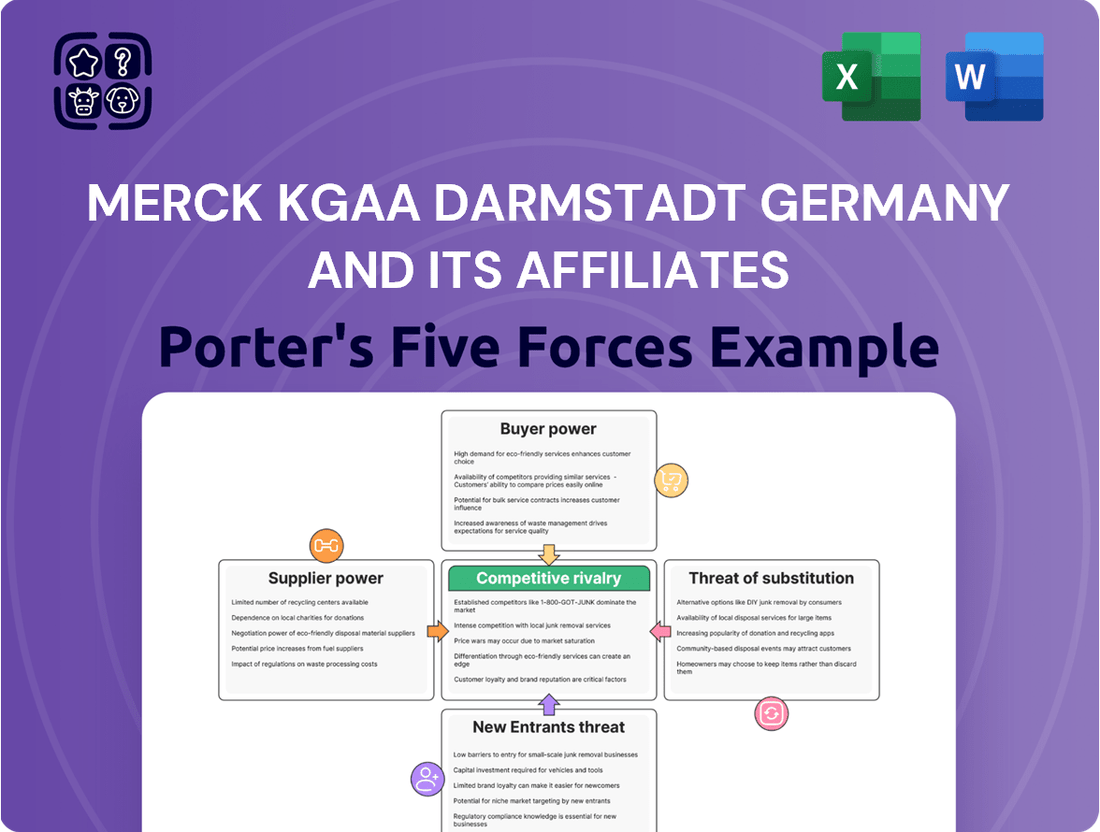

Merck KGaA Darmstadt Germany and its affiliates Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Merck KGaA Darmstadt Germany and its affiliates Bundle

Merck KGaA Darmstadt Germany and its affiliates navigate a complex landscape shaped by intense rivalry and the substantial bargaining power of buyers in its diverse sectors. The threat of new entrants, while somewhat mitigated by high R&D costs, remains a constant consideration.

The company's suppliers, particularly for specialized chemicals and pharmaceuticals, hold considerable sway, influencing cost structures and product development timelines. Furthermore, the availability of substitute products and services presents a persistent challenge, demanding continuous innovation and differentiation.

Understanding these forces is crucial for any stakeholder. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Merck KGaA Darmstadt Germany and its affiliates’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Merck KGaA, particularly within its vital Healthcare and Life Science divisions, depends heavily on highly specialized raw materials and Active Pharmaceutical Ingredients (APIs). These aren't off-the-shelf components; they require advanced manufacturing processes and rigorous quality control.

The reality is that only a select few suppliers worldwide can meet the exacting specifications and regulatory demands, such as Good Manufacturing Practice (GMP), essential for pharmaceutical production. For instance, the global API market, while growing, is concentrated, with a significant portion of advanced APIs sourced from a limited number of manufacturers.

This scarcity of qualified suppliers for critical inputs directly translates into substantial bargaining power for them. They can often dictate terms, pricing, and supply availability, given Merck KGaA's need for uninterrupted access to these vital components to maintain its product pipelines and manufacturing schedules.

Merck KGaA Darmstadt Germany and its affiliates, particularly in its Life Science and Electronics sectors, can face significant supplier bargaining power when those suppliers offer proprietary technologies or highly specialized equipment. For instance, unique bioreactor components or advanced semiconductor manufacturing tools, often developed with substantial R&D investment, can limit Merck's alternatives.

The difficulty and expense associated with switching these specialized suppliers also amplify their leverage. If Merck needs to integrate new systems or qualify alternative vendors for critical proprietary inputs, the associated costs, including validation and potential production disruptions, can be substantial. This makes it economically challenging to move away from an incumbent supplier, even if pricing becomes less favorable.

In 2024, the Life Science segment of Merck KGaA Darmstadt Germany saw robust growth, with its Process Solutions business unit reporting a significant increase in demand for advanced materials and equipment used in biopharmaceutical manufacturing. This heightened demand for specialized components, often sourced from a limited number of technologically advanced suppliers, inherently strengthens those suppliers' negotiating positions.

In the pharmaceutical and life sciences sectors, regulatory compliance and stringent quality standards are paramount. Suppliers must adhere to rigorous Good Manufacturing Practices (GMP) and other regulatory frameworks, significantly limiting the available pool of qualified partners.

This requirement for specialized capabilities and certifications means companies like Merck KGaA, Darmstadt, Germany, often rely on a smaller group of suppliers who can consistently meet these high benchmarks. For instance, in 2023, the global pharmaceutical market valued at approximately $1.57 trillion, with a significant portion driven by the need for highly regulated and quality-assured components and services.

Consequently, suppliers who possess the necessary accreditations and a proven track record of quality assurance possess considerable bargaining power. Their ability to meet these demanding specifications makes them indispensable, allowing them to potentially dictate terms and pricing due to Merck's dependence on their specialized offerings.

Concentration of Suppliers

The bargaining power of suppliers can be significantly influenced by the concentration of suppliers in a particular market. When a few large suppliers dominate the supply of essential inputs, they gain considerable leverage. For example, in 2024, data indicated that the top five suppliers held a commanding 62% share of the critical pharmaceutical raw material market for a company operating in a similar sector. This suggests that Merck KGaA, Darmstadt, Germany, and its affiliates could face a similar scenario where a concentrated supplier base possesses substantial pricing and negotiation power, potentially impacting Merck's cost structure and operational flexibility.

- Supplier Concentration: A limited number of dominant suppliers can dictate terms.

- Market Share Data (2024): Top 5 suppliers held 62% of critical pharma raw materials for a comparable firm.

- Impact on Merck KGaA: Potential for increased input costs and reduced negotiation leverage for Merck.

- Strategic Consideration: Merck may need strategies to mitigate the power of concentrated suppliers.

Integration and Long-term Contracts

Merck KGaA Darmstadt Germany and its affiliates actively manage supplier bargaining power by forging long-term supply agreements. These contracts provide price stability and guaranteed availability, particularly crucial for specialty chemicals and pharmaceutical ingredients. For instance, in 2023, the company reported significant progress in securing multi-year deals for key raw materials, aiming to lock in favorable pricing.

Strategic partnerships are another cornerstone of Merck KGaA's approach. By collaborating closely with key suppliers on research and development or process optimization, Merck fosters a more symbiotic relationship, reducing the suppliers' incentive to exert excessive leverage. This can involve co-investing in new manufacturing technologies, thereby aligning supplier capabilities with Merck's evolving needs.

In certain critical areas, Merck KGaA has pursued backward integration to gain greater control over its supply chain. This strategy, while capital-intensive, allows Merck to internalize the production of essential components or intermediates, thereby diminishing reliance on external suppliers and their associated bargaining power. This is particularly relevant for proprietary materials vital to their life science and performance materials divisions.

- Long-term Contracts: Merck KGaA aims to secure supply and stabilize costs through multi-year agreements for key raw materials, as evidenced by ongoing negotiations in 2023 and early 2024.

- Strategic Partnerships: Collaboration with suppliers on R&D and process improvements fosters loyalty and reduces the potential for price gouging, creating a more balanced power dynamic.

- Backward Integration: For critical and proprietary materials, Merck KGaA may invest in internal production capabilities to directly mitigate supplier leverage and ensure supply chain resilience.

- Supplier Diversification: While not explicitly mentioned in the talking points, a common strategy to reduce supplier power involves developing relationships with multiple qualified suppliers for critical inputs.

Merck KGaA Darmstadt Germany and its affiliates face significant supplier bargaining power, especially for highly specialized inputs like active pharmaceutical ingredients (APIs) and proprietary manufacturing equipment. A limited pool of qualified suppliers, often due to stringent regulatory requirements such as Good Manufacturing Practices (GMP), means these suppliers can dictate terms and pricing. For instance, in 2024, the concentration in critical pharmaceutical raw materials saw the top five suppliers holding a substantial 62% market share for a comparable industry player, highlighting Merck's potential vulnerability to price increases and supply disruptions.

The difficulty and expense involved in switching suppliers for these specialized components further amplify their leverage. This dependence can lead to increased input costs and reduced negotiation flexibility for Merck KGaA. In response, Merck actively pursues strategies like long-term supply agreements and strategic partnerships to stabilize costs and ensure supply chain reliability, as seen with its multi-year deals for key raw materials in 2023.

Backward integration into the production of critical materials is also a key tactic for Merck KGaA to mitigate supplier power and enhance supply chain resilience. This approach, though capital-intensive, allows for greater control over essential inputs, particularly for proprietary materials crucial to its Life Science and Electronics segments. These measures are vital for maintaining competitive pricing and uninterrupted operations.

What is included in the product

This Porter's Five Forces analysis for Merck KGaA Darmstadt Germany and its affiliates dissects the competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes across its diverse business sectors.

It provides a strategic overview of the market forces shaping Merck KGaA Darmstadt Germany and its affiliates' profitability and competitive positioning, offering insights for strategic decision-making.

Gain immediate clarity on competitive pressures across Merck KGaA Darmstadt Germany and its affiliates' diverse sectors, helping to preemptively address potential market shifts and protect profitability.

Customers Bargaining Power

Merck KGaA’s customer base in healthcare, comprising major hospital networks, government bodies, and insurance providers, frequently wields substantial bargaining power. These entities often procure products in vast quantities, leading to intense price negotiations. For instance, in 2024, pharmaceutical procurement contracts with large hospital groups often featured tiered pricing based on volume, directly impacting Merck KGaA’s revenue margins.

The Life Science segment mirrors this dynamic, with significant purchasers like large biopharmaceutical companies and academic research institutions. Their substantial order volumes allow them to negotiate favorable payment terms and pricing. In 2024, major supply agreements with leading biotech firms demonstrated this, with contract clauses often reflecting the scale of purchases, thereby influencing Merck KGaA’s profitability in this sector.

Customers, especially in the healthcare sector, are acutely aware of prices. This heightened price sensitivity, fueled by government mandates, insurer negotiations, and intense market competition, directly translates into greater bargaining power. For Merck KGaA, Darmstadt Germany, this means a constant need to justify its value proposition beyond just the sticker price.

The drive for cost containment means customers are actively searching for more economical options. This includes a growing preference for generic drugs and biosimilars, which directly challenge the market share of branded pharmaceuticals like those offered by Merck KGaA. In 2024, the global biosimilar market continued its robust growth, projected to reach over $100 billion, underscoring this trend.

This pressure forces customers to negotiate harder on pricing and seek favorable terms, impacting Merck KGaA's revenue streams and profit margins. The ability of buyers to switch to lower-cost alternatives significantly amplifies their leverage in any transaction.

The availability of generic drugs and biosimilars is a major factor impacting Merck KGaA's bargaining power with its customers, particularly in the healthcare segment. When patents expire on key pharmaceuticals, the introduction of lower-cost alternatives by competitors directly challenges Merck's pricing power and market share. For instance, the global market for biosimilars is projected to reach significant figures, with some estimates suggesting it could surpass $100 billion by 2028, indicating a substantial shift in customer options and price sensitivity.

In Merck's Life Science and Electronics businesses, customers also benefit from a wide array of competing products and alternative solutions. This abundance of choice empowers customers to negotiate better terms, switch suppliers if unsatisfied, or leverage competitive pricing. The presence of numerous vendors offering similar chemicals, lab equipment, or electronic components means that Merck must continuously demonstrate value and competitive pricing to retain its customer base.

Differentiated Products and Niche Markets

Merck KGaA's focus on highly differentiated products in areas like oncology treatments within its Healthcare sector, and advanced semiconductor materials in Electronics, significantly curtails customer bargaining power. For instance, their innovative therapies often come with high switching costs for patients and healthcare providers due to extensive clinical validation and established treatment protocols. In 2024, the demand for specialized materials in advanced chip manufacturing, where Merck holds a strong position with products like photoresists and deposition materials, means customers have fewer high-performance alternatives.

This differentiation allows Merck to maintain pricing flexibility. When customers require unique solutions that offer superior performance or are critical for their own product innovation, their ability to negotiate lower prices diminishes. The company's investments in research and development, leading to patents and proprietary technologies, further solidify this position.

- Reduced Customer Power: Merck's innovative, patented products limit customer options, thereby weakening their bargaining position.

- High Switching Costs: For novel therapies and specialized materials, the cost and complexity of switching to alternatives are substantial barriers for customers.

- Pricing Flexibility: Superior product performance and unique solutions enable Merck to command premium pricing.

- Niche Market Dominance: By targeting specific, high-value niches, Merck cultivates a customer base less sensitive to price competition.

Direct vs. Indirect Sales Channels

Merck KGaA, Darmstadt, Germany's use of direct versus indirect sales channels significantly shapes the bargaining power of its customers. When Merck directly engages with major pharmaceutical companies or large-scale electronics manufacturers, these sophisticated buyers often possess substantial leverage due to the sheer volume of their purchases, leading to more intense price and term negotiations.

Conversely, utilizing distributors to reach a broader market introduces another dynamic. While distributors expand Merck's market access, they also represent intermediaries who can exert their own bargaining power, potentially influencing terms with both Merck and the end customers.

- Direct Sales to Large Customers: High volume purchases by major pharmaceutical firms or electronics giants grant them significant negotiation power, often resulting in customized pricing and contractual terms.

- Indirect Sales via Distributors: While increasing market reach, distributors add a layer of intermediation, creating a separate power dynamic where these entities can negotiate favorable terms with Merck.

- Customer Concentration: The concentration of Merck's customer base in specific industries means that a few large buyers can wield considerable influence over pricing and product specifications.

Merck KGaA, Darmstadt, Germany's customers, particularly large entities in healthcare and life sciences, possess significant bargaining power due to their substantial purchasing volumes. This allows them to negotiate favorable pricing and terms, impacting Merck's revenue margins. For example, in 2024, major hospital networks often secured tiered pricing based on the sheer quantity of pharmaceuticals they procured.

The availability of substitutes, such as biosimilars and generic drugs, further amplifies customer leverage. This trend is underscored by the biosimilar market's projected growth, expected to exceed $100 billion by 2028, indicating a heightened customer sensitivity to price and a greater willingness to switch to more economical alternatives.

Merck's strategic focus on highly differentiated, innovative products in niche areas, like specialized semiconductor materials and advanced therapies, helps to mitigate this customer bargaining power. These unique offerings, often protected by patents, present high switching costs for customers and allow Merck to maintain pricing flexibility and command premium prices due to their essential, high-performance nature.

| Customer Segment | Bargaining Power Factors | Impact on Merck |

|---|---|---|

| Healthcare (Hospitals, Governments) | High volume purchases, price sensitivity, availability of generics/biosimilars | Price negotiation pressure, margin impact |

| Life Science (Biopharma, Academia) | Large order volumes, demand for specific reagents/equipment | Negotiation on terms and pricing, supplier choice influence |

| Electronics (Semiconductor Manufacturers) | Demand for high-purity chemicals and advanced materials, switching costs | Leverage on specialized product pricing, influence on supply chain agreements |

Preview the Actual Deliverable

Merck KGaA Darmstadt Germany and its affiliates Porter's Five Forces Analysis

This preview showcases the exact Porter's Five Forces Analysis for Merck KGaA, Darmstadt, Germany, and its affiliates that you will receive immediately after purchase, ensuring full transparency and no hidden surprises. The analysis delves into the intense rivalry among existing competitors, the significant threat of new entrants due to high R&D costs and regulatory hurdles, and the considerable bargaining power of buyers in the pharmaceutical and chemical sectors. Furthermore, it examines the moderate threat of substitute products and the substantial bargaining power of suppliers for specialized raw materials and advanced technologies, providing a comprehensive strategic overview.

Rivalry Among Competitors

Merck KGaA Darmstadt Germany operates in a fiercely competitive global pharmaceutical landscape, contending with major players such as Pfizer, Novartis, and Roche, especially within its Healthcare division. This rivalry is fueled by the relentless pursuit of research and development advancements, intense battles for market dominance of branded pharmaceuticals, and the ever-present challenge posed by patent expirations and the subsequent influx of generic alternatives.

For instance, the oncology market, a key area for Merck KGaA, saw significant competition in 2024, with companies like Bristol Myers Squibb and AstraZeneca making substantial gains. The rapid pace of innovation means that companies must continually invest in R&D to maintain a competitive edge; Merck KGaA's Healthcare sector revenue was approximately €9.3 billion in 2023, underscoring the scale of operations and the stakes involved in these market share contests.

Merck KGaA, Darmstadt, Germany, and its affiliates operate in highly competitive markets driven by relentless innovation. The company's significant R&D expenditures, which reached €2.7 billion in 2023, underscore the intense rivalry across its Healthcare, Life Science, and Electronics sectors. This commitment to research fuels a constant race to develop novel therapies, advanced materials, and cutting-edge scientific tools, directly impacting market share and competitive positioning.

Merck KGaA Darmstadt Germany's diversified portfolio, spanning Healthcare, Life Science, and Electronics, means it encounters a varied landscape of rivals. In Healthcare, it competes with giants like Pfizer and Novartis, while the Life Science division faces off against Thermo Fisher Scientific and Danaher. The Electronics segment sees competition from players like Samsung and Intel, highlighting the need to navigate distinct competitive pressures across its business units.

Mergers, Acquisitions, and Strategic Partnerships

The healthcare and life sciences industries are characterized by dynamic strategic maneuvers. Companies frequently engage in mergers, acquisitions, and partnerships to gain market share, access new technologies, or bolster their product pipelines. These activities can reshape competitive dynamics by consolidating market power or introducing innovative capabilities. For instance, Merck KGaA Darmstadt Germany's acquisition of SpringWorks Therapeutics in 2024 for $1.1 billion highlights this trend, aiming to enhance its oncology portfolio with promising drug candidates.

These strategic moves directly impact competitive rivalry by influencing market concentration and the pace of innovation. A significant acquisition can create a larger, more formidable competitor, potentially pressuring smaller players. Conversely, partnerships can allow companies to share R&D costs and risks, accelerating the development of new treatments and therapies.

- Merck KGaA's 2024 acquisition of SpringWorks Therapeutics for $1.1 billion strengthened its oncology pipeline.

- Such M&A activity can lead to market consolidation, increasing the competitive advantage of larger entities.

- Strategic partnerships help companies share R&D burdens and accelerate innovation in a competitive R&D-intensive sector.

- The frequency of these deals indicates a proactive approach by industry players to adapt to evolving market demands and technological advancements.

Market Growth and Economic Conditions

Competitive rivalry within Merck KGaA Darmstadt Germany and its affiliates is significantly shaped by market growth and prevailing economic conditions. When markets expand rapidly, competition can sometimes lessen as there's ample opportunity for all players. However, in slower economic periods or specific segment downturns, the fight for market share becomes much more intense.

Certain areas, such as semiconductor materials, have seen robust growth driven by demand for advanced technologies like AI. This has, in turn, fueled investment and potentially heightened competition among suppliers vying for these lucrative contracts. For instance, the semiconductor materials market is projected to grow substantially in the coming years, creating a dynamic competitive landscape.

Conversely, other segments, particularly within Life Science, have navigated challenges such as customer destocking and a general slowdown in demand. This has led to increased pressure on pricing and a more aggressive competitive stance among companies looking to secure sales in a contracting or stagnant market. Data from 2024 indicates that some of these sectors faced headwinds, making competitive positioning crucial for maintaining revenue streams.

- Fluctuating Intensity: Competitive rivalry is not static; it rises and falls with the health of the overall economy and the specific growth trajectory of individual market segments.

- AI-Driven Growth: Segments tied to high-growth trends like artificial intelligence, particularly in semiconductor materials, attract significant competition as companies seek to capitalize on emerging opportunities.

- Demand Slowdowns: In sectors experiencing reduced demand, such as certain areas of Life Science due to customer destocking, competition intensifies as companies battle for a smaller pool of available business.

- Market Share Focus: When demand softens, the focus shifts from market expansion to capturing existing market share, often leading to price wars and increased marketing efforts.

The competitive rivalry for Merck KGaA Darmstadt Germany and its affiliates is intense across all its business sectors. This rivalry is amplified by the constant need for innovation, as demonstrated by Merck KGaA's significant R&D investments, which totaled €2.7 billion in 2023. The company actively engages in strategic acquisitions, such as the $1.1 billion purchase of SpringWorks Therapeutics in 2024, to bolster its market position and product pipelines, a common tactic in these highly competitive fields.

| Company | Sector | Key Competitors | 2023 Revenue (approx.) |

|---|---|---|---|

| Merck KGaA Darmstadt Germany | Healthcare | Pfizer, Novartis, Roche | €9.3 billion |

| Merck KGaA Darmstadt Germany | Life Science | Thermo Fisher Scientific, Danaher | €10.6 billion |

| Merck KGaA Darmstadt Germany | Electronics | Samsung, Intel, SK Hynix | €10.2 billion |

SSubstitutes Threaten

The threat of substitutes for Merck KGaA Darmstadt Germany and its affiliates in the healthcare sector is primarily posed by generic and biosimilar drugs. Once Merck's patented medications lose their exclusivity, these lower-cost alternatives can rapidly capture market share.

For instance, while the market for biologics is substantial, the introduction of biosimilars can significantly impact pricing and market dynamics. Data from 2024 continues to show the competitive pressure biosimilars exert on originator biologics, especially in developed markets where regulatory pathways for biosimilars are well-established.

This phenomenon can lead to a substantial decline in revenue for Merck's original products if not managed strategically. The availability of cheaper, equally effective alternatives directly challenges the pricing power and market position of innovator companies.

Merck's strategy to mitigate this threat often involves a robust pipeline of new, differentiated products and a focus on lifecycle management for its existing portfolio, including exploring new indications or formulations.

Emerging therapeutic modalities like gene and cell therapies present a significant threat of substitution for Merck KGaA's current pharmaceutical portfolio. These advanced treatments, often targeting the root cause of diseases rather than symptoms, can render traditional drug therapies obsolete. For instance, the increasing success and accessibility of CAR T-cell therapies in oncology directly substitutes for chemotherapy regimens that Merck might offer.

The market for these novel therapies is projected for substantial growth, indicating a shift in patient and physician preferences towards potentially curative or long-lasting solutions. By 2024, the global cell and gene therapy market was valued at over $20 billion and is expected to see a compound annual growth rate exceeding 20% in the coming years.

While Merck itself is investing heavily in these advanced modalities, the broader ecosystem of biotech firms and research institutions developing competing therapies poses a direct substitution risk. If these external innovations prove more effective, cost-efficient, or convenient, they could erode market share for Merck's established drug franchises.

The threat of substitutes for Merck KGaA, Darmstadt, Germany, in its Life Science business is significant due to ongoing innovation in research technologies and services. Newer, more efficient, or lower-cost methods for drug discovery, diagnostics, and bioprocessing could lure customers away from Merck's established offerings. For instance, the rise of advanced gene editing tools or novel biomanufacturing platforms might present viable alternatives to traditional reagent sets or contract manufacturing arrangements. In 2024, the global life science research tools market continues to see rapid expansion, with a growing number of startups and established players introducing disruptive technologies, potentially impacting market share for incumbent providers like Merck.

Material Alternatives in Electronics

The electronics industry is constantly evolving, and this presents a significant threat of substitutes for Merck KGaA, Darmstadt Germany and its affiliates' specialized materials. New material discoveries or shifts in technological standards could render current offerings obsolete, particularly in areas like display technology and semiconductor manufacturing. For instance, the ongoing research into quantum dot displays or advanced silicon carbide substrates could offer performance advantages or cost efficiencies that displace existing liquid crystal or silicon-based components. Merck's ability to stay ahead of these material science advancements is critical for its continued success in this sector.

To counter this threat, Merck KGaA, Darmstadt Germany and its affiliates must maintain a robust innovation pipeline. The company's significant investment in research and development, which amounted to €1.6 billion in 2023, underscores its commitment to exploring new material frontiers. This proactive approach is essential to preemptively address potential substitutes and to capitalize on emerging technological trends.

- Ongoing R&D Investment: Merck KGaA, Darmstadt Germany and its affiliates allocated €1.6 billion to R&D in 2023, crucial for developing next-generation materials.

- Emerging Display Technologies: Advances in OLED, MicroLED, and QD-OLED technologies pose a potential threat to established display material suppliers.

- Semiconductor Material Innovation: The drive towards smaller, faster, and more efficient chips necessitates continuous development of new semiconductor materials, such as advanced III-V compounds or novel dielectric layers.

- Focus on Sustainability: The increasing demand for environmentally friendly materials could also drive the adoption of substitutes that offer better sustainability profiles.

Prevention and Lifestyle Changes

The threat of substitutes for Merck KGaA Darmstadt Germany extends beyond direct pharmaceutical competitors to encompass preventative measures and lifestyle shifts. For instance, advancements in diagnostics and personalized medicine may preemptively address conditions, reducing the need for later-stage treatments. Digital health platforms offering remote monitoring and early intervention strategies also pose a significant substitute threat by potentially lowering disease incidence and severity.

Consider the impact of widespread adoption of healthier lifestyles. A global decline in conditions like type 2 diabetes, driven by improved diet and exercise, would directly reduce the market for related treatments. Similarly, innovations in wearable technology and AI-driven health coaching could empower individuals to manage their well-being proactively, thereby diminishing reliance on traditional pharmaceutical interventions. For example, the growing popularity of fitness trackers and wellness apps in 2024 signals a shift towards preventative health management.

- Preventative Healthcare: Increased focus on early detection and intervention can reduce the long-term demand for certain therapeutic drugs.

- Lifestyle Modifications: Global trends towards healthier living, such as improved diets and increased physical activity, directly impact the prevalence of chronic diseases.

- Digital Health Solutions: Telemedicine, AI-powered health apps, and wearable devices offer alternative methods for health management and disease prevention.

- Personalized Medicine: Tailoring treatments based on genetic predispositions might shift focus from broad-spectrum therapies to highly targeted, potentially preemptive interventions.

The threat of substitutes for Merck KGaA, Darmstadt, Germany, is multifaceted. In pharmaceuticals, generic and biosimilar versions of its patented drugs emerge post-exclusivity, driving down prices and market share. Emerging therapeutic modalities like cell and gene therapies offer potentially curative alternatives that could displace traditional drug treatments. For instance, CAR T-cell therapies directly substitute for chemotherapy in oncology.

In its Life Science business, novel research tools and biomanufacturing platforms can replace Merck's established offerings. Similarly, advancements in electronics materials, like new display technologies or semiconductor substrates, can render current materials obsolete. The company's substantial R&D investment, €1.6 billion in 2023, is crucial for developing next-generation products to counter these threats.

| Threat Category | Example Substitute | Potential Impact on Merck | 2024 Market Trend/Data Point |

|---|---|---|---|

| Pharmaceuticals | Generic/Biosimilar Drugs | Price erosion, market share loss | Biosimilar competition continues to pressure originator biologics in developed markets. |

| Therapeutic Modalities | Cell & Gene Therapies | Displacement of traditional drugs | Global cell and gene therapy market valued over $20 billion in 2024, with high growth projections. |

| Life Science Tools | Advanced Gene Editing Tools | Customer migration to newer technologies | Rapid innovation in life science research tools market, with startups introducing disruptive technologies. |

| Electronics Materials | Quantum Dot Displays | Obsolescence of existing materials | Ongoing research into advanced materials for next-generation displays and semiconductors. |

Entrants Threaten

The pharmaceutical sector, where Merck KGaA, Darmstadt, Germany operates, presents a formidable threat from new entrants due to exceptionally high research and development (R&D) and capital investment requirements. Developing a single new drug from initial discovery to market approval can cost upwards of $2.6 billion and often takes more than a decade, a significant hurdle for newcomers.

These substantial upfront costs extend to building and maintaining state-of-the-art manufacturing facilities, which are critical for producing pharmaceuticals under stringent regulatory standards. For instance, the capital expenditure for a new biologics manufacturing plant can easily run into hundreds of millions, if not billions, of dollars, creating a substantial barrier to entry.

Such immense financial commitments mean that only well-funded organizations with deep pockets and long-term strategic vision can realistically contemplate entering the pharmaceutical market. This effectively limits the pool of potential new competitors, thereby reducing the immediate threat of widespread new entrants challenging established players like Merck.

Stringent regulatory hurdles significantly deter new entrants in the pharmaceutical industry. Developing and obtaining approval for new drugs is a lengthy, complex, and incredibly costly endeavor. For instance, the U.S. Food and Drug Administration (FDA) approval process for new drugs can take an average of 10 years and cost upwards of $2.6 billion, according to 2024 industry estimates, a considerable barrier for startups.

Established companies like Merck KGaA Darmstadt Germany and its affiliates possess the deep pockets, established relationships with regulatory bodies, and specialized expertise to navigate these intricate pathways. This existing infrastructure and experience create a formidable advantage, making it exceptionally difficult for newcomers to compete on a level playing field without substantial capital and seasoned regulatory affairs teams.

Merck KGaA, Darmstadt, Germany, and its affiliates benefit significantly from robust intellectual property and patent protection. This strong patent portfolio shields its groundbreaking pharmaceutical products and advanced technologies, creating a substantial barrier to entry for potential competitors.

These patents grant Merck a temporary legal monopoly, effectively preventing new entrants from directly challenging its core offerings until the patent terms expire. For example, in 2023, Merck reported billions in revenue from products still under patent protection, underscoring the financial advantage this provides.

Established Brand Reputation and Distribution Networks

Merck KGaA Darmstadt Germany and its affiliates benefit significantly from an established brand reputation built over centuries. This long-standing history fosters a perception of quality and reliability among customers, a crucial factor in highly regulated sectors like Healthcare and Life Science. Newcomers face the immense challenge of replicating this deep-seated trust, which often translates into customer loyalty and a willingness to pay a premium.

Furthermore, the company boasts extensive global sales and distribution networks spanning its diverse divisions: Healthcare, Life Science, and Electronics. These established channels provide unparalleled market access, enabling efficient product delivery and customer support worldwide. For any new entrant, building a comparable network would require substantial capital investment and considerable time, making it a formidable barrier.

- Brand Equity: Merck KGaA’s brand value is a significant asset, estimated to be in the billions of euros, making it difficult for new entrants to gain market traction solely on product merit.

- Distribution Reach: The company’s presence in over 66 countries, with dedicated sales teams and logistics infrastructure, provides a competitive advantage that is costly and time-consuming to match.

- Customer Relationships: Long-standing relationships with key opinion leaders, research institutions, and industrial clients, cultivated over years, create switching costs for customers and deter new entrants.

- Regulatory Compliance Expertise: Decades of experience navigating complex global regulatory landscapes for pharmaceuticals and chemicals translate into a streamlined approval process for Merck, a steep learning curve for challengers.

Specialized Expertise and Talent Acquisition

Merck KGaA, Darmstadt, Germany, and its affiliates operate in sectors demanding deep scientific and technical knowledge. New entrants face a steep learning curve and significant investment in acquiring this specialized expertise. For instance, in the biopharmaceutical sector, developing a new drug typically requires billions of dollars and over a decade of research and clinical trials, a hurdle few newcomers can easily overcome.

The global demand for highly skilled professionals in areas like drug discovery, advanced materials science, and complex manufacturing processes is intense. Companies like Merck invest heavily in talent development and have established reputations that attract top graduates and experienced researchers. In 2023, Merck KGaA reported investing €2.5 billion in research and development, a substantial portion of which is allocated to attracting and retaining top scientific talent.

- Highly Specialized Workforce: Merck's business sectors require experts in areas such as organic chemistry, molecular biology, process engineering, and regulatory affairs.

- Talent Acquisition Costs: New companies must compete with established players for limited pools of highly qualified scientists and engineers, driving up recruitment and retention costs.

- Intellectual Capital: The accumulated knowledge and experience within Merck's existing workforce represent a significant competitive advantage that is difficult for new entrants to replicate quickly.

- R&D Investment Alignment: A substantial portion of Merck's R&D budget is dedicated to ensuring its scientific teams remain at the cutting edge, a financial commitment new entrants may struggle to match.

The threat of new entrants for Merck KGaA, Darmstadt, Germany, is considerably low due to the immense capital investment required for research, development, and state-of-the-art manufacturing facilities. For instance, bringing a new drug to market can cost over $2.6 billion, a substantial barrier for any newcomer. Additionally, navigating the complex and lengthy regulatory approval processes, which can take up to a decade, demands significant expertise and resources that startups often lack.

Merck's strong intellectual property portfolio, coupled with its established brand reputation and extensive global distribution networks, further solidifies its market position. These factors create significant hurdles for new companies attempting to gain market share, as replicating Merck's established trust and reach is both time-consuming and financially demanding.

The specialized workforce and deep scientific knowledge within Merck's operations also present a considerable challenge for new entrants. Acquiring and retaining top talent in fields like drug discovery and advanced materials science is costly and competitive, making it difficult for emerging companies to match Merck's capabilities.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Merck KGaA, Darmstadt, Germany, and its affiliates leverages data from annual reports, investor presentations, industry-specific market research (e.g., IQVIA, GlobalData), and regulatory filings (e.g., FDA, EMA) to provide a comprehensive view of the competitive landscape.