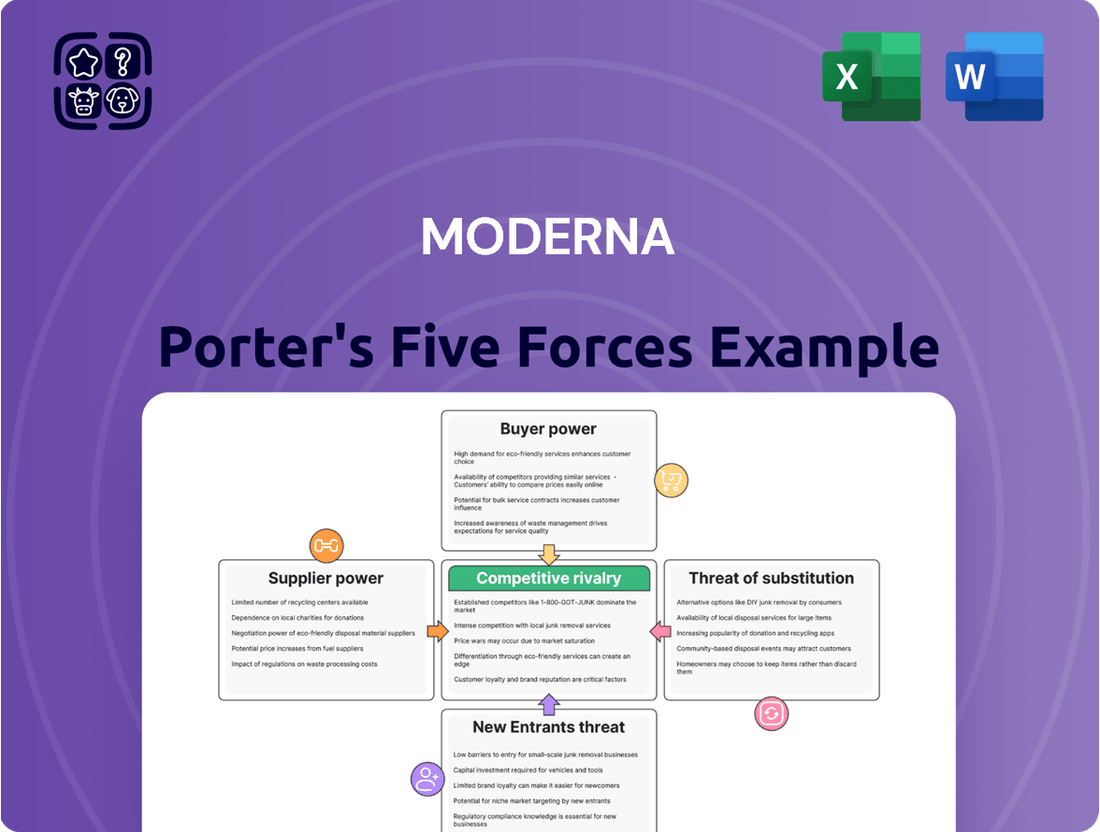

Moderna Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moderna Bundle

Moderna's competitive landscape is shaped by powerful forces, from the intense rivalry among vaccine developers to the significant bargaining power of governments and large healthcare institutions.

The threat of new entrants, while high in terms of scientific innovation, is tempered by substantial regulatory hurdles and the need for massive capital investment in mRNA technology.

Suppliers of raw materials and specialized equipment wield some influence, but Moderna's scale and proprietary processes mitigate this considerably.

The threat of substitutes, though evolving with other vaccine platforms, is currently moderate due to the proven efficacy and rapid deployment capabilities of mRNA technology.

Buyer power is a critical factor, as major purchasers like national health systems and international organizations can negotiate pricing and terms, significantly impacting profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Moderna’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Moderna's reliance on specialized raw materials, such as high-purity nucleotides, lipids, and enzymes essential for mRNA synthesis and LNP formulation, grants suppliers significant bargaining power. These critical components are not readily available from multiple sources, meaning a limited number of specialized manufacturers hold sway over pricing and availability.

The scarcity and specificity of these pharmaceutical-grade materials mean that suppliers are not easily substitutable. This concentration among a few key players allows them to command premium prices, directly impacting Moderna's cost of goods sold. For instance, the cost of lipid excipients, crucial for LNP delivery, has been a notable factor in vaccine manufacturing expenses.

This dependency creates potential supply chain vulnerabilities for Moderna. Any disruption in the supply of these specialized inputs, whether due to production issues, geopolitical factors, or increased demand from other biopharmaceutical companies, could directly hinder Moderna's ability to produce its vaccines and therapies. The company's 2024 production targets are therefore heavily influenced by its ability to secure these vital raw materials.

Moderna relies on Contract Development and Manufacturing Organizations (CDMOs) for critical aspects of its operations, especially for scaling up production and handling complex manufacturing steps. This reliance can give CDMOs a degree of bargaining power, as they possess specialized expertise and facilities that Moderna needs to bring its mRNA vaccines and therapeutics to market.

The market for mRNA CDMO services is experiencing significant growth, with projections indicating a substantial increase in demand. For instance, the global mRNA CDMO market was valued at approximately $6.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030. This rising demand empowers specialized CDMOs, allowing them to negotiate favorable pricing and contract terms with clients like Moderna.

While Moderna has established long-term partnerships with certain CDMOs, which can foster stability and ensure capacity, these agreements can also reduce the company's agility. The commitment to existing contracts might limit Moderna's flexibility to readily switch providers if more advantageous terms or services become available elsewhere, potentially strengthening the bargaining position of its current CDMO partners.

Suppliers who possess critical intellectual property (IP) for essential technologies or components wield significant power. This leverage can manifest as demands for higher royalty payments or the imposition of restrictive licensing terms, directly impacting a company's operational costs and strategic flexibility. For instance, Moderna has been involved in patent disputes concerning its lipid nanoparticle (LNP) delivery technology, underscoring the substantial influence that IP holders can exert.

Skilled Labor and Expertise

The biotechnology sector, particularly in advanced fields like mRNA technology, relies heavily on a specialized talent pool. This includes scientists, researchers, and manufacturing experts who possess unique skills. The limited availability of this highly trained workforce can translate into significant bargaining power for these individuals and the educational institutions that cultivate them.

This scarcity directly impacts operational efficiency and labor expenses for companies like Moderna. For instance, in 2024, the demand for experienced biomanufacturing professionals continued to outstrip supply, leading to increased recruitment costs and potential delays in scaling production. The ability to attract and retain top-tier talent is therefore a critical factor in maintaining a competitive edge.

- High Demand for mRNA Specialists: The rapid advancements and investment in mRNA technology have intensified the need for scientists with specific expertise in this domain.

- Limited Talent Pool: The specialized nature of mRNA research and development means there are fewer qualified individuals compared to broader scientific fields.

- Impact on Labor Costs: This imbalance can drive up salaries and benefits for skilled professionals, increasing operational expenses for companies.

- Strategic Importance of Talent Acquisition: Companies must invest in robust recruitment and retention strategies to secure the necessary expertise for innovation and production.

Regulatory Compliance and Quality Standards

Suppliers to the pharmaceutical sector, including those serving Moderna, face a landscape defined by rigorous regulatory compliance and exacting quality standards. Adherence to protocols like current Good Manufacturing Practices (cGMP) is non-negotiable, demanding substantial investment in specialized facilities, advanced technology, and highly skilled personnel. This creates a barrier to entry, naturally restricting the number of suppliers capable of meeting these stringent requirements. Consequently, suppliers who consistently demonstrate the ability to meet Moderna’s demanding quality and regulatory expectations possess amplified bargaining power.

The ability of suppliers to navigate complex regulatory frameworks, such as those overseen by the FDA and EMA, is a critical differentiator. For instance, in 2024, the pharmaceutical industry continued to see increased scrutiny on supply chain integrity and product quality, reinforcing the value of compliant suppliers. Companies like Moderna rely on a select group of these specialized suppliers, enhancing their leverage. This concentrated demand for highly qualified suppliers means they can command better terms, impacting Moderna’s cost of goods sold.

- High Compliance Costs: Suppliers incur significant costs to maintain cGMP certification and other pharmaceutical-grade standards.

- Limited Qualified Suppliers: The stringent requirements narrow the pool of potential suppliers for critical raw materials and components.

- Supplier Leverage: Those few suppliers meeting these standards can negotiate more favorable pricing and contract terms with pharmaceutical companies like Moderna.

- Quality Assurance Investment: Suppliers must continuously invest in quality control and assurance to retain their approved status, further solidifying their position.

Moderna's reliance on a concentrated group of specialized raw material providers, such as those supplying high-purity nucleotides and lipid excipients, grants these suppliers considerable bargaining power. The scarcity and unique specifications of these inputs mean fewer manufacturers can meet Moderna's stringent quality demands, allowing them to influence pricing and supply availability. For example, the cost of lipid nanoparticles, critical for mRNA delivery, has been a significant component of vaccine production expenses, with reports indicating significant price increases for these specialized materials in 2024.

The limited number of qualified Contract Development and Manufacturing Organizations (CDMOs) capable of handling complex mRNA production processes also empowers these service providers. With the global mRNA CDMO market projected to grow substantially, CDMOs can negotiate favorable terms, impacting Moderna's operational costs. Furthermore, suppliers holding key intellectual property for essential technologies, such as LNP delivery systems, leverage their patents to demand higher royalties or impose restrictive licensing conditions, as seen in ongoing patent disputes.

What is included in the product

Analyzes the competitive intensity and profitability potential for Moderna by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and quantify competitive threats, supplier power, and customer bargaining power to proactively address market pressures.

Customers Bargaining Power

Governments and large healthcare institutions wield significant influence as buyers of vaccines and treatments, particularly during widespread health events. Their capacity to purchase in massive quantities and negotiate nationwide agreements grants them considerable leverage, often resulting in downward pressure on prices and demands for specific contract conditions.

For instance, Moderna's financial outlook for 2025 anticipates a decrease in revenue from COVID-19 vaccine sales, a direct consequence of this evolving customer power dynamic as national procurement strategies shift.

Customers, especially large buyers like governments and insurance companies, are becoming more sensitive to prices. This is particularly true as the market for vaccines and treatments, like those for COVID-19, matures and competition increases. For instance, in 2024, many countries are negotiating lower prices for established vaccines compared to the initial pandemic phase, reflecting this heightened price scrutiny.

The availability of alternative treatments and vaccines significantly amplifies customer bargaining power for companies like Moderna. For instance, the presence of Pfizer/BioNTech's COVID-19 vaccine directly challenges Moderna's market share, forcing it to compete on factors beyond just initial availability. Similarly, in the RSV vaccine market, GSK and Pfizer's offerings provide customers with choices, compelling Moderna to highlight its vaccine's unique advantages, such as efficacy or duration of protection.

Customer Concentration

Moderna's customer base, while global, exhibits a degree of concentration, particularly with government entities and large pharmaceutical distributors. This means a few key buyers can wield significant influence, impacting pricing and contract negotiations. For instance, in 2023, major government contracts for its COVID-19 vaccines represented a substantial portion of its revenue.

This customer concentration directly translates to increased bargaining power for these large clients. They can leverage their purchasing volume to demand lower prices or more favorable terms, potentially squeezing Moderna's profit margins.

- Government Contracts: National health agencies often procure vaccines in massive quantities, giving them considerable leverage.

- Distributor Relationships: Large pharmaceutical wholesalers act as intermediaries, consolidating demand and negotiating on behalf of numerous smaller entities.

- Bulk Purchasing Power: The sheer volume purchased by these key customers allows them to dictate terms more effectively than a fragmented customer base.

Information Asymmetry and Product Knowledge

As mRNA technology advances, information asymmetry concerning its benefits and limitations is steadily decreasing. By July 2025, medical professionals and public health bodies will possess a deeper understanding of mRNA vaccines and therapeutics, directly impacting their negotiation stance with manufacturers like Moderna.

This growing product knowledge empowers customers. For instance, in 2024, several health agencies, armed with comparative efficacy and safety data, began scrutinizing pricing models for advanced therapies, indicating a shift towards more informed purchasing. This transparency allows them to better assess value and challenge higher price points.

- Increased Transparency: Publicly available clinical trial data and real-world evidence for mRNA products are becoming more comprehensive.

- Comparative Analysis: Customers can now more easily compare the performance and cost-effectiveness of mRNA solutions against traditional alternatives.

- Informed Negotiation: A well-informed customer base is better equipped to negotiate terms, including pricing and supply agreements.

- Reduced Reliance on Manufacturer Data: Customers are less dependent on manufacturer-provided information, diminishing the impact of information asymmetry.

Customers, particularly large purchasers like governments and healthcare systems, exert significant bargaining power over Moderna. This is driven by their substantial order volumes, the increasing availability of competing mRNA and traditional therapies, and a growing understanding of product value and pricing. For example, in 2024, many nations are renegotiating vaccine contracts, securing lower prices due to the maturing market and broader competitive landscape.

| Customer Type | Bargaining Power Driver | Impact on Moderna |

|---|---|---|

| Governments & Public Health Agencies | Bulk purchasing, price sensitivity, alternative procurement | Price negotiation leverage, contract terms |

| Large Healthcare Institutions & Insurers | Volume discounts, formulary placement, value-based pricing demands | Margin pressure, evidence-based selling |

| Pharmaceutical Distributors | Consolidated demand, supply chain control | Distribution channel leverage, inventory management |

Preview the Actual Deliverable

Moderna Porter's Five Forces Analysis

This preview showcases the complete Moderna Porter's Five Forces Analysis, demonstrating the depth and detail you'll receive immediately after purchase. You're looking at the actual, professionally written analysis, which meticulously examines the competitive landscape for Moderna, including supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. This comprehensive document is ready for your immediate use, providing actionable insights into Moderna's strategic positioning. No placeholders or sample content; what you see is precisely what you'll download, ensuring no surprises and full value for your investment.

Rivalry Among Competitors

Moderna faces significant competition from other mRNA developers, with BioNTech, partnered with Pfizer, being a primary rival. They directly vie for market share in crucial areas such as infectious disease vaccines, including COVID-19 and RSV, and are increasingly targeting oncology and rare disease treatments.

The race to develop and commercialize mRNA-based therapies means these competitors are constantly innovating and seeking regulatory approvals. For instance, the success of the COVID-19 vaccines highlighted the potent commercial and public health impact of mRNA technology, intensifying the competitive landscape.

Beyond BioNTech, other biotechnology firms are actively investing in and advancing their own mRNA platforms. This broad interest signifies a robust competitive environment where speed to market and scientific efficacy are paramount for capturing market opportunities.

Traditional pharmaceutical giants are formidable competitors due to their deep R&D pockets and established market footholds. Companies like Pfizer, Moderna’s partner for its COVID-19 vaccine, reported $58.5 billion in revenue for 2022, demonstrating their substantial financial capacity to invest in new technologies, including mRNA. These established players can swiftly deploy their vast distribution networks and regulatory expertise to bring competing products to market, often at a faster pace than newer entrants.

Their diversified portfolios also mean they can weather fluctuations in specific therapeutic areas more effectively than a company like Moderna, which has a more concentrated focus on mRNA technology. For instance, Merck & Co. has a broad range of successful drugs and vaccines across various medical fields, providing a buffer against any single product’s performance. This broad base allows them to absorb the costs of developing alternative therapies or investing heavily in competing mRNA platforms.

Competitive rivalry in the mRNA therapeutic space is intense, fueled by the race to develop groundbreaking and highly effective treatments and vaccines. Companies are constantly vying for market share through innovation.

Moderna's strategy to stay ahead involves robust pipeline development, highlighted by updates on its next-generation COVID-19 vaccines and promising flu/COVID combination candidates. These advancements are designed to set its products apart.

The sheer breadth and the demonstrated success rate of a company's product pipeline are paramount. For instance, in early 2024, Moderna announced positive Phase 2 data for its RSV vaccine candidate, MRESV, further bolstering its competitive standing.

Market Growth and Saturation

While the mRNA therapeutics market shows robust growth potential, certain areas are becoming intensely competitive. For instance, demand for COVID-19 vaccines is softening, forcing companies like Moderna to revise revenue expectations amidst a crowded field. This shift highlights how market maturity in specific applications directly fuels competitive rivalry.

New therapeutic areas, such as Respiratory Syncytial Virus (RSV), are also witnessing rapid escalation in competition. With multiple players already having approved products, the barrier to entry for new entrants increases, and established companies face pressure to innovate and differentiate. This dynamic is a clear indicator of intensifying rivalry as the market expands.

Moderna’s financial performance reflects these market dynamics. For 2024, the company has projected revenues between $4.0 billion and $6.0 billion, a reduction from earlier forecasts, largely due to lower expected sales of its COVID-19 vaccine. This adjustment underscores the impact of increased competition and evolving market demand on revenue streams.

The competitive landscape is characterized by:

- Declining demand for COVID-19 vaccines, leading to increased price competition and a focus on market share.

- Emergence of multiple competitors in new mRNA segments, such as RSV, intensifying the race for market penetration and product differentiation.

- Significant R&D investments by all players to develop next-generation mRNA therapies, creating a constant need for innovation to stay ahead.

- Strategic partnerships and collaborations becoming crucial for market access and technological advancement in the face of heightened rivalry.

Global Reach and Manufacturing Capacity

Competitors in the global vaccine market actively seek to expand their reach by building robust manufacturing capacities and extensive distribution networks. Companies are strategically investing in international facilities to ensure a steady supply of critical vaccines and to penetrate diverse geographical markets. For instance, as of early 2024, major players like Pfizer-BioNTech and AstraZeneca continued to leverage their established global manufacturing footprints, often supported by government partnerships and agreements to secure production volumes. Moderna itself is significantly enhancing its international manufacturing presence, with plans for new facilities in locations like Canada and Spain, aiming to bolster its supply chain resilience and market access.

This intense competition means that maintaining and expanding global manufacturing capacity is a key battleground for market share. Companies are not just focused on production volume but also on the efficiency and scalability of their operations to meet fluctuating global demand. The ability to quickly pivot manufacturing lines for new or updated vaccines is also a critical differentiator.

- Global Manufacturing Investment: Competitors are pouring billions into expanding international manufacturing sites to ensure supply chain security and broader market access.

- Distribution Network Development: Establishing and strengthening global distribution networks is crucial for timely and effective vaccine delivery to diverse populations.

- Moderna's Strategy: Moderna is actively investing in international manufacturing facilities, aiming to bolster its global supply chain and reach.

- Rival Footprints: Established competitors already possess significant global manufacturing and distribution capabilities, creating a competitive hurdle for newer entrants.

Competitive rivalry in the mRNA space is fierce, driven by companies like BioNTech, partnered with Pfizer, vying for dominance in vaccines for COVID-19, RSV, and emerging oncology markets. The rapid success of mRNA technology has attracted significant investment, creating a dynamic environment where innovation speed and efficacy are paramount.

Established pharmaceutical giants, with their deep R&D budgets and extensive distribution networks, pose a substantial competitive threat. For instance, Pfizer's 2022 revenue of $58.5 billion illustrates their financial might to compete across multiple therapeutic areas, including mRNA advancements.

Moderna's 2024 revenue projections between $4.0 billion and $6.0 billion, down from earlier forecasts, reflect the impact of increased competition, particularly in the softening COVID-19 vaccine market, and the emergence of rivals in areas like RSV.

Companies are actively expanding global manufacturing and distribution capabilities, investing billions to secure supply chains and market access. Moderna is also enhancing its international presence with new facilities, aiming to strengthen its position against competitors who already possess significant global infrastructure.

| Competitor | Key Therapeutic Areas | Recent Financial Highlight (Approx.) |

|---|---|---|

| BioNTech (Pfizer Partner) | COVID-19, RSV, Oncology | Pfizer 2022 Revenue: $58.5 billion |

| Moderna | COVID-19, RSV, Oncology, Rare Diseases | Moderna 2024 Revenue Projection: $4.0 - $6.0 billion |

| Other Biotech/Pharma | Various mRNA applications | Significant R&D Investment (Industry-wide) |

SSubstitutes Threaten

For infectious diseases, traditional vaccine technologies like inactivated, attenuated, and subunit vaccines are viable substitutes. These established methods often boast proven safety records and come with lower price tags, making them a significant competitive force. For instance, the global vaccine market, excluding COVID-19 vaccines, was valued at approximately $50 billion in 2023, a substantial segment that mRNA technologies must compete with.

Emerging gene and cell therapies pose a significant threat of substitution for Moderna's mRNA platform, particularly in treating genetic and rare diseases. For instance, gene therapies aim to correct underlying genetic defects, offering a potentially curative approach that differs from mRNA's protein-replacement strategy. The market for gene therapies is rapidly expanding, with projections indicating substantial growth, potentially reaching tens of billions of dollars annually in the coming years, presenting a direct competitive alternative.

CRISPR gene editing, another advanced modality, offers precise DNA modification that could circumvent the need for mRNA-based vaccines or therapeutics in certain applications. While still in earlier stages for widespread clinical use compared to some mRNA vaccines, CRISPR's potential to permanently alter disease pathways represents a compelling substitute. The investment in and development of these alternative technologies are accelerating, signaling a competitive landscape where novel solutions could displace current mRNA applications.

Non-pharmaceutical interventions can significantly reduce the need for vaccines and treatments. For instance, robust public health campaigns promoting hygiene, like handwashing, can curb the spread of infectious diseases, thereby lessening demand for vaccinations. In 2023, global spending on public health initiatives aimed at disease prevention reached an estimated $1.8 trillion, demonstrating a substantial investment in these substitute strategies.

Biosimilars and Generics (Long-Term)

While mRNA technology represents a significant innovation, the long-term threat of biosimilars and generics looms. As patents on Moderna's mRNA-based therapies eventually expire, it opens the door for competitors to develop and market similar, lower-cost versions. This could dramatically intensify price competition and erode Moderna's current market exclusivity, impacting revenue streams.

The emergence of biosimilars could force significant price reductions. For example, in the established biosimilar market for biologics, prices can fall by 20-40% or more upon biosimilar entry, a trend likely to impact mRNA therapeutics as well. By 2024, the global biosimilars market was projected to reach over $100 billion, indicating a robust and growing sector ready to challenge established players.

- Patent Expiration: Key patents for Moderna's foundational mRNA technology and specific drug candidates will eventually lapse, creating opportunities for generic or biosimilar development.

- Price Erosion: The introduction of lower-cost biosimilars could lead to substantial price competition, potentially reducing the profit margins on Moderna's successful therapies.

- Market Share Dilution: As more affordable alternatives become available, Moderna may see its market share diminish, especially in indications where efficacy differences between originator and biosimilar products are minimal.

- R&D Investment Pressure: To maintain its competitive edge, Moderna will need to continuously invest in developing new, differentiated mRNA therapies rather than relying solely on older, off-patent products.

Cost-Effectiveness and Accessibility

The threat of substitutes for Moderna's mRNA-based therapies hinges significantly on the cost-effectiveness and accessibility of alternative medical interventions. If other treatments, whether traditional vaccines, small molecule drugs, or gene therapies, can achieve similar health outcomes at a lower price point or are more easily administered, it presents a challenge. For instance, the widespread availability and established manufacturing processes for many traditional vaccines can make them a more accessible substitute in certain therapeutic areas, particularly in resource-constrained settings.

Consider the influenza vaccine market. While Moderna is exploring mRNA technology for flu shots, traditional flu vaccines, often manufactured using egg-based or cell-culture methods, have decades of established production and distribution networks. In 2023, the global influenza vaccine market was valued at approximately USD 10 billion, with a significant portion held by these established methods. Should Moderna's mRNA flu vaccine prove substantially more expensive or face supply chain hurdles, the existing, more accessible substitutes could limit its market share.

Furthermore, the development of novel therapeutic modalities outside of mRNA, such as advanced antibody therapies or sophisticated gene editing techniques, could also emerge as substitutes. The perceived or actual cost-effectiveness and accessibility of these future alternatives will directly impact Moderna's ability to capture and retain market share. If these substitutes offer comparable efficacy with greater ease of patient access or lower long-term healthcare system costs, they could divert demand from Moderna's pipeline.

The pricing power of mRNA therapies is directly challenged by the cost of substitutes. For example, if a new antiviral drug for a specific respiratory illness offers comparable efficacy to an mRNA therapeutic but at a fraction of the cost, healthcare providers and payers may favor the less expensive option. This dynamic is crucial for Moderna as it expands its portfolio into areas with existing treatment paradigms.

Key factors influencing the threat of substitutes include:

- Cost of alternative treatments: Lower prices for comparable therapies increase the threat.

- Availability and accessibility: Wider distribution and easier access to substitutes pose a greater risk.

- Efficacy and safety profiles: Substitutes with similar or superior outcomes and safety records are more competitive.

- Technological advancements in alternative fields: New breakthroughs in non-mRNA therapies can create new substitute options.

- Regulatory pathways for substitutes: Faster or less stringent approval processes for alternatives can impact market entry.

The threat of substitutes for Moderna's mRNA platform is multifaceted, encompassing traditional vaccines, emerging gene therapies, and even non-pharmaceutical interventions. Established vaccine technologies, often more affordable, represent a significant competitive force, especially in infectious disease markets. For instance, the global vaccine market, excluding COVID-19 vaccines, was valued at approximately $50 billion in 2023.

Emerging gene and cell therapies, along with CRISPR gene editing, offer potentially curative alternatives for genetic and rare diseases, presenting a direct challenge to mRNA's protein-replacement strategy. These advanced modalities are seeing accelerated development and investment, indicating a future where they could displace current mRNA applications.

Moreover, non-pharmaceutical interventions like public health campaigns for hygiene can reduce the demand for vaccines, with global spending on disease prevention reaching an estimated $1.8 trillion in 2023. The eventual patent expiration of Moderna's therapies also introduces the threat of biosimilars and generics, potentially leading to price erosion and market share dilution.

Entrants Threaten

Developing mRNA therapeutics and vaccines demands immense financial commitment to research and development. This includes costly preclinical testing, extensive human clinical trials across multiple phases, and navigating complex regulatory approval processes. For instance, bringing a new vaccine to market can easily cost hundreds of millions, if not billions, of dollars, as seen with the extensive development cycles for novel treatments.

These high capital expenditures, coupled with the lengthy development timelines that can span many years, create a formidable barrier for aspiring companies looking to enter the mRNA space. The sheer financial risk and the need for specialized scientific expertise deter many potential new entrants, safeguarding established players like Moderna.

The biotechnology and pharmaceutical sectors, where Moderna operates, are characterized by exceptionally stringent regulatory hurdles. Navigating the complex approval processes mandated by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is a significant barrier to entry for new players.

These lengthy and costly regulatory pathways require substantial investment in research, clinical trials, and documentation. For instance, bringing a new drug to market can take over a decade and cost billions of dollars, making it incredibly difficult for nascent companies to compete with established entities that have already weathered these challenges.

In 2024, the FDA continued to emphasize rigorous data requirements for new drug approvals, particularly for novel therapeutics like mRNA vaccines. Companies must demonstrate not only efficacy but also extensive safety profiles, adding to the initial investment and time commitment for any potential entrant.

The intellectual property landscape presents a significant barrier to new entrants in the mRNA technology space. Moderna, like its peers, operates within a complex patent ecosystem that safeguards its innovations. This dense web of patents covers critical aspects such as mRNA sequence design, lipid nanoparticle (LNP) delivery systems, and intricate manufacturing processes, making it challenging for newcomers to navigate without infringing on existing rights. For instance, by early 2024, Moderna had amassed a substantial patent portfolio, with thousands of granted patents and pending applications worldwide, many of which are foundational to its mRNA vaccine and therapeutic platforms.

Need for Specialized Manufacturing Capabilities

The necessity for specialized manufacturing capabilities presents a significant barrier to entry for new players in the mRNA therapeutics and vaccine market. Developing and operating facilities capable of producing these complex biological products requires substantial capital expenditure and deep technical expertise. For instance, the intricate cold chain logistics and stringent quality control measures needed for mRNA products demand specialized infrastructure that is not readily available.

This high barrier to entry is further amplified by the complex regulatory landscape governing pharmaceutical manufacturing. New entrants must navigate extensive approval processes and demonstrate compliance with Good Manufacturing Practices (GMP), adding considerable time and cost to market entry. Moderna, for example, invested heavily in its mRNA manufacturing platform, underscoring the significant upfront commitment required.

Consequently, the threat of new entrants is somewhat mitigated by the sheer difficulty and expense of establishing competitive manufacturing operations. Potential competitors face the challenge of acquiring or building state-of-the-art facilities, securing specialized raw materials, and developing a highly skilled workforce. These factors combine to create a formidable hurdle for any new company aiming to compete in this sector.

Key aspects of these specialized manufacturing needs include:

- Proprietary Lipid Nanoparticle (LNP) Formulation Technology: Essential for mRNA delivery, requiring advanced chemical synthesis and formulation expertise.

- Sterile Fill-and-Finish Capabilities: Critical for ensuring product safety and efficacy, demanding highly controlled environments and specialized equipment.

- Scalable Bioreactor and Purification Processes: Necessary for large-scale mRNA production, involving complex biological engineering and downstream processing.

- Robust Cold Chain Infrastructure: Vital for maintaining mRNA stability from manufacturing to patient administration, requiring significant investment in logistics and storage.

Established Player Dominance and Brand Loyalty

Established players like Moderna, Pfizer, and BioNTech benefit from significant brand recognition and extensive clinical trial data, particularly following their roles in the COVID-19 pandemic. These incumbents have cultivated deep relationships within supply chains and regulatory bodies, creating formidable barriers for newcomers. For instance, the sheer volume of data and established manufacturing capacity demonstrated by these companies during vaccine development sets a high bar.

New entrants face the daunting task of not only matching this established market presence but also building equivalent levels of trust with healthcare providers and the public. The capital investment required for rigorous clinical trials, regulatory approvals, and scaling production is substantial, making it difficult for nascent companies to compete effectively.

- Brand Recognition: Leading mRNA vaccine developers have cemented strong brand equity, a critical factor in healthcare adoption.

- Clinical Data & Trust: Years of research and successful pandemic response have built significant trust in established players' data.

- Supply Chain Integration: Existing companies possess complex, pre-existing supply chain networks and manufacturing capabilities.

- Resource Intensity: Overcoming these advantages demands immense financial and operational resources from new entrants.

The threat of new entrants in the mRNA therapeutics space is significantly constrained by the immense capital requirements for research, development, and navigating stringent regulatory pathways. Building brand recognition and trust, as exemplified by Moderna's role in the COVID-19 pandemic, also presents a substantial hurdle for newcomers. Furthermore, the complex intellectual property landscape and specialized manufacturing needs create formidable barriers to entry.

In 2024, the ongoing investment in mRNA technology continued to highlight the high cost of entry, with companies reporting R&D expenditures in the hundreds of millions. Regulatory bodies like the FDA maintained rigorous approval standards, demanding extensive safety and efficacy data, which can take years and significant financial outlay to compile. For instance, securing approval for a new therapeutic can involve multiple phases of clinical trials, each costing tens to hundreds of millions of dollars.

The established players, including Moderna, possess thousands of patents covering key mRNA technologies and delivery systems, making it difficult for new entrants to operate without potential infringement. This robust IP portfolio, combined with existing manufacturing infrastructure and established supply chains, acts as a powerful deterrent to new competition. Acquiring or building comparable capabilities requires billions in investment and years of development.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| Research & Development | Preclinical testing, clinical trials (Phases I-III) | Hundreds of millions to billions of USD; 5-15 years |

| Regulatory Approval | FDA/EMA submissions and reviews | Tens of millions of USD; 1-3 years post-clinical trials |

| Intellectual Property | Navigating and potentially licensing existing patents | Variable, can involve significant legal fees and royalties |

| Manufacturing & Supply Chain | Building specialized facilities, securing raw materials, cold chain logistics | Billions of USD; 3-5 years for facility construction |

| Brand Recognition & Trust | Building reputation and clinical validation | Years of consistent performance and significant marketing investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Moderna is built upon a foundation of comprehensive data, including Moderna's own SEC filings, investor presentations, and annual reports. We supplement this with industry reports from reputable market research firms and analyses from financial institutions specializing in the biotechnology and pharmaceutical sectors.