Banca MPS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banca MPS Bundle

Unlock the strategic blueprint behind Banca MPS's resilient business model. This comprehensive Business Model Canvas delves into how they deliver value to diverse customer segments, leveraging key partnerships and robust channels. Discover their core activities and cost structures that drive profitability in a dynamic financial landscape.

Want to understand the engine of Banca MPS’s success? Our full Business Model Canvas provides a detailed, section-by-section breakdown, revealing their customer relationships, revenue streams, and key resources. It's the perfect tool for anyone looking to benchmark, analyze, or adapt proven strategies.

Dive deep into the operational framework of Banca MPS with our complete Business Model Canvas. From identifying their unique value propositions to understanding their cost drivers, this downloadable resource offers a clear, actionable view of their strategic advantages. Get it now to gain a competitive edge.

Partnerships

The Italian government, through the Ministry of Economy and Finance, remains a critical partner, holding approximately 39.23% of Banca Monte dei Paschi di Siena as of early 2024. This significant stake provides essential capital support and dictates strategic direction, particularly concerning the ongoing privatization efforts. Close collaboration with the Bank of Italy is mandatory for national regulatory compliance and supervision. Furthermore, the European Central Bank’s Single Supervisory Mechanism oversees Banca MPS, conducting crucial stress tests and issuing operational licenses to maintain financial stability. This deep integration with state and supranational regulators is fundamental to the bank's operational viability and future trajectory.

Strategic alliances, particularly with partners like AXA, are crucial for Banca MPS's bancassurance model. These partnerships enable MPS to distribute a wide array of insurance products through its extensive branch network. This generates significant commission income, enhancing the bank's non-interest revenue streams. For instance, in 2024, such collaborations continue to offer clients integrated financial protection and investment solutions, aligning with evolving market demands.

Collaborating with fintech and technology providers is crucial for Banca MPS's digital transformation, enhancing its mobile banking app, bolstering cybersecurity, and modernizing core banking systems. These partnerships enable the bank to improve operational efficiency and customer experience significantly. For instance, in 2024, investments in cloud-based solutions and AI-driven security protocols through these alliances are projected to optimize processing times by over 15% and reduce fraud attempts. Such strategic alliances are vital for Banca MPS to maintain competitiveness against more agile financial players.

Payment Networks

Partnerships with major payment networks like Visa and Mastercard are absolutely essential for Banca MPS. These collaborations enable the bank to issue a full range of debit, credit, and prepaid cards, facilitating seamless domestic and international transactions for all customer segments. Such alliances are critical, considering that by early 2024, Visa and Mastercard collectively processed over 70% of global card payments. These networks ensure a robust infrastructure for the bank's millions of cardholders across Italy and beyond.

- Facilitates diverse card issuance for customers.

- Enables smooth domestic and international transactions.

- Leverages global payment network infrastructure.

- Supports bank's competitive position in the payment ecosystem.

Correspondent Banks & Clearing Houses

Banca MPS relies on a vital network of correspondent banks for international trade finance, foreign exchange, and seamless cross-border payments, facilitating global transactions for its clientele.

Relationships with key clearing and settlement systems, such as the Eurosystem's TARGET2 (now T2) and national systems like Express II in Italy, are fundamental for processing the high volumes of daily transactions securely and efficiently within the national and European financial system. These partnerships ensure MPS's operational resilience.

- MPS processes millions of daily transactions through these systems, crucial for liquidity management.

- Correspondent banking supports an estimated 15-20% of MPS's corporate international business volume.

Banca MPS relies on key partnerships spanning regulatory oversight, strategic alliances, and crucial operational collaborations. The Italian government's 39.23% stake as of early 2024, alongside ECB and Bank of Italy supervision, ensures stability. Alliances with AXA enhance bancassurance revenue, while fintech collaborations modernize digital platforms, projected to optimize processing times by over 15% in 2024.

| Partnership Type | Key Partner Example | 2024 Impact Metric |

|---|---|---|

| Government/Regulatory | Italian MEF | 39.23% Ownership Stake |

| Bancassurance | AXA | Enhanced Commission Income |

| Fintech/Tech | Cloud Providers | >15% Processing Time Opt. |

| Payment Networks | Visa/Mastercard | >70% Global Card Processing |

What is included in the product

A comprehensive, pre-written business model tailored to Banca MPS’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

A clear, visual representation of Banca MPS's strategic approach, simplifying complex operations and identifying areas for efficiency gains.

Provides a structured framework to pinpoint operational bottlenecks and customer value propositions, facilitating targeted improvements.

Activities

Retail and corporate lending forms the bedrock of Banca MPS's operations, focusing on meticulous credit risk assessment for loan origination. This includes mortgages for individuals and families, alongside credit lines and term loans for businesses across Italy. Managing this diverse loan portfolio, which totaled approximately 88.5 billion euros at the end of 2023, is crucial for balancing risk and maximizing returns. The bank's profitability in 2024 significantly hinges on the effective management and growth of these lending activities, maintaining a strong net interest income.

Banca MPS's primary funding mechanism centers on attracting and meticulously managing customer deposits. This involves securing funds through a diverse range of current accounts, savings accounts, and various term deposits from both retail and corporate clients. As of March 31, 2024, Banca MPS reported total direct deposits of approximately €116.8 billion, underpinning its operational stability. Effective liquidity management is crucial, ensuring the bank can meet its immediate financial obligations and comply with stringent regulatory requirements. The bank maintained a strong Liquidity Coverage Ratio (LCR) of 274% and a Net Stable Funding Ratio (NSFR) of 152% in Q1 2024, demonstrating robust financial health.

Banca MPS actively provides financial advisory services, comprehensive portfolio management, and access to diverse investment funds specifically for affluent and high-net-worth individuals. This core activity is crucial for generating stable fee-based income, which helps diversify the bank's revenue streams beyond traditional interest margins. As of Q1 2024, Banca MPS reported a significant increase in net commissions, partly driven by wealth management activities, contributing to solid financial performance. These efforts are vital for cultivating and maintaining strong, long-term client relationships.

Risk Management & Compliance

Risk management at Banca MPS is a continuous, vital activity focused on identifying, measuring, and mitigating diverse exposures including credit, market, operational, and reputational risks. Strict adherence to a complex framework of national and European regulations, such as those from the ECB and EBA, is paramount to maintaining the bank's operational license and ensuring its stability. This robust compliance framework is crucial for sustaining investor confidence and meeting supervisory expectations. As of Q1 2024, MPS reported a strong CET1 ratio of 18.2%, reflecting its improved capital adequacy and risk absorption capacity.

- Ongoing risk identification across all business lines.

- Measurement and monitoring of credit, market, and operational risks.

- Strict compliance with EU and Italian banking regulations.

- Maintaining capital buffers; CET1 ratio at 18.2% in Q1 2024.

Digital Platform Operation

The continuous development and robust maintenance of Banca MPS digital channels, including its website and mobile banking application, are critical. This involves enhancing user experience and introducing new digital services, aligning with the bank's strategic focus on digitalization for 2024. Protecting customer data from evolving cyber threats remains a paramount concern, with ongoing investments in security infrastructure. The goal is to provide seamless, secure access to banking services, fostering increased digital engagement among clients.

- Ongoing enhancement of mobile banking app features and website functionality.

- Introduction of new digital payment solutions and self-service options.

- Strengthening cybersecurity defenses against 2024's sophisticated cyber threats.

- Focus on improving customer digital journey and accessibility.

Banca MPS actively manages retail and corporate lending, with loans around €88.5 billion in 2023, while robustly securing customer deposits, totaling €116.8 billion by Q1 2024. It provides wealth management and investment advisory services, enhancing fee income. Critical activities include stringent risk management, reflected in an 18.2% CET1 ratio in Q1 2024, and continuous digital channel development for seamless client access.

| Key Activity | 2023 Data | Q1 2024 Data |

|---|---|---|

| Lending Portfolio | €88.5 billion | N/A |

| Direct Deposits | N/A | €116.8 billion |

| CET1 Ratio | N/A | 18.2% |

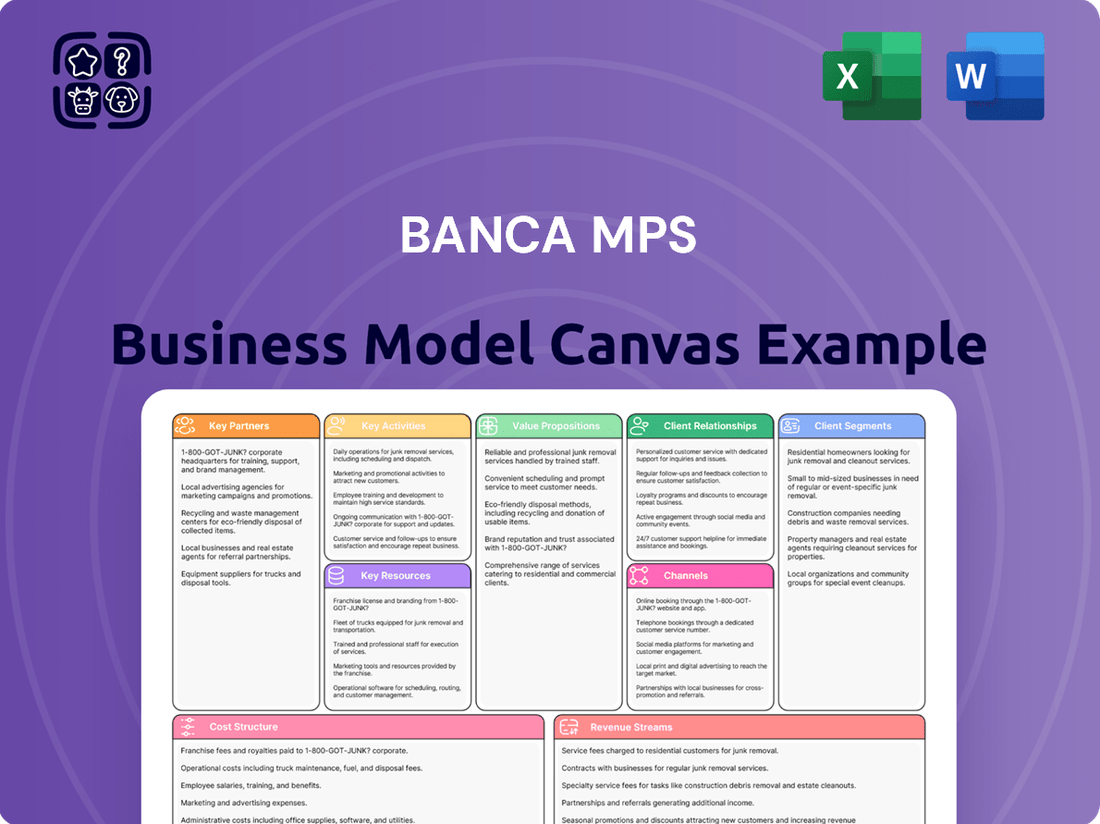

Preview Before You Purchase

Business Model Canvas

The Banca MPS Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, meticulously crafted analysis of Banca MPS's strategic framework. You can be confident that the detailed sections on key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams are precisely what you'll gain access to. This ensures complete transparency and no surprises, providing you with a ready-to-use, professional business model document for your strategic planning.

Resources

Banca MPS relies heavily on its financial capital, encompassing Tier 1 and Tier 2 capital, which stands as its most critical resource. This robust capital base directly determines the bank's lending capacity and its crucial ability to absorb unexpected financial shocks. Maintaining capital adequacy ratios well above regulatory minimums, like the CET1 ratio which was 18.1% for MPS as of March 2024, remains a continuous focus for both management and supervisory bodies. This strong capital position enables the bank to support economic activity and manage risks effectively.

Banca MPS leverages its extensive physical branch network across Italy as a vital key resource. This network, which included approximately 1,350 branches at the close of 2023, provides crucial points for customer service, sales, and advisory functions. While maintaining such a widespread physical presence is costly, it remains essential for serving less digitally-savvy customers and reinforcing the bank's deep ties within local communities. This approach balances modernization with traditional banking accessibility for a diverse client base.

Banca MPS leverages its unique brand heritage, established in 1472, fostering trust and stability despite past challenges. This deep history underpins a substantial and loyal customer base, which is a key intangible asset. As of Q1 2024, customer deposits remained robust at €153.8 billion, providing a stable funding source. This extensive client network also offers significant opportunities for cross-selling a diverse range of financial products.

Human Capital & Financial Expertise

Banca MPS heavily relies on its human capital, encompassing the diverse skills of its employees, from branch tellers and relationship managers to sophisticated risk analysts and investment bankers. Their collective expertise in credit assessment, navigating complex financial markets, and delivering exceptional customer service is crucial for the bank's value proposition and managing its operations. This specialized knowledge directly contributes to the bank's stability and strategic execution. As of early 2024, Banca MPS continued its focus on talent development.

- Employee count: Banca MPS reported approximately 20,000 employees as of December 2023, reflecting its significant human capital base.

- Training investment: Ongoing investment in employee training programs to enhance digital skills and financial advisory capabilities.

- Customer relationship management: Specialized teams focus on retaining and expanding client relationships.

- Risk management prowess: Expert risk analysts are vital for navigating the current economic climate and regulatory landscape.

Technology Infrastructure

The technology infrastructure, encompassing core banking platforms, secure data centers, and robust digital channels, is a vital resource for Banca MPS's operations. Continuous investment in a modern, secure, and scalable IT framework is critical for driving operational efficiency and supporting future growth. For instance, the banking sector's IT spending is projected to increase, with a focus on cloud adoption and cybersecurity, essential for MPS's strategic plan.

- Banca MPS's 2022-2026 Business Plan emphasizes digital transformation.

- Modern IT systems are crucial for operational resilience and customer experience.

- Cybersecurity investments are paramount given increasing digital threats in 2024.

- Cloud migration and data analytics enhance scalability and decision-making.

Banca MPS relies on its robust financial capital, with a strong 18.1% CET1 ratio as of March 2024, and an extensive physical branch network of approximately 1,350 locations as of late 2023. Its deep-rooted brand heritage supports a loyal customer base, evidenced by €153.8 billion in Q1 2024 customer deposits. Crucial human capital, comprising around 20,000 employees in December 2023, and a continually evolving technology infrastructure further underpin its operations and strategic digital transformation.

| Key Resource | Description | Latest Data Point |

|---|---|---|

| Financial Capital | Capital adequacy and shock absorption | CET1 Ratio: 18.1% (March 2024) |

| Physical Network | Customer service and local presence | Branches: ~1,350 (End 2023) |

| Customer Base | Stable funding and revenue opportunities | Customer Deposits: €153.8 billion (Q1 2024) |

| Human Capital | Expertise and operational delivery | Employees: ~20,000 (December 2023) |

| Technology | Operational efficiency and digital services | Digital Transformation Focus (2022-2026 Plan) |

Value Propositions

Banca MPS operates as a comprehensive financial solutions provider, serving as a one-stop shop for diverse financial needs across Italy. It caters to individuals, families, and businesses, offering a broad spectrum of services from basic current accounts and mortgages to sophisticated corporate financing. In 2024, MPS continued to expand its wealth management services, managing significant assets for its client base. This integrated approach ensures clients can access tailored solutions, from retail banking to complex investment products, all within a single institution. The bank's focus remains on delivering holistic financial support to its over 3.5 million customers.

Banca MPS provides customers with the security of a large, systemically important institution. Regulated by the European Central Bank, it adheres to stringent financial stability standards. The Italian state's continued backing, evidenced by its significant shareholding in 2024, reinforces depositor and investor confidence. This robust oversight and state support offer a strong sense of safety for customer assets, making it a trusted choice.

Banca MPS ensures accessibility through omni-channel banking, allowing customers to engage via their preferred method. This includes physical branches for personalized advice, which saw continued use by a segment of customers in 2024 for complex transactions. The mobile app enables daily transactions, with mobile banking usage projected to increase further into 2025 across Italy. Additionally, the website provides comprehensive information and services. This blend of digital and physical access offers significant convenience and choice for all customer segments.

Local Presence and Community Focus

Banca MPS leverages its historical deep roots and extensive branch network to position itself as a bank intrinsically linked to local Italian communities. This strong local presence, despite network rationalization, remains a core value for small businesses and individuals seeking personalized banking relationships. As of 2024, MPS continues to serve a significant customer base, with its physical branches acting as vital touchpoints in many regions.

- MPS reported a net profit of 2.05 billion euros in 2023, reflecting a turnaround supported by its customer relationships.

- The bank maintained approximately 1,300 branches across Italy as of early 2024, emphasizing its widespread accessibility.

- Its focus on local SMEs and retail clients is evident in its tailored product offerings.

- Customer satisfaction often correlates with accessible local support, a key MPS strength.

Tailored Advisory for Businesses and Individuals

Banca MPS offers highly personalized advisory services, ensuring diverse customer needs are met with precision. Families benefit from dedicated mortgage advisors, guiding them through significant financial commitments. For businesses, including small and medium-sized enterprises (SMEs) and large corporate clients, Banca MPS provides dedicated relationship managers. This tailored guidance helps customers navigate complex financial decisions, fostering trust and enabling them to achieve their specific financial goals.

- Personalized advice enhances client retention, a key focus for Banca MPS's 2024 strategy.

- Specialized mortgage advisors support families in Italy, where home ownership remains a primary goal.

- Dedicated relationship managers serve corporate clients, improving credit access and financial planning for over 100,000 Italian SMEs.

- This approach aligns with Banca MPS's 2024-2026 plan to deepen customer relationships and increase cross-selling.

Banca MPS provides comprehensive financial solutions, acting as a secure and trusted partner with state backing. Its extensive network of approximately 1,300 branches in early 2024 ensures accessibility and deep local connections across Italy. Tailored services, including dedicated advisors for families and relationship managers for over 100,000 Italian SMEs, deliver personalized support. This integrated approach, focused on client retention, underpins its value proposition.

| Value Proposition | Key Feature | 2024 Data Point |

|---|---|---|

| Comprehensive Solutions | One-stop shop for diverse needs | Expanded wealth management services |

| Security & Trust | State backing, ECB regulated | Italian state significant shareholding |

| Accessibility | Omni-channel banking | ~1,300 branches in early 2024 |

| Personalized Advice | Dedicated advisors for clients | Relationship managers for >100,000 SMEs |

Customer Relationships

Banca MPS provides dedicated relationship managers for corporate, SME, and high-net-worth clients, acting as a singular point of contact. This approach fosters deep, long-term relationships grounded in personalized advice and a thorough understanding of each client's unique financial needs. In 2024, Italian banks continue to emphasize relationship-based models, with a focus on enhancing digital and human touchpoints. This strategy is critical as the bank aims to strengthen its market position, particularly within the SME segment which saw a notable increase in credit demand in early 2024.

In-person branch service remains a cornerstone for Banca MPS, offering essential face-to-face interaction for complex transactions, advisory services, and catering to demographics that prefer traditional banking. Branch staff provide personalized assistance, building crucial rapport and handling sensitive customer issues directly. While digital channels expand, branches still facilitate a significant portion of new account openings and loan applications for many Italian banks, with roughly 70% of customers still valuing in-person advice for major financial decisions in 2024. Banca MPS continues to leverage its network, which included 1,328 branches as of early 2024, to serve these vital customer segments.

Banca MPS cultivates an increasingly automated customer relationship primarily through its robust online and mobile banking platforms. These digital channels empower customers to perform most routine transactions, manage their accounts, and even apply for new products independently. This approach offers significant convenience and ensures 24/7 access to banking services. As of 2024, the focus remains on enhancing user experience and expanding digital functionalities to meet evolving customer expectations for seamless self-service.

Customer Support Center

The Customer Support Center acts as a vital hub for Banca MPS, providing a centralized call center that handles a wide array of customer queries and technical issues. This channel offers a crucial human touch, especially for customers who prefer direct interaction over digital options or cannot visit a physical branch. In 2024, call centers remain essential, with many banking customers still valuing personalized assistance for complex transactions or problem resolution. A well-managed center can significantly enhance customer satisfaction and loyalty.

- In 2024, approximately 65% of banking customers still use phone support for complex issues.

- Effective call centers aim for average handling times under 300 seconds for standard inquiries.

- Customer satisfaction scores for phone support often average above 75% for leading banks.

- Banca MPS's 2023 annual report indicated a focus on digital but maintained robust phone support.

Automated & Personalized Communication

Banca MPS leverages digital channels for automated customer communications, sending essential account alerts and transaction notifications. By analyzing customer data, the bank increasingly delivers personalized product offers and tailored financial advice. This strategy helps maintain high customer engagement, with digital interactions projected to rise significantly through 2024. Personalized outreach, informed by individual behavior, enhances client satisfaction and retention.

- In 2024, approximately 70% of banking customers expect personalized digital interactions.

- Digital banking adoption in Italy continued to grow, with a focus on mobile-first solutions.

- Personalized offers can boost conversion rates by 10-15% for financial institutions.

- Automated alerts reduce customer service inquiries by up to 25%.

Banca MPS maintains diverse customer relationships, blending dedicated relationship managers and essential in-person branch services with extensive digital platforms for self-service. A vital Customer Support Center offers human assistance, complemented by automated communications and personalized digital offers. This multi-channel approach ensures comprehensive support and engagement for all client segments in 2024.

| Relationship Channel | 2024 Focus | Key Metric (2024) |

|---|---|---|

| Relationship Managers | Personalized Advice | SME Credit Demand: Increased |

| Branch Service | In-person Advisory | Customers Valuing In-person Advice: 70% |

| Digital Platforms | User Experience | Personalized Digital Expectations: 70% |

| Customer Support | Problem Resolution | Complex Issues via Phone: 65% |

Channels

The extensive network of physical bank branches across Italy remains a primary channel for Banca MPS, facilitating customer acquisition and high-touch advisory services. These branches are crucial for complex product sales, such as mortgages and investment solutions, offering personalized interaction. While digital channels are growing, the physical presence still underpins significant customer relationships, especially for those seeking detailed financial guidance. As of 2024, Banca MPS continues to optimize its branch footprint, balancing traditional service with evolving digital preferences. This network ensures a tangible presence for clients across various regions.

The mobile banking application serves as a crucial channel for daily banking activities, seeing a significant surge in usage for checking balances, making payments, and transfers. This digital platform is essential for engaging younger demographics, with over 70% of Gen Z and Millennials in Europe preferring mobile apps for their banking needs by 2024. It greatly improves customer convenience, offering 24/7 access to services and driving digital adoption for Banca MPS.

The Banca MPS online banking website serves as a foundational digital channel, providing customers with a comprehensive portal to manage their accounts and access detailed financial information. It offers extensive features for transactions, investments, and more complex service requests, complementing the mobile application with broader functionality. In 2024, digital channels are critical, with an estimated 70-80% of banking interactions globally occurring online or via mobile platforms, underscoring the website's importance for customer engagement and operational efficiency.

Automated Teller Machine (ATM) Network

The Automated Teller Machine (ATM) network serves as a crucial channel for Banca MPS, offering customers 24/7 access to essential banking services. This includes convenient cash withdrawals, deposits, and immediate account balance inquiries, significantly enhancing customer accessibility. By offloading these routine transactions from physical branches, the ATM network plays a vital role in improving operational efficiency and reducing branch queues. In 2024, the widespread availability of ATMs continues to be a cornerstone of retail banking, supporting a significant volume of daily transactions across Italy.

- ATMs handle millions of transactions annually, reducing branch traffic.

- Customers can access funds and services around the clock.

- Digital integration allows for real-time balance updates.

- The network complements online and mobile banking services.

Corporate Banking Centers & Advisors

Banca MPS leverages specialized corporate banking centers and dedicated relationship managers as a key channel for large corporations and small and medium-sized enterprises (SMEs). This direct, personalized approach ensures tailored financial solutions, including credit facilities and expert advisory services, which are crucial for complex business needs and cannot be effectively delivered through mass-market channels. As of 2024, MPS continues to focus on strengthening these relationships, with corporate loan portfolios being a significant segment of their operations. This strategic channel supports business growth and financial stability for their corporate clients.

- Dedicated advisors offer bespoke financial solutions.

- Direct channels facilitate complex credit facilities.

- Expert advice supports strategic business decisions.

- Focus on large corporations and SMEs in 2024.

Banca MPS maintains a diverse channel strategy, balancing its extensive physical branch network for personalized advisory services with robust digital platforms. The mobile app and online banking website are critical for daily transactions and broader financial management, reflecting a trend where 70-80% of banking interactions occur digitally by 2024. Additionally, the ATM network ensures 24/7 access for routine services, while specialized corporate centers provide tailored solutions for large businesses and SMEs.

| Channel Type | Primary Function | 2024 Relevance | ||

|---|---|---|---|---|

| Physical Branches | High-touch advisory, complex sales | Optimized footprint, personalized interaction | ||

| Digital Platforms (App/Web) | Daily banking, comprehensive access | 70-80% of interactions digital | ||

| Corporate Centers | Tailored business solutions | Strengthening SME/corporate relationships |

Customer Segments

Individuals and families represent Banca MPS primary customer segment, seeking essential retail banking services. This extensive group looks for current accounts, savings products, and versatile debit and credit cards for daily use. Their financial needs also extend to personal loans for various purposes and mortgages for homeownership, which remain core offerings. As of 2024, Italian household deposits continued to be a significant funding source for banks, highlighting the importance of this segment.

Small and Medium-Sized Enterprises represent a core segment for Banca MPS, leveraging its extensive local presence across Italy to provide essential financial services. These businesses, which account for a significant portion of the Italian economy, require tailored solutions such as business loans and credit lines, crucial for investment and working capital. In 2024, Italian banks, including MPS, continue to focus on supporting SMEs, with total lending to non-financial corporations, predominantly SMEs, reflecting ongoing demand. MPS also offers vital payment processing and sophisticated cash management services, ensuring efficient daily operations for these local and regional companies.

Corporate Clients represent a crucial segment for Banca MPS, encompassing large national and multinational companies requiring sophisticated financial solutions. These entities often have complex needs, driving demand for specialized services.

Banca MPS provides them with structured finance, investment banking, and comprehensive treasury management. The bank also facilitates international trade finance, a growing area given global economic interconnectedness. For example, Banca MPS reported a significant increase in net interest income in Q1 2024, reflecting strength across core banking activities, including corporate lending and services.

High-Net-Worth Individuals (HNWI)

High-Net-Worth Individuals represent a crucial customer segment for Banca MPS, primarily served through its wealth management and private banking divisions. These affluent clients are offered bespoke financial solutions, including personalized investment strategies and sophisticated portfolio management, designed to meet their unique financial objectives. Services extend to comprehensive estate planning and exclusive banking privileges, reflecting their significant asset base. As of early 2024, the global HNWI population continued to expand, with their wealth projected to reach over USD 100 trillion by 2025, highlighting the growth opportunity within this segment for institutions like Banca MPS.

- Personalized investment strategies tailored to individual risk profiles.

- Advanced portfolio management for diverse asset classes.

- Comprehensive estate planning and succession services.

- Exclusive banking services and dedicated relationship managers.

Institutional Clients

Institutional clients represent a core segment for Banca MPS, encompassing other financial institutions, pension funds, and asset managers. The bank provides essential services to these entities, including custody solutions for their assets, robust securities trading platforms, and comprehensive correspondent banking services facilitating international transactions. This focus aligns with the bank's strategy to diversify revenue streams beyond traditional retail banking.

- In 2024, Banca MPS continued to strengthen its institutional client relationships, crucial for its capital markets operations.

- Services like securities trading support significant transaction volumes, essential for market liquidity.

- Custody services manage vast asset portfolios for pension funds and investment houses.

- Correspondent banking facilitates cross-border payments, supporting global financial flows.

Banca MPS caters to a broad spectrum, from individual retail clients seeking everyday banking and mortgages to Small and Medium-Sized Enterprises requiring crucial business financing and cash management. Corporate Clients leverage sophisticated structured finance and investment banking, while High-Net-Worth Individuals benefit from bespoke wealth management. Institutional Clients rely on custody, securities trading, and correspondent banking, reflecting a robust and diversified customer base.

| Segment | Key Service | 2024 Trend/Data | ||

|---|---|---|---|---|

| Individuals | Retail Banking, Mortgages | Strong household deposit base | ||

| SMEs | Business Loans, Cash Management | Ongoing demand for corporate lending | ||

| Corporate Clients | Structured Finance, Trade Finance | Q1 2024 net interest income increase | ||

| HNWIs | Wealth Management, Private Banking | Global HNWI wealth projected >$100T by 2025 |

Cost Structure

Personnel costs are a significant operating expense for Banca MPS, encompassing salaries, benefits, and pension contributions for its extensive workforce. These expenses are directly linked to the bank's wide branch network and numerous administrative functions. For example, in 2023, Banca MPS reported total operating expenses, with staff costs being a primary component, reflecting the labor-intensive nature of banking. The bank's ongoing strategic plan aims to optimize these costs while maintaining service levels. In 2024, managing this cost structure remains crucial for profitability and efficiency.

Banca MPS faces significant IT and technology infrastructure costs, encompassing the maintenance and upgrading of its core banking systems and robust data centers. These expenses also cover critical cybersecurity measures and the ongoing development of its digital channels. As of 2024, the bank's digital transformation initiatives continue to drive substantial investment in technology, reflecting a sector-wide trend. These growing costs are vital for operational resilience and enhancing customer digital experiences. The bank's 2024-2026 business plan emphasizes further digital acceleration, underscoring this cost area's strategic importance.

Property and branch network expenses represent significant operational costs for Banca MPS, encompassing rent, utilities, maintenance, and security for its physical locations. These costs are a crucial part of the bank's overall cost structure. As of early 2024, Banca MPS continued its strategic optimization efforts, aiming to reduce its branch count to enhance efficiency. The bank has been actively consolidating its footprint, with plans to streamline operations and lower fixed overheads associated with its physical infrastructure, impacting its financial performance positively.

Interest Expense

Interest expense represents the significant cost Banca MPS incurs by paying interest to customers on their deposits, such as savings accounts and term deposits. This financial outlay is a primary component of the bank's operational costs, directly impacting its profitability. It serves as a crucial determinant in calculating the bank's net interest margin, which is the difference between interest earned on assets and interest paid on liabilities. For example, Banca MPS reported a strong Net Interest Income of EUR 618 million in Q1 2024, reflecting effective management of both interest income and expenses.

- Major financial cost for Banca MPS.

- Paid on customer deposits like savings and term accounts.

- Key factor in determining the bank's net interest margin.

- Reflected in Banca MPS Q1 2024 Net Interest Income of EUR 618 million.

Regulatory Compliance & Risk Management Costs

Significant expenses are incurred by Banca MPS to comply with extensive national and European banking regulations, encompassing costs for detailed reporting, rigorous stress testing, and legal counsel. Implementing robust risk management systems also contributes heavily to these outlays. These compliance and risk management costs have increased substantially in the post-financial crisis era, reflecting intensified oversight. For instance, European banks continue to face rising compliance burdens, with estimates showing significant portions of operational budgets dedicated to regulatory adherence.

- Banca MPS allocates substantial resources to meet stringent EU and Italian banking regulations.

- Costs cover extensive regulatory reporting and mandatory stress tests.

- Investment in advanced risk management systems is a key expenditure.

- Post-2008, regulatory compliance expenses across European banks have seen a notable increase.

Banca MPS's cost structure is primarily shaped by significant operating expenses, including substantial personnel costs and ongoing investments in IT and technology infrastructure for digital transformation. Property and branch network expenses are being strategically optimized to enhance efficiency, with plans to reduce physical footprint in 2024. A major financial cost is interest expense on customer deposits, which directly influences the bank's net interest margin, reflected in a strong Q1 2024 Net Interest Income of EUR 618 million. Additionally, the bank incurs considerable and increasing costs for regulatory compliance and robust risk management systems.

| Cost Category | 2024 Trend/Impact | Key Data Point |

|---|---|---|

| Personnel Costs | Optimization efforts | Strategic plan focus |

| IT & Technology | Increased investment | Digital transformation |

| Interest Expense | Impacts profitability | Q1 2024 Net Interest Income: EUR 618M |

| Regulatory Compliance | Rising burden | Enhanced oversight |

Revenue Streams

Net Interest Income serves as Banca MPS's primary revenue driver, originating from the spread between interest collected on its asset portfolio, such as loans and mortgages, and interest paid on liabilities like customer deposits. This core banking activity is fundamental to profitability, with the bank reporting a robust Net Interest Income of €628 million in the first quarter of 2024. The effective management of this spread is crucial for maximizing earnings and ensuring stable financial performance. This stream reflects the direct result of the bank's lending and deposit-taking operations.

Fee and commission income is a crucial and expanding revenue stream for Banca MPS, reflecting a strategic shift towards service-based earnings. This includes charges for account maintenance and payment transactions, which contribute steadily to non-interest income. Commissions from robust asset management services, including mutual funds and wealth advisory, are significant contributors. Furthermore, fees from bancassurance products, such as insurance sales, generated €144 million in the first quarter of 2024, demonstrating consistent growth in this diversified income source.

Banca MPS generates significant revenue from its trading income, derived from activities in financial markets. This includes active trading in government bonds, foreign exchange, and various derivative instruments. This income stream, however, is inherently volatile and highly dependent on prevailing market conditions, such as interest rate fluctuations and global economic sentiment. For instance, Banca MPS reported net trading income of €119 million in Q1 2024, demonstrating its contribution to the bank’s overall performance, albeit subject to market shifts.

Gains on Financial Assets and Liabilities

Gains on financial assets and liabilities for Banca MPS primarily reflect income or losses from selling or revaluing the bank's investment portfolio and other financial instruments. This revenue stream is inherently non-recurring and can be quite unpredictable, influenced by market volatility and interest rate movements. For instance, in Q1 2024, Banca MPS reported significant net gains on financial assets and liabilities, contributing to its strong performance. This segment often includes results from hedging activities and proprietary trading.

- Q1 2024 net gains on financial assets and liabilities: €100 million.

- Primary sources: Investment portfolio revaluation and sales.

- Nature: Non-recurring and highly sensitive to market fluctuations.

- Impact: Contributes to overall profitability but lacks predictability.

Corporate Finance & Investment Banking Fees

Banca MPS earns significant revenue from its corporate finance and investment banking activities, providing essential advisory services to corporate clients. These fees stem from managing complex mergers and acquisitions, guiding companies through stock and bond issuances, and orchestrating syndicated loans. For instance, in Q1 2024, MPS reported strong net fees and commissions, reflecting robust activity in these areas.

- Net fees and commissions for Banca MPS reached 416 million euros in Q1 2024.

- Advisory services include M&A deal management.

- Revenue is generated from underwriting new stock and bond issuances.

- Arranging syndicated loans contributes to corporate finance fees.

Banca MPS primarily generates revenue from Net Interest Income, reaching €628 million in Q1 2024, stemming from lending and deposit operations. Fee and commission income, including asset management and bancassurance, is a growing stream, contributing €416 million in total net fees in Q1 2024. Trading income and gains on financial assets further diversify earnings, adding €119 million and €100 million respectively in Q1 2024, showcasing a robust and multi-faceted financial performance. Corporate finance and investment banking activities also contribute significantly to fee-based revenue.

| Revenue Stream | Q1 2024 Data (€ million) | Nature |

|---|---|---|

| Net Interest Income | 628 | Primary, core banking |

| Net Fees & Commissions | 416 | Service-based, growing |

| Trading Income | 119 | Volatile, market-dependent |

| Net Gains on Financial Assets & Liabilities | 100 | Non-recurring, market-sensitive |

Business Model Canvas Data Sources

The Banca MPS Business Model Canvas is constructed using a blend of internal financial data, extensive market research on the Italian banking sector, and strategic insights derived from competitor analysis and regulatory reports. This multi-faceted approach ensures a robust and accurate representation of the bank's strategic framework.