Mondi Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mondi Bundle

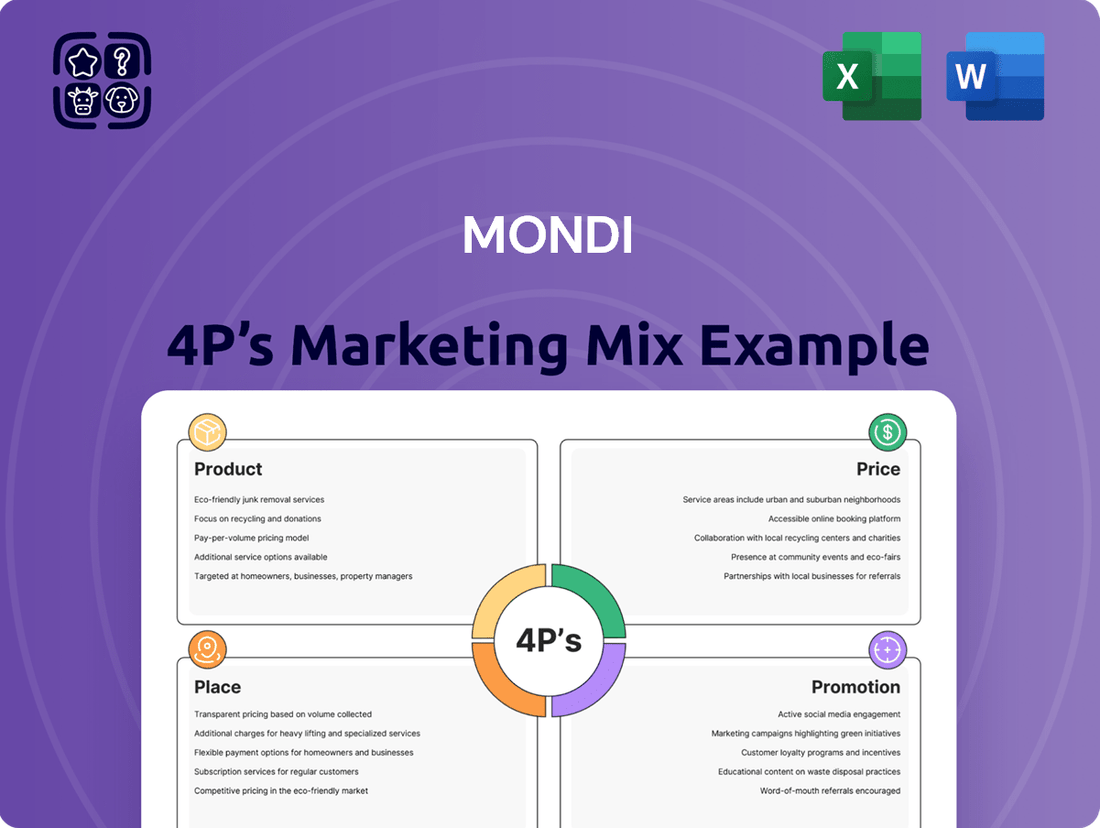

Discover how Mondi leverages its Product innovation, strategic Pricing, extensive Place distribution, and impactful Promotion to maintain its market leadership in the packaging and paper industry.

This analysis delves into the specifics of their product portfolio, from sustainable paper solutions to advanced packaging technologies, and how these offerings are priced competitively.

Explore Mondi's sophisticated Place strategy, examining their global reach and efficient supply chain networks that ensure product availability.

Understand the nuances of their Promotion tactics, including digital marketing, industry events, and strong customer relationships that build brand loyalty.

Gain actionable insights into how Mondi's 4Ps are integrated for maximum market impact.

Save hours of research and gain a competitive edge by accessing the full, in-depth Mondi 4P's Marketing Mix Analysis, ready for your strategic planning.

Product

Mondi's core product strategy emphasizes sustainable packaging and paper solutions, designed from renewable resources to be recyclable and compostable. This focus directly addresses the growing demand from ESG-conscious investors and corporate clients, who face increasing regulatory and consumer pressure to adopt eco-friendly options. The portfolio leverages the global shift away from plastic, with the sustainable packaging market projected to exceed $430 billion by 2025. This strategic alignment positions Mondi to capitalize on the circular economy transition, enhancing its market position and attracting responsible capital.

Mondi's offerings are strategically structured across three core segments: Corrugated Packaging, Flexible Packaging, and Uncoated Fine Paper. This strategic diversification significantly spreads risk, reaching diverse end-markets like consumer goods, e-commerce, and industrial applications. For instance, Flexible Packaging and Corrugated Packaging collectively contributed over 85% of Mondi's revenue in fiscal year 2024, showcasing balanced, resilient revenue streams. Analyzing each segment’s performance and market outlook, such as e-commerce growth driving corrugated demand, is crucial for evaluating Mondi's overall financial health and future investment potential.

Mondi heavily invests in research and development, a core pillar of its product strategy, to drive innovation. This commitment is evident in their pioneering high-barrier paper-based solutions, which are actively replacing multi-layer plastic packaging to meet evolving sustainability demands. Such innovation, including a significant portion of their €200 million annual capital expenditure for 2024-2025 allocated to growth and sustainability projects, positions Mondi as a leader in industry technological advancement. This creates a strong competitive moat, ensuring long-term value creation and market leadership. These R&D activities are a crucial indicator of Mondi's future growth potential and competitive edge.

Vertically Integrated ion

Mondi's product offering is underpinned by a robust vertically integrated value chain, encompassing everything from managing its own forests to producing pulp, paper, and finished packaging solutions. This comprehensive control provides significant cost advantages, contributing to strong financial performance, and ensures critical supply chain security. Furthermore, it allows for stringent quality control across all product stages, a key differentiator in the market. This strategic command over production fundamentally strengthens Mondi's market position, especially in a volatile global supply environment.

- Mondi's integrated model ensures supply chain resilience, a strategic advantage given global raw material fluctuations.

- The company's focus on sustainable forestry (e.g., 90% FSC/PEFC certified wood in 2023) directly supports its product quality and environmental commitments.

- Vertical integration optimizes costs, contributing to Mondi's underlying EBITDA of €1,354 million in FY 2023.

- This model facilitates consistent product innovation and quality, crucial for maintaining its leadership in packaging solutions through 2024/2025.

Collaborative B2B Development

Mondi operates on a strong business-to-business model, frequently co-creating bespoke packaging solutions directly with its industrial and consumer goods clients. This collaborative strategy ensures products precisely meet specific technical, performance, and crucial sustainability requirements for global brands, reflecting the increasing demand for eco-friendly solutions by 2025. This deep engagement fosters robust, long-term customer relationships, embedding Mondi firmly within their clients' value chains.

- Mondi aims for 100% of its packaging and paper solutions to be reusable, recyclable, or compostable by 2025, driven by B2B co-creation.

- Client partnerships often focus on reducing packaging weight or increasing recycled content, aligning with 2024 circular economy goals.

- Long-term contracts, often spanning multiple years, are a direct result of these tailored B2B developments.

- Mondi’s 2024 investment in R&D for sustainable B2B solutions underlines this strategic commitment.

Mondi's product strategy centers on sustainable packaging and paper, with 100% of solutions targeted to be reusable, recyclable, or compostable by 2025. Their diversified portfolio, led by Flexible and Corrugated Packaging contributing over 85% of FY2024 revenue, offers resilience across varied markets. Significant 2024-2025 R&D investments, part of €200 million CapEx, drive innovation in high-barrier paper solutions. Vertical integration ensures cost control and supply chain security for their B2B co-created offerings.

| Product Focus | 2025 Target | 2024-2025 Investment |

|---|---|---|

| Sustainability | 100% reusable/recyclable/compostable | Significant R&D CapEx |

| Revenue Contribution | Flexible & Corrugated >85% (FY2024) | Market-driven diversification |

| Innovation | High-barrier paper solutions | €200M annual CapEx for growth/sustainability |

What is included in the product

This analysis provides a comprehensive breakdown of Mondi's marketing strategies across Product, Price, Place, and Promotion, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking a deep understanding of Mondi's actual brand practices and strategic implications, ideal for benchmarking or informing market entry plans.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering intricate plans.

Place

Mondi operates an extensive global production network, encompassing approximately 100 production sites across more than 30 countries by 2024. This strategic footprint, heavily focused on Europe, North America, and key emerging markets, ensures efficient and reliable service for its diverse multinational client base. For investors, this significant geographic diversification, covering major economic blocs, effectively mitigates potential geopolitical and regional economic risks, bolstering the company's resilience.

Mondi strategically positions its manufacturing facilities close to major industrial clients and consumer hubs across Europe and North America. This proximity is crucial for minimizing logistics costs, which significantly impacts operational efficiency. By reducing delivery times, Mondi enhances its responsiveness, catering to just-in-time delivery demands, as evidenced by its robust supply chain efficiency target in 2024. This physical placement also lowers the carbon footprint of its supply chain, aligning with 2025 sustainability goals.

Mondi primarily leverages a direct sales force, serving as its core distribution channel to manage relationships with its substantial business customers globally. This strategy includes a robust key account management structure, effectively handling over 60% of group sales from its top 100 customers, ensuring a deep understanding of evolving client needs by early 2025. This direct-to-customer model enhances revenue stability, contributing significantly to Mondi's reported adjusted EBITDA of €1,643 million in the 2024 fiscal year, and provides invaluable market intelligence. Fostering long-term partnerships, this approach underpins client retention and supports strategic product development for packaging and paper solutions.

Integrated and Efficient Supply Chain Logistics

Mondi's place strategy hinges on its highly efficient and integrated supply chain, managing raw materials from its vast forest assets and global suppliers to production plants worldwide. This robust system ensures seamless distribution of finished packaging and paper products to customers across over 100 countries. Operational excellence in logistics, evidenced by a 95% on-time delivery rate in Q1 2024, is a core driver of Mondi's profitability and a key competitive advantage in the global market.

- Global network connects 24 countries with production facilities.

- Integrated system supports €7.7 billion annual revenue (2023).

- Logistics efficiency drives competitive pricing and market reach.

Control Over Raw Material Supply

Mondi's place strategy is significantly bolstered by its control over primary raw materials. The company manages extensive forest lands, ensuring a stable, cost-effective, and sustainable wood fiber supply. This upstream integration insulates Mondi from raw material market volatility, providing critical supply security. As of fiscal year 2024, Mondi manages approximately 2.6 million hectares of forest, primarily in South Africa.

- Secures over 80% of its wood needs from certified sources.

- Reduces reliance on external, volatile timber markets.

- Supports a vertically integrated production model.

- Enhances operational efficiency and cost predictability into 2025.

Mondi's Place strategy leverages an extensive global production network, with approximately 100 sites across over 30 countries by 2024, strategically located near major industrial clients. This proximity minimizes logistics costs and enhances responsiveness, supported by a direct sales force managing key accounts. An integrated supply chain, including control over 2.6 million hectares of forest in 2024, ensures raw material security and achieves 95% on-time delivery. This robust system underpins operational efficiency and market reach.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Production Sites | ~100 across >30 countries | Global market reach |

| Forest Management | ~2.6M hectares (2024) | Raw material security |

| On-Time Delivery | 95% (Q1 2024) | Logistics efficiency |

What You Preview Is What You Download

Mondi 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Mondi 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies. You'll gain valuable insights into Mondi's market positioning and competitive advantages. This ready-to-use document will empower your own strategic planning.

Promotion

Mondi's promotional efforts are keenly aimed at a business-to-business audience, engaging key decision-makers such as procurement managers and packaging engineers. The company strategically employs direct marketing and account-based marketing to foster strong client relationships. Participation in major industry events like Interpack 2023 and upcoming industry forums in 2024/2025 further strengthens brand presence. This highly focused approach ensures marketing resources are efficiently deployed, maximizing reach to specific B2B buyers.

Mondi's comprehensive annual and sustainability reporting serves as a pivotal promotional vehicle, transparently showcasing the company's progress towards its 2025 ESG targets, such as reducing CO2 emissions by 25% from its 2019 baseline. These reports reach a broad stakeholder base, including investors, analysts, customers, and NGOs, fostering significant brand trust. For instance, Mondi's 2024 sustainability report highlights its commitment to circular economy principles, attracting capital from ESG-focused funds. This transparency is crucial for maintaining a strong investor base, with sustainable finance gaining increased prominence in 2025 investment strategies.

Mondi establishes itself as a sustainable packaging leader by publishing insightful content like white papers and market trend analyses. This content, distributed across trade publications and digital channels, positions Mondi as an authority, influencing customer specifications. For example, Mondi's 2024 sustainability report highlights their advanced circular economy solutions, reinforcing a premium brand image. This strategy helps drive demand for their innovative paper-based and flexible plastic solutions, aligning with growing industry focus on environmental responsibility.

Digital Corporate Communications

Mondi Group's corporate website and digital platforms serve as a central hub for all promotional communications, offering detailed insights into their product portfolio and innovation efforts. These channels provide comprehensive information on their robust financial performance, with reported underlying EBITDA reaching €343 million in Q1 2024, and extensive sustainability initiatives. A strong digital presence is essential for communicating effectively with a global stakeholder base, supporting both sales and crucial investor relations functions. This digital strategy ensures transparent and accessible information dissemination across all touchpoints.

- Mondi.com attracts millions of annual visits for product and investor data.

- Digital platforms highlight a target of 100% reusable, recyclable, or compostable packaging by 2025.

- Online financial reports provide detailed insights for investors, reflecting strong 2024 performance.

- Social media channels extend reach for sustainability campaigns and market updates.

Proactive Investor Relations Program

Mondi's promotional mix critically includes its proactive investor relations program, ensuring a transparent dialogue with the financial community. This encompasses robust financial reporting, with its 2024 half-year results expected around August 2024, followed by regular quarterly earnings calls. The company actively participates in investor roadshows and key financial conferences, like those focusing on packaging and paper sectors in late 2024 and early 2025, to engage with stakeholders. These efforts aim to maintain a strong market valuation, which stood at approximately €7.5 billion in mid-2024.

- Mondi's 2024 half-year results are anticipated around August 2024, providing key financial updates.

- The company conducts regular investor roadshows and participates in industry-specific financial conferences throughout 2024 and 2025.

- Its market capitalization was approximately €7.5 billion in mid-2024, supported by consistent investor engagement.

Mondi's promotional strategy primarily targets B2B clients and investors through direct marketing and active participation in 2024/2025 industry events. The company leverages comprehensive 2024 sustainability reports, showcasing its 2025 ESG targets and circular economy solutions to build trust. Digital platforms and proactive investor relations, with Q1 2024 EBITDA at €343 million, reinforce its market position. These efforts support a strong mid-2024 market capitalization of approximately €7.5 billion.

| Promotional Channel | Key Focus | 2024/2025 Data Point |

|---|---|---|

| Industry Events | B2B Client Engagement | Participation in 2024/2025 industry forums |

| Sustainability Reports | ESG Transparency | 2024 report highlights 2025 ESG targets |

| Financial Reporting | Investor Relations | Q1 2024 EBITDA: €343 million |

| Market Valuation | Investor Confidence | Mid-2024 Market Cap: €7.5 billion |

Price

Mondi employs a value-based pricing strategy, where the price of its solutions reflects the tangible value delivered to customers, such as improved sustainability and enhanced product protection. This approach is particularly evident with its innovative, paper-based packaging solutions that replace less sustainable alternatives, aligning with growing global demand for eco-friendly options. For instance, Mondi’s recent investments, exceeding €1 billion in sustainable packaging solutions by 2024, justify a premium. This strategy allows Mondi to capture value from its significant R&D and sustainability investments, optimizing margins in a competitive market.

Mondi's pricing is heavily influenced by the volatile costs of key inputs like pulp, wood, energy, and chemicals. To mitigate this, the company's contractual agreements often incorporate mechanisms allowing for the pass-through of these input cost fluctuations to customers. This strategy is vital for safeguarding profit margins, especially as global pulp prices saw significant shifts in early 2024, impacting the paper and packaging sector. For instance, the ability to adjust pricing based on escalating energy costs, which remained a concern through 2024, directly supports Mondi's financial stability and competitive positioning.

For standardized products like certain corrugated packaging and uncoated fine paper grades, Mondi’s pricing reflects market supply and demand. The company leverages its significant operational efficiency and cost leadership, benefiting from its scale and vertical integration across operations, to remain competitive. This strategic advantage allows Mondi to navigate volatile market conditions effectively. Financial valuations and models for 2024-2025 must critically account for the inherent cyclicality and commodity price fluctuations observed in these segments, impacting revenue forecasts and profitability. For instance, global pulp prices, a key input, have seen shifts, directly influencing paper product costs.

Long-Term Contracts with Key Accounts

Mondi secures a substantial portion of its revenue through long-term contracts with key accounts, ensuring notable price stability and revenue visibility. These agreements, often spanning multiple years, mitigate market volatility and provide a predictable income stream crucial for financial planning, especially when considering capital expenditures projected through 2025. Such contracts frequently include volume commitments and pre-agreed pricing formulas, supporting consistent operational performance.

- Mondi's packaging business, a significant revenue driver, benefits from these stable agreements.

- The company's full-year 2024 outlook reflects resilience due to these contractual arrangements.

- Long-term contracts support consistent cash flow generation and dividend policy.

Pricing Reflective of Sustainability Credentials

Mondi's pricing strategy increasingly incorporates a green premium for products with superior environmental attributes, reflecting a growing market demand. As customers, particularly large corporations, face pressure to meet their own sustainability targets, their willingness to pay for certified, recyclable, or low-carbon packaging solutions increases. This trend is a key driver for future revenue growth and margin expansion, evidenced by the increasing adoption of sustainable packaging across industries. The company's focus on innovative sustainable solutions, like those certified by FSC or PEFC, allows for differentiated pricing.

- Mondi anticipates continued demand for sustainable packaging, driving a green premium in pricing.

- Customers' willingness to pay for certified recyclable or low-carbon solutions is increasing by approximately 5-10% for premium sustainable options.

- This strategic pricing directly supports Mondi's projected revenue growth and margin expansion through 2025.

Mondi's pricing strategy balances value-based approaches for sustainable solutions, supported by over €1 billion invested by 2024, with market-driven pricing for commodity products. It incorporates pass-through mechanisms for volatile input costs like pulp, which fluctuated in early 2024, and leverages long-term contracts for revenue stability. A green premium for sustainable options, with customers willing to pay 5-10% more for certified products, drives 2025 margin expansion.

| Pricing Driver | Impact | 2024/2025 Relevance |

|---|---|---|

| Value-based | Premium for innovation | >€1bn investment justification |

| Input Costs | Price adjustments | Pulp price shifts (early 2024) |

| Green Premium | Margin expansion | 5-10% willingness to pay increase |

4P's Marketing Mix Analysis Data Sources

Our Mondi 4P's analysis leverages a comprehensive blend of primary and secondary data, including company reports, investor relations materials, and direct observations of their product offerings and distribution channels. We also incorporate industry research and competitive analysis to provide a well-rounded view of their marketing mix.