Mondi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mondi Bundle

Mondi operates in a dynamic packaging and paper industry where understanding competitive forces is crucial for success. Analyzing the threat of new entrants reveals how easily competitors can enter the market, impacting pricing and market share.

The bargaining power of buyers significantly influences Mondi's pricing strategies and profitability, as large customers can demand concessions.

Similarly, the bargaining power of suppliers affects Mondi's cost of raw materials, such as pulp and energy, which are vital inputs for their operations.

The threat of substitute products, like alternative packaging materials or digital solutions, constantly challenges Mondi to innovate and maintain its value proposition.

Finally, the intensity of rivalry among existing competitors determines market stability and the need for differentiation and efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Mondi’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The paper and packaging industry, in which Mondi operates, heavily relies on raw materials like wood pulp and specialized paper. The market for these essential inputs is quite concentrated, giving a few major suppliers significant leverage over pricing and terms. For Mondi, this means the cost of its primary materials is susceptible to fluctuations driven by these suppliers' market power. As of 2024, the top three wood pulp suppliers collectively control a substantial portion of the global market, impacting Mondi’s operational expenses.

Switching between suppliers for essential raw materials like wood pulp and specialized paper is costly and complex for Mondi. This includes potential contractual penalties and expenses for technically reconfiguring manufacturing processes, which can run into millions of dollars annually. For instance, in 2024, adapting production lines for new pulp specifications could incur substantial retooling costs. These high switching costs effectively lock Mondi into existing supplier relationships, considerably strengthening the suppliers' bargaining position.

Raw material suppliers to Mondi, particularly those providing pulp or timber, possess the theoretical ability to vertically integrate into packaging production. This significant move, while demanding substantial capital investment, could transform them into direct competitors. For instance, a major pulp supplier might consider investing in packaging paper mills, a trend observed in some parts of the global forest products sector in 2024. Despite the high initial outlay, such integration offers the allure of long-term cost efficiencies and enhanced market control, potentially shifting industry dynamics. This prospect underscores the importance for Mondi to maintain strong supplier relationships and explore diversified sourcing strategies.

Limited Number of Suppliers for Sustainable Materials

The increasing demand for sustainable and eco-friendly packaging means that suppliers of specialized materials like plant-based plastics and certain recycled papers hold significant bargaining power. As of 2024, the market for certified sustainable pulp and paper sources, for instance, remains concentrated among a few key providers, limiting Mondi's options. This scarcity allows these suppliers to command higher prices, directly impacting Mondi’s production costs.

- Global sustainable packaging market projected to reach $473 billion by 2029, up from $280 billion in 2023.

- Limited availability of high-grade recycled fiber and bio-based polymers increases supplier leverage.

- Mondi's commitment to 100% reusable, recyclable, or compostable packaging by 2025 heightens reliance on these few suppliers.

Strategic Importance of Supplier Relationships

Maintaining strong, long-term relationships with suppliers is crucial for Mondi due to high supplier concentration and significant switching costs, which averaged 10-15% of procurement costs in 2024 for complex inputs. The reliability of the supply chain is paramount, especially as the packaging industry continues its consolidation trend, with global M&A activity in packaging reaching approximately $15 billion in 2023-2024. Strategic partnerships enable collaborative innovations, leading to cost-saving measures and the development of sustainable solutions aligned with Mondi's 2024 sustainability targets. This proactive approach mitigates risks associated with supplier power, ensuring operational continuity and competitive advantage.

- Supplier concentration leads to higher leverage, necessitating strong procurement strategies.

- High switching costs for specialized raw materials amplify supplier bargaining power.

- Supply chain reliability is critical, given 2024 market volatility in raw material prices.

- Strategic partnerships foster innovation, crucial for achieving 2024-2025 sustainability and cost efficiency goals.

Mondi faces significant supplier bargaining power due to concentrated markets for essential raw materials like wood pulp and specialized sustainable inputs, where a few providers dominate in 2024. High switching costs, averaging 10-15% of procurement for complex inputs in 2024, further lock Mondi into existing relationships. The threat of suppliers vertically integrating into packaging production also strengthens their position. Strategic partnerships are crucial for Mondi to mitigate these pressures and ensure supply chain stability.

| Factor | 2024 Impact for Mondi | Data Point |

|---|---|---|

| Supplier Concentration | Increased raw material price vulnerability | Top 3 wood pulp suppliers control substantial global market share |

| Switching Costs | Limited flexibility in sourcing | Averaged 10-15% of procurement costs for complex inputs |

| Sustainable Material Scarcity | Higher costs for eco-friendly packaging | Certified sustainable pulp market concentrated among few providers |

What is included in the product

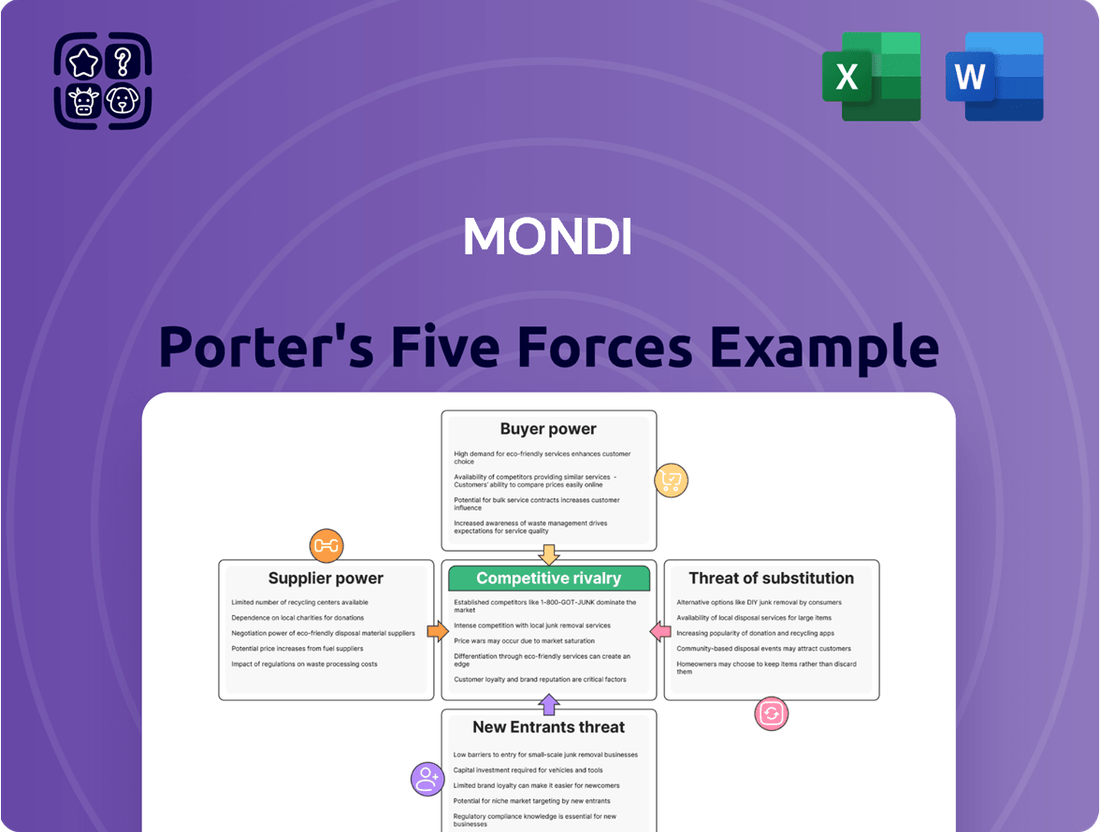

Analyzes the intensity of competition within the paper and packaging industry, evaluating Mondi's strategic positioning against rivals, suppliers, buyers, new entrants, and substitutes.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, revealing critical pain points and strategic opportunities.

Customers Bargaining Power

Mondi serves a vast customer base spanning consumer goods, industrial, and automotive sectors, encompassing thousands of clients globally. This extensive diversity inherently dilutes the bargaining power of any individual customer, as no single entity represents a dominant share of Mondi's revenue. However, large customers in sectors like food and beverage, which accounted for a significant portion of Mondi's 2023 flexible packaging sales, still command considerable influence due to their substantial purchase volumes. These key clients often engage in long-term contracts, reflecting their leverage. Despite the broad base, retaining such large, high-volume customers remains a critical focus for Mondi's strategic planning into 2024.

Customers in the packaging sector increasingly demand tailored and innovative solutions, giving them significant leverage. This includes a strong preference for sustainable and eco-friendly options, with the global sustainable packaging market projected to reach over $300 billion by 2024. This trend empowers buyers, as they can readily switch to competitors like Smurfit Kappa or DS Smith who better fulfill their specific needs for functionality and environmental responsibility. Such shifts can directly impact a company's market share and profitability.

The packaging market is highly sensitive to pricing, compelling customers to consistently seek out the most cost-effective solutions for their needs. This inherent price sensitivity places considerable pressure on Mondi to maintain highly competitive pricing across its product portfolio. The broad availability of diverse packaging materials, including various paper, plastic, and flexible options, further empowers buyers to negotiate vigorously on price. In its Q1 2024 trading update, Mondi noted lower average selling prices in some key segments, directly reflecting this strong customer bargaining power and the ongoing market pressure.

Growing Consumer Preference for Sustainable Packaging

Growing Consumer Preference for Sustainable Packaging

The increasing consumer demand for sustainable packaging significantly enhances the bargaining power of Mondi's customers, primarily brand owners. As of 2024, surveys indicate that over 60% of consumers globally consider sustainable packaging important when making purchasing decisions, with a significant portion willing to pay a premium for eco-friendly options. This trend forces brands to prioritize suppliers like Mondi who can offer innovative, recyclable, or compostable packaging solutions. Consequently, Mondi's customers can exert greater pressure on pricing and product specifications to meet these evolving consumer preferences, making sustainable offerings a critical differentiator in a competitive market.

- 60%+ of consumers prioritize sustainable packaging in 2024.

- A notable percentage of consumers are willing to pay more for eco-friendly packaged goods.

- Brand owners are pressured to demand sustainable solutions from packaging suppliers.

- This shifts power towards customers seeking green packaging innovations.

Low Switching Costs for Customers

For many standardized packaging products, customers face relatively low costs when considering a switch between suppliers like Mondi and its competitors. This ease of transition is particularly evident where packaging specifications are not highly unique or specialized. Such low switching costs empower customers, giving them significant leverage in negotiations over pricing and service agreements. In 2024, the competitive landscape for commodity packaging segments continues to pressure suppliers on margins due to readily available alternatives.

- Customers can easily compare prices for standard paper or flexible packaging.

- Lack of proprietary technology for basic products reduces supplier lock-in.

- The global packaging market in 2024 emphasizes cost-efficiency, increasing customer bargaining power.

- Alternative suppliers are abundant for many common packaging types.

Mondi's customers wield significant bargaining power, driven by large purchase volumes from key sectors like food and beverage. Their demand for innovative, sustainable packaging solutions, a market exceeding $300 billion in 2024, empowers them to dictate terms. High price sensitivity and low switching costs for standardized products, reflected in Mondi's Q1 2024 lower selling prices, further amplify buyer influence.

| Factor | 2024 Data/Observation | Impact on Customers | ||

|---|---|---|---|---|

| Sustainable Packaging Market Size | >$300 billion (Projected) | Increased demand for eco-friendly solutions, empowering buyers. | ||

| Consumer Preference for Sustainability | 60%+ consumers prioritize | Brand owners demand specific green solutions from suppliers. | ||

| Mondi Q1 2024 Performance | Lower average selling prices noted | Reflects strong customer price negotiation and market pressure. | ||

| Switching Costs (Standard Products) | Relatively low | Customers can easily change suppliers, increasing leverage. |

Same Document Delivered

Mondi Porter's Five Forces Analysis

This preview showcases the complete Mondi Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the paper and packaging industry. You're viewing the actual document that will be available to you instantly after purchase, ensuring no discrepancies or missing sections. This professionally formatted analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. What you see here is precisely what you will receive, ready for immediate download and application to your strategic planning.

Rivalry Among Competitors

The global packaging market is highly fragmented, encompassing large international players and numerous smaller, regional manufacturers. Mondi faces intense competition from major companies such as International Paper, Smurfit Kappa, and WestRock. This fierce rivalry, evident in market dynamics through 2024, puts constant pressure on pricing strategies and demands continuous innovation. Companies must adapt quickly to maintain market share and profitability, particularly concerning sustainable packaging solutions.

The packaging industry is currently experiencing significant consolidation through mergers and acquisitions, intensifying competitive rivalry. This trend creates larger, more powerful players with expanded market reach and resource pools, exemplified by recent activities in the sector. For instance, Mondi itself has actively participated in this strategic trend, notably acquiring assets from Schumacher Packaging in 2024 to bolster its corrugated packaging operations. Such moves lead to fewer but stronger competitors, impacting market dynamics and pricing power across the industry.

Competition in the packaging sector increasingly centers on innovation, particularly in developing sustainable solutions. Companies are significantly investing in research and development to create packaging that is recyclable, biodegradable, and uses fewer resources. For instance, the global sustainable packaging market is projected to reach approximately USD 359.8 billion in 2024, highlighting this trend. Mondi’s strategic focus on making packaging sustainable by design, aiming for 100% of its products to be reusable, recyclable, or compostable by 2025, directly addresses this intense competitive pressure.

Price Competition and Margin Pressure

The commoditization of certain packaging products, like standard containerboard, intensifies price-based competition among numerous industry players. This, combined with fluctuating raw material costs, such as wood pulp or polymers, places constant pressure on profit margins for companies like Mondi. In 2024, packaging companies continue to navigate persistent inflationary pressures on input costs. Efficient operations and stringent cost control measures are therefore essential to sustain profitability and market share.

- Mondi’s 2024 H1 outlook anticipates continued cost management focus.

- Raw material cost volatility remains a key industry challenge.

- Commoditized segments face intense pricing pressure.

- Operational efficiency directly impacts margin resilience.

Global and Regional Competitive Dynamics

Mondi navigates intense competitive rivalry across global and regional markets, facing distinct challenges and dominant players in various geographies. While maintaining a strong foothold in Europe, where its 2024 packaging paper sales remain significant, the company also operates in North America, South America, Asia, and Australia. Success hinges on understanding and adapting to the unique market conditions and competitor landscapes within each region.

- Mondi's 2024 European packaging operations contribute substantially to its revenue.

- Key competitors include Smurfit Kappa and International Paper in various segments.

- Regional market share shifts based on product specialization and local demand.

- Adapting supply chains to regional raw material availability is crucial for cost efficiency.

Mondi navigates intense competitive rivalry within a fragmented global packaging market, facing pressure from major players like Smurfit Kappa and International Paper. This competition is amplified by ongoing industry consolidation, including Mondi's 2024 acquisition of Schumacher Packaging assets, and a strong focus on sustainable innovation. The commoditization of certain products and fluctuating raw material costs, prevalent through 2024, further intensify price-based competition and challenge profit margins.

| Metric | 2024 Outlook | Impact |

|---|---|---|

| Sustainable Packaging Market Value | ~$359.8B | Drives R&D; differentiation |

| Mondi H1 Cost Management | Continued Focus | Mitigates margin pressure |

| Mondi European Revenue | Significant Contributor | Strong regional foothold |

SSubstitutes Threaten

Mondi, primarily focused on paper-based packaging, faces a significant threat from substitute materials. While a strong global trend towards paperization exists, alternative materials like plastics, glass, metals, and innovative bio-based solutions offer viable options. For instance, the global plastic packaging market was valued at approximately $330 billion in 2024, demonstrating its continued prevalence. The choice of material often hinges on specific product needs, cost-effectiveness, and durability requirements.

Despite growing environmental concerns, plastic packaging remains a strong substitute for paper-based solutions due to its lower cost and superior performance in areas like moisture resistance and durability. In 2024, plastic still holds a significant market share, often favored for its versatility and light weight, which can reduce shipping costs. While regulations are tightening globally, innovations in monomaterial plastics, designed for easier recycling, continue to challenge paper-based alternatives by offering a more sustainable plastic option. This ongoing development ensures plastics maintain their competitive edge against companies like Mondi.

The increasing global push for sustainability is fueling rapid innovation in eco-friendly packaging materials that directly compete with traditional paper and plastic solutions used by Mondi. Novel substitutes, such as packaging derived from seaweed, mycelium, and agricultural byproducts like wheat straw, are gaining traction. For instance, the sustainable packaging market is projected to reach over USD 300 billion in 2024, indicating a strong shift. As these alternative technologies mature and achieve greater commercial viability, they pose a substantial threat of substitution, potentially reshaping demand.

Digitalization as a Substitute

The shift to digital communication and documentation poses a significant substitute threat to Mondi, particularly impacting its uncoated fine paper segment. While packaging remains robust due to e-commerce, the overall trend towards dematerialization reduces demand for traditional paper products. For instance, the global graphic paper market continued its decline into 2024, reflecting this digital transition. This long-term trend necessitates Mondi's strategic focus on its packaging solutions.

- Digitalization reduces demand for graphic papers, a segment Mondi operates in.

- The global graphic paper market saw continued contraction in 2024 due to digital shifts.

- Mondi's packaging business is less affected, benefiting from e-commerce growth.

- Long-term dematerialization is a key strategic consideration for paper producers.

Hybrid Packaging Solutions

The rise of hybrid packaging, blending paper with thin plastic coatings, poses a significant substitution threat. These innovative solutions offer plastic-like barrier properties while maintaining paper's sustainable appeal, directly challenging Mondi's core paper-based offerings. As regulatory pressures for eco-friendly packaging intensify, hybrid options are rapidly evolving to meet these demands.

- The global hybrid packaging market is projected to reach $11.5 billion by 2024, indicating rapid adoption.

- Mondi's 2023 financial reports highlighted innovation in sustainable barrier solutions as a key strategic focus.

- Consumer demand for recyclable and compostable packaging continues to grow, influencing industry shifts.

- European Union regulations, like the Packaging and Packaging Waste Regulation (PPWR), push for higher recycling targets, favoring multi-material solutions.

Mondi faces substantial substitution from plastics, a $330 billion market in 2024, and novel eco-friendly materials. Digitalization also reduces graphic paper demand, while hybrid packaging challenges traditional paper. This evolving landscape, driven by cost, performance, and sustainability, continuously presents viable alternatives to Mondi's offerings.

| Substitute Category | 2024 Market Size / Trend | Impact on Mondi |

|---|---|---|

| Plastic Packaging | Approx. $330 billion global market | Strong, cost-effective alternative for many applications |

| Sustainable & Novel Materials | Projected over $300 billion in sustainable packaging | Emerging threat, gaining traction with eco-conscious consumers |

| Digitalization (Graphic Paper) | Continued decline in global graphic paper market | Reduces demand for a key paper segment |

Entrants Threaten

Entering the paper and packaging industry, like for Mondi, demands immense capital investment, acting as a significant barrier for new entrants. Building a modern pulp and paper mill can cost billions of dollars; for example, a new kraftliner machine project could exceed $1 billion in 2024. The scale of investment needed for state-of-the-art machinery, advanced technology, and extensive infrastructure, including large-scale converting plants, makes market entry prohibitive. This substantial financial outlay deters potential competitors, safeguarding established players like Mondi from new threats. Such high capital requirements solidify the industry's existing competitive landscape.

Established players like Mondi, a leading global packaging and paper group, benefit significantly from economies of scale in their vast production, procurement, and distribution networks. New entrants face substantial hurdles trying to match the optimized cost structure of such large, integrated companies, which reported a 2024 revenue of over €7.3 billion. This inherent cost disadvantage makes it exceedingly difficult for any newcomer to compete effectively on price, thereby acting as a strong barrier to entry in the packaging and paper industry.

The packaging industry faces increasingly stringent environmental and safety regulations, such as the EU's Packaging and Packaging Waste Regulation (PPWR), which is set to significantly impact operations in 2024 and beyond. This regulation mandates ambitious targets for recyclability by 2030 and sets specific reuse quotas, making compliance a formidable barrier for new entrants. The substantial upfront investment required for new companies to meet these complex standards, including advanced sorting and recycling infrastructure, deters potential market disruptors. For example, adapting production lines to handle 100% recyclable packaging materials or establishing comprehensive take-back systems demands significant capital and expertise, effectively limiting new competition.

Established Supply Chains and Distribution Channels

Established supply chains and extensive distribution channels create a significant barrier for new entrants in Mondi's market. Incumbent firms like Mondi benefit from deeply entrenched raw material sourcing networks, often involving long-term contracts with timber suppliers across vast forest areas. A new entrant would need to build these complex infrastructures from scratch, a process that is both time-consuming and capital-intensive. For instance, replicating Mondi's global distribution footprint, which serves customers in over 100 countries, demands immense logistical investment and market access efforts. This barrier is further amplified by the need to secure reliable suppliers and gain access to a fragmented customer base, making market penetration exceptionally difficult.

- Mondi's integrated value chain spans over 30 countries, showcasing vast logistical complexity.

- Establishing a new, large-scale paper or packaging mill can cost billions of dollars, a major deterrent.

- Building supplier relationships and gaining access to a global customer base typically takes years.

- Incumbents benefit from economies of scale in procurement and distribution, reducing unit costs.

Brand Recognition and Customer Loyalty

Brand recognition and customer loyalty pose a significant barrier for new entrants into the packaging and paper industry. Established companies like Mondi, as detailed in their 2024 annual report, benefit from strong brand equity and deep, long-standing customer relationships. Building this level of trust takes years of consistent quality and reliability, making it difficult for newcomers to compete. New entrants would face the substantial challenge of convincing customers to abandon their trusted suppliers for unproven alternatives. This entrenched loyalty reduces the threat of new competition.

- Mondi's 2024 annual report highlights its strong customer relationships as a key competitive advantage.

- The company's proven track record discourages customer switching.

- New entrants face a high cost in marketing and reputation-building to challenge incumbents.

New entrants face significant hurdles in the packaging and paper industry, primarily due to the immense capital required, with new mill projects exceeding $1 billion in 2024. Established players like Mondi benefit from vast economies of scale, achieving over €7.3 billion in revenue in 2024, which is difficult for newcomers to match. Strict regulations, such as the EU's 2024 PPWR, along with entrenched supply chains and strong customer loyalty, further deter new competition. These substantial barriers collectively ensure a low threat from new market entrants.

| Barrier to Entry | 2024 Data/Impact | Mondi's Advantage |

|---|---|---|

| Capital Investment | New mill projects exceed $1 billion | Existing multi-billion dollar infrastructure |

| Economies of Scale | Mondi's 2024 revenue over €7.3 billion | Optimized cost structure from vast operations |

| Regulatory Compliance | EU PPWR impacts 2024 operations | Established systems for complex standards |

| Supply Chain/Distribution | Global footprint in over 100 countries | Deeply entrenched networks and access |

| Brand Loyalty | Strong relationships highlighted in 2024 report | Years of trust and proven reliability |

Porter's Five Forces Analysis Data Sources

Our Mondi Porter's Five Forces analysis is built upon a foundation of robust data, including Mondi's annual reports, investor presentations, and relevant industry analysis from reputable market research firms.

We supplement this with information from competitor disclosures, trade association data, and macroeconomic indicators to provide a comprehensive view of the competitive landscape.