Medline Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

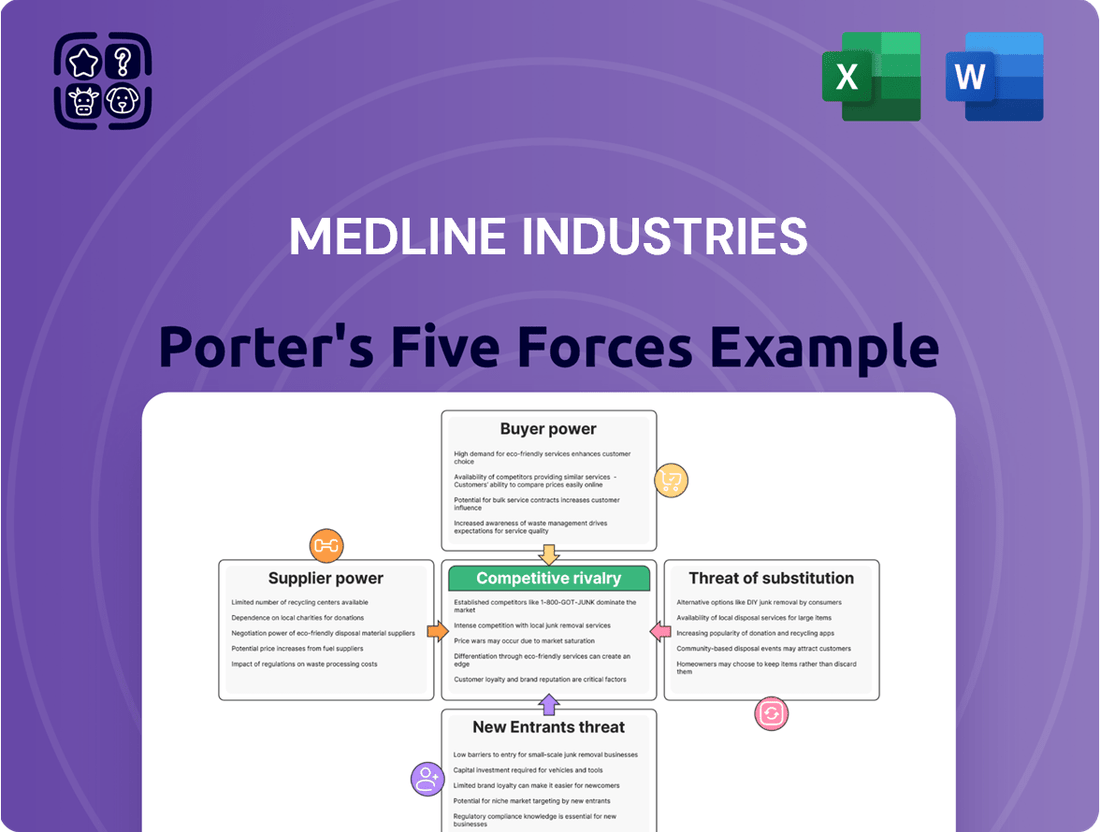

Medline Industries operates within a complex healthcare landscape, where understanding competitive pressures is paramount. Our Porter's Five Forces analysis reveals how buyer power, supplier leverage, and the threat of substitutes significantly shape Medline's strategic environment.

We delve into the intensity of rivalry among existing competitors and the critical threat of new entrants, providing a clear picture of market dynamics.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Medline Industries’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of companies supplying essential raw materials like specialized resins and textiles significantly elevates supplier power within the medical products sector. Medline Industries strategically mitigates this by operating its own rail yard and silos, capable of storing up to 60 days of resin, a key input for many medical devices. Despite such efforts, the broader healthcare manufacturing industry remains vulnerable due to its reliance on a limited number of critical component providers. This dynamic was evident in 2024, with ongoing supply chain pressures impacting raw material costs globally.

Suppliers providing highly specialized or patented medical components and technologies wield considerable power over distributors like Medline. For instance, unique components in critical medical devices, such as advanced imaging systems or specialized surgical tools, often come from a very limited pool of manufacturers. This differentiation means Medline faces significant challenges and costs if attempting to switch suppliers for these essential, unique products. Consequently, Medline may have to absorb higher procurement costs or pass them onto healthcare providers, impacting their margins and pricing strategies in 2024. The reliance on these distinct suppliers underlines a key vulnerability in the supply chain.

The healthcare industry faces significant switching costs when changing suppliers, driven by stringent regulatory hurdles and essential product validation processes. Suppliers deeply integrated into healthcare systems, through technology or long-term contracts, inherently gain greater bargaining power. Medline strategically addresses this by diversifying its supplier base. Since 2018, Medline has onboarded nearly 150 new vendors from various global regions, enhancing supply chain resilience and mitigating supplier power. This ongoing diversification effort strengthens Medline's position in 2024 against potential supplier leverage.

Forward Integration Threat by Suppliers

Manufacturers of medical products pose a potential threat of forward integration, aiming to distribute directly to end-users and bypass distributors like Medline. While establishing large-scale distribution networks requires substantial investment in logistics and infrastructure, this threat grants manufacturers considerable leverage in negotiations. Medline's extensive global distribution network, which includes over 50 distribution centers across North America, serves as a significant barrier to such integration efforts.

- Direct distribution could bypass established channels.

- High capital investment for suppliers to integrate forward.

- Medline's 2024 footprint deters supplier entry.

- Supplier leverage increases during contract renewals.

Importance of Volume to Suppliers

While some suppliers may hold power, they critically depend on high-volume distributors like Medline for substantial revenue. Medline's immense purchasing power, with its annual sales expected to exceed $22 billion in 2024, grants significant leverage in negotiating favorable terms. This scale allows Medline to dictate conditions, ensuring competitive pricing and reliable supply. Furthermore, the company's strategy of sourcing over 50% of its Medline-branded products from North America enhances its control over regional supply chains and strengthens its bargaining position.

- Medline's 2024 projected annual sales: Over $22 billion.

- Over 50% of Medline-branded products sourced from North America.

Suppliers of specialized components and concentrated raw materials maintain significant bargaining power over Medline due to high switching costs and market dynamics, evident in 2024 supply chain pressures. Medline counters this through strategic inventory management, like 60-day resin storage, and by diversifying its supplier base, onboarding nearly 150 new vendors since 2018. Medline's substantial purchasing power, with annual sales over $22 billion in 2024, and its vast distribution network also significantly mitigate supplier leverage.

| Supplier Power Factor | Medline Mitigation | 2024 Impact/Data |

|---|---|---|

| Concentrated Raw Materials | 60-day resin storage | Ongoing supply chain pressures |

| High Switching Costs | 150 new vendors (since 2018) | Enhanced supply chain resilience |

| Manufacturer Forward Integration | 50+ North American DCs | Medline sales over $22B |

What is included in the product

This analysis delves into the five competitive forces impacting Medline Industries, assessing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the potential for substitutes.

Instantly identify and address competitive threats in the medical supply industry with a clear visualization of Medline's Porter's Five Forces.

Customers Bargaining Power

The increasing consolidation of healthcare providers into large health systems significantly amplifies customer bargaining power. Group Purchasing Organizations (GPOs) further enhance this leverage by aggregating demand from numerous healthcare facilities, including those large systems. This collective purchasing volume allows GPOs to demand lower prices and more favorable terms from suppliers like Medline. While even the largest U.S. health system represents less than 5% of the market in 2024, GPOs effectively pool demand, creating immense negotiation power.

Healthcare providers operate under intense pressure to control costs, making them highly price-sensitive. Policies aimed at reducing healthcare expenditures and shifting towards value-based care models, such as those emphasized by the Centers for Medicare & Medicaid Services in 2024, significantly amplify this pressure. This forces medical distributors like Medline to compete aggressively on price. They must also clearly demonstrate the total cost-of-ownership gains their products offer to secure and retain contracts, aligning with customer demands for efficiency.

Customers, especially large hospital networks, possess extensive information, enabling them to meticulously compare prices and product offerings from various medical distributors. The strong presence of key competitors like McKesson, Cardinal Health, and Cencora (formerly AmerisourceBergen), which collectively dominate a significant portion of the healthcare distribution market, ensures viable alternatives for buyers. This intense competition empowers customers with considerable leverage, allowing them to readily switch suppliers in 2024 if pricing or service quality does not meet their expectations. Such access to alternatives significantly enhances customer bargaining power against Medline.

Low Switching Costs for Standardized Products

For many standardized medical supplies, such as examination gloves or basic wound dressings, switching costs for customers like hospitals or clinics are notably low. This allows buyers to easily shift between distributors based on price competitiveness, increasing their bargaining power. Medline counteracts this by leveraging its vast portfolio, which exceeded 335,000 unique products in 2024, and bundling these with value-added services.

This strategy aims to build customer loyalty and differentiate Medline from competitors.

- Medline's product portfolio: Over 335,000 unique products as of 2024.

- Customer switching costs: Low for commodity medical supplies.

- Bundled services: Include education and clinical programs.

- Strategic aim: Increase customer loyalty and differentiation.

High Customer Retention and Prime Vendor Agreements

Despite the inherent strong buyer power in healthcare, Medline Industries effectively mitigates this through high customer retention. Medline boasts a prime vendor customer retention rate exceeding 98%, a figure consistently maintained through 2024, demonstrating significant customer loyalty. By securing long-term prime vendor agreements with major health systems, such as Sutter Health and Lehigh Valley Health Network, Medline locks in substantial purchasing volumes. These agreements create a strategic dependency, making it financially and operationally challenging for customers to switch suppliers.

- Medline's prime vendor customer retention rate consistently stays above 98%.

- Long-term prime vendor agreements with major health systems like Sutter Health reduce buyer leverage.

- These agreements create high switching costs and operational dependency for healthcare providers.

- The company's strategic contract structure limits customer bargaining power in 2024.

Customers, especially large health systems and GPOs, wield significant bargaining power due to market consolidation and intense cost pressures, driven by policies like those from CMS in 2024. They possess extensive information and low switching costs for many commodity items. However, Medline mitigates this with a 98% prime vendor retention rate and long-term agreements for its vast 335,000-product portfolio. This strategy creates high operational dependency, limiting customer leverage.

| Customer Power Factor | Impact | Medline's Mitigation (2024) |

|---|---|---|

| GPO/Consolidation | High Leverage | 98%+ Prime Vendor Retention |

| Cost Sensitivity | Price Pressure | Value-added services, Bundling |

| Low Switching Costs | Easy Switching | Long-term Agreements, 335k+ Products |

Same Document Delivered

Medline Industries Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Medline Industries meticulously examines the competitive landscape, dissecting the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry. Understanding these forces is crucial for Medline's strategic decision-making and maintaining its market position within the healthcare supply chain.

Rivalry Among Competitors

The healthcare distribution market is highly concentrated, with a few dominant players like Medline, McKesson Corporation, Cardinal Health, and AmerisourceBergen. This creates an oligopolistic environment where intense rivalry is the norm, as actions by one directly influence the others. For instance, McKesson reported revenues around $276 billion for its fiscal year ending March 31, 2024, highlighting the scale of these competitors. These major distributors fiercely compete for lucrative contracts with large hospital systems and Group Purchasing Organizations. Such competitive pressures necessitate constant innovation and aggressive pricing strategies to maintain market share.

The global medical supplies market is projected for steady growth, with a Compound Annual Growth Rate (CAGR) expected to range from 4.4% to 7.1% through the early 2030s. This expansion often allows companies like Medline Industries to grow without intensely competing for existing market share. However, despite this growth, the immense scale of the market and the strategic ambition for market leadership ensure that competitive rivalry remains elevated. Firms continuously vie for position, even within an expanding industry landscape. This dynamic means that while the pie is getting bigger, the desire for the largest slice intensifies competition.

While many medical products are commodities, competitive rivalry intensifies as companies differentiate through extensive product portfolios and brand reputation. Medline, for instance, offers over 335,000 products and enhances its value proposition with clinical solutions and educational programs. Competitors like Cardinal Health and Owens & Minor also focus on advanced logistics, technology integration, and robust customer support to gain an edge in 2024. This strategic emphasis on value-added services beyond basic product supply is crucial for market share.

Strategic Acquisitions and Consolidation

The medical supply industry is consistently marked by significant consolidation, with major entities frequently acquiring smaller firms to broaden their product lines and extend market reach. This M&A activity, such as Medline's 2022 acquisition of Ecolab Inc.'s surgical solutions business, strategically enhances portfolios. Such moves intensify competitive rivalry as companies strive for greater scale and a more comprehensive market offering. In 2024, the trend of strategic acquisitions continues to reshape the competitive landscape, pressuring firms to innovate and integrate new capabilities.

- Medline's acquisition of Ecolab's surgical solutions, completed in Q3 2022, added over 300 products to its portfolio.

- The global medical devices M&A market reached approximately $40 billion in 2023, with similar levels projected for 2024, indicating continued consolidation.

- Acquisitions allow companies like Medline to gain market share and achieve cost efficiencies, driving up competitive pressure.

- This ongoing consolidation reduces the number of independent players, increasing the competitive intensity among the remaining large entities.

High Stakes of Prime Vendor Contracts

The intense competition for prime vendor agreements with major healthcare systems is a critical battleground for Medline. These long-term, high-volume contracts are exceptionally valuable, often spanning multiple years and worth hundreds of millions, significantly reshaping market share in the medical-surgical distribution sector. This fierce rivalry, involving key players like Cardinal Health and Owens & Minor, drives substantial pricing pressure and demands that distributors like Medline continuously offer superior service, advanced logistical capabilities, and a comprehensive product portfolio to secure and maintain these essential partnerships.

- Prime vendor contracts typically last 3-5 years, providing stable revenue streams.

- Winning a single large integrated delivery network (IDN) contract can represent over $100 million in annual revenue.

- Logistics efficiency, including order fulfillment rates exceeding 98%, is crucial for retaining these agreements.

- Cost-saving initiatives and value-added services are often key differentiators in competitive bids.

Competitive rivalry in the healthcare distribution market is exceptionally high due to an oligopolistic structure dominated by a few large players like Medline, McKesson, and Cardinal Health. These firms engage in intense competition for lucrative prime vendor contracts with major hospital systems, driving aggressive pricing and a strong focus on differentiation. The ongoing industry consolidation, marked by strategic acquisitions, further intensifies this rivalry by consolidating market power and necessitating continuous innovation and efficiency among competitors in 2024.

| Metric | Key Data Point (2024) | Impact on Rivalry |

|---|---|---|

| Market Share Indicator | McKesson FY2024 Revenue: ~$276 Billion | Illustrates scale of dominant competitors |

| Product Breadth | Medline Product Portfolio: >335,000 items | Crucial for differentiation and comprehensive offerings |

| Consolidation Trends | Global Med Devices M&A (Projected 2024): ~$40 Billion | Reduces players, intensifies competition among remaining large firms |

SSubstitutes Threaten

New treatment modalities pose a significant threat as technological advancements reduce reliance on traditional medical supplies. Minimally invasive surgeries, which are increasingly common in 2024, often require fewer disposable items compared to older open procedures, impacting demand for conventional surgical kits. The growing adoption of telemedicine further shifts needs towards remote monitoring devices and digital health solutions, moving away from high-volume in-clinic consumables. These innovations push healthcare providers towards different supply chains, challenging Medline's core product lines.

3D printing technology presents a long-term substitute, enabling on-demand, customized manufacturing of certain medical devices. This innovation could allow hospitals to produce specific items in-house, reducing their reliance on traditional distributors like Medline. While still evolving, the global medical 3D printing market was valued at over $2.5 billion in 2023 and is projected to grow significantly by 2025, potentially disrupting the supply chain for product categories like surgical guides and prosthetic components. This emerging trend necessitates distributors to innovate their offerings to maintain relevance.

A significant shift towards preventative care and home healthcare presents a growing substitute threat to traditional acute care supply demand. The global home healthcare market is projected to reach approximately $430 billion by 2024, emphasizing a move away from hospital-centric care. This expansion drives demand for specialized product kits and remote monitoring devices, directly substituting supplies typically used in inpatient settings. Medline must strategically adapt its product offerings to cater to this rapidly expanding segment of patient care, which increasingly prioritizes convenience and cost-effectiveness outside of hospitals.

Reusable vs. Disposable Products

The ongoing dynamic between reusable and disposable medical products presents a clear threat of substitution. While disposable items offer convenience and critical infection control, increasing cost pressures and environmental sustainability goals are driving interest in reusable alternatives. A significant shift towards reusable products, such as surgical instruments or textile products, could reduce the high-volume demand for disposables that distributors like Medline Industries currently fulfill. For instance, the global reusable medical devices market was projected to reach over $30 billion in 2024, indicating a growing preference in certain segments.

- In 2024, hospitals faced increasing pressure to reduce waste, with single-use plastics being a major concern.

- The average cost saving from switching to reusable surgical gowns can be up to 30% per use compared to disposables.

- Some healthcare systems are targeting a 25% reduction in disposable medical waste by 2030, favoring reusable options.

- Innovations in sterilization technologies are making reusable alternatives more viable and safer for broader adoption.

Alternative Therapies and Digital Health Solutions

The rise of digital health solutions and alternative therapies poses a substitution threat to traditional medical supplies. Digital therapeutics for chronic conditions, for example, may reduce the need for frequent physical tests and diagnostic supplies. This shift in healthcare management, though not fully replacing all products, impacts demand. The global digital therapeutics market was valued at approximately $6.1 billion in 2024, indicating significant growth.

- Digital health adoption: Growing use of apps and remote monitoring.

- Market value: Digital therapeutics estimated at $6.1 billion in 2024.

- Reduced demand: Less need for certain traditional diagnostic supplies.

- Healthcare shift: Evolution towards preventative and digital care models.

Medline faces significant substitute threats from evolving healthcare models and technologies. The rise of home healthcare, valued at approximately $430 billion in 2024, shifts demand away from traditional hospital supplies. Additionally, the growing reusable medical devices market, projected at over $30 billion in 2024, directly challenges disposable product sales. Digital health solutions, a $6.1 billion market in 2024, further reduce the need for certain physical diagnostics.

| Substitute Category | 2024 Market Value (Approx.) | Impact |

|---|---|---|

| Home Healthcare | $430 Billion | Shifts supply demand |

| Reusable Devices | $30 Billion | Reduces disposable sales |

| Digital Therapeutics | $6.1 Billion | Decreases diagnostic needs |

Entrants Threaten

Entering the medical supply distribution sector demands massive capital investment in warehousing, logistics, and inventory. Medline, for instance, has invested billions in its infrastructure, including over 50 distribution centers globally. This extensive network, continuously enhanced through 2024, creates a formidable financial barrier. Such a scale makes it incredibly challenging for new companies to compete effectively on a national or global level.

New entrants into the healthcare supply industry face significant regulatory hurdles, acting as a major deterrent. Compliance with bodies like the FDA and frameworks such as the OIG’s compliance program guidance is extensive and costly. In 2024, the average cost of a medical device regulatory submission can range into the millions, requiring substantial expertise. States are also increasing scrutiny and notification requirements for healthcare transactions, adding layers of complexity. This evolving landscape demands immense resources, making market entry challenging for new companies.

Established players like Medline Industries benefit from significant economies of scale, achieving cost advantages through high-volume purchasing and expansive distribution networks. This allows them to offer highly competitive pricing in the healthcare supply market. New entrants in 2024 would face immense challenges matching these cost efficiencies, struggling to compete on price, which remains a critical factor for hospital systems and healthcare providers. Medline's procurement leverage, stemming from its vast operational scale, creates a formidable barrier, as new players lack the initial volume to negotiate similar favorable terms with suppliers.

Established Distribution Channels and Customer Relationships

New entrants face a formidable barrier due to Medline Industries' deeply entrenched distribution channels and long-standing customer relationships. Incumbents like Medline have cultivated prime vendor contracts and strong ties with major healthcare providers, including hospitals and Group Purchasing Organizations (GPOs), over decades. A new player in 2024 would struggle immensely to penetrate these established networks and persuade customers to switch from reliable, long-term partners. Medline's reported 98% customer retention rate underscores the significant difficulty of displacing such a dominant player.

- Established prime vendor contracts create high switching costs for healthcare institutions.

- Medline’s extensive logistics infrastructure is difficult for new entrants to replicate quickly.

- Customer loyalty, evidenced by a 98% retention rate, limits market access for newcomers.

- Long-term GPO agreements act as significant deterrents to market entry.

Brand Recognition and Trust

Established distributors like Medline Industries have cultivated deep brand recognition and trust over many decades. In the healthcare sector, where product quality and reliability are paramount for patient safety, providers are highly reluctant to switch to unproven suppliers. A new entrant would need substantial, long-term investments, potentially billions of dollars, to build a comparable level of trust and reputation in a market dominated by giants like Medline, Cardinal Health, and Owens & Minor.

- Medline's extensive 2024 network includes over 27,000 products and a vast global supply chain.

- Healthcare provider loyalty is high, with switching costs encompassing not just price but also integration and training.

- Building a new, compliant distribution network and gaining regulatory approvals can take years.

- Marketing and sales efforts to overcome incumbent loyalty are extraordinarily expensive.

New entrants face formidable barriers from Medline's massive capital outlays for infrastructure, including over 50 global distribution centers, and extensive regulatory compliance costs. Deeply entrenched customer relationships, evidenced by a 98% retention rate, and significant economies of scale deter new competition. Replicating Medline’s brand trust and vast 2024 network requires billions and years, making market entry exceptionally difficult.

| Barrier Type | Medline's Advantage | 2024 Impact for New Entrants |

|---|---|---|

| Capital Investment | 50+ Global DCs, Billions Invested | High initial cost of entry |

| Customer Loyalty | 98% Retention Rate | Difficult to gain market share |

| Regulatory Compliance | Extensive Approvals | Millions in submission costs |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Medline Industries is built upon a robust foundation of data, including Medline's annual reports, SEC filings, and investor relations materials. We also incorporate insights from reputable industry research firms, healthcare trade publications, and market intelligence databases to provide a comprehensive view of the competitive landscape.