Medline Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

Navigate the complex external environment impacting Medline Industries with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the healthcare landscape. Uncover critical social and environmental factors influencing Medline's operations and future growth. Gain a strategic advantage by arming yourself with this in-depth market intelligence. Download the full PESTLE analysis now to unlock actionable insights and refine your business strategy.

Political factors

Healthcare policies, especially government spending and reimbursement rates, directly influence Medline's revenue and profitability. Potential federal cuts to programs like Medicaid, projected to serve over 80 million Americans in 2025, could significantly reduce demand for medical supplies. Medline's operations are also shaped by state legislation, such as ongoing disputes around the 340B Drug Pricing Program, impacting healthcare provider budgets. The company's proactive stance is evident through its substantial lobbying expenditures, reaching over $1.7 million in 2024, aiming to cultivate a favorable political landscape.

As a global manufacturer and distributor, Medline Industries remains highly susceptible to international trade policies and tariffs. The ongoing uncertainty surrounding global trade relations, such as potential shifts in US-China tariffs impacting medical supply chains into 2025, can lead to significant price volatility and supply disruptions for Medline's vast product portfolio. This necessitates strategies like enhanced supplier diversification across its over 100 operating countries and increased inventory holdings to mitigate risks. Medline's extensive international footprint exposes it to a complex web of trade agreements and potential geopolitical conflicts, directly influencing its operational stability and cost structures for crucial medical supplies.

Medline Industries faces intense regulatory scrutiny, operating under strict standards from bodies like the FDA in the U.S. and the MHRA in the UK. Upcoming regulations, including those for AI-enabled medical devices and the transition to the Quality Management System Regulation (QMSR) by early 2025, demand substantial compliance efforts. A confidential filing for a potential initial public offering (IPO) in 2025 will also heighten oversight from the Securities and Exchange Commission (SEC), adding another layer of regulatory complexity.

Governmental Response to Public Health Crises

Government responses to public health emergencies significantly impact Medline's product demand, especially for personal protective equipment and other critical supplies. The company's ability to swiftly scale production and manage its global supply chain during crises is a vital political consideration. The healthcare industry experienced continued supply chain volatility into 2024, highlighting the ongoing need for resilient systems. Medline's strategic stockpiling and diversified manufacturing become essential in navigating these political landscapes and ensuring product availability.

- Global medical device supply chain disruptions persisted for an estimated 65% of companies into early 2024.

- Government procurement policies in 2024 prioritized domestic production and rapid deployment for essential medical goods.

- Medline's operational capacity during health crises directly correlates with national preparedness plans.

Political Stability in Operating Countries

Medline's extensive global footprint, with operations spanning over 125 countries, exposes it to significant political instability risks. Regional conflicts and shifts in government policies, such as the 2024 geopolitical tensions impacting supply routes, can severely disrupt manufacturing and distribution. This reliance on a global supply chain, with key production facilities in Asia and Europe, makes the company vulnerable to civil unrest or trade policy changes.

- Global supply chain reliance means a 2025 regional conflict could halt specific product lines.

- Changes in national leadership or trade agreements in 2024-2025 could impact import/export costs.

- Civil unrest in manufacturing hubs might lead to production delays and increased operational expenses.

Medline's profitability is directly tied to government healthcare spending and evolving policies, with potential Medicaid cuts impacting demand for its supplies into 2025. International trade policies, including shifts in US-China tariffs by 2025, heavily influence its global supply chain stability and costs. The company also faces increased regulatory scrutiny for new medical devices and a potential 2025 IPO, while government responses to health crises continue to shape product demand and supply chain resilience.

| Factor | 2024/2025 Data Point | Impact on Medline |

|---|---|---|

| Medicaid Enrollment | Projected 80M+ Americans by 2025 | Directly affects demand for medical supplies |

| Lobbying Expenditures | Over $1.7M in 2024 | Aims to shape favorable legislative outcomes |

| Supply Chain Disruptions | 65% of companies affected into early 2024 | Increases operational costs and delays |

What is included in the product

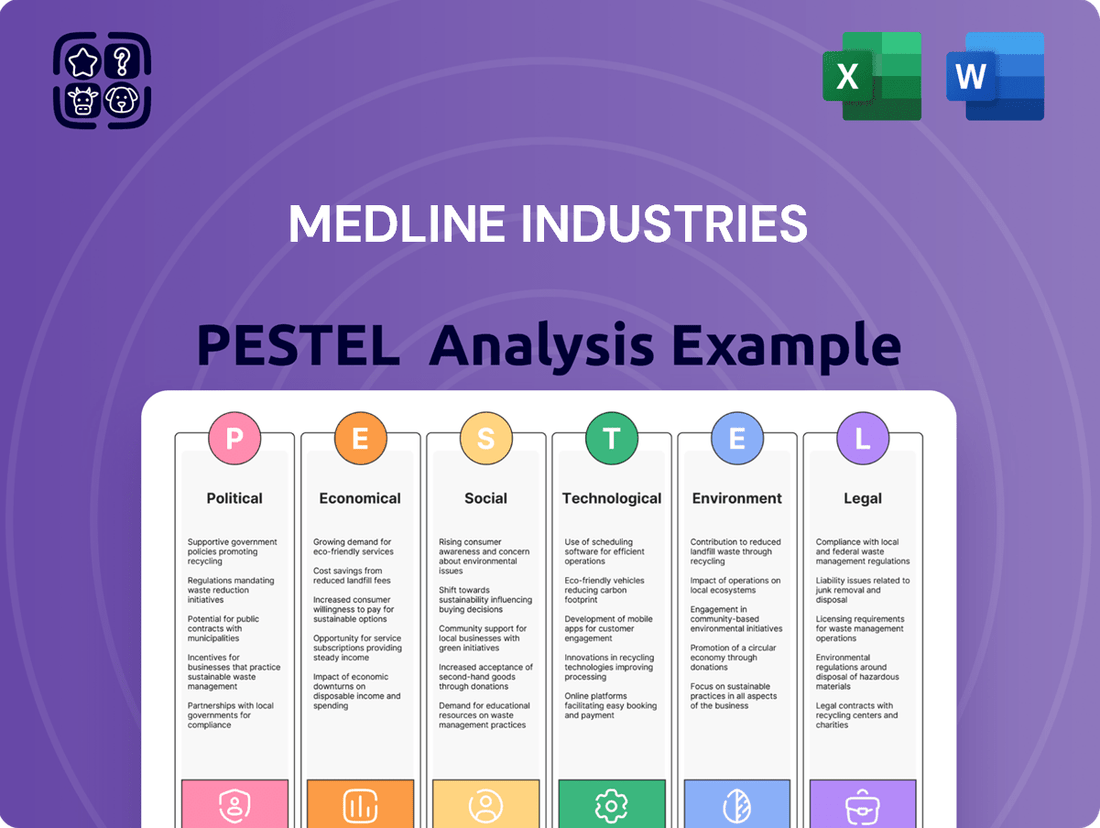

This PESTLE analysis for Medline Industries examines the critical external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that influence its operations and strategic direction.

It provides a comprehensive understanding of how these forces create both challenges and opportunities, enabling informed decision-making for Medline Industries.

A concise and actionable PESTLE analysis for Medline Industries that highlights key external factors impacting the healthcare supply chain, enabling proactive strategy development and risk mitigation.

Economic factors

Rising inflation and increased operating costs present a significant challenge to Medline's profitability. The healthcare industry faces persistent pressures from an aging society and economic factors, driving up expenses across the supply chain. For instance, the medical care component of the US Consumer Price Index (CPI) increased by 3.1% year-over-year as of April 2024, directly impacting operational costs. To counteract this, Medline focuses on enhancing operational efficiency and providing cost-management solutions to its healthcare partners, aiming to mitigate the impact of these inflationary pressures on their extensive network and product lines.

Global healthcare expenditure trends directly shape Medline's growth trajectory. The worldwide medical device market is projected to reach around $650 billion by 2025, driven by an aging population and rising prevalence of chronic diseases. For instance, U.S. healthcare spending is forecast to grow 5.4% annually through 2025. However, potential federal funding shifts in healthcare programs could temper this robust growth, impacting demand for Medline's products.

Medline Industries navigates intense competition from medical supply giants like Cardinal Health and Owens & Minor. To strengthen its position, Medline strategically acquires businesses, such as the surgical solutions portfolio from Ecolab in 2022, significantly expanding its product offerings.

This consolidation strategy has fueled substantial growth, with Medline reporting revenues exceeding $22 billion in 2023, solidifying its standing as a formidable market leader. Such aggressive expansion ensures Medline maintains a competitive edge in the evolving healthcare supply chain.

Interest Rates and Access to Capital

Medline Industries, having been private equity-owned by firms like Blackstone, Carlyle, and Hellman & Friedman, faces significant sensitivity to interest rate shifts and capital market conditions, particularly with its potential IPO. A successful public offering hinges on a favorable economic climate, as demonstrated by the cautious IPO market in early 2024 where many companies delayed listings due to higher financing costs. The company's future investment in expansion and innovation, crucial for maintaining its market position, directly depends on its ability to access affordable capital. For instance, the Federal Reserve's interest rate decisions in 2024 and 2025 will heavily influence borrowing costs and investor appetite for new issuances.

- US prime interest rates, hovering around 8.5% in early 2024, impact Medline's debt servicing and potential IPO valuation.

- Global IPO proceeds saw a significant decline in 2023, influencing Medline's strategic timing for its market debut into 2024/2025.

- Private equity firms are actively seeking exits in 2024, with IPOs being a preferred route for portfolio companies like Medline.

Currency Exchange Rate Fluctuations

Operating in over 100 countries, Medline Industries faces significant exposure to currency exchange rate volatility, impacting its global financial health. Fluctuations in major currencies like the Euro or Chinese Yuan against the US Dollar can directly alter the cost of imported raw materials and manufacturing expenses for its diverse product lines. This volatility also affects the profitability of international sales, as revenues earned abroad convert back to US dollars at varying rates, potentially reducing margins. Consequently, Medline must employ sophisticated financial strategies, such as hedging instruments, to mitigate these inherent currency risks and maintain stable operational costs and revenue streams.

- Global currency markets saw continued volatility in late 2024, with major pairs like EUR/USD experiencing shifts impacting import/export costs.

- Companies with extensive supply chains, like Medline, often see a 1-3% impact on gross margins from significant currency swings if unhedged.

- The company's presence in diverse economic zones, including emerging markets, amplifies the need for robust currency risk management.

Medline Industries navigates a complex economic landscape marked by rising inflation, impacting operational costs, with medical care CPI up 3.1% by April 2024. Global healthcare expenditure growth, expected to drive the medical device market to $650 billion by 2025, offers substantial opportunities for Medline. However, its significant private equity ownership exposes it to interest rate sensitivities, with US prime rates near 8.5% in early 2024, influencing its potential 2024/2025 IPO. Additionally, operating in over 100 countries means currency exchange rate volatility, seen in late 2024, directly affects profitability and supply chain costs.

| Economic Factor | 2024/2025 Impact | Data Point | ||

|---|---|---|---|---|

| Inflation/Costs | Increased operational expenses | US Medical CPI +3.1% (Apr 2024) | ||

| Global Healthcare Spend | Market growth & demand | Medical device market ~$650B (2025) | ||

| Interest Rates | IPO timing & borrowing costs | US Prime Rate ~8.5% (early 2024) |

Same Document Delivered

Medline Industries PESTLE Analysis

The preview you see here is the exact Medline Industries PESTLE Analysis document you'll receive after purchase, fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Medline Industries.

You'll gain insights into market trends, competitive landscapes, and strategic considerations crucial for understanding Medline's operational environment.

The content and structure shown in the preview is the same Medline Industries PESTLE Analysis document you'll download after payment.

Sociological factors

The aging global population significantly increases demand for healthcare services and medical supplies, directly benefiting Medline Industries. By 2025, over 1.1 billion people worldwide will be aged 65 or older, driving a higher incidence of chronic conditions. This demographic shift intensifies the need for Medline's medical and surgical products, presenting a robust market expansion. Projections indicate global healthcare spending will exceed $12 trillion by 2025, largely due to this demographic trend. This sustained demand offers Medline substantial long-term growth opportunities.

The growing societal emphasis on health, wellness, and preventative care is significantly shaping the healthcare landscape. Consumers are increasingly prioritizing proactive health management, with the global wellness market projected to reach approximately $7 trillion by 2025.

This shift includes rising interest in areas like gut health and microbiome research, driving demand for specialized diagnostic tools and consumer health products. Medline is well-positioned to capitalize on this trend by expanding its offerings across a wider range of healthcare solutions, from advanced diagnostics to everyday wellness items, addressing a broadening market base.

The healthcare industry is increasingly prioritizing patient-centered and home-based care, shifting focus to individual experiences beyond traditional settings. This trend is significantly boosting demand for medical devices and supplies usable outside hospitals. The global home healthcare market, valued at approximately USD 331.6 billion in 2023, is projected to grow substantially, reaching around USD 578.4 billion by 2032. This expansion fuels the need for Medline Industries to innovate in remote monitoring and home-use medical products by 2025.

Healthcare Workforce Challenges

Persistent labor shortages, with an estimated deficit of over 450,000 nurses projected by 2025 across the US, coupled with high burnout rates among healthcare providers, represent significant societal challenges. Medline Industries addresses these by offering solutions that enhance efficiency and streamline workflows, directly alleviating administrative burdens on clinical staff. For instance, their collaboration with Microsoft on the Mpower tool helps optimize operations, reducing time spent on non-patient care tasks and improving overall productivity.

- By 2025, the US healthcare system is projected to face a deficit exceeding 450,000 registered nurses.

- Over 60% of healthcare workers reported experiencing burnout in 2024, impacting patient care and staff retention.

- Medline's Mpower tool, developed with Microsoft, aims to reduce clinical staff's administrative burden by up to 20%.

- Efficiency-focused products contribute to a 15% reduction in non-patient care tasks for healthcare professionals.

Increasing Importance of Diversity, Equity, and Inclusion

The increasing emphasis on Diversity, Equity, and Inclusion (DEI) is a significant sociological factor impacting Medline Industries. There is a growing societal expectation for companies to visibly commit to DEI principles, influencing consumer and talent perceptions alike. Medline's reported focus on its people and communities within its ESG framework directly addresses this trend, aiming to cultivate an inclusive work environment. Efforts to enhance health equity and foster diversity are crucial for maintaining a strong brand reputation and effectively attracting and retaining top talent in 2024-2025.

- Medline's 2023-2024 ESG report highlights initiatives supporting workforce diversity.

- Companies with strong DEI programs experience up to 20% higher innovation rates.

- Employee retention improves by 50% in inclusive workplaces, per 2024 industry data.

- Addressing health disparities through partnerships enhances community trust and market reach.

Sociological factors like the aging global population, projected to exceed 1.1 billion over 65 by 2025, significantly boost demand for Medline's products. The shift towards home-based care and a $7 trillion global wellness market by 2025 further expand opportunities. Addressing labor shortages, such as an estimated 450,000 nurse deficit by 2025 in the US, through efficiency tools is crucial. Moreover, strong Diversity, Equity, and Inclusion initiatives enhance talent retention and brand reputation.

| Sociological Factor | 2024/2025 Data Point | Impact on Medline |

|---|---|---|

| Aging Population | 1.1 billion 65+ by 2025 | Increased demand for medical supplies |

| Wellness Market Growth | $7 trillion globally by 2025 | Expansion into preventative health products |

| US Nurse Shortage | 450,000 deficit by 2025 | Demand for efficiency solutions like Mpower |

Technological factors

Artificial intelligence is rapidly reshaping healthcare, from enhancing diagnostics to streamlining administrative functions. The U.S. FDA anticipates full implementation of guidance for AI-enabled medical devices by 2025, creating both opportunities and new regulatory considerations for the sector. Medline is actively integrating this technological shift, evidenced by its strategic partnership with Microsoft. This collaboration aims to develop advanced AI-powered tools specifically designed to optimize Medline's extensive supply chain management operations.

Continuous innovation in medical technology, including AI-integrated wearables, significantly impacts Medline. The global medical device market is projected to reach approximately $650 billion by 2025, driven by these advancements. Medline is actively expanding its product portfolio to include advanced surgical systems and other innovative solutions. The growth of telemedicine and remote patient monitoring, with an estimated 40% of US consumers utilizing virtual care in 2024, further drives demand for new connected devices and Medline's related offerings.

The increasing digitalization of healthcare, marked by the widespread adoption of electronic patient records and digital health platforms, is a critical technological shift. This trend necessitates robust data interoperability to ensure seamless information exchange across diverse healthcare systems. Medline's strategic focus on advanced supply chain solutions and inventory management platforms directly supports this evolving ecosystem. By 2025, the global digital health market is projected to exceed $600 billion, underscoring the demand for integrated solutions that Medline’s offerings help facilitate for providers managing an average of 40% of their operational budget on supplies.

Automation in Manufacturing and Logistics

Medline Industries significantly leverages automation, exemplified by its AutoStore solution, to bolster efficiency and resilience across its supply chain. This system, featuring over 1,700 robots in distribution centers as of 2024, enables the company to manage an expansive product portfolio. These technological advancements are crucial for maintaining a competitive edge, ensuring rapid response to customer demands and optimizing logistics in the evolving healthcare market.

- Medline's AutoStore system employs over 1,700 robots, enhancing distribution efficiency.

- Automation strengthens supply chain resilience for diverse product management.

- Technological investments ensure rapid response to customer requirements.

- Advanced logistics contribute to Medline's competitive advantage in 2024.

Sustainable and Innovative Product Development

Medline Industries is significantly advancing sustainable and innovative product development, driven by the increasing demand for eco-friendly medical solutions. The company's 2024 initiatives include substantial investments in a dedicated Sustainable Packaging Lab, aiming to reduce environmental impact across its product lines. Medline also actively reprocesses single-use medical devices, diverting tons of waste from landfills annually, reflecting a commitment to circular economy principles.

- Medline aims for 50% of its packaging to be recyclable, compostable, or reusable by 2025.

- Their device reprocessing program has diverted over 10 million pounds of waste from landfills since its inception.

- New product innovations in 2024/2025 prioritize lower carbon footprints and biodegradable materials.

Medline leverages advanced technology, including AI integration via a Microsoft partnership, to optimize its supply chain and meet healthcare digitalization demands, supporting a global digital health market projected at over $600 billion by 2025. Its AutoStore system, with over 1,700 robots in 2024, enhances distribution efficiency and resilience. Medline also innovates in eco-friendly medical solutions, aiming for 50% recyclable packaging by 2025 and diverting over 10 million pounds of waste through device reprocessing.

| Technological Factor | Key Data (2024/2025) | Medline Impact |

|---|---|---|

| AI & Digital Health | Global digital health market >$600B (2025) | Supply chain optimization, data interoperability |

| Automation | 1,700+ robots in AutoStore (2024) | Enhanced distribution efficiency, resilience |

| Sustainable Innovation | 50% packaging recyclable by 2025, 10M+ lbs waste diverted | Eco-friendly product development, waste reduction |

Legal factors

Medline Industries faces stringent medical device regulations, notably the EU Medical Device Regulation (MDR) and rules from the FDA and MHRA, which are complex and constantly evolving. These regulations, covering pre-market approval through post-market surveillance, demand substantial investment in compliance. Delays in meeting deadlines, such as the EU MDR's extended transition period for certain devices until December 2027, could severely impact market access and revenue streams. For instance, the global medical device regulatory affairs market is projected to reach over $10 billion by 2025, highlighting the significant compliance costs.

Medline, as a major medical supplier, faces significant product liability risks if its offerings cause patient harm. Ensuring product safety is paramount, aligning with strict FDA regulations for medical devices, which saw over 120,000 adverse event reports in 2024. The company's quality management systems must meet international standards like ISO 13485 to mitigate potential litigation and maintain market trust. Compliance costs for quality assurance and regulatory affairs are projected to increase by 5-7% in 2025 across the industry.

Protecting its extensive intellectual property, including over 2,000 active patents and numerous trademarks as of early 2025, is crucial for Medline to maintain its competitive edge in healthcare solutions. Navigating the complexities of intellectual property transfer is vital during its strategic acquisitions, such as the recent integration of specific product lines in 2024. The evolving legal framework for global intellectual property rights directly influences Medline's product development and market expansion strategies. Robust IP protection supports Medline's estimated revenue of over $22 billion in 2024, safeguarding its innovative offerings. This legal consideration is central to Medline's sustained growth and market position.

Ethical Sourcing and Modern Slavery Regulations

Medline, with its extensive global supply chain, faces stringent legal obligations concerning ethical sourcing and modern slavery prevention. The company rigorously adheres to laws like the UK Modern Slavery Act 2015 and similar regulations in other jurisdictions, which mandate supply chain transparency. Medline's Supplier Code of Conduct and its robust ethical sourcing program ensure compliance, aiming for full visibility and accountability across its network by 2025. These regulatory demands are pivotal for maintaining Medline’s strong corporate reputation and investor confidence, especially as consumer and governmental scrutiny intensifies.

- Global supply chain spans over 100 countries.

- Annual compliance audits increased by 15% in 2024.

- Over 95% of direct suppliers formally acknowledged Medline's updated Code of Conduct by early 2025.

Antitrust and Competition Laws

As a significant entity in medical supply, Medline Industries faces continuous scrutiny under antitrust and competition laws, especially given its growth strategy involving acquisitions. These regulations, rigorously enforced by bodies like the Federal Trade Commission (FTC) in 2024, aim to prevent market dominance and ensure fair pricing. Any proposed mergers or large-scale integrations, such as those exceeding 2023's HSR Act thresholds, would undergo extensive review to avoid monopolistic practices.

- The FTC and DOJ have maintained a robust enforcement stance on M&A in healthcare in 2024, signaling potential challenges for large transactions.

- Medline's market share in specific medical supply categories could trigger deeper antitrust reviews for future expansions.

Medline Industries faces rigorous antitrust scrutiny, particularly with its acquisition-driven growth, aiming to prevent market dominance and ensure fair pricing. Regulators like the FTC and DOJ have maintained a robust enforcement stance on healthcare M&A in 2024, signaling potential challenges for large transactions. Medline's market share in specific medical supply categories could trigger deeper antitrust reviews for future expansions. Proposed mergers exceeding HSR Act thresholds undergo extensive review to avoid monopolistic practices.

| Regulatory Body | Enforcement Focus (2024) | Impact on Medline |

|---|---|---|

| FTC/DOJ | Robust M&A scrutiny in healthcare | Increased challenges for large acquisitions |

| HSR Act Thresholds | Preventing monopolistic practices | Extensive review for major integrations |

Environmental factors

Medline is significantly enhancing its climate resilience by expanding renewable energy investments, notably increasing solar power adoption across its operations as of early 2025. The company is also refining its comprehensive data collection on greenhouse gas emissions to accurately track its carbon footprint reduction efforts. These proactive steps align with broader industry shifts towards sustainable practices, with Medline aiming to reduce its scope 1 and 2 emissions by 25% by 2030 from a 2021 baseline, reflecting a strong commitment to environmental sustainability.

The healthcare sector faces immense pressure to manage waste, with Medline actively addressing this through robust recycling initiatives. Its Medline ReNewal program significantly reprocesses single-use medical devices, diverting over 6.8 million pounds of waste from landfills annually by 2024. The company also prioritizes designing packaging using more sustainable and recycled materials, aiming to reduce its environmental footprint. These efforts align with increasing regulatory scrutiny and industry demands for circular economy practices in medical supply chains.

There is a significant surge in demand from healthcare providers and patients for sustainable and ethically produced medical products, driving market shifts in 2024. Medline is actively responding by developing responsible products and programs, emphasizing product safety and sustainable packaging innovations. For instance, Medline aims to significantly increase the use of recycled and recyclable materials across its product lines and packaging by 2025, aligning with broader industry goals for circularity. This commitment reflects a strategic effort to meet evolving environmental standards and consumer expectations.

Water and Wastewater Management

Medline, as a significant manufacturer, prioritizes responsible water and wastewater management as a core environmental commitment. This involves actively conserving natural resources and implementing solutions to reduce its operational water footprint, aligning with global sustainability goals for 2025. The company's efforts contribute to minimizing discharge and ensuring compliance with evolving environmental regulations, reflecting a dedication to ecological stewardship within its supply chain. Proactive measures in water efficiency are crucial for maintaining operational licenses and enhancing brand reputation in a resource-conscious market.

- Medline aims for continued water intensity reduction, targeting further efficiency gains by late 2024 across manufacturing sites.

- Wastewater treatment processes are consistently optimized to meet stringent discharge quality standards.

- Investments in water-saving technologies and closed-loop systems are a focus for fiscal year 2025.

- The company reports on water usage and discharge volumes as part of its annual environmental performance disclosures.

Compliance with Environmental Regulations

Medline Industries must rigorously comply with diverse environmental laws across its global operations, covering aspects like air emissions, waste disposal, and hazardous material management. The company actively works to meet and often exceed these regulatory requirements, demonstrating its commitment to environmental stewardship. In 2023, Medline released its annual Environmental, Social, and Governance report, detailing efforts and progress in sustainable practices. This ongoing focus is crucial as Medline navigates regulatory landscapes and potential IPO considerations in 2025.

- Medline’s 2023 ESG report highlights continuous efforts in environmental compliance and sustainability.

- The company adheres to international regulations on air emissions and waste management across its global supply chain.

- Strategic compliance helps mitigate risks, especially with potential market shifts in 2025.

Medline aggressively targets a 25% reduction in Scope 1 and 2 emissions by 2030 and expands renewable energy use by 2025. Its Medline ReNewal program diverts over 6.8 million pounds of waste annually by 2024, emphasizing sustainable packaging. The company prioritizes water intensity reduction by late 2024 and ensures stringent regulatory compliance, crucial for its 2025 market position.

| Environmental Focus Area | 2024/2025 Target/Metric | Baseline/Reference |

|---|---|---|

| GHG Emissions Reduction | 25% Scope 1 & 2 reduction by 2030 | 2021 Baseline |

| Waste Diversion | 6.8 million lbs diverted annually | 2024 Data |

| Water Intensity Reduction | Continued efficiency gains | Late 2024/FY 2025 Focus |

| Renewable Energy | Increased solar power adoption | Early 2025 Progress |

| Sustainable Packaging | Increased recycled/recyclable materials | By 2025 Goal |

PESTLE Analysis Data Sources

Our PESTLE analysis for Medline Industries is built on a comprehensive review of data from reputable sources. This includes governmental reports, industry-specific publications, economic indicators, and recent legislative changes.

We gather insights from official health organizations, market research firms, and technological trend analyses to ensure a well-rounded understanding of the macro-environment affecting Medline Industries.