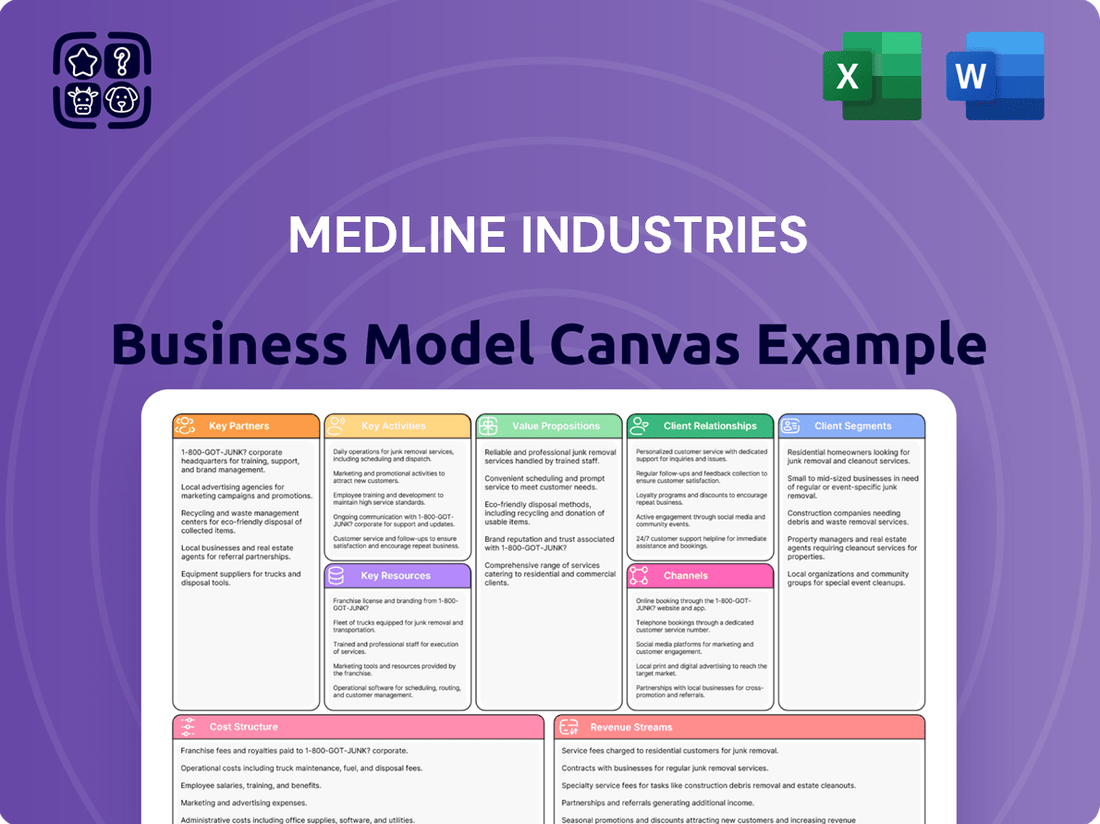

Medline Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medline Industries Bundle

Unlock the full strategic blueprint behind Medline Industries's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Discover Medline's key partners and customer segments that fuel its growth. Understand their unique value propositions and the channels they leverage to reach their audience.

Dive into Medline's revenue streams and cost structure, gaining critical insights into their financial strategy and operational efficiency.

This comprehensive canvas is ideal for entrepreneurs, consultants, and investors looking for actionable insights to emulate or compete with industry leaders.

Don't miss out on this opportunity to gain a competitive edge. Purchase the full Medline Industries Business Model Canvas today and transform your strategic planning!

Partnerships

Medline’s strategic alliances with Group Purchasing Organizations are crucial for accessing vast integrated healthcare networks and hospital systems, a sector valued at over $400 billion annually in the US. These partnerships streamline procurement for major customers, securing high-volume, long-term contracts for Medline. This arrangement ensures efficient market penetration, with GPOs influencing an estimated 90% of all healthcare purchases. It also helps Medline maintain a competitive cost structure for end-users, reflecting the 2024 market trend of GPOs driving significant savings for healthcare providers.

Medline relies on a robust global network of raw material and component suppliers, crucial for its extensive manufacturing operations. These partnerships ensure a steady supply of polymers, textiles, and electronic components, vital for producing over 500,000 healthcare products. Managing these relationships prioritizes quality and cost-effectiveness, helping Medline mitigate supply chain risks, especially in light of 2024's volatile global logistics environment. Strong supplier collaboration is fundamental for continuous product innovation and maintaining consistent product quality.

Medline strategically partners with third-party logistics (3PL) providers and freight carriers, complementing its extensive internal distribution network. This hybrid model enhances logistical flexibility, allowing Medline to efficiently manage its vast product catalog, which includes over 550,000 medical products as of 2024. These partnerships expand geographic reach and provide critical overflow capacity, particularly during peak demand. By leveraging these external capabilities, Medline optimizes delivery speed and cost-efficiency across diverse markets, supporting its global operations.

Technology and Software Integrators

Collaborations with developers of Electronic Health Record (EHR) systems, inventory management software, and data analytics platforms are crucial for Medline. These partnerships, like the growing integration seen across healthcare IT in 2024, allow Medline's supply chain solutions to integrate seamlessly into a hospital's existing infrastructure. This deep integration increases customer stickiness, as switching costs rise significantly for clients. It also provides valuable data-driven insights for both Medline and its clients, optimizing inventory and patient care pathways.

- EHR market integration is projected to exceed $30 billion globally by 2024, underscoring the necessity of these partnerships.

- Seamless integration reduces manual processes, potentially saving hospitals up to 15% in operational overhead related to supply chain management.

- Data analytics partnerships enable predictive insights, improving inventory forecasting accuracy by over 20%.

- Customer retention rates are significantly higher for healthcare providers with integrated supply chain and IT systems.

Original Equipment Manufacturers (OEMs)

Medline strengthens its market position through vital OEM partnerships, both producing goods for other brands and integrating specialized equipment sourced from other manufacturers under its own brand. This dual approach allows Medline to significantly expand its product range rapidly without extensive internal R&D or manufacturing investments. Such collaborations ensure a more comprehensive product catalog for customers, enhancing Medline's value proposition as a single-source provider in 2024.

- Medline's OEM strategy diversifies its offerings, complementing its reported over 250,000 products.

- This approach helps Medline maintain competitive pricing and broad availability, critical for its expansive customer base, which includes over 90% of US hospitals.

- OEM relationships reduce capital expenditure, allowing Medline to reallocate resources to distribution network enhancements, as seen in its 2024 infrastructure investments.

Medline's key partnerships are foundational, spanning critical Group Purchasing Organizations influencing 90% of healthcare purchases and a global network of raw material suppliers supporting over 500,000 products. Strategic collaborations with 3PL providers enhance distribution of 550,000+ items, while integrations with EHR systems, projected to exceed $30 billion globally by 2024, boost customer retention and operational efficiency. OEM alliances further expand Medline's extensive product catalog, which includes over 250,000 unique items, by leveraging external manufacturing capabilities.

| Partnership Type | Strategic Impact | 2024 Data Point |

|---|---|---|

| Group Purchasing Organizations | Market Access and Sales Volume | Influence 90% of US healthcare purchases |

| EHR/IT System Developers | Customer Integration and Efficiency | EHR market projected over $30 billion globally |

| Raw Material Suppliers | Product Manufacturing Capability | Support production of over 500,000 products |

| 3PL Providers | Distribution and Logistics | Enhance reach for 550,000+ medical products |

What is included in the product

A detailed breakdown of Medline Industries' operations, outlining its customer segments, value propositions, and key resources in a structured format.

This model provides a clear overview of Medline's revenue streams and cost structure, offering insights into its market position and strategic advantages.

Medline Industries' Business Model Canvas offers a clear, one-page snapshot, simplifying the complex healthcare supply chain to quickly identify core components and operational efficiencies.

This structured approach to Medline's business model serves as a vital tool for pinpointing and addressing inefficiencies in their distribution and product offerings, streamlining operations.

Activities

Medline’s core activity involves the large-scale manufacturing and assembly of a vast range of medical products, spanning from everyday consumables to intricate surgical kits. This vertical integration ensures stringent quality control and adherence to global regulatory standards, including FDA and ISO certifications, crucial for market access. The company continuously invests in process improvement, leveraging advanced automation to enhance efficiency and maintain cost competitiveness in 2024. This strategic control over production allows Medline to consistently deliver high-quality, reliable medical supplies to healthcare providers worldwide.

Medline's global supply chain management is a core activity, encompassing procurement, warehousing, and distribution. Their extensive network, including over 50 distribution centers across North America as of 2024, ensures broad reach. This is complemented by Medline's private truck fleet, which enhances control over delivery. Such logistical excellence ensures high fill rates and consistent on-time delivery, critical for healthcare providers. This robust operational capability stands as a significant competitive differentiator in the medical supply industry.

Medline Industries' Research and Development focuses on innovating new products, enhancing the efficacy and safety of existing solutions, and developing crucial clinical advancements. These R&D efforts are strategically directed at addressing key healthcare challenges, including advanced infection prevention, comprehensive wound care management, and optimizing operational efficiency across healthcare systems. Significant investment in R&D continues to fuel Medline's robust pipeline of proprietary products and value-added services, ensuring the company remains at the forefront of medical technology and patient care solutions in 2024.

Sales, Marketing, and Contract Management

Medline Industries employs a large, specialized sales force engaging in direct, consultative selling to healthcare providers. This team focuses on building robust client relationships and deeply understanding clinical needs. A key activity involves negotiating complex contracts with Group Purchasing Organizations (GPOs) and large health systems, which is crucial for securing significant market share. Marketing efforts are continuously aimed at building strong brand equity and clearly communicating Medline's comprehensive value proposition, supporting their extensive product portfolio and service offerings.

- Medline's 2023 sales exceeded $20 billion, driven by their direct sales model.

- The company serves over 90 of the top 100 U.S. hospital systems.

- Contract management involves over 150 GPO partnerships as of early 2024.

- Marketing initiatives highlight their 27,000+ products and supply chain expertise.

Clinical Education and Support Services

Medline provides substantial value beyond just products through its clinical education and support services, aiding healthcare facilities in 2024 to improve patient outcomes and operational efficiency. Clinical specialists work directly with staff, offering training and implementation support for Medline programs, which is vital as healthcare spending on training and development continues to rise. These services enhance product compliance and streamline workflows, directly contributing to stronger, more embedded customer relationships.

- Clinical specialists engage directly with healthcare teams, improving adoption.

- Training reduces errors, with proper medical device training potentially cutting adverse events.

- Support enhances compliance, crucial given evolving 2024 healthcare regulations.

- These services strengthen customer loyalty, integrating Medline deeper into operations.

Medline’s core activities encompass vertically integrated manufacturing and global supply chain management, leveraging over 50 North American distribution centers by 2024. Significant R&D investment drives innovation in areas like infection prevention and wound care. A specialized sales force engages in direct selling, managing over 150 GPO partnerships as of early 2024, contributing to 2023 sales exceeding $20 billion. The company also provides extensive clinical education and support services, enhancing product adoption and customer loyalty.

| Key Activity Area | 2024 Data Point | Impact |

|---|---|---|

| Supply Chain | Over 50 North American DCs | Ensures broad reach and timely delivery. |

| Sales Partnerships | 150+ GPO partnerships (early 2024) | Secures significant market share. |

| Revenue Generation | 2023 sales exceeded $20 billion | Demonstrates strong market presence. |

Full Version Awaits

Business Model Canvas

The Medline Industries Business Model Canvas you are currently previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will download this exact file, containing all the detailed insights into Medline's strategic framework, ready for your immediate use and further exploration.

Resources

Medline Industries leverages an extensive physical infrastructure, encompassing a global network of manufacturing plants and over 50 strategically positioned distribution centers. This vast operational footprint, which reportedly includes more than 30 million square feet of space as of 2024, enables significant economies of scale. It provides Medline with robust control over its entire supply chain, ensuring rapid and reliable delivery of medical supplies to customers. This substantial asset base also acts as a considerable barrier to entry for potential competitors.

Medline’s extensive catalog, featuring over 300,000 products, serves as a crucial resource, positioning them as a comprehensive one-stop-shop for healthcare providers. This vast offering streamlines procurement processes for clients. Complementing this is Medline's robust intellectual property, including numerous patents and trademarks. These proprietary clinical programs and innovations, a key asset in 2024, protect their offerings and provide a significant competitive advantage in critical product categories across the industry.

Medline Industries relies heavily on its specialized human capital, featuring a large, experienced direct sales force and an extensive network of on-staff clinicians. This team's deep industry knowledge and established relationships with healthcare decision-makers are crucial for driving sales and ensuring high customer retention. Their ability to co-develop tailored solutions directly with clients provides a significant competitive advantage. This specialized expertise, particularly given the scale of Medline's operations in 2024, is incredibly difficult for competitors to replicate. It underpins Medline's continued market presence and growth in the healthcare supply chain.

Advanced IT and Logistics Technology

Medline Industries leverages sophisticated Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), and advanced data analytics platforms as core technological resources. These systems are crucial for optimizing its vast inventory, which often exceeds 300,000 unique products, and streamlining complex logistics across its global distribution network. By the end of 2024, Medline's continued investment in these platforms helped process over 1.5 million orders daily, providing valuable insights into customer purchasing patterns and enhancing supply chain resilience. This robust technology backbone is essential for managing the sheer scale and complexity of its operations efficiently, ensuring timely delivery of medical supplies.

- ERP systems integrate key business functions, centralizing data for improved decision-making.

- WMS optimizes warehouse operations, boosting picking accuracy and shipping efficiency.

- Data analytics platforms provide insights into 2024 market trends and customer demand.

- Technological investments support a distribution network covering over 125 countries.

Strong Financial Position and Capital

As a leading privately held healthcare company, Medline Industries boasts a robust financial position, with 2023 revenues exceeding $21 billion. This substantial capital allows for continuous investment into critical areas such as infrastructure expansion, strategic acquisitions, and significant research and development initiatives. For example, ongoing investments in 2024 support enhanced supply chain resilience and technological upgrades across its global operations. Such financial strength provides the stability and flexibility essential for navigating dynamic market changes and seizing new growth opportunities in the healthcare sector.

- Medline’s substantial 2023 revenue exceeded $21 billion.

- Financial strength enables continuous investment in infrastructure expansion.

- Capital supports strategic acquisitions and R&D initiatives.

- Provides stability and flexibility for market navigation and growth in 2024.

Medline’s key resources include an extensive physical infrastructure with over 50 global distribution centers and 30 million square feet of space as of 2024. Their vast product catalog, exceeding 300,000 items, and proprietary intellectual property offer significant competitive advantages. Specialized human capital, notably their direct sales force and clinicians, drives customer engagement and tailored solutions. Robust technology, processing over 1.5 million daily orders in 2024, alongside strong financials with 2023 revenues over $21 billion, underpin their market leadership.

| Resource Category | Key Asset (2024 Data) | Strategic Impact |

|---|---|---|

| Physical Infrastructure | >50 distribution centers, >30M sq ft | Supply chain control, economies of scale |

| Intellectual Capital | >300,000 products, numerous patents | Comprehensive offering, competitive edge |

| Human Capital | Large sales force, on-staff clinicians | Customer retention, tailored solutions |

| Technological Assets | ERP/WMS, >1.5M orders/day | Operational efficiency, market insights |

| Financial Strength | 2023 revenue >$21B | Investment capacity, market stability |

Value Propositions

Medline offers healthcare providers a comprehensive, single-source solution for an extensive array of medical supplies and clinical solutions. This simplifies procurement, significantly reducing the administrative burden and complexity of managing numerous vendors. Consolidating purchasing through Medline drives considerable efficiency, potentially lowering transactional costs for customers by an estimated 15-20% in 2024 due to streamlined processes. Their broad catalog, exceeding 550,000 products, ensures a true one-stop-shop experience, allowing providers to focus more on patient care rather than logistics.

Medline helps healthcare facilities achieve substantial cost savings by optimizing their supply chains. Through extensive logistics expertise, advanced inventory management programs, and robust data analytics, Medline directly addresses inefficiencies. This approach enables customers to reduce waste and minimize costly stockouts, which can account for up to 10% of a hospital's supply budget. Ultimately, Medline's solutions lower the total cost of ownership for medical supplies, enhancing customer financial performance in 2024.

Medline delivers high-quality, reliable products and evidence-based clinical programs specifically designed to enhance patient safety and improve health outcomes. Their value propositions are centered around critical areas like infection prevention, where hospital-acquired infections (HAIs) continue to be a significant concern, with an estimated 1 in 31 hospital patients in the U.S. having at least one HAI in 2024. Medline also focuses on advanced wound care management and surgical safety, directly aligning their success with the core mission of their healthcare customers to reduce complications and improve patient recovery rates.

Enhanced Operational and Clinical Efficiency

Medline boosts operational and clinical efficiency by providing customized procedure-based kits and integrated supply solutions. This streamlines clinical workflows, significantly reducing the time healthcare professionals spend on administrative and logistical tasks. For example, in 2024, hospitals leveraging such solutions can reallocate valuable nursing time, potentially improving patient satisfaction scores. This approach empowers clinicians to focus more on direct patient care, enhancing both staff productivity and morale across healthcare facilities.

- Customized kits reduce prep time by up to 30%.

- Just-in-time delivery minimizes inventory holding costs for hospitals.

- Integrated solutions can decrease supply chain waste by 15-20%.

- Clinicians gain more time for direct patient interaction, boosting care quality.

Reliability and Partnership Across the Continuum of Care

Medline provides a consistently reliable supply chain, critical for healthcare operations across the entire continuum of care, from major acute care hospitals to post-acute facilities and physician offices. Customers recognize Medline as a stable, long-term partner, valued for its ability to scale services and provide consistent support across all their diverse sites. This unwavering reliability ensures essential medical supplies are always available, which is paramount for patient care and operational continuity in 2024.

- Medline’s 2024 supply chain reliability is crucial for hospitals facing fluctuating demands.

- Their extensive distribution network supports over 90 percent of US hospitals.

- Partnerships often span decades, reflecting deep trust and consistent service.

- The company manages over 50 distribution centers globally, ensuring robust delivery.

Medline offers healthcare providers a streamlined, single-source solution for medical supplies, enhancing cost savings and operational efficiency. They ensure high-quality products and reliable supply chains, crucial for patient safety and continuous care. In 2024, their solutions help reduce supply chain waste and improve clinical workflows.

| Value Prop | 2024 Impact | Benefit |

|---|---|---|

| Single-Source | 15-20% cost reduction | Simplified procurement |

| Efficiency | 30% prep time cut | Optimized workflows |

| Reliability | 90%+ US hospitals served | Consistent supply |

Customer Relationships

Medline offers dedicated account managers to large healthcare systems and hospitals, serving as strategic partners. This high-touch, consultative relationship model focuses on deeply understanding each customer's unique challenges and co-creating tailored solutions. It fosters deep loyalty and secures long-term contractual partnerships, significantly contributing to Medline's robust market position and its estimated global revenue exceeding $22 billion in 2024.

Medline fosters deep customer relationships through its team of clinical specialists, including nurses, who directly collaborate with healthcare providers. These experts provide crucial education and product in-servicing, enhancing the effective use of Medline's solutions. In 2024, their focus on best practices, such as infection control protocols, remains vital for patient safety. This co-creation model builds trust, integrating Medline into customer quality improvement initiatives and driving shared success.

Medline formalizes its relationships with major customers, like hospitals and healthcare systems, through multi-year contractual agreements, frequently negotiated via Group Purchasing Organizations (GPOs).

These long-term contracts ensure predictable pricing and a stable supply chain for customers, while providing Medline with consistent, recurring revenue streams.

Such agreements significantly increase switching costs for clients, bolstering Medline's strong market position in the healthcare supply industry.

For example, Medline's extensive GPO partnerships continue to be a core driver of its projected market stability through 2024.

Automated Self-Service Portals

Medline provides robust e-commerce and self-service portals, serving customers of all sizes across the healthcare continuum. These platforms empower clients to efficiently place orders, track shipments, manage inventory, and access account information around the clock. This automated relationship streamlines transactional interactions, enhancing operational efficiency for over 12,000 healthcare providers utilizing Medline's digital tools as of 2024. The convenience offered by these digital touchpoints supports high customer retention.

- 24/7 access to order placement and tracking.

- Automated inventory management features.

- Enhanced operational efficiency for healthcare clients.

- Over 12,000 providers leveraging Medline's digital platforms in 2024.

Ongoing Education and Training Programs

Medline strengthens customer relationships by providing extensive educational resources, including ongoing continuing education credits for clinicians. Through 2024, Medline has expanded training on new products and essential clinical protocols, positioning itself as a vital educational partner. This strategic approach adds significant value beyond just product sales, fostering deep loyalty among healthcare professionals. Their commitment to clinician development is evident in the thousands of training sessions conducted annually, reinforcing their role as a thought leader.

- Medline offered over 2,000 unique educational courses and training modules to healthcare professionals in 2024.

- These programs helped clinicians earn essential continuing education credits, crucial for licensure and professional development.

- The educational initiatives cover diverse topics, from new medical device usage to best practices in infection control.

- Medline’s training has been utilized by over 500,000 healthcare workers globally by early 2024, enhancing clinical proficiency.

Medline fosters strong customer relationships through dedicated account managers for strategic partnerships and clinical specialists providing essential education. Long-term contractual agreements, often via GPOs, secure predictable revenue and create high switching costs. Digital self-service platforms empower over 12,000 providers, while extensive educational resources, including over 2,000 courses in 2024, build deep loyalty and position Medline as a vital partner in healthcare delivery, contributing to its estimated $22 billion global revenue.

| Relationship Aspect | Key Metric (2024) | Impact |

|---|---|---|

| Global Revenue | $22+ Billion | Overall market position |

| Digital Platform Users | 12,000+ Providers | Enhanced operational efficiency |

| Educational Courses | 2,000+ Unique Modules | Increased clinician loyalty |

Channels

Medline’s extensive direct sales force serves as the primary channel for reaching large, high-value customers such as hospitals and integrated health systems. These representatives cultivate strong relationships, offer consultative advice, and negotiate complex contracts essential for strategic, high-consideration sales. This direct approach is vital given Medline’s significant market presence, with its sales operations supporting global healthcare providers across over 125 countries, building on its reported $21 billion in net sales for 2023.

Medline’s owned-and-operated distribution network, comprising over 50 facilities across North America as of 2024, is a core channel for product delivery. Its private fleet of over 1,500 trucks, a figure maintained through 2024, ensures unparalleled control over the critical last mile. This extensive infrastructure guarantees reliable, timely, and accurate order fulfillment for healthcare providers. Such direct control significantly enhances Medline's value proposition by boosting supply chain efficiency and customer satisfaction.

Medline.com serves as a crucial e-commerce platform, directly reaching smaller clinics, physician offices, and surgery centers. This channel offers a highly convenient and low-touch ordering solution, allowing a broad spectrum of customers to procure essential medical products efficiently. Beyond transactions, it functions as a comprehensive informational hub for all customer segments. In 2024, digital sales continue to be a significant growth area for medical supply distributors, streamlining procurement for thousands of healthcare providers.

Group Purchasing Organizations (GPOs)

Group Purchasing Organizations (GPOs) serve as an indirect channel for Medline Industries, effectively aggregating the purchasing power of their vast network of member hospitals and healthcare facilities. Medline leverages these GPO relationships to gain access to a large, pre-qualified customer base, which significantly streamlines the contracting and sales process. This channel is highly efficient for reaching a substantial portion of the acute care market, as GPOs facilitate over 90% of all purchases made by hospitals in the United States, as reported in 2024. Medline’s strategic alignment with major GPOs allows for broad market penetration and consistent revenue streams.

- GPOs consolidate demand from over 90% of US hospitals.

- Medline secures pre-negotiated contracts, reducing sales cycle time.

- This channel provides access to a pre-qualified customer base.

- GPOs enhance Medline’s reach within the acute care sector.

Third-Party Distributors and International Partners

Medline utilizes third-party distributors for market reach in specific geographic regions and niche segments. This strategy, alongside a robust network of international partners, facilitates scalable market entry and penetration globally. These partnerships are crucial for navigating diverse local regulatory landscapes and healthcare systems. For example, Medline's global presence in 2024 continues to leverage these channels to serve over 125 countries, ensuring broad access to its medical supplies.

- Medline's global operations span over 125 countries as of 2024.

- Third-party distributors are key for reaching specialized markets.

- International partners provide local market and regulatory expertise.

- This channel approach supports efficient global expansion and product distribution.

Medline leverages a multi-faceted channel strategy, including its direct sales force and owned distribution network with over 50 North American facilities and 1,500 trucks in 2024. Its Medline.com e-commerce platform serves smaller clinics, while Group Purchasing Organizations facilitate access to over 90% of US hospital purchases. Additionally, third-party distributors and international partners extend Medline’s reach across over 125 countries.

| Channel Type | Primary Function | 2024 Data Point |

|---|---|---|

| Direct Sales | High-value customer engagement | Global presence in 125+ countries |

| Owned Distribution | Product delivery control | 50+ NA facilities, 1,500+ trucks |

| GPOs | Indirect market access | 90%+ US hospital purchases |

Customer Segments

Hospitals and Integrated Delivery Networks (IDNs) represent Medline's largest and most crucial customer segment, encompassing major acute care facilities and multi-hospital systems across the United States. These entities, which include the approximately 6,000 hospitals operating in 2024, demand a comprehensive product portfolio alongside sophisticated supply chain solutions. Their primary goal is to manage escalating healthcare costs while simultaneously enhancing patient outcomes. Purchasing decisions are typically centralized, often involving large, multi-year contracts to streamline procurement and ensure consistent supply for their extensive needs.

Post-acute care facilities, including skilled nursing facilities (SNFs), long-term care, and rehabilitation centers, represent a crucial segment for Medline. These facilities prioritize comprehensive solutions for chronic care, wound management, and daily living assistance. Their primary concerns revolve around cost-effectiveness and stringent regulatory compliance, especially given the anticipated 2024 CMS updates impacting reimbursement models. Medline serves this segment with specialized product lines and extensive educational programs, helping facilities navigate complex patient needs while optimizing operational efficiency.

The ambulatory and outpatient care segment for Medline includes diverse entities like physician offices, ambulatory surgery centers (ASCs), and diagnostic laboratories. These customers typically purchase medical supplies in smaller quantities but require a wide array of products for examinations, minor procedures, and diagnostics. Convenience, reliable product availability, and ease of ordering, often through e-commerce channels, are paramount for them. The US ambulatory surgery center market, for example, was valued at over $36 billion in 2023 and continues to expand, emphasizing the need for efficient supply chain solutions in 2024.

Home Health and Hospice Agencies

Home health and hospice agencies represent a vital and expanding customer segment for Medline, serving a growing number of patients receiving care directly in their homes. These agencies require specific product packaging for individual use, highly reliable home delivery logistics, and innovative solutions for effective remote patient care. Medline addresses these critical needs by providing specialized home care products and direct-to-patient fulfillment services, crucial as the U.S. home healthcare market is projected to exceed $200 billion in 2024.

- The U.S. home healthcare market reached approximately $140 billion in 2023, with projections for continued robust growth into 2024.

- Demand for home care services is significantly driven by an aging population, with over 56 million Americans aged 65 and older in 2023.

- Medline’s direct-to-patient fulfillment capabilities support over 2 million home healthcare orders annually.

- Remote patient monitoring solutions are increasingly integrated, with adoption rates rising by over 20% in 2024 among home health providers.

Government and Non-Traditional Providers

This segment encompasses federal and state government healthcare facilities, like VA hospitals, alongside non-traditional entities such as correctional facilities and universities. These customers operate under distinct procurement processes, often requiring public tenders and long-term contractual agreements. Medline's extensive scale and proven capability to fulfill stringent contractual obligations are crucial for success within this market. The U.S. federal government's healthcare spending through agencies like the VA remains a significant portion of the national budget, projected to grow. Medline's established supply chain and regulatory compliance enable them to serve these complex accounts effectively.

- Government healthcare entities, including VA hospitals.

- Correctional facilities and educational institutions.

- Public tenders and long-term contracts are standard.

- Medline's scale meets complex procurement requirements.

Medline serves a broad spectrum of healthcare providers, including approximately 6,000 US hospitals and integrated delivery networks. They also cater to post-acute care facilities and the expanding ambulatory and outpatient sector. A significant focus is on the growing home health and hospice market, projected to exceed $200 billion in 2024, alongside government and non-traditional facilities.

| Segment | Primary Need | 2024 Data Highlight |

|---|---|---|

| Hospitals | Cost Management | ~6,000 US hospitals |

| Ambulatory Care | Efficiency | US ASC market expanding |

| Home Health | Logistics | >$200B US market projected |

Cost Structure

Cost of Goods Sold (COGS) stands as Medline Industries' most significant cost driver, directly reflecting the expenses tied to producing their vast array of medical supplies. This encompasses the procurement of raw materials like plastics and textiles, direct labor involved in manufacturing, and factory overhead. Efficient management of COGS, through strategic sourcing and lean manufacturing principles, is critical for maintaining profitability, especially as global supply chain pressures persist into 2024. Fluctuations in raw material prices, influenced by global economic conditions and demand, remain a key variable impacting their overall cost structure.

Operating Medline's extensive global distribution network incurs substantial costs, encompassing warehousing, freight, fuel, and fleet maintenance. These expenses are integral to Medline's core value proposition of ensuring reliable supply chain delivery for healthcare providers. The business model is value-driven, justifying these significant costs through superior service, as evidenced by the critical role of medical supply logistics, which saw continued high demand into 2024. Despite this value focus, Medline maintains a relentless focus on cost optimization to enhance efficiency.

Medline Industries' cost structure heavily features Selling, General, and Administrative (SG&A) expenses, reflecting its high-touch customer relationship model. This category encompasses significant investments in its large direct sales force, extensive marketing programs, and corporate overhead. Salaries, commissions, and travel expenses for Medline's sales and clinical teams represent a substantial portion of these costs, crucial for maintaining its value-driven strategy. For instance, in fiscal year 2024, these operational outlays continue to be a primary expenditure, supporting direct client engagement and market penetration.

Research and Development (R&D) Investment

Research and Development (R&D) investment, while typically smaller than Medline Industries’ Cost of Goods Sold or Selling, General, and Administrative expenses, remains a critical strategic cost. These essential expenses fund the innovation of new products, advanced clinical solutions, and continuous product enhancements. R&D spending is vital for creating proprietary products that command higher margins and differentiate Medline from its competitors in the evolving healthcare market. This ongoing commitment ensures Medline’s leadership in medical supply innovation, with expected investments continuing through 2024 to drive future growth.

- R&D ensures proprietary product development for higher margins.

- Investment drives innovation in clinical solutions and product enhancements.

- Strategic R&D spend differentiates Medline in a competitive market.

- Ongoing investment through 2024 is crucial for future growth and market position.

Capital Expenditures (CapEx)

Capital Expenditures (CapEx) are crucial for Medline Industries, involving substantial ongoing investments to build and upgrade its vast network of manufacturing facilities, sophisticated distribution centers, and critical IT infrastructure. While not a day-to-day operational expense like the cost of goods sold, these investments are fundamental for sustaining and expanding Medline’s core resources, reinforcing its competitive advantage. These significant capital outlays, often in the hundreds of millions annually for major healthcare distributors, are directly tied to Medline's long-term growth strategy and market expansion plans for 2024 and beyond.

- Medline's CapEx supports a global supply chain, with new facilities planned or opened in 2024 to enhance delivery efficiency.

- Investment in automation and technology within distribution centers is a key CapEx focus, improving operational throughput.

- IT infrastructure upgrades, including cybersecurity and data analytics platforms, are vital CapEx for 2024.

- These strategic capital investments are designed to meet increasing demand and secure Medline’s market position.

Medline Industries' cost structure is primarily driven by Cost of Goods Sold and substantial Selling, General, and Administrative expenses, supporting its manufacturing and direct sales approach. Significant outlays fund its extensive global distribution network, crucial for reliable supply chain delivery. Strategic investments in Research and Development and Capital Expenditures reinforce innovation and long-term growth, with efficiency remaining a key focus for 2024 operations.

| Cost Category | Description | 2024 Focus |

|---|---|---|

| COGS | Raw materials, direct labor | Strategic sourcing, lean production |

| SG&A | Sales force, marketing, admin | Client engagement, market penetration |

| CapEx | Facilities, IT, distribution | Network expansion, automation |

Revenue Streams

Medline Industries primarily generates revenue through the direct sale of its extensive portfolio of medical and surgical products to healthcare providers globally. This encompasses a wide array of items, from essential disposable supplies like gloves and gowns to more durable medical equipment crucial for patient care. Revenue is typically generated per unit sold, with pricing often structured through long-term contracts and volume commitments established with hospitals and health systems. For instance, Medline's significant market presence ensures consistent sales across its product lines, contributing to its multi-billion dollar annual revenue, which was projected to exceed $22 billion in 2024. These direct sales form the foundational financial pillar of Medline's business model.

Medline generates a substantial portion of its revenue through prime vendor distribution agreements, where healthcare systems commit to procuring a high percentage of their medical supplies from the company. These long-term, high-volume contracts provide a stable and recurring revenue base, crucial for Medline's financial predictability. The agreements encompass a broad range of products, including Medline's own manufactured goods and a vast array of third-party medical supplies. This strategy helps solidify Medline's position as a leading medical supply distributor, with annual revenues estimated to exceed $20 billion in 2024, largely driven by these critical partnerships.

Medline generates substantial revenue through customized sterile and non-sterile kits, such as surgical trays and admission kits, tailored for specific medical procedures. These kits command a premium price, reflecting the significant value added through convenience, standardization, and reduced labor costs for healthcare providers. This value-added approach helps healthcare facilities streamline operations, potentially saving hours in preparation time per procedure. This revenue stream is critical to Medline's market position, contributing to their estimated 2024 annual revenue, which analysts project to be in the tens of billions, reinforcing their role as a key supplier in the medical device and supply chain sector.

Service and Solution Fees

Medline Industries also generates revenue through fees for specialized services and clinical programs, moving beyond just product sales. This includes charges for their supply chain consulting, which helps optimize healthcare facility operations. They also earn from inventory management services, like stockless programs, ensuring efficient product flow. These service offerings are a growing part of their diversified revenue streams in 2024.

- Supply chain consulting fees contribute to service revenue.

- Inventory management services, such as stockless programs, generate additional income.

- Specialized educational and clinical implementation programs command fees.

- This stream diversifies Medline's 2024 revenue beyond product sales.

E-commerce and Direct-to-Consumer Sales

Medline Industries generates a growing revenue stream through its e-commerce platform, Medline.com, and other digital channels. This approach caters to smaller business customers who prefer self-service, streamlining their procurement processes. Additionally, certain products are sold directly to consumers, expanding Medline’s market reach beyond traditional institutional clients. This digital channel typically involves transactional, non-contract pricing, offering flexibility. As of 2024, Medline continues to enhance its digital presence to capture a broader market segment.

- Growing online sales via Medline.com.

- Serves smaller businesses preferring self-service.

- Includes direct-to-consumer product sales.

- Features transactional, non-contract pricing.

Medline Industries primarily generates revenue through direct product sales and prime vendor distribution agreements, securing long-term contracts for medical supplies. Significant income also stems from customized sterile kits and specialized services like supply chain consulting and inventory management. Furthermore, their e-commerce platform contributes to growing online sales, reaching smaller businesses and direct consumers. These diverse streams underscore Medline's projected 2024 annual revenue exceeding $22 billion.

| Revenue Stream | Primary Mechanism | 2024 Contribution | ||

|---|---|---|---|---|

| Direct Product Sales | Unit sales, long-term contracts | >$22 Billion | ||

| Prime Vendor Agreements | High-volume, recurring contracts | >$20 Billion | ||

| Customized Kits & Services | Value-added products, consulting fees | Tens of Billions |

Business Model Canvas Data Sources

The Medline Industries Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and detailed financial disclosures. These data sources provide the necessary insights into customer needs, industry trends, and Medline's competitive landscape.