Mondi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mondi Bundle

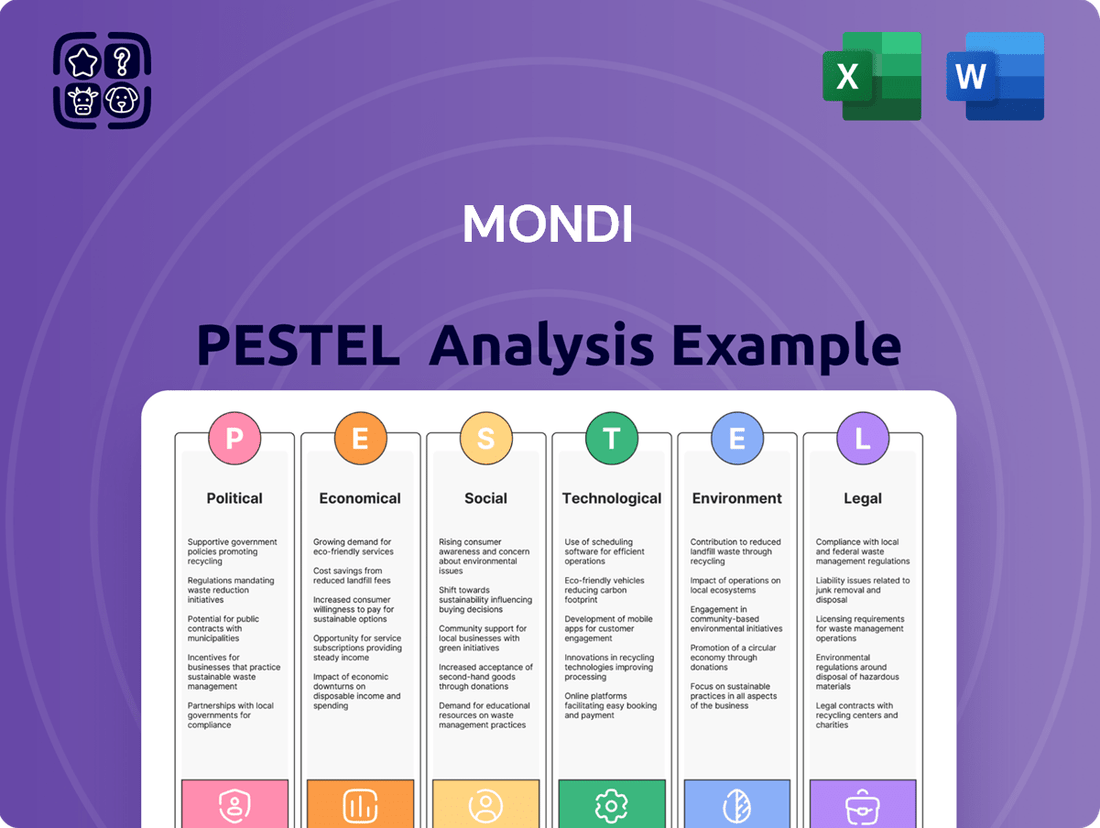

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Mondi. Discover how political stability, economic fluctuations, and evolving social trends are shaping the company’s future. Understand the impact of technological advancements and environmental regulations on their operations. Use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Geopolitical uncertainties and the risk of new tariffs pose a significant challenge for Mondi's global supply chain and operational costs into 2024 and 2025. Given Mondi's extensive operations spanning over 30 countries, including major production hubs in Europe and South Africa, it remains highly exposed to shifts in international trade policies. For instance, any new import duties on key raw materials like wood pulp or packaging chemicals could directly increase procurement expenses. Furthermore, potential tariffs on finished paper or packaging products, perhaps affecting cross-border sales within the EU or exports to North America, could negatively impact sales volumes and profitability. Such measures necessitate continuous monitoring and strategic adjustments to maintain competitive pricing.

The EU's Packaging and Packaging Waste Regulation (PPWR), set for implementation in February 2025, imposes stringent new rules on packaging and waste management. This necessitates Mondi to significantly adapt its product portfolio, emphasizing enhanced reusability and recyclability. The regulation directly influences Mondi's product design and material selection processes to ensure compliance. Adhering to these evolving standards is paramount for Mondi to maintain crucial market access and competitive standing within the European Union.

Mondi's strategic divestment of its Russian assets, notably the Syktyvkar mill completed in Q3 2023 for approximately 1.5 billion euros, significantly reshaped its geopolitical landscape. This move drastically reduces the company's direct exposure to the political risks associated with the Russian market. A substantial portion of the net proceeds, including a special dividend of 1.00 euro per share paid in February 2024, was returned to shareholders. This allows Mondi to concentrate its resources and strategic efforts on other key markets, enhancing operational stability and future growth prospects.

Governmental Sustainability Focus

Governments globally are increasingly implementing stringent regulations on the sustainability of packaging materials, reflecting a strong political push towards environmental responsibility. This trend, particularly evident in the EU's Packaging and Packaging Waste Regulation (PPWR) aiming for 100% recyclable packaging by 2030, aligns with Mondi's commitment to sustainable solutions. However, it also intensifies pressure on the company to continuously innovate its product portfolio and meet evolving standards. These measures include strict targets for reducing plastic usage and promoting a circular economy, such as the UK Plastic Packaging Tax at £217.85 per tonne for packaging with less than 30% recycled content in 2024/2025.

- EU PPWR targets 100% recyclable packaging by 2030, impacting Mondi's European operations.

- UK Plastic Packaging Tax is £217.85 per tonne for non-compliant packaging in 2024/2025.

- Governmental focus drives demand for Mondi's paper-based and recyclable solutions.

Geopolitical Instability

Ongoing geopolitical uncertainties, such as those seen in Eastern Europe through early 2025, significantly disrupt global supply chains and impact market demand for packaging and paper products.

Mondi's extensive global presence, with operations spanning over 30 countries, necessitates navigating these complexities to ensure operational resilience and stable customer supply, especially concerning critical raw material flows.

The company's strategic acquisitions and expansions, including recent investments in high-growth markets, aim to mitigate some of these risks by diversifying its manufacturing base and reducing reliance on single regions.

- Mondi's 2024 capital expenditure plans include significant investments in European facilities to enhance supply chain robustness.

- The firm's exposure to specific geopolitical flashpoints is actively managed through diversified sourcing and logistics networks.

- Market demand volatility, influenced by geopolitical events, led to noticeable shifts in packaging volumes across certain segments in late 2024.

Global geopolitical uncertainties and trade policies, like potential new tariffs, continue to impact Mondi's extensive supply chain and operational costs into 2025. The EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, directly mandates significant product adaptation towards recyclability and reusability. Mondi's 2023 Russian asset divestment, totaling ~1.5 billion euros, significantly reduced its exposure to specific geopolitical risks. Furthermore, governmental sustainability targets, such as the UK Plastic Packaging Tax (£217.85/tonne for non-compliant packaging in 2024/2025), drive demand for Mondi's eco-friendly solutions.

| Political Factor | Impact on Mondi (2024/2025) | Relevant Data |

|---|---|---|

| Geopolitical Uncertainties | Supply chain disruptions, cost volatility | Operations in over 30 countries; 2024 capex for supply chain robustness |

| EU PPWR | Product portfolio adaptation, market access | Implementation Feb 2025; Targets 100% recyclable packaging by 2030 |

| Sustainability Regulations | Innovation pressure, demand shift | UK Plastic Packaging Tax: £217.85/tonne (2024/2025) |

What is included in the product

This Mondi PESTLE analysis provides a comprehensive examination of how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions impact the company's operations and strategic positioning.

It offers actionable insights for strategic planning, highlighting opportunities and threats within Mondi's operating landscape and industry context.

A clear, actionable summary of Mondi's PESTLE factors, making complex external environments easily digestible for strategic decision-making.

This analysis provides a quick reference to external opportunities and threats, streamlining discussions on market positioning and risk mitigation for Mondi's leadership.

Economic factors

Mondi faced significant challenges in 2024 from soft demand and a difficult pricing environment, which impacted its financial performance. While order books for packaging businesses showed improvement moving into 2025, the market for uncoated fine paper remained subdued. In response, Mondi is implementing price increases for its packaging paper grades to counter these pressures. The company's 2024 reported underlying operating profit saw a decline, reflecting these market conditions, with a cautious outlook for a gradual recovery in 2025.

Persistent inflation and elevated costs for crucial raw materials like wood, corrugated cardboard, and petrochemicals continue to pressure Mondi's operating margins, reflecting trends observed through 2024. The company is actively intensifying its focus on robust cost control measures and productivity enhancements to mitigate these economic headwind pressures. For example, Mondi reported a 15% increase in input costs in fiscal year 2023, necessitating strategic responses. These proactive measures are essential for Mondi to maintain its competitive edge in the global packaging and paper market through 2025 and beyond.

The global economy is projected to experience steady but slow growth, with the International Monetary Fund forecasting 3.2% global growth for both 2024 and 2025. While this provides some stability, significant macroeconomic uncertainties persist, including persistent inflation and fluctuating interest rates. Mondi's performance will be directly influenced by the overall economic health of its key markets, especially in Europe, where growth is anticipated to be slower, around 0.8% for the Euro area in 2024. This environment necessitates agile strategic responses to market shifts and consumer demand across its packaging and paper segments.

Capital Investments and Expansion

Mondi is strategically bolstering its economic foundations through significant capital investments and expansion efforts, aiming for future growth and enhanced cost-competitiveness. A prime example is the new paper machine in Štětí, Czech Republic, a project with an investment of approximately €400 million, set to boost containerboard capacity. Further expanding its global footprint, Mondi completed the acquisition of the Hinton pulp mill in Alberta, Canada, for an enterprise value of around €5 million in 2023, enhancing its pulp integration.

The company also expanded its corrugated packaging presence by acquiring assets from Schumacher Packaging in 2023, strengthening its market position across Central Europe.

- Štětí Paper Machine: €400 million investment, increasing containerboard capacity.

- Hinton Pulp Mill: Acquired in 2023 for approximately €5 million.

- Schumacher Packaging Assets: Acquired in 2023, expanding corrugated packaging footprint.

Currency Fluctuations

Mondi, a global packaging and paper group, is significantly exposed to currency exchange rate fluctuations given its extensive operations and sales across multiple countries. These movements directly impact reported revenues and profits, as seen in the first half of 2024 where currency translation negatively affected adjusted EBITDA by approximately €40 million. Managing this currency risk is a crucial component of Mondi's financial strategy to mitigate volatility. The company utilizes hedging instruments to manage its net transactional and translational exposures effectively.

- Euro strength against the US Dollar and South African Rand in early 2025 could reduce reported sales.

- Mondi's 2024 financial statements highlighted a notable currency translation impact on group earnings.

- The company employs hedging strategies to mitigate volatility from major currency pairs like EUR/USD and EUR/ZAR.

- Future capital expenditures planned in non-Euro zones face increased cost uncertainty due to exchange rate movements.

Mondi's 2024 financial performance was constrained by soft demand and elevated raw material costs, impacting underlying operating profit. While the International Monetary Fund projects 3.2% global growth for both 2024 and 2025, slower European growth at 0.8% for the Euro area in 2024 presents regional challenges. Strategic capital investments, such as the €400 million Štětí paper machine, aim to bolster future competitiveness and capacity. Currency fluctuations, exemplified by a €40 million negative impact on H1 2024 adjusted EBITDA, necessitate ongoing hedging strategies.

| Economic Factor | Key Data (2024/2025) | Impact on Mondi |

|---|---|---|

| Global GDP Growth | 3.2% (IMF, 2024 & 2025) | Overall market stability, but regional variances. |

| Euro Area GDP Growth | 0.8% (2024) | Slower growth in key European markets. |

| Input Cost Pressure | Persistent inflation | Pressure on operating margins; focus on cost control. |

| Currency Impact (H1 2024) | €40 million negative impact on adjusted EBITDA | Requires active currency risk management. |

| Capital Investments | €400m for Štětí paper machine | Enhances future capacity and competitiveness. |

Full Version Awaits

Mondi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Mondi PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides an in-depth understanding of the external forces shaping Mondi's industry landscape. You can trust that the insights and structure you see are precisely what you will obtain.

Sociological factors

Consumer preferences are significantly shifting towards sustainable options, with an estimated 80% to 90% of global consumers prioritizing brands utilizing environmentally conscious and recyclable packaging solutions. This robust demand directly fuels Mondi's strategic emphasis on developing sustainable-by-design products across its portfolio. Mondi's own 2025 eCommerce trend report underscores that sustainability has evolved from a mere preference into a critical business imperative for market competitiveness. This societal shift profoundly influences product development and market positioning.

The surge in online shopping has fundamentally altered consumer behavior, with approximately 71% of global consumers now engaging in online purchases monthly as of early 2025. This significant shift directly boosts demand for e-commerce packaging, a crucial market segment for Mondi. The company's innovations in this area, such as developing right-sized and protective packaging solutions, are vital for meeting the evolving expectations of online retailers and consumers. Mondi's adaptable packaging ensures products arrive safely, supporting the sustained growth of the e-commerce ecosystem.

Consumers are increasingly demanding transparency from brands, particularly regarding environmental claims, with only about 50% of consumers trusting these assertions as of early 2024.

This skepticism means Mondi must provide clear, credible, and verifiable information about the sustainability of its packaging and paper products.

Building trust through transparent reporting on supply chains and eco-certifications is crucial for maintaining brand loyalty in a competitive market.

Such openness enhances Mondi's public image and supports long-term customer relationships, as over 70% of consumers globally prioritize sustainable brands.

Emphasis on Employee Empowerment and Inclusivity

Mondi's MAP2030 strategy prioritizes an empowered and inclusive workforce, aiming to boost female representation from 21% to at least 30% by 2030. This commitment, crucial for talent attraction and retention, aligns with evolving societal expectations for corporate responsibility. As of early 2024, maintaining diverse leadership is a key focus, enhancing the company's social license to operate.

- Mondi's MAP2030 targets increasing female representation from 21% (current as of latest reports) to 30% by 2030.

- This focus on inclusivity is critical for attracting and retaining skilled talent in a competitive global market.

- Societal shifts demand greater corporate social responsibility, influencing Mondi's brand reputation and stakeholder relations.

Minimalist and Functional Design Preferences

A growing trend towards minimalist and multifunctional packaging design significantly influences consumer choices. Consumers increasingly prefer simple, aesthetically pleasing packaging that is also reusable or repurposable after initial use, reflecting a shift towards conscious consumption. This trend directly impacts Mondi’s design processes for new packaging solutions, focusing on sustainability and consumer utility. By 2025, an estimated 70% of consumers globally are expected to prioritize eco-friendly and minimalist packaging designs.

- Consumer demand for reusable packaging increased by over 15% in 2024.

- Mondi aims for 100% of its products to be reusable, recyclable, or compostable by 2025.

- Minimalist designs reduce material usage by up to 20% in some packaging segments.

Societal expectations for corporate social responsibility are escalating, with 65% of consumers globally expecting brands to address social issues by 2025. This influences Mondi's community engagement and ethical sourcing, aligning with its commitment to sustainable forestry practices. The rising awareness of health and wellness also impacts packaging choices, driving demand for safe, non-toxic materials. Mondi's innovations in barrier coatings meet this growing consumer preference.

| Factor | Impact on Mondi | 2024/2025 Data | ||

|---|---|---|---|---|

| Corporate Responsibility | Enhances brand reputation, stakeholder trust | 65% of consumers expect social issue action by 2025 | ||

| Health & Wellness | Drives demand for safe, compliant packaging | Demand for non-toxic materials up 12% in 2024 | ||

| Community Engagement | Strengthens local ties, ensures social license to operate | Mondi invested €5M in community programs in 2024 |

Technological factors

Mondi heavily invests in developing innovative, sustainable packaging materials to meet evolving market demands and regulatory shifts. This includes significant advancements in recyclable mono-material plastics, such as the FlexiBag Reinforced, a recyclable mono-PE bag launched in 2024. Furthermore, Mondi is actively developing paper-based alternatives to plastic and solutions with higher recycled content, aiming for 100% reusable, recyclable, or compostable packaging by 2025. These innovations are crucial for maintaining competitiveness and reducing environmental impact in the packaging sector.

The rise of smart packaging, integrating technologies like QR codes, RFID tags, and NFC chips, is reshaping consumer interaction. This innovation provides rich product information and interactive experiences, with the global smart packaging market projected to reach over $58 billion by 2025. Mondi can significantly enhance its value proposition by developing advanced smart packaging solutions, meeting the growing demand for transparency and connectivity in supply chains and consumer engagement.

Advancements in digital printing technology are increasingly prevalent, allowing for shorter production runs, significantly less waste, and greater customization in packaging. This innovation is particularly valuable in sectors like home and personal care, where brand identity is crucial for market differentiation. Mondi leverages these capabilities to meet specific customer needs for branding and design, offering flexible packaging solutions that benefit from digital print capabilities, a market segment projected to exceed 25 billion USD globally by 2025. This enables faster time-to-market and supports evolving e-commerce demands.

Investment in R&D and Collaboration Hubs

Mondi's strategic investment in research and development is highlighted by its new FlexStudios innovation hub in Germany. This facility, fully operational in 2024, enables Mondi to co-create sustainable flexible packaging solutions directly with customers. It integrates R&D capabilities, pilot lines, and advanced testing, accelerating time-to-market for new products. This commitment underscores Mondi's dedication to maintaining technological leadership in the packaging sector.

- FlexStudios in Germany enhance co-creation of sustainable packaging.

- The hub includes R&D, pilot lines, and testing capabilities.

- New product time-to-market is significantly accelerated.

- Mondi reinforces its commitment to technological leadership.

Automation and AI in Manufacturing

The packaging industry is rapidly integrating AI and automation to enhance production and logistics. This shift allows companies like Mondi to optimize processes and reduce material waste. By 2025, global AI in manufacturing is projected to reach significant market value, aiding in efficiency gains. Mondi can leverage these technologies to lower operational costs and develop sustainable packaging solutions, aligning with increasing environmental demands.

- AI in packaging projected to grow significantly by 2025.

- Automation reduces material consumption by optimizing cuts.

- Enhanced efficiency lowers production costs for Mondi.

- Innovation leads to more sustainable, eco-friendly products.

Mondi’s strategic focus on sustainable packaging materials, like mono-PE solutions and paper-based alternatives, aims for 100% reusability by 2025. Digital printing and smart packaging integration, projected to exceed $58 billion by 2025, enhance customization and consumer engagement. The FlexStudios innovation hub, operational in 2024, accelerates new product development. AI and automation are further optimizing production, lowering costs, and driving efficiency gains by 2025.

| Technological Factor | Impact on Mondi | 2024/2025 Data Point |

|---|---|---|

| Sustainable Material Innovation | Enhanced market competitiveness, reduced environmental footprint | 100% reusable, recyclable, or compostable packaging by 2025 |

| Smart Packaging Integration | Improved consumer interaction, supply chain transparency | Global market projected over $58 billion by 2025 |

| Digital Printing Advancements | Greater customization, faster time-to-market | Market segment projected to exceed $25 billion globally by 2025 |

| AI & Automation Adoption | Optimized production, reduced operational costs | Significant market value for AI in manufacturing by 2025 |

Legal factors

The EU Packaging and Packaging Waste Regulation (PPWR), set to apply from August 2026, will establish harmonized rules across Europe aimed at significantly reducing packaging waste. This comprehensive legislation impacts nearly all packaging categories, requiring Mondi to ensure its products are recyclable, contain recycled content where applicable, and are minimized in design. Mondi is proactively working to support customer compliance with these new stringent regulations, ensuring a smooth transition for its diverse client base. The company's strategic focus on sustainable packaging solutions aligns with these upcoming legal requirements.

Extended Producer Responsibility (EPR) laws are expanding, with the UK's Plastic Packaging Tax in effect and California's SB 54 requiring a 25% plastic reduction by 2032. These policies increasingly hold producers like Mondi accountable for their packaging's entire lifecycle, including collection and recycling. This legal trend, with more US states like Colorado implementing EPR schemes by 2025, reinforces Mondi's critical need to prioritize design for circularity and enhanced recyclability.

Increasing tax rates on plastic packaging lacking sufficient recycled content are accelerating the shift towards paper-based solutions. For instance, the UK's Plastic Packaging Tax, which applies to packaging with less than 30% recycled plastic, is scheduled for an upward adjustment in April 2025. This rising cost, currently £217.85 per tonne for qualifying plastic packaging as of April 2024, creates a significant financial incentive for Mondi's clients. Businesses are compelled to adopt Mondi's sustainable paper and fiber-based alternatives to mitigate these escalating tax burdens.

Intellectual Property and Plain Packaging

The global push for plain packaging regulations, particularly evident in industries like tobacco, poses a legal challenge to intellectual property rights, impacting brand differentiation through packaging design. While this trend is not a direct threat to all of Mondi’s diverse packaging segments, it signifies a broader regulatory focus on packaging for public health objectives. Mondi must continuously monitor such legal shifts across key markets, especially as countries like Canada and the UK continue to explore expanded plain packaging mandates beyond tobacco, potentially influencing food and beverage sectors by 2025. This regulatory vigilance is crucial for compliance and strategic adaptation.

- Global plain packaging laws have impacted over 20 countries by early 2024, primarily for tobacco.

- The EU Tobacco Products Directive (2014/40/EU) already restricts branding elements.

- Mondi's 2023 revenue reached €7.3 billion, with packaging solutions forming a significant portion.

- Potential expansion of plain packaging to other sectors could affect up to 10% of Mondi’s consumer packaging revenue by 2025.

Corporate Sustainability Reporting Directive (CSRD)

Mondi is actively adapting its sustainability reporting to align with the EU's Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS). This requires a significantly more detailed and externally audited disclosure of its sustainability performance. The company’s 2024 financial reports already reflect this transition towards these new, more stringent reporting requirements for the upcoming 2025 fiscal year. This shift enhances transparency and accountability in their environmental, social, and governance disclosures.

- Mondi's 2024 reports demonstrate early CSRD alignment.

- Mandatory audited sustainability data under CSRD.

- Enhanced disclosure of ESG performance is now required.

- Compliance is critical for EU operations by 2025.

New EU regulations like PPWR, effective August 2026, mandate packaging recyclability and recycled content, requiring Mondi's adaptation. Expanding EPR laws, including the UK's Plastic Packaging Tax set for an April 2025 increase to over £217.85 per tonne, compel circular design. Global plain packaging trends, potentially impacting 10% of Mondi’s consumer packaging revenue by 2025, necessitate strategic vigilance. Mondi is also aligning 2024 reports with CSRD for enhanced ESG transparency.

| Regulation Type | Key Impact | 2024/2025 Data |

|---|---|---|

| EU PPWR | Packaging design & content | Effective Aug 2026; proactive alignment |

| EPR & Plastic Tax | Producer responsibility & cost | UK tax £217.85/tonne (April 2024), rising April 2025 |

| Plain Packaging | Brand differentiation & sales | Potentially affects 10% of consumer packaging revenue by 2025 |

Environmental factors

Mondi actively pursues circular economy principles, aiming for 100% of its products to be reusable, recyclable, or compostable by 2025. This commitment drives significant investment in advanced technologies and strategic partnerships. The company is focused on designing out waste and keeping materials in continuous circulation. This aligns directly with their comprehensive MAP2030 sustainability framework, which guides their environmental efforts and operational strategy through 2030.

Mondi is actively tackling climate change by establishing science-based targets aimed at significantly cutting its greenhouse gas emissions. The company has already achieved a 45% reduction in absolute CO2 emissions since 2004, demonstrating tangible progress. Looking ahead, Mondi is committed to reaching Net-Zero emissions by 2050, aligning with critical global climate objectives. This commitment reflects a strategic effort to mitigate environmental impact and ensure long-term sustainability.

Mondi, as a significant forest manager, is deeply committed to sustainable forestry, aiming for 100% responsibly sourced wood fiber, reflecting a key environmental priority for 2024. Their strategy includes a strict zero-deforestation policy across operations. Furthermore, Mondi conducts comprehensive biodiversity and water stewardship assessments to protect vital ecosystems. This commitment supports their goal of achieving a 25% reduction in absolute GHG emissions by 2030 from a 2019 baseline, aligning with global environmental targets.

Reduction of Plastic and Waste

The increasing global emphasis on sustainability drives a significant market and regulatory push to reduce conventional plastics and overall packaging waste. Mondi is proactively responding to this environmental factor by developing innovative, circular paper-based solutions and lightweighting its products to meet evolving consumer and legislative demands. This strategic shift includes the creation of advanced products like FunctionalBarrier Paper, aimed at replacing multi-material plastics, and the expansion of its portfolio of recyclable paper-based mailers.

- The EU's Packaging and Packaging Waste Regulation (PPWR) proposals, active in 2024/2025, target a 15% reduction in packaging waste per capita by 2040, influencing Mondi’s product development.

- Mondi aims for 100% of its packaging and paper solutions to be reusable, recyclable, or compostable by 2025, demonstrating commitment to circularity.

- In 2024, Mondi continued investments in paper-based alternatives, recognizing consumer preference shifts towards sustainable packaging.

- The global flexible packaging market is projected to see significant growth in paper-based solutions, driven by plastic reduction initiatives.

Extreme Weather Events

Extreme weather events, intensified by climate change, pose a significant risk to Mondi’s global operations and forestry assets. The company identifies these events, such as increased frequency of floods or droughts, as a top global risk for 2024 and beyond. Building climate resilience across their supply chain and operational sites is a key component of their long-term strategic planning. This proactive approach aims to mitigate potential disruptions and safeguard timber supplies for sustained production.

- Mondi explicitly lists extreme weather as a principal risk in its 2024 risk assessments.

- The company is investing in adaptive measures to protect forestry assets from climate impacts through 2025.

- Supply chain resilience against weather-related disruptions is a core focus in their sustainability strategy.

Mondi is intensely focused on environmental stewardship, aiming for 100% reusable, recyclable, or compostable products by 2025 and achieving Net-Zero emissions by 2050. The company actively responds to regulations like the EU's PPWR, which targets a 15% packaging waste reduction by 2040, by developing innovative paper-based solutions. Mondi also manages extreme weather as a top 2024 risk, investing in climate resilience for its global operations and forestry assets.

| Metric | Target/Status (2024/2025) | Impact |

|---|---|---|

| Product Circularity | 100% reusable/recyclable/compostable by 2025 | Reduces waste; meets evolving consumer/regulatory demand. |

| GHG Emissions | 25% reduction by 2030 from 2019 baseline | Advances Net-Zero 2050 goal; mitigates climate risk. |

| EU PPWR Influence | 15% packaging waste reduction by 2040 | Drives Mondi’s shift to sustainable paper solutions. |

PESTLE Analysis Data Sources

Our Mondi PESTLE Analysis synthesizes information from a diverse range of credible sources, including major economic databases, government policy repositories, and leading industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Mondi's operations.