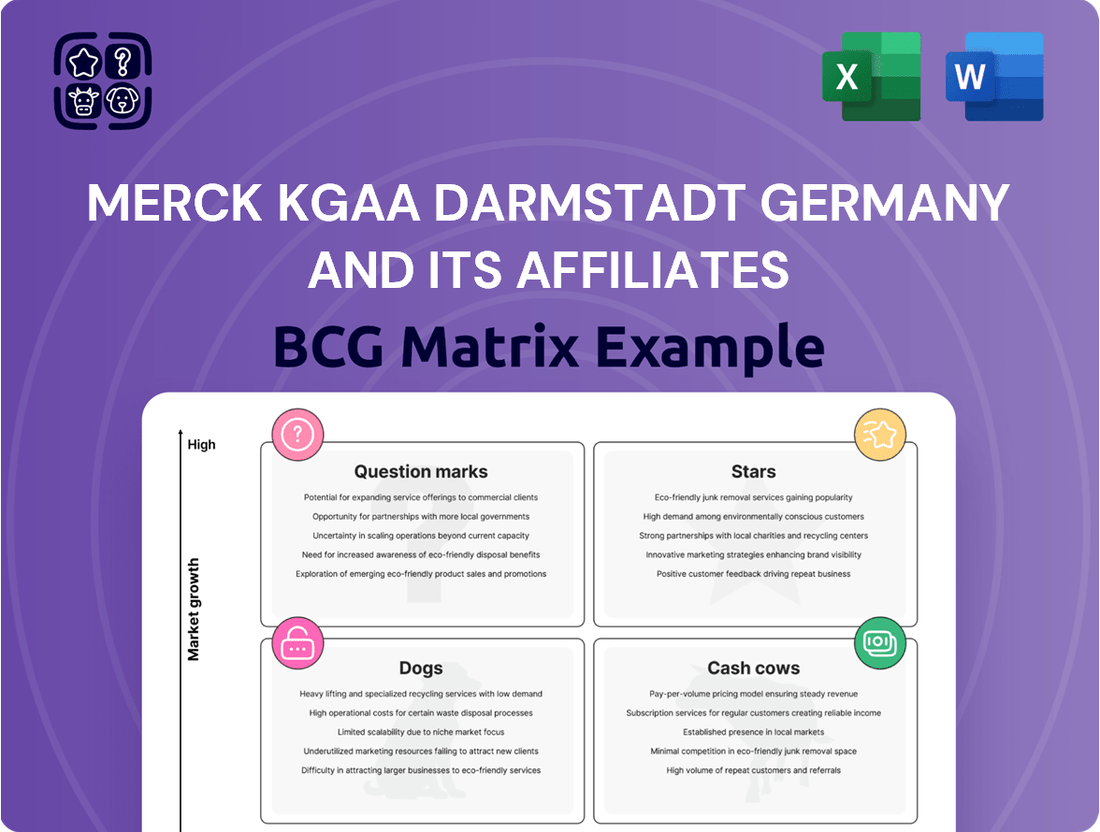

Merck KGaA Darmstadt Germany and its affiliates Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Merck KGaA Darmstadt Germany and its affiliates Bundle

Merck KGaA, Darmstadt, Germany, a global science and technology powerhouse, operates across Healthcare, Life Science, and Electronics. Understanding their product portfolio through the lens of the BCG Matrix is crucial for strategic decision-making. This preview offers a glimpse into their market positioning, hinting at the potential for strong performers and areas needing development.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Merck KGaA Darmstadt Germany's Semiconductor Solutions unit is a clear Star in its BCG Matrix. This segment, focusing on materials for cutting-edge semiconductor manufacturing and the booming AI chip sector, is experiencing robust growth.

The demand for advanced electronics and artificial intelligence is a major driver for this business. Merck KGaA's strong market position in supplying critical materials for these sophisticated applications underpins its Star status.

In 2024, the Semiconductor Solutions business demonstrated its strength with an impressive organic sales growth of 7.8%. This growth highlights the unit's leadership and its ability to capitalize on the expanding semiconductor market, particularly within AI-driven technologies.

Merck KGaA's Process Solutions business, a vital part of its Life Science sector, stands as a prominent Star in the BCG matrix. This segment is a significant growth engine, offering essential products and services across the pharmaceutical manufacturing lifecycle. It supports everything from traditional drug production to cutting-edge treatments like cell and gene therapies.

In the first quarter of 2025, Process Solutions achieved impressive double-digit organic growth. This surge was fueled by a rebound in customer demand for its comprehensive offerings. The business unit’s strong performance solidifies its status as a high-growth, high-market-share segment within the industry.

Merck KGaA, Darmstadt, Germany's oncology pipeline, particularly its focus on DNA Damage Response inhibitors (DDRi) like tuvusertib and M9466, alongside Antibody-Drug Conjugates (ADCs) such as M9140 and M3554, clearly positions these programs as Stars within its BCG Matrix.

These advanced therapeutic modalities target high-growth oncology segments with considerable unmet patient needs, driving significant R&D investment.

The company plans to initiate multiple new Phase Ib and II clinical trials in 2024 and 2025, underscoring its commitment and the strong potential for these assets to capture substantial market share.

This aggressive clinical development strategy in areas like DDR inhibition and ADC technology reflects Merck KGaA's aim to lead in next-generation cancer treatments.

Pimicotinib (TGCT Treatment)

Pimicotinib, an investigational drug targeting tenosynovial giant cell tumors (TGCT), is positioned as a Star within Merck KGaA, Darmstadt, Germany's portfolio. This drug, a selective CSF-1R inhibitor, addresses a significant unmet medical need in a rare cancer indication.

The drug's trajectory is bolstered by strong regulatory progress. In June 2025, its marketing authorization application was accepted in China, accompanied by a Priority Review designation. Furthermore, Pimicotinib has received Breakthrough Therapy Designation in both the United States and the European Union, underscoring its potential to revolutionize TGCT treatment.

Clinical validation from the Phase 3 MANEUVER study provides robust evidence for Pimicotinib's efficacy and market potential. This data suggests a high growth trajectory and a strong market entry, positioning it as a key future revenue driver for the company.

- Investigational Drug: Pimicotinib, a CSF-1R inhibitor for TGCT.

- Regulatory Milestones: Marketing authorization application accepted in China (June 2025) with Priority Review; Breakthrough Therapy Designation in US and EU.

- Clinical Support: Positive Phase 3 MANEUVER study data indicates high growth potential.

- Market Position: Addresses a significant unmet need in a rare tumor indication, suggesting strong market entry.

Acquired Growth Drivers (e.g., SpringWorks Therapeutics)

Merck KGaA Darmstadt Germany's strategic acquisitions, like the anticipated purchase of SpringWorks Therapeutics, are positioned within its growth strategy akin to Stars in the BCG Matrix. These moves are deliberate, aimed at strengthening the company's mid- to long-term viability and fueling expansion in lucrative sectors such as rare tumors.

The deal, slated for completion in the latter half of 2025, is designed for immediate revenue contribution and earnings accretion. This reflects a focused investment in opportunities that are both high-growth and possess leading market positions.

- Strategic Acquisition as Star: SpringWorks Therapeutics acquisition signifies Merck KGaA's strategy to invest in businesses with high growth potential and market leadership, aligning with the 'Star' category in the BCG matrix.

- Focus on Rare Tumors: The acquisition specifically targets the rare tumors segment, a high-potential area chosen to bolster Merck KGaA's long-term sustainability and accelerate growth.

- Financial Impact: Expected to close in the second half of 2025, the SpringWorks deal is projected to immediately contribute to revenues and be accretive to earnings, indicating a positive financial outlook.

Merck KGaA Darmstadt Germany's Semiconductor Solutions unit is a clear Star in its BCG Matrix, driven by robust growth in materials for advanced semiconductor manufacturing and the AI chip sector. In 2024, this business achieved an impressive 7.8% organic sales growth, reflecting its strong market position and ability to capitalize on the expanding semiconductor market, particularly in AI-driven technologies.

The Process Solutions business within the Life Science sector also shines as a Star, acting as a significant growth engine with essential products for pharmaceutical manufacturing. This unit experienced double-digit organic growth in Q1 2025, fueled by a rebound in customer demand, further solidifying its high-growth, high-market-share status.

Merck KGaA's oncology pipeline, specifically its DNA Damage Response inhibitors and Antibody-Drug Conjugates, are also Stars. These advanced therapies target high-growth oncology segments with significant unmet needs, supported by aggressive clinical development plans including multiple new trials slated for 2024 and 2025.

Pimicotinib, an investigational drug for tenosynovial giant cell tumors, is another Star, benefiting from strong regulatory progress including Priority Review in China and Breakthrough Therapy Designation in the US and EU. Positive Phase 3 MANEUVER study data further supports its high growth trajectory.

Strategic acquisitions, such as the anticipated purchase of SpringWorks Therapeutics, are also positioned as Stars, designed to bolster mid- to long-term viability and fuel expansion in lucrative sectors like rare tumors. This deal, expected to close in H2 2025, is projected to contribute immediately to revenue and earnings.

| Business Unit/Pipeline | BCG Status | Key Drivers | 2024/2025 Data Points | Strategic Importance |

| Semiconductor Solutions | Star | AI chip demand, advanced manufacturing materials | 7.8% organic sales growth (2024) | High-growth technology enabler |

| Process Solutions (Life Science) | Star | Pharmaceutical manufacturing, cell & gene therapy support | Double-digit organic growth (Q1 2025) | Core growth engine in Life Science |

| Oncology Pipeline (DDRi, ADCs) | Star | Unmet medical needs, next-gen cancer treatments | Multiple Phase Ib/II trials planned (2024-2025) | Leadership in innovative oncology |

| Pimicotinib | Star | Rare cancer indication, strong regulatory progress | China MAA accepted with Priority Review (June 2025); US/EU Breakthrough Therapy Designation | Addressing significant unmet need |

| SpringWorks Therapeutics Acquisition | Star | Rare tumors, revenue and earnings accretion | Expected H2 2025 completion; immediate revenue/EPS contribution | Strategic expansion into high-potential areas |

What is included in the product

Merck KGaA's diverse portfolio, analyzed via the BCG Matrix, reveals strategic opportunities.

The company balances established Cash Cows with promising Stars and Question Marks.

Merck KGaA's BCG Matrix offers a pain point reliever by providing a clear, visual overview of its diverse business units.

This allows for strategic resource allocation and identification of areas needing investment or divestment, streamlining complex portfolio management.

Cash Cows

Merck KGaA Darmstadt Germany’s established Cardiovascular, Metabolism, and Endocrinology (CM&E) franchise continues to be a cornerstone of its Healthcare sector, demonstrating robust organic sales growth. This mature market segment is characterized by Merck KGaA’s strong and stable market share, translating into reliable cash flow generation with comparatively lower promotional investment needs.

In the first quarter of 2025, the CM&E portfolio was the largest contributor to growth within Merck KGaA's Healthcare business. This sustained performance underscores its role as a cash cow, consistently generating significant revenue and supporting the company's overall financial health and investment capacity.

Merck KGaA's Science & Lab Solutions business unit is a prime example of a Cash Cow within their BCG matrix. This segment, serving pharmaceutical, biotech, and academic research, holds a significant market share in a stable, albeit slower-growing, life science sector. It consistently generates substantial revenue, allowing Merck to fund other strategic initiatives. For instance, in 2023, the Life Science sector, which encompasses this unit, reported net sales of €10.6 billion, demonstrating its robust contribution to the company's overall financial health.

Merck KGaA's established pharmaceutical products, such as the oncology drug Erbitux and the multiple sclerosis treatment Mavenclad, function as cash cows within its portfolio. These treatments hold significant market share in their respective, mature therapeutic areas, ensuring a reliable stream of income for the company. Their consistent revenue generation provides the financial stability needed to fund research and development into new therapies.

Display Solutions (now Optronics)

Merck KGaA's Display Solutions business, rebranded as Optronics in January 2025, functions as a Cash Cow within their Electronics sector. This unit supplies essential materials to the mature display industry, maintaining a robust market position and delivering steady revenue streams. Although not a high-growth segment, its stability and established market share are key to its cash-generating capability.

This strategic positioning allows Optronics to contribute significantly to Merck KGaA's overall financial health. The company's recent decision to divest portions of its Surface Solutions business, announced in late 2024, underscores a broader strategy to concentrate on and maximize value from its core, high-performing segments like Optronics.

- Segment: Display Solutions (now Optronics)

- BCG Matrix Classification: Cash Cow

- Key Contribution: Consistent revenue generation from a mature market

- Strategic Rationale: Focus on optimizing stable, high-share businesses

Basic Research Chemicals & Lab Materials

Merck KGaA's Basic Research Chemicals & Lab Materials segment within its Life Science business is a quintessential Cash Cow. This broad portfolio, encompassing essential reagents and general laboratory supplies, generates a steady and substantial revenue stream due to its high-volume, routine use across global research institutions and industries.

The consistent demand for these foundational products, vital for daily laboratory operations, translates into predictable sales. For instance, in 2024, the Life Science sector of Merck KGaA, Darmstadt, Germany, continued to demonstrate robust performance, contributing significantly to the company's overall financial health, with its diverse catalog of chemicals and consumables underpinning much of this stability.

The established market presence and widespread adoption of these basic chemicals mean that marketing and promotional expenditures can be kept relatively low. This efficiency, coupled with the high volume of sales, allows for attractive profit margins, further solidifying its Cash Cow status.

- Segment: Basic Research Chemicals & Lab Materials (Life Science)

- Role: Cash Cow

- Key Characteristics: High volume, essential products, routine usage, low promotional investment, high profit margins.

- Financial Impact (Illustrative based on 2024 trends): Consistent revenue generation and significant contribution to overall profitability due to market maturity and low reinvestment needs.

Merck KGaA Darmstadt Germany's established Healthcare franchise, particularly in Cardiovascular, Metabolism, and Endocrinology (CM&E), continues to be a significant Cash Cow. This segment benefits from strong market share in mature therapeutic areas, leading to consistent revenue generation with manageable investment needs.

The Life Science sector, encompassing Basic Research Chemicals & Lab Materials, also operates as a Cash Cow. Its broad portfolio of essential laboratory supplies generates high-volume sales, ensuring predictable revenue streams and healthy profit margins due to its mature market status and lower promotional costs.

Merck KGaA's Optronics business, formerly Display Solutions, functions as a Cash Cow within the Electronics sector. It commands a robust position in the mature display materials market, delivering stable revenue that supports the company's overall financial stability and funding for growth initiatives.

Established pharmaceutical products like Erbitux and Mavenclad are also key Cash Cows. Their strong market presence in mature indications provides a reliable income stream, enabling Merck KGaA to reinvest in the development of innovative future therapies.

| Business Unit | BCG Matrix Classification | Key Characteristics | Financial Contribution |

| Cardiovascular, Metabolism, and Endocrinology (CM&E) | Cash Cow | Mature market, strong market share, stable revenue | Significant contributor to Healthcare sector growth and profitability |

| Life Science (Basic Research Chemicals & Lab Materials) | Cash Cow | High volume, essential products, low promotional investment | Consistent revenue generation and strong profit margins |

| Optronics (formerly Display Solutions) | Cash Cow | Mature display industry, robust market position | Steady revenue streams supporting overall financial health |

| Established Pharmaceuticals (e.g., Erbitux, Mavenclad) | Cash Cow | Mature therapeutic areas, strong market share | Reliable income to fund R&D for new treatments |

What You’re Viewing Is Included

Merck KGaA Darmstadt Germany and its affiliates BCG Matrix

The BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase, offering a comprehensive strategic overview of Merck KGaA, Darmstadt, Germany, and its affiliates. This detailed analysis, meticulously crafted by industry experts, is designed to provide actionable insights into the company's diverse business units and their market positions. You will download the exact, unwatermarked report, ready for immediate integration into your strategic planning, business development, or investor relations efforts. The full document contains no demo content and is formatted for professional use, ensuring you gain the clarity needed to make informed decisions about Merck KGaA's portfolio.

Dogs

LAGEVRIO, Merck KGaA's antiviral treatment for COVID-19, is showing signs of becoming a 'Dog' in the BCG matrix. Global demand for COVID-19 specific therapies has significantly softened as the pandemic shifts and vaccination rates increase. This declining demand directly impacts LAGEVRIO's market position, pushing it into a low-growth, competitive environment.

Merck KGaA's 2023 financial reports indicated a substantial drop in LAGEVRIO sales, with the company projecting further declines. For instance, the company reported approximately $1.3 billion in LAGEVRIO sales for the first nine months of 2023, a sharp decrease from previous periods. This trend points to a product with a diminishing market share and low growth prospects.

As a 'Dog' in the BCG matrix, LAGEVRIO is likely to generate low returns or even break even. Maintaining its market presence requires continued investment in marketing and distribution, which may not yield significant returns given the shrinking market. Merck KGaA may consider divesting or phasing out production to reallocate resources to more promising ventures.

Merck KGaA Darmstadt Germany's Surface Solutions business, specifically segments like performance materials for automotive coatings and other industrial applications, has been classified as a Dog in the BCG Matrix. These areas typically exhibit low growth rates and hold a relatively small market share, making them less strategic for the company's future. In 2024, this classification reflects the ongoing strategic shift by Merck KGaA to divest these non-core assets.

The divestiture of these particular Surface Solutions units, with an agreement signed in late 2023, underscores their status as low-growth, non-core operations. Merck KGaA's decision to shed these businesses is aimed at concentrating resources on its more promising, high-growth sectors within its Electronics business, such as semiconductors and display materials. This move is designed to streamline operations and improve overall profitability.

Merck KGaA Darmstadt Germany, like other pharmaceutical giants, likely manages a portfolio that includes older, off-patent small molecule drugs. These products, facing significant generic competition, would typically occupy a low market share in mature, slow-growth therapeutic areas. While specific examples for Merck KGaA are not publicly detailed in a BCG matrix format, such assets would generally generate modest returns due to commoditization and pricing pressures. For instance, the global market for off-patent small molecules is highly competitive, with price erosion being a common characteristic.

Legacy Products with Limited Innovation Potential

Merck KGaA's portfolio may include legacy products in sectors like Healthcare, Life Science, or Electronics that exhibit limited innovation prospects within mature or declining markets. These offerings, while potentially still contributing to revenue, are unlikely to experience significant growth. In 2024, companies are increasingly scrutinizing such assets to optimize capital allocation and focus on high-potential areas.

Identifying specific "Dog" products for Merck KGaA is challenging without direct disclosure of their internal BCG matrix analysis. However, products facing intense competition, patent expirations without robust pipeline replacements, or those in therapeutic areas experiencing shifts in treatment paradigms could fall into this category. For instance, older prescription drugs whose market share has eroded due to newer, more effective treatments are prime candidates.

The strategic approach for these "Dog" products typically involves minimizing investment and exploring divestment options. This allows resources to be redirected towards "Stars" and "Question Marks" with higher growth potential. In 2024, the pressure to maintain lean operations and maximize return on investment makes a critical evaluation of all product lines essential.

- Limited Growth Potential: Products operating in stagnant or declining market segments with little room for product line extensions or significant market share gains.

- Low Innovation Pipeline: Assets lacking a clear roadmap for future development or significant technological advancements.

- Resource Reallocation: Management focus shifts away from these products to reinvest capital in more promising ventures.

- Potential Divestment Consideration: Companies may explore selling off these units to streamline operations and improve overall portfolio efficiency.

Discontinued or Underperforming R&D Programs

Merck KGaA, Darmstadt, Germany, like any major pharmaceutical and life sciences company, navigates the inherent risks within its research and development pipeline. Early-stage R&D programs that do not meet efficacy, safety, or market viability benchmarks are often discontinued. These represent investments that, while necessary for innovation, consume capital without yielding future returns. For instance, a hypothetical discontinued oncology drug candidate in Phase I trials that showed insufficient tumor response would be categorized here. Such terminations are a standard part of portfolio management, allowing for the reallocation of resources to more promising projects.

The company’s strategic review process involves assessing the potential of ongoing R&D initiatives. Programs that consistently underperform against predefined milestones or face insurmountable scientific or regulatory hurdles are candidates for discontinuation. This disciplined approach is crucial for maintaining financial health and focusing on areas with the highest probability of success and market impact. For example, a neurological drug candidate failing to demonstrate a statistically significant improvement over placebo in a Phase II study might be terminated.

- Pipeline Review: Merck KGaA, Darmstadt, Germany, regularly evaluates its R&D portfolio to identify programs that are no longer viable.

- Resource Reallocation: Discontinuing underperforming or unsuccessful R&D efforts frees up capital and personnel for more promising ventures.

- Risk Management: The termination of early-stage R&D programs is a critical component of managing the inherent risks associated with drug discovery and development.

- Focus on Success: This process ensures that the company’s investments are directed towards research with the greatest potential for clinical and commercial success.

Merck KGaA Darmstadt Germany's Surface Solutions business, particularly in areas like performance materials for automotive coatings, is a prime example of a 'Dog' in their BCG matrix. These segments operate in low-growth markets with a relatively small market share, indicating they are less central to the company's future strategic direction. The company's decision to divest these units, as agreed upon in late 2023, highlights their classification as non-core, low-growth operations. This move allows Merck KGaA to concentrate its resources on more dynamic and high-potential sectors within its Electronics business, such as semiconductor and display materials.

| Business Segment | BCG Classification | Strategic Implication | 2024 Outlook |

|---|---|---|---|

| Surface Solutions (e.g., automotive coatings) | Dog | Divestiture/Resource Reallocation | Continued focus on divestment to streamline operations. |

| LAGEVRIO (COVID-19 antiviral) | Dog | Potential phasing out or reduced investment | Declining sales indicate a shrinking market presence. |

| Legacy Small Molecule Drugs | Dog | Modest returns, potential for divestment in competitive markets | Facing commoditization and pricing pressures in mature therapeutic areas. |

Question Marks

Merck KGaA's early-stage oncology pipeline, outside of its lead Antibody-Drug Conjugates (ADCs) and DNA Damage Response Inhibitors (DDRi), includes promising but unproven assets. These innovative candidates are positioned within the rapidly expanding oncology market, a sector projected for significant growth. For instance, their investment in novel immuno-oncology targets and cell therapy platforms reflects a strategy to capture future market share.

These early-stage programs, while holding potential, represent significant R&D expenditures with uncertain future returns. As of 2024, a substantial portion of Merck KGaA's R&D budget is allocated to these nascent therapies, reflecting their high-risk, high-reward profile. The company is focusing on areas like oncolytic viruses and novel combination strategies, aiming to differentiate its offerings.

Merck KGaA, Darmstadt, Germany's Life Science business, particularly its Process Solutions division, is a strong performer. However, emerging modalities within this segment, such as those supporting mRNA technology and sophisticated cell and gene therapies, represent significant future opportunities. These areas are experiencing rapid expansion, demanding substantial R&D and infrastructure investment to secure a competitive position.

The company is actively allocating capital to these nascent fields, signaling their perceived high growth potential. Despite this investment, their current market share in these specialized new modalities is relatively modest. This strategic focus positions Merck KGaA, Darmstadt, Germany to capitalize on the evolving landscape of biopharmaceutical manufacturing and therapeutic innovation.

Merck KGaA, Darmstadt, Germany, through its Performance Materials business sector (now part of the Electronics business sector), is actively investing in novel advanced materials for future electronics that extend beyond current AI chip advancements. These materials are crucial for emerging technologies like quantum computing, advanced displays, and novel sensor applications, representing significant future growth potential. While these markets are still in their nascent stages with low current penetration, the long-term growth prospects are substantial, demanding considerable research and development expenditure from Merck KGaA, Darmstadt, Germany. For instance, materials supporting the development of stable qubits for quantum computers are a key focus, a field projected to reach tens of billions of dollars in value by 2030.

Digital Health Solutions and AI-driven Technologies

Merck KGaA Darmstadt Germany is strategically investing in digital health solutions and neuroinspired AI inference acceleration, recognizing their high-growth potential and disruptive capabilities. While these areas represent nascent markets for the company, significant R&D and strategic partnerships are underway to build market share. For instance, in 2024, Merck KGaA continued to expand its digital health portfolio, focusing on areas like AI-powered diagnostics and personalized medicine platforms.

The company's commitment to these forward-looking technologies positions them to potentially transition these ventures from question marks to stars within the BCG matrix. This requires sustained investment in development, targeted market adoption strategies, and fostering key collaborations to gain a competitive edge. Merck KGaA’s 2024 initiatives in AI for drug discovery and digital patient management underscore this ambition.

- Digital Health Investment: Merck KGaA’s 2024 focus includes expanding AI-driven platforms for patient monitoring and data analytics.

- AI Inference Acceleration: Development in neuroinspired AI aims to speed up complex data processing for healthcare applications.

- Market Potential: These technologies operate in high-growth segments with significant disruptive potential for the healthcare industry.

- Strategic Imperative: Continued investment and strategic partnerships are crucial for Merck KGaA to establish strong market positions in these emerging areas.

Biosafety Testing and Contract Testing Services Expansion

Merck KGaA, Darmstadt, Germany, is significantly expanding its biosafety testing and contract testing services, a strategic move to capture a larger share of a burgeoning market. These expansions, exemplified by the €290 million facility in Rockville, Maryland, represent a considerable upfront investment in a high-growth service sector.

- Facility Investment: The new €290 million biosafety testing facility in Rockville, Maryland, is a key component of Merck KGaA's expansion strategy.

- Market Dynamics: This investment is driven by increasing demand for biosafety testing and contract services within the life sciences industry.

- Strategic Objective: Merck KGaA aims to bolster its market position by enhancing its capacity and service offerings in this specialized area.

- Financial Outlook: While the return on these substantial capital outlays is anticipated to be strong, it is still in the initial phases of realization.

Merck KGaA, Darmstadt, Germany's investments in digital health and AI inference acceleration represent areas with high growth potential but currently low market share for the company. These ventures are critical for future competitive positioning, requiring substantial R&D and strategic alliances. The company's 2024 initiatives, including AI for drug discovery, highlight the ambition to transform these question marks into market leaders.

| Business Area | BCG Category | Current Market Position | Future Potential | Merck KGaA 2024 Focus |

|---|---|---|---|---|

| Digital Health Solutions | Question Mark | Nascent for Merck KGaA | High Growth, Disruptive | AI-driven patient monitoring, personalized medicine platforms |

| Neuroinspired AI Inference Acceleration | Question Mark | Nascent for Merck KGaA | High Growth, Disruptive | Accelerating complex data processing for healthcare |

| Early-stage Oncology Pipeline (non-ADC/DDRi) | Question Mark | Promising but Unproven | Rapidly Expanding Oncology Market | Oncolytic viruses, novel combination strategies |

| Novel Modalities in Life Science (mRNA, Cell/Gene Therapy Support) | Question Mark | Modest Current Share | Rapid Expansion, Significant Opportunity | Infrastructure investment for biopharma manufacturing |

| Advanced Materials for Future Electronics (Quantum Computing, Advanced Displays) | Question Mark | Nascent Markets, Low Penetration | Substantial Long-term Growth Prospects | Materials for stable qubits, novel sensor applications |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Merck KGaA's annual reports and investor presentations, alongside reputable market research and industry growth forecasts, to accurately position its business units.