Banca MPS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca MPS Bundle

Banca MPS faces significant competitive pressures, with the bargaining power of buyers and the threat of substitutes demanding careful strategic navigation. Understanding the intensity of these forces is crucial for any stakeholder. The threat of new entrants, while present, is somewhat mitigated by regulatory hurdles in the banking sector.

The complete report reveals the real forces shaping Banca MPS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology and IT providers wield considerable influence over Banca MPS and the broader Italian banking sector. Banks increasingly depend on these specialized firms for everything from core banking software to advanced cybersecurity and emerging technologies like AI. This reliance is amplified as the Italian banking system invests heavily in digital transformation, with IT spending in the sector projected to reach €25.6 billion in 2024, according to a report by Osservatori Digital Innovation.

Depositors, while customers, act as suppliers of funds, wielding significant bargaining power. Their collective decisions on where to place their money, influenced by interest rates and alternative investments, directly impact a bank's funding costs. For instance, as of early 2024, deposit rates saw increases as central banks adjusted monetary policy, forcing banks like Banca MPS to compete more aggressively for this crucial resource.

Skilled employees, particularly in areas like fintech and AI within banking, wield significant bargaining power. The demand for professionals with expertise in digital transformation and complex financial instruments often outstrips supply. For instance, in 2024, the average salary for a senior data scientist in the European financial sector could exceed €100,000 annually, reflecting this high demand and specialized skill set. Their ability to move between institutions with ease, especially in specialized roles, allows them to negotiate favorable compensation and working conditions, impacting Banca MPS's labor costs.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies, such as the European Central Bank (ECB) and Bank of Italy, exert significant influence over Banca MPS by dictating operational frameworks and imposing stringent compliance requirements. These requirements cover capital adequacy, reporting standards, and increasingly, environmental, social, and governance (ESG) factors, as well as digital asset reporting. In 2024, the financial sector continued to see a heightened focus on regulatory compliance, with significant investments made by banks across Europe to meet these evolving demands.

Banca MPS, like its peers, must allocate substantial resources to compliance systems and often engages specialized legal and consulting firms to navigate this complex environment. The escalating regulatory burden effectively amplifies the bargaining power of these essential service providers, as non-compliance carries substantial financial and reputational risks. For instance, fines for regulatory breaches can amount to millions of euros, impacting profitability and investor confidence.

- Regulatory Burden: Increased focus on ESG and digital assets in 2024 has intensified compliance demands for banks like Banca MPS.

- Compliance Costs: Banks are investing heavily in technology and expertise to meet these evolving regulatory standards.

- External Reliance: The complexity of regulations necessitates reliance on specialized legal and consulting firms, enhancing their supplier power.

- Risk of Non-Compliance: Significant financial penalties and reputational damage underscore the importance of adhering to regulatory mandates.

Data and Information Providers

In the financial sector, data and information providers hold significant sway. Banks like Banca Monte dei Paschi di Siena (MPS) rely heavily on their services for everything from risk management to market analysis. For instance, in 2024, the global financial analytics market was valued at over $25 billion, indicating the essential nature of these services.

The proprietary nature of specialized financial data and the complex integration of analytical tools often create substantial switching costs for banks. This means that once a bank, like MPS, implements a particular data provider's system, moving to another can be both time-consuming and expensive, thereby strengthening the suppliers' bargaining power.

- Critical Dependence: Banks depend on data providers for accurate market insights, regulatory compliance, and strategic planning.

- High Switching Costs: The integration of data platforms and the associated training create barriers to changing providers.

- Proprietary Data: Unique datasets and advanced analytical models offered by these suppliers are not easily replicated.

- Industry Concentration: A few key players often dominate the provision of specialized financial data, further concentrating power.

Suppliers of specialized financial data and analytical tools wield considerable influence over Banca MPS. The high cost and complexity of integrating these systems mean banks often face significant switching costs, locking them into existing relationships. This dependence is amplified by the critical need for accurate market insights and regulatory compliance data, with the global financial analytics market valued at over $25 billion in 2024.

| Supplier Type | Impact on Banca MPS | 2024 Data/Trend |

|---|---|---|

| Technology & IT Providers | Essential for core banking, cybersecurity, and digital transformation. High dependency due to IT spending reaching €25.6 billion in Italy for 2024. | Increasing reliance on AI and advanced analytics. |

| Depositors | Suppliers of funds; their decisions on deposit rates directly impact funding costs. | Deposit rates saw increases in early 2024 due to monetary policy shifts. |

| Skilled Employees (Fintech/AI) | High demand for specialized skills drives up labor costs. | Senior data scientists in Europe could earn over €100,000 annually in 2024. |

| Data & Information Providers | Crucial for risk management and market analysis; high switching costs due to system integration. | Global financial analytics market exceeded $25 billion in 2024. |

What is included in the product

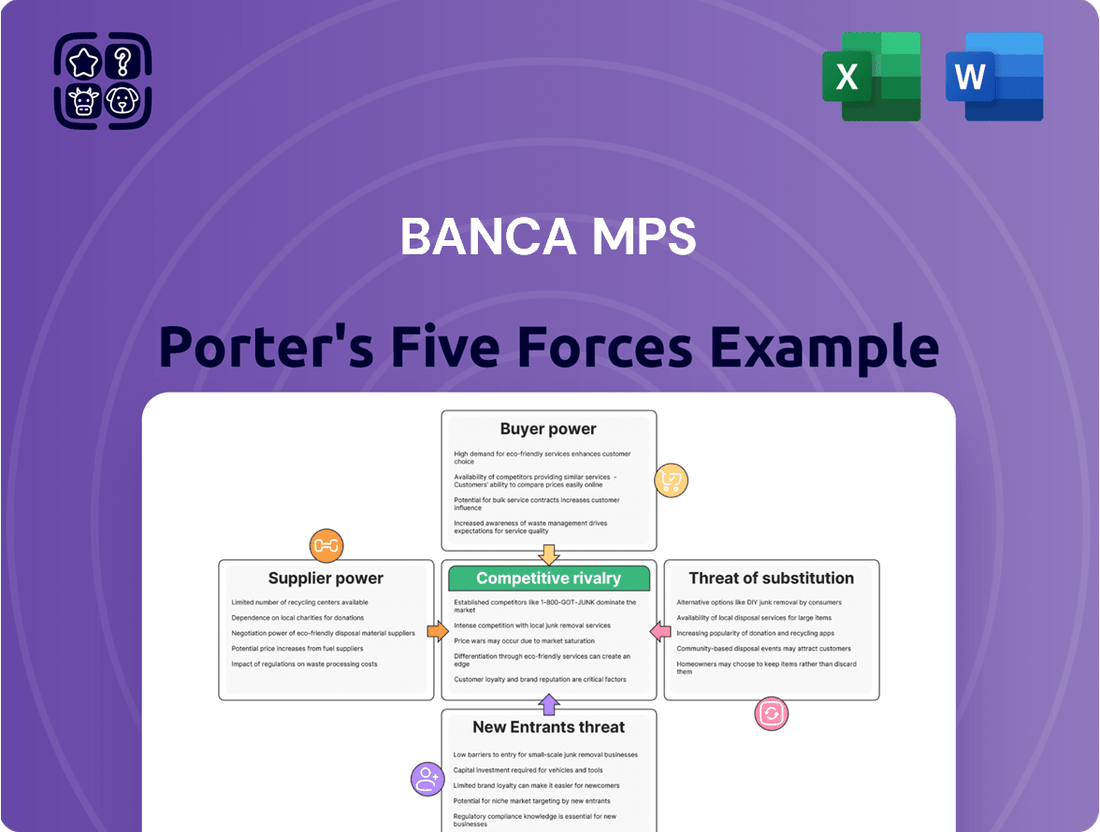

This analysis delves into the competitive landscape for Banca MPS, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and ultimately assessing the company's strategic positioning and profitability.

Banca MPS's Porter's Five Forces Analysis provides a dynamic framework to anticipate and mitigate competitive threats, offering actionable insights for strategic planning.

Customers Bargaining Power

Retail customers and their deposit mobility significantly influence the banking sector. The increasing ease of switching banks, particularly through digital channels, empowers these customers. For instance, in 2024, a significant portion of Italian banking customers are actively using or considering digital platforms for their banking needs, making it simpler to compare interest rates and account features across different institutions.

While traditional branch networks remain important for some segments of the Italian population, the consistent growth in online and mobile banking adoption means customers have readily available tools to evaluate and move their deposits. This trend forces banks to focus on offering attractive interest rates and a superior customer experience to retain this increasingly mobile customer base.

Customers are becoming more sophisticated, not only demanding competitive financial terms but also valuing advanced digital tools and personalized banking services. Banks that fail to meet these evolving expectations risk losing deposits to competitors offering more seamless and tailored digital solutions.

Corporate and SME clients wield significant bargaining power, especially those with substantial business volume. They can negotiate more favorable terms on loans and credit lines due to their ability to foster multiple banking relationships. For instance, a large corporation might leverage its €50 million annual turnover to secure a lower interest rate on a €10 million credit facility.

The availability of alternative financing sources, such as fintech lenders and corporate bond markets, further amplifies client bargaining power. If Banca MPS's loan terms are uncompetitive, a corporation might opt for a €20 million bond issuance instead, potentially securing funding at a 4% interest rate compared to a bank offer of 5%.

Banca MPS, with its strong local presence, competes for these clients not only with other Italian banks but also with larger national and international institutions that may offer more aggressive pricing or broader service packages. This competitive landscape forces Banca MPS to remain vigilant in its pricing and service offerings to retain its corporate and SME customer base.

Customers today are incredibly digitally sophisticated. They expect banking to be as seamless and instantaneous as their favorite apps, demanding intuitive online platforms and mobile banking that offers instant transactions. This means banks need to keep pace with evolving digital expectations, or risk falling behind.

This heightened digital expectation places significant pressure on traditional institutions like Banca MPS. They must invest substantially in digital transformation to offer the kind of user-friendly, accessible services customers now consider standard. Failing to do so can lead to customer churn, as clients seek out more agile fintech providers or competitors who have already embraced digital innovation.

For instance, in 2024, customer retention rates are heavily influenced by digital service quality. A study by Accenture in early 2024 indicated that over 60% of banking customers would consider switching providers if their digital experience was poor. This underscores the critical need for banks to continuously upgrade their digital offerings to meet and exceed these customer demands.

Price Sensitivity and Product Homogeneity

For standardized banking products like current accounts, basic loans, and mortgages, customer price sensitivity can be quite high. This is because the differentiating factors between different banks' offerings are often minimal. When products are seen as similar, customers tend to focus more on the price, leading to fierce competition based on interest rates and fees.

This ease of comparison puts significant pressure on banks. They are often compelled to lower their margins or introduce extra services to justify their pricing structures. For instance, in 2024, the average interest rate on a new variable-rate mortgage in Italy hovered around 4.5%, a figure that customers actively compare across institutions.

- Price Sensitivity: Customers for basic banking services often prioritize cost savings.

- Product Homogeneity: Standardized offerings like checking accounts lack unique features, making price the primary decision driver.

- Competitive Pressure: Banks face constant pressure to offer competitive rates and lower fees due to easy product comparison.

- Margin Erosion: Intense competition can lead to reduced profitability for banks as they compete on price.

Access to Information and Comparison Tools

Customers today have unprecedented access to information, significantly boosting their bargaining power. The rise of online comparison websites, financial blogs, and independent reviews means consumers can easily research and compare banking products and services. This transparency levels the playing field, reducing the traditional information gap between banks and their clients.

With readily available data on fees, interest rates, and service quality, customers are empowered to make informed choices. For instance, in 2024, comparison sites in Italy, where Banca MPS operates, saw a significant increase in traffic as consumers actively sought the best deals on mortgages and savings accounts. This allows customers to negotiate better terms or readily switch to a competitor offering superior value, putting pressure on banks like Banca MPS to remain competitive.

- Information Proliferation: Online platforms provide extensive data on banking products.

- Reduced Asymmetry: Transparency empowers customers with knowledge.

- Informed Decision-Making: Customers can easily compare offerings.

- Increased Negotiation: Access to information strengthens the customer's position.

The bargaining power of customers for Banca MPS is substantial, driven by increased digital savviness and access to information. Customers can easily compare rates and services online, forcing banks to offer competitive terms. For standardized products, price sensitivity is high, leading to pressure on margins.

| Factor | Impact on Banca MPS | Example (2024 Data) |

| Digital Accessibility | High | Over 60% of customers consider switching for poor digital experience (Accenture). |

| Information Availability | High | Increased traffic on Italian comparison sites for mortgages and savings accounts. |

| Price Sensitivity (Standard Products) | High | Average new variable-rate mortgage interest rate around 4.5% in Italy. |

Full Version Awaits

Banca MPS Porter's Five Forces Analysis

This preview showcases the complete Banca MPS Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the banking sector. You're viewing the exact document you'll receive immediately after purchase, detailing the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes. This professionally formatted analysis is ready for your immediate use, providing actionable insights into Banca MPS's strategic landscape without any surprises.

Rivalry Among Competitors

The Italian banking landscape is heavily influenced by major national banks like Intesa Sanpaolo and UniCredit. These giants command substantial market share, boast extensive branch networks across the country, and wield considerable financial clout, making them formidable competitors.

Banca MPS, while a historically significant institution, finds itself in direct competition with these dominant players. They vie for customers across all banking services, from everyday retail accounts to complex corporate financing, intensifying the rivalry.

For instance, as of the first quarter of 2024, UniCredit reported total assets of approximately €969 billion, while Intesa Sanpaolo had total assets around €964 billion, dwarfing Banca MPS's financial capacity and amplifying the competitive pressure.

The Italian banking landscape is in flux, marked by significant consolidation. Major players are actively pursuing mergers and acquisitions to bolster their market position and operational efficiency. This trend is driven by the pursuit of economies of scale and a desire to streamline operations in a competitive environment. For instance, the ongoing discussions and potential interest from UniCredit in acquiring Banco BPM highlight this aggressive M&A strategy.

Italian banks, including Banca MPS, are locked in an intense digital transformation race. Major players are pouring significant capital into mobile banking advancements, artificial intelligence integration, and cloud computing infrastructure. For instance, by early 2024, many Italian banks reported substantial increases in their IT budgets, with a notable portion allocated to digital initiatives aimed at improving customer interfaces and streamlining internal processes.

This relentless pursuit of innovation is creating a highly competitive environment, where the ability to offer cutting-edge digital services is paramount for customer acquisition and retention. Banks that fail to keep pace with these technological shifts risk falling behind, potentially losing market share to more digitally agile competitors. The digital sphere has become a crucial battleground, directly impacting a bank's ability to attract and maintain its customer base.

Profitability Pressures and Interest Rate Environment

Italian banks, including Banca MPS, have recently enjoyed robust profitability driven by widening net interest margins. However, the prospect of declining interest rates presents a significant headwind, potentially reducing net interest income. This anticipated squeeze on profitability could heighten competitive rivalry as institutions scramble to maintain earnings.

Banks may respond by aggressively pursuing market share, implementing stringent cost-saving measures, and diversifying revenue beyond traditional lending. Fee-based services, such as wealth management and advisory, become increasingly crucial income streams. For example, in 2023, Italian banks generally saw significant profit growth, with some reporting net interest income increases exceeding 50% year-on-year, partly due to the European Central Bank's rate hikes. However, the outlook for 2024 and beyond suggests a moderation in these gains as interest rates stabilize or decline.

- Profitability Pressure: Falling interest rates threaten to reduce net interest income, the primary driver of recent bank profitability.

- Intensified Rivalry: Banks may compete more fiercely for market share and clients to offset potential revenue declines.

- Diversification Imperative: Growing reliance on fee-based services like asset management and insurance is likely to increase.

- Cost Efficiency Focus: Operational cost reduction will be paramount for banks to sustain margins in a lower-rate environment.

Regulatory Landscape and State Influence

The regulatory environment is a powerful force shaping competition within the Italian banking sector, with stringent capital requirements and directives on non-performing loan (NPL) management directly impacting how banks operate and compete. For Banca MPS, its history of state ownership and continued government influence, even post-privatization, can create a unique competitive dynamic. This governmental stake can influence strategic decisions, potentially offering advantages or imposing limitations compared to its privately held peers.

- Regulatory Capital: As of late 2024, European banks, including Banca MPS, are navigating evolving capital adequacy frameworks, with Basel III finalization continuing to influence risk-weighted asset calculations and capital ratios.

- NPL Management: Ongoing efforts to reduce NPLs across the Italian banking system, driven by ECB guidelines, have led to significant portfolio sales and securitizations, impacting asset quality and competitive pricing of loans.

- State Influence: The Italian government's strategic interest in consolidating the banking sector, aiming for the creation of a robust third national banking group, directly affects competitive strategies and merger and acquisition activity.

- Competitive Positioning: Banca MPS's ability to leverage or adapt to state influence, while managing stringent regulations, distinguishes its competitive positioning from fully private, uninfluenced entities in the Italian market.

The competitive rivalry for Banca MPS is fierce, primarily due to the dominance of larger Italian banks like Intesa Sanpaolo and UniCredit. These behemoths possess significantly larger asset bases, as evidenced by their respective total assets in Q1 2024, around €969 billion for UniCredit and €964 billion for Intesa Sanpaolo, compared to Banca MPS's smaller financial capacity. This disparity intensifies competition for customers and market share across all banking services.

Furthermore, the Italian banking sector is characterized by ongoing consolidation and a strong push towards digital transformation. Banks are investing heavily in technology to enhance customer experience, with IT budgets increasing in early 2024. This digital race means banks that lag in innovation risk losing ground to more agile competitors, further escalating the rivalry.

The recent trend of widening net interest margins, which boosted profitability in 2023 for many Italian banks with some seeing over 50% year-on-year net interest income growth, is expected to moderate as interest rates potentially decline. This anticipated pressure on profitability will likely lead to even more aggressive competition for market share and a greater focus on fee-based services and cost efficiency.

| Competitor | Total Assets (Q1 2024, approx. €bn) | Market Share (Retail Deposits, est. 2024) | Digital Investment Focus |

|---|---|---|---|

| UniCredit | 969 | High | AI, Cloud, Mobile Banking |

| Intesa Sanpaolo | 964 | High | AI, Cloud, Mobile Banking |

| Banca MPS | (Significantly lower than above) | Medium-Low | Digitalization efforts |

SSubstitutes Threaten

Fintech companies and neobanks present a significant threat of substitution for traditional banks like Banca MPS. These agile digital players offer specialized services such as digital payments, peer-to-peer lending, and robo-advisory, often at lower costs and with greater convenience than incumbent banks. For instance, the global fintech market was projected to reach over $300 billion in 2024, highlighting its rapid expansion and appeal.

Neobanks, operating exclusively online, are particularly adept at capturing younger, tech-savvy demographics with their user-friendly interfaces and streamlined processes. Many of these customers might otherwise use traditional banks for routine transactions. In 2024, neobanks continued to gain traction, with some reporting millions of active users, indicating a clear shift in consumer preference for digital-first financial solutions.

Poste Italiane, Italy's national postal service, presents a significant threat of substitution for traditional banks like Banca MPS. It offers a broad spectrum of financial services, encompassing savings accounts, payment solutions, and insurance. This allows Poste Italiane to cater to basic banking needs, particularly in more remote areas where bank branch access might be limited.

The extensive physical network of Poste Italiane, with its numerous branches across Italy, provides a tangible advantage, especially for demographics less inclined towards digital banking solutions. This widespread presence makes it a convenient alternative for everyday financial transactions and savings, directly competing with the core offerings of banks.

In 2023, Poste Italiane reported a revenue of approximately €12 billion, with its financial services division playing a crucial role. The company's ability to attract and retain customers through its accessible physical infrastructure and diversified financial products poses a direct challenge to incumbent banks seeking to maintain market share, particularly among older or less tech-savvy populations.

The rise of direct lending and alternative financing platforms presents a significant threat to Banca MPS. Small and medium-sized enterprises (SMEs), a key customer base for banks, are actively seeking funding beyond traditional bank loans. This shift is driven by the increasing availability of capital from investment funds, peer-to-peer lending, and even corporate bond issuances.

In Italy, regulatory and tax changes in recent years have further bolstered these alternative credit providers. These reforms have made it more attractive for non-bank entities to offer financing, thereby reducing companies' historical dependence on banks like Banca MPS for their capital needs. For example, by the end of 2023, the Italian alternative finance market saw significant growth, with over €20 billion raised through various non-bank channels, impacting traditional lending volumes.

Investment Funds and Wealth Management Platforms

Customers increasingly bypass traditional banks for specialized wealth management and investment platforms. These alternatives often provide a broader selection of investment vehicles and more competitive fee structures, directly challenging banks' market share in these areas.

For instance, the global wealth management market is projected to reach approximately $67.8 trillion by 2027, with significant growth driven by non-bank entities. This indicates a substantial shift where consumers find greater value outside traditional banking channels.

The proliferation of robo-advisors and fintech solutions offers lower-cost, tech-driven investment management, making them attractive substitutes. Furthermore, independent financial advisors can provide tailored advice, a service that some banks struggle to match at a competitive price point.

- Disintermediation: Customers can directly access investment products without going through a bank's intermediary services.

- Cost Efficiency: Specialized platforms often have lower overheads, enabling them to offer more attractive fees than traditional banks.

- Product Specialization: Niche firms can offer a more focused and potentially superior range of investment products or advisory services.

Cryptocurrencies and Blockchain-based Financial Services

Cryptocurrencies and blockchain-based financial services represent a burgeoning threat of substitutes for traditional banking. While still in development, decentralized finance (DeFi) platforms offer alternatives for payments, lending, and asset management, potentially disintermediating established banks.

The Italian government's reduction in crypto tax rates to 26% on capital gains above €1,000, effective from January 1, 2024, signals a more favorable regulatory environment, encouraging adoption. Banks themselves are exploring blockchain technology for various applications, acknowledging its disruptive potential.

- Growing DeFi Adoption: The total value locked in DeFi protocols reached over $100 billion in early 2024, demonstrating increasing user engagement and capital flows away from traditional finance.

- Regulatory Evolution: As global regulatory frameworks for digital assets mature, cryptocurrencies and blockchain services are likely to become more accessible and competitive substitutes for traditional banking products.

- Bank Exploration: Major banking institutions are actively piloting blockchain solutions for cross-border payments and trade finance, indicating a recognition of the technology's efficiency and potential to bypass traditional intermediaries.

Fintech innovators and neobanks are increasingly offering streamlined digital financial services, providing direct competition to Banca MPS. These platforms often boast lower fees and enhanced user experiences, particularly appealing to younger demographics. For instance, the global fintech market's projected growth past $300 billion in 2024 underscores this trend, with neobanks actively attracting millions of users seeking convenient, tech-first solutions.

Alternative lending platforms and direct financing options are also siphoning off key business, especially for SMEs. In Italy, supportive regulatory shifts by early 2024 have encouraged non-bank lenders, contributing to a significant expansion in alternative credit markets, with over €20 billion raised through these channels by the end of 2023, reducing reliance on traditional bank loans.

Specialized wealth management firms and robo-advisors present a potent substitute by offering competitive fees and a wider array of investment products. As the global wealth management market heads toward an estimated $67.8 trillion by 2027, many consumers are finding greater value and accessibility outside conventional banking structures for their investment needs.

Entrants Threaten

The Italian banking sector presents a formidable challenge for new entrants due to significant regulatory and capital hurdles. Obtaining a banking license from both the European Central Bank (ECB) and the Bank of Italy is a complex process, demanding substantial compliance efforts. Furthermore, stringent capital requirements, with a minimum of €10 million for joint-stock companies, necessitate considerable financial commitment before operations can even begin.

These robust entry barriers, including adherence to extensive prudential supervision and ongoing regulatory compliance, effectively deter many prospective new players. For instance, as of early 2024, the ongoing consolidation and recapitalization efforts within the European banking system, influenced by directives like Basel III endgame implementation, further elevate the capital thresholds and operational complexities for any aspiring new bank.

The banking sector fundamentally relies on trust. Established institutions like Banca MPS, with centuries of history, possess a significant advantage in terms of ingrained customer loyalty and brand recognition, especially within their core markets like Italy. Newcomers must overcome this hurdle, which demands considerable investment in marketing and a lengthy period to cultivate a dependable reputation.

For retail banking specifically, customers often gravitate towards familiar and trusted brands. This makes it exceptionally difficult for new entrants to attract deposits and loan business without a proven track record. For instance, in 2024, traditional banks continued to hold the majority of market share for consumer deposits, reflecting this inherent trust barrier.

Banca Monte dei Paschi di Siena (MPS), like many established Italian banks, benefits from a deeply entrenched physical branch network. As of late 2023, MPS operated approximately 1,600 branches across Italy, a significant footprint that offers widespread accessibility. This extensive infrastructure represents a substantial barrier to entry for new financial institutions, as replicating such a physical presence would demand enormous capital investment and considerable time.

Economies of Scale and Scope

Incumbent banks, including Banca MPS, leverage significant economies of scale. This advantage allows them to spread operational, technological, and compliance costs across a vast customer base, leading to lower average costs per service. For instance, in 2024, major European banks reported substantial investments in digital transformation, a cost that is more manageable for established players than for new entrants trying to build similar infrastructure from scratch.

New entrants face a considerable hurdle in matching these cost efficiencies. To achieve comparable economies of scale, they would require massive initial capital outlays and rapid customer acquisition, which is challenging in a mature and competitive banking landscape. Consider the regulatory compliance costs alone, which can represent a significant percentage of revenue for smaller, newer institutions.

- Economies of Scale: Established banks benefit from lower per-unit costs due to high-volume operations.

- Technological Investment: Large banks can absorb significant R&D and IT infrastructure costs, unlike startups.

- Compliance Burden: Regulatory adherence is less dilutive for large, experienced institutions.

- Customer Acquisition Cost: New entrants must overcome high costs to build market share against incumbents.

Fintech Sandbox and Regulatory Adaptation

Italy's efforts to foster fintech innovation, through initiatives like the Fintech Sandbox Programme, are designed to create a more welcoming environment for new players. This program allows businesses to test innovative financial products and services in a controlled regulatory setting, potentially reducing the traditional high entry barriers. By adapting its legal framework to align with EU regulations such as MiCAR and the DLT Pilot Regime, Italy is signaling a commitment to embracing technological advancements in finance.

These regulatory adaptations and sandbox initiatives could significantly lower the barriers for specialized fintechs and neobanks. Companies focusing on niche services, for example, might find it easier to enter the market and scale their operations. This is particularly true as these new entrants can leverage regulatory sandboxes to prove the efficacy and safety of their offerings before a full market launch, potentially disrupting established players like Banca MPS.

- Fintech Sandbox Programme: Offers a controlled environment for testing new financial technologies and services.

- Regulatory Adaptation: Italy's alignment with EU regulations like MiCAR and the DLT Pilot Regime aims to encourage innovation.

- Lowered Entry Barriers: These initiatives can reduce the cost and complexity for specialized fintechs to enter the market.

- Niche Service Focus: New entrants may target specific underserved segments of the financial market.

The threat of new entrants for Banca MPS remains moderate, primarily due to persistent high barriers. While regulatory hurdles and substantial capital requirements are significant deterrents, Italy's push for fintech innovation, evidenced by programs like the Fintech Sandbox Programme, offers potential pathways for specialized newcomers. These initiatives, coupled with regulatory alignment with EU directives, aim to ease entry for agile fintechs, though replicating the scale and trust of incumbents like MPS is still a considerable challenge.

| Factor | Barrier Level | Impact on Banca MPS |

|---|---|---|

| Regulatory Hurdles & Capital Requirements | High | Significantly deters new banks, protecting incumbents. |

| Brand Loyalty & Trust | High | Favors established players like MPS with long-standing customer relationships. |

| Economies of Scale & Infrastructure | High | MPS's extensive branch network and operational scale create cost advantages. |

| Fintech Innovation & Sandboxes | Moderate | Creates opportunities for niche fintechs, potentially fragmenting certain market segments. |

Porter's Five Forces Analysis Data Sources

Our Banca MPS Porter's Five Forces analysis is built upon a foundation of credible data, including the bank's annual reports, regulatory filings with the Bank of Italy, and industry-specific research from financial institutions like S&P Global and Moody's.