readily available through annual reports and public disclosures. This dedication to transparency is crucial for stakeholders evaluating the bank's commitment to sustainability.

The evolving regulatory landscape, particularly new EU directives like the updated Non-Financial Reporting Directive (NFRD), significantly impacts large banks. These directives mandate more comprehensive and detailed ESG disclosures, with 2025 marking a key year for initial compliance for certain requirements. For instance, the upcoming Corporate Sustainability Reporting Directive (CSRD) is set to broaden the scope of reporting, affecting approximately 50,000 companies across the EU by 2028, with many financial institutions falling under its purview.

- Increased Transparency: New EU directives will require Banca MPS to provide more detailed information on its environmental and social impact.

- 2025 Reporting Year: This year marks a critical point for the implementation of enhanced ESG disclosure requirements for many financial institutions.

- Broader Scope: Regulations like the CSRD will expand the number of entities and the types of data that need to be reported.

- Enhanced Accountability: Stricter reporting standards foster greater accountability for the bank's sustainability performance.

Banca MPS is actively integrating environmental considerations into its operations and lending practices, recognizing the growing importance of sustainability. The bank aims to reduce its direct emissions by 60% from 2017 levels, demonstrating a clear commitment to operational environmental responsibility. Furthermore, MPS is increasing its focus on green finance, with a target for 30% of new financing activities to incorporate specific ESG objectives by 2028.

The bank is also enhancing its risk management framework to account for climate-related risks, as mandated by the European Central Bank. This includes assessing the impact of physical and transition risks on its loan portfolio, a trend seen across the European banking sector, with many institutions mapping climate exposures by the end of 2023.

Banca MPS is supporting sustainable finance through instruments like social covered bonds, as exemplified by its July 2024 issuance, which will fund projects with social impact, such as affordable housing and support for SMEs in lower-GDP regions. This reflects a strategic shift towards channeling capital towards environmentally and socially beneficial initiatives.

Regulatory changes, particularly EU directives like the CSRD, are pushing for greater transparency in ESG reporting, with 2025 being a key year for initial compliance. This will require Banca MPS to provide more detailed disclosures on its environmental and social impact, fostering increased accountability.

| Environmental Focus Area | Target/Initiative | Timeline/Status |

|---|---|---|

| Emissions Reduction | 60% reduction in direct emissions | From 2017 baseline |

| Sustainable Financing | 30% of new financing with ESG objectives | By 2028 |

| Green Finance Instruments | Social Covered Bond issuance | July 2024 |

| Climate Risk Management | Integration into ICAAP and stress testing | Ongoing, influenced by ECB guidance |

| ESG Reporting | Enhanced disclosures under new EU directives | Key compliance year 2025 |

PESTLE Analysis Data Sources

Our Banca MPS PESTLE Analysis is meticulously crafted using data from official banking regulatory bodies, national economic statistics agencies, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, and social landscapes impacting the Italian banking sector.