Merck KGaA Darmstadt Germany and its affiliates PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Merck KGaA Darmstadt Germany and its affiliates Bundle

Unlock the strategic landscape of Merck KGaA Darmstadt Germany and its affiliates with our comprehensive PESTLE analysis. Understand how evolving political stability, economic fluctuations, and technological advancements are directly impacting their operations and future growth. We delve into the social shifts and environmental regulations that present both challenges and opportunities for this global science and technology leader. Gain a critical edge by identifying potential risks and emerging trends before your competitors do. Download the full PESTLE analysis now to arm yourself with the actionable intelligence needed to make informed decisions.

Political factors

Government healthcare policies are a major driver for Merck KGaA. Regulations around drug pricing and reimbursement in key markets like Germany and across the European Union directly affect how profitable their pharmaceutical products can be. For instance, shifts in market access rules can open or close significant revenue streams.

The evolving regulatory landscape presents both opportunities and challenges. New legislation, such as Germany's Medical Research Act set to take effect in January 2025, is designed to boost pharmaceutical research and manufacturing within the country. This proactive approach by the German government could create a more favorable environment for Merck KGaA's innovation and production efforts.

Global trade tensions and the imposition of tariffs present a significant political factor for Merck KGaA, Darmstadt Germany. These disruptions can impact the company's intricate global supply chains, affecting the cost and availability of raw materials and finished products. For instance, trade disputes between major economies, like those involving the United States and China, directly influence Merck's ability to operate efficiently and reach its customer base.

Merck KGaA has explicitly acknowledged the influence of the macroeconomic and geopolitical landscape, including tariff uncertainties, on its financial outlook. The company adjusted its 2025 guidance to reflect these external pressures, highlighting the sensitivity of its business to trade policies. This demonstrates a proactive approach to managing the financial ramifications of an unpredictable trade environment.

While recent diplomatic efforts have led to some de-escalation and potential scaling back of tariffs in certain trade relationships, the overall volatility persists. This ongoing uncertainty means that Merck KGaA must remain adaptable, continuously assessing and potentially revising its strategies to mitigate the impact of shifting trade regulations and tariffs on its global operations and profitability.

Political stability in key regions where Merck KGaA operates, such as Germany, the United States, and China, is crucial. Instability can disrupt operations and affect market access. For instance, ongoing geopolitical tensions in Eastern Europe have presented challenges to global supply chains in 2024, impacting logistics and raw material sourcing for many pharmaceutical companies.

Global geopolitical risks, including trade disputes and regional conflicts, create uncertainty for Merck KGaA's international business. These events can influence consumer spending on healthcare products and affect the company's ability to conduct research and development in certain areas.

Merck KGaA's 2025 financial outlook has been cautiously adjusted, acknowledging the impact of the prevailing macro-economic and geopolitical climate. This recalibration underscores the company's sensitivity to external political events, which can alter market demand and investment strategies.

The company's resilience to geopolitical shifts is tested by its diverse global footprint. Navigating varying political landscapes requires agile strategies to mitigate risks associated with supply chain disruptions and regulatory changes, which were evident in the pharmaceutical sector throughout 2024.

Intellectual Property Protection

Merck KGaA's reliance on innovation makes strong intellectual property (IP) protection absolutely vital. The company invests billions in research and development for new pharmaceuticals and advanced materials, and these patents are the bedrock of its competitive edge, preventing cheaper copies from entering the market too soon. For instance, in 2023, Merck KGaA reported €2.7 billion in R&D spending, underscoring the significance of safeguarding these investments.

The strength and consistent enforcement of IP laws across its operating regions directly impact Merck KGaA's ability to recoup its R&D expenditures and fund future breakthroughs. Weakening IP regulations in key markets like the United States or European Union could expose its highly profitable products, such as its oncology or immunology drugs, to premature generic competition, thereby eroding market share and profitability.

- R&D Investment: Merck KGaA's significant R&D expenditure, reaching €2.7 billion in 2023, highlights the critical need for IP protection to ensure a return on these investments.

- Patent Safeguard: Robust IP laws are essential to protect Merck KGaA's patented medicines and high-tech materials from unauthorized replication and market entry by competitors.

- Market Risk: Any deterioration or inconsistency in IP enforcement across major markets poses a direct threat to Merck KGaA's pricing power and long-term competitive advantage.

- Innovation Incentive: Strong IP frameworks encourage Merck KGaA to continue its substantial investment in developing novel treatments and advanced materials.

Government Funding for Research and Development

Government funding and incentives are crucial for driving innovation, especially within sectors like life sciences and electronics where Merck KGaA operates. These initiatives can significantly accelerate advancements in areas such as drug discovery and cutting-edge technology development. For instance, the U.S. government's investment in scientific research, while subject to shifts, directly impacts the landscape for contract research organizations, potentially influencing Merck KGaA's collaborative projects.

Government support, through grants and tax credits, acts as a catalyst for R&D. In 2024, the U.S. National Institutes of Health (NIH) budget remained substantial, funding critical biomedical research. However, concerns about potential reductions in academic and government lab spending, as observed in past fiscal cycles, can create headwinds for companies reliant on external research partnerships.

Supportive government policies can also streamline regulatory pathways for new therapies and technologies. Initiatives aimed at fostering a robust scientific ecosystem can lead to:

- Increased investment in early-stage research

- Faster translation of scientific discoveries into marketable products

- Enhanced competitiveness in global markets

- Development of specialized research infrastructure

Government healthcare policies profoundly shape Merck KGaA's operational landscape, influencing everything from drug pricing and reimbursement to market access. Legislation like Germany's upcoming Medical Research Act in January 2025 aims to bolster domestic pharmaceutical research and manufacturing, potentially creating favorable conditions for the company's innovation pipeline.

Global trade dynamics and tariff impositions present ongoing political risks for Merck KGaA, impacting its supply chains and the cost of materials. Despite some de-escalation in certain trade relationships, persistent volatility necessitates continuous strategic adaptation to mitigate the effects of shifting trade regulations on its global operations.

Political stability in key markets such as Germany, the US, and China is paramount for Merck KGaA's business continuity and market access. Geopolitical tensions, like those observed in Eastern Europe throughout 2024, have demonstrably disrupted global supply chains, affecting logistics and raw material sourcing.

Merck KGaA's 2025 financial outlook reflects a cautious approach, acknowledging the influence of the broader geopolitical and macroeconomic climate. This recalibration underscores the company's sensitivity to external political events that can alter market demand and strategic investment decisions.

What is included in the product

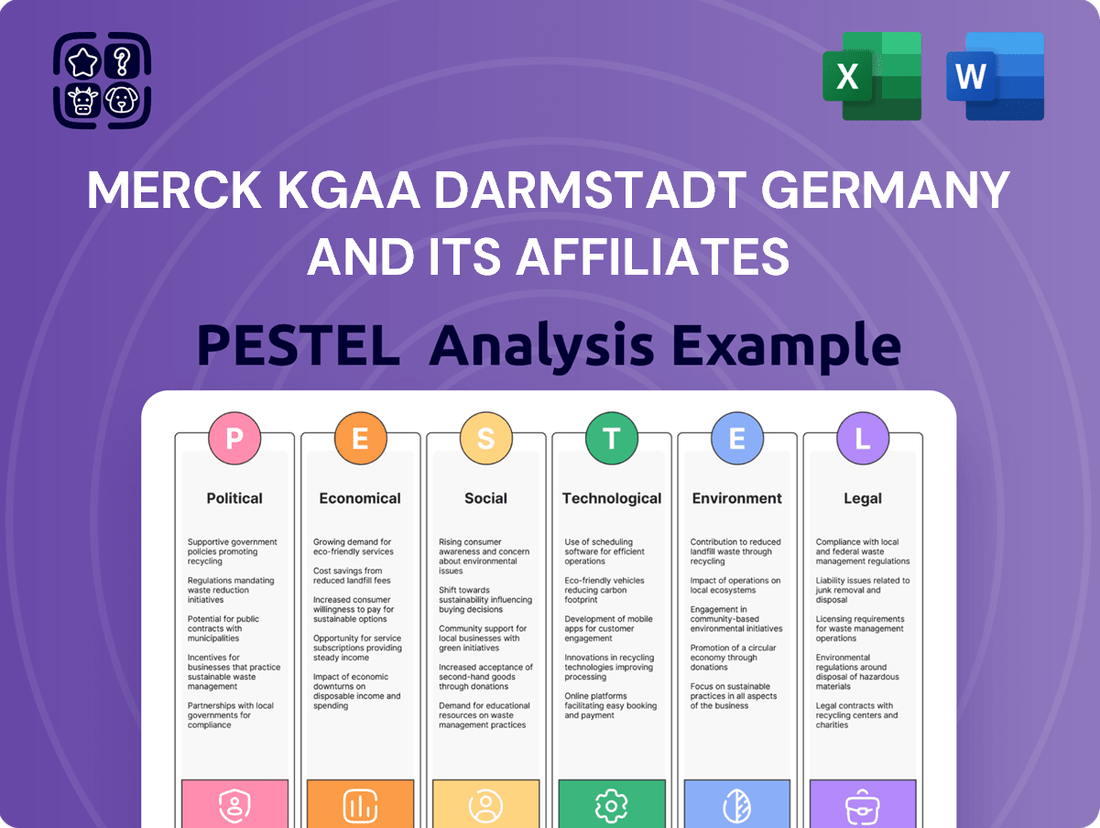

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting Merck KGaA, Darmstadt, Germany, and its global affiliates.

It provides actionable insights into how these macro-environmental factors create both challenges and strategic opportunities for the company in its diverse markets.

This PESTLE analysis provides a clean, summarized version of external factors impacting Merck KGaA Darmstadt Germany and its affiliates, simplifying complex market dynamics for easier referencing during strategic discussions.

By visually segmenting external influences into Political, Economic, Social, Technological, Environmental, and Legal categories, this analysis allows for quick interpretation and identification of key pain points and opportunities for Merck KGaA Darmstadt Germany and its affiliates.

Economic factors

Global economic growth remains a key driver for Merck KGaA, Darmstadt, Germany. In 2024, projections for global GDP growth were around 2.7%, a slight slowdown from previous years, but still indicating expansion. This growth directly impacts demand for Merck's pharmaceuticals, as higher disposable incomes often translate to increased healthcare expenditure.

However, recession risks persist, particularly in certain regions. For instance, the ongoing geopolitical tensions and inflationary pressures in early 2025 could lead to revised growth forecasts. A significant economic downturn would likely curb consumer spending on elective treatments and reduce industrial demand for Merck's life science and electronics materials.

The life science segment, crucial for research and development, is sensitive to R&D budgets, which can be pressured during economic contractions. Similarly, the electronics sector, supplying materials for semiconductors and displays, faces cyclical demand tied to consumer electronics and automotive production, both vulnerable to economic headwinds.

Merck’s diversified business model, spanning healthcare, life science, and electronics, offers some resilience. Yet, a synchronized global recession in late 2024 or early 2025 would undoubtedly present significant challenges to sales volumes and pricing power across all its divisions.

Merck KGaA, operating globally, faces risks from currency exchange rate shifts. These fluctuations affect how their sales and profits, initially in foreign currencies, are reported in Euros. For example, in the first quarter of 2025, currency movements provided a modest boost to sales in certain business areas, though generally, they introduce unpredictability into the company's financial performance.

The strength or weakness of currencies like the US Dollar against the Euro can significantly alter the reported value of Merck's international transactions. If the Euro strengthens, foreign earnings translate to fewer Euros, potentially impacting revenue figures. Conversely, a weaker Euro can inflate reported foreign earnings, making international sales appear more robust than they might be in local currency terms.

For 2024, analysts projected that a 5% appreciation of the Euro against a basket of major currencies could reduce Merck's reported earnings per share by approximately 1-2%, highlighting the tangible impact of these monetary shifts on profitability.

Inflationary pressures present a significant challenge for Merck KGaA, Darmstadt, Germany. For instance, in 2024, global inflation rates, while moderating from previous peaks, remained elevated in many regions, directly impacting the cost of essential inputs like specialty chemicals, active pharmaceutical ingredients, and energy. This upward trend in procurement and operational expenditures can squeeze profit margins if not effectively managed through strategic sourcing and pricing adjustments.

Furthermore, the prevailing interest rate environment, influenced by central bank policies aimed at curbing inflation, directly affects Merck KGaA's financing costs. As of mid-2024, major central banks continued to maintain higher benchmark interest rates. This translates to increased expenses for any debt financing required for capital expenditures, research and development initiatives, or potential acquisitions, thereby influencing the company's investment capacity and overall financial strategy.

Healthcare Spending and Reimbursement Trends

Healthcare spending is a significant driver for pharmaceutical companies like Merck KGaA. Governments and private insurers are increasingly scrutinizing these costs, leading to evolving reimbursement models that directly influence market access and pricing power. For instance, in 2024, many European countries, including Germany, continued to implement stricter price negotiation frameworks and value-based assessment criteria for new medicines.

These trends put pressure on drug prices and can impact revenue generation within Merck KGaA's Healthcare sector. Changes in reimbursement mechanisms, such as the German drug pricing regulation (Arzneimittelmarktneuordnungsgesetz - AMNOG), which assesses added benefit and influences pricing, are crucial factors.

- Global healthcare spending is projected to reach $10 trillion by 2025, according to some estimates, highlighting the immense market but also the increased focus on cost containment.

- In 2024, reimbursement policies in key markets like the US and EU continued to favor drugs demonstrating clear clinical utility and cost-effectiveness.

- Germany's IQWiG assessments play a vital role in determining the added benefit of pharmaceuticals, directly impacting their reimbursement status and price negotiations.

- The trend towards value-based healthcare means that outcomes and patient benefit are increasingly tied to reimbursement levels.

Semiconductor and Life Science Market Dynamics

Merck KGaA's performance is closely tied to the economic cycles of its key markets. The semiconductor sector, after a period of adjustment, is showing signs of recovery. For instance, industry analysts projected global semiconductor revenue to grow by approximately 13% in 2024, reaching over $600 billion, a positive indicator for Merck's electronics business which supplies advanced materials for chip manufacturing.

The life science segment, however, continues its trajectory of steady growth. This sector benefits from ongoing investment in biopharmaceutical research and development, diagnostics, and bioprocessing. In 2023, Merck KGaA reported robust sales in its Life Science business sector, indicating sustained demand for its products and services, a trend expected to continue into 2025.

Looking ahead to 2025, a rebound in semiconductor demand is expected to bolster Merck KGaA's electronics division. Simultaneously, the life science business is anticipated to maintain its growth momentum, driven by innovation and expanding healthcare needs worldwide. These combined dynamics position the company favorably for continued financial success.

- Semiconductor Market Recovery: Global semiconductor revenue forecast for 2024 is over $600 billion, representing a significant year-over-year increase.

- Life Science Growth: The life science segment has demonstrated consistent sales growth, supported by advancements in biotechnology and healthcare.

- 2025 Outlook: Merck KGaA anticipates that the recovery in semiconductors and ongoing strength in life sciences will positively impact its financial performance.

- Key Market Drivers: Demand for advanced materials in chip production and investment in biopharma R&D are critical economic factors for Merck's businesses.

Economic factors significantly influence Merck KGaA's performance across its diverse business segments. Global economic growth, while projected to moderate in 2024 around 2.7%, directly impacts demand for its products. However, persistent recession risks and regional geopolitical tensions in early 2025 could dampen consumer spending and industrial demand, affecting both the life science and electronics sectors.

Inflationary pressures and the resulting higher interest rates in 2024 and into 2025 increase operational costs and financing expenses for Merck. Currency exchange rate fluctuations also introduce financial unpredictability, as seen with a 5% Euro appreciation potentially reducing earnings per share by 1-2% in 2024. Healthcare spending trends, particularly cost containment measures and evolving reimbursement models in key markets, directly impact the Healthcare sector's pricing power and market access.

The semiconductor market is showing signs of recovery, with industry projections for 2024 global revenue growth exceeding 13%, benefiting Merck's electronics business. Concurrently, the life science segment continues its steady growth trajectory, driven by robust investment in biopharmaceutical R&D and diagnostics, a trend expected to persist into 2025, positioning Merck favorably for continued financial success.

Preview the Actual Deliverable

Merck KGaA Darmstadt Germany and its affiliates PESTLE Analysis

This preview accurately reflects the comprehensive PESTLE analysis of Merck KGaA, Darmstadt, Germany, and its affiliates that you will receive upon purchase. The document meticulously details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting this global science and technology company. You can trust that the content and structure you see here are precisely what you'll be working with after completing your transaction.

Sociological factors

The world's population is getting older, and with that comes more chronic illnesses. This trend is a major driver for healthcare companies like Merck KGaA. As more people live longer with conditions such as cancer, diabetes, and heart disease, the need for prescription medicines and treatments continues to grow. For example, in 2023, the global population aged 65 and over was projected to reach over 770 million people, a significant increase that translates directly into sustained demand for pharmaceuticals. This demographic shift is a key factor supporting the long-term growth prospects for Merck KGaA's Healthcare sector, as its portfolio often addresses these very conditions.

Growing public awareness about health and a strong emphasis on preventative measures are significantly shaping consumer choices and healthcare spending. This trend directly benefits companies like Merck KGaA, Darmstadt, Germany, as it fuels demand for their diagnostic tools, vaccines, and early detection products. For instance, the global vaccine market, a key area for Merck KGaA, was projected to reach over $130 billion in 2024, highlighting the substantial impact of public health initiatives and individual health-consciousness.

Societal trends are strongly favoring personalized medicine, with individuals increasingly seeking treatments tailored to their unique genetic makeup and lifestyle. This shift, driven by greater health awareness and a desire for more effective therapies, is reshaping demand within the life sciences sector.

Merck KGaA, recognizing this evolution, is actively investing in research and development that supports precision medicine. Their pipeline includes diagnostics and targeted therapies designed to address specific patient profiles, reflecting a strategic alignment with these growing lifestyle-driven demands.

For instance, advancements in companion diagnostics, which identify patients most likely to benefit from specific drugs, are crucial. By 2024, the global personalized medicine market was projected to reach hundreds of billions, underscoring the significant commercial opportunity for companies like Merck KGaA that can deliver these specialized solutions.

Public Perception and Corporate Social Responsibility

Public perception significantly shapes the success of pharmaceutical giants like Merck KGaA, Darmstadt, Germany. A strong commitment to Corporate Social Responsibility (CSR) directly influences brand reputation, customer trust, and the ability to attract top talent in a competitive industry. In 2023, surveys indicated that over 70% of consumers consider a company's social and environmental impact when making purchasing decisions, a figure likely to grow.

Merck KGaA's strategic focus on sustainable science and technology is pivotal for cultivating a positive societal image. Their transparent reporting on sustainability initiatives, including progress towards their 2025 environmental targets, builds credibility. For instance, their 2023 sustainability report highlighted a 15% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline.

- Brand Reputation: Positive CSR perception can lead to increased brand loyalty and preference, crucial in the healthcare sector.

- Talent Attraction: A strong CSR record makes companies more attractive to potential employees, particularly younger generations who prioritize purpose-driven work. In 2024, LinkedIn data showed a 30% increase in job applications to companies with strong CSR commitments.

- Stakeholder Trust: Transparency in sustainability reporting, as demonstrated by Merck KGaA's annual disclosures, fosters trust among investors, regulators, and the general public.

- Societal Impact: Beyond financial performance, a company's contribution to societal well-being, such as through access to medicines or environmental stewardship, is increasingly scrutinized.

Access to Healthcare and Equity

Societal expectations for fair access to healthcare, including vital medicines and vaccines, are increasingly shaping pharmaceutical companies' strategic decisions. This demand for equity influences research and development priorities, pricing strategies, and distribution models.

Merck KGaA, Darmstadt, Germany, actively addresses these societal pressures. Their commitment to broadening access to their products, exemplified by initiatives like the Merck PACT (Partnership for Access to Cancer Treatment), directly responds to these expectations and bolsters their social license to operate. Such programs aim to make critical therapies available in underserved regions, reflecting a growing awareness of global health disparities.

- Global Health Initiatives: Merck KGaA's participation in programs like the Global Alliance for Vaccines and Immunization (GAVI) underscores their role in addressing vaccine access challenges, particularly in low- and middle-income countries.

- Philanthropic Contributions: The company's investments in disease prevention and treatment programs in developing nations, often in partnership with NGOs, demonstrate a tangible response to calls for greater equity.

- Affordability and Access Programs: Merck KGaA often implements patient assistance programs and works on tiered pricing models to improve the affordability of its medicines, acknowledging that cost is a significant barrier to equitable access.

- Advocacy for Universal Healthcare: While specific company stances may vary, the broader industry trend, which Merck KGaA participates in, involves engaging in discussions and supporting policies that aim for more universal healthcare coverage.

Societal trends are increasingly prioritizing health and wellness, driving demand for preventative care and advanced treatments, which directly benefits Merck KGaA's diverse portfolio. For instance, the global population aged 65 and over was projected to exceed 770 million in 2023, highlighting a sustained need for pharmaceutical solutions. Furthermore, a growing emphasis on personalized medicine, with the market projected to reach hundreds of billions by 2024, underscores the advantage of Merck KGaA's investment in precision therapies and diagnostics.

Public perception and corporate social responsibility are crucial for Merck KGaA's reputation and talent acquisition, with over 70% of consumers considering social impact in 2023. Merck KGaA's commitment to sustainability, evidenced by a 15% reduction in Scope 1 and 2 emissions by 2023 against a 2020 baseline, builds stakeholder trust. The company’s engagement in global health initiatives, like GAVI, and patient assistance programs addresses societal expectations for equitable access to healthcare.

| Sociological Factor | Impact on Merck KGaA | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Aging Population | Increased demand for pharmaceuticals and treatments for chronic diseases. | Global population aged 65+ projected over 770 million (2023). |

| Health & Wellness Awareness | Growth in demand for diagnostics, vaccines, and preventative products. | Global vaccine market projected over $130 billion (2024). |

| Personalized Medicine | Opportunity for targeted therapies and diagnostics. | Personalized medicine market projected to reach hundreds of billions (by 2024). |

| CSR & Public Perception | Enhances brand reputation, talent attraction, and stakeholder trust. | Over 70% of consumers consider social impact (2023); 30% increase in job applications to CSR-strong companies (2024). |

| Healthcare Access Equity | Drives strategic focus on affordability and distribution initiatives. | Merck KGaA's participation in global health initiatives and patient assistance programs. |

Technological factors

Merck KGaA, Darmstadt, Germany, is heavily influenced by rapid advancements in biotechnology. Areas like genomics, biologics, and novel therapeutic modalities are fundamental to driving innovation within its healthcare and life science divisions. These scientific leaps are not just theoretical; they translate directly into new product development and market opportunities.

The company's commitment to research and development is substantial, with significant investments fueling its ability to capitalize on these technological breakthroughs. For instance, in 2023, Merck KGaA reported R&D expenses of approximately €2.7 billion. This financial backing is crucial for exploring cutting-edge science and bringing new treatments to patients.

Strategic acquisitions are also a key component of Merck KGaA's approach to leveraging technological progress. The company's acquisition of SpringWorks Therapeutics in late 2023, valued at up to $2.5 billion, exemplifies this strategy. This move aims to strengthen Merck KGaA's pipeline, particularly in oncology, by integrating innovative therapies and research capabilities.

These technological factors empower Merck KGaA to develop next-generation medicines and diagnostics. By staying at the forefront of fields like gene editing and personalized medicine, the company can address unmet medical needs and maintain a competitive edge in the rapidly evolving pharmaceutical landscape.

Merck KGaA is actively embracing digital transformation, with a significant focus on integrating generative AI and advanced data analytics across its operations. This strategic shift aims to revolutionize its research and development pipelines, making discoveries faster and more efficient. For instance, in 2024, the company continued to invest in AI-driven drug discovery platforms, anticipating a substantial acceleration in identifying novel therapeutic candidates.

The adoption of cloud computing is central to Merck KGaA’s digital strategy, enabling greater scalability and data accessibility for its global teams. By leveraging these cloud-based infrastructures, the company is enhancing its supply chain visibility, ensuring more resilient operations and timely delivery of critical products. This digital backbone is crucial for managing the complexities of the life sciences sector, especially in light of increasing global demand and regulatory requirements.

Generative AI holds particular promise for Merck KGaA, offering new avenues for personalized medicine and optimizing clinical trial designs. The company is exploring AI’s potential to analyze vast datasets, leading to more targeted treatments and improved patient outcomes. This technological advancement is expected to provide a competitive edge, allowing Merck KGaA to respond more dynamically to market needs and scientific breakthroughs throughout 2024 and into 2025.

Operational excellence is a key driver for Merck KGaA’s digital transformation efforts. By implementing AI and advanced analytics, the company is streamlining internal processes, from manufacturing to customer engagement. This focus on efficiency not only reduces costs but also frees up resources for innovation, positioning Merck KGaA for sustained growth in the rapidly evolving life sciences landscape.

The relentless pace of innovation in advanced materials like gallium nitride (GaN) and graphene is fundamentally reshaping the electronics sector. These materials are crucial for developing components that offer superior energy efficiency and enhanced performance, directly impacting everything from consumer electronics to industrial applications.

Merck KGaA, through its dedicated electronics business, is a key player in this dynamic landscape. The company supplies essential materials and sophisticated solutions that enable these high-tech advancements. For example, in 2023, Merck KGaA reported significant growth in its Electronics business sector, driven by demand for its semiconductor materials, highlighting the direct correlation between material science innovation and business success.

Automation and Smart Manufacturing

Merck KGaA is significantly investing in automation and smart manufacturing. For instance, in 2024, the company announced plans to expand its semiconductor materials production facilities, incorporating advanced automation to boost output and efficiency. This push towards Industry 4.0 principles, including the Internet of Things (IoT) and advanced robotics, is crucial for maintaining a competitive edge in its Life Science and Electronics business sectors.

These technological advancements offer tangible benefits. By integrating IoT sensors and data analytics, Merck KGaA can achieve real-time monitoring and predictive maintenance, thereby reducing downtime and operational costs. Furthermore, the adoption of 3D printing, particularly in specialized applications within Life Science, allows for greater customization and faster prototyping, accelerating product development cycles.

The impact on Merck KGaA's operations is substantial:

- Enhanced Efficiency: Automation streamlines complex processes, leading to higher throughput and reduced waste.

- Cost Reduction: Optimized resource utilization and reduced manual labor contribute to lower production expenses.

- Improved Quality: Precision control offered by smart manufacturing minimizes errors and ensures consistent product quality.

- Increased Flexibility: Agile manufacturing systems enable quicker adaptation to market demands and product variations.

Data Analytics and Personalized Medicine Technologies

Technological advancements in data analytics are fueling the growth of personalized medicine, a key area for Merck KGaA. The ability to process vast amounts of patient data allows for more targeted and effective treatments. For instance, by 2024, the global big data and business analytics market was projected to reach over $333 billion, underscoring the pervasive influence of data in driving innovation across industries, including pharmaceuticals.

Merck KGaA's commitment to precision therapies directly leverages these technological shifts. Sophisticated data analytics and advanced diagnostic tools are critical for identifying individual patient profiles and tailoring treatments accordingly. This approach is central to their strategy in areas like oncology, where understanding genetic mutations is paramount for selecting the most effective therapy.

- Data-Driven Drug Discovery: Merck KGaA utilizes AI and machine learning to accelerate the identification of potential drug candidates and predict treatment efficacy, analyzing massive biological datasets.

- Genomic Sequencing and Biomarkers: The company relies on advanced genomic sequencing technologies to identify patient-specific biomarkers, which guide the selection of personalized treatments.

- Real-World Evidence (RWE): Merck KGaA is increasingly incorporating RWE from electronic health records and patient registries to refine treatment protocols and demonstrate the value of its therapies in diverse patient populations.

- Digital Health Platforms: Investment in digital health platforms supports the collection and analysis of patient data, enabling remote monitoring and the development of integrated care pathways for chronic diseases.

Merck KGaA, Darmstadt, Germany, is actively integrating generative AI and advanced data analytics to enhance its research and development, aiming to accelerate drug discovery and optimize clinical trials. The company's significant R&D investment, reaching approximately €2.7 billion in 2023, underscores its commitment to leveraging these technological advancements. Strategic acquisitions, such as the late 2023 deal for SpringWorks Therapeutics (up to $2.5 billion), further bolster its capacity to capitalize on cutting-edge science and personalized medicine approaches throughout 2024 and into 2025.

The company's electronics business is deeply intertwined with innovations in advanced materials like gallium nitride (GaN) and graphene, which are crucial for high-performance components. Merck KGaA's investment in automation and smart manufacturing, including expansion of semiconductor materials production in 2024, highlights its drive towards Industry 4.0 principles to boost efficiency and output. This focus on operational excellence through digital transformation is key to maintaining its competitive edge across its Life Science and Electronics sectors.

Legal factors

Merck KGaA operates under a rigorous regulatory framework governing its pharmaceutical activities. Compliance with agencies like the FDA in the US and EMA in Europe is paramount for drug approval, manufacturing standards, and marketing practices. For instance, the recent EU Pharma Package, expected to be fully implemented in 2025, aims to streamline and potentially accelerate approval processes while also introducing stricter post-market surveillance.

Changes to regulations, such as the EU's Variation Regulation, directly influence how Merck KGaA manages post-approval changes to its medicines. These updates can affect the speed and cost associated with bringing updated treatments to market or maintaining existing ones. The pharmaceutical industry's reliance on robust clinical trials and data integrity is also heavily scrutinized by these regulatory bodies, making adherence to Good Clinical Practice (GCP) a critical ongoing requirement.

Merck KGaA, like all pharmaceutical giants, operates within a complex web of intellectual property laws, with patent protection being absolutely crucial. These legal frameworks safeguard the company's innovative drug discoveries and diagnostic technologies, forming the bedrock of its revenue streams and competitive advantage. Without robust patent protection, the significant investment in research and development would be vulnerable to immediate replication by competitors.

A significant challenge for Merck KGaA in 2024 and heading into 2025 is managing the impact of impending patent expirations for key blockbuster drugs. For instance, while specific current drug patent cliffs are proprietary, the general industry trend means that as patents expire, generic competition enters the market, dramatically reducing sales for originator products. This necessitates a proactive approach to innovation and strategic portfolio management to ensure a pipeline of new, patent-protected treatments to offset anticipated revenue declines.

Merck KGaA, Darmstadt, Germany, a major global pharmaceutical and life science company, operates under strict antitrust and competition laws across all its markets. These regulations are designed to prevent monopolies and ensure a level playing field for all businesses, which is particularly crucial in the highly competitive healthcare sector.

The company's growth strategies, including mergers and acquisitions, are closely scrutinized by regulatory bodies. For instance, its proposed acquisition of SpringWorks Therapeutics, valued at approximately $1.1 billion in March 2024, requires approval from antitrust authorities to ensure it does not unduly stifle competition in the oncology drug market.

Data Privacy and Cybersecurity Regulations

Merck KGaA, Darmstadt, Germany, and its affiliates must navigate a complex web of data privacy and cybersecurity regulations, with the General Data Protection Regulation (GDPR) in Europe being a prime example. These laws dictate how the company collects, processes, and stores sensitive patient and research data, directly impacting operational procedures and requiring significant investment in compliance. Failure to adhere can result in substantial fines; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust cybersecurity is therefore not just a legal necessity but a critical component of preserving patient trust and safeguarding proprietary research. In 2023, the global average cost of a data breach reached $4.45 million, underscoring the financial imperative for strong data protection measures.

The company's commitment to data protection is demonstrated through ongoing investments in cybersecurity infrastructure and employee training. Key areas of focus include:

- Data Minimization: Only collecting and retaining data that is strictly necessary for specified purposes.

- Consent Management: Ensuring clear and informed consent is obtained for data processing activities.

- Security by Design: Integrating data protection principles into the development of new products and systems.

- Incident Response: Establishing and regularly testing plans to address and mitigate data breaches effectively.

Labor Laws and Employment Regulations

Merck KGaA, like any global enterprise, navigates a complex web of labor laws and employment regulations across its operating regions. These laws govern everything from hiring practices and compensation structures to employee benefits and termination procedures, directly impacting Merck's ability to manage its diverse workforce effectively. For instance, in Germany, the Works Constitution Act (Betriebsverfassungsgesetz) grants significant co-determination rights to employee works councils, influencing decisions on working conditions and personnel matters. The company's commitment to compliance across its approximately 64,000 employees as of the end of 2023 is paramount for maintaining stable employee relations and avoiding costly legal disputes.

Staying abreast of evolving employment legislation is critical for Merck KGaA's global strategy. This includes adapting to new regulations concerning remote work, data privacy for employees, and diversity and inclusion mandates that are becoming increasingly stringent in major markets. For example, the European Union's General Data Protection Regulation (GDPR) significantly shapes how employee personal data can be collected and processed. Failure to comply can result in substantial fines, impacting both financial performance and corporate reputation. Merck's workforce planning and HR policies must therefore be flexible enough to accommodate these varying legal landscapes.

- Global Workforce Diversity: Merck KGaA operates in over 66 countries, necessitating adherence to a wide array of national labor laws.

- Compliance Costs: Significant resources are allocated annually to ensure adherence to employment regulations, including training and legal counsel.

- Safety Standards: Workplace safety regulations, such as those mandated by OSHA in the United States, are critical in Merck's research and manufacturing facilities.

- Employee Relations: Managing employee expectations and rights within different legal frameworks is a continuous focus for Merck's human resources division.

Merck KGaA, Darmstadt, Germany, faces significant legal and regulatory hurdles concerning drug approvals, manufacturing, and marketing. Compliance with bodies like the FDA and EMA is crucial, with new frameworks like the EU Pharma Package impacting approval timelines and post-market surveillance, set to be fully implemented by 2025.

Intellectual property law, especially patent protection, is fundamental to Merck's revenue and competitive edge. The company must navigate patent expirations for key drugs, a trend expected to intensify in 2024-2025, necessitating a strong pipeline of new, patented treatments to offset potential sales declines from generic competition.

Antitrust laws scrutinize Merck's growth strategies, including acquisitions like the $1.1 billion deal for SpringWorks Therapeutics, requiring regulatory approval to prevent market monopolization. Data privacy laws, such as GDPR, mandate stringent data handling, with GDPR fines potentially reaching up to 4% of global annual revenue, underscoring the need for robust cybersecurity measures, which cost an average of $4.45 million globally in 2023.

Labor laws, including Germany's Works Constitution Act granting co-determination rights, affect Merck's workforce management across its 66 operating countries. Adapting to evolving employment legislation, such as new remote work policies and stricter diversity mandates, is critical for maintaining stable employee relations and avoiding legal disputes.

Environmental factors

Merck KGaA is actively addressing climate change and its impact on operations, recognizing the growing pressure from regulators and society for environmental responsibility. The company has established clear targets to reduce its greenhouse gas (GHG) emissions.

A key commitment is to achieve net-zero GHG emissions across all global operations, encompassing Scopes 1, 2, and 3, by the year 2045. This ambitious goal is supported by significant interim reduction targets set for 2030, demonstrating a phased approach to decarbonization.

Water is a critical element in Merck KGaA's manufacturing, particularly within its Life Science sector, where it's used extensively in production. The company actively assesses water-related risks across its operations to ensure reliable supply and mitigate potential disruptions.

Merck KGaA has set a sustainability goal to maintain its water usage at or below 2015 levels by the year 2025, demonstrating a commitment to reducing its water footprint. This objective is supported by the implementation of advanced technologies designed for greater water efficiency.

Effective management of water resources is paramount for the long-term operational sustainability of Merck KGaA, impacting both cost-efficiency and environmental responsibility. The company's focus on resource management aligns with broader industry trends toward conservation and sustainable practices.

Merck KGaA Darmstadt Germany is actively pursuing waste reduction and embedding circular economy principles across its operations. A key objective is to ensure that by 2025, no more than 20% of global operational waste is sent to landfills or incinerators without energy recovery. This commitment reflects a proactive approach to environmental stewardship and aligns with increasing global regulatory pressures and heightened consumer demand for sustainable business practices.

Pollution Control and Environmental Compliance

Merck KGaA, Darmstadt, Germany, operates under stringent environmental protection laws, mandating rigorous compliance in areas like pollution control, hazardous waste management, and emissions reduction. Failure to adhere to these regulations can lead to significant fines and reputational damage, making proactive environmental stewardship a business imperative.

The company demonstrates its commitment by implementing high environmental standards across its manufacturing processes to minimize ecological footprints and proactively manage associated risks. This includes investments in advanced technologies for waste treatment and emission abatement.

- Environmental Investments: In 2023, Merck KGaA reported a significant increase in its sustainability efforts, with €347 million invested in environmental protection measures, a notable rise from previous years, indicating a strong focus on compliance and impact reduction.

- Emissions Reduction Targets: The company is committed to ambitious targets, aiming for a 50% reduction in Scope 1 and Scope 2 greenhouse gas emissions by 2030 compared to a 2020 baseline, a crucial aspect of its pollution control strategy.

- Waste Management Efficiency: Merck KGaA aims to increase the proportion of waste recycled or recovered to 75% by 2025, reflecting its dedication to responsible hazardous waste disposal and circular economy principles.

Sustainable Sourcing and Supply Chain Responsibility

Merck KGaA, Darmstadt, Germany, is increasingly integrating stringent sustainability standards into its procurement processes, aiming to foster environmental responsibility throughout its extensive supply chain. This commitment is crucial for managing its environmental impact, particularly concerning Scope 3 emissions, which represent a substantial part of the company's overall carbon footprint.

The company actively collaborates with its suppliers to identify and implement strategies for reducing these indirect emissions. This collaborative approach is essential for achieving broader sustainability goals and ensuring that environmental considerations are embedded at every stage of product development and delivery. For instance, in 2023, Merck KGaA reported progress in engaging suppliers on climate action, with a significant percentage of its key suppliers setting their own emissions reduction targets.

- Scope 3 Emissions Focus: Merck KGaA is prioritizing the reduction of its Scope 3 emissions, which are generated from its value chain and are a major component of its environmental impact.

- Supplier Engagement: The company actively works with its suppliers to encourage and support their efforts in adopting sustainable practices and setting emission reduction goals.

- Sustainable Procurement Standards: Strict sustainability criteria are being applied to procurement activities, ensuring that suppliers align with Merck KGaA's environmental commitments.

- Value Chain Responsibility: This focus extends environmental responsibility beyond direct operations, encompassing the entire lifecycle of its products and services.

Merck KGaA is making substantial environmental investments, with €347 million dedicated in 2023 to environmental protection measures, reflecting a strong commitment to compliance and impact reduction.

The company is on track to achieve its goal of sending no more than 20% of global operational waste to landfills or incinerators without energy recovery by 2025, and aims for 75% of waste to be recycled or recovered by the same year.

Merck KGaA is also focused on reducing its greenhouse gas emissions, targeting a 50% decrease in Scope 1 and 2 emissions by 2030 compared to a 2020 baseline, and is actively engaging suppliers to address Scope 3 emissions.

| Environmental Commitment | Target Year | Key Metrics/Goals |

| Net-zero GHG Emissions | 2045 | Scopes 1, 2, and 3 emissions reduction |

| Scope 1 & 2 GHG Emissions Reduction | 2030 | 50% reduction from 2020 baseline |

| Operational Waste to Landfill/Incinerator (without energy recovery) | 2025 | Maximum 20% |

| Waste Recycled or Recovered | 2025 | At least 75% |

| Water Usage | 2025 | At or below 2015 levels |

| Environmental Protection Investments | 2023 | €347 million |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Merck KGaA, Darmstadt, Germany, and its affiliates is constructed using a comprehensive blend of data from reputable financial institutions, regulatory bodies, and leading market research firms. We integrate insights from official government publications, economic databases, and industry-specific reports to ensure a robust understanding of the macro-environmental landscape.